Market Synopsis

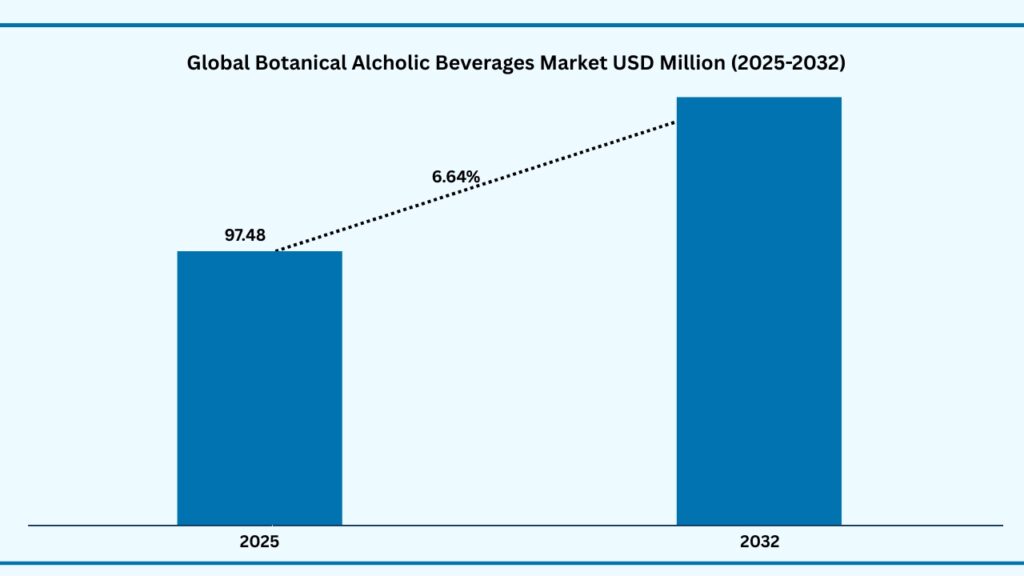

The global Botanical Alcoholic Beverages market size was USD 91.61 Million in 2024 and is expected to reach USD 153.21 million at a CAGR of 6.64% during the forecast period. Revenue growth is being driven by rising consumer preference for natural, plant-based ingredients, increasing demand for premium craft spirits, and the growing popularity of botanical-infused beers, ciders, wines, and RTD beverages. Expanding urban populations with evolving social lifestyles, coupled with stronger demand for low- and no-alcohol alternatives among health-conscious consumers, are further accelerating adoption. Additionally, innovations in botanical formulations, sustainable sourcing, and the introduction of organic and functional botanicals are reshaping product offerings and strengthening appeal across younger demographics. The global market is benefiting from shifting consumer perceptions of alcohol—from being merely recreational to offering lifestyle, wellness, and artisanal value. With over 56% of the world’s population now living in urban areas (World Bank, 2024), changing drinking cultures, premiumization trends, and the rising popularity of mixology and craft cocktails in Europe, North America, and Asia–Pacific are fueling strong growth opportunities for botanical beverages. Consumers are increasingly drawn to unique flavors, authenticity, and experiential drinking, making botanical alcohols a fast-growing segment within the wider alcoholic drinks market.

Global Botanical Alcoholic Beverages Market (USD Million)

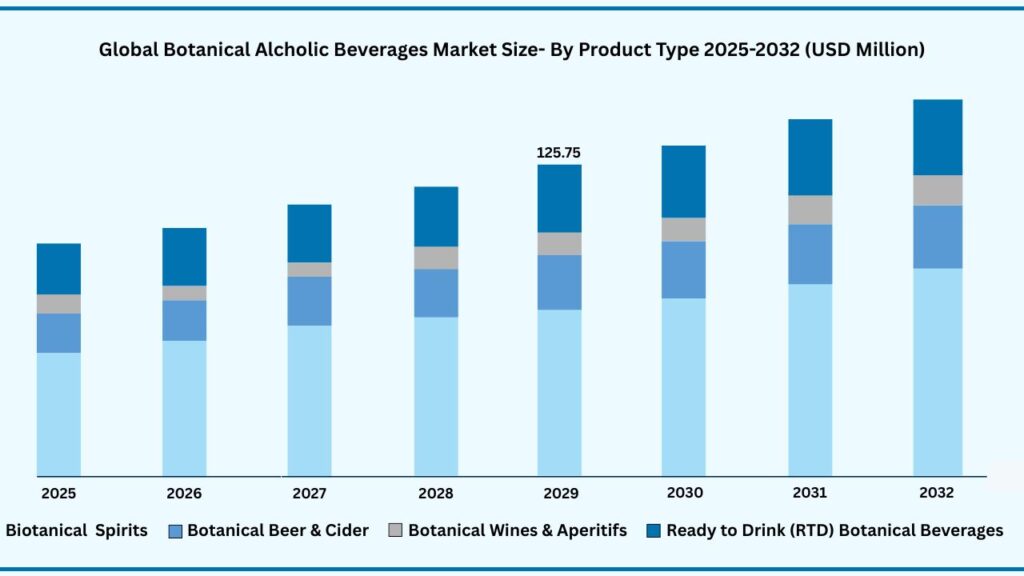

Global Botanical Alcoholic Beverages Market By Product Type Insights:

Botanical Spirit segment accounted for market share of share 53.26% in 2024 in the global botanical alcoholic beverages food market.

The botanical spirit segment accounted for the largest share of the global Botanical alcoholic beverages market in 2024, representing 53.26% of total revenues. Botanical spirit segment is expected to register a CAGR of 6.67% during the forecast year from 2025 to 2032 and expected to reach USD 81.77 million in 2032. Rising global demand for premium, artisanal, and craft spirits is fueling interest in botanical gins, vodkas, and liqueurs. Consumers are increasingly seeking unique flavor profiles, authenticity, and small-batch production that botanicals naturally provide.

A growing preference for natural, plant-based, and lower-sugar alcoholic options is encouraging adoption of botanical spirits, which are perceived as cleaner and healthier alternatives compared to conventional spirits. The surge of mixology culture, cocktail bars, and at-home experimentation has made botanical spirits—especially gin—a core ingredient in modern drinking rituals, driving consistent demand across both on-trade and off-trade channels. Producers are continuously innovating with herbs, spices, flowers, fruits, and exotic botanicals, offering consumers an ever-expanding portfolio of distinct tastes and aromas. This aligns with the rising global trend of personalization in alcoholic beverages.

Global Botanical Alcoholic Beverages Market By Product Type (USD Million)

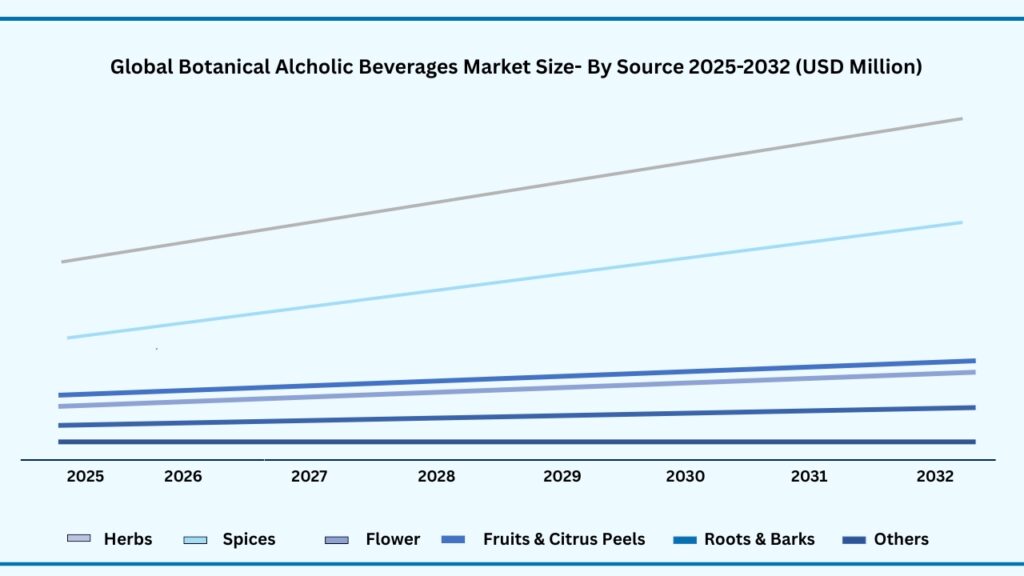

Global Botanical Alcoholic Beverages Maret by Source Insights:

Herbs segment accounted for the largest market share of share 43.49% in 2024 in the global Botanical Alcoholic Beverages market.

Based on the source, the global botanical alcoholic beverages is segmented into Herbs, Spices, Flowers, Fruits & Citrus Peels, Roots & Barks and others. Among these, the herbs segment held the largest revenue share of 43.49% 2024, and expected to register a CAGR of 6.67% between 2025 to 2032 and the market is expected to reach USD 66.80 million by 2032. Modern consumers are increasingly shifting toward plant-based, natural, and functional ingredients in their alcoholic beverages, and herbs such as basil, rosemary, mint, and sage deliver both flavor complexity and a perception of health benefits. These ingredients resonate with health-conscious Millennials and Gen Z who associate herbal infusions with “clean label” products, lower sugar content, and a more authentic drinking experience. The rise of craft and premium spirits, especially botanical gins and liqueurs, has further propelled the demand for herbs, as they allow for unique taste profiles and innovation in mixology.

