Market Synopsis

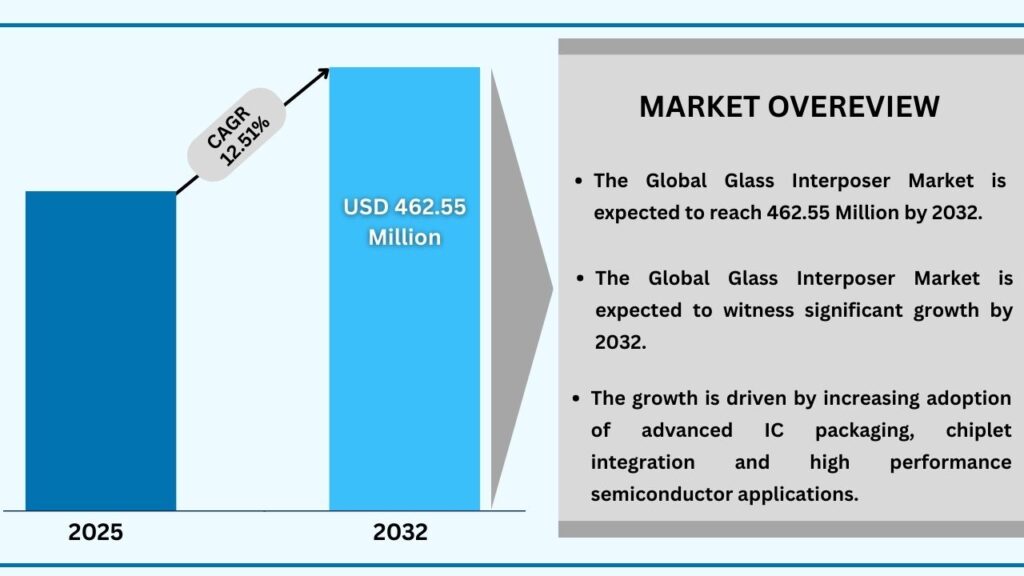

The Glass Interposers Market size was USD 180.89 Million in 2024 and is expected to reach USD 462.55 million in 20232 at a CAGR of 12.51% during the forecast period.

Rising Need for Advanced Packaging Substrates in High-Performance Semiconductor Systems

The rapid expansion of artificial intelligence, high-performance computing, and data-intensive applications is reshaping semiconductor design and packaging requirements. As chip architectures evolve toward multi-die and chiplet-based systems, traditional substrate and interconnect technologies are reaching their performance and scaling limits. Glass interposers are emerging as a critical solution, offering superior signal integrity, fine-pitch routing, and mechanical stability needed to support next-generation semiconductor workloads. Growing demand for high-bandwidth, low-latency data transfer is accelerating global adoption of glass interposer technologies.

Expanding Adoption Across Foundries, OSATs, and End-Use Industries

Semiconductor foundries, outsourced semiconductor assembly and test (OSAT) providers, and advanced packaging specialists are increasingly incorporating glass interposers into production roadmaps. Adoption is being driven by applications in AI accelerators, data centers, networking equipment, 5G infrastructure, and advanced automotive electronics. Technology companies and system designers are leveraging glass interposers to enable heterogeneous integration, higher I/O density, and improved power efficiency. This broad-based adoption across enterprise, cloud infrastructure, and industrial electronics is moving glass interposers from pilot projects to high-value commercial deployment.

Increasing Demand for High-Bandwidth, Low-Loss Interconnect Platforms

Next-generation electronic systems require precise, high-speed interconnects capable of supporting dense signal routing and minimal electrical loss. Glass interposers address these requirements by enabling ultra-fine redistribution layers and low-dielectric substrates, making them well-suited for high-frequency and high-performance applications. As semiconductor systems shift toward real-time processing, advanced memory integration, and chiplet-based architectures, the need for reliable, low-latency interposer platforms is becoming increasingly critical, driving sustained market momentum.

Advances in Glass Processing, TGV Formation, and Packaging Integration

Ongoing advancements in glass manufacturing, Through-Glass Via (TGV) technologies, and panel-level packaging processes are significantly improving the scalability and cost efficiency of glass interposers. Innovations in laser drilling, chemical etching, redistribution layer patterning, and material engineering are enhancing yield, reliability, and thermal performance. Additionally, tighter integration with advanced packaging ecosystems—including 2.5D and 3D IC architectures—is accelerating commercialization. These technological improvements are positioning glass interposers as a mature, production-ready solution within the evolving semiconductor packaging landscape.

Global Glass Interposers Market (USD Million)

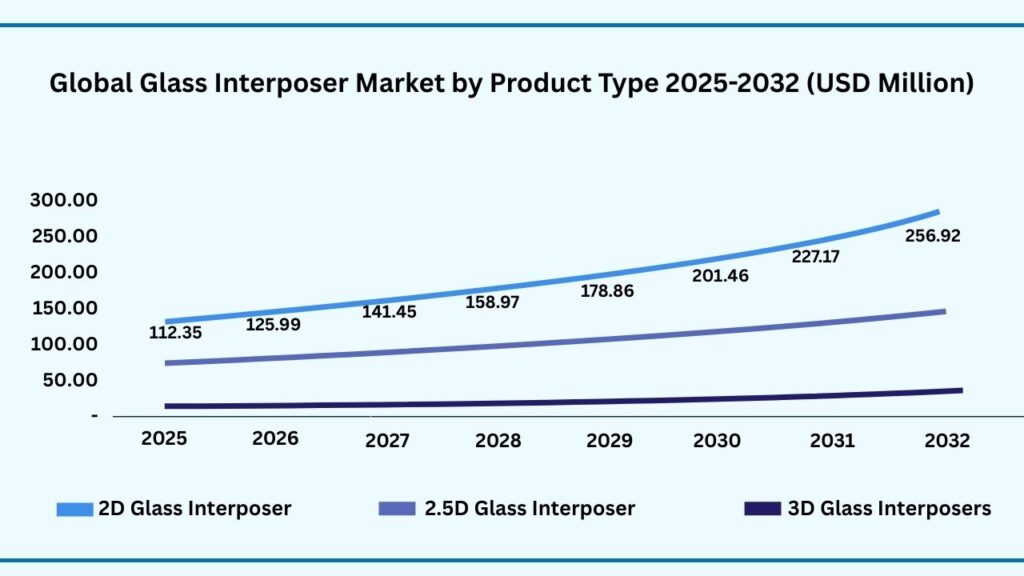

Global Glass Interposers Market by Product Type Insights:

2D Glass Interposers segment accounted for market share of share 55.44% in 2024 in the global Glass Interposers market.

The 2D Glass Interposers segment accounted for the largest share of the global Glass Interposers market in 2024, representing 55.44% of total revenues. 2D Glass Interposers segment is expected to register a CAGR of 12.54% during the forecast year from 2025 to 2032. The 2D Glass Interposers segment holds the dominant position in the global Glass Interposers market, driven by its established manufacturing ecosystem, cost-effectiveness, and broad applicability across advanced semiconductor packaging applications. Its compatibility with existing fabrication and assembly processes, along with the ability to support high-density redistribution layers and stable electrical performance, has led to widespread adoption across data centers, networking equipment, and consumer electronics.

Over the forecast period, the 2D Glass Interposers segment is expected to witness strong and sustained growth, supported by increasing demand for high-performance computing, artificial intelligence workloads, and next-generation communication systems. Ongoing improvements in glass processing techniques, yield enhancement, and scalability are further strengthening its adoption, positioning the segment as a key contributor to overall market expansion in the coming years.

Global Glass Interposers Market by Product Type (USD Million)

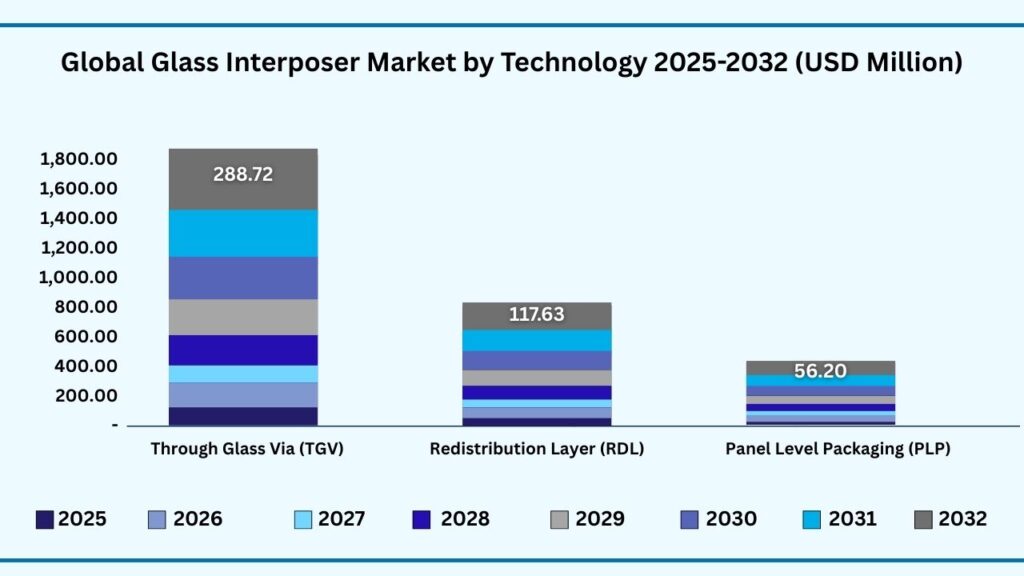

Global Glass Interposers Market by Technology Insights:

Through-Glass Via (TGV) segment accounted for the largest market share of 62.32% in 2024 in the global Glass Interposers market.

Based on the Through-Glass Via (TGV) held the largest revenue share of 62.32 2024, and expected to register a CAGR of 12.54% between 2025 to 2032 and the market is expected to reach USD 288.72 million by 2032. Based on technology, the Through-Glass Via (TGV) segment holds the leading position in the global Glass Interposers market, driven by its ability to support high I/O density, fine-pitch interconnections, and superior electrical performance. TGV technology is widely adopted in advanced semiconductor packaging due to its low signal loss, excellent dimensional accuracy, and strong compatibility with high-frequency and high-bandwidth applications, including artificial intelligence accelerators, data center processors, and advanced networking systems.

Over the forecast period, the TGV segment is expected to witness robust growth, supported by increasing adoption of advanced packaging architectures such as 2.5D and 3D ICs, chiplet-based integration, and heterogeneous system designs. Continued investments in panel-level glass processing, improvements in via formation technologies, and rising demand from high-performance computing and next-generation communication infrastructure are expected to sustain the segment’s strong growth trajectory through the forecast period.

