Market Synopsis

The global green solvents market was valued at USD 2,093.22 million in 2024 and is projected to reach USD 4,036.80 million by 2032, growing at a strong CAGR of 8.60%. The market is is experiencing robust expansion due to the increasing demand for sustainable and eco-friendly alternatives to conventional petrochemical solvents. Growing regulatory pressure from governments and international bodies to curb volatile organic compound (VOC) emissions and reduce carbon footprints is one of the strongest growth drivers. Industries such as paints & coatings, personal care, pharmaceuticals, and agrochemicals are rapidly shifting toward bio-based and renewable solvents derived from plant-based feedstocks, agricultural waste, and algae. Rising consumer awareness about the environmental and health hazards of chemical solvents is also creating strong market pull, particularly in developed economies with stricter sustainability targets.

Furthermore, the market outlook is strengthened by advances in biotechnology and green chemistry, which are enabling cost-effective production and improved performance of bio-based solvents. The integration of circular economy models, such as waste-to-solvent technologies and industrial by-product utilization, is expanding opportunities across industries. Additionally, global corporations are aligning with sustainability and ESG (Environmental, Social, and Governance) goals, driving adoption of green solvents in manufacturing processes and supply chains. These combined factors are positioning the green solvents market for sustained long-term growth, with innovation and regulatory compliance acting as twin pillars supporting its expansion.

Global Green Solvents Market (USD Million)

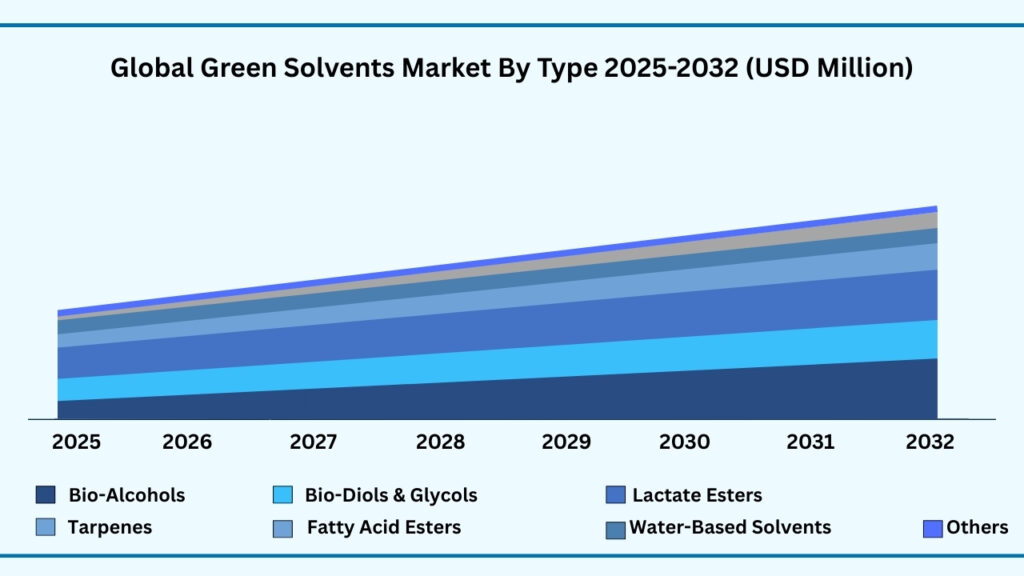

Global green solvents Market By Type Insights:

Lactate Esters segment accounted for market share of share 30.89% in 2024 in the global green solvents market.

The Lactate Esters segment accounted for the largest share of the global green solvents market in 2024, representing 30.89% of total revenues. Lactate Esters segment is expected to register a CAGR of 8.60 % during the forecast year from 2025 to 2032 and expected to reach USD 1,246.97 million in 2032.

Global Green Solvents Market By Type (USD Million)

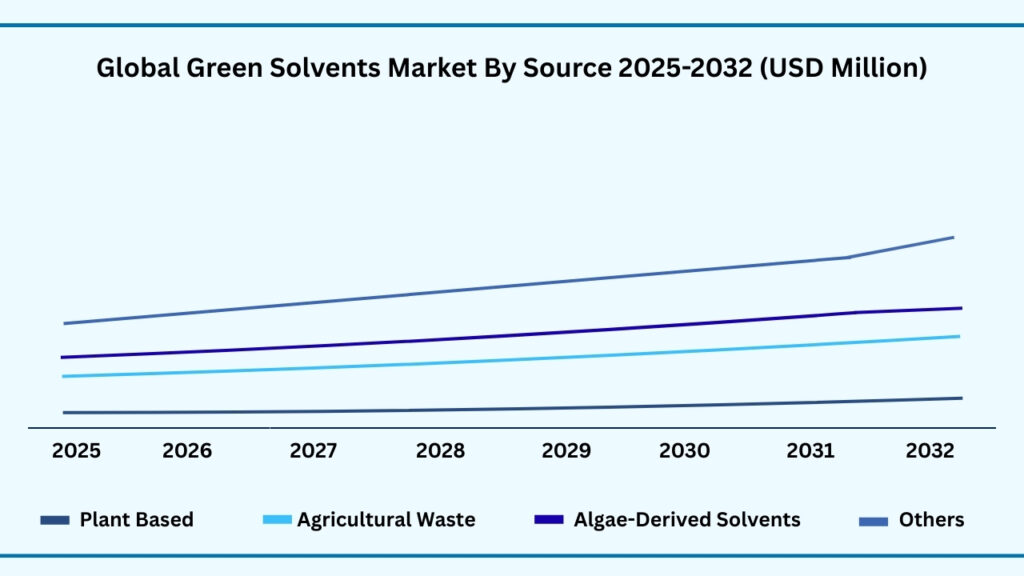

Global Green Solvents Maret by Source Insights:

Plant-Based segment accounted for the largest market share of share 42.32% in 2024 in the global green solvents market.