This growth will be supported by continued experimentation by distillers and brewers, the surge in low- and no-alcohol botanical beverages, and increasing adoption of herbs in ready-to-drink (RTD) cocktails. Additionally, the sustainability trend is pushing manufacturers to use locally sourced and organic herbs, enhancing both environmental appeal and premium positioning. The versatility of herbs across spirits, wines, beers, and RTDs ensures that they remain a cornerstone ingredient, driving both innovation and consumer acceptance in the botanical alcoholic beverages market through 2032.

Global Botancial Alcoholic Beverages MARKET By Source (USD Million)

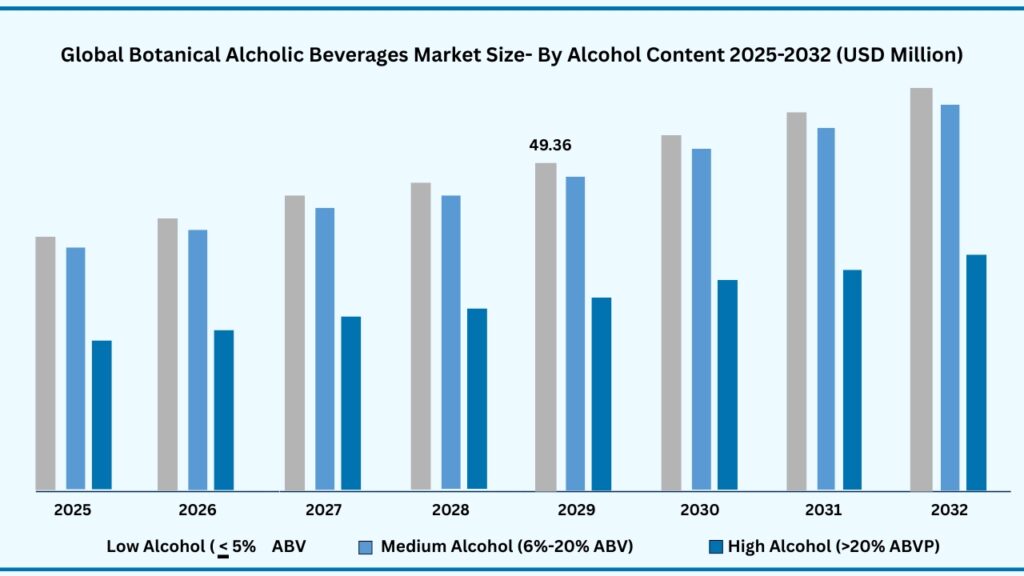

Global Botanical Alcoholic Beverages Maret by Alcoholic content Insights:

Low Alcohol (≤5% ABV segment accounted for the largest market share of share 39.23% in 2024 in the global botanical alcoholic beverages market.

Based on source, the global botanical alcoholic beverages market is segmented into Low Alcohol (≤5% ABV, Medium Alcohol (6%–20% ABV) and High Alcohol (>20% ABV)). Among these, the Low Alcohol (≤5% ABV segment held the largest revenue share of 39.23% in the global botanical alcoholic beverages market in 2024 and expected to register a CAGR of 6.66% from 2025 to 2032 and expected to reach USD 60.18 million. The dominance of the Low Alcohol (≤5% ABV) segment is driven by shifting consumer preferences toward healthier and lighter drinking options, particularly among younger demographics such as Gen Z and Millennials. With rising awareness around wellness and moderation, consumers are increasingly seeking beverages that offer the social and sensory appeal of alcohol without the negative health effects of higher alcohol content. Botanical infusions in low-ABV beverages align strongly with this trend, as they combine refreshing flavors with natural, plant-based ingredients that are perceived as cleaner and more premium. Additionally, the global movement toward mindful drinking, coupled with the popularity of sessional drinks suitable for casual and frequent consumption, has positioned this category as a mainstream choice across both developed and emerging markets. Growth is further supported by the expansion of innovative product offerings, such as ready-to-drink (RTD) botanical cocktails, low-ABV spritzers, and flavored botanical beers and ciders that cater to on-the-go lifestyles and urban consumers. These products are gaining strong traction through supermarkets, convenience stores, and especially e-commerce platforms, where low-ABV beverages are often marketed as modern, aspirational lifestyle products. The category also benefits from government initiatives in some regions encouraging moderation and from premium positioning in bars and restaurants where mixologists highlight botanical flavors as sophisticated alternatives. This balance of health, convenience, and indulgence, backed by continuous innovation in flavors and packaging, ensures that the low-alcohol botanical beverages segment will remain the most dynamic growth engine within the market.

Global Botanical Alcoholic Beverages MARKET By Alcoholic Content (USD Million)

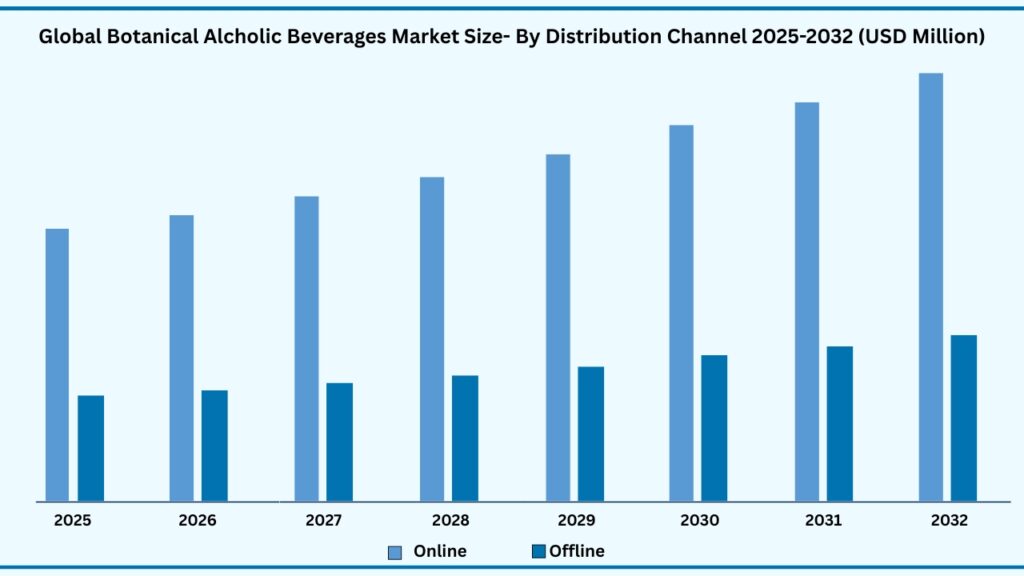

Global Botanical Alcoholic Beverages Food Market by Distribution Channel Insights:

Online segment accounted for the largest market share of share 71.71% in 2024 in the global botanical alcoholic beverages market.

Based on distribution channel, the global botanical alcoholic beverages market is segmented into online and offline. Among these, online segment held the largest revenue share of 71.71% in the global botanical alcoholic beverages market in 2024 and expected to register a CAGR of 6.62% from 2025 to 2032 and the conventional segment is expected to reach USD 109.72 million. The online distribution channel is gaining dominance in the botanical alcoholic beverages market as digital retailing provides unmatched accessibility, product variety, and convenience for consumers. With the rise of e-commerce platforms and direct-to-consumer (D2C) brand strategies, shoppers now have access to a much broader selection of botanical spirits, wines, beers, and RTDs compared to traditional brick-and-mortar outlets. Online platforms allow brands to highlight unique attributes such as organic sourcing, sustainable practices, or craft production, which strongly resonate with health-conscious and premium-oriented consumers. The ability to browse, compare, and purchase products from anywhere, supported by secure payment systems and reliable home delivery, has made online purchasing the preferred channel for a large portion of urban consumers globally.

In addition, digital marketing tools and personalized recommendations are playing a critical role in fueling this growth. Social media platforms, influencer partnerships, and targeted advertising campaigns are creating awareness and driving trial among younger demographics who are more inclined toward botanical and low-ABV alternatives. Subscription models, virtual tasting events, and exclusive online launches are further strengthening brand loyalty and recurring purchases in this segment. The accelerated adoption of e-commerce during the COVID-19 pandemic also permanently shifted consumer behaviour toward online shopping for alcohol, and with ongoing technological improvements, this trend is expected to remain sticky. As a result, the online channel continues to act not only as a sales platform but also as a powerful brand-building and consumer engagement tool, solidifying its leadership in the market.