Global Glass Interposers Market by Technology (USD Million)

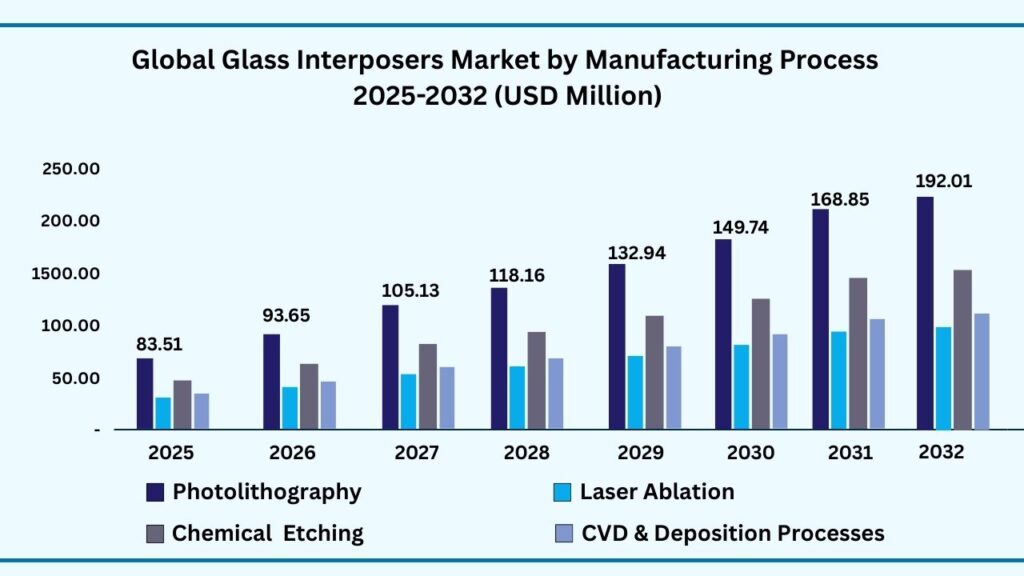

Global Glass Interposers Maret by Manufacturing Process Insights:

Photolithography segment accounted for the largest market share of share 41.21% in 2024 in the global Glass Interposers market.

Based on Manufacturing Process , Photolithography segment held the largest revenue share of 41.21% in the global Glass Interposers market in 2024 and expected to register a CAGR of 12.63 from 2025 to 2032 and expected to reach USD 192.01 million. Based on manufacturing process, the photolithography segment holds the leading share in the global Glass Interposers market, driven by its high precision, process maturity, and ability to support ultra-fine line patterning required in advanced semiconductor packaging. Photolithography enables accurate redistribution layer formation, consistent dimensional control, and high production reliability, making it the preferred manufacturing approach for high-density glass interposers used in performance-critical applications such as high-performance computing, artificial intelligence accelerators, and advanced networking systems.

Over the forecast period, the photolithography segment is expected to experience strong growth, supported by rising demand for advanced packaging technologies, increasing adoption of chiplet-based architectures, and continued innovation in glass substrate processing. Ongoing improvements in yield optimization, scalability, and integration with panel-level manufacturing are further strengthening the role of photolithography in glass interposer production, positioning the segment as a key contributor to overall market expansion in the coming years.

Global Glass Interposers Market by Manufacturing Process (USD Million)

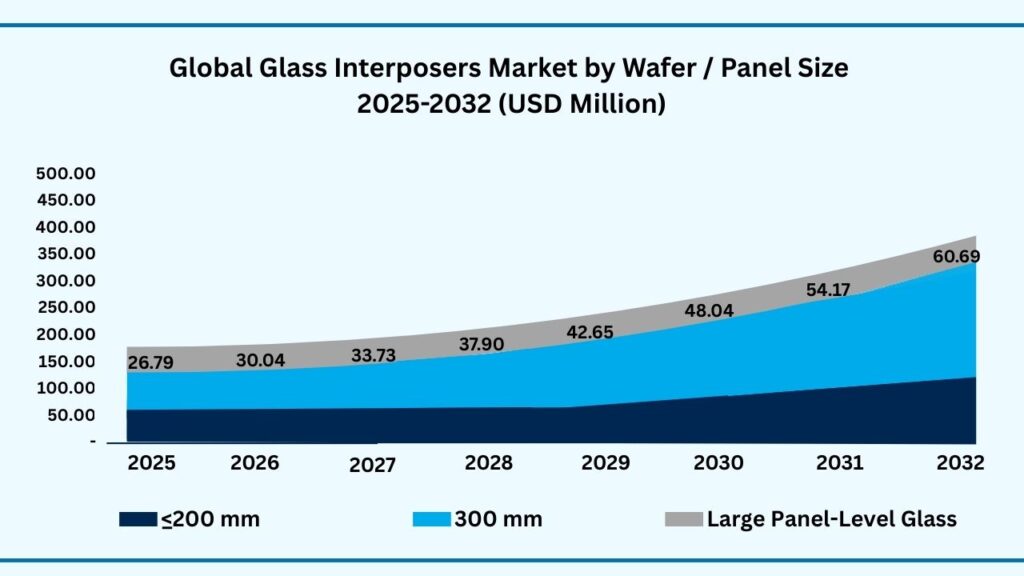

Global Glass Interposers Market by Wafer / Panel Size :

300 mm segment accounted for the largest market share of share 59.33% in 2024 in the global Glass Interposers market.

Based on Wafer / Panel Size segment , 300 mm held the largest revenue share of 59.33% in the global Glass Interposers market in 2024 and expected to register a CAGR of 12.48% from 2025 to 2032 is expected to reach USD 274.89 million. Based on wafer and panel size, the 300 mm segment held the largest share of the global Glass Interposers market, supported by its compatibility with advanced semiconductor manufacturing infrastructure and its ability to deliver higher production efficiency. The widespread adoption of this format is driven by better process standardization, improved yield performance, and suitability for high-volume manufacturing of advanced packaging solutions. The segment is extensively used in applications requiring high I/O density and precise interconnect performance, particularly in data center processors, artificial intelligence accelerators, and advanced networking systems.

During the forecast period, the 300 mm segment is expected to witness strong and sustained growth, driven by increasing demand for advanced semiconductor packaging, rising adoption of chiplet-based architectures, and continued investments in scalable manufacturing technologies. As semiconductor manufacturers focus on optimizing cost structures and enhancing throughput, the preference for larger wafer and panel sizes is expected to strengthen further, supporting the segment’s significant contribution to overall market expansion in the coming years.

Global Glass Interposers Market by Wafer / Panel Size (USD Million)

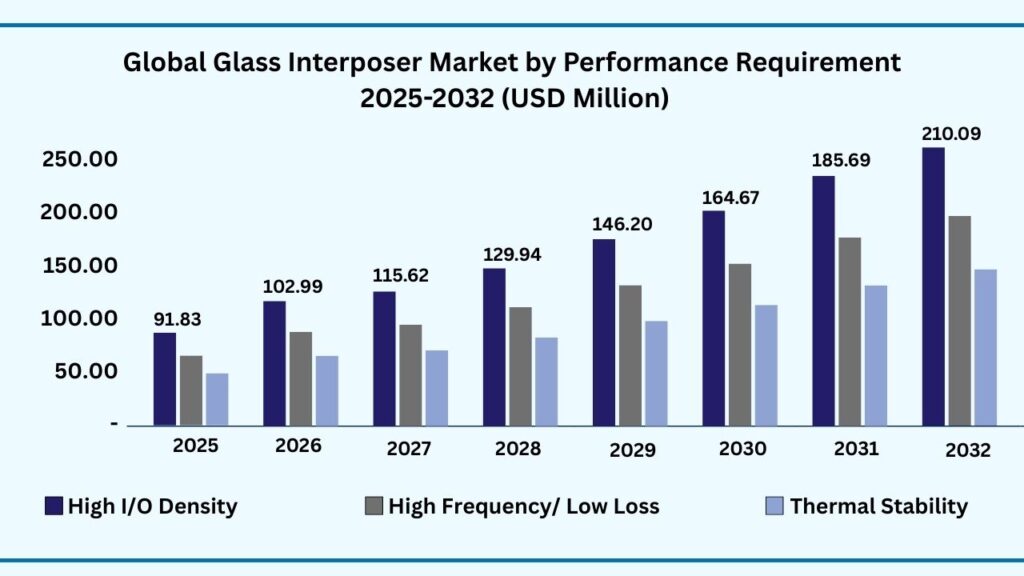

Global Glass Interposers Market by Performance Requirement Insights:

High I/O Density segment accounted for the largest market share of share 45.32% in 2024 in the global Glass Interposers market.

Based on Performance Requirement segment, High I/O Density held the largest revenue share of 45.32% in the global Glass Interposers market in 2024 and expected to register a CAGR of 12.48% from 2025 to 2032 and expected to reach USD 210.09 million in 2032. Based on performance requirement, the High I/O Density segment holds the leading position in the global Glass Interposers market, driven by the increasing need for dense interconnect architectures in advanced semiconductor systems. This segment benefits from its ability to support a large number of input/output connections within compact form factors while maintaining signal integrity and power efficiency. High I/O density glass interposers are widely used in artificial intelligence accelerators, high-performance computing processors, and advanced networking equipment, where fast and reliable data transfer is critical.

During the forecast period, the High I/O Density segment is expected to experience strong growth, supported by the rapid adoption of chiplet-based designs, heterogeneous integration, and data-intensive computing architectures. Continued advancements in glass processing, redistribution layer patterning, and interposer design are further enhancing performance capabilities, reinforcing the segment’s role as a key contributor to the overall expansion of the global Glass Interposers market.

Global Glass Interposers by Performance Requirement (USD Million)

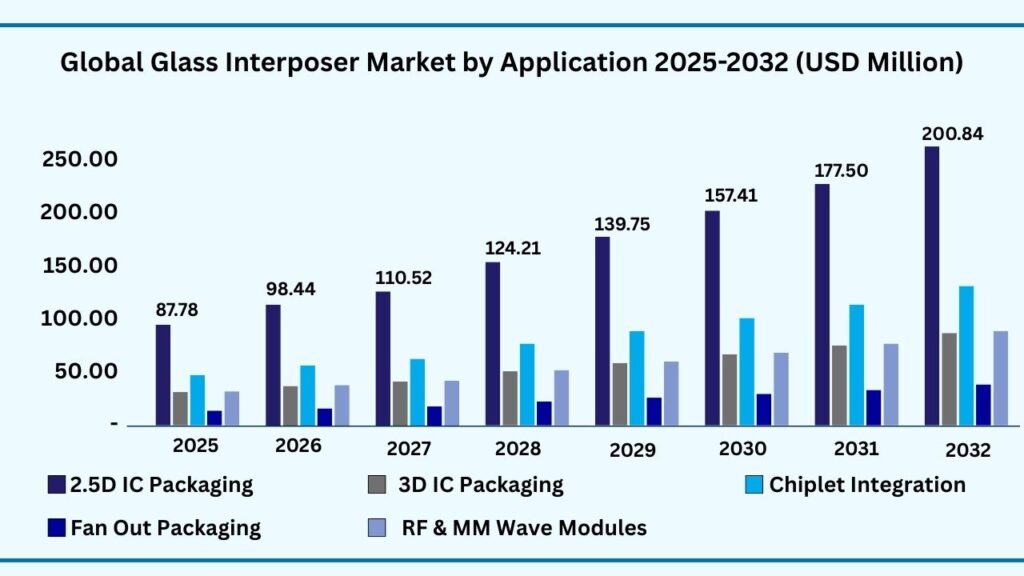

Global Glass Interposers Market by Application Insights:

BFSI segment accounted for the largest market share of share 43.32% in 2024 in the global Glass Interposers market.

Based on Application segment Organization Size held the largest revenue share of 43.32% in the global Glass Interposers market in 2024 and expected to register a CAGR of 12.48% from 2025 to 2032 and expected to reach USD 200.84 million in 2032. Based on application, the organization size segment holds the largest share of the global Glass Interposers market, driven by strong adoption from large enterprises and established semiconductor manufacturers. Larger organizations possess the financial capacity, technical expertise, and manufacturing scale required to adopt advanced packaging technologies such as glass interposers. These players are increasingly integrating glass interposers into high-performance computing, artificial intelligence, and advanced communication systems to enhance performance, scalability, and system reliability.

