Market Synopsis

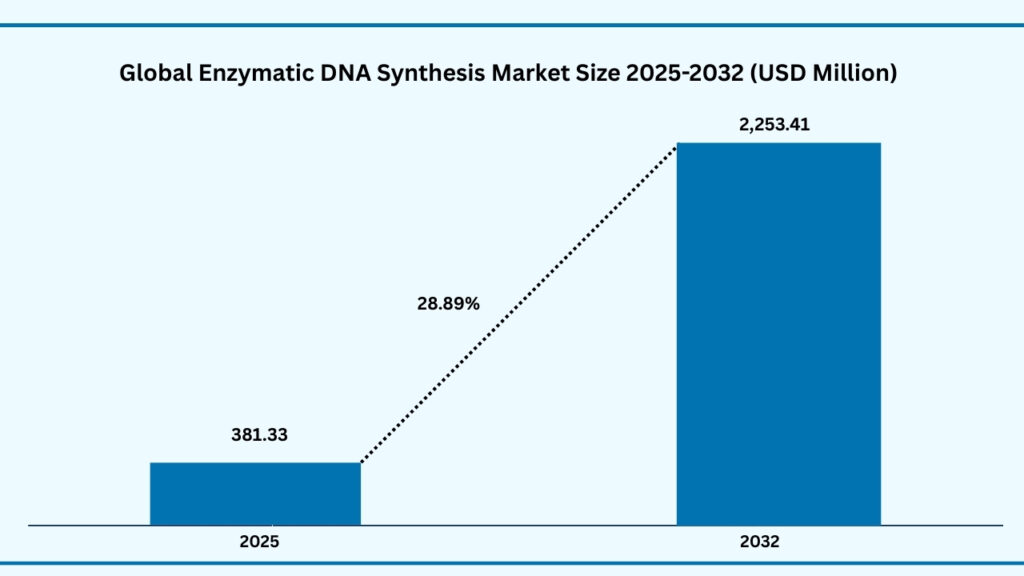

The global Enzymatic DNA synthesis market size was USD 295.86 million in 2024 and is expected to reach USD 2253.41 million during a forecast period from 2025-2032 at a CAGR of 28.89%. The global enzymatic DNA synthesis market is gaining strong momentum as demand rises for faster, more sustainable, and high-accuracy DNA assembly in synthetic biology, gene therapies, and diagnostics. Enzymatic methods, which avoid toxic chemicals and enable longer, high-fidelity sequences, are increasingly viewed as a next-generation alternative to traditional synthesis. North America leads adoption due to advanced R&D infrastructure, while Asia-Pacific is emerging as the fastest-growing region with expanding biotech investments. Although high costs and technical challenges in scaling remain restraints, advancements in automation, enzyme engineering, and benchtop platforms are helping overcome these barriers. Collectively, these trends position enzymatic DNA synthesis as a transformative technology shaping the future of biotechnology and personalized medicine.

Global Enzymatic DNA Synthesis Market (USD Million)

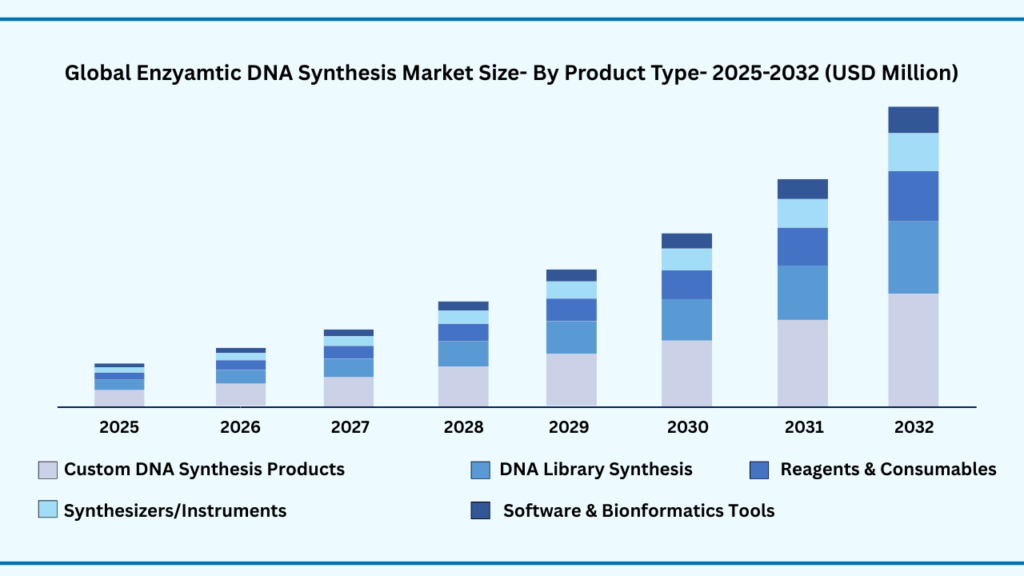

Global Enzymatic DNA Synthesis Market by Product Type Insights:

Custom DNA Synthesis Products segments accounted for 36.56% of share in 2024 in Global Enzymatic DNA Synthesis market.

The Custom DNA Synthesis Products segment holds the largest share of the global enzymatic DNA synthesis market, accounting for 36.56% in 2024, and is projected to expand at a CAGR of 29.02% during the forecast period from 2025 to 2032. Its market revenue is expected to reach USD 830.45 million by end of forecast period, driven by the growing demand for precision-designed DNA sequences across applications such as gene therapy, synthetic biology, diagnostics, and drug discovery. The increasing emphasis on personalized medicine and the ability to accelerate R&D workflows make this segment the backbone of the market, with companies heavily investing in innovation to enhance synthesis accuracy, turnaround time, and scalability.

Meanwhile, DNA Library Synthesis has gained strong momentum as researchers and pharmaceutical companies rely on large-scale, high-quality DNA libraries for applications in antibody discovery, protein engineering, and functional genomics. This segment benefits from expanding biopharma pipelines and the growing use of DNA libraries in drug screening and synthetic biology. Similarly, the Reagents and Consumables segment plays a critical supporting role, with consistent demand fueled by the recurring need for high-quality enzymes, nucleotides, and related consumables, ensuring reliability and efficiency in synthesis processes.

Instruments such as Synthesizers are seeing rising adoption as laboratories and research organizations seek automation and advanced platforms to streamline DNA synthesis workflows. Additionally, Software and Services are becoming integral in enabling design, error-checking, and analysis of complex DNA sequences, ensuring higher efficiency and reducing costs. Together, these segments reflect a dynamic and diversified market, with Custom DNA Synthesis Products driving scale, while complementary segments like DNA libraries, reagents, instruments, and software strengthen the ecosystem, underscoring the market’s robust growth trajectory.

Global Enzymatic DNA Synthesis Market, By Product Type (USD Million)

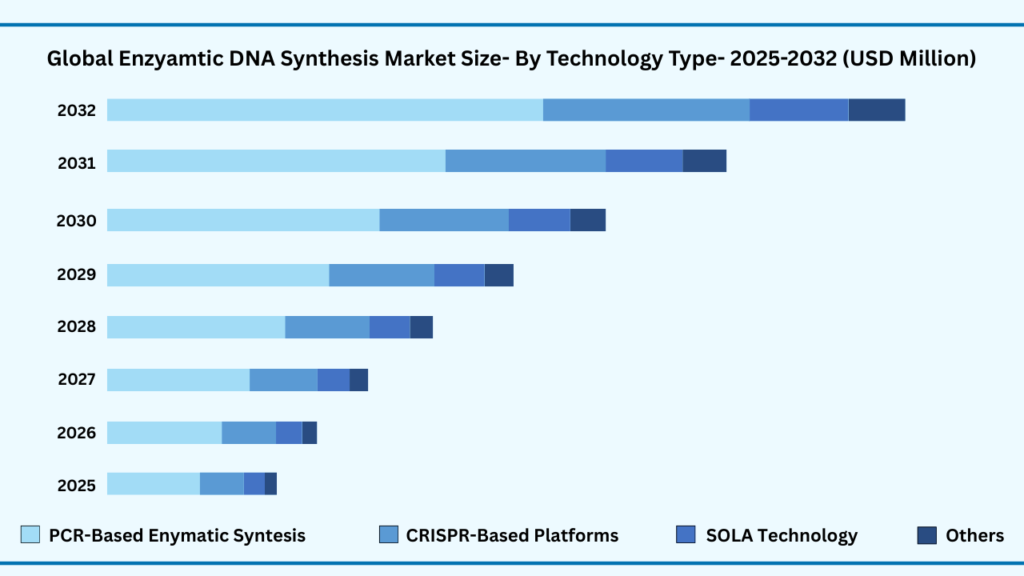

Global Enzymatic DNA Synthesis Market by Technology Type Insights:

PCRbased enzymatic synthesis segments accounted for 54.25% of share in 2024 in Global Enzymatic DNA Synthesis market.

The PCR-based enzymatic synthesis segment leads the global enzymatic DNA synthesis market, capturing 54.25% of the share in 2024, with revenues expected to reach USD 1,227.34 million by 2032 at a CAGR of 28.95% during the forecast from 2025 to 2032. Its dominance is attributed to its well-established role in amplifying DNA with high accuracy, scalability, and efficiency, making it indispensable in applications like molecular diagnostics, genetic engineering, and synthetic biology. The widespread adoption of PCR-driven platforms across academic, clinical, and industrial research ensures strong confidence among users, while ongoing innovations in high-fidelity enzymes and error-reduction methods further strengthen its position as the cornerstone of the market.

Beyond PCR, CRISPR-based platforms are rapidly gaining recognition for enabling highly precise DNA editing and synthesis capabilities. Their growing application in functional genomics, therapeutic development, and agricultural biotechnology highlights their transformative potential, though the segment is still evolving toward large-scale commercial adoption. Meanwhile, SOLA technology (Systems for Oligonucleotide Ligation and Assembly) has emerged as a valuable approach for constructing long DNA sequences with improved accuracy and reduced error rates, making it particularly attractive for synthetic biology and complex genome projects.

The Others category, which includes novel enzyme platforms and emerging proprietary chemistries, represents the cutting edge of innovation. These technologies are designed to overcome existing limitations such as synthesis length, fidelity, and speed, positioning them as strong candidates for next-generation applications. Together, these technology segments highlight how PCR maintains market leadership, while CRISPR, SOLA, and emerging chemistries collectively push the boundaries of what enzymatic DNA synthesis can achieve, driving the market’s dynamic growth path.

Global Enzymatic DNA Synthesis Market, By Technology Type (USD Million)

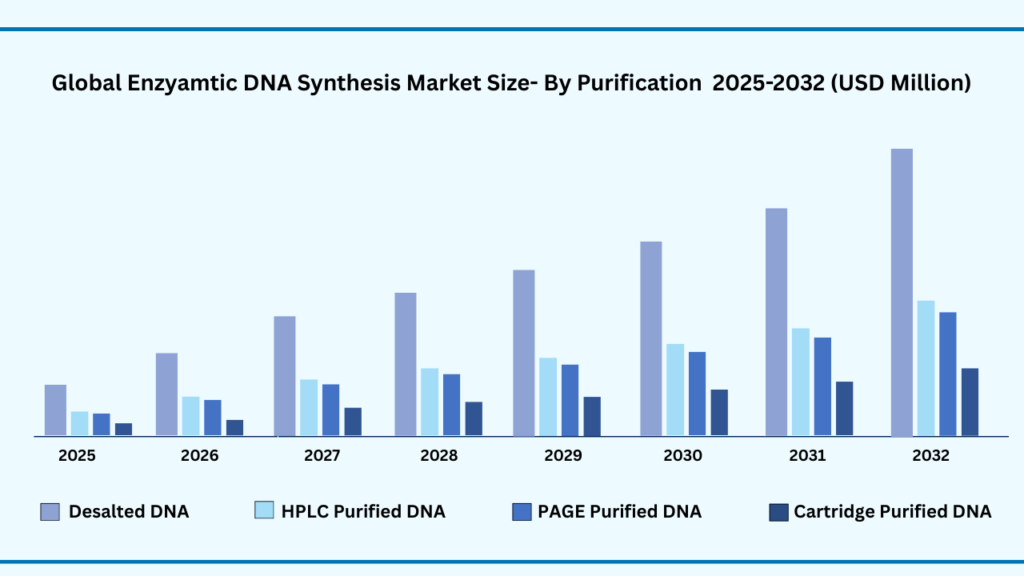

Global Enzymatic DNA Synthesis Market by Purification Insights:

Desalted DNA segments accounted for 49.91% of share in 2024 in Global Enzymatic DNA Synthesis market.