Global Botanical Alcoholic Beverages MARKET By Ingredient (USD Million)

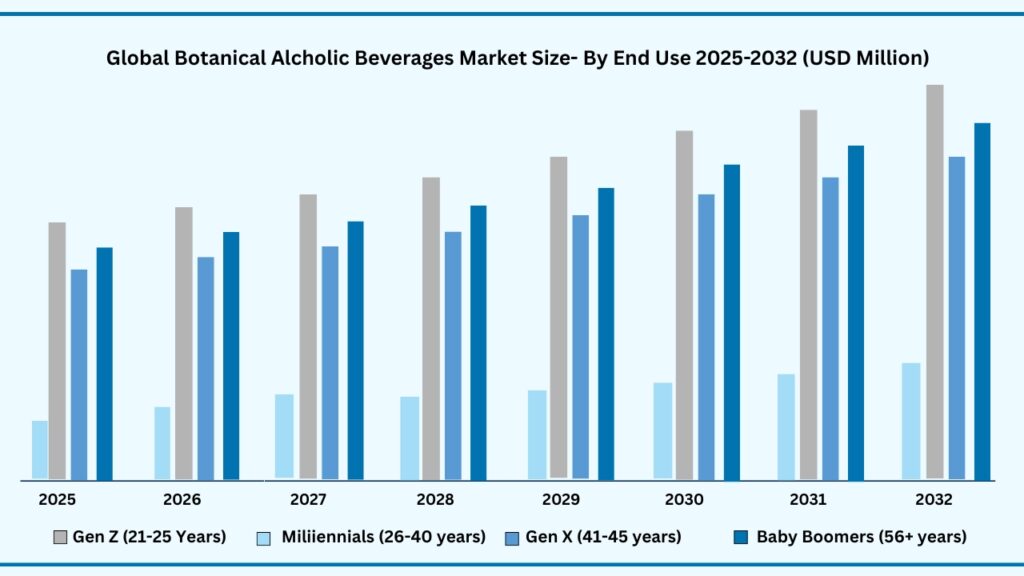

Global Botanical Alcoholic Beverages Market by end use:

Millennials (26–40 years) segment accounted for the largest market share of share 33.23% in 2024 in the global botanical alcoholic beverages market.

Based on end use millennials (26–40 years), the global botanical alcoholic beverages market is segmented into Gen Z (21–25 years), Millennials (26–40 years), Gen X (41–55 years) and Baby Boomers (56+ years). Among these, Millennials (26–40 years), segment held the largest revenue share of 33.23% in the global botanical alcoholic beverages market in 2024 and expected to register a CAGR of 6.69% from 2025 to 2032 and expected to reach USD 51.10 million in 2032. Millennials (26–40 years) represent the largest consumer group in the botanical alcoholic beverages market due to their strong preference for healthier, natural, and premium drinking options. This generation is highly experimental, open to trying new flavors, and driven by curiosity for unique sensory experiences, which aligns well with botanical spirits, wines, and RTD cocktails. Millennials are also at a life stage where disposable incomes are rising, and social occasions — from casual gatherings to upscale dining — remain central to their lifestyle, fueling consistent demand. Their awareness of sustainability and wellness trends further boosts the appeal of botanical beverages, which are often marketed as cleaner-label, eco-conscious, and craft-oriented alternatives to conventional alcohol.

The segment’s growth is also being accelerated by the strong digital presence of Millennials, who rely heavily on e-commerce platforms, influencer marketing, and peer recommendations when choosing beverages. Online retail, subscription services, and virtual events make botanical beverages more accessible to this demographic, while premium packaging and artisanal branding reinforce perceived value. In addition, Millennials are moderating their alcohol consumption compared to previous generations, which makes low- and medium-ABV botanical beverages particularly attractive.

Global Botanical Alcoholic Beverages By End Use (USD Million)

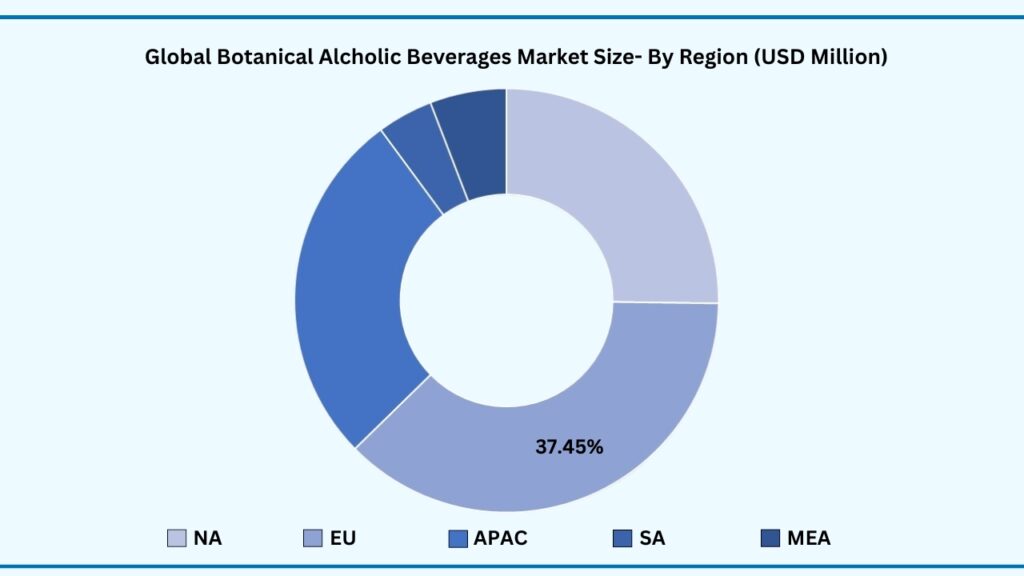

Global Botanical Alcoholic Beverages Market by Region:

Europe segment accounted for the largest market share of share of 37.45% in 2024 in the global botanical alcoholic beverages market.

Based on region, the global botanical alcoholic beverages market is segmented into Europe, Asia-Pacific, North America, Latin America and Middle East & Africa. Among these, Europe region held the largest revenue share of 37.45% in the global botanical alcoholic beverages market in 2024 and expected to register a CAGR of 6.55% from 2025 to 2032 and the Retort segment is expected to reach USD 57.01 million in 2032. The market is largest in Europe due to its deep-rooted tradition of herbal infusions, aperitifs, and botanical spirits. Countries such as Italy, France, Germany, and the UK have long histories of producing botanical-based drinks like vermouth, gin, and herbal liqueurs, which creates a strong cultural foundation for this category. The region’s well-established premium alcohol market, combined with rising consumer preference for artisanal, craft, and natural products, is driving demand for botanical spirits, wines, and RTDs. Additionally, the EU’s regulatory emphasis on clean-label ingredients and organic certifications further strengthens consumer trust, boosting adoption of botanical alcohol products.

Growth in Europe is also supported by shifting lifestyle and consumption patterns, particularly among younger demographics who are moderating alcohol intake and seeking lower-ABV, wellness-oriented options. The region’s robust retail infrastructure — from specialty liquor outlets to strong e-commerce penetration — ensures high product accessibility. Moreover, tourism and hospitality sectors, especially in Mediterranean countries, continue to promote botanical beverages as part of premium dining and social experiences, further fueling demand.

Global Botanical Alcoholic Beverages MARKET By Region (USD Million)

Major Companies and Competitive Landscape

The global botanical alcoholic beverages market is fragmented, with a mix of large multinational brands and emerging craft producers competing for market share. Major players are actively pursuing strategies such as mergers and acquisitions, collaborations with craft distilleries, and partnerships with hospitality and retail channels to expand their presence. Many companies are also investing in product innovation — from low-ABV botanical spirits to functional botanical blends — to cater to diverse consumer preferences. These efforts are aimed at enhancing flavor authenticity, ensuring consistent quality, and broadening product accessibility across both online and offline channels.

In addition, leading players are increasingly focusing on sustainable sourcing of botanicals, eco-friendly packaging solutions, and transparent labeling to strengthen consumer trust and brand loyalty. The rise of health-conscious consumers and demand for natural, plant-based ingredients is pushing companies to experiment with unique botanicals such as herbs, spices, flowers, and citrus peels. This innovation pipeline, combined with premiumization strategies and the expansion of distribution networks, is expected to intensify competition and drive long-term growth in the botanical alcoholic beverages market. Some of the leading companies profiled in the global botanical alcoholic beverages market report include:

- Diageo Plc

- Pernod Ricard S.A.

- Bacardi Limited

- Belvedere (LVMH)

- The Sazerac Company

- Grey Goose (Bacardi)

- Absolut Juice (Pernod Ricard)

- Nestlé S.A.

- Archer Daniels Midland (ADM)

- Bumblezest

- Cotswolds Distillery

- Martin Bauer Group

- Fever-Tree

- Blue Sky Botanics Ltd.

- IDo Herbal & Functional Producers

- Chartreuse

- Strega

- Becherovka

- Underberg

- Hendrick’s Gin

- Monkey 47

- Bombay Sapphire

- Aviation American Gin

- Roku Gin (Suntory)

- The Botanist Gin (Bruichladdich)

Strategic Development

Diageo Scaling Up to meet the demand: Portfolio Modernization & Strategic Divestment

Diageo: Scaling Up Circular Packaging Globally (2023–2024)

- In December 2023, Diageo expanded its ecoSPIRITS partnership globally after successful 2022 trials in Indonesia.

- The rollout will cover 18 markets over the next three years, using reusable ecoTOTE packaging to cut carbon emissions and packaging waste.

- This forms part of its Society 2030: Spirit of Progress sustainability agenda.