Over the forecast period, the organization size segment is expected to witness sustained growth, supported by continued investments in advanced semiconductor packaging infrastructure and expanding deployment across data centers, networking equipment, and next-generation electronic systems. As large organizations focus on improving interconnect density, signal integrity, and power efficiency, the demand for glass interposers within this segment is expected to remain strong, contributing significantly to the overall expansion of the global Glass Interposers market.

Global Glass Interposers by Application (USD Million)

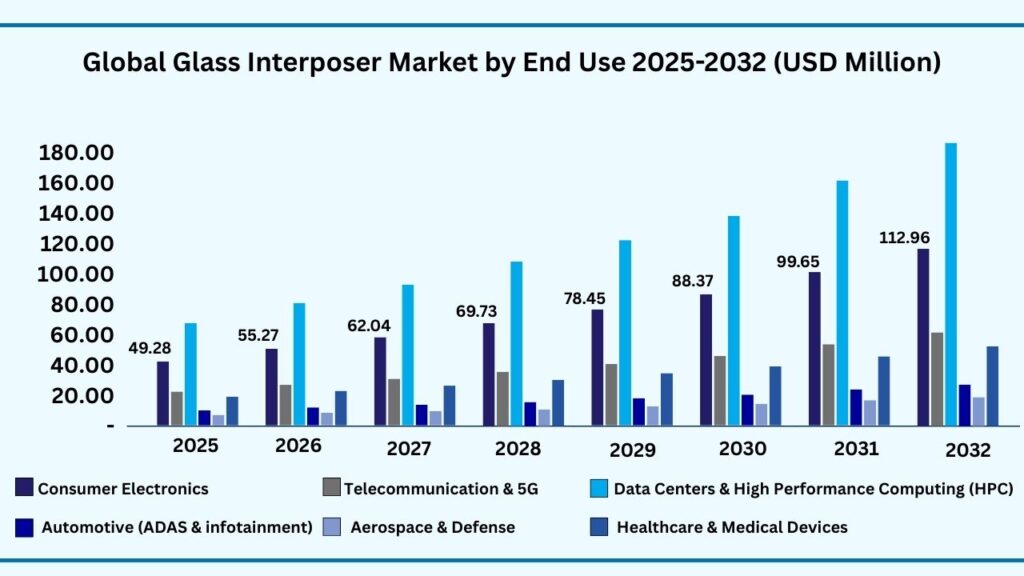

Global Glass Interposers Market by End Use Insights:

Data Centers & High-Performance Computing (HPC) segment accounted for the largest market share of share 33.32% in 2024 in the global Glass Interposers market.

Based on End Use segment, Data Centers & High-Performance Computing (HPC) held the largest revenue share of 12.45% in the global Glass Interposers market in 2024 and expected to register a CAGR of 27.75% from 2025 to 2032 and expected to reach USD 154.12 million in 2032. Based on end use, the Data Centers & High-Performance Computing (HPC) segment holds the leading position in the global Glass Interposers market, driven by the rapid expansion of artificial intelligence workloads, cloud computing infrastructure, and data-intensive processing requirements. Glass interposers are increasingly utilized in data center and HPC applications due to their ability to support high I/O density, low signal loss, and enhanced thermal performance, which are essential for advanced processors, accelerators, and memory integration.

Over the forecast period, the Data Centers & HPC segment is expected to witness strong and accelerated growth, supported by continued investments in next-generation computing architectures and rising demand for high-speed, energy-efficient systems. The increasing deployment of chiplet-based designs, heterogeneous integration, and advanced packaging solutions across data centers is expected to further strengthen the role of glass interposers, making this segment a key contributor to overall market expansion.

Global Glass Interposers by End Use (USD Million)

Global Glass Interposers Market by Region Insights:

Asia-Pacific segment accounted for the largest market share of share of 44.21% in 2024 in the global Glass Interposers market.

Based on region, the global Glass Interposers market is segmented into Europe, Asia-Pacific, North America, Latin America and Middle East & Africa. Among these, Asia-Pacific region held the largest revenue share of 44.21% in the global Glass Interposers market in 2024 and expected to reach USD 205.42 million in 2032. Based on region, the global Glass Interposers market is segmented across Europe, Asia-Pacific, North America, Latin America, and the Middle East & Africa. Among these regions, Asia-Pacific dominates the global market, supported by its strong semiconductor manufacturing ecosystem, high concentration of foundries and OSAT providers, and extensive production of consumer electronics, networking equipment, and advanced computing systems. The region benefits from robust investments in advanced packaging technologies, along with rapid adoption of glass interposers across applications such as artificial intelligence, high-performance computing, and next-generation communication infrastructure.

Over the forecast period, the Asia-Pacific region is expected to maintain its leading position, driven by continued expansion of semiconductor manufacturing capacity and increasing focus on high-density, low-loss packaging solutions. Strong government support for domestic semiconductor production, coupled with rising demand from data centers, automotive electronics, and 5G infrastructure, is expected to further accelerate adoption. As advanced packaging becomes a strategic priority across the region, Asia-Pacific is likely to remain the primary growth engine for the global Glass Interposers market.

Global Glass Interposers Market by Region (USD Million)

Major Companies and Competitive Landscape

The competitive landscape of the Glass Interposers market is shaped by a combination of established semiconductor manufacturers, advanced packaging specialists, glass substrate suppliers, and emerging technology developers focused on next-generation interconnect solutions. Market participants are actively advancing glass-based interposer technologies to address the growing demand for high I/O density, low signal loss, and superior thermal and mechanical stability across advanced semiconductor applications. Competition is primarily driven by innovation in Through-Glass Via (TGV) formation, redistribution layer optimization, panel-level processing, and integration with 2.5D and 3D IC architectures.

Leading companies are concentrating on improving manufacturing scalability, yield performance, and cost efficiency to support high-volume adoption in data centers, high-performance computing, artificial intelligence accelerators, networking equipment, and advanced automotive electronics. Strategic emphasis is placed on enabling chiplet-based system designs, heterogeneous integration, and high-frequency applications, where glass interposers offer performance advantages over traditional silicon-based solutions. Continuous investment in process automation, materials engineering, and advanced lithography is strengthening competitive positioning across the value chain.

Strategic collaborations play a critical role in market development, with key players partnering with semiconductor foundries, OSAT providers, equipment manufacturers, and material suppliers to accelerate commercialization and ecosystem alignment. Competitive strategies focus on expanding panel-level glass interposer capabilities, enhancing TGV reliability, and aligning product offerings with evolving semiconductor roadmaps. While established players leverage manufacturing scale, technical expertise, and long-standing customer relationships, emerging innovators are gaining traction by introducing novel glass processing techniques and application-specific interposer solutions. This mix of incumbents and new entrants creates a dynamic, innovation-driven competitive environment that continues to advance the global Glass Interposers market.

Key Companies Operating in the Global Glass Interposers Market Include

- Corning Incorporated

- AGC Inc.

- SCHOTT AG

- Intel Corporation

- Samsung Electronics

- TSMC

- ASE Group

- Amkor Technology

- IBM Corporation

- Absolics Inc.

- Samsung Electro-Mechanics

- AT&S

- LG Innotek

- KLA Corporation

- Applied Materials

Strategic Development

Corning Incorporated – Expansion of Advanced Glass Interposer Manufacturing (2025)

In 2025, Corning announced the expansion of its advanced glass interposer production lines to support high-density 2.5D and 3D IC packaging. The development focuses on improving Through-Glass Via (TGV) precision, thermal performance, and panel-level scalability. This expansion aims to meet the rising demand from data centers, AI accelerators, and high-performance computing applications, reinforcing Corning’s leadership in the glass interposer market.

AGC Inc. – Strategic Partnership for Panel-Level Packaging Solutions (2024)

In 2024, AGC Inc. entered into a strategic partnership with a leading OSAT provider to deliver next-generation panel-level glass interposer solutions. The collaboration focuses on enhancing manufacturing throughput, fine-pitch redistribution layers, and high-frequency signal performance for 2.5D and 3D IC architectures. This initiative is expected to accelerate the adoption of glass interposers in telecommunications, AI, and high-performance computing sectors.

Scope of Research

| Report Details | Outcome |

|---|---|

| Market size in 2024 | USD 180.89 Million |

| CAGR (2024–2032) | 12.51% |

| Revenue forecast to 2033 | USD 462.55 Million |

| Base year for estimation | 2024 |

| Historical data | 2019–2023 |

| Forecast period | 2025–2032 |

| Quantitative units | Revenue in USD Million, and CAGR in % from 2025 to 2032 |

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | By Product Type , By Technology, By Manufacturing Process , By Wafer / Panel Size, By Performance Requirement, By Application, By End Use and By region for 2019 to 2032 |

| Regional scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Country scope | U.S., Canada, Mexico, Germany, France, U.K., Italy, Spain, Benelux, Russia, Finland, Sweden, Rest of Europe, China, India, Japan, South Korea, Indonesia, Thailand, Vietnam, Australia, New Zealand Rest of APAC, Brazil, Rest of LATAM, Saudi Arabia, Rest of MEA |

| Key companies profiled | “Corning Incorporated, AGC Inc., SCHOTT AG, Intel Corporation, Samsung Electronics, TSMC, ASE Group, Amkor Technology, IBM Corporation, Absolics Inc., Samsung Electro-Mechanics, AT&S, LG Innotek, KLA Corporation, Applied Materials” |

| Customization scope | 10 hours of free customization and expert consultation |

Some Key Questions the Report Will Answer

- What is the expected revenue Compound Annual Growth Rate (CAGR) of the global Glass Interposers market over the forecast period (2025–2032)?

- The global Glass Interposers market revenue is expected to register a Compound Annual Growth Rate (CAGR) of 12.51% during the forecast period.

- What was the size of the global Glass Interposers in 2024?

- The global Glass Interposers market size was USD 180.89 Million in 2024.

- Which factors are expected to drive the global Glass Interposers market growth?

- The global Glass Interposers market is expected to grow due to rising demand for high-performance semiconductor packaging, including 2.5D and 3D IC architectures, and the increasing adoption of glass interposers in AI accelerators, data centers, and advanced networking applications. Additionally, advancements in Through-Glass Via (TGV) technology, panel-level packaging, and high-density interconnects are driving market expansion.

- Which was the leading segment in the global Glass Interposers market in terms of Product Type in 2024?

- 2D Glass Interposers segment was leading in the Glass Interposers market on the basis of component in 2024.

- What are some restraints for revenue growth of the global Glass Interposers market?

- Revenue growth in the global Glass Interposers market is restrained by high manufacturing costs, complex fabrication processes, and technical challenges associated with Through-Glass Via (TGV) formation and panel-level integration. Additionally, limited standardization and dependency on advanced semiconductor foundries may slow widespread adoption.

Follow us on: Facebook, Twitter, Instagram and LinkedIn.