Based on the source, plant-based segment held the largest revenue share of 42.32% in 2024, and expected to register a CAGR of 9.00% between 2025 to 2032 and the market is expected to reach USD 1,753.59 million by 2032. This is primarily due to the abundance of renewable raw materials and growing preference for bio-based, non-toxic, and biodegradable alternatives to petrochemical solvents. Rising concerns over environmental sustainability, stricter VOC emission norms, and consumer demand for clean-label, eco-friendly products have accelerated adoption across industries such as pharmaceuticals, personal care & cosmetics, paints & coatings, and food processing. Plant-derived solvents, such as bio-ethanol, bio-butanol, terpenes, and lactate esters, are increasingly valued for their versatility, lower toxicity, and compatibility with green chemistry principles, making them a preferred choice for both manufacturers and end-users.

This growth will be driven by advancements in agricultural biotechnology and fermentation technologies that are improving yield efficiency and reducing production costs. The integration of sustainable sourcing practices, combined with investments in circular economy models, is further boosting scalability. Moreover, the rising focus on ESG compliance and increasing collaborations between chemical producers, biofuel companies, and biotech firms are expected to accelerate commercialization and innovation in plant-based solvents, cementing their position as the leading source in the global green solvents market.

Global Green Solvents Market By Source (USD Million)

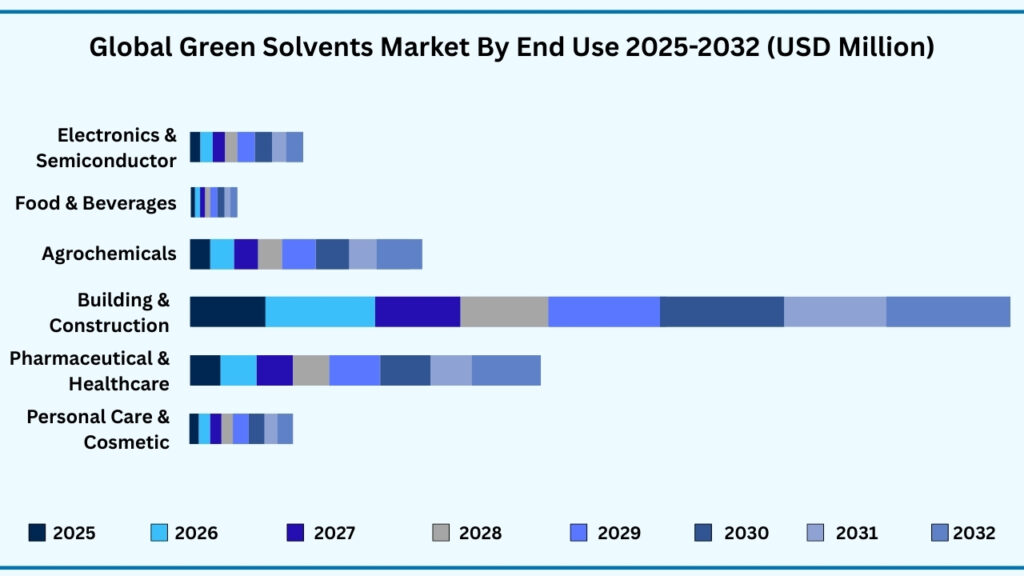

Global Green Solvents Maret by End Use Insights:

Building & Construction segment accounted for the largest market share of share 65.32% in 2024 in the global green solvents market.

Based on end use, 65.32%segment held the largest revenue share of 65.32% in the global green solvents market market in 2024 and expected to register a CAGR of 8.60% from 2025 to 2032 and expected to reach USD 2,663.89 million. The dominance of the largest end-use segment in the green solvents market is underpinned by its widespread adoption across industries where sustainability, safety, and regulatory compliance are top priorities. Growing concerns over the environmental and health impacts of petrochemical solvents are driving industries such as pharmaceuticals, personal care, food & beverages, and coatings to transition toward bio-based, low-toxicity alternatives. Green solvents are increasingly valued not only for their ability to reduce volatile organic compound emissions but also for their role in improving worker safety and aligning with clean-label and eco-conscious consumer demands. Their compatibility with diverse applications, from drug formulation and cosmetics production to food processing and packaging, ensures their strong presence in critical, high-demand industries.

Looking ahead, this segment is expected to sustain its leading position due to the convergence of regulatory pressure, technological advancements, and rising consumer expectations for sustainable products. Industries are investing heavily in green chemistry innovations and renewable feedstocks to ensure efficiency while minimizing their ecological footprint. Additionally, cross-industry collaborations and research partnerships are expanding the functional range of bio-based solvents, enabling their integration into processes that traditionally relied on petrochemicals. As global supply chains continue to emphasize ESG compliance and circular economy principles, the largest end-use segment is poised to benefit significantly, reinforcing its role as a cornerstone of the green solvents market’s long-term growth trajectory.