Scope of Research

| Report Details | Outcome |

|---|---|

| Market size in 2024 | USD 91.61 Million |

| CAGR (2024–2032) | 6.64% |

| Revenue forecast to 2033 | USD 153.21 Million |

| Base year for estimation | 2024 |

| Historical data | 2019–2023 |

| Forecast period | 2025–2032 |

| Quantitative units | Revenue in USD Million, and CAGR in % from 2025 to 2032 |

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | By Product Type, By Sources, By Alcohol Content, High Alcohol, By Distribution Channel, By End Use |

| Regional scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Country scope | U.S., Canada, Mexico, Germany, France, U.K., Italy, Spain, Benelux, Russia, Finland, Sweden, Rest of Europe, China, India, Japan, South Korea, Indonesia, Thailand, Vietnam, Australia, New Zealand Rest of APAC, Brazil, Rest of LATAM, Saudi Arabia, UAE, South Africa, Turkey, Rest of MEA |

| Key companies profiled | Diageo Plc, Pernod Ricard S.A. , Bacardi Limited, William Grant & Sons Ltd, Davide Campari-Milano N.V., Suntory Holdings (Suntory Global Spirits), Rémy Cointreau, Radico Khaitan Ltd, San Miguel Corporation (Ginebra San Miguel), Maison Ferrand, Brown-Forman Corp, Hotaling & Co., Spearhead Spirits, Spearhead Spirits, Hernö Gin Distillery AB, Masons of Yorkshire, Globus Spirits Ltd., Berry Bros. & Rudd Ltd., Four Pillars Distillery, Distell Group Ltd., Brooklyn Gin Co. Ukiyo Spirits Co. |

| Customization scope | 10 hours of free customization and expert consultation |

Some Key Questions the Report Will Answer

- What is the expected revenue Compound Annual Growth Rate (CAGR) of the global botanical alcoholic beverages market over the forecast period (2025–2032)?

- The global botanical alcoholic beverages market revenue is expected to register a Compound Annual Growth Rate (CAGR) of 6.64% during the forecast period.

- What was the size of the global botanical alcoholic beverages in 2024?

- The global botanical alcoholic beverages market size was USD 91.61 Million in 2024.

- Which factors are expected to drive the global botanical alcoholic beverages market growth?

- The growth of the global botanical alcoholic beverages market is being driven by rising consumer demand for natural, clean-label, and health-oriented drinks that combine wellness with indulgence. Younger demographics, particularly Millennials and Gen Z, are showing a strong preference for beverages infused with herbs, spices, flowers, fruits, and other botanicals due to their perceived functional benefits, unique flavor profiles, and premium appeal. In addition, the rapid expansion of low- and no-alcohol variants is catering to the sober-curious movement, further widening the consumer base. Innovation in craft distilling, sustainable sourcing of ingredients, and eco-friendly packaging are also attracting health-conscious and environmentally aware consumers. Strong distribution growth through online retail channels, premium bars, and specialty stores, coupled with increasing popularity of cocktails and mixology culture worldwide, is further accelerating market expansion.

- Which was the leading segment in the global botanical alcoholic beverages market in terms of product type in 2024?

- Botanical spirits segment was leading in the botanical alcoholic beverages market on the basis of product type in 2024.

- What are some restraints for revenue growth of the global botanical alcoholic beverages market?

- Revenue growth of the global botanical alcoholic beverages market faces several restraints despite strong consumer interest. High production costs associated with sourcing premium botanicals, sustainable ingredients, and small-batch distilling can limit affordability and mass adoption, particularly in price-sensitive markets. Strict regulatory frameworks governing alcohol production, labeling, and marketing—especially for products positioned as “healthier” or functional—pose compliance challenges and may restrict product innovation. Additionally, limited consumer awareness in developing regions, supply chain complexities in maintaining ingredient consistency, and strong competition from traditional alcoholic beverages such as beer, wine, and spirits can slow market penetration. Economic uncertainties and inflationary pressures also influence discretionary spending on premium and craft beverages, potentially hindering long-term revenue growth.

Follow us on: Facebook, Twitter, Instagram and LinkedIn.

Chapter 1. Introduction

1.1. Market Definition

1.2. Objectives of the study

1.3. Overview of Botanical Alcoholic Beverages market

1.4. Currency and pricing

1.5. Limitation

1.6. Markets covered

1.7. Research Scope

Chapter 2. Research Methodology

2.1. Research Sources

2.1.1. Primary

2.1.2. Secondary

2.1.3. Paid Sources

2.2. Years considered for the study

2.3. Assumptions

2.3.1. Market value

2.3.2. Market volume

2.3.3. Exchange rate

2.3.4. Price

2.3.5. Economic & political stability

Chapter 3. Executive Summary

3.1. Summary Snapshot, 2025–2032

Chapter 4. Key Insights

4.1. Production consumption analysis

4.2. Strategic partnerships & alliances

4.3. Joint ventures

4.4. Acquisition of local players

4.5. Contract manufacturing

4.6. Digital & e-commerce sales channels

4.7. Compliance with standards

4.8. Value chain analysis

4.9. Raw material sourcing

4.10. Formulation & manufacturing

4.11. Distribution & retail

4.12. Import-export analysis

4.13. Brand comparative analysis

4.14. Technological advancements

4.15. Porter’s five force

4.15.1. Threat of new entrants

4.15.1.1. Capital requirment

4.15.1.2. Product knowledge

4.15.1.3. Technical knowledge

4.15.1.4. Customer relation

4.15.1.5. Access to appliation and technology

4.15.2. Threat of substitutes

4.15.2.1. Cost

4.15.2.2. Performance

4.15.2.3. Availability

4.15.2.4. Technical knowledge

4.15.2.5. Durability

4.15.3. Bargainning power of buyers

4.15.3.1. Numbers of buyers relative to suppliers

4.15.3.2. Product differentiation

4.15.3.3. Threat of forward integration

4.15.3.4. Buyers volume

4.15.4. Bargainning power of suppliers

4.15.4.1. Suppliers concentration

4.15.4.2. Buyers switching cost to other suppliers

4.15.4.3. Threat of backward integration

4.15.5. Bargainning power of suppliers

4.15.5.1. Industry concentration

4.15.5.2. Industry growth rate

4.15.5.3. Product differentiation

4.16. Patent analysis

4.17. Regulation coverage

4.18. Pricing analysis

4.19. Competitive Metric Space Analysis

Chapter 5. Market Overview

5.1. Drivers

5.1.1. Rising consumer preference for natural and plant-based ingredients

5.1.2. Premiumization and craft innovation

5.2. Growth in millennial and Gen Z alcohol consumption trends

5.3. Restraints

5.3.1. High production costs

5.3.2. Stringent alcohol regulations

5.4. Opportunities

5.4.1. Expansion of low- and no-alcohol botanical drinks

5.4.2. Emergence of sustainable and eco-friendly sourcing

5.4.3. Growth of e-commerce and D2C channels

5.5. Threat

5.5.1. Maintaining consistent flavor profiles

5.5.2. Intensifying competition

Chapter 6. Botanical Alcoholic Beverages Market By Product Type Insights & Trends,

Revenue (USD Million),

6.1. Product Type Dynamics & Market Share, 2025–2032

6.1.1. Botanical Spirits

6.1.1.1. Gin

6.1.1.2. Botanical Vodka

6.1.1.3. Botanical Rum

6.1.1.4. Botanical Tequila

6.1.2. Botanical Beer & Ciders

6.1.2.1. Botanical Beer (Herb/Spice-infused)

6.1.2.2. Botanical CiderBotanical Vodka

6.1.3. Botanical Wines & Aperitifs

6.1.3.1. Vermouth & Aperitifs

6.1.3.2. Botanical-Infused Wines

6.1.4. Ready-to-Drink (RTD) Botanical Beverages

6.1.4.1. Botanical Cocktails

6.1.4.2. Hard Seltzers & Spritzers

Chapter 7. Botanical Alcoholic Beverages Market By Source Insights & Trends, Revenue

(USD Million),

7.1. Botanical Source Dynamics & Market Share, 2024–2033

7.1.1. Herbs

7.1.2. Spices

7.1.3. Flowers

7.1.4. Fruits & Citrus Peels

7.1.5. Roots & Barks,

7.1.6. Others

Chapter 8. Botanical Alcoholic Beverages Market By Alcohol Content Insights & Trends,

Revenue (USD Million),

8.1. Alcohol Content Dynamics & Market Share, 2024–2033

8.1.1. Low Alcohol (≤5% ABV)

8.1.2. Medium Alcohol (6%–20% ABV)

8.1.3. High Alcohol (>20% ABV)

Chapter 9. Botanical Alcoholic Beverages Market By Distribution Channel Insights &

Trends, Revenue (USD Million),

9.1. Distribution Channel & Market Share, 2024–2033

9.1.1. Offline

9.1.1.1. Bars

9.1.1.2. Pubs

9.1.1.3. Restaurants

9.1.1.4. Hotels & Clubs

9.1.2. Online

9.1.2.1. E-commerce Platforms

9.1.2.2. Direct-to-Consumer (D2C) Websites

Chapter 10. Botanical Alcoholic Beverages Market By End Use Insights & Trends,

Revenue (USD Million),

10.1. End Use Dynamics & Market Share, 2024–2033

10.1.1.Gen Z (21–25 years)