Chapter 1. Introduction

1.1. Market Definition

1.2. Objectives of the study

1.3. Overview of Global Glass Interposers Market Market

1.4. Currency and pricing

1.5. Limitation

1.6. Market s covered

1.7. Research Scope

Chapter 2. Research Methodology

2.1. Research Sources

2.1.1. Primary

2.1.2. Secondary

2.1.3. Paid Sources

2.2. Years considered for the study

2.3. Assumptions

2.3.1. Market value

2.3.2. Market volume

2.3.3. Exchange rate

2.3.4. Price

2.3.5. Economic & political stability

Chapter 3. Executive Summary

3.1. Summary Snapshot, 2019–2032

Chapter 4. Key Insights

4.1. Production consumption analysis

4.2. Strategic partnerships & alliances

4.3. Joint ventures

4.4. Acquisition of local players

4.5. Contract manufacturing

4.6. Digital & e-commerce sales channels

4.7. Compliance with standards

4.8. Value chain analysis

4.9. Raw material sourcing

4.10. Formulation & manufacturing4.11.Distribution & retail

4.12. Import-export analysis

4.13. Brand comparative analysis

4.14. Technological advancements

4.15. Porter’s five force

4.16. Threat of new entrants

4.16.1.1. Capital requirment

4.16.1.2. Product knowledge

4.16.1.3. Technical knowledge

4.16.1.4. Customer relation

4.16.1.5. Access to appliation and technology

4.16.2. Threat of substitutes

4.16.2.1. Cost

4.16.2.2. Performance

4.16.2.3. Availability

4.16.2.4. Technical knowledge

4.16.2.5. Durability

4.16.3. Bargainning power of buyers

4.16.3.1. Numbers of buyers relative to suppliers

4.16.3.2. Product differentiation

4.16.3.3. Threat of forward integration

4.16.3.4. Buyers volume

4.16.4. Bargainning power of suppliers

4.16.4.1. Suppliers concentration

4.16.4.2. Buyers switching cost to other suppliers

4.16.4.3. Threat of backward integration

4.16.5. Bargainning power of suppliers

4.16.5.1. Industry concentration

4.16.5.2. Industry growth rate

4.16.5.3. Product differentiation

4.17. Patent analysis

4.18. Regulation coverage

4.19. Pricing analysis

4.20. Competitive Metric Space Analysis

Chapter 5. Market Overview

5.1. Drivers

5.1.1. Rising demand for advanced semiconductor packaging

5.1.2. Miniaturization and higher I/O density requirements

5.1.3. Expansion of advanced consumer electronics and automotive electronics

5.2. Restraints

5.2.1. High manufacturing complexity and cost:

5.2.2. Limited large-scale production ecosystem

5.3. Opportunities

5.3.1. Emergence of chiplet-based architectures

5.3.2. 5G, AI, and advanced networking applications

5.3.3. Panel-level packaging (PLP) adoption

5.4. Challenges

5.4.1. Mechanical fragility and handling issues

5.4.2. Competition from alternative technologies

Chapter 6. Global Glass Interposers Market By Product Type Insights & Trends, Revenue (USD Million)

6.1. Product Type Dynamics & Market Share, 2019–2032

6.1.1. 2D Glass Interposers

6.1.2. 2.5D Glass Interposers

6.1.3. 3D Glass Interposers

Chapter 7. Global Glass Interposers Market By Technology Insights & Trends, Revenue (USD

Million)

7.1. Technology Dynamics & Market Share, 2019–2032

7.1.1. Through-Glass Via (TGV)

7.1.2. Redistribution Layer (RDL)

7.1.3. Panel-Level Packaging (PLP)

Chapter 8. Global Glass Interposers Market By Manufacturing Process Insights & Trends,

Revenue (USD Million)

8.1. Manufacturing Process Dynamics & Market Share, 2019–2032

8.1.1. Photolithography

8.1.2. Laser Ablation

8.1.3. Chemical Etching

8.1.4. CVD & Deposition Processes

Chapter 9. Global Glass Interposers Market By Wafer / Panel Size Insights & Trends, Revenue

(USD Million)

9.1. Wafer / Panel Size Dynamics & Market Share, 2019–2032

9.1.1. ≤200 mm

9.1.2. 300 mm

9.1.3. Large Panel-Level Glass

Chapter 10. Global Glass Interposers Market By Performance Requirement Insights & Trends, Revenue (USD Million)

10.1. Performance Requirement Dynamics & Market Share, 2019–2032

10.1.1. High I/O Density

10.1.2. High-Frequency / Low-Loss

10.1.3. Thermal Stability

Chapter 11. Global Glass Interposers Market By Application Insights & Trends, Revenue (USD

Million)

11.1. Application Size Dynamics & Market Share, 2019–2032

11.1.1. 2.5D IC Packaging

11.1.2. 3D IC Packaging

11.1.3. Chiplet Integration

11.1.4. Fan-Out Packaging

11.1.5. RF & mmWave Modules

Chapter 12. Global Glass Interposers Market By End Use Insights & Trends, Revenue (USD

Million)

12.1. End Use Size Dynamics & Market Share, 2019–2032

12.1.1. Consumer Electronics

12.1.2. Telecommunications & 5G

12.1.3. Data Centers & High-Performance Computing (HPC)

12.1.4. Automotive (ADAS & Infotainment)

12.1.5. Aerospace & Defense

12.1.6. Healthcare & Medical Devices

Chapter 13. Global Glass Interposers Market Market Regional Outlook

13.1. Glass Interposers Market Share By Region, 2019–2032

13.2. North America

13.2.1. North America Market By Product Type Insights & Trends, Revenue (USD

Million)

13.2.1.1. 2D Glass Interposers

13.2.1.2. 2.5D Glass Interposers

13.2.1.3. 3D Glass Interposers

13.2.2. North America Glass Interposers Market By Technology Insights & Trends,

Revenue (USD Million)

13.2.2.1. Through-Glass Via (TGV)

13.2.2.2. Redistribution Layer (RDL)

13.2.2.3. Panel-Level Packaging (PLP)

13.2.3. North America Glass Interposers Market By Manufacturing Process Insights &

Trends, Revenue (USD Million)

13.2.3.1. Photolithography

13.2.3.2. Laser Ablation

13.2.3.3. Chemical Etching

13.2.3.4. CVD & Deposition Processes

13.2.4. North America Glass Interposers Market By Wafer / Panel Size Insights &

Trends, Revenue (USD Million)

13.2.4.1. ≤200 mm

13.2.4.2. 300 mm

13.2.4.3. Large Panel-Level Glass

13.2.5. North America Glass Interposers Market By Technology Insights & Trends,

Revenue (USD Million)

13.2.5.1. HNSW / Graph ANN

13.2.5.2. IVF / PQ (product quantization)

13.2.5.3. Brute-force / exact (GPU accelerated)

13.2.5.4. Sparse vs dense vector support

13.2.5.5. Vector + graph hybrid databases

13.2.6. North America Glass Interposers Market By Performance Requirement Insights

& Trends, Revenue (USD Million)

13.2.6.1. High I/O Density

13.2.6.2. High-Frequency / Low-Loss

13.2.6.3. Thermal Stability

13.2.7. North America Glass Interposers Market By Application Insights & Trends,

Revenue (USD Million)

13.2.7.1. 2.5D IC Packaging

13.2.7.2. 3D IC Packaging

13.2.7.3. Chiplet Integration

13.2.7.4. Fan-Out Packaging

13.2.7.5. RF & mmWave Modules

13.2.8. North America Glass Interposers Market By End Use Insights & Trends,

Revenue (USD Million)

13.2.8.1. Consumer Electronics

13.2.8.2. Telecommunications & 5G

13.2.8.3. Data Centers & High-Performance Computing (HPC)

13.2.8.4. Automotive (ADAS & Infotainment)

13.2.8.5. Aerospace & Defense

13.2.8.6. Healthcare & Medical Devices

13.2.9. North America Market By Country, Market Estimates and Forecast, USD

Million, 2025-2032

13.2.9.1. US

13.2.9.2. Canada

13.2.9.3. Mexico

13.3. Europe

13.3.1. Europe Market By Product Type Insights & Trends, Revenue (USD Million)

13.3.1.1. 2D Glass Interposers

13.3.1.2. 2.5D Glass Interposers

13.3.1.3. 3D Glass Interposers

13.3.2. Europe Glass Interposers Market By Technology Insights & Trends, Revenue

(USD Million)

13.3.2.1. Through-Glass Via (TGV)

13.3.2.2. Redistribution Layer (RDL)

13.3.2.3. Panel-Level Packaging (PLP)

13.3.3. Europe Glass Interposers Market By Manufacturing Process Insights & Trends,

Revenue (USD Million)

13.3.3.1. Photolithography

13.3.3.2. Laser Ablation

13.3.3.3. Chemical Etching

13.3.3.4. CVD & Deposition Processes

13.3.4. Europe Glass Interposers Market By Wafer / Panel Size Insights & Trends,

Revenue (USD Million)

13.3.4.1. ≤200 mm

13.3.4.2. 300 mm

13.3.4.3. Large Panel-Level Glass

13.3.5. Europe Glass Interposers Market By Technology Insights & Trends, Revenue

(USD Million)

13.3.5.1. HNSW / Graph ANN

13.3.5.2. IVF / PQ (product quantization)

13.3.5.3. Brute-force / exact (GPU accelerated)

13.3.5.4. Sparse vs dense vector support

13.3.5.5. Vector + graph hybrid databases

13.3.6. Europe Glass Interposers Market By Performance Requirement Insights &

Trends, Revenue (USD Million)

13.3.6.1. High I/O Density

13.3.6.2. High-Frequency / Low-Loss

13.3.6.3. Thermal Stability

13.3.7. Europe Glass Interposers Market By Application Insights & Trends, Revenue

(USD Million)

13.3.7.1. 2.5D IC Packaging

13.3.7.2. 3D IC Packaging

13.3.7.3. Chiplet Integration

13.3.7.4. Fan-Out Packaging

13.3.7.5. RF & mmWave Modules

13.3.8. Europe Glass Interposers Market By End Use Insights & Trends, Revenue (USD

Million)

13.3.8.1. Consumer Electronics

13.3.8.2. Telecommunications & 5G

13.3.8.3. Data Centers & High-Performance Computing (HPC)

13.3.8.4. Automotive (ADAS & Infotainment)

13.3.8.5. Aerospace & Defense

13.3.8.6. Healthcare & Medical Devices

13.3.9. Europe Market By Country, Market Estimates and Forecast, USD Million,

13.3.9.1. Germany

13.3.9.2. France

13.3.9.3. U.K

13.3.9.4. Italy

13.3.9.5. Spain

13.3.9.6. Benelux

13.3.9.7. Russia

13.3.9.8. Finland

13.3.9.9. Sweden

13.3.9.10. Rest Of Europe

13.4. Asia-Pacific

13.4.1. Asia-Pacific Market By Product Type Insights & Trends, Revenue (USD Million)

13.4.1.1. 2D Glass Interposers

13.4.1.2. 2.5D Glass Interposers

13.4.1.3. 3D Glass Interposers

13.4.2. Asia-Pacific Glass Interposers Market By Technology Insights & Trends,

Revenue (USD Million)

13.4.2.1. Through-Glass Via (TGV)

13.4.2.2. Redistribution Layer (RDL)

13.4.2.3. Panel-Level Packaging (PLP)

13.4.3. Asia-Pacific Glass Interposers Market By Manufacturing Process Insights &

Trends, Revenue (USD Million)

