Global Glass Interposers Market

Published Date : December 22, 2025 Category: Electronics and Semiconductor

Enabling Next-Generation Semiconductor Packaging Through Precision Substrates and Advanced Integration

Industry Landscape Overview

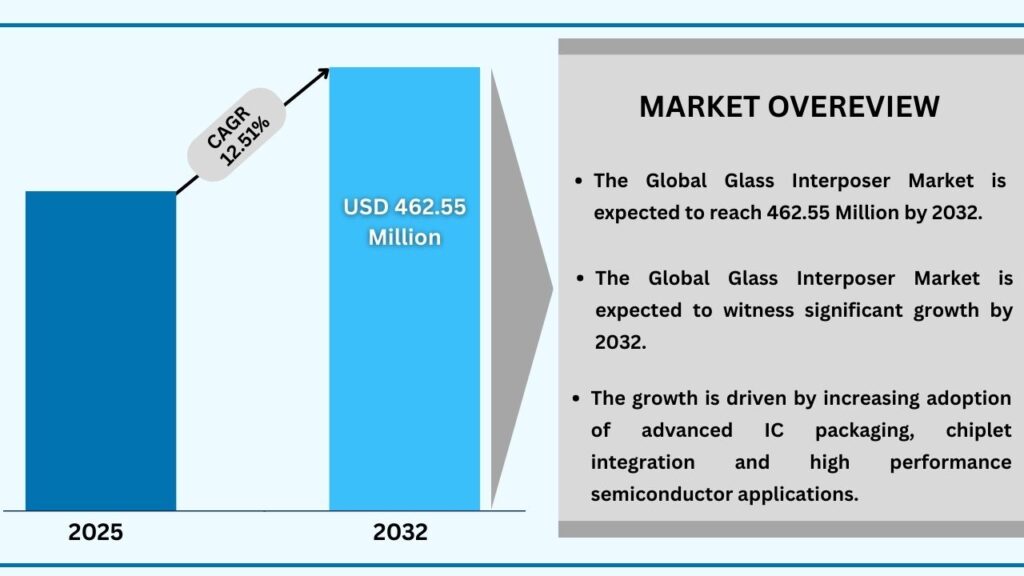

The Global Glass Interposers Market is gaining strategic importance as the semiconductor industry accelerates toward advanced packaging solutions to meet rising performance, bandwidth, and power-efficiency requirements. As chip architectures evolve beyond traditional monolithic designs, the demand for high-density interconnect platforms capable of supporting complex multi-die systems is intensifying. Glass interposers are emerging as a compelling alternative to conventional silicon interposers, offering superior electrical performance, dimensional stability, and scalability for next-generation semiconductor applications.

Driven by the rapid expansion of artificial intelligence workloads, high-performance computing, 5G and future communication standards, and data-centric processing, semiconductor manufacturers are increasingly prioritizing packaging innovations that enhance signal integrity and system reliability. Glass interposers enable ultra-fine routing, low dielectric loss, and high I/O density, making them well-suited for advanced system-in-package (SiP), chiplet-based designs, and heterogeneous integration platforms.

As advanced packaging shifts from niche adoption toward mainstream deployment, glass interposers are transitioning from experimental technology into a critical enabler of semiconductor performance scaling. Strong investment across foundries, OSATs, material suppliers, and equipment providers is reshaping the competitive and technological landscape of the market.

Global Glass Interposers Market-Overview

Market Scope and Functional Definition

The Glass Interposers Market encompasses materials, processing technologies, and advanced packaging solutions that utilize glass substrates as an intermediate interconnection layer between multiple semiconductor dies. These interposers facilitate dense signal routing, mechanical support, and electrical connectivity in complex integrated systems.

Key functional elements include:

Glass interposers serve as a foundational building block for advanced semiconductor packaging, supporting performance scaling beyond traditional silicon limits.