10.1.2.Millennials (26–40 years)

10.1.3.Gen X (41–55 years)

10.1.4.Baby Boomers (56+ years)

Chapter 11. Botanical Alcoholic Beverages Market Regional Outlook

11.1. Botanical Alcoholic BeveragesMarket Share By Region, 2024–2033

11.2. North America

11.2.1. Market By Product Type, Market Estimates and Forecast, USD Million,

11.2.2. Botanical Spirits

11.2.2.1. Gin

11.2.2.2. Botanical Vodka

11.2.2.3. Botanical Rum

11.2.2.4. Botanical Tequila

11.2.3. Botanical Beer & Ciders

11.2.3.1. Botanical Beer (Herb/Spice-infused)

11.2.3.2. Botanical CiderBotanical Vodka

11.2.4. Botanical Wines & Aperitifs

11.2.4.1. Vermouth & Aperitifs

11.2.4.2. Botanical-Infused Wines

11.2.5. Ready-to-Drink (RTD) Botanical Beverages

11.2.5.1. Botanical Cocktails

11.2.5.2. Hard Seltzers & Spritzers

11.3.Market By Source, Market Estimates and Forecast, USD Million,

11.3.1.Herbs

11.3.2.Spices

11.3.3.Flowers

11.3.4.Fruits & Citrus Peels

11.3.5.Roots & Barks,

11.3.6.Others

11.4.Market By Alcohol Content, Market Estimates and Forecast, USD Million,

11.4.1.2- Low Alcohol (≤5% ABV)

11.4.2.Medium Alcohol (6%–20% ABV)

11.4.3.High Alcohol (>20% ABV)

11.5.Market By Distribution Channel, Market Estimates and Forecast, USD Million,

11.5.1. Offline

11.5.1.1. Bars

11.5.1.2. Pubs

11.5.1.3. Restaurants

11.5.1.4. Hotels & Clubs

11.5.2.Online

11.5.2.1. E-commerce Platforms

11.5.2.2. Direct-to-Consumer (D2C) Websites

11.6.Market By End Use, Market Estimates and Forecast, USD Million,

11.6.1.Gen Z (21–25 years)

11.6.2.Millennials (26–40 years)

11.6.3.Gen X (41–55 years)

11.6.4.Baby Boomers (56+ years)

11.7.Market By Country, Market Estimates and Forecast, USD Million,

11.7.1.US

11.7.2.Canada

11.7.3.Mexico

11.8. Europe

11.8.1. Market By Product Type, Market Estimates and Forecast, USD Million,

11.8.2. Botanical Spirits

11.8.2.1. Gin

11.8.2.2. Botanical Vodka

11.8.2.3. Botanical Rum

11.8.2.4. Botanical Tequila

11.8.3. Botanical Beer & Ciders

11.8.3.1. Botanical Beer (Herb/Spice-infused)

11.8.3.2. Botanical CiderBotanical Vodka

11.8.4. Botanical Wines & Aperitifs

11.8.4.1. Vermouth & Aperitifs

11.8.4.2. Botanical-Infused Wines

11.8.5. Ready-to-Drink (RTD) Botanical Beverages

11.8.5.1. Botanical Cocktails

11.8.5.2. Hard Seltzers & Spritzers

11.9.Market By Source, Market Estimates and Forecast, USD Million,

11.9.1.Herbs

11.9.2.Spices

11.9.3.Flowers

11.9.4.Fruits & Citrus Peels

11.9.5.Roots & Barks,

11.9.6.Others

11.10. Market By Alcohol Content, Market Estimates and Forecast, USD Million,

11.10.1. 2- Low Alcohol (≤5% ABV)

11.10.2. Medium Alcohol (6%–20% ABV)

11.10.3. High Alcohol (>20% ABV)

11.11 Market By Distribution Channel, Market Estimates and Forecast, USD Million,

11.11.1. Offline

11.11.1.1. Bars

11.11.1.2. Pubs

11.11.1.3. Restaurants

11.11.1.4. Hotels & Clubs

11.11.2. Online

11.11.2.1. E-commerce Platforms

11.11.2.2. Direct-to-Consumer (D2C) Websites

11.12. Market By End Use, Market Estimates and Forecast, USD Million,

11.12.1. Gen Z (21–25 years)

11.12.2. Millennials (26–40 years)

11.12.3. Gen X (41–55 years)

11.12.4. Baby Boomers (56+ years)

11.13. Market By Country, Market Estimates and Forecast, USD Million,

11.13.1. Germany

11.13.2. France

11.13.3. U.K

11.13.4. Italy

11.13.5. Spain

11.13.6. Benelux

11.13.7. Russia

11.13.8. Finland

11.13.9. Sweden

11.13.10. Rest Of Europe

11.14. Asia-Pacific

11.14.1. Market By Product Type, Market Estimates and Forecast, USD Million,

11.14.2. Botanical Spirits

11.14.2.1. Gin

11.14.2.2. Botanical Vodka

11.14.2.3. Botanical Rum

11.14.2.4. Botanical Tequila

11.14.3. Botanical Beer & Ciders

11.14.3.1. Botanical Beer (Herb/Spice-infused)

11.14.3.2. Botanical CiderBotanical Vodka

11.14.4. Botanical Wines & Aperitifs

11.14.4.1. Vermouth & Aperitifs

11.14.4.2. Botanical-Infused Wines

11.14.5. Ready-to-Drink (RTD) Botanical Beverages

11.14.5.1. Botanical Cocktails

11.14.5.2. Hard Seltzers & Spritzers

11.15. Market By Source, Market Estimates and Forecast, USD Million,

11.15.1. Herbs

11.15.2. Spices

11.15.3. Flowers

11.15.4. Fruits & Citrus Peels

11.15.5. Roots & Barks,

11.15.6. Others

11.16. Market By Alcohol Content, Market Estimates and Forecast, USD Million,

11.16.1. 2- Low Alcohol (≤5% ABV)

11.16.2. Medium Alcohol (6%–20% ABV)

11.16.3. High Alcohol (>20% ABV)

11.17. Market By Distribution Channel, Market Estimates and Forecast, USD Million,

11.17.1. Offline

11.17.1.1. Bars

11.17.1.2. Pubs

11.17.1.3. Restaurants

11.17.1.4. Hotels & Clubs

11.17.2. Online

11.17.2.1. E-commerce Platforms

11.17.2.2. Direct-to-Consumer (D2C) Websites

11.18. Market By End Use, Market Estimates and Forecast, USD Million,

11.18.1. Gen Z (21–25 years)

11.18.2. Millennials (26–40 years)

11.18.3. Gen X (41–55 years)

11.18.4. Baby Boomers (56+ years)

11.19. Market By Country, Market Estimates and Forecast, USD Million,

11.19.1.1. China

11.19.1.2. India

11.19.1.3. Japan

11.19.1.4. South Korea

11.19.1.5. Indonesia

11.19.1.6. Thailand

11.19.1.7. Vietnam

11.19.1.8. Australia

11.19.1.9. New Zeland

11.19.1.10. Rest of APAC

11.20. Latin America

11.20.1. Market By Product Type, Market Estimates and Forecast, USD Million,

11.20.2. Botanical Spirits

11.20.2.1. Gin

11.20.2.2. Botanical Vodka

11.20.2.3. Botanical Rum

11.20.2.4. Botanical Tequila

11.20.3. Botanical Beer & Ciders

11.20.3.1. Botanical Beer (Herb/Spice-infused)

11.20.3.2. Botanical CiderBotanical Vodka

11.20.4. Botanical Wines & Aperitifs

11.20.4.1. Vermouth & Aperitifs

11.20.4.2. Botanical-Infused Wines

11.20.5. Ready-to-Drink (RTD) Botanical Beverages

11.20.5.1. Botanical Cocktails

11.20.5.2. Hard Seltzers & Spritzers

11.21. Market By Source, Market Estimates and Forecast, USD Million,

11.21.1. Herbs

11.21.2. Spices

11.21.3. Flowers

11.21.4. Fruits & Citrus Peels

11.21.5. Roots & Barks,

11.21.6. Others

11.22. Market By Alcohol Content, Market Estimates and Forecast, USD Million,

11.22.1. 2- Low Alcohol (≤5% ABV)