Global Green Solvents Market By End Use (USD Million)

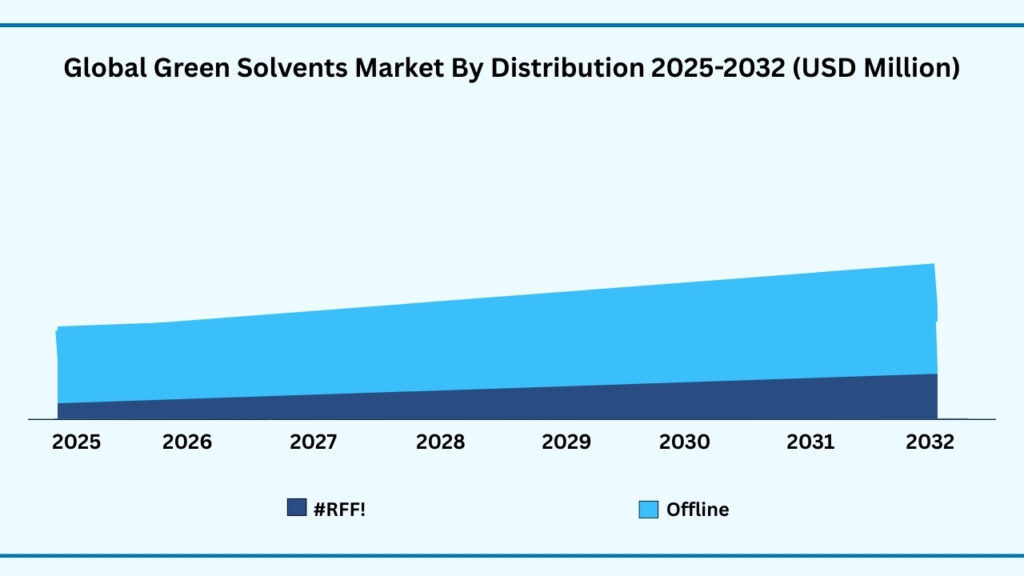

Global Green Solvents Market by Distribution Channel Insights:

Offline segment accounted for the largest market share of share of 80.79% in 2024 in the global green solvents market.

Based on distribution channel, offline segment held the largest revenue share of 80.79% in the global green solvents market in 2024 and expected to register a CAGR of 8.59% from 2024 to 2032 and expected to reach USD 3,269.41 million in 2032. The offline segment leads the global green solvents market largely due to the entrenched role of traditional distribution networks, which remain the primary channel for bulk purchases and industrial supply. Large-scale buyers such as chemical manufacturers, pharmaceutical companies, and coatings producers prefer direct procurement through distributors, wholesalers, and specialty chemical retailers because it ensures product availability, reliability, and logistical support. Offline channels also provide buyers with the advantage of personal interaction, technical consultation, and bulk order customization, which are crucial when sourcing green solvents for specialized industrial applications. The trust and long-term relationships built through offline distribution further reinforce its dominance, as clients often rely on established partners for consistent quality and after-sales support.

Another key factor driving the strength of the offline segment is its capacity to manage regulatory compliance and technical certification requirements. Green solvents, often used in highly regulated industries like healthcare, food, and personal care, require strict quality assurance, testing, and documentation. Offline distributors are better equipped to handle these needs by offering certified products, guidance on safe handling, and tailored solutions for end-use industries. Moreover, offline networks play a critical role in introducing innovative formulations and educating buyers on the advantages of green solvents, enabling faster adoption. As industrial demand grows and sustainability mandates strengthen, the offline segment continues to be the preferred channel for businesses seeking reliability, compliance, and personalized service.

Global Green Solvents By Distribution Channel (USD Million)

Global Green Solvents Market by Region Insights:

North America segment accounted for the largest market share of share of 35.21% in 2024 in the global green solvents market.

Based on region, the global Green Solvents market is segmented into Europe, Asia-Pacific, North America, Latin America and Middle East & Africa. Among these, North America region held the largest revenue share of 35.21% in the global Green Solvents market in 2024 and expected to register a CAGR of 8.59% from 2024 to 2032 and expected to reach USD 1,420.55 million in 2032. North America dominates the global green solvents market primarily due to its strong emphasis on sustainability, stringent environmental regulations, and early adoption of eco-friendly technologies. Governments and regulatory bodies in the region, such as the U.S. Environmental Protection Agency (EPA) and Canada’s environmental agencies, have implemented strict guidelines on reducing volatile organic compounds (VOCs) and hazardous chemicals. This regulatory push has accelerated the demand for bio-based and renewable solvents in industries such as paints and coatings, pharmaceuticals, personal care, and cleaning products. In addition, the region benefits from a well-established industrial base, advanced R&D infrastructure, and strong consumer awareness around green chemistry, which collectively strengthen the market presence of North America.

The region’s leadership is also reinforced by the presence of key global players and innovative startups actively investing in green solvent technologies. Collaboration between academic institutions, private companies, and government agencies drives continuous innovation and commercialization of next-generation bio-based solvents. Moreover, rising demand from end-use industries such as automotive, construction, and healthcare adds further momentum to market growth. Strong distribution networks, widespread industrial adoption, and increasing investment in sustainable raw materials such as plant-based feedstocks ensure that North America remains a pivotal hub for green solvents in the global landscape.

Global Green Solvnets Market By Region (USD Million)

Major Companies and Competitive Landscape

he global green solvents market is highly fragmented, featuring a diverse mix of multinational chemical corporations, specialized bio-based solution providers, and innovative startups. Leading players are actively pursuing strategies such as mergers and acquisitions, joint ventures, and strategic collaborations with raw material suppliers and end-use industries to strengthen their market position. Companies are also investing in expanding production capacities and developing advanced bio-based formulations to meet the evolving needs of industries such as paints and coatings, pharmaceuticals, personal care, and industrial cleaning. These efforts are primarily directed toward improving efficiency, reducing costs, and scaling production while maintaining high environmental standards.

In addition, market leaders are placing a strong emphasis on sustainability and circular economy principles. They are adopting renewable feedstocks, reducing carbon emissions in production processes, and ensuring compliance with stringent environmental regulations. Transparent sourcing, eco-label certifications, and green chemistry initiatives are also becoming central to competitive positioning. The growing demand from environmentally conscious consumers and industries is pushing players to differentiate their portfolios with innovative, low-toxicity, and biodegradable solvent solutions. This focus on R&D, coupled with premiumization strategies and global distribution network expansion, is expected to drive competitive intensity and accelerate adoption of green solvents worldwide.