The global enzymatic DNA synthesis market by purification is segmented into Desalted DNA, HPLC Purified DNA, PAGE Purified DNA, and Cartridge Purified DNA. Among these, Desalted DNA dominates with a 49.91% share in 2024 and is projected to grow at a CAGR of 29.01% during the forecast from 2025 to 2032, reaching USD 1,132.89 million by end of the period. Its leadership stems from its cost-effectiveness and suitability for a wide range of routine applications in molecular biology, diagnostics, and cloning where ultra-high purity is not critical. The ease of large-scale production and accessibility make desalted DNA the preferred choice for researchers and industry players, ensuring its continued stronghold as the market’s foundation.

By contrast, HPLC Purified DNA plays a pivotal role in applications demanding higher precision, such as therapeutic research, gene editing, and advanced diagnostics. Its ability to deliver highly purified oligonucleotides supports its adoption in clinical-grade studies, though higher costs limit its widespread use compared to desalted DNA. Similarly, PAGE Purified DNA addresses the need for ultra-high purity in sensitive experiments like mutagenesis and sequencing, making it a niche but essential segment. Cartridge Purified DNA offers a balance between cost and quality, providing an efficient solution for mid-scale applications where moderate purification is sufficient.

Together, these purifications reflect a market dynamic where Desalted DNA anchors growth through accessibility and scalability, while HPLC, PAGE, and cartridge-based approaches drive innovation and reliability in specialized domains. As synthetic biology, precision medicine, and genomics continue to expand, these purification segments collectively ensure a versatile ecosystem, meeting both high-volume commercial needs and the stringent requirements of cutting-edge research.

Global Enzymatic DNA Synthesis Market, By Purification (USD Million)

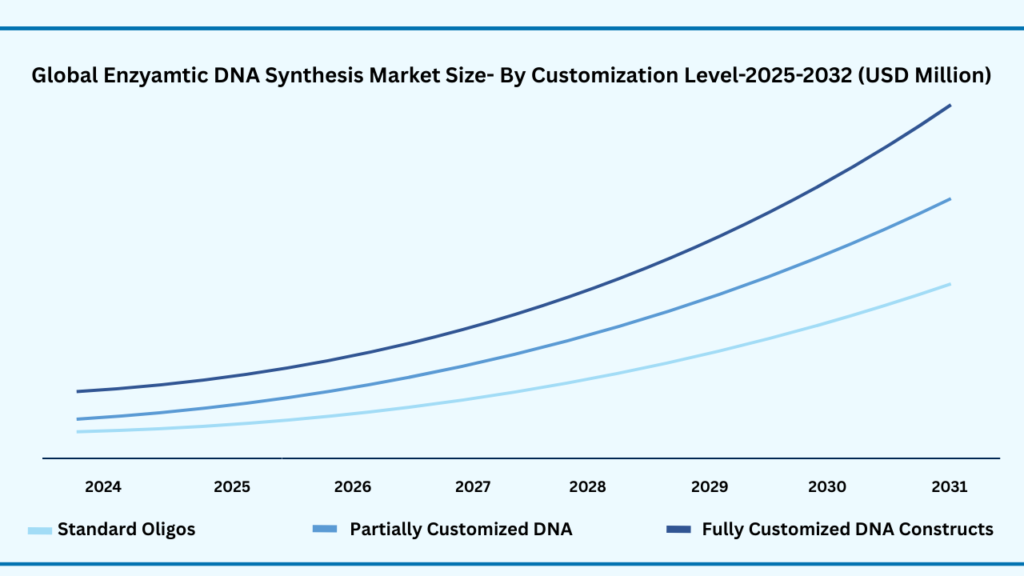

Global Enzymatic DNA Synthesis Market by Customization Level Insights:

Standard Oligos segments accounted for 48.98% of share in 2024 in Global Enzymatic DNA Synthesis market.

The global enzymatic DNA synthesis market by customization level is segmented into Standard Oligos, Partially Customized DNA, and Fully Customized DNA Constructs. Among these, Standard Oligos lead with a 48.98% share in 2024 and are expected to grow at a CAGR of 29.02% during the forecast period from 2025 to 2032, reaching USD 1,111.53 million by end of the period. This strong position is supported by their widespread use in academic research, diagnostics, PCR, sequencing, and routine laboratory workflows, where cost-efficiency and quick turnaround are critical. Standard oligos benefit from streamlined manufacturing, scalability, and broad accessibility, making them the most widely adopted product type and a cornerstone of the market’s rapid expansion.

In comparison, Partially Customized DNA caters to applications that require higher levels of specificity and functionality, such as targeted assays, probe development, and therapeutic research. This segment offers a balance between affordability and customization, allowing researchers to adapt oligos to unique experimental needs while avoiding the high costs of fully tailored constructs. Meanwhile, Fully Customized DNA Constructs represent the most advanced segment, designed for specialized uses in gene therapy, synthetic biology, and next-generation therapeutics. Although adoption is limited due to complexity and higher production costs, these constructs hold immense promise in driving innovation and enabling breakthroughs in precision medicine.

Together, these segments showcase a market dynamic where Standard Oligos remain the primary growth engine, while partially and fully customized DNA solutions push the boundaries of innovation. With rising demand for flexible, accurate, and scalable DNA synthesis tools, this segmentation highlights a balanced ecosystem serving both high-volume routine needs and cutting-edge research.

Global Enzymatic DNA synthesis Market, Customization Level (USD Million)

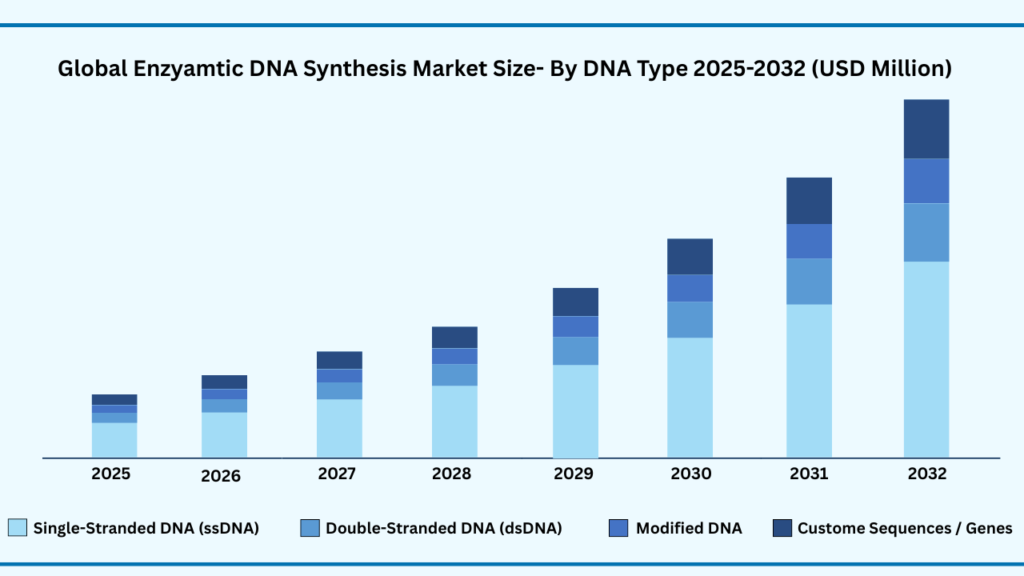

Global Enzymatic DNA Synthesis Market by DNA Type Insights:

Single-Stranded DNA (ssDNA) segments accounted for 52.65% of share in 2024 in Global Enzymatic DNA Synthesis market.

The global enzymatic DNA synthesis market, based on DNA type, is segmented into Single-Stranded DNA (ssDNA), Double-Stranded DNA (dsDNA), Modified DNA, and Custom Sequences/Genes. Among these, Single-Stranded DNA (ssDNA) leads with the largest share of 52.65% in 2024 and is projected to expand at a CAGR of 29.08% during forecast period from 2025 to 2032, reaching USD 1,200.80 million by end of the period. This dominance stems from the broad application of ssDNA in PCR, CRISPR-based editing, sequencing, and probe generation, where flexibility, ease of design, and rapid synthesis are crucial. Their adaptability to high-throughput workflows and compatibility with advanced molecular biology techniques makes ssDNA the preferred choice for both research and clinical applications, solidifying their position as the backbone of the market.

The growth of this segment is further accelerated by innovations in enzymatic synthesis that improve accuracy, yield, and length of ssDNA production. With increasing adoption in diagnostics, synthetic biology, and therapeutic development, ssDNA continues to gain traction as a cost-effective and scalable solution. While Double-Stranded DNA (dsDNA) offers higher stability and is vital for cloning, gene expression studies, and functional genomics, its uptake is more specialized compared to ssDNA. Similarly, Modified DNA, such as oligos with fluorescent labels or linkers, is growing steadily as demand rises for advanced molecular assays, imaging, and drug discovery. Custom Sequences/Genes form a niche yet transformative category, enabling precise applications in gene therapy, synthetic constructs, and biotechnology innovation.

Collectively, these segments highlight a dynamic and steadily advancing market landscape. ssDNA continues to be the primary revenue contributor, driven by its versatility and scalability, while dsDNA, modified DNA, and custom gene sequences are paving the way for more advanced and specialized applications in precision research and healthcare. This evolution reflects the market’s dual focus—making DNA synthesis more accessible for routine use while simultaneously driving innovation to support next-generation scientific and therapeutic breakthroughs.

Global Enzymatic DNA Synthesis Market, DNA Type (USD Million)

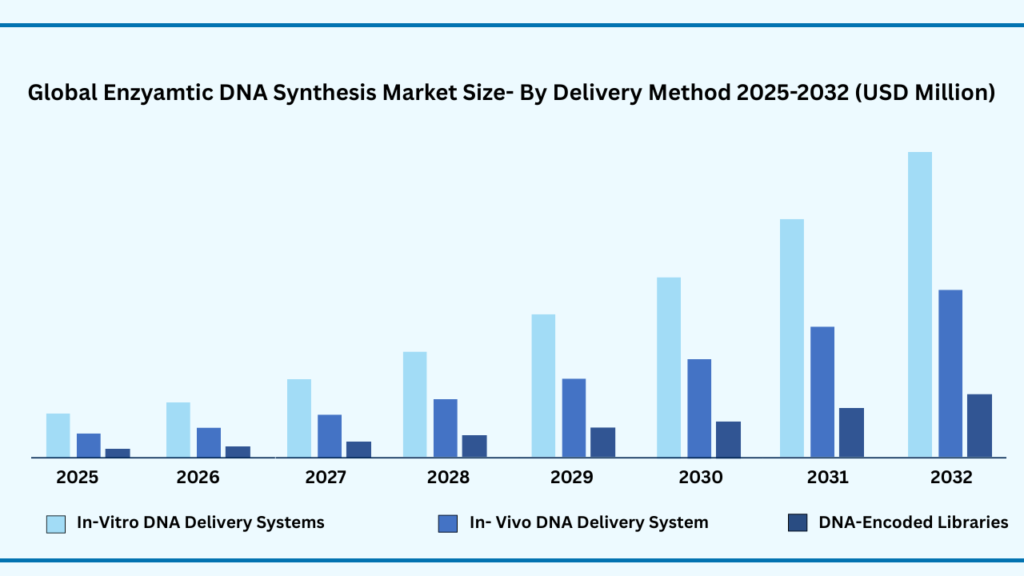

Global Enzymatic DNA Synthesis Market by Delivery Method Insights:

In-Vitro DNA Delivery Systems segments accounted for 56.87% of share in 2024 in Global Enzymatic DNA Synthesis market.

