Global Battery Materials Market – Powering the Next Era of Energy Storage

Published Date : November 21, 2025 Category: Chemicals and Materials

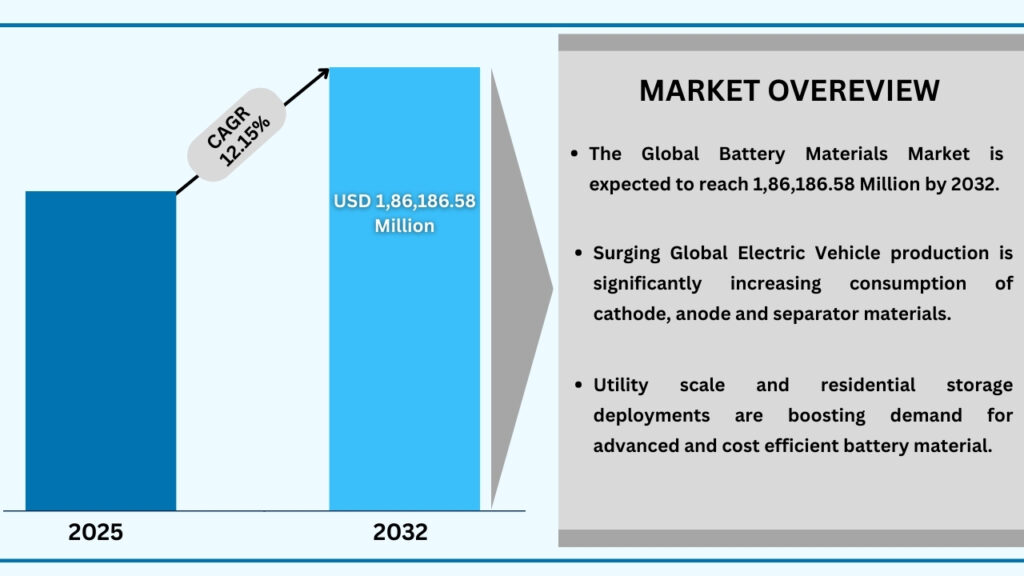

Market Overview

The Global Battery Materials Market is undergoing rapid and transformative expansion, driven by the global shift toward electric mobility, renewable energy storage, smart electronics, and grid-scale energy management. With governments, industries, and consumers accelerating electrification, demand for high-performance cathode materials, anodes, electrolytes, separators, and advanced additives continues to rise sharply. Technologies such as lithium-ion, solid-state, sodium-ion, and next-generation batteries require highly engineered materials that deliver superior conductivity, longevity, safety, and energy density. These developments are propelling large-scale investments in material refinement, precursor chemistry, and innovative manufacturing processes.

The growing emphasis on sustainability, low-carbon material production, and circularity is encouraging companies to adopt advanced battery chemistries such as LFP, NMC, NCA, and LMFP, supported by innovations in nano-coatings, engineered graphite, high-purity lithium compounds, and silicon-enhanced anodes. Manufacturers are scaling R&D to minimize material degradation, improve charging efficiency, and optimize cost per kWh. From electric vehicles and consumer electronics to stationary storage and industrial automation, battery materials have become essential enablers of global energy transition.

Driven by multi-billion-dollar investments from automotive OEMs, gigafactory developers, mining companies, and chemical producers, the market is rapidly evolving into a highly competitive and innovation-led ecosystem. The push toward achieving net-zero emissions, reducing fossil-fuel dependency, and increasing energy security is significantly boosting demand for advanced battery materials. As global supply chains mature, companies are focusing on improving purity levels, securing raw material availability, and implementing closed-loop recycling to strengthen long-term resilience and cost optimization.

Large-scale government initiatives—such as the U.S. Inflation Reduction Act, Europe’s Battery Passport initiative, and Asia’s strategic EV policies—are accelerating market expansion by ensuring local manufacturing, critical mineral security, and R&D support. Battery materials are increasingly being engineered to deliver higher thermal stability, superior power density, minimal resource consumption, and improved safety across full lifecycle performance. This ecosystem of technology advancement, regulatory support, and commercialization is expected to propel the industry toward exponential long-term growth.

Market Overview- Battery Materials Market

Market Definition

The Battery Materials Market includes a wide range of engineered materials used in the production of modern energy storage systems, including lithium-ion, sodium-ion, lead-acid, NiMH, and next-generation solid-state batteries. These materials consist of cathode active materials, anode materials, electrolytes, separators, conductive additives, binders, and specialty precursors, each designed to enhance electrochemical performance, cycle life, and safety.

Battery materials form the foundational building blocks of rechargeable batteries, enabling higher energy density, faster charging, improved thermal stability, and extended product lifespan. Their application spans electric vehicles (EVs), consumer electronics, renewable energy storage systems, industrial power solutions, aerospace, and smart devices—supporting global shifts toward electrification, sustainability, and energy efficiency.

Technological Innovation and Product Evolution

Rapid technological progress is transforming the capabilities of battery materials, with manufacturers prioritizing high-purity, high-capacity, low-resistance formulations to meet rising performance requirements. Leading companies are developing high-nickel NCM/NCA cathodes, LFP chemistries, silicon-enhanced anodes, ceramic solid electrolytes, fluorinated electrolytes, and advanced separator films that deliver superior conductivity, stability, and safety.

Breakthroughs in material engineering—including atomic-scale doping, surface coating technologies, precision synthesis, continuous manufacturing, and material recycling innovations—are enabling better control over particle morphology, purity, and reactivity. As production efficiency improves and costs decline, these advanced materials are increasingly adopted across mainstream battery technologies, expanding the commercial scope of the market.