Process Innovation and Manufacturing Advancements

Continuous progress in glass processing, microfabrication, and materials engineering is accelerating the commercial viability of glass interposers. Manufacturers are focusing on improving yield, throughput, and cost efficiency to support volume production for advanced semiconductor applications.

Key innovation areas include:

These advancements are positioning glass interposers as a scalable and high-performance solution for next-generation packaging requirements.

Policy Environment and Industry Alignment

As semiconductor devices become integral to safety-critical and infrastructure-level applications, regulatory compliance and quality assurance are increasingly shaping packaging technology adoption. Glass interposer development is aligned with industry standards related to reliability, traceability, and environmental sustainability.

Government-led semiconductor initiatives, domestic manufacturing incentives, and strategic investments in advanced packaging capabilities are indirectly strengthening the market outlook. Glass interposers are being incorporated into long-term technology roadmaps aimed at improving supply chain resilience and technological sovereignty.

Integration with Advanced Packaging Ecosystems

Glass interposers are deeply embedded within modern semiconductor packaging workflows, enabling:

Their ability to support heterogeneous integration positions glass interposers as a key enabler of future semiconductor system architectures.

Adoption Barriers and Market Constraints

Despite strong growth potential, the market faces several technical and commercial challenges:

Addressing these challenges will be essential for accelerating large-scale adoption and cost optimization.

Geographic Market Perspective

Asia-Pacific

Asia-Pacific represents the most dynamic region, driven by large-scale semiconductor manufacturing, strong OSAT presence, and rapid adoption of advanced packaging across consumer electronics, AI processors, and networking equipment. Countries such as Taiwan, South Korea, Japan, and China play a central role in market expansion.

North America

North America remains a key innovation center, supported by strong demand from AI accelerators, data centers, and defense-related electronics. The presence of leading semiconductor designers and advanced packaging R&D initiatives continues to support early adoption.

Europe

Europe shows steady growth, driven by automotive electronics, industrial automation, and aerospace applications. Emphasis on reliability, safety, and sustainability strengthens the role of glass interposers in high-value applications.

Competitive Environment and Industry Participants

The Glass Interposers Market features a diverse mix of semiconductor foundries, OSAT providers, glass material suppliers, and advanced packaging technology developers. Competitive differentiation is driven by process expertise, scalability, cost efficiency, and integration capabilities.

Market participants are focusing on:

Strategic collaboration and ecosystem development are critical to long-term success.

Recent Strategic Industry Activity

Expansion of Advanced Packaging Capabilities

Packaging providers and substrate manufacturers are scaling panel-level glass interposer production to meet rising demand from AI and high-performance computing applications.

Cross-Industry Collaboration

Partnerships between material suppliers, equipment manufacturers, and semiconductor companies are accelerating process standardization and reducing commercialization timelines.

Future Outlook and Strategic Direction

The evolution of the Glass Interposers Market will be driven by:

Glass interposers are expected to transition from a complementary solution to a core element of advanced semiconductor packaging strategies.

Conclusion

The Global Glass Interposers Market is entering a phase of accelerated development as the semiconductor industry seeks new pathways to sustain performance scaling and system integration. Supported by material advantages, manufacturing innovation, and expanding application demand, glass interposers are emerging as a critical enabler of next-generation packaging technologies. As advanced computing, communication, and automotive systems continue to evolve, glass interposers will play an increasingly central role in shaping the future of semiconductor design and integration.

At Advantia Business Consulting, we support semiconductor manufacturers, OSATs, material suppliers, and investors in translating glass interposer innovation into scalable, commercially viable packaging strategies. Our expertise spans market intelligence, technology roadmap development, ecosystem partner analysis, and go-to-market planning—helping clients navigate advanced packaging complexity and accelerate adoption across AI, HPC, RF, and next-generation computing applications. Partner with Advantia Business Consulting to unlock sustainable growth opportunities in the evolving glass interposers landscape.