Based on delivery method, the global enzymatic DNA synthesis market is segmented into In-Vitro DNA Delivery Systems, In-Vivo DNA Delivery Systems, and DNA-Encoded Libraries. Among these, the In-Vitro DNA Delivery Systems segment holds the largest share of 56.87% in 2024 and is projected to grow at a CAGR of 29.02% during the forecast period from 2025 to 2032, reaching USD 1,291.73 million by the forecast period. This dominance is primarily due to the widespread adoption of in-vitro platforms in laboratory research, drug discovery, and genetic engineering, where controlled environments allow for high precision and reproducibility. In-vitro systems are preferred for their ability to support diverse applications such as gene editing, synthetic biology, and diagnostic assay development, offering researchers flexibility, scalability, and efficiency in producing high-quality DNA sequences.

The growth of this segment is further reinforced by strong clinical and commercial adoption, as in-vitro approaches are already well-integrated into existing workflows across academia, biotechnology, and pharmaceutical industries. Advancements in automation, miniaturization, and high-throughput screening have enhanced the efficiency of in-vitro delivery systems, reducing costs and turnaround times. Moreover, ongoing innovation is expanding their use in therapeutic research, enabling the design of precise genetic constructs for novel treatments. While in-vivo delivery methods and DNA-encoded libraries represent emerging frontiers with the potential to revolutionize targeted therapies and drug discovery, in-vitro delivery systems remain the backbone of current DNA synthesis applications. Their proven reliability, versatility, and accessibility ensure that they will continue to be the driving force of market expansion in the near-to-midterm.

In-Vitro DNA Delivery Systems dominance stems from widespread use in controlled lab environments for applications such as gene editing, synthetic biology, and diagnostics, supported by advancements in automation and scalability. Meanwhile, innovations like droplet-based microfluidics for high-fidelity synthesis and novel DNA-encoded library techniques such as on-DNA C–H functionalization are expanding capabilities, positioning this segment as both the current leader and a key driver of next-generation DNA delivery solutions.

Global Enzymatic DNA Synthesis Market, Delivery Method (USD Million)

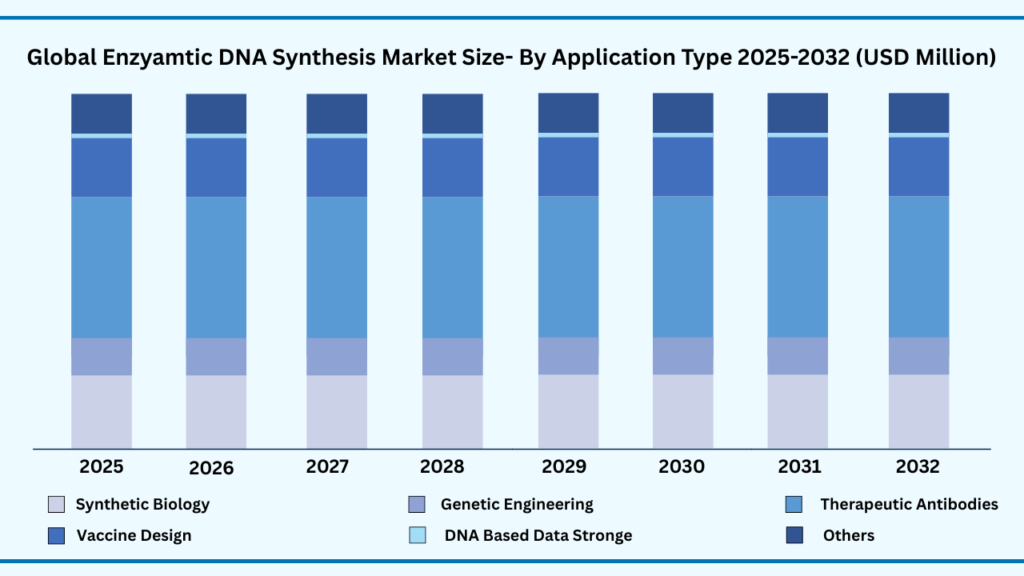

Global Enzymatic DNA Synthesis Market by Application Type Insights:

Therapeutic antibodies segments accounted for 52.73% of share in 2024 in Global Enzymatic DNA Synthesis market.

Based on application, the global enzymatic DNA synthesis market is segmented into Synthetic Biology, Genetic Engineering, Therapeutic Antibodies, Vaccine Design, DNA-Based Data Storage, and Others (including molecular diagnostics and pathogen detection). Among these, the Therapeutic Antibodies segment holds the largest revenue share of 52.73% in 2024 and is projected to grow at a CAGR of 28.89% during the forecast period from 2025 to 2032, with revenues expected to reach USD 1,188.38 million by end of the period. The strong position of this segment is driven by the growing demand for precision-targeted biologics in treating cancers, autoimmune conditions, and infectious diseases. Enzymatic DNA synthesis plays a pivotal role in accelerating antibody discovery and optimization, enabling rapid generation of diverse, high-fidelity DNA sequences for developing next-generation therapeutics. This not only improves efficiency but also reduces reliance on traditional, time-consuming methods, making it a preferred tool in modern drug development pipelines.

The segment’s growth is further reinforced by increasing clinical success and regulatory approvals of monoclonal antibodies, which are now a cornerstone of advanced treatment options. Pharmaceutical and biotech companies are heavily investing in antibody research, leveraging enzymatic DNA synthesis to create tailored antibody libraries with enhanced specificity, stability, and reduced immunogenicity. Recent advancements, such as automated platforms and high-throughput synthesis, are further shortening development timelines while ensuring consistent quality. Together, these developments highlight why therapeutic antibodies remain the leading application area, positioning enzymatic DNA synthesis as an indispensable enabler of innovation in biologics.

Recent developments in this segment reflect growing momentum, with several biotech firms adopting AI-driven platforms to pair enzymatic DNA synthesis with antibody discovery, accelerating candidate screening and reducing development costs. Additionally, partnerships between synthesis technology providers and pharmaceutical companies are expanding pipelines of monoclonal and bispecific antibodies, while advancements in high-throughput synthesis are enabling rapid prototyping for therapeutic innovation. These trends signal a strong future outlook for therapeutic antibody applications within the enzymatic DNA synthesis market.

Global Enzymatic DNA Synthesis Market, Application Type (USD Million)

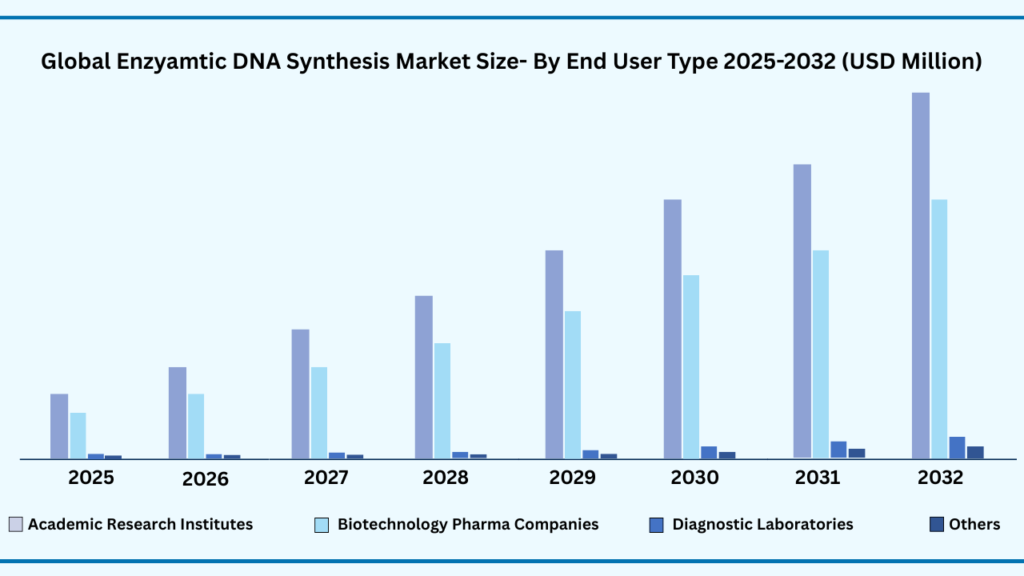

Global Enzymatic DNA Synthesis Market by End User Type Insights:

Academic research institutes segments accounted for 56.21% of share in 2024 in Global Enzymatic DNA Synthesis market.

Academic research institutes represent the largest end-user segment in the global enzymatic DNA synthesis market, accounting for 56.21% of the share in 2024 and projected to grow at a CAGR of 29.01% during forecast from 2025 to 2032, reaching USD 1,275.84 million by end of the period. Their leadership is attributed to their pivotal role in advancing genomic and molecular biology research, where enzymatic DNA synthesis is extensively used for gene editing, synthetic biology, and functional genomics studies. These institutes serve as hubs of innovation, leveraging the technology to design DNA constructs with higher accuracy, speed, and flexibility, enabling breakthroughs in areas like precision medicine, molecular diagnostics, and drug discovery.

The segment’s growth is further supported by government funding, academic–industry collaborations, and global initiatives focused on life sciences innovation. Research institutes often partner with biotechnology and pharmaceutical companies, not only to accelerate the translation of benchside discoveries into real-world applications but also to expand access to cutting-edge tools and methodologies. While biotechnology firms and diagnostic laboratories are integral to commercialization and clinical application, academic institutions dominate this space due to their strong focus on early-stage innovation, talent development, and foundational research. This makes them the driving force behind the adoption and evolution of enzymatic DNA synthesis technologies worldwide.

Global Enzymatic DNA Synthesis Market, END User Type (USD Million)

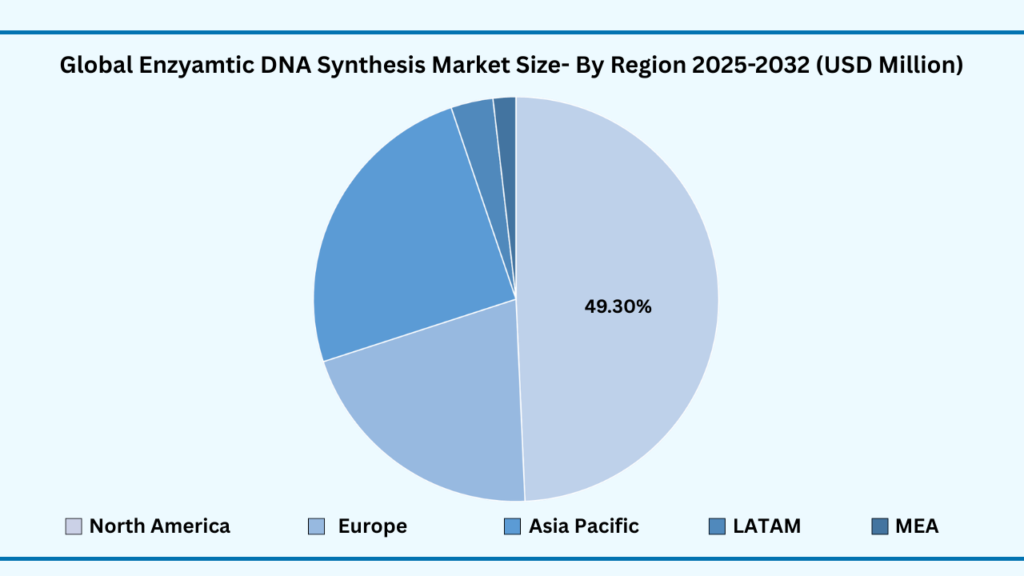

Global Enzymatic DNA Synthesis Market by Region Insights:

North America segments accounted for 49.25% of share in 2024 in Global Enzymatic DNA Synthesis market.