13.4.3.1. Photolithography

13.4.3.2. Laser Ablation

13.4.3.3. Chemical Etching

13.4.3.4. CVD & Deposition Processes

13.4.4. Asia-Pacific Glass Interposers Market By Wafer / Panel Size Insights & Trends,

Revenue (USD Million)

13.4.4.1. ≤200 mm

13.4.4.2. 300 mm

13.4.4.3. Large Panel-Level Glass

13.4.5. Asia-Pacific Glass Interposers Market By Technology Insights & Trends,

Revenue (USD Million)

13.4.5.1. HNSW / Graph ANN

13.4.5.2. IVF / PQ (product quantization)

13.4.5.3. Brute-force / exact (GPU accelerated)

13.4.5.4. Sparse vs dense vector support

13.4.5.5. Vector + graph hybrid databases

13.4.6. Asia-Pacific Glass Interposers Market By Performance Requirement Insights &

Trends, Revenue (USD Million)

13.4.6.1. High I/O Density

13.4.6.2. High-Frequency / Low-Loss

13.4.6.3. Thermal Stability

13.4.7. Asia-Pacific Glass Interposers Market By Application Insights & Trends,

Revenue (USD Million)

13.4.7.1. 2.5D IC Packaging

13.4.7.2. 3D IC Packaging

13.4.7.3. Chiplet Integration

13.4.7.4. Fan-Out Packaging

13.4.7.5. RF & mmWave Modules

13.4.8. Asia-Pacific Glass Interposers Market By End Use Insights & Trends, Revenue

(USD Million)

13.4.8.1. Consumer Electronics

13.4.8.2. Telecommunications & 5G

13.4.8.3. Data Centers & High-Performance Computing (HPC)

13.4.8.4. Automotive (ADAS & Infotainment)

13.4.8.5. Aerospace & Defense

13.4.8.6. Healthcare & Medical Devices

13.4.9. Asia-Pacific Market By Country, Market Estimates and Forecast, USD Million,

13.4.9.1. China

13.4.9.2. India

13.4.9.3. Japan

13.4.9.4. South Korea

13.4.9.5. Indonesia

13.4.9.6. Thailand

13.4.9.7. Vietnam

13.4.9.8. Australia

13.4.9.9. New Zeland

13.4.9.10. Rest of APAC

13.5. Latin America

13.5.1. Latin America Market By Product Type Insights & Trends, Revenue (USD

Million)

13.5.1.1. 2D Glass Interposers

13.5.1.2. 2.5D Glass Interposers

13.5.1.3. 3D Glass Interposers

13.5.2. Latin America Glass Interposers Market By Technology Insights & Trends,

Revenue (USD Million)

13.5.2.1. Through-Glass Via (TGV)

13.5.2.2. Redistribution Layer (RDL)

13.5.2.3. Panel-Level Packaging (PLP)

13.5.3. Latin America Glass Interposers Market By Manufacturing Process Insights &

Trends, Revenue (USD Million)

13.5.3.1. Photolithography

13.5.3.2. Laser Ablation

13.5.3.3. Chemical Etching

13.5.3.4. CVD & Deposition Processes

13.5.4. Latin America Glass Interposers Market By Wafer / Panel Size Insights &

Trends, Revenue (USD Million)

13.5.4.1. ≤200 mm

13.5.4.2. 300 mm

13.5.4.3. Large Panel-Level Glass

13.5.5. Latin America Glass Interposers Market By Technology Insights & Trends,

Revenue (USD Million)

13.5.5.1. HNSW / Graph ANN

13.5.5.2. IVF / PQ (product quantization)

13.5.5.3. Brute-force / exact (GPU accelerated)

13.5.5.4. Sparse vs dense vector support

13.5.5.5. Vector + graph hybrid databases

13.5.6. Latin America Glass Interposers Market By Performance Requirement Insights

& Trends, Revenue (USD Million)

13.5.6.1. High I/O Density

13.5.6.2. High-Frequency / Low-Loss

13.5.6.3. Thermal Stability

13.5.7. Latin America Glass Interposers Market By Application Insights & Trends,

Revenue (USD Million)

13.5.7.1. 2.5D IC Packaging

13.5.7.2. 3D IC Packaging

13.5.7.3. Chiplet Integration

13.5.7.4. Fan-Out Packaging

13.5.7.5. RF & mmWave Modules

13.5.8. Latin America Glass Interposers Market By End Use Insights & Trends,

Revenue (USD Million)

13.5.8.1. Consumer Electronics

13.5.8.2. Telecommunications & 5G

13.5.8.3. Data Centers & High-Performance Computing (HPC)

13.5.8.4. Automotive (ADAS & Infotainment)

13.5.8.5. Aerospace & Defense

13.5.8.6. Healthcare & Medical Devices

13.5.9. Latin America Market By Country, Market Estimates and Forecast, USD Million,

13.5.9.1. Brazil

13.5.9.2. Rest of LATAM

13.6. Middle East & Africa

13.6.1. Middle East & Africa Market By Product Type Insights & Trends, Revenue (USD

Million)

13.6.1.1. 2D Glass Interposers

13.6.1.2. 2.5D Glass Interposers

13.6.1.3. 3D Glass Interposers

13.6.2. Middle East & Africa Glass Interposers Market By Technology Insights &

Trends, Revenue (USD Million)

13.6.2.1. Through-Glass Via (TGV)

13.6.2.2. Redistribution Layer (RDL)

13.6.2.3. Panel-Level Packaging (PLP)

13.6.3. Middle East & Africa Glass Interposers Market By Manufacturing Process

Insights & Trends, Revenue (USD Million)

13.6.3.1. Photolithography

13.6.3.2. Laser Ablation

13.6.3.3. Chemical Etching

13.6.3.4. CVD & Deposition Processes

13.6.4. Middle East & Africa Glass Interposers Market By Wafer / Panel Size Insights &

Trends, Revenue (USD Million)

13.6.4.1. ≤200 mm

13.6.4.2. 300 mm

13.6.4.3. Large Panel-Level Glass

13.6.5. Middle East & Africa Glass Interposers Market By Technology Insights & Trends,

Revenue (USD Million)

13.6.5.1. HNSW / Graph ANN

13.6.5.2. IVF / PQ (product quantization)

13.6.5.3. Brute-force / exact (GPU accelerated)

13.6.5.4. Sparse vs dense vector support

13.6.5.5. Vector + graph hybrid databases

13.6.6. Middle East & Africa Glass Interposers Market By Performance Requirement

Insights & Trends, Revenue (USD Million)

13.6.6.1. High I/O Density

13.6.6.2. High-Frequency / Low-Loss

13.6.6.3. Thermal Stability

13.6.7. Middle East & Africa Glass Interposers Market By Application Insights & Trends,

Revenue (USD Million)

13.6.7.1. 2.5D IC Packaging

13.6.7.2. 3D IC Packaging

13.6.7.3. Chiplet Integration

13.6.7.4. Fan-Out Packaging

13.6.7.5. RF & mmWave Modules

13.6.8. Middle East & Africa Glass Interposers Market By End Use Insights & Trends,

Revenue (USD Million)

13.6.8.1. Consumer Electronics

13.6.8.2. Telecommunications & 5G

13.6.8.3. Data Centers & High-Performance Computing (HPC)

13.6.8.4. Automotive (ADAS & Infotainment)

13.6.8.5. Aerospace & Defense

13.6.8.6. Healthcare & Medical Devices

13.6.9. Middle East & Africa Market By Country, Market Estimates and Forecast, USD

Million,

13.6.9.1. Saudi Arabia

13.6.9.2. Rest of MEA

Chapter 14. Competitive Landscape

14.1. Market Revenue Share By Manufacturers

14.2. Mergers & Acquisitions

14.3. Competitor’s Positioning

14.4. Strategy Benchmarking

14.5. Vendor Landscape

14.6. Distributors

14.6.1.1. North America

14.6.1.2. Europe

14.6.1.3. Asia Pacific

14.6.1.4. Middle East & Africa

14.6.1.5. Latin America

Chapter 15. Company Profiles

15.1. Intel Corporation

15.1.1. Company Overview

15.1.2. Product & Service Offerings

15.1.3. Strategic Initiatives

15.1.4. Financials

15.1.5. Conclusion

15.2. Samsung Electronics Co., Ltd.

15.2.1. Company Overview

15.2.2. Product & Service Offerings

15.2.3. Strategic Initiatives

15.2.4. Financials

15.2.5. Conclusion

15.3. Taiwan Semiconductor Manufacturing Company (TSMC)

15.3.1. Company Overview

15.3.2. Product & Service Offerings

15.3.3. Strategic Initiatives

15.3.4. Financials

15.3.5. Conclusion

15.4. Advanced Semiconductor Engineering, Inc. (ASE Group)

15.4.1. Company Overview

15.4.2. Product & Service Offerings

15.4.3. Strategic Initiatives

15.4.4. Financials

15.4.5. Conclusion

15.5. Amkor Technology, Inc.

15.5.1. Company Overview

15.5.2. Product & Service Offerings

15.5.3. Strategic Initiatives

15.5.4. Financials

15.5.5. Conclusion

15.6. Corning Incorporated

15.6.1. Company Overview

15.6.2. Product & Service Offerings

15.6.3. Strategic Initiatives

15.6.4. Financials

15.6.5. Conclusion

15.7. SCHOTT AG

15.7.1. Company Overview

15.7.2. Product & Service Offerings

15.7.3. Strategic Initiatives

15.7.4. Financials

15.7.5. Conclusion

15.8. AGC Inc.

15.8.1. Company Overview

15.8.2. Product & Service Offerings

15.8.3. Strategic Initiatives

15.8.4. Financials

15.8.5. Conclusion

15.9. SK hynix Inc.

15.9.1. Company Overview

15.9.2. Product & Service Offerings

15.9.3. Strategic Initiatives

15.9.4. Financials

15.9.5. Conclusion

15.10. Micron Technology, Inc.

15.10.1. Company Overview

15.10.2. Product & Service Offerings

15.10.3. Strategic Initiatives

15.10.4. Financials

15.10.5. Conclusion

15.11. Applied Materials, Inc.

15.11.1. Company Overview

15.11.2. Product & Service Offerings

15.11.3. Strategic Initiatives

15.11.4. Financials

15.11.5. Conclusion

15.12. Lam Research Corporation

15.12.1. Company Overview

15.12.2. Product & Service Offerings

15.12.3. Strategic Initiatives

15.12.4. Financials

15.12.5. Conclusion

15.13. Tokyo Electron Limited

15.13.1. Company Overview

15.13.2. Product & Service Offerings

15.13.3. Strategic Initiatives

15.13.4. Financials

15.13.5. Conclusion

15.14. KLA Corporation

15.14.1. Company Overview

15.14.2. Product & Service Offerings

15.14.3. Strategic Initiatives

15.14.4. Financials

15.14.5. Conclusion

15.15. DISCO Corporation

15.15.1. Company Overview

15.15.2. Product & Service Offerings

15.15.3. Strategic Initiatives

15.15.4. Financials

15.15.5. Conclusion

15.16. Canon Inc.

15.16.1. Company Overview

15.16.2. Product & Service Offerings

15.16.3. Strategic Initiatives

15.16.4. Financials

15.16.5. Conclusion

15.17. Entegris, Inc.

15.17.1. Company Overview

15.17.2. Product & Service Offerings

15.17.3. Strategic Initiatives

15.17.4. Financials

15.17.5. Conclusion

15.18. Fujifilm Holdings Corporation

15.18.1. Company Overview

15.18.2. Product & Service Offerings

15.18.3. Strategic Initiatives

15.18.4. Financials

15.18.5. Conclusion

15.19. Veeco Instruments Inc.

15.19.1. Company Overview

15.19.2. Product & Service Offerings

15.19.3. Strategic Initiatives

15.19.4. Financials

15.19.5. Conclusion

15.20. Onto Innovation Inc.

15.20.1. Company Overview

15.20.2. Product & Service Offerings

15.20.3. Strategic Initiatives

15.20.4. Financials

15.20.5. Conclusion

Segments Covered in Report

For the purpose of this report, Advantia Business Consulting LLP has segmented Global Glass Interposers Market on the basis of By Product Type , By Technology, By Manufacturing Process , By Wafer / Panel Size, By Performance Requirement, By Application, By End Use and By region for 2019 to 2032