11.22.2. Medium Alcohol (6%–20% ABV)

11.22.3. High Alcohol (>20% ABV)

11.23. Market By Distribution Channel, Market Estimates and Forecast, USD Million,

11.23.1. Offline

11.23.1.1. Bars

11.23.1.2. Pubs

11.23.1.3. Restaurants

11.23.1.4. Hotels & Clubs

11.23.2. Online

11.23.2.1. E-commerce Platforms

11.23.2.2. Direct-to-Consumer (D2C) Websites

11.24. Market By End Use, Market Estimates and Forecast, USD Million,

11.24.1. Gen Z (21–25 years)

11.24.2. Millennials (26–40 years)

11.24.3. Gen X (41–55 years)

11.24.4. Baby Boomers (56+ years)

11.25. Market By Country, Market Estimates and Forecast, USD Million,

11.25.1. Market By Country, Market Estimates and Forecast, USD Million,

11.25.1.1. Brazil

11.25.1.2. Rest of LATAM

11.26. Middle East & Africa

11.26.1. Market By Product Type, Market Estimates and Forecast, USD Million,

11.26.2. Botanical Spirits

11.26.2.1. Gin

11.26.2.2. Botanical Vodka

11.26.2.3. Botanical Rum

11.26.2.4. Botanical Tequila

11.26.3. Botanical Beer & Ciders

11.26.3.1. Botanical Beer (Herb/Spice-infused)

11.26.3.2. Botanical CiderBotanical Vodka

11.26.4. Botanical Wines & Aperitifs

11.26.4.1. Vermouth & Aperitifs

11.26.4.2. Botanical-Infused Wines

11.26.5. Ready-to-Drink (RTD) Botanical Beverages

11.26.5.1. Botanical Cocktails

11.26.5.2. Hard Seltzers & Spritzers

11.27. Market By Source, Market Estimates and Forecast, USD Million,

11.27.1. Herbs

11.27.2. Spices

11.27.3. Flowers

11.27.4. Fruits & Citrus Peels

11.27.5. Roots & Barks,

11.27.6. Others

11.28. Market By Alcohol Content, Market Estimates and Forecast, USD Million,

11.28.1. 2- Low Alcohol (≤5% ABV)

11.28.2. Medium Alcohol (6%–20% ABV)

11.28.3. High Alcohol (>20% ABV)

11.29. Market By Distribution Channel, Market Estimates and Forecast, USD Million,

11.29.1. Offline

11.29.1.1. Bars

11.29.1.2. Pubs

11.29.1.3. Restaurants

11.29.1.4. Hotels & Clubs

11.29.2. Online

11.29.2.1. E-commerce Platforms

11.29.2.2. Direct-to-Consumer (D2C) Websites

11.30. Market By End Use, Market Estimates and Forecast, USD Million,

11.30.1. Gen Z (21–25 years)

11.30.2. Millennials (26–40 years)

11.30.3. Gen X (41–55 years)

11.30.4. Baby Boomers (56+ years)

11.30.5. Market By Country, Market Estimates and Forecast, USD Million,

11.30.5.1. Saudi Arabia

11.30.5.2. UAE

11.30.5.3. South Africa

11.30.5.4. Rest of MEA

Chapter 12. Competitive Landscape

12.1. Market Revenue Share By Manufacturers

12.2. Mergers & Acquisitions

12.3. Competitor’s Positioning

12.4. Strategy Benchmarking

12.5. Vendor Landscape

12.5.1. Distributors

12.5.1.1. North America

12.5.1.2. Europe

12.5.1.3. Asia Pacific

12.5.1.4. Middle East & Africa

12.5.1.5. Latin America

Chapter 13. Company Profiles

13.1. Diageo Plc

13.1.1. Company Overview

13.1.2. Product & Service Offerings

13.1.3. Strategic Initiatives

13.1.4. Financials

13.1.5. Research Insights

13.2. Pernod Ricard S.A.

13.2.1. Company Overview

13.2.2. Product & Service Offerings

13.2.3. Strategic Initiatives

13.2.4. Financials

13.2.5. Research Insights

13.3. Bacardi Limited

13.3.1. Company Overview

13.3.2. Product & Service Offerings

13.3.3. Strategic Initiatives

13.3.4. Financials

13.3.5. Research Insights

13.4. William Grant & Sons Ltd

13.4.1. Company Overview

13.4.2. Product & Service Offerings

13.4.3. Strategic Initiatives

13.4.4. Financials

13.4.5. Research Insights

13.5. Davide Campari-Milano N.V.

13.5.1. Company Overview

13.5.2. Product & Service Offerings

13.5.3. Strategic Initiatives

13.5.4. Financials

13.5.5. Research Insights

13.6. Suntory Holdings (Suntory Global Spirits)

13.6.1. Company Overview

13.6.2. Product & Service Offerings

13.6.3. Strategic Initiatives

13.6.4. Financials

13.6.5. Research Insights

13.7. Rémy Cointreau

13.7.1. Company Overview

13.7.2. Product & Service Offerings

13.7.3. Strategic Initiatives

13.7.4. Financials

13.7.5. Conclusion

13.8. Radico Khaitan Ltd

13.8.1. Company Overview

13.8.2. Product & Service Offerings

13.8.3. Strategic Initiatives

13.8.4. Financials

13.8.5. Conclusion

13.9. San Miguel Corporation (Ginebra San Miguel),

13.9.1. Company Overview

13.9.2. Product & Service Offerings

13.9.3. Strategic Initiatives

13.9.4. Financials

13.9.5. Conclusion

13.10. Maison Ferrand

13.10.1. Company Overview

13.10.2. Product & Service Offerings

13.10.3. Strategic Initiatives

13.10.4. Financials

13.10.5. Conclusion

13.11. Brown-Forman Corp

13.11.1. Company Overview

13.11.2. Product & Service Offerings

13.11.3. Strategic Initiatives

13.11.4. Financials

13.11.5. Conclusion

13.12. Hotaling & Co.

13.12.1. Company Overview

13.12.2. Product & Service Offerings

13.12.3. Strategic Initiatives

13.12.4. Financials

13.12.5. Conclusion

13.13. Spearhead Spirits

13.13.1. Company Overview

13.13.2. Product & Service Offerings

13.13.3. Strategic Initiatives

13.13.4. Financials

13.13.5. Conclusion

13.14. Hernö Gin Distillery AB

13.14.1. Company Overview

13.14.2. Product & Service Offerings

13.14.3. Strategic Initiatives

13.14.4. Financials

13.14.5. Conclusion

13.15. Masons of Yorkshire

13.15.1. Company Overview

13.15.2. Product & Service Offerings

13.15.3. Strategic Initiatives

13.15.4. Financials

13.15.5. Conclusion

13.16. Globus Spirits Ltd.

13.16.1. Company Overview

13.16.2. Product & Service Offerings

13.16.3. Strategic Initiatives

13.16.4. Financials

13.16.5. Conclusion

13.17. Berry Bros. & Rudd Ltd.

13.17.1. Company Overview

13.17.2. Product & Service Offerings

13.17.3. Strategic Initiatives

13.17.4. Financials

13.17.5. Conclusion

13.18. Four Pillars Distillery

13.18.1. Company Overview

13.18.2. Product & Service Offerings

13.18.3. Strategic Initiatives

13.18.4. Financials

13.18.5. Conclusion

13.19. Distell Group Ltd.

13.19.1. Company Overview

13.19.2. Product & Service Offerings

13.19.3. Strategic Initiatives

13.19.4. Financials

13.19.5. Conclusion

13.20. Brooklyn Gin Co.

13.20.1. Company Overview

13.20.2. Product & Service Offerings

13.20.3. Strategic Initiatives

13.20.4. Financials

13.20.5. Conclusion

13.21. Ukiyo Spirits Co.

13.21.1. Company Overview

13.21.2. Product & Service Offerings

13.21.3. Strategic Initiatives

13.21.4. Financials

13.21.5. Conclusion

For the purpose of this report, Advantia Business Consulting LLP. has segmented global botanical alcoholic beverages market on the basis of By Product Type, By Sources, By Alcohol Content, By Distribution Channel, By End Use and By region for 2019 to 2032

Global Product Type Outlook (Revenue, USD Million 2019-2032)

|

|

|

|

Global Source (Revenue, USD Million; 2019-2032)

-

- Herbs

-

- Spices

-

- Flowers

-

- Fruits & Citrus Peels

-

- Roots & Barks

-

- Others

Global Alcohol Content Outlook (Revenue, USD Million; 2019-2032)

|

|

|

Global Distribution Channel (Revenue, USD Million; 2019-2032)

|

|

Global End Use (Revenue, USD Million; 2019-2032)

|

|

|

- North America

-

- North America Product Type Outlook (Revenue, USD Million 2019-2032)

|

|

|

|

-

- North America Source (Revenue, USD Million; 2019-2032)

-

-

- Herbs

-

-

-

- Spices

-

-

-

- Flowers

-

-

-

- Fruits & Citrus Peels

-

-

-

- Roots & Barks

-

-

-

- Others

-

-

- North America Alcohol Content Outlook (Revenue, USD Million; 2019-2032)

|

|

|

-

- North America Distribution Channel (Revenue, USD Million; 2019-2032)

|

|

-

- North America End Use (Revenue, USD Million; 2019-2032)

|

|

|

- U.S

-

- U.S Product Type Outlook (Revenue, USD Million 2019-2032)

|

|

|

|

-

- U.S Source (Revenue, USD Million; 2019-2032)

-

-

- Herbs

-

-

-

- Spices

-

-

-

- Flowers

-

-

-

- Fruits & Citrus Peels

-

-

-

- Roots & Barks

-

-

-

- Others

-

-

- U.S Alcohol Content Outlook (Revenue, USD Million; 2019-2032)

|

|

|

-

- U.S Distribution Channel (Revenue, USD Million; 2019-2032)

|

|

-

- U.S End Use (Revenue, USD Million; 2019-2032)

|

|

|

- Canada

-

- Canada Product Type Outlook (Revenue, USD Million 2019-2032)

|

|

|

|

-

- Canada Source (Revenue, USD Million; 2019-2032)