North America holds the largest share of the global enzymatic DNA synthesis market, accounting for 49.25% in 2025, and is projected to grow at a CAGR of 29.01% during the forecast period from 2025 to 2032, reaching USD 1,117.84 million by end of the period. This leadership is fueled by the region’s advanced biotechnology ecosystem, strong presence of leading pharmaceutical and life sciences companies, and well-established research infrastructure. With widespread adoption of synthetic biology and genetic engineering tools, North America has become the hub for pioneering applications of enzymatic DNA synthesis in therapeutic antibody development, vaccine design, and precision medicine. The region also benefits from favorable regulatory frameworks and substantial government as well as private sector funding, which further accelerates technology adoption and commercialization.

The segment’s strength is reinforced by a robust network of academic institutions, contract research organizations, and biotech startups that collaborate closely to translate cutting-edge research into clinical and industrial applications. Additionally, the growing demand for faster, more accurate DNA synthesis to support advancements in molecular diagnostics and drug discovery continues to drive investment in this market. While Europe and Asia Pacific are emerging as strong growth regions with expanding research capabilities and rising healthcare investments, North America maintains its dominance due to its innovation-driven environment, integrated research-to-commercialization pipeline, and early adoption of advanced technologies, ensuring its position at the forefront of global market growth.

Global Enzymatic DNA Synthesis Market, Region (USD Million)

Major Companies and Competitive Landscape

The global enzymatic DNA synthesis market is highly fragmented, with both established players and emerging innovators contributing significantly to overall revenue. Companies in this space are actively pursuing strategies such as mergers and acquisitions, strategic collaborations, licensing partnerships, and portfolio expansions to strengthen their market presence. A major focus lies in improving synthesis accuracy, reducing turnaround times, scaling production capabilities, and developing cost-effective solutions to support diverse applications ranging from synthetic biology and genetic engineering to therapeutic antibody development and vaccine design. Some of the leading companies profiled in the global enzymatic DNA synthesis market report include:

-

- Telesis Bio Inc.

- Twist Bioscience Corporation

- GenScript Biotech Corp.

- Evonetix

- Ansa Biotechnologies, Inc.

- Camena Bio

- Molecular Assemblies

- DNA Script

- Touchlight

- Kern Systems

- Aldevron LLC by Danaher Corporation

- Almac Group Limited

- Biotium, Inc.

- Biozym Scientific GmbH

- CD Genomics

- Merck KGaA

- Moligo Technologies AB

- Stemnovate Limited

- Thermo Fisher Scientific Inc.

- Touchlight Genetics Limited

- Centrillion Biosciences

- OriCiro Genomics

- Helixworks

- Viridos

- Bio-Synthesis, Inc.

Scope of Research

| Report Details | Outcome |

|---|---|

| Market size in 2024 | USD 381.33 Million |

| CAGR (2024–2032) | 28.89% |

| Revenue forecast to 2033 | USD 2,253.41 Million |

| Base year for estimation | 2025 |

| Historical data | 2019–2032 |

| Forecast period | 2025–2032 |

| Quantitative units | Revenue in USD Million and CAGR in % from 2025 to 2032 |

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | By Product Type, By Technology Type, By Purification Type, By Customization Level, By DNA Type, By Delivery Method, By Application Type, By End User and By Region |

| Regional scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Country scope | U.S., Canada, Mexico, Germany, France, U.K., Italy, Spain, Benelux, Russia, Finland, Sweden, Rest of Europe, China, India, Japan, South Korea, Indonesia, Thailand, Vietnam, Australia, New Zealand Rest of APAC, Brazil, Rest of LATAM, Saudi Arabia, UAE, South Africa, Turkey, Rest of MEA |

| Key companies profiled | Telesis Bio Inc., Twist Bioscience Corporation, GenScript Biotech Corp., Evonetix, Ansa Biotechnologies, Inc., Camena Bio, Molecular Assemblies, DNA Script, Touchlight, Kern Systems, Aldevron LLC by Danaher Corporation, Almac Group Limited, Biotium, Inc., Biozym Scientific GmbH, CD Genomics, Merck KGaA, Moligo Technologies AB, Stemnovate Limited, Thermo Fisher Scientific Inc., Touchlight Genetics Limited, Centrillion Biosciences, OriCiro Genomics, Helixworks, Viridos, and Bio-Synthesis, Inc. |

| Customization scope | 10 hours of free customization and expert consultation |

Chapter 1. Introduction

1.1. Market Definition

1.2. Objectives of the study

1.3. Overview of global enzymatic DNA synthesis market

1.4. Currency and pricing

1.5. Limitation

1.6. Markets covered

1.7. Research Scope

Chapter 2. Research Methodology

2.1. Research Sources

2.1.1.Primary

2.1.2.Secondary

2.1.3.Paid Sources

2.2. Years considered for the study

2.3. Assumptions

2.3.1.Market value

2.3.2.Market volume

2.3.3.Exchange rate

2.3.4.Price

2.3.5.Economic & political stability

Chapter 3. Executive Summary

3.1. Summary Snapshot, 2024–2032

Chapter 4. Key Insights

4.1. Production consumption analysis

4.2. Strategic partnerships & alliances

4.3. Joint ventures

4.4. Acquisition of local players

4.5. Contract manufacturing

4.6. Digital & e-commerce sales channels

4.7. Compliance with standards

4.8. Value chain analysis

4.9. Raw material sourcing

4.10. Formulation & manufacturing

4.11. Distribution & retail

4.12. Import-export analysis

4.13. Brand comparative analysis

4.14. Technological advancements

4.15. Porter’s five force

4.15.1. Threat of new entrants

4.15.1.1. Capital requirment

4.15.1.2. Product knowledge

4.15.1.3. Technical knowledge

4.15.1.4. Customer relation

4.15.1.5. Access to appliation and technology

4.15.2. Threat of substitutes

4.15.2.1. Cost

4.15.2.2. Performance

4.15.2.3. Availability

4.15.2.4. Technical knowledge

4.15.2.5. Durability

4.15.3. Bargainning power of buyers

4.15.3.1. Numbers of buyers relative to suppliers

4.15.3.2. Product differentiation

4.15.3.3. Threat of forward integration

4.15.3.4. Buyers volume

4.15.4. Bargainning power of suppliers

4.15.4.1. Suppliers concentration

4.15.4.2. Buyers switching cost to other suppliers

4.15.4.3. Threat of backward integration

4.15.5. Bargainning power of suppliers

4.15.5.1. Industry concentration

4.15.5.2. Industry growth rate

4.15.5.3. Product differentiation

4.15.6. Patent analysis

4.16. Patent quality and strength

4.17. Regulation coverage

4.18. Pricing analysis

4.19. Competitive Metric Space Analysis

Chapter 5. Market Overview

5.1. Drivers

5.1.1.Increasing demand for synthetic biology and genomics

5.1.2.Advancements in enzymatic synthesis technologies offering high-fidelity and eco-friendly

production

5.1.3.Growing R&D investments and strategic partnerships in bioplasma and diagnostics

5.2. Restraints

5.2.1.Higher costs and limited commercial scalability compared to traditional methods

5.2.2.Technical challenges in achieving long, accurate DNA constructs at scale

5.3. Opportunities

5.3.1.Expansion into applications like personalized therapeutics, vaccine development, gene

therapy, and mRNA platforms

5.3.2.Adoption of green synthesis and benchtop/instrument-based platforms for faster,

decentralized workflows

5.3.3.Rising demand in Asia-Pacific for Reagents and Consumables

5.4. Threat

5.4.1.Competition from entrenched chemical DN in A synthesis techniques with lower costs and

established infrastructure

5.4.2.Concerns over synthesis safety, ethical use, and intellectual property risks

Chapter 6. Global Enzyamatic DNA Synthesis Market By Product Type Insights & Trends,

Revenue (USD Million)

6.1. Product Type Dynamics & Market Share, 2024–2032

6.1.1.Custom DNA Synthesis Products

6.1.2.DNA Library Synthesis

6.1.3.Reagents and Consumables

6.1.4.Synthesizers/Instruments

6.1.5.Software and services

Chapter 7. Global Enzymatic DNA Synthesis Market By Technology Type Insights &

Trends, Revenue (USD Million)

7.1. Technology Type Dynamics & Market Share, 2024–2032

7.1.1.PCRbased enzymatic synthesis

7.1.2.CRISPRbased platforms

7.1.3.SOLA technology (Systems for Oligonucleotide Ligation and Assembly)

7.1.4.Others (novel enzyme platforms, emerging proprietary chemistries)

Chapter 8. Global Enzymatic DNA Synthesis Market By Purification Type Insights &

Trends, Revenue (USD Million)

8.1. Purification Type Dynamics & Market Share, 2024–2032

8.1.1.Desalted DNA

8.1.2.HPLC Purified DNA

8.1.3.PAGE Purified DNA

8.1.4.Cartridge Purified DNA

Chapter 9. Global Enzymatic DNA Synthesis Market By Customization Level Type Insights

& Trends, Revenue (USD Million)

9.1. Customization Level Dynamics & Market Share, 2024–2032

9.1.1.Standard Oligos

9.1.2.Partially Customized DNA

9.1.3.Fully Customized DNA Constructs

Chapter 10. Global Enzymatic DNA Synthesis Market By DNA Type Insights & Trends,

Revenue (USD Million)

10.1. DNA Type Dynamics & Market Share, 2024–2032

10.1.1. Single-Stranded DNA (ssDNA)

10.1.2. Double-Stranded DNA (dsDNA)

10.1.3. Modified DNA

10.1.4. Custom Sequences / Genes

Chapter 11. Global Enzymatic DNA Synthesis Market By Delivery Method Insights &

Trends, Revenue (USD Million)

11.1. Delivery Method Dynamics & Market Share, 2024–2032

11.1.1. In-Vitro DNA Delivery Systems

11.1.2. In-Vivo DNA Delivery Systems

11.1.3.DNA-Encoded Libraries

Chapter 12. Global Enzymatic DNA Synthesis Market By Application Type Insights &

Trends, Revenue (USD Million)

12.1. Application Type Dynamics & Market Share, 2024–2032

12.1.1. Synthetic Biology

12.1.2. Genetic Engineering

12.1.3. Therapeutic antibodies

12.1.4. Vaccine Design

12.1.5. DNA Based Data Storage

12.1.6. Others (molecular diagnostics, pathogen detection)

Chapter 13. Global Enzymatic DNA Synthesis Market By End Use Type Insights &

Trends, Revenue (USD Million)