Global Glass Interposers Market Systems By Product Type Outlook (Revenue, USD Million)

- 2D Glass Interposers

- 2.5D Glass Interposers

- 3D Glass Interposers

Global Glass Interposers Market By Technology Outlook (Revenue, USD Million)

- Through-Glass Via (TGV)

- Redistribution Layer (RDL)

- Panel-Level Packaging (PLP)

Global Glass Interposers Market By Manufacturing Process (Revenue, USD Million)

- Photolithography

- Laser Ablation

- Chemical Etching

- CVD & Deposition Processes

Global Glass Interposers Market By Wafer / Panel Size Outlook, Revenue (USD Million)

- ≤200 mm

- 300 mm

- Large Panel-Level Glass

Global Glass Interposers Market By Performance Requirement Outlook, Revenue (USD Million)

- High I/O Density

- High-Frequency / Low-Loss

- Thermal Stability

Global Glass Interposers Market By Application Outlook, Revenue (USD Million)

- 2.5D IC Packaging

- 3D IC Packaging

- Chiplet Integration

- Fan-Out Packaging

- RF & mmWave Modules

Global Glass Interposers Market By End Use Outlook, Revenue (USD Million)

- Consumer Electronics

- Telecommunications & 5G

- Data Centers & High-Performance Computing (HPC)

- Automotive (ADAS & Infotainment)

- Aerospace & Defense

- Healthcare & Medical Devices

North America

North America Glass Interposers Market Systems By Product Type Outlook (Revenue, USD Million)

- 2D Glass Interposers

- 2.5D Glass Interposers

- 3D Glass Interposers

North America Glass Interposers Market By Technology Outlook (Revenue, USD Million)

- Through-Glass Via (TGV)

- Redistribution Layer (RDL)

- Panel-Level Packaging (PLP)

North America Glass Interposers Market By Manufacturing Process (Revenue, USD Million)

- Photolithography

- Laser Ablation

- Chemical Etching

- CVD & Deposition Processes

North America Glass Interposers Market By Wafer / Panel Size Outlook, Revenue (USD Million)

- ≤200 mm

- 300 mm

- Large Panel-Level Glass

North America Glass Interposers Market By Performance Requirement Outlook, Revenue (USD Million)

- High I/O Density

- High-Frequency / Low-Loss

- Thermal Stability

North America Glass Interposers Market By Application Outlook, Revenue (USD Million)

- 2.5D IC Packaging

- 3D IC Packaging

- Chiplet Integration

- Fan-Out Packaging

- RF & mmWave Modules

North America Glass Interposers Market By End Use Outlook, Revenue (USD Million)

- Consumer Electronics

- Telecommunications & 5G

- Data Centers & High-Performance Computing (HPC)

- Automotive (ADAS & Infotainment)

- Aerospace & Defense

- Healthcare & Medical Devices

U.S

U.S Glass Interposers Market Systems By Product Type Outlook (Revenue, USD Million)

- 2D Glass Interposers

- 2.5D Glass Interposers

- 3D Glass Interposers

U.S Glass Interposers Market By Technology Outlook (Revenue, USD Million)

- Through-Glass Via (TGV)

- Redistribution Layer (RDL)

- Panel-Level Packaging (PLP)

U.S Glass Interposers Market By Manufacturing Process (Revenue, USD Million)

- Photolithography

- Laser Ablation

- Chemical Etching

- CVD & Deposition Processes

U.S Glass Interposers Market By Wafer / Panel Size Outlook, Revenue (USD Million)

- ≤200 mm

- 300 mm

- Large Panel-Level Glass

U.S Glass Interposers Market By Performance Requirement Outlook, Revenue (USD Million)

- High I/O Density

- High-Frequency / Low-Loss

- Thermal Stability

U.S Glass Interposers Market By Application Outlook, Revenue (USD Million)

- 2.5D IC Packaging

- 3D IC Packaging

- Chiplet Integration

- Fan-Out Packaging

- RF & mmWave Modules

U.S Glass Interposers Market By End Use Outlook, Revenue (USD Million)

- Consumer Electronics

- Telecommunications & 5G

- Data Centers & High-Performance Computing (HPC)

- Automotive (ADAS & Infotainment)

- Aerospace & Defense

- Healthcare & Medical Devices

Canada

Canada Glass Interposers Market Systems By Product Type Outlook (Revenue, USD Million)

- 2D Glass Interposers

- 2.5D Glass Interposers

- 3D Glass Interposers

Canada Glass Interposers Market By Technology Outlook (Revenue, USD Million)

- Through-Glass Via (TGV)

- Redistribution Layer (RDL)

- Panel-Level Packaging (PLP)

Canada Glass Interposers Market By Manufacturing Process (Revenue, USD Million)

- Photolithography

- Laser Ablation

- Chemical Etching

- CVD & Deposition Processes

Canada Glass Interposers Market By Wafer / Panel Size Outlook, Revenue (USD Million)

- ≤200 mm

- 300 mm

- Large Panel-Level Glass

Canada Glass Interposers Market By Performance Requirement Outlook, Revenue (USD Million)

- High I/O Density

- High-Frequency / Low-Loss

- Thermal Stability

Canada Glass Interposers Market By Application Outlook, Revenue (USD Million)

- 2.5D IC Packaging

- 3D IC Packaging

- Chiplet Integration

- Fan-Out Packaging

- RF & mmWave Modules

Canada Glass Interposers Market By End Use Outlook, Revenue (USD Million)

- Consumer Electronics

- Telecommunications & 5G

- Data Centers & High-Performance Computing (HPC)

- Automotive (ADAS & Infotainment)

- Aerospace & Defense

- Healthcare & Medical Devices

Mexico

Mexico Glass Interposers Market Systems By Product Type Outlook (Revenue, USD Million)

- 2D Glass Interposers

- 2.5D Glass Interposers

- 3D Glass Interposers

Mexico Glass Interposers Market By Technology Outlook (Revenue, USD Million)

- Through-Glass Via (TGV)

- Redistribution Layer (RDL)

- Panel-Level Packaging (PLP)

Mexico Glass Interposers Market By Manufacturing Process (Revenue, USD Million)

- Photolithography

- Laser Ablation

- Chemical Etching

- CVD & Deposition Processes

Mexico Glass Interposers Market By Wafer / Panel Size Outlook, Revenue (USD Million)

- ≤200 mm

- 300 mm

- Large Panel-Level Glass

Mexico Glass Interposers Market By Performance Requirement Outlook, Revenue (USD Million)

- High I/O Density

- High-Frequency / Low-Loss

- Thermal Stability

Mexico Glass Interposers Market By Application Outlook, Revenue (USD Million)

- 2.5D IC Packaging

- 3D IC Packaging

- Chiplet Integration

- Fan-Out Packaging

- RF & mmWave Modules

Mexico Glass Interposers Market By End Use Outlook, Revenue (USD Million)

- Consumer Electronics

- Telecommunications & 5G

- Data Centers & High-Performance Computing (HPC)

- Automotive (ADAS & Infotainment)

- Aerospace & Defense

- Healthcare & Medical Devices

Europe

Europe Glass Interposers Market Systems By Product Type Outlook (Revenue, USD Million)

- 2D Glass Interposers

- 2.5D Glass Interposers

- 3D Glass Interposers

Europe Glass Interposers Market By Technology Outlook (Revenue, USD Million)

- Through-Glass Via (TGV)

- Redistribution Layer (RDL)

- Panel-Level Packaging (PLP)

Europe Glass Interposers Market By Manufacturing Process (Revenue, USD Million)

- Photolithography

- Laser Ablation

- Chemical Etching

- CVD & Deposition Processes

Europe Glass Interposers Market By Wafer / Panel Size Outlook, Revenue (USD Million)

- ≤200 mm

- 300 mm

- Large Panel-Level Glass

Europe Glass Interposers Market By Performance Requirement Outlook, Revenue (USD Million)

- High I/O Density

- High-Frequency / Low-Loss

- Thermal Stability

Europe Glass Interposers Market By Application Outlook, Revenue (USD Million)

- 2.5D IC Packaging

- 3D IC Packaging

- Chiplet Integration

- Fan-Out Packaging

- RF & mmWave Modules

Europe Glass Interposers Market By End Use Outlook, Revenue (USD Million)

- Consumer Electronics

- Telecommunications & 5G

- Data Centers & High-Performance Computing (HPC)

- Automotive (ADAS & Infotainment)

- Aerospace & Defense

- Healthcare & Medical Devices

Germany

Germany Glass Interposers Market Systems By Product Type Outlook (Revenue, USD Million)

- 2D Glass Interposers

- 2.5D Glass Interposers

- 3D Glass Interposers

Germany Glass Interposers Market By Technology Outlook (Revenue, USD Million)

- Through-Glass Via (TGV)

- Redistribution Layer (RDL)

- Panel-Level Packaging (PLP)

Germany Glass Interposers Market By Manufacturing Process (Revenue, USD Million)

- Photolithography

- Laser Ablation

- Chemical Etching

- CVD & Deposition Processes

Germany Glass Interposers Market By Wafer / Panel Size Outlook, Revenue (USD Million)

- ≤200 mm

- 300 mm

- Large Panel-Level Glass

Germany Glass Interposers Market By Performance Requirement Outlook, Revenue (USD Million)

- High I/O Density

- High-Frequency / Low-Loss

- Thermal Stability

Germany Glass Interposers Market By Application Outlook, Revenue (USD Million)

- 2.5D IC Packaging

- 3D IC Packaging

- Chiplet Integration

- Fan-Out Packaging

- RF & mmWave Modules

Germany Glass Interposers Market By End Use Outlook, Revenue (USD Million)

- Consumer Electronics

- Telecommunications & 5G

- Data Centers & High-Performance Computing (HPC)

- Automotive (ADAS & Infotainment)

- Aerospace & Defense

- Healthcare & Medical Devices

France

France Glass Interposers Market Systems By Product Type Outlook (Revenue, USD Million)

- 2D Glass Interposers

- 2.5D Glass Interposers

- 3D Glass Interposers

France Glass Interposers Market By Technology Outlook (Revenue, USD Million)

- Through-Glass Via (TGV)

- Redistribution Layer (RDL)

- Panel-Level Packaging (PLP)

France Glass Interposers Market By Manufacturing Process (Revenue, USD Million)

- Photolithography

- Laser Ablation

- Chemical Etching

- CVD & Deposition Processes

France Glass Interposers Market By Wafer / Panel Size Outlook, Revenue (USD Million)