-

-

- Herbs

-

-

-

- Spices

-

-

-

- Flowers

-

-

-

- Fruits & Citrus Peels

-

-

-

- Roots & Barks

-

-

-

- Others

-

-

- Canada Alcohol Content Outlook (Revenue, USD Million; 2019-2032)

|

|

|

-

- Canada Distribution Channel (Revenue, USD Million; 2019-2032)

|

|

-

- Canada End Use (Revenue, USD Million; 2019-2032)

|

|

|

|

- Europe

-

- Europe Product Type Outlook (Revenue, USD Million 2019-2032)

|

|

|

|

-

- Mexico Source (Revenue, USD Million; 2019-2032)

-

-

- Herbs

-

-

-

- Spices

-

-

-

- Flowers

-

-

-

- Fruits & Citrus Peels

-

-

-

- Roots & Barks

-

-

-

- Others

-

-

- Mexico Alcohol Content Outlook (Revenue, USD Million; 2019-2032)

|

|

|

-

- Mexico Distribution Channel (Revenue, USD Million; 2019-2032)

|

|

-

- Mexico End Use (Revenue, USD Million; 2019-2032)

|

|

|

- France

-

- France Product Outlook (Revenue, USD Million 2019-2032)

|

|

|

|

-

- France Source (Revenue, USD Million; 2019-2032)

-

-

- Herbs

-

-

-

- Spices

-

-

-

- Flowers

-

-

-

- Fruits & Citrus Peels

-

-

-

- Roots & Barks

-

-

-

- Others

-

-

- France Alcohol Content Outlook (Revenue, USD Million; 2019-2032)

|

|

|

-

- France Distribution Channel (Revenue, USD Million; 2019-2032)

|

|

-

- France End Use (Revenue, USD Million; 2019-2032)

|

|

- U.K

-

- U.K Product Type Outlook (Revenue, USD Million 2019-2032)

|

|

|

|

-

- U.K Source (Revenue, USD Million; 2019-2032)

-

-

- Herbs

-

-

-

- Spices

-

-

-

- Flowers

-

-

-

- Fruits & Citrus Peels

-

-

-

- Roots & Barks

-

-

-

- Others

-

-

- U.K Alcohol Content Outlook (Revenue, USD Million; 2019-2032)

|

|

|

-

- U.K Distribution Channel (Revenue, USD Million; 2019-2032)

|

|

-

- U.K End Use (Revenue, USD Million; 2019-2032)

|

|

- Italy

-

- Italy Product Type Outlook (Revenue, USD Million 2019-2032)

|

|

|

|

-

- Italy Source (Revenue, USD Million; 2019-2032)

-

-

- Herbs

-

-

-

- Spices

-

-

-

- Flowers

-

-

-

- Fruits & Citrus Peels

-

-

-

- Roots & Barks

-

-

-

- Others

-

-

- Italy Alcohol Content Outlook (Revenue, USD Million; 2019-2032)

|

|

|

-

- Italy Distribution Channel (Revenue, USD Million; 2019-2032)

|

|

-

- Italy End Use (Revenue, USD Million; 2019-2032)

|

|

- Spain

-

- Spain Product Type Outlook (Revenue, USD Million 2019-2032)

|

|

|

|

-

- Spain Source (Revenue, USD Million; 2019-2032)

-

-

- Herbs

-

-

-

- Spices

-

-

-

- Flowers

-

-

-

- Fruits & Citrus Peels

-

-

-

- Roots & Barks

-

-

-

- Others

-

-

- Spain Alcohol Content Outlook (Revenue, USD Million; 2019-2032)

|

|

|

-

- Spain Distribution Channel (Revenue, USD Million; 2019-2032)

|

|

-

- Spain End Use (Revenue, USD Million; 2019-2032)

|

|

|

- Russia

-

- Russia Product Type Outlook (Revenue, USD Million 2019-2032)

|

|

|

|

-

- Russia Source (Revenue, USD Million; 2019-2032)

-

-

- Herbs

-

-

-

- Spices

-

-

-

- Flowers

-

-

-

- Fruits & Citrus Peels

-

-

-

- Roots & Barks

-

-

-

- Others

-

-

- Russia Alcohol Content Outlook (Revenue, USD Million; 2019-2032)

|

|

|

-

- Russia Distribution Channel (Revenue, USD Million; 2019-2032)

|

|

-

- Russia End Use (Revenue, USD Million; 2019-2032)

|

|

- Finland

-

- Finland Product Type Outlook (Revenue, USD Million 2019-2032)

|

|

|

|

-

- Finland Source (Revenue, USD Million; 2019-2032)

-

-

- Herbs

-

-

-

- Spices

-

-

-

- Flowers

-

-

-

- Fruits & Citrus Peels

-

-

-

- Roots & Barks

-

-

-

- Others

-

-

- Finland Alcohol Content Outlook (Revenue, USD Million; 2019-2032)

|

|

|

-

- Finland Distribution Channel (Revenue, USD Million; 2019-2032)

|

|

-

- Finland End Use (Revenue, USD Million; 2019-2032)

|

|

- Sweden

-

- Sweden Product Type Outlook (Revenue, USD Million 2019-2032)

|

|

|

|

-

- Sweden Source (Revenue, USD Million; 2019-2032)

-

-

- Herbs

-

-

-

- Spices

-

-

-

- Flowers

-

-

-

- Fruits & Citrus Peels

-

-

-

- Roots & Barks

-

-

-

- Others

-

-

- Sweden Alcohol Content Outlook (Revenue, USD Million; 2019-2032)

|

|

|

-

- Sweden Distribution Channel (Revenue, USD Million; 2019-2032)

|

|

-

- Sweden End Use (Revenue, USD Million; 2019-2032)

|

|

|

- Rest Of Europe

-

- Sweden Product Type Outlook (Revenue, USD Million 2019-2032)

|

|

|

|

-

- Sweden Source (Revenue, USD Million; 2019-2032)

-

-

- Herbs

-

-

-

- Spices

-

-

-

- Flowers

-

-

-

- Fruits & Citrus Peels

-

-

-

- Roots & Barks

-

-

-

- Others

-

-

- Sweden Alcohol Content Outlook (Revenue, USD Million; 2019-2032)

|

|

|

-

- Sweden Distribution Channel (Revenue, USD Million; 2019-2032)

|

|

-

- Sweden End Use (Revenue, USD Million; 2019-2032)

|

|

- Asia Pacific

- Asia Pacific Product Type Outlook (Revenue, USD Million 2019-2032)

|

|

|

|

- Asia Pacific Source (Revenue, USD Million; 2019-2032)

-

- Herbs

-

- Spices

-

- Flowers

-

- Fruits & Citrus Peels

-

- Roots & Barks

-

- Others

- Asia Pacific Alcohol Content Outlook (Revenue, USD Million; 2019-2032)

|

|

|

- Asia Pacific Distribution Channel (Revenue, USD Million; 2019-2032)

|

|

- Asia Pacific End Use (Revenue, USD Million; 2019-2032)

|

|

|

- China

-

- China Product Type Outlook (Revenue, USD Million 2019-2032)

|

|

|

|

-

- China Source (Revenue, USD Million; 2019-2032)

-

-

- Herbs

-

-

-

- Spices

-

-

-

- Flowers

-

-

-

- Fruits & Citrus Peels

-

-

-

- Roots & Barks

-

-

-

- Others

-

-

- China Alcohol Content Outlook (Revenue, USD Million; 2019-2032)

|

|

|

-

- China Distribution Channel (Revenue, USD Million; 2019-2032)

|

|

-

- China End Use (Revenue, USD Million; 2019-2032)

|

|

- India

-

- India Product Type Outlook (Revenue, USD Million 2019-2032)

|

|

|

|

-

- India Source (Revenue, USD Million; 2019-2032)

-

-

- Herbs

-

-

-

- Spices

-

-

-

- Flowers

-

-

-

- Fruits & Citrus Peels

-

-

-

- Roots & Barks

-

-

-

- Others

-

-

- India Alcohol Content Outlook (Revenue, USD Million; 2019-2032)

|

|

|

-

- India Distribution Channel (Revenue, USD Million; 2019-2032)

|

|

-

- India End Use (Revenue, USD Million; 2019-2032)

|

|

|

- Japan

-

- Japan Product Type Outlook (Revenue, USD Million 2019-2032)

|

|

|

|

-

- Japan Source (Revenue, USD Million; 2019-2032)

-

-

- Herbs

-

-

-

- Spices

-

-

-

- Flowers

-

-

-

- Fruits & Citrus Peels

-

-

-

- Roots & Barks

-

-

-

- Others

-

-

- Japan Alcohol Content Outlook (Revenue, USD Million; 2019-2032)

|

|

|

-

- Japan Distribution Channel (Revenue, USD Million; 2019-2032)

|

|

-

- Japan End Use (Revenue, USD Million; 2019-2032)

|

|

|

- South Korea

-

- South Korea Product Type Outlook (Revenue, USD Million 2019-2032)

|

|

|

|

-

- South Korea Source (Revenue, USD Million; 2019-2032)