13.1. End Use Dynamics & Market Share, 2024–2032

13.1.1. Academic research institutes

13.1.2. Biotechnology pharmaceutical companies

13.1.3. Diagnostic laboratories

13.1.4. Others (Contract Research Organizations)

Chapter 14. Global Enzymatic DNA Synthesis Market Regional Outlook

14.1. Global Enzymatic DNA Synthesis Market Share By Region, 2024–2032

14.2. North America

14.2.1. Market By ProductType, Market Estimates and Forecast, USD Million

14.2.2. Custom DNA Synthesis Products

14.2.3. DNA Library Synthesis

14.2.4. Reagents and Consumables

14.2.5. Synthesizers/Instruments

14.2.6. Software and services

14.3. Market By Technology Type, Market Estimates and Forecast, USD Million

14.3.1. PCRbased enzymatic synthesis

14.3.2. CRISPRbased platforms

14.3.3. SOLA technology (Systems for Oligonucleotide Ligation and Assembly)

14.3.4. Others (novel enzyme platforms, emerging proprietary chemistries)

14.4. Market By Purification Type, Market Estimates and Forecast, USD Million

14.4.1. Desalted DNA

14.4.2. HPLC Purified DNA

14.4.3. PAGE Purified DNA

14.4.4. Cartridge Purified DNA

14.5. Market By Customization level, Market Estimates and Forecast, USD Million

14.5.1. Standard Oligos

14.5.2. Partially Customized DNA

14.5.3. Fully Customized DNA Constructs

14.6. Market By DNA Type, Market Estimates and Forecast, USD Million

14.6.1. Single-Stranded DNA (ssDNA)

14.6.2. Double-Stranded DNA (dsDNA)

14.6.3. Modified DNA (e.g., with fluorescent labels, linkers)

14.6.4. Custom Sequences / Genes

14.7. Market By Delivery Method, Market Estimates and Forecast, USD Million

14.7.1. In-Vitro DNA Delivery Systems

14.7.2. In-Vivo DNA Delivery Systems

14.7.3. DNA-Encoded Libraries

14.8. Market By Application Type, Market Estimates and Forecast, USD Million

14.8.1. Synthetic Biology

14.8.2. Genetic Engineering

14.8.3. Therapeutic antibodies

14.8.4. Vaccine Design

14.8.5. DNA Based Data Storage

14.8.6. Others (molecular diagnostics, pathogen detection)

14.9. Market By Application Type, Market Estimates and Forecast, USD Million

14.9.1. Academic research institutes

14.9.2. Biotechnology pharmaceutical companies

14.9.3. Diagnostic laboratories

14.9.4. Others (Contract Research Organizations)

14.10. Market By Country, Market Estimates and Forecast, USD Million

14.10.1. US

14.10.2. Canada

14.10.3. Mexico

14.11. Europe

14.12. Market By ProductType, Market Estimates and Forecast, USD Million

14.12.1. Custom DNA Synthesis Products

14.12.2. DNA Library Synthesis

14.12.3. Reagents and Consumables

14.12.4. Synthesizers/Instruments

14.12.5. Software and services

14.13. Market By Technology Type, Market Estimates and Forecast, USD Million

14.13.1. PCRbased enzymatic synthesis

14.13.2. CRISPRbased platforms

14.13.3. SOLA technology (Systems for Oligonucleotide Ligation and Assembly)

14.13.4. Others (novel enzyme platforms, emerging proprietary chemistries)

14.14. Market By Purification Type, Market Estimates and Forecast, USD Million,

14.14.1. Desalted DNA

14.14.2. HPLC Purified DNA

14.14.3. PAGE Purified DNA

14.14.4. Cartridge Purified DNA

14.15. Market By Customization level, Market Estimates and Forecast, USD Million

14.15.1. Standard Oligos

14.15.2. Partially Customized DNA

14.15.3. Fully Customized DNA Constructs

14.16. Market By DNA Type, Market Estimates and Forecast, USD Million,

14.16.1. Single-Stranded DNA (ssDNA)

14.16.2. Double-Stranded DNA (dsDNA)

14.16.3. Modified DNA (e.g., with fluorescent labels, linkers)

14.16.4. Custom Sequences / Genes

14.17. Market By Delivery Method, Market Estimates and Forecast, USD Million

14.17.1. In-Vitro DNA Delivery Systems

14.17.2. In-Vivo DNA Delivery Systems

14.17.3. DNA-Encoded Libraries

14.18. Market By Application Type, Market Estimates and Forecast, USD Million

14.18.1. Synthetic Biology

14.18.2. Genetic Engineering

14.18.3. Therapeutic antibodies

14.18.4. Vaccine Design

14.18.5. DNA Based Data Storage

14.18.6. Others (molecular diagnostics, pathogen detection)

14.19. Market By End User, Market Estimates and Forecast, USD Million

14.19.1. Academic research institutes

14.19.2. Biotechnology pharmaceutical companies

14.19.3. Diagnostic laboratories

14.19.4. Others (Contract Research Organizations)

14.20. Market By Country, Market Estimates and Forecast, USD Million

14.20.1. Germany

14.20.2. France

14.20.3. U.K

14.20.4. Italy

14.20.5. Spain

14.20.6. Benelux

14.20.7. Russia

14.20.8. Finland

14.20.9. Sweden

14.20.10. Rest Of Europe

14.21. Asia-Pacific

14.22. Market By ProductType, Market Estimates and Forecast, USD Million

14.22.1. Custom DNA Synthesis Products

14.22.2. DNA Library Synthesis

14.22.3. Reagents and Consumables

14.22.4. Synthesizers/Instruments

14.22.5. Software and services

14.23. Market By Technology Type, Market Estimates and Forecast, USD Million

14.23.1. PCRbased enzymatic synthesis

14.23.2. CRISPRbased platforms

14.23.3. SOLA technology (Systems for Oligonucleotide Ligation and Assembly)

14.23.4. Others (novel enzyme platforms, emerging proprietary chemistries)

14.24. Market By Purification Type, Market Estimates and Forecast, USD Million

14.24.1. Desalted DNA

14.24.2. HPLC Purified DNA

14.24.3. PAGE Purified DNA

14.24.4. Cartridge Purified DNA

14.25. Market By Customization level, Market Estimates and Forecast, USD Million

14.25.1. Standard Oligos

14.25.2. Partially Customized DNA

14.25.3. Fully Customized DNA Constructs

14.26. Market By DNA Type, Market Estimates and Forecast, USD Million

14.26.1. Single-Stranded DNA (ssDNA)

14.26.2. Double-Stranded DNA (dsDNA)

14.26.3. Modified DNA (e.g., with fluorescent labels, linkers)

14.26.4. Custom Sequences / Genes

14.27. Market By Delivery Method, Market Estimates and Forecast, USD Million

14.27.1. In-Vitro DNA Delivery Systems

14.27.2. In-Vivo DNA Delivery Systems

14.27.3. DNA-Encoded Libraries

14.28. Market By Application Type, Market Estimates and Forecast, USD Million

14.28.1. Synthetic Biology

14.28.2. Genetic Engineering

14.28.3. Therapeutic antibodies

14.28.4. Vaccine Design

14.28.5. DNA Based Data Storage

14.28.6. Others (molecular diagnostics, pathogen detection)

14.29. Market By End User, Market Estimates and Forecast, USD Million

14.29.1. Academic research institutes

14.29.2. Biotechnology pharmaceutical companies

14.29.3. Diagnostic laboratories

14.29.4. Others (Contract Research Organizations)

14.30. Market By Country, Market Estimates and Forecast, USD Million

14.30.1. China

14.30.2. India

14.30.3. Japan

14.30.4. South Korea

14.30.5. Indonesia

14.30.6. Thailand

14.30.7. Vietnam

14.30.8. Australia

14.30.9. New Zeland

14.30.10. Rest of APAC

14.31. Latin America

14.32. Market By ProductType, Market Estimates and Forecast, USD Million

14.32.1. Custom DNA Synthesis Products

14.32.2. DNA Library Synthesis

14.32.3. Reagents and Consumables

14.32.4. Synthesizers/Instruments

14.32.5. Software and services

14.33. Market By Technology Type, Market Estimates and Forecast, USD Million

14.33.1. PCRbased enzymatic synthesis

14.33.2. CRISPRbased platforms

14.33.3. SOLA technology (Systems for Oligonucleotide Ligation and Assembly)

14.33.4. Others (novel enzyme platforms, emerging proprietary chemistries)

14.34. Market By Purification Type, Market Estimates and Forecast, USD Million

14.34.1. Desalted DNA

14.34.2. HPLC Purified DNA

14.34.3. PAGE Purified DNA

14.34.4. Cartridge Purified DNA

14.35. Market By Customization level, Market Estimates and Forecast, USD Million

14.35.1. Standard Oligos

14.35.2. Partially Customized DNA

14.35.3. Fully Customized DNA Constructs

14.36. Market By DNA Type, Market Estimates and Forecast, USD Million

14.36.1. Single-Stranded DNA (ssDNA)

14.36.2. Double-Stranded DNA (dsDNA)

14.36.3. Modified DNA (e.g., with fluorescent labels, linkers)

14.36.4. Custom Sequences / Genes

14.37. Market By Application Type, Market Estimates and Forecast, USD Million

14.37.1. Synthetic Biology

14.37.2. Genetic Engineering

14.37.3. Therapeutic antibodies

14.37.4. Vaccine Design

14.37.5. DNA Based Data Storage

14.37.6. Others (molecular diagnostics, pathogen detection)

14.38. Market By Delivery Method, Market Estimates and Forecast, USD Million

14.38.1. In-Vitro DNA Delivery Systems

14.38.2. In-Vivo DNA Delivery Systems

14.38.3. DNA-Encoded Libraries

14.39. Market By End User, Market Estimates and Forecast, USD Million

14.39.1. Academic research institutes

14.39.2. Biotechnology pharmaceutical companies

14.39.3. Diagnostic laboratories

14.39.4. Others (Contract Research Organizations)

14.40. Market By Country, Market Estimates and Forecast, USD Million

14.40.1. Brazil

14.40.2. Rest of LATAM

14.41. Middle East & Africa

14.42. Market By ProductType, Market Estimates and Forecast, USD Million

14.42.1. Custom DNA Synthesis Products

14.42.2. DNA Library Synthesis

14.42.3. Reagents and Consumables

14.42.4. Synthesizers/Instruments

14.42.5. Software and services

14.43. Market By Technology Type, Market Estimates and Forecast, USD Million

14.43.1. PCRbased enzymatic synthesis

14.43.2. CRISPRbased platforms

14.43.3. SOLA technology (Systems for Oligonucleotide Ligation and Assembly)

14.43.4. Others (novel enzyme platforms, emerging proprietary chemistries)

14.44. Market By Purification Type, Market Estimates and Forecast, USD Million

14.44.1. Desalted DNA

14.44.2. HPLC Purified DNA

14.44.3. PAGE Purified DNA

14.44.4. Cartridge Purified DNA

14.45. Market By Customization level, Market Estimates and Forecast, USD Million

14.45.1. Standard Oligos

14.45.2. Partially Customized DNA

14.45.3. Fully Customized DNA Constructs

14.46. Market By DNA Type, Market Estimates and Forecast, USD Million

14.46.1. Single-Stranded DNA (ssDNA)

14.46.2. Double-Stranded DNA (dsDNA)

14.46.3. Modified DNA (e.g., with fluorescent labels, linkers)

14.46.4. Custom Sequences / Genes

14.47. Market By Delivery Method, Market Estimates and Forecast, USD Million

14.47.1. In-Vitro DNA Delivery Systems

14.47.2. In-Vivo DNA Delivery Systems

14.47.3. DNA-Encoded Libraries

14.48. Market By Application Type, Market Estimates and Forecast, USD Million

14.48.1. Synthetic Biology

14.48.2. Genetic Engineering