- ≤200 mm

- 300 mm

- Large Panel-Level Glass

France Glass Interposers Market By Performance Requirement Outlook, Revenue (USD Million)

- High I/O Density

- High-Frequency / Low-Loss

- Thermal Stability

France Glass Interposers Market By Application Outlook, Revenue (USD Million)

- 2.5D IC Packaging

- 3D IC Packaging

- Chiplet Integration

- Fan-Out Packaging

- RF & mmWave Modules

France Glass Interposers Market By End Use Outlook, Revenue (USD Million)

- Consumer Electronics

- Telecommunications & 5G

- Data Centers & High-Performance Computing (HPC)

- Automotive (ADAS & Infotainment)

- Aerospace & Defense

- Healthcare & Medical Devices

Italy

Italy Glass Interposers Market Systems By Product Type Outlook (Revenue, USD Million)

- 2D Glass Interposers

- 2.5D Glass Interposers

- 3D Glass Interposers

Italy Glass Interposers Market By Technology Outlook (Revenue, USD Million)

- Through-Glass Via (TGV)

- Redistribution Layer (RDL)

- Panel-Level Packaging (PLP)

Italy Glass Interposers Market By Manufacturing Process (Revenue, USD Million)

- Photolithography

- Laser Ablation

- Chemical Etching

- CVD & Deposition Processes

Italy Glass Interposers Market By Wafer / Panel Size Outlook, Revenue (USD Million)

- ≤200 mm

- 300 mm

- Large Panel-Level Glass

Italy Glass Interposers Market By Performance Requirement Outlook, Revenue (USD Million)

- High I/O Density

- High-Frequency / Low-Loss

- Thermal Stability

Italy Glass Interposers Market By Application Outlook, Revenue (USD Million)

- 2.5D IC Packaging

- 3D IC Packaging

- Chiplet Integration

- Fan-Out Packaging

- RF & mmWave Modules

Italy Glass Interposers Market By End Use Outlook, Revenue (USD Million)

- Consumer Electronics

- Telecommunications & 5G

- Data Centers & High-Performance Computing (HPC)

- Automotive (ADAS & Infotainment)

- Aerospace & Defense

- Healthcare & Medical Devices

U.K

U.K Glass Interposers Market Systems By Product Type Outlook (Revenue, USD Million)

- 2D Glass Interposers

- 2.5D Glass Interposers

- 3D Glass Interposers

U.K Glass Interposers Market By Technology Outlook (Revenue, USD Million)

- Through-Glass Via (TGV)

- Redistribution Layer (RDL)

- Panel-Level Packaging (PLP)

U.K Glass Interposers Market By Manufacturing Process (Revenue, USD Million)

- Photolithography

- Laser Ablation

- Chemical Etching

- CVD & Deposition Processes

U.K Glass Interposers Market By Wafer / Panel Size Outlook, Revenue (USD Million)

- ≤200 mm

- 300 mm

- Large Panel-Level Glass

U.K Glass Interposers Market By Performance Requirement Outlook, Revenue (USD Million)

- High I/O Density

- High-Frequency / Low-Loss

- Thermal Stability

U.K Glass Interposers Market By Application Outlook, Revenue (USD Million)

- 2.5D IC Packaging

- 3D IC Packaging

- Chiplet Integration

- Fan-Out Packaging

- RF & mmWave Modules

U.K Glass Interposers Market By End Use Outlook, Revenue (USD Million)

- Consumer Electronics

- Telecommunications & 5G

- Data Centers & High-Performance Computing (HPC)

- Automotive (ADAS & Infotainment)

- Aerospace & Defense

- Healthcare & Medical Devices

Benelux

Benelux Glass Interposers Market Systems By Product Type Outlook (Revenue, USD Million)

- 2D Glass Interposers

- 2.5D Glass Interposers

- 3D Glass Interposers

Benelux Glass Interposers Market By Technology Outlook (Revenue, USD Million)

- Through-Glass Via (TGV)

- Redistribution Layer (RDL)

- Panel-Level Packaging (PLP)

Benelux Glass Interposers Market By Manufacturing Process (Revenue, USD Million)

- Photolithography

- Laser Ablation

- Chemical Etching

- CVD & Deposition Processes

Benelux Glass Interposers Market By Wafer / Panel Size Outlook, Revenue (USD Million)

- ≤200 mm

- 300 mm

- Large Panel-Level Glass

Benelux Glass Interposers Market By Performance Requirement Outlook, Revenue (USD Million)

- High I/O Density

- High-Frequency / Low-Loss

- Thermal Stability

Benelux Glass Interposers Market By Application Outlook, Revenue (USD Million)

- 2.5D IC Packaging

- 3D IC Packaging

- Chiplet Integration

- Fan-Out Packaging

- RF & mmWave Modules

Benelux Glass Interposers Market By End Use Outlook, Revenue (USD Million)

- Consumer Electronics

- Telecommunications & 5G

- Data Centers & High-Performance Computing (HPC)

- Automotive (ADAS & Infotainment)

- Aerospace & Defense

- Healthcare & Medical Devices

Russia

Russia Glass Interposers Market Systems By Product Type Outlook (Revenue, USD Million)

- 2D Glass Interposers

- 2.5D Glass Interposers

- 3D Glass Interposers

Russia Glass Interposers Market By Technology Outlook (Revenue, USD Million)

- Through-Glass Via (TGV)

- Redistribution Layer (RDL)

- Panel-Level Packaging (PLP)

Russia Glass Interposers Market By Manufacturing Process (Revenue, USD Million)

- Photolithography

- Laser Ablation

- Chemical Etching

- CVD & Deposition Processes

Russia Glass Interposers Market By Wafer / Panel Size Outlook, Revenue (USD Million)

- ≤200 mm

- 300 mm

- Large Panel-Level Glass

Russia Glass Interposers Market By Performance Requirement Outlook, Revenue (USD Million)

- High I/O Density

- High-Frequency / Low-Loss

- Thermal Stability

Russia Glass Interposers Market By Application Outlook, Revenue (USD Million)

- 2.5D IC Packaging

- 3D IC Packaging

- Chiplet Integration

- Fan-Out Packaging

- RF & mmWave Modules

Russia Glass Interposers Market By End Use Outlook, Revenue (USD Million)

- Consumer Electronics

- Telecommunications & 5G

- Data Centers & High-Performance Computing (HPC)

- Automotive (ADAS & Infotainment)

- Aerospace & Defense

- Healthcare & Medical Devices

Finland

Finland Glass Interposers Market Systems By Product Type Outlook (Revenue, USD Million)

- 2D Glass Interposers

- 2.5D Glass Interposers

- 3D Glass Interposers

Finland Glass Interposers Market By Technology Outlook (Revenue, USD Million)

- Through-Glass Via (TGV)

- Redistribution Layer (RDL)

- Panel-Level Packaging (PLP)

Finland Glass Interposers Market By Manufacturing Process (Revenue, USD Million)

- Photolithography

- Laser Ablation

- Chemical Etching

- CVD & Deposition Processes

Finland Glass Interposers Market By Wafer / Panel Size Outlook, Revenue (USD Million)

- ≤200 mm

- 300 mm

- Large Panel-Level Glass

Finland Glass Interposers Market By Performance Requirement Outlook, Revenue (USD Million)

- High I/O Density

- High-Frequency / Low-Loss

- Thermal Stability

Finland Glass Interposers Market By Application Outlook, Revenue (USD Million)

- 2.5D IC Packaging

- 3D IC Packaging

- Chiplet Integration

- Fan-Out Packaging

- RF & mmWave Modules

Finland Glass Interposers Market By End Use Outlook, Revenue (USD Million)

- Consumer Electronics

- Telecommunications & 5G

- Data Centers & High-Performance Computing (HPC)

- Automotive (ADAS & Infotainment)

- Aerospace & Defense

- Healthcare & Medical Devices

Sweden

Sweden Glass Interposers Market Systems By Product Type Outlook (Revenue, USD Million)

- 2D Glass Interposers

- 2.5D Glass Interposers

- 3D Glass Interposers

Sweden Glass Interposers Market By Technology Outlook (Revenue, USD Million)

- Through-Glass Via (TGV)

- Redistribution Layer (RDL)

- Panel-Level Packaging (PLP)

Sweden Glass Interposers Market By Manufacturing Process (Revenue, USD Million)

- Photolithography

- Laser Ablation

- Chemical Etching

- CVD & Deposition Processes

Sweden Glass Interposers Market By Wafer / Panel Size Outlook, Revenue (USD Million)

- ≤200 mm

- 300 mm

- Large Panel-Level Glass

Sweden Glass Interposers Market By Performance Requirement Outlook, Revenue (USD Million)

- High I/O Density

- High-Frequency / Low-Loss

- Thermal Stability

Sweden Glass Interposers Market By Application Outlook, Revenue (USD Million)

- 2.5D IC Packaging

- 3D IC Packaging

- Chiplet Integration

- Fan-Out Packaging

- RF & mmWave Modules

Sweden Glass Interposers Market By End Use Outlook, Revenue (USD Million)

- Consumer Electronics

- Telecommunications & 5G

- Data Centers & High-Performance Computing (HPC)

- Automotive (ADAS & Infotainment)

- Aerospace & Defense

- Healthcare & Medical Devices

Rest of Europe

Rest of Europe Glass Interposers Market Systems By Product Type Outlook (Revenue, USD Million)

- 2D Glass Interposers

- 2.5D Glass Interposers

- 3D Glass Interposers

Rest of Europe Glass Interposers Market By Technology Outlook (Revenue, USD Million)

- Through-Glass Via (TGV)

- Redistribution Layer (RDL)

- Panel-Level Packaging (PLP)

Rest of Europe Glass Interposers Market By Manufacturing Process (Revenue, USD Million)

- Photolithography

- Laser Ablation

- Chemical Etching

- CVD & Deposition Processes

Rest of Europe Glass Interposers Market By Wafer / Panel Size Outlook, Revenue (USD Million)

- ≤200 mm

- 300 mm

- Large Panel-Level Glass

Rest of Europe Glass Interposers Market By Performance Requirement Outlook, Revenue (USD Million)

- High I/O Density

- High-Frequency / Low-Loss

- Thermal Stability

Rest of Europe Glass Interposers Market By Application Outlook, Revenue (USD Million)

- 2.5D IC Packaging

- 3D IC Packaging

- Chiplet Integration

- Fan-Out Packaging

- RF & mmWave Modules

Rest of Europe Glass Interposers Market By End Use Outlook, Revenue (USD Million)

- Consumer Electronics

- Telecommunications & 5G

- Data Centers & High-Performance Computing (HPC)

- Automotive (ADAS & Infotainment)

- Aerospace & Defense

- Healthcare & Medical Devices

Asia-Pacific

Asia-Pacific Glass Interposers Market Systems By Product Type Outlook (Revenue, USD Million)

- 2D Glass Interposers

- 2.5D Glass Interposers

- 3D Glass Interposers

Asia-Pacific Glass Interposers Market By Technology Outlook (Revenue, USD Million)

- Through-Glass Via (TGV)

- Redistribution Layer (RDL)

- Panel-Level Packaging (PLP)

Asia-Pacific Glass Interposers Market By Manufacturing Process (Revenue, USD Million)