Some of the leading companies profiled in the global Green Solvents market report include:

- BASF

- Dow Chemical

- DuPont

- Solvay

- Arkema

- Novozymes

- Clariant

- Evonik

- Mitsubishi Chemical Holdings Corporation

- DSM (Koninklijke DSM N.V.)

Strategic Development

Evonik

In 2024 Evonik launched a pair of new biosurfactants, TEGO Wet 570 Terra and TEGO Wet 580 Terra, produced via fermentation; these are intended for use in coatings and inks, with very low VOC levels and enhanced biodegradability

Scope of Research

| Report Details | Outcome |

|---|---|

| Market size in 2024 | USD 2,093.22 Million |

| CAGR (2024–2032) | 8.60% |

| Revenue forecast to 2033 | USD 4,036.80 Million |

| Base year for estimation | 2024 |

| Historical data | 2019–2023 |

| Forecast period | 2025–2032 |

| Quantitative units | Revenue in USD Million, and CAGR in % from 2025 to 2032 |

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | By Ingredient, By Product Form, By Type, By Source, By Distribution Channel, By End Use and By region |

| Regional scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Country scope | U.S., Canada, Mexico, Germany, France, U.K., Italy, Spain, Benelux, Russia, Finland, Sweden, Rest of Europe, China, India, Japan, South Korea, Indonesia, Thailand, Vietnam, Australia, New Zealand Rest of APAC, Brazil, Rest of LATAM, Saudi Arabia, Rest of MEA |

| Key companies profiled | BASF, Dow Chemical, DuPont, Solvay, Arkema, Novozymes, Clariant, Evonik, Mitsubishi Chemical Holdings Corporation, DSM (Koninklijke DSM N.V.), Burt’s Bees, Cargill, Incorporated ADM (Archer Daniels Midland Company), InKemia Green Chemicals, Inc., BioLogiQ, Inc.Dr., GFBiochemicals Ltd., Plantic Technologies Limited, VertecBioSolvents Inc., Conagen, Inc.,Global Green Chemicals Public Company Limited, 12.21. Impact Nano |

| Customization scope | 10 hours of free customization and expert consultation |

Some Key Questions the Report Will Answer

- What is the expected revenue Compound Annual Growth Rate (CAGR) of the global Green Solvents market over the forecast period (2025–2032)?

- The global Green Solvents market revenue is expected to register a Compound Annual Growth Rate (CAGR) of 8.60% during the forecast period.

- What was the size of the global Green Solvents in 2024?

- The global alkyl amines market size was USD 4,036.80 Million in 2024.

- Which factors are expected to drive the global Green Solvents market growth?

- The growth of the global Green Solvents market is expected to be driven by increasing environmental regulations that restrict the use of hazardous petrochemical solvents, coupled with rising demand for eco-friendly and biodegradable alternatives across industries. Growing awareness of sustainability among manufacturers and consumers, along with the push for low-VOC formulations in paints, coatings, adhesives, and cleaning products, is further boosting adoption. In addition, technological advancements in bio-based production, government incentives promoting green chemistry, and the rising preference for plant-based raw materials are creating strong momentum for the market’s expansion.

- Which was the leading segment in the global Green Solvents market in terms of type in 2024?

- In 2024, the lactate esters segment held the largest share of the global Green Solvents market, primarily due to their exceptional biodegradability, low toxicity, and effectiveness as replacements for conventional petrochemical-based solvents. Derived from renewable resources such as corn starch and sugarcane, lactate esters are widely used in applications including paints and coatings, cleaners, inks, and personal care products. Their strong solvency power, coupled with compliance to stringent environmental and workplace safety regulations, has made them highly attractive to industries seeking sustainable alternatives. Growing demand for eco-friendly formulations and increasing regulatory pressure to reduce volatile organic compounds (VOCs) further strengthened the dominance of the lactate esters segment.

- What are some restraints for revenue growth of the global Green Solvents market?

- One of the key restraints for the revenue growth of the global Green Solvents market is the high production cost compared to conventional petrochemical-based solvents, which limits large-scale adoption, especially in price-sensitive industries. In addition, limited performance compatibility in certain applications, such as industrial-scale manufacturing or specialized formulations, restricts their substitution potential. Challenges in raw material availability, scalability of bio-based feedstocks, and lack of widespread infrastructure for green chemistry also hinder rapid expansion. Moreover, fluctuating agricultural input prices and competition from well-established synthetic solvents further act as barriers to market growth.

Follow us on: Facebook, Twitter, Instagram and LinkedIn.