14.48.3. Therapeutic antibodies

14.48.4. Vaccine Design

14.48.5. DNA Based Data Storage

14.48.6. Others (molecular diagnostics, pathogen detection)

14.49. Market By End User, Market Estimates and Forecast, USD Million

14.49.1. Academic research institutes

14.49.2. Biotechnology pharmaceutical companies

14.49.3. Diagnostic laboratories

14.49.4. Others (Contract Research Organizations)

14.50. Market By Country, Market Estimates and Forecast, USD Million

14.50.1. Saudi Arabia

14.50.2. UAE

14.50.3. South Africa

14.50.4. Turkey

14.50.5. Rest of MEA

Chapter 15. Competitive Landscape

15.1. Market Revenue Share By Manufacturers

15.2. Mergers & Acquisitions

15.3. Competitor’s Positioning

15.4. Strategy Benchmarking

15.5. Vendor Landscape

15.5.1. Distributors

15.5.1.1. North America

15.5.1.2. Europe

15.5.1.3. Asia Pacific

15.5.1.4. Middle East & Africa

15.5.1.5. Latin America

15.5.2. Others

Chapter 16. Company Profiles

16.1. GenScript Biotech Corp.

16.1.1. Company Overview

16.1.2. Product & Service Offerings

16.1.3. Strategic Initiatives

16.1.4. Financials

16.1.5. Research Insights

16.2. Telesis Bio Inc.

16.2.1. Company Overview

16.2.2. Product & Service Offerings

16.2.3. Strategic Initiatives

16.2.4. Financials

16.2.5. Research Insights

16.3. Twist Bioscience Corporation

16.3.1. Company Overview

16.3.2. Product & Service Offerings

16.3.3. Strategic Initiatives

16.3.4. Financials

16.3.5. Research Insights

16.4. Evonetix

16.4.1. Company Overview

16.4.2. Product & Service Offerings

16.4.3. Strategic Initiatives

16.4.4. Financials

16.4.5. Research Insights

16.5. Ansa Biotechnologies, Inc.

16.5.1. Company Overview

16.5.2. Product & Service Offerings

16.5.3. Strategic Initiatives

16.5.4. Financials

16.5.5. Research Insights

16.6. Camena Bio

16.6.1. Company Overview

16.6.2. Product & Service Offerings

16.6.3. Strategic Initiatives

16.6.4. Financials

16.6.5. Research Insights

16.7. Molecular Assemblies

16.7.1. Company Overview

16.7.2. Product & Service Offerings

16.7.3. Strategic Initiatives

16.7.4. Financials

16.7.5. Conclusion

16.8. DNA Script

16.8.1. Company Overview

16.8.2. Product & Service Offerings

16.8.3. Strategic Initiatives

16.8.4. Financials

16.8.5. Conclusion

16.9. Touchlight

16.9.1. Company Overview

16.9.2. Product & Service Offerings

16.9.3. Strategic Initiatives

16.9.4. Financials

16.9.5. Conclusion

16.10. Kern Systems

16.10.1. Company Overview

16.10.2. Product & Service Offerings

16.10.3. Strategic Initiatives

16.10.4. Financials

16.10.5. Conclusion

16.11. Aldevron LLC by Danaher Corporation

16.11.1. Company Overview

16.11.2. Product & Service Offerings

16.11.3. Strategic Initiatives

16.11.4. Financials

16.11.5. Conclusion

16.12. Almac Group Limited

16.12.1. Company Overview

16.12.2. Product & Service Offerings

16.12.3. Strategic Initiatives

16.12.4. Financials

16.12.5. Conclusion

16.13. Biotium, Inc.

16.13.1. Company Overview

16.13.2. Product & Service Offerings

16.13.3. Strategic Initiatives

16.13.4. Financials

16.13.5. Conclusion

16.14. Biozym Scientific GmbH

16.14.1. Company Overview

16.14.2. Product & Service Offerings

16.14.3. Strategic Initiatives

16.14.4. Financials

16.14.5. Conclusion

16.15. CD Genomics

16.15.1. Company Overview

16.15.2. Product & Service Offerings

16.15.3. Strategic Initiatives

16.15.4. Financials

16.15.5. Conclusion

16.16. Merck KGaA

16.16.1. Company Overview

16.16.2. Product & Service Offerings

16.16.3. Strategic Initiatives

16.16.4. Financials

16.16.5. Conclusion

16.17. Moligo Technologies AB

16.17.1. Company Overview

16.17.2. Product & Service Offerings

16.17.3. Strategic Initiatives

16.17.4. Financials

16.17.5. Conclusion

16.18. Stemnovate Limited

16.18.1. Company Overview

16.18.2. Product & Service Offerings

16.18.3. Strategic Initiatives

16.18.4. Financials

16.18.5. Conclusion

16.19. Thermo Fisher Scientific Inc.

16.19.1. Company Overview

16.19.2. Product & Service Offerings

16.19.3. Strategic Initiatives

16.19.4. Financials

16.19.5. Conclusion

16.20. Touchlight Genetics Limited

16.20.1. Company Overview

16.20.2. Product & Service Offerings

16.20.3. Strategic Initiatives

16.20.4. Financials

16.20.5. Conclusion

16.21. Elegen Corporation

16.21.1. Company Overview

16.21.2. Product & Service Offerings

16.21.3. Strategic Initiatives

16.21.4. Financials

16.21.5. Conclusion

16.22. Eurofins Genomics

16.22.1. Company Overview

16.22.2. Product & Service Offerings

16.22.3. Strategic Initiatives

16.22.4. Financials

16.22.5. Conclusion

16.23. Synbio Technologies

16.23.1.Company Overview

16.23.2.Product & Service Offerings

16.23.3.Strategic Initiatives

16.23.4.Financials

16.23.5.Conclusion

16.24. Yeasen Biotech

16.24.1.Company Overview

16.24.2.Product & Service Offerings

16.24.3.Strategic Initiatives

16.24.4.Financials

16.24.5.Conclusion

16.25. ATUM (formerly DNA2.0)

16.25.1. Company Overview

16.25.2. Product & Service Offerings

16.25.3. Strategic Initiatives

16.25.4. Financials

16.25.5. Conclusion

Segments Covered in Report

For the purpose of this report, Advantia Business Consulting LLP. has segmented global enzymatic DNA synthesis market on the basis of Product Type, By Technology Type, By Purification Type, By Customization level, By DNA Type, By Delivery Method, By Application Type, By End User, By region for 2019 to 2032

- Global Product Type Outlook (Revenue, USD Million; 2024-2032)

-

- Custom DNA Synthesis Products

-

- DNA Library Synthesis

-

- Reagents and Consumables

-

- Synthesizers/Instruments

-

- Software and services

- Global Technology Type Outlook (Revenue, USD Million; 2024-2032)

-

- PCRbased enzymatic synthesis

-

- CRISPRbased platforms

-

- SOLA technology (Systems for Oligonucleotide Ligation and Assembly)

-

- Others (novel enzyme platforms, emerging proprietary chemistries)

- Global Purification Type Outlook (Revenue, USD Million; 2024-2032)

-

- Desalted DNA

-

- HPLC Purified DNA

-

- PAGE Purified DNA

-

- Cartridge Purified DNA

- Global Customization level Outlook (Revenue, USD Million; 2024-2032)

-

- Standard Oligos

-

- Partially Customized DNA

-

- Fully Customized DNA Constructs

- Global DNA Type Outlook (Revenue, USD Million; 2024-2032)

-

- Single-Stranded DNA (ssDNA)

-

- Double-Stranded DNA (dsDNA)

-

- Modified DNA (with fluorescent labels, linkers)

-

- Custom Sequences / Genes

- Global Delivery Method Outlook (Revenue, USD Million; 2024-2032)

-

- In-Vitro DNA Delivery Systems

-

- In-Vivo DNA Delivery Systems

-

- DNA-Encoded Libraries

- Global Application Type Outlook (Revenue, USD Million; 2024-2032)

-

- Synthetic Biology

-

- Genetic Engineering

-

- Therapeutic antibodies

-

- Vaccine Design

-

- DNA Based Data Storage

-

- Others (molecular diagnostics, pathogen detection)

- Global End User Type Outlook (Revenue, USD Million; 2024-2032)

-

- Academic research institutes

-

- Biotechnology pharmaceutical companies

-

- Diagnostic laboratories

-

- Others (Contract Research Organizations)

- North America

- North America Product Type Outlook (Revenue, USD Million; 2024-2032)

-

- Custom DNA Synthesis Products

-

- DNA Library Synthesis

-

- Reagents and Consumables

-

- Synthesizers/Instruments

-

- Software and services

- North America Technology Type Outlook (Revenue, USD Million; 2024-2032)

-

- PCRbased enzymatic synthesis

-

- CRISPRbased platforms

-

- SOLA technology (Systems for Oligonucleotide Ligation and Assembly)

-

- Others (novel enzyme platforms, emerging proprietary chemistries)

- North America Purification Type Outlook (Revenue, USD Million; 2024-2032)

-

- Desalted DNA

-

- HPLC Purified DNA

-

- PAGE Purified DNA

-

- Cartridge Purified DNA

- North America Customization level Outlook (Revenue, USD Million; 2024-2032)

-

- Standard Oligos

-

- Partially Customized DNA

-

- Fully Customized DNA Constructs

- North America DNA Type Outlook (Revenue, USD Million; 2024-2032)

-

- Single-Stranded DNA (ssDNA)

-

- Double-Stranded DNA (dsDNA)

-

- Modified DNA AAA

-

- Custom Sequences / Genes

- North America Delivery Method (Revenue, USD Million; 2024-2032)

-

- In-Vitro DNA Delivery Systems

-

- In-Vivo DNA Delivery Systems

-

- DNA-Encoded Libraries

- North America Application Type (Revenue, USD Million; 2024-2032)

-

- Synthetic Biology

-

- Genetic Engineering

-

- Therapeutic antibodies

-

- Vaccine Design

-

- DNA Based Data Storage

-

- Others (molecular diagnostics, pathogen detection)

- North America End User (Revenue, USD Million; 2024-2032)

-

- Academic research institutes

-

- Biotechnology pharmaceutical companies

-

- Diagnostic laboratories

-

- Others (Contract Research Organizations)

- U.S

- U.S Product Type Outlook (Revenue, USD Million; 2024-2032)

-

- Custom DNA Synthesis Products

-

- DNA Library Synthesis

-

- Reagents and Consumables

-

- Synthesizers/Instruments

-

- Software and services

- U.S Technology Type Outlook (Revenue, USD Million; 2024-2032)

-

- PCRbased enzymatic synthesis

-

- CRISPRbased platforms

-

- SOLA technology (Systems for Oligonucleotide Ligation and Assembly)

-

- Others (novel enzyme platforms, emerging proprietary chemistries)

- U.S Purification Type Outlook (Revenue, USD Million; 2024-2032)

-

- Desalted DNA

-

- HPLC Purified DNA

-

- PAGE Purified DNA

-

- Cartridge Purified DNA

- U.S Customization level Outlook (Revenue, USD Million; 2024-2032)

-

- Standard Oligos

-

- Partially Customized DNA

-

- Fully Customized DNA Constructs

- U.S DNA Type Outlook (Revenue, USD Million; 2024-2032)

-

- Single-Stranded DNA (ssDNA)

-

- Double-Stranded DNA (dsDNA)

-

- Modified DNA (with fluorescent labels, linkers)

-

- Custom Sequences / Genes

- U.S Delivery Method (Revenue, USD Million; 2024-2032)

-

- In-Vitro DNA Delivery Systems

-

- In-Vivo DNA Delivery Systems

-

- DNA-Encoded Libraries

- U.S Application Type (Revenue, USD Million; 2024-2032)

-

- Synthetic Biology

-

- Genetic Engineering

-

- Therapeutic antibodies

-

- Vaccine Design

-

- DNA Based Data Storage

-

- Others (molecular diagnostics, pathogen detection)