Policy Support and Sustainable Innovation

Governments worldwide are accelerating the growth of the Battery Materials market through EV mandates, renewable energy targets, and incentives for local battery production (gigafactories). Major regions—including Europe, China, the U.S., and India—are investing heavily in battery supply chain security, critical mineral processing, and circular-economy infrastructure to support long-term sustainability.

Global initiatives focused on decarbonization, emissions reduction, and energy independence are driving demand for safe, durable, and environmentally responsible battery materials. This includes strong emphasis on low-cobalt chemistries, recycling-based material recovery, and greener manufacturing methods, helping companies align with evolving regulatory and ESG expectations.

Integration with AI, Big Data & Smart Manufacturing

Digitalization is emerging as a critical component in battery material development. AI-driven modeling, machine-learning simulations, digital twins, and predictive analytics are accelerating material discovery by identifying optimal chemistries and performance parameters. These tools help reduce R&D time and predict long-term battery behavior under various operating conditions.

Industry 4.0 manufacturing—supported by automation, robotics, advanced analytics, and quality-monitoring sensors—is enabling high-precision production of battery materials with improved scalability and reduced waste. The integration of smart manufacturing and material informatics is expanding opportunities in EVs, grid storage, aerospace, medical devices, defense systems, and next-generation electronics.

Market Restraints and Challenges

Despite robust growth prospects, the Battery Materials market faces several challenges, including high raw material costs (lithium, nickel, cobalt), supply chain dependencies, and geopolitical risks that affect pricing stability. Complex production processes and stringent purity requirements increase manufacturing costs and slow capacity expansion.

Environmental, health, and safety regulations surrounding mining, chemical processing, and waste disposal add further barriers. Limited standardization in emerging battery chemistries, coupled with the challenge of scaling high-performance materials (like silicon anodes and solid electrolytes), continues to restrict rapid commercialization. Addressing these barriers requires cross-sector collaboration, technology innovation, and long-term policy alignment.

Regional Outlook

Asia-Pacific

Asia-Pacific dominates the Battery Materials market, supported by massive EV production, strong government subsidies, and the world’s largest network of battery manufacturers. China, Japan, and South Korea lead in cathode materials, anode materials, separators, and electrolytes, while India is rapidly scaling its local supply chain. Rising investments in gigafactories and raw material processing further strengthen the region’s leadership.

Europe

Europe is rapidly expanding its battery ecosystem, driven by strict emissions norms, strong sustainability targets, and heavy investments in domestic battery manufacturing. The region leads in solid-state battery development, green materials, and recycling technologies, backed by robust R&D infrastructure and the EU Battery Regulation.

North America

North America is witnessing strong demand driven by EV adoption, advanced energy storage initiatives, and government support for domestic battery manufacturing. The U.S. and Canada are investing in lithium refining, cathode manufacturing, silicon-anode technologies, and recycling capabilities, positioning the region as a growing global competitor in high-performance battery materials.

Major Companies and Competitive Landscape

The global Battery Materials market includes leading chemical producers, energy-material innovators, and specialized component manufacturers. Key players include:

• BASF SE

• Umicore

• POSCO Future M

• LG Chem / LG Energy Solution

• Ganfeng Lithium

• BTR New Material Group

• Johnson Matthey

• Tinci Materials

• EcoPro BM

• Sumitomo Metal Mining

These companies are focusing on high-purity materials, cost-efficient chemistries, solid-state innovations, and large-scale production capabilities to strengthen competitive positioning. Strategic partnerships, vertical integration, technological breakthroughs, and recycling initiatives are core differentiators.

Strategic Developments

Strategic Expansion (2025)

In early 2025, a leading battery material manufacturer expanded its production capacity in Asia to meet accelerating demand for high-nickel cathode materials, LFP chemistries, and advanced anodes. The expansion integrates cutting-edge processing systems designed to enhance efficiency, purity, and performance for EV and energy storage applications.

Strategic Collaboration (2025)

In mid-2025, a European battery materials company partnered with a U.S.-based technology firm to co-develop next-generation solid-state battery materials, high-performance separator films, and fast-charging anode technologies. This collaboration aims to accelerate commercialization of safer, higher-density battery solutions for automotive, aerospace, and grid applications.

Future Market Direction and Strategic Insights

The Battery Materials market is shifting toward high-performance, sustainable, and next-generation materials designed for longer life cycles, faster charging, improved safety, and lower cost. Breakthroughs in silicon anodes, cobalt-free cathodes, solid-state electrolytes, lithium-sulfur systems, and LFP advancements will reshape the competitive landscape.

Growing demand for electrification, renewable energy storage, and circular-economy solutions will define long-term market direction. Companies investing in scalable manufacturing, recycling-based material sourcing, AI-driven material design, and environmentally responsible production methods will secure strong competitive advantages.

Conclusion

The Global Battery Materials Market is undergoing rapid transformation driven by electrification, sustainability imperatives, and continuous technological evolution. As innovations in material science, gigafactory expansion, digital manufacturing, and environmental regulations converge, battery materials are becoming a cornerstone of global clean-energy transitions. Strong R&D momentum, growing investments, and expanding industrial adoption will continue to propel the market toward a high-growth, innovation-led future.

As the battery materials ecosystem rapidly evolves toward high-performance chemistries, sustainable sourcing, and advanced manufacturing, informed decision-making is essential for long-term competitiveness. Advantia Business Consulting supports battery manufacturers, chemical producers, gigafactory developers, and investors with deep market intelligence, competitive analysis, regulatory insight, and commercialization strategy tailored to the global energy-storage value chain. Our expertise helps organizations identify emerging opportunities, strengthen supply-chain resilience, and accelerate innovation across next-generation battery materials and technologies.