Chapter 1. Introduction

1.1. Market Definition

1.2. Objectives of the study

1.3. Overview of Green Solvents Market

1.4. Currency and pricing

1.5. Limitation

1.6. Markets covered

1.7. Research Scope

Chapter 2. Research Methodology

2.1. Research Sources

2.1.1.Primary

2.1.2.Secondary

2.1.3.Paid Sources

2.2. Years considered for the study

2.3. Assumptions

2.3.1.Market value

2.3.2.Market volume

2.3.3.Exchange rate

2.3.4.Price

2.3.5.Economic & political stability

Chapter 3. Executive Summary

3.1. Summary Snapshot, 2019–2032

Chapter 4. Key Insights

4.1. Production consumption analysis

4.2. Strategic partnerships & alliances

4.3. Joint ventures

4.4. Acquisition of local players

4.5. Contract manufacturing

4.6. Digital & e-commerce sales channels

4.7. Compliance with standards

4.8. Value chain analysis

4.9. Raw material sourcing

4.10. Formulation & manufacturing4.11.Distribution & retail

4.12. Import-export analysis

4.13. Brand comparative analysis

4.14. Technological advancements

4.15. Porter’s five force

4.15.1. Threat of new entrants

4.15.1.1. Capital requirment

4.15.1.2. Product knowledge

4.15.1.3. Technical knowledge

4.15.1.4. Customer relation

4.15.1.5. Access to appliation and technology

4.15.2. Threat of substitutes

4.15.2.1. Cost

4.15.2.2. Performance

4.15.2.3. Availability

4.15.2.4. Technical knowledge

4.15.2.5. Durability

4.15.3. Bargainning power of buyers

4.15.3.1. Numbers of buyers relative to suppliers

4.15.3.2. Product differentiation

4.15.3.3. Threat of forward integration

4.15.3.4. Buyers volume

4.15.4. Bargainning power of suppliers

4.15.4.1. Suppliers concentration

4.15.4.2. Buyers switching cost to other suppliers

4.15.4.3. Threat of backward integration

4.15.5. Bargainning power of suppliers

4.15.5.1. Industry concentration

4.15.5.2. Industry growth rate

4.15.5.3. Product differentiation

4.16. Patent analysis

4.17. Regulation coverage

4.18. Pricing analysis

4.19. Competitive Metric Space Analysis

Chapter 5. Market Overview

5.1. Drivers

5.1.1.Environmental Regulations and Sustainability Initiatives

5.1.2.Growing Awareness of Health and Safety

5.1.3.Rising Adoption in Key Industries

5.2. Restraints

5.2.1.Higher Production Costs

5.2.2.Limited Availability of Feedstock

5.3. Opportunities

5.3.1.Innovation in Bio-Based and Circular Economy Solutions

5.3.2.Expansion into Emerging Markets

5.3.3.Strategic Partnerships and Collaborations

5.4. Challenges

5.4.1.Performance Limitations Compared to Conventional Solvents

5.4.2.Lack of Standardization and Certifications

Chapter 6. Global Green Solvents Market By Type Insights & Trends, Revenue (USD Million),

Volume (Kiloton)

6.1. Type Dynamics & Market Share, 2019–2032

6.1.1.1. Bio-Alcohols

6.1.1.1.1. Ethanol

6.1.1.1.2. Butanol

6.1.1.1.3. Propanol

6.1.1.1.4. Isopropanol

6.1.1.2. Bio-Diols & Glycols

6.1.1.2.1. Propylene glycol

6.1.1.2.2. Butylene glycol

6.1.1.3. Lactate Esters

6.1.1.3.1. Ethyl lactate

6.1.1.3.2. Butyl lactate

6.1.1.4. Tarpenes

6.1.1.4.1. D-Limonene

6.1.1.4.2. Pinene

6.1.1.5. Fatty Acid Esters

6.1.1.5.1. Methyl soyate

6.1.1.5.2. Ethyl oleate

6.1.1.6. Water-Based Solvents

6.1.1.6.1. Non-ionic surfactants

6.1.1.6.2. Anionic surfactants

6.1.1.6.3. Cationic surfactants

6.1.1.7. Others

Chapter 7. Global Green Solvents Market By Source Insights & Trends, Revenue (USD Million),

Volume (Kiloton)

7.1. Source Dynamics & Market Share, 2019–2032

7.1.1. Plant-Based

7.1.1.1. Soybean oil derivatives

7.1.1.2. Corn-based alcohols

7.1.1.3. Citrus peel extracts

7.1.1.4. Sugar-derived solvents

7.1.2. Agricultural Waste

7.1.2.1. Corn husks

7.1.2.2. Rice bran oil

7.1.2.3. Coconut shells

7.1.2.4. Sugarcane bagasse

7.1.2.5. Wheat straw

7.1.3. Algae-Derived Solvents

7.1.3.1. Microalgae lipid

7.1.3.2. Marine algae bio-oils

7.1.3.3. Omega-rich solvent

7.1.4. Bioengineered

7.1.4.1. Bio-butanol

7.1.4.2. Bio-propylene glycol

7.1.4.3. Bio-succinic acid

7.1.5. Other

Chapter 8. Global Green Solvents Market By End Use Insights & Trends, Revenue (USD Million),

Volume (Kiloton)