- U.S End User (Revenue, USD Million; 2024-2032)

-

- Academic research institutes

-

- Biotechnology pharmaceutical companies

-

- Diagnostic laboratories

-

- Others (Contract Research Organizations)

- Canada

- Canada Product Type Outlook (Revenue, USD Million; 2024-2032)

-

- Custom DNA Synthesis Products

-

- DNA Library Synthesis

-

- Reagents and Consumables

-

- Synthesizers/Instruments

-

- Software and services

- Canada Technology Type Outlook (Revenue, USD Million; 2024-2032)

-

- PCRbased enzymatic synthesis

-

- CRISPRbased platforms

-

- SOLA technology (Systems for Oligonucleotide Ligation and Assembly)

-

- Others (novel enzyme platforms, emerging proprietary chemistries)

- Canada Purification Type Outlook (Revenue, USD Million; 2024-2032)

-

- Desalted DNA

-

- HPLC Purified DNA

-

- PAGE Purified DNA

-

- Cartridge Purified DNA

- Canada Customization level Outlook (Revenue, USD Million; 2024-2032)

-

- Standard Oligos

-

- Partially Customized DNA

-

- Fully Customized DNA Constructs

- Canada DNA Type Outlook (Revenue, USD Million; 2024-2032)

-

- Single-Stranded DNA (ssDNA)

-

- Double-Stranded DNA (dsDNA)

-

- Modified DNA (with fluorescent labels, linkers)

-

- Custom Sequences / Genes

- Canada Delivery Method (Revenue, USD Million; 2024-2032)

-

- In-Vitro DNA Delivery Systems

-

- In-Vivo DNA Delivery Systems

-

- DNA-Encoded Libraries

- Canada Application Type (Revenue, USD Million; 2024-2032)

-

- Synthetic Biology

-

- Genetic Engineering

-

- Therapeutic antibodies

-

- Vaccine Design

-

- DNA Based Data Storage

-

- Others (molecular diagnostics, pathogen detection)

- Canada End User (Revenue, USD Million; 2024-2032)

-

- Academic research institutes

-

- Biotechnology pharmaceutical companies

-

- Diagnostic laboratories

-

- Others (Contract Research Organizations)

- Mexico

- Mexico Product Type Outlook (Revenue, USD Million; 2024-2032)

-

- Custom DNA Synthesis Products

-

- DNA Library Synthesis

-

- Reagents and Consumables

-

- Synthesizers/Instruments

-

- Software and services

- Mexico Technology Type Outlook (Revenue, USD Million; 2024-2032)

-

- PCRbased enzymatic synthesis

-

- CRISPRbased platforms

-

- SOLA technology (Systems for Oligonucleotide Ligation and Assembly)

-

- Others (novel enzyme platforms, emerging proprietary chemistries)

- Mexico Purification Type Outlook (Revenue, USD Million; 2024-2032)

-

- Desalted DNA

-

- HPLC Purified DNA

-

- PAGE Purified DNA

-

- Cartridge Purified DNA

- Mexico Customization level Outlook (Revenue, USD Million; 2024-2032)

-

- Standard Oligos

-

- Partially Customized DNA

-

- Fully Customized DNA Constructs

- Mexico DNA Type Outlook (Revenue, USD Million; 2024-2032)

-

- Single-Stranded DNA (ssDNA)

-

- Double-Stranded DNA (dsDNA)

-

- Modified DNA (with fluorescent labels, linkers)

-

- Custom Sequences / Genes

- Mexico Delivery Method (Revenue, USD Million; 2024-2032)

-

- In-Vitro DNA Delivery Systems

-

- In-Vivo DNA Delivery Systems

-

- DNA-Encoded Libraries

- Mexico Application Type (Revenue, USD Million; 2024-2032)

-

- Synthetic Biology

-

- Genetic Engineering

-

- Therapeutic antibodies

-

- Vaccine Design

-

- DNA Based Data Storage

-

- Others (molecular diagnostics, pathogen detection)

- Mexico End User (Revenue, USD Million; 2024-2032)

-

- Academic research institutes

-

- Biotechnology pharmaceutical companies

-

- Diagnostic laboratories

-

- Others (Contract Research Organizations)

- Europe

- Europe Product Type Outlook (Revenue, USD Million; 2024-2032)

-

- Custom DNA Synthesis Products

-

- DNA Library Synthesis

-

- Reagents and Consumables

-

- Synthesizers/Instruments

-

- Software and services

- Europe Technology Type Outlook (Revenue, USD Million; 2024-2032)

-

- PCRbased enzymatic synthesis

-

- CRISPRbased platforms

-

- SOLA technology (Systems for Oligonucleotide Ligation and Assembly)

-

- Others (novel enzyme platforms, emerging proprietary chemistries)

- Europe Purification Type Outlook (Revenue, USD Million; 2024-2032)

-

- Desalted DNA

-

- HPLC Purified DNA

-

- PAGE Purified DNA

-

- Cartridge Purified DNA

- Europe Customization level Outlook (Revenue, USD Million; 2024-2032)

-

- Standard Oligos

-

- Partially Customized DNA

-

- Fully Customized DNA Constructs

- Europe DNA Type Outlook (Revenue, USD Million; 2024-2032)

-

- Single-Stranded DNA (ssDNA)

-

- Double-Stranded DNA (dsDNA)

-

- Modified DNA (with fluorescent labels, linkers)

-

- Custom Sequences / Genes

- Europe Delivery Method (Revenue, USD Million; 2024-2032)

-

- In-Vitro DNA Delivery Systems

-

- In-Vivo DNA Delivery Systems

-

- DNA-Encoded Libraries

- Europe Application Type (Revenue, USD Million; 2024-2032)

-

- Synthetic Biology

-

- Genetic Engineering

-

- Therapeutic antibodies

-

- Vaccine Design

-

- DNA Based Data Storage

-

- Others (molecular diagnostics, pathogen detection)

- Europe End User (Revenue, USD Million; 2024-2032)

-

- Academic research institutes

-

- Biotechnology pharmaceutical companies

-

- Diagnostic laboratories

-

- Others (Contract Research Organizations)

- Germany

- Germany Product Type Outlook (Revenue, USD Million; 2024-2032)

-

- Custom DNA Synthesis Products

-

- DNA Library Synthesis

-

- Reagents and Consumables

-

- Synthesizers/Instruments

-

- Software and services

- Germany Technology Type Outlook (Revenue, USD Million; 2024-2032)

-

- PCRbased enzymatic synthesis

-

- CRISPRbased platforms

-

- SOLA technology (Systems for Oligonucleotide Ligation and Assembly)

-

- Others (novel enzyme platforms, emerging proprietary chemistries)

- Germany Purification Type Outlook (Revenue, USD Million; 2024-2032)

-

- Desalted DNA

-

- HPLC Purified DNA

-

- PAGE Purified DNA

-

- Cartridge Purified DNA

- Germany Customization level Outlook (Revenue, USD Million; 2024-2032)

-

- Standard Oligos

-

- Partially Customized DNA

-

- Fully Customized DNA Constructs

- Germany DNA Type Outlook (Revenue, USD Million; 2024-2032)

-

- Single-Stranded DNA (ssDNA)

-

- Double-Stranded DNA (dsDNA)

-

- Modified DNA (with fluorescent labels, linkers)

-

- Custom Sequences / Genes

- Germany Delivery Method (Revenue, USD Million; 2024-2032)

-

- In-Vitro DNA Delivery Systems

-

- In-Vivo DNA Delivery Systems

-

- DNA-Encoded Libraries

- Germany Application Type (Revenue, USD Million; 2024-2032)

-

- Synthetic Biology

-

- Genetic Engineering

-

- Therapeutic antibodies

-

- Vaccine Design

-

- DNA Based Data Storage

-

- Others (molecular diagnostics, pathogen detection)

- Germany End User (Revenue, USD Million; 2024-2032)

-

- Academic research institutes

-

- Biotechnology pharmaceutical companies

-

- Diagnostic laboratories

-

- Others (Contract Research Organizations)

- France

- France Product Type Outlook (Revenue, USD Million; 2024-2032)

-

- Custom DNA Synthesis Products

-

- DNA Library Synthesis

-

- Reagents and Consumables

-

- Synthesizers/Instruments

-

- Software and services

- France Technology Type Outlook (Revenue, USD Million; 2024-2032)

-

- PCRbased enzymatic synthesis

-

- CRISPRbased platforms

-

- SOLA technology (Systems for Oligonucleotide Ligation and Assembly)

-

- Others (novel enzyme platforms, emerging proprietary chemistries)

- France Purification Type Outlook (Revenue, USD Million; 2024-2032)

-

- Desalted DNA

-

- HPLC Purified DNA

-

- PAGE Purified DNA

-

- Cartridge Purified DNA

- France Customization level Outlook (Revenue, USD Million; 2024-2032)

-

- Standard Oligos

-

- Partially Customized DNA

-

- Fully Customized DNA Constructs

- France DNA Type Outlook (Revenue, USD Million; 2024-2032)

-

- Single-Stranded DNA (ssDNA)

-

- Double-Stranded DNA (dsDNA)

-

- Modified DNA (with fluorescent labels, linkers)

-

- Custom Sequences / Genes

- France Delivery Method (Revenue, USD Million; 2024-2032)

-

- In-Vitro DNA Delivery Systems

-

- In-Vivo DNA Delivery Systems

-

- DNA-Encoded Libraries

- France Application Type (Revenue, USD Million; 2024-2032)

-

- Synthetic Biology

-

- Genetic Engineering

-

- Therapeutic antibodies

-

- Vaccine Design

-

- DNA Based Data Storage

-

- Others (molecular diagnostics, pathogen detection)

- France End User (Revenue, USD Million; 2024-2032)

-

- Academic research institutes

-

- Biotechnology pharmaceutical companies

-

- Diagnostic laboratories

-

- Others (Contract Research Organizations)

- U.K

- U.K Product Type Outlook (Revenue, USD Million; 2024-2032)

-

- Custom DNA Synthesis Products

-

- DNA Library Synthesis

-

- Reagents and Consumables

-

- Synthesizers/Instruments

-

- Software and services

- U.K Technology Type Outlook (Revenue, USD Million; 2024-2032)

-

- PCRbased enzymatic synthesis

-

- CRISPRbased platforms

-

- SOLA technology (Systems for Oligonucleotide Ligation and Assembly)

-

- Others (novel enzyme platforms, emerging proprietary chemistries)

- U.K Purification Type Outlook (Revenue, USD Million; 2024-2032)

-

- Desalted DNA

-

- HPLC Purified DNA

-

- PAGE Purified DNA

-

- Cartridge Purified DNA

- U.K Customization level Outlook (Revenue, USD Million; 2024-2032)

-

- Standard Oligos

-

- Partially Customized DNA

-

- Fully Customized DNA Constructs

- U.K DNA Type Outlook (Revenue, USD Million; 2024-2032)

-

- Single-Stranded DNA (ssDNA)

-

- Double-Stranded DNA (dsDNA)

-

- Modified DNA (with fluorescent labels, linkers)

-

- Custom Sequences / Genes

- U.K Delivery Method (Revenue, USD Million; 2024-2032)

-

- In-Vitro DNA Delivery Systems

-

- In-Vivo DNA Delivery Systems

-

- DNA-Encoded Libraries

- U.K Application Type (Revenue, USD Million; 2024-2032)

-

- Synthetic Biology

-

- Genetic Engineering

-

- Therapeutic antibodies

-

- Vaccine Design

-

- DNA Based Data Storage

-

- Others (molecular diagnostics, pathogen detection)

- U.K End User (Revenue, USD Million; 2024-2032)