- Photolithography

- Laser Ablation

- Chemical Etching

- CVD & Deposition Processes

Asia-Pacific Glass Interposers Market By Wafer / Panel Size Outlook, Revenue (USD Million)

- ≤200 mm

- 300 mm

- Large Panel-Level Glass

Asia-Pacific Glass Interposers Market By Performance Requirement Outlook, Revenue (USD Million)

- High I/O Density

- High-Frequency / Low-Loss

- Thermal Stability

Asia-Pacific Glass Interposers Market By Application Outlook, Revenue (USD Million)

- 2.5D IC Packaging

- 3D IC Packaging

- Chiplet Integration

- Fan-Out Packaging

- RF & mmWave Modules

Asia-Pacific Glass Interposers Market By End Use Outlook, Revenue (USD Million)

- Consumer Electronics

- Telecommunications & 5G

- Data Centers & High-Performance Computing (HPC)

- Automotive (ADAS & Infotainment)

- Aerospace & Defense

- Healthcare & Medical Devices

China

China Glass Interposers Market Systems By Product Type Outlook (Revenue, USD Million)

- 2D Glass Interposers

- 2.5D Glass Interposers

- 3D Glass Interposers

China Glass Interposers Market By Technology Outlook (Revenue, USD Million)

- Through-Glass Via (TGV)

- Redistribution Layer (RDL)

- Panel-Level Packaging (PLP)

China Glass Interposers Market By Manufacturing Process (Revenue, USD Million)

- Photolithography

- Laser Ablation

- Chemical Etching

- CVD & Deposition Processes

China Glass Interposers Market By Wafer / Panel Size Outlook, Revenue (USD Million)

- ≤200 mm

- 300 mm

- Large Panel-Level Glass

China Glass Interposers Market By Performance Requirement Outlook, Revenue (USD Million)

- High I/O Density

- High-Frequency / Low-Loss

- Thermal Stability

China Glass Interposers Market By Application Outlook, Revenue (USD Million)

- 2.5D IC Packaging

- 3D IC Packaging

- Chiplet Integration

- Fan-Out Packaging

- RF & mmWave Modules

China Glass Interposers Market By End Use Outlook, Revenue (USD Million)

- Consumer Electronics

- Telecommunications & 5G

- Data Centers & High-Performance Computing (HPC)

- Automotive (ADAS & Infotainment)

- Aerospace & Defense

- Healthcare & Medical Devices

India

India Glass Interposers Market Systems By Product Type Outlook (Revenue, USD Million)

- 2D Glass Interposers

- 2.5D Glass Interposers

- 3D Glass Interposers

India Glass Interposers Market By Technology Outlook (Revenue, USD Million)

- Through-Glass Via (TGV)

- Redistribution Layer (RDL)

- Panel-Level Packaging (PLP)

India Glass Interposers Market By Manufacturing Process (Revenue, USD Million)

- Photolithography

- Laser Ablation

- Chemical Etching

- CVD & Deposition Processes

India Glass Interposers Market By Wafer / Panel Size Outlook, Revenue (USD Million)

- ≤200 mm

- 300 mm

- Large Panel-Level Glass

India Glass Interposers Market By Performance Requirement Outlook, Revenue (USD Million)

- High I/O Density

- High-Frequency / Low-Loss

- Thermal Stability

India Glass Interposers Market By Application Outlook, Revenue (USD Million)

- 2.5D IC Packaging

- 3D IC Packaging

- Chiplet Integration

- Fan-Out Packaging

- RF & mmWave Modules

India Glass Interposers Market By End Use Outlook, Revenue (USD Million)

- Consumer Electronics

- Telecommunications & 5G

- Data Centers & High-Performance Computing (HPC)

- Automotive (ADAS & Infotainment)

- Aerospace & Defense

- Healthcare & Medical Devices

Japan

Japan Glass Interposers Market Systems By Product Type Outlook (Revenue, USD Million)

- 2D Glass Interposers

- 2.5D Glass Interposers

- 3D Glass Interposers

Japan Glass Interposers Market By Technology Outlook (Revenue, USD Million)

- Through-Glass Via (TGV)

- Redistribution Layer (RDL)

- Panel-Level Packaging (PLP)

Japan Glass Interposers Market By Manufacturing Process (Revenue, USD Million)

- Photolithography

- Laser Ablation

- Chemical Etching

- CVD & Deposition Processes

Japan Glass Interposers Market By Wafer / Panel Size Outlook, Revenue (USD Million)

- ≤200 mm

- 300 mm

- Large Panel-Level Glass

Japan Glass Interposers Market By Performance Requirement Outlook, Revenue (USD Million)

- High I/O Density

- High-Frequency / Low-Loss

- Thermal Stability

Japan Glass Interposers Market By Application Outlook, Revenue (USD Million)

- 2.5D IC Packaging

- 3D IC Packaging

- Chiplet Integration

- Fan-Out Packaging

- RF & mmWave Modules

Japan Glass Interposers Market By End Use Outlook, Revenue (USD Million)

- Consumer Electronics

- Telecommunications & 5G

- Data Centers & High-Performance Computing (HPC)

- Automotive (ADAS & Infotainment)

- Aerospace & Defense

- Healthcare & Medical Devices

Indonesia

Indonesia Glass Interposers Market Systems By Product Type Outlook (Revenue, USD Million)

- 2D Glass Interposers

- 2.5D Glass Interposers

- 3D Glass Interposers

Indonesia Glass Interposers Market By Technology Outlook (Revenue, USD Million)

- Through-Glass Via (TGV)

- Redistribution Layer (RDL)

- Panel-Level Packaging (PLP)

Indonesia Glass Interposers Market By Manufacturing Process (Revenue, USD Million)

- Photolithography

- Laser Ablation

- Chemical Etching

- CVD & Deposition Processes

Indonesia Glass Interposers Market By Wafer / Panel Size Outlook, Revenue (USD Million)

- ≤200 mm

- 300 mm

- Large Panel-Level Glass

Indonesia Glass Interposers Market By Performance Requirement Outlook, Revenue (USD Million)

- High I/O Density

- High-Frequency / Low-Loss

- Thermal Stability

Indonesia Glass Interposers Market By Application Outlook, Revenue (USD Million)

- 2.5D IC Packaging

- 3D IC Packaging

- Chiplet Integration

- Fan-Out Packaging

- RF & mmWave Modules

Indonesia Glass Interposers Market By End Use Outlook, Revenue (USD Million)

- Consumer Electronics

- Telecommunications & 5G

- Data Centers & High-Performance Computing (HPC)

- Automotive (ADAS & Infotainment)

- Aerospace & Defense

- Healthcare & Medical Devices

Thailand

Thailand Glass Interposers Market Systems By Product Type Outlook (Revenue, USD Million)

- 2D Glass Interposers

- 2.5D Glass Interposers

- 3D Glass Interposers

Thailand Glass Interposers Market By Technology Outlook (Revenue, USD Million)

- Through-Glass Via (TGV)

- Redistribution Layer (RDL)

- Panel-Level Packaging (PLP)

Thailand Glass Interposers Market By Manufacturing Process (Revenue, USD Million)

- Photolithography

- Laser Ablation

- Chemical Etching

- CVD & Deposition Processes

Thailand Glass Interposers Market By Wafer / Panel Size Outlook, Revenue (USD Million)

- ≤200 mm

- 300 mm

- Large Panel-Level Glass

Thailand Glass Interposers Market By Performance Requirement Outlook, Revenue (USD Million)

- High I/O Density

- High-Frequency / Low-Loss

- Thermal Stability

Thailand Glass Interposers Market By Application Outlook, Revenue (USD Million)

- 2.5D IC Packaging

- 3D IC Packaging

- Chiplet Integration

- Fan-Out Packaging

- RF & mmWave Modules

Thailand Glass Interposers Market By End Use Outlook, Revenue (USD Million)

- Consumer Electronics

- Telecommunications & 5G

- Data Centers & High-Performance Computing (HPC)

- Automotive (ADAS & Infotainment)

- Aerospace & Defense

- Healthcare & Medical Devices

Vietnam

Vietnam Glass Interposers Market Systems By Product Type Outlook (Revenue, USD Million)

- 2D Glass Interposers

- 2.5D Glass Interposers

- 3D Glass Interposers

Vietnam Glass Interposers Market By Technology Outlook (Revenue, USD Million)

- Through-Glass Via (TGV)

- Redistribution Layer (RDL)

- Panel-Level Packaging (PLP)

Vietnam Glass Interposers Market By Manufacturing Process (Revenue, USD Million)

- Photolithography

- Laser Ablation

- Chemical Etching

- CVD & Deposition Processes

Vietnam Glass Interposers Market By Wafer / Panel Size Outlook, Revenue (USD Million)

- ≤200 mm

- 300 mm

- Large Panel-Level Glass

Vietnam Glass Interposers Market By Performance Requirement Outlook, Revenue (USD Million)

- High I/O Density

- High-Frequency / Low-Loss

- Thermal Stability

Vietnam Glass Interposers Market By Application Outlook, Revenue (USD Million)

- 2.5D IC Packaging

- 3D IC Packaging

- Chiplet Integration

- Fan-Out Packaging

- RF & mmWave Modules

Vietnam Glass Interposers Market By End Use Outlook, Revenue (USD Million)

- Consumer Electronics

- Telecommunications & 5G

- Data Centers & High-Performance Computing (HPC)

- Automotive (ADAS & Infotainment)

- Aerospace & Defense

- Healthcare & Medical Devices

Australia

Australia Glass Interposers Market Systems By Product Type Outlook (Revenue, USD Million)

- 2D Glass Interposers

- 2.5D Glass Interposers

- 3D Glass Interposers

Australia Glass Interposers Market By Technology Outlook (Revenue, USD Million)

- Through-Glass Via (TGV)

- Redistribution Layer (RDL)

- Panel-Level Packaging (PLP)

Australia Glass Interposers Market By Manufacturing Process (Revenue, USD Million)

- Photolithography

- Laser Ablation

- Chemical Etching

- CVD & Deposition Processes

Australia Glass Interposers Market By Wafer / Panel Size Outlook, Revenue (USD Million)

- ≤200 mm

- 300 mm

- Large Panel-Level Glass

Australia Glass Interposers Market By Performance Requirement Outlook, Revenue (USD Million)

- High I/O Density

- High-Frequency / Low-Loss

- Thermal Stability

Australia Glass Interposers Market By Application Outlook, Revenue (USD Million)

- 2.5D IC Packaging

- 3D IC Packaging

- Chiplet Integration

- Fan-Out Packaging

- RF & mmWave Modules

Australia Glass Interposers Market By End Use Outlook, Revenue (USD Million)

- Consumer Electronics

- Telecommunications & 5G

- Data Centers & High-Performance Computing (HPC)

- Automotive (ADAS & Infotainment)

- Aerospace & Defense

- Healthcare & Medical Devices

New Zealand

New Zealand Glass Interposers Market Systems By Product Type Outlook (Revenue, USD Million)

- 2D Glass Interposers

- 2.5D Glass Interposers

- 3D Glass Interposers

New Zealand Glass Interposers Market By Technology Outlook (Revenue, USD Million)

- Through-Glass Via (TGV)

- Redistribution Layer (RDL)

- Panel-Level Packaging (PLP)

New Zealand Glass Interposers Market By Manufacturing Process (Revenue, USD Million)

- Photolithography

- Laser Ablation

- Chemical Etching

- CVD & Deposition Processes