8.1. End Use Dynamics & Market Share, 2019–2032

8.1.1.Personal Care & Cosmetics

8.1.1.1. Skincare

8.1.1.1.1. Creams

8.1.1.1.2. Lotions

8.1.1.1.3. Gels

8.1.1.1.4. Serums

8.1.1.1.5. Others

8.1.1.2. Hair Care

8.1.1.2.1. Shampoos

8.1.1.2.2. Conditioners

8.1.1.2.3. hair oils

8.1.1.2.4. Other

8.1.1.3. Makeup

8.1.1.3.1. Foundations

8.1.1.3.2. Primers

8.1.1.3.3. Concealers

8.1.1.3.4. antioxidants

8.1.1.3.5.Other

8.1.2.Pharmaceuticals & Healthcare

8.1.2.1. Drug Formulations

8.1.2.2. Vaccines & Biologics

8.1.2.3. Medical Devices & Diagnostics

8.1.3.Building & Construction

8.1.3.1. Architectural Coatings

8.1.3.1.1. Wall paints and primers

8.1.3.1.2. Waterproofing formulations

8.1.3.1.3. Anti-corrosion coatings

8.1.3.2. Industrial Coatings

8.1.3.2.1. Automotive paints

8.1.3.2.2. Protective coatings for machinery

8.1.3.2.3. Anti-fouling marine coatings

8.1.3.3. Printing Inks

8.1.3.3.1. Packaging inks

8.1.3.3.2. Textile printing formulations

8.1.3.3.3. Conductive inks for electronics

8.1.4. Agrochemicals

8.1.4.1. Pesticides & Herbicides

8.1.4.1.1. Solubilizers

8.1.4.1.2. Adjuvants

8.1.4.2. Fertilizers

8.1.4.2.1. nutrient blends

8.1.4.2.2. Adjuvants Chelating agents

8.1.4.3. Seed Treatment

8.1.4.3.1. seed coatings

8.1.4.3.2. Fungicidal and insecticidal carriers

8.1.4.3.3. Enhanced nutrient uptake agents

8.1.5. Food & Beverages

8.1.5.1. Extraction of Natural Ingredients

8.1.5.1.1. Essential oils

8.1.5.1.2. Flavors

8.1.5.1.3. colors

8.1.5.2. Beverage Formulations

8.1.5.2.1. Solubilizers

8.1.5.2.2. Carriers for vitamins and supplements

8.1.5.2.3. Stabilizers in emulsions and syrups

8.1.5.3. Food Preservation

8.1.5.3.1. Antimicrobial agents

8.1.5.3.2. Moisture retention enhancers

8.1.5.3.3. Packaging adhesives

8.1.6.Electronics & Semiconductors

8.1.6.1. Printed Circuit Board (PCB) Cleaning

8.1.6.1.1. Removal of flux residues

8.1.6.1.2. Surface preparation solvents

8.1.6.1.3. High-purity cleaning agents

8.1.6.1.4. Others

8.1.6.2. Semiconductor Processing

8.1.6.2.1. Photoresist stripping solvents

8.1.6.2.2. Dielectric cleaning formulations

8.1.6.2.3. Solvent carriers for doping agents

8.1.6.2.4. Others

8.1.6.3. Battery Manufacturing

8.1.6.3.1. Electrolyte formulations

8.1.6.3.2. Solvent carriers for active materials

8.1.6.3.3. Stabilizers in lithium-based batteries

8.1.6.4. Others

Chapter 9. Global Green Solvents Market By Distribution Channel Insights & Trends, Revenue

(USD Million), Volume (Kiloton)

9.1. Source Dynamics & Market Share, 2019–2032

9.1.1. Offline

9.1.1.1. Distributors / Wholesalers

9.1.1.2. Retail Stores

9.1.1.3. Trade Fairs / Exhibitions / Conferences

9.1.2. Online

9.1.2.1. E-Commerce Platforms

9.1.2.2. Manufacturer Websites

9.1.2.3. Social Media & Influencer Marketing

9.1.2.4. Digital B2B Marketplaces

Chapter 10. Global Green Solvents Market Regional Outlook, Revenue (USD Million), Volume

(Kiloton)

10.1. Green Solvents Share By Region, 2019–2032

10.2. North America

10.2.1. Market By Type Estimates and Forecast, USD Million, Volume (Kiloton)

2019-2032

10.2.1.1. Bio-Alcohols

10.2.1.1.1. Ethanol

10.2.1.1.2. Butanol

10.2.1.1.3. Propanol

10.2.1.1.4. Isopropanol

10.2.1.2. Bio-Diols & Glycols

10.2.1.2.1. Propylene glycol

10.2.1.2.2. Butylene glycol

10.2.1.3. Lactate Esters

10.2.1.3.1. Ethyl lactate

10.2.1.3.2. Butyl lactate

10.2.1.4. Tarpenes

10.2.1.4.1. D-Limonene

10.2.1.4.2. Pinene

10.2.1.5. Fatty Acid Esters

10.2.1.5.1. Methyl soyate

10.2.1.5.2. Ethyl oleate

10.2.1.6. Water-Based Solvents

10.2.1.6.1. Non-ionic surfactants

10.2.1.6.2. Anionic surfactants

10.2.1.6.3. Cationic surfactants

10.2.1.7. Others

10.2.2. Market By Source, Market Estimates and Forecast, USD Million, Volume

(Kiloton) 2019-2032

10.2.3. Plant-Based

10.2.3.1. Soybean oil derivatives

10.2.3.2. Corn-based alcohols

10.2.3.3. Citrus peel extracts

10.2.3.4. Sugar-derived solvents

10.2.4. Agricultural Waste

10.2.4.1. Corn husks

10.2.4.2. Rice bran oil

10.2.4.3. Coconut shells

10.2.4.4. Sugarcane bagasse

10.2.4.5. Wheat straw

10.2.5. Algae-Derived Solvents

10.2.5.1. Microalgae lipid

10.2.5.2. Marine algae bio-oils

10.2.5.3. Omega-rich solvent

10.2.6. Algae-Derived Solvents

10.2.6.1. Microalgae lipid

10.2.6.2. Marine algae bio-oils

10.2.6.3. Omega-rich solvent

10.2.7. Bioengineered

10.2.7.1. Bio-butanol

10.2.7.2. Bio-propylene glycol

10.2.7.3. Bio-succinic acid

10.2.8. Other

10.2.9. Market By End Use, Market Estimates and Forecast, USD Million, Volume

(Kiloton) 2019-2032

10.2.10.