-

- Academic research institutes

-

- Biotechnology pharmaceutical companies

-

- Diagnostic laboratories

-

- Others (Contract Research Organizations)

- Italy

- Italy Product Type Outlook (Revenue, USD Million; 2024-2032)

-

- Custom DNA Synthesis Products

-

- DNA Library Synthesis

-

- Reagents and Consumables

-

- Synthesizers/Instruments

-

- Software and services

- Italy Technology Type Outlook (Revenue, USD Million; 2024-2032)

-

- PCRbased enzymatic synthesis

-

- CRISPRbased platforms

-

- SOLA technology (Systems for Oligonucleotide Ligation and Assembly)

-

- Others (novel enzyme platforms, emerging proprietary chemistries)

- Italy Purification Type Outlook (Revenue, USD Million; 2024-2032)

-

- Desalted DNA

-

- HPLC Purified DNA

-

- PAGE Purified DNA

-

- Cartridge Purified DNA

- Italy Customization level Outlook (Revenue, USD Million; 2024-2032)

-

- Standard Oligos

-

- Partially Customized DNA

-

- Fully Customized DNA Constructs

- Italy DNA Type Outlook (Revenue, USD Million; 2024-2032)

-

- Single-Stranded DNA (ssDNA)

-

- Double-Stranded DNA (dsDNA)

-

- Modified DNA (with fluorescent labels, linkers)

-

- Custom Sequences / Genes

- Italy Delivery Method (Revenue, USD Million; 2024-2032)

-

- In-Vitro DNA Delivery Systems

-

- In-Vivo DNA Delivery Systems

-

- DNA-Encoded Libraries

- Italy Application Type (Revenue, USD Million; 2024-2032)

-

- Synthetic Biology

-

- Genetic Engineering

-

- Therapeutic antibodies

-

- Vaccine Design

-

- DNA Based Data Storage

-

- Others (molecular diagnostics, pathogen detection)

- Italy End User (Revenue, USD Million; 2024-2032)

-

- Academic research institutes

-

- Biotechnology pharmaceutical companies

-

- Diagnostic laboratories

-

- Others (Contract Research Organizations)

- Spain

- Spain Product Type Outlook (Revenue, USD Million; 2024-2032)

-

- Custom DNA Synthesis Products

-

- DNA Library Synthesis

-

- Reagents and Consumables

-

- Synthesizers/Instruments

-

- Software and services

- Spain Technology Type Outlook (Revenue, USD Million; 2024-2032)

-

- PCRbased enzymatic synthesis

-

- CRISPRbased platforms

-

- SOLA technology (Systems for Oligonucleotide Ligation and Assembly)

-

- Others (novel enzyme platforms, emerging proprietary chemistries)

- Spain Purification Type Outlook (Revenue, USD Million; 2024-2032)

-

- Desalted DNA

-

- HPLC Purified DNA

-

- PAGE Purified DNA

-

- Cartridge Purified DNA

- Spain Customization level Outlook (Revenue, USD Million; 2024-2032)

-

- Standard Oligos

-

- Partially Customized DNA

-

- Fully Customized DNA Constructs

- Spain DNA Type Outlook (Revenue, USD Million; 2024-2032)

-

- Single-Stranded DNA (ssDNA)

-

- Double-Stranded DNA (dsDNA)

-

- Modified DNA (with fluorescent labels, linkers)

-

- Custom Sequences / Genes

- Spain Delivery Method (Revenue, USD Million; 2024-2032)

-

- In-Vitro DNA Delivery Systems

-

- In-Vivo DNA Delivery Systems

-

- DNA-Encoded Libraries

- Spain Application Type (Revenue, USD Million; 2024-2032)

-

- Synthetic Biology

-

- Genetic Engineering

-

- Therapeutic antibodies

-

- Vaccine Design

-

- DNA Based Data Storage

-

- Others (molecular diagnostics, pathogen detection)

- Spain End User (Revenue, USD Million; 2024-2032)

-

- Academic research institutes

-

- Biotechnology pharmaceutical companies

-

- Diagnostic laboratories

-

- Others (Contract Research Organizations)

- Benelux

- Benelux Product Type Outlook (Revenue, USD Million; 2024-2032)

-

- Custom DNA Synthesis Products

-

- DNA Library Synthesis

-

- Reagents and Consumables

-

- Synthesizers/Instruments

-

- Software and services

- Benelux Technology Type Outlook (Revenue, USD Million; 2024-2032)

-

- PCRbased enzymatic synthesis

-

- CRISPRbased platforms

-

- SOLA technology (Systems for Oligonucleotide Ligation and Assembly)

-

- Others (novel enzyme platforms, emerging proprietary chemistries)

- Benelux Purification Type Outlook (Revenue, USD Million; 2024-2032)

-

- Desalted DNA

-

- HPLC Purified DNA

-

- PAGE Purified DNA

-

- Cartridge Purified DNA

- Benelux Customization level Outlook (Revenue, USD Million; 2024-2032)

-

- Standard Oligos

-

- Partially Customized DNA

-

- Fully Customized DNA Constructs

- Benelux DNA Type Outlook (Revenue, USD Million; 2024-2032)

-

- Single-Stranded DNA (ssDNA)

-

- Double-Stranded DNA (dsDNA)

-

- Modified DNA (with fluorescent labels, linkers)

-

- Custom Sequences / Genes

- Benelux Delivery Method (Revenue, USD Million; 2024-2032)

-

- In-Vitro DNA Delivery Systems

-

- In-Vivo DNA Delivery Systems

-

- DNA-Encoded Libraries

- Benelux Application Type (Revenue, USD Million; 2024-2032)

-

- Synthetic Biology

-

- Genetic Engineering

-

- Therapeutic antibodies

-

- Vaccine Design

-

- DNA Based Data Storage

-

- Others (molecular diagnostics, pathogen detection)

- Benelux End User (Revenue, USD Million; 2024-2032)

-

- Academic research institutes

-

- Biotechnology pharmaceutical companies

-

- Diagnostic laboratories

-

- Others (Contract Research Organizations)

- Russia

- Russia Product Type Outlook (Revenue, USD Million; 2024-2032)

-

- Custom DNA Synthesis Products

-

- DNA Library Synthesis

-

- Reagents and Consumables

-

- Synthesizers/Instruments

-

- Software and services

- Russia Technology Type Outlook (Revenue, USD Million; 2024-2032)

-

- PCRbased enzymatic synthesis

-

- CRISPRbased platforms

-

- SOLA technology (Systems for Oligonucleotide Ligation and Assembly)

-

- Others (novel enzyme platforms, emerging proprietary chemistries)

- Russia Purification Type Outlook (Revenue, USD Million; 2024-2032)

-

- Desalted DNA

-

- HPLC Purified DNA

-

- PAGE Purified DNA

-

- Cartridge Purified DNA

- Russia Customization level Outlook (Revenue, USD Million; 2024-2032)

-

- Standard Oligos

-

- Partially Customized DNA

-

- Fully Customized DNA Constructs

- Russia DNA Type Outlook (Revenue, USD Million; 2024-2032)

-

- Single-Stranded DNA (ssDNA)

-

- Double-Stranded DNA (dsDNA)

-

- Modified DNA (with fluorescent labels, linkers)

-

- Custom Sequences / Genes

- Russia Delivery Method (Revenue, USD Million; 2024-2032)

-

- In-Vitro DNA Delivery Systems

-

- In-Vivo DNA Delivery Systems

-

- DNA-Encoded Libraries

- Russia Application Type (Revenue, USD Million; 2024-2032)

-

- Synthetic Biology

-

- Genetic Engineering

-

- Therapeutic antibodies

-

- Vaccine Design

-

- DNA Based Data Storage

-

- Others (molecular diagnostics, pathogen detection)

- Russia End User (Revenue, USD Million; 2024-2032)

-

- Academic research institutes

-

- Biotechnology pharmaceutical companies

-

- Diagnostic laboratories

-

- Others (Contract Research Organizations)

- Finland

- Finland Product Type Outlook (Revenue, USD Million; 2024-2032)

-

- Custom DNA Synthesis Products

-

- DNA Library Synthesis

-

- Reagents and Consumables

-

- Synthesizers/Instruments

-

- Software and services

- Finland Technology Type Outlook (Revenue, USD Million; 2024-2032)

-

- PCRbased enzymatic synthesis

-

- CRISPRbased platforms

-

- SOLA technology (Systems for Oligonucleotide Ligation and Assembly)

-

- Others (novel enzyme platforms, emerging proprietary chemistries)

- Finland Purification Type Outlook (Revenue, USD Million; 2024-2032)

-

- Desalted DNA

-

- HPLC Purified DNA

-

- PAGE Purified DNA

-

- Cartridge Purified DNA

- Finland Customization level Outlook (Revenue, USD Million; 2024-2032)

-

- Standard Oligos

-

- Partially Customized DNA

-

- Fully Customized DNA Constructs

- Finland DNA Type Outlook (Revenue, USD Million; 2024-2032)

-

- Single-Stranded DNA (ssDNA)

-

- Double-Stranded DNA (dsDNA)

-

- Modified DNA (with fluorescent labels, linkers)

-

- Custom Sequences / Genes

- Finland Delivery Method (Revenue, USD Million; 2024-2032)

-

- In-Vitro DNA Delivery Systems

-

- In-Vivo DNA Delivery Systems

-

- DNA-Encoded Libraries

- Finland Application Type (Revenue, USD Million; 2024-2032)

-

- Synthetic Biology

-

- Genetic Engineering

-

- Therapeutic antibodies

-

- Vaccine Design

-

- DNA Based Data Storage

-

- Others (molecular diagnostics, pathogen detection)

- Finland End User (Revenue, USD Million; 2024-2032)

-

- Academic research institutes

-

- Biotechnology pharmaceutical companies

-

- Diagnostic laboratories

-

- Others (Contract Research Organizations)

- Sweden

- Sweden Product Type Outlook (Revenue, USD Million; 2024-2032)

-

- Custom DNA Synthesis Products

-

- DNA Library Synthesis

-

- Reagents and Consumables

-

- Synthesizers/Instruments

-

- Software and services

- Sweden Technology Type Outlook (Revenue, USD Million; 2024-2032)

-

- PCRbased enzymatic synthesis

-

- CRISPRbased platforms

-

- SOLA technology (Systems for Oligonucleotide Ligation and Assembly)

-

- Others (novel enzyme platforms, emerging proprietary chemistries)

- Sweden Purification Type Outlook (Revenue, USD Million; 2024-2032)

-

- Desalted DNA

-

- HPLC Purified DNA

-

- PAGE Purified DNA

-

- Cartridge Purified DNA

- Sweden Customization level Outlook (Revenue, USD Million; 2024-2032)

-

- Standard Oligos

-

- Partially Customized DNA

-

- Fully Customized DNA Constructs

- Sweden DNA Type Outlook (Revenue, USD Million; 2024-2032)

-

- Single-Stranded DNA (ssDNA)

-

- Double-Stranded DNA (dsDNA)

-

- Modified DNA (with fluorescent labels, linkers)

-

- Custom Sequences / Genes

- Sweden Delivery Method (Revenue, USD Million; 2024-2032)

-

- In-Vitro DNA Delivery Systems

-

- In-Vivo DNA Delivery Systems

-

- DNA-Encoded Libraries

- Sweden Application Type (Revenue, USD Million; 2024-2032)

-

- Synthetic Biology

-

- Genetic Engineering

-

- Therapeutic antibodies

-

- Vaccine Design

-

- DNA Based Data Storage

-

- Others (molecular diagnostics, pathogen detection)

- Sweden End User (Revenue, USD Million; 2024-2032)

-

- Academic research institutes

-