-

-

- Herbs

-

-

-

- Spices

-

-

-

- Flowers

-

-

-

- Fruits & Citrus Peels

-

-

-

- Roots & Barks

-

-

-

- Others

-

-

- South Korea Alcohol Content Outlook (Revenue, USD Million; 2019-2032)

|

|

|

-

- South Korea Distribution Channel (Revenue, USD Million; 2019-2032)

|

|

-

- End Use (Revenue, USD Million; 2019-2032)

|

|

|

- Indonesia

-

- South Korea Product Type Outlook (Revenue, USD Million 2019-2032)

|

|

|

|

-

- Source (Revenue, USD Million; 2019-2032)

-

-

- Herbs

-

-

-

- Spices

-

-

-

- Flowers

-

-

-

- Fruits & Citrus Peels

-

-

-

- Roots & Barks

-

-

-

- Others

-

-

- Alcohol Content Outlook (Revenue, USD Million; 2019-2032)

|

|

|

-

- Distribution Channel (Revenue, USD Million; 2019-2032)

|

|

-

- End Use (Revenue, USD Million; 2019-2032)

|

|

- Thailand

-

- South Korea Product Type Outlook (Revenue, USD Million 2019-2032)

|

|

|

|

-

- Source (Revenue, USD Million; 2019-2032)

-

-

- Herbs

-

-

-

- Spices

-

-

-

- Flowers

-

-

-

- Fruits & Citrus Peels

-

-

-

- Roots & Barks

-

-

-

- Others

-

-

- South Korea Alcohol Content Outlook (Revenue, USD Million; 2019-2032)

|

|

|

-

- South Korea Distribution Channel (Revenue, USD Million; 2019-2032)

|

|

-

- South Korea End Use (Revenue, USD Million; 2019-2032)

|

|

- Vietnam

-

- Vietnam Product Type Outlook (Revenue, USD Million 2019-2032)

|

|

|

|

-

- Vietnam Source (Revenue, USD Million; 2019-2032)

-

-

- Herbs

-

-

-

- Spices

-

-

-

- Flowers

-

-

-

- Fruits & Citrus Peels

-

-

-

- Roots & Barks

-

-

-

- Others

-

-

- Vietnam Alcohol Content Outlook (Revenue, USD Million; 2019-2032)

|

|

-

- Vietnam Distribution Channel (Revenue, USD Million; 2019-2032)

|

|

-

- Vietnam End Use (Revenue, USD Million; 2019-2032)

|

|

- Australia

-

- Australia Product Type Outlook (Revenue, USD Million 2019-2032)

|

|

|

|

-

- Australia Source (Revenue, USD Million; 2019-2032)

-

-

- Herbs

-

-

-

- Spices

-

-

-

- Flowers

-

-

-

- Fruits & Citrus Peels

-

-

-

- Roots & Barks

-

-

-

- Others

-

-

- Australia Alcohol Content Outlook (Revenue, USD Million; 2019-2032)

|

|

|

-

- Australia Distribution Channel (Revenue, USD Million; 2019-2032)

|

|

-

- Australia End Use (Revenue, USD Million; 2019-2032)

|

|

- New Zeeland

-

- New Zeeland Product Type Outlook (Revenue, USD Million 2019-2032)

|

|

|

|

-

- New Zeeland Source (Revenue, USD Million; 2019-2032)

-

-

- Herbs

-

-

-

- Spices

-

-

-

- Flowers

-

-

-

- Fruits & Citrus Peels

-

-

-

- Roots & Barks

-

-

-

- Others

-

-

- New Zeeland Alcohol Content Outlook (Revenue, USD Million; 2019-2032)

|

|

|

-

- New Zeeland Distribution Channel (Revenue, USD Million; 2019-2032)

|

|

-

- New Zeeland End Use (Revenue, USD Million; 2019-2032)

|

|

- Rest of APAC

-

- Rest of APAC Product Type Outlook (Revenue, USD Million 2019-2032)

|

|

|

|

-

- Rest of APAC Source (Revenue, USD Million; 2019-2032)

-

-

- Herbs

-

-

-

- Spices

-

-

-

- Flowers

-

-

-

- Fruits & Citrus Peels

-

-

-

- Roots & Barks

-

-

-

- Others

-

-

- Rest of APAC Alcohol Content Outlook (Revenue, USD Million; 2019-2032)

|

|

|

-

- Rest of APAC Distribution Channel (Revenue, USD Million; 2019-2032)

|

|

-

- Rest of APAC End Use (Revenue, USD Million; 2019-2032)

|

|

- Latin America

-

- Latin America Product Type Outlook (Revenue, USD Million 2019-2032)

|

|

|

|

-

- Latin America Source (Revenue, USD Million; 2019-2032)

-

-

- Herbs

-

-

-

- Spices

-

-

-

- Flowers

-

-

-

- Fruits & Citrus Peels

-

-

-

- Roots & Barks

-

-

-

- Others

-

-

- Latin America Alcohol Content Outlook (Revenue, USD Million; 2019-2032)

|

|

|

-

- Latin America Distribution Channel (Revenue, USD Million; 2019-2032)

|

|

-

- Latin America End Use (Revenue, USD Million; 2019-2032)

|

|

- Brazil

-

- Brazil Product Type Outlook (Revenue, USD Million 2019-2032)

|

|

|

|

-

- Brazil Source (Revenue, USD Million; 2019-2032)

-

-

- Herbs

-

-

-

- Spices

-

-

-

- Flowers

-

-

-

- Fruits & Citrus Peels

-

-

-

- Roots & Barks

-

-

-

- Others

-

-

- Brazil Alcohol Content Outlook (Revenue, USD Million; 2019-2032)

|

|

|

-

- Brazil Distribution Channel (Revenue, USD Million; 2019-2032)

|

|

-

- End Use (Revenue, USD Million; 2019-2032)

|

|

- Middle East & Africa

-

- Middle East & Africa Product Type Outlook (Revenue, USD Million 2019-2032)

|

|

|

|

-

- Middle East & Africa Source (Revenue, USD Million; 2019-2032)

-

-

- Herbs

-

-

-

- Spices

-

-

-

- Flowers

-

-

-

- Fruits & Citrus Peels

-

-

-

- Roots & Barks

-

-

-

- Others

-

-

- Middle East & Africa Alcohol Content Outlook (Revenue, USD Million; 2019-2032)

|

|

|

-

- Middle East & Africa Distribution Channel (Revenue, USD Million; 2019-2032)

|

|

-

- Middle East & Africa End Use (Revenue, USD Million; 2019-2032)

|

|

- Saudi Arabia

-

- Saudi Arabia Product Type Outlook (Revenue, USD Million 2019-2032)

|

|

|

|

-

- Saudi Arabia Source (Revenue, USD Million; 2019-2032)

-

-

- Herbs

-

-

-

- Spices

-

-

-

- Flowers

-

-

-

- Fruits & Citrus Peels

-

-

-

- Roots & Barks

-

-

-

- Others

-

-

- Saudi Arabia Alcohol Content Outlook (Revenue, USD Million; 2019-2032)

|

|

|

-

- Saudi Arabia Distribution Channel (Revenue, USD Million; 2019-2032)

|

|

-

- Saudi Arabia End Use (Revenue, USD Million; 2019-2032)

|

|

- UAE

-

- UAE Product Type Outlook (Revenue, USD Million 2019-2032)

|

|

|

|

-

- UAE Source (Revenue, USD Million; 2019-2032)

-

-

- Herbs

-

-

-

- Spices

-

-

-

- Flowers

-

-

-

- Fruits & Citrus Peels

-

-

-

- Roots & Barks

-

-

-

- Others

-

-

- UAE Alcohol Content Outlook (Revenue, USD Million; 2019-2032)

|

|

|

-

- UAE Distribution Channel (Revenue, USD Million; 2019-2032)

|

|

-

- UAE End Use (Revenue, USD Million; 2019-2032)

|

|

- South Africa

-

- South Africa Product Type Outlook (Revenue, USD Million 2019-2032)

|

|

|

|

-

- South Africa Source (Revenue, USD Million; 2019-2032)

-

-

- Herbs

-

-

-

- Spices

-

-

-

- Flowers

-

-

-

- Fruits & Citrus Peels

-

-

-

- Roots & Barks

-

-

-

- Others

-

-

- South Africa Alcohol Content Outlook (Revenue, USD Million; 2019-2032)

|

|

|

-

- South Africa Distribution Channel (Revenue, USD Million; 2019-2032)

|

|

-

- South Africa End Use (Revenue, USD Million; 2019-2032)

|

|

- Rest of Middle East & Africa

-

- Rest of Middle East & Africa Product Type Outlook (Revenue, USD Million 2019-2032)

|

|

|

|

-

- Rest of Middle East & Africa Source (Revenue, USD Million; 2019-2032)

-

-

- Herbs

-

-

-

- Spices

-

-

-

- Flowers

-

-

-

- Fruits & Citrus Peels

-

-

-

- Roots & Barks

-

-

-

- Others

-

-

- Rest of Middle East & Africa Alcohol Content Outlook (Revenue, USD Million; 2019-2032)

|

|

|

-

- Rest of Middle East & Africa Distribution Channel (Revenue, USD Million; 2019-2032)

|

|

-

- Rest of Middle East & Africa End Use (Revenue, USD Million; 2019-2032)

|

|