10.2.11. Personal Care & Cosmetics

10.2.11.1. Skincare

10.2.11.1.1. Creams

10.2.11.1.2. Lotions

10.2.11.1.3. Gels

10.2.11.1.4. Serums

10.2.11.1.5. Others

10.2.11.2. Hair Care

10.2.11.2.1. Shampoos

10.2.11.2.2. Conditioners

10.2.11.2.3. hair oils

10.2.11.2.4. Other

10.2.11.3. Makeup

10.2.11.3.1. Foundations

10.2.11.3.2. Primers

10.2.11.3.3. Concealers

10.2.11.3.4. antioxidants

10.2.11.3.5. Other

10.2.12. Pharmaceuticals & Healthcare

10.2.12.1. Drug Formulations

10.2.12.2. Vaccines & Biologics

10.2.12.3. Medical Devices & Diagnostics

10.2.13. Building & Construction

10.2.13.1. Architectural Coatings

10.2.13.1.1. Wall paints and primers

10.2.13.1.2. Waterproofing formulations

10.2.13.1.3. Anti-corrosion coatings

10.2.13.2. Industrial Coatings

10.2.13.2.1. Automotive paints

10.2.13.2.2. Protective coatings for machinery

10.2.13.2.3. Anti-fouling marine coatings

10.2.13.3. Printing Inks

10.2.13.3.1. Packaging inks

10.2.13.3.2. Textile printing formulations

10.2.13.3.3. Conductive inks for electronics

10.2.14. Agrochemicals

10.2.14.1.Pesticides & Herbicides

10.2.14.1.1. Solubilizers

10.2.14.1.2. Adjuvants

10.2.14.2. Fertilizers

10.2.14.2.1. nutrient blends

10.2.14.2.2. Adjuvants Chelating agents

10.2.14.3. Seed Treatment

10.2.14.3.1. seed coatings

10.2.14.3.2. Fungicidal and insecticidal carriers

10.2.14.3.3. Enhanced nutrient uptake agents

10.2.15. Food & Beverages

10.2.15.1. Extraction of Natural Ingredients

10.2.15.1.1. Essential oils

10.2.15.1.2. Flavors

10.2.15.1.3. colors

10.2.15.2. Beverage Formulations

10.2.15.2.1. Solubilizers

10.2.15.2.2. Carriers for vitamins and supplements

10.2.15.2.3. Stabilizers in emulsions and syrups

10.2.15.3. Food Preservation

10.2.15.3.1. Antimicrobial agents

10.2.15.3.2. Moisture retention enhancers

10.2.15.3.3. Packaging adhesives

10.2.16. Electronics & Semiconductors

10.2.16.1. Printed Circuit Board (PCB) Cleaning

10.2.16.1.1. Removal of flux residues

10.2.16.1.2. Surface preparation solvents

10.2.16.1.3. High-purity cleaning agents

10.2.16.1.4. Others

10.2.16.2. Semiconductor Processing

10.2.16.2.1. Photoresist stripping solvents

10.2.16.2.2. Dielectric cleaning formulations

10.2.16.2.3. Solvent carriers for doping agents

10.2.16.2.4. Others

10.2.16.3. Battery Manufacturing

10.2.16.3.1. Electrolyte formulations

10.2.16.3.2. Solvent carriers for active materials

10.2.16.3.3. Stabilizers in lithium-based batteries

10.2.17. Market By Distribution Channel, Market Estimates and Forecast, USD Million,

Volume (Kiloton) 2019-2032

10.2.18. Offline

10.2.18.1. Distributors / Wholesalers

10.2.18.2. Retail Stores

10.2.18.3. Trade Fairs / Exhibitions / Conferences

10.2.19. Online

10.2.19.1. E-Commerce Platforms

10.2.19.2. Manufacturer Websites

10.2.19.3. Social Media & Influencer Marketing

10.2.19.4. Digital B2B Marketplaces

10.2.20. Market By Country, Market Estimates and Forecast, USD Million,

10.2.20.1. US

10.2.20.2. Canada

10.2.20.3. Mexico

10.3. Europe

10.3.1. Market By Type Estimates and Forecast, USD Million, Volume (Kiloton) 2019-

2032

10.3.1.1. Bio-Alcohols

10.3.1.1.1. Ethanol

10.3.1.1.2. Butanol

10.3.1.1.3. Propanol

10.3.1.1.4. Isopropanol

10.3.1.2. Bio-Diols & Glycols

10.3.1.2.1. Propylene glycol

10.3.1.2.2. Butylene glycol

10.3.1.3. Lactate Esters

10.3.1.3.1. Ethyl lactate

10.3.1.3.2. Butyl lactate

10.3.1.4. Tarpenes

10.3.1.4.1. D-Limonene

10.3.1.4.2. Pinene

10.3.1.5. Fatty Acid Esters

10.3.1.5.1. Methyl soyate

10.3.1.5.2. Ethyl oleate

10.3.1.6. Water-Based Solvents

10.3.1.6.1. Non-ionic surfactants

10.3.1.6.2. Anionic surfactants

10.3.1.6.3. Cationic surfactants

10.3.1.7. Others

10.3.2. Market By Source, Market Estimates and Forecast, USD Million, Volume

(Kiloton) 2019-2032

10.3.3. Plant-Based

10.3.3.1. Soybean oil derivatives

10.3.3.2. Corn-based alcohols

10.3.3.3. Citrus peel extracts

10.3.3.4.Sugar-derived solvents

10.3.4. Agricultural Waste

10.3.4.1. Corn husks

10.3.4.2. Rice bran oil

10.3.4.3. Coconut shells

10.3.4.4. Sugarcane bagasse

10.3.4.5. Wheat straw

10.3.5. Algae-Derived Solvents

10.3.5.1. Microalgae lipid

10.3.5.2. Marine algae bio-oils

10.3.5.3. Omega-rich solvent

10.3.6. Algae-Derived Solvents

10.3.6.1. Microalgae lipid

10.3.6.2. Marine algae bio-oils

10.3.6.3. Omega-rich solvent

10.3.7.Bioengineered

10.3.7.1. Bio-butanol

10.3.7.2. Bio-propylene glycol

10.3.7.3. Bio-succinic acid

10.3.8.Other

10.3.9.Market By End Use, Market Estimates and Forecast, USD Million, Volume

(Kiloton) 2019-2032

10.3.10.

10.3.11. Personal Care & Cosmetics

10.3.11.1. Skincare

10.3.11.1.1. Creams

10.3.11.1.2. Lotions

10.3.11.1.3. Gels

10.3.11.1.4. Serums

10.3.11.1.5. Others

10.3.11.2. Hair Care

10.3.11.2.1. Shampoos

10.3.11.2.2. Conditioners

10.3.11.2.3. hair oils

10.3.11.2.4. Other

10.3.11.3. Makeup

10.3.11.3.1. Foundations

10.3.11.3.2. Primers

10.3.11.3.3. Concealers

10.3.11.3.4. antioxidants

10.3.11.3.5. Other

10.3.12. Pharmaceuticals & Healthcare

10.3.12.1. Drug Formulations

10.3.12.2. Vaccines & Biologics

10.3.12.3. Medical Devices & Diagnostics

10.3.13. Building & Construction

10.3.13.1. Architectural Coatings

10.3.13.1.1. Wall paints and primers

10.3.13.1.2. Waterproofing formulations

10.3.13.1.3. Anti-corrosion coatings

10.3.13.2. Industrial Coatings

10.3.13.2.1. Automotive paints

10.3.13.2.2. Protective coatings for machinery

10.3.13.2.3. Anti-fouling marine coatings

10.3.13.3. Printing Inks

10.3.13.3.1. Packaging inks

10.3.13.3.2. Textile printing formulations

10.3.13.3.3. Conductive inks for electronics

10.3.14. Agrochemicals

10.3.14.1. Pesticides & Herbicides

10.3.14.1.1. Solubilizers

10.3.14.1.2. Adjuvants

10.3.14.2. Fertilizers

10.3.14.2.1. nutrient blends

10.3.14.2.2. Adjuvants Chelating agents

10.3.14.3. Seed Treatment

10.3.14.3.1. seed coatings

10.3.14.3.2. Fungicidal and insecticidal carriers

10.3.14.3.3. Enhanced nutrient uptake agents

10.3.15. Food & Beverages

10.3.15.1. Extraction of Natural Ingredients

10.3.15.1.1. Essential oils

10.3.15.1.2. Flavors

10.3.15.1.3. colors

10.3.15.2. Beverage Formulations

10.3.15.2.1. Solubilizers

10.3.15.2.2. Carriers for vitamins and supplements

10.3.15.2.3. Stabilizers in emulsions and syrups

10.3.15.3. Food Preservation

10.3.15.3.1. Antimicrobial agents

10.3.15.3.2. Moisture retention enhancers

10.3.15.3.3. Packaging adhesives

10.3.16. Electronics & Semiconductors

10.3.16.1. Printed Circuit Board (PCB) Cleaning

10.3.16.1.1. Removal of flux residues

10.3.16.1.2. Surface preparation solvents

10.3.16.1.3. High-purity cleaning agents

10.3.16.1.4. Others

10.3.16.2. Semiconductor Processing

10.3.16.2.1. Photoresist stripping solvents

10.3.16.2.2. Dielectric cleaning formulations

10.3.16.2.3. Solvent carriers for doping agents

10.3.16.2.4. Others

10.3.16.3. Battery Manufacturing

10.3.16.3.1. Electrolyte formulations

10.3.16.3.2. Solvent carriers for active materials

10.3.16.3.3. Stabilizers in lithium-based batteries

10.3.17. Market By Distribution Channel, Market Estimates and Forecast, USD Million,

Volume (Kiloton) 2019-2032

10.3.18. Offline

10.3.18.1. Distributors / Wholesalers

10.3.18.2. Retail Stores

10.3.18.3. Trade Fairs / Exhibitions / Conferences

10.3.19. Online

10.3.19.1. E-Commerce Platforms

10.3.19.2. Manufacturer Websites

10.3.19.3. Social Media & Influencer Marketing

10.3.19.4. Digital B2B Marketplaces

10.3.20. Market By Country, Market Estimates and Forecast, USD Million,

10.3.20.1. Germany

10.3.20.2. France

10.3.20.3. U.K

10.3.20.4. Italy

10.3.20.5. Spain

10.3.20.6. Benelux

10.3.20.7. Russia

10.3.20.8. Finland

10.3.20.9. Sweden

10.3.20.10. Rest Of Europe

10.4. Asia-Pacific

10.4.1. Market By Type Estimates and Forecast, USD Million, Volume (Kiloton)

2019-2032

10.4.1.1. Bio-Alcohols

10.4.1.1.1. Ethanol

10.4.1.1.2. Butanol

10.4.1.1.3. Propanol

10.4.1.1.4. Isopropanol

10.4.1.2. Bio-Diols & Glycols

10.4.1.2.1. Propylene glycol

10.4.1.2.2. Butylene glycol

10.4.1.3. Lactate Esters

10.4.1.3.1. Ethyl lactate

10.4.1.3.2. Butyl lactate

10.4.1.4. Tarpenes

10.4.1.4.1. D-Limonene

10.4.1.4.2. Pinene

10.4.1.5. Fatty Acid Esters

10.4.1.5.1. Methyl soyate

10.4.1.5.2. Ethyl oleate

10.4.1.6. Water-Based Solvents

10.4.1.6.1. Non-ionic surfactants

10.4.1.6.2. Anionic surfactants

10.4.1.6.3. Cationic surfactants

10.4.1.7. Others

10.4.2. Market By Source, Market Estimates and Forecast, USD Million, Volume

(Kiloton) 2019-2032

10.4.3. Plant-Based

10.4.3.1. Soybean oil derivatives

10.4.3.2. Corn-based alcohols

10.4.3.3. Citrus peel extracts

10.4.3.4. Sugar-derived solvents

10.4.4. Agricultural Waste

10.4.4.1. Corn husks

10.4.4.2. Rice bran oil

10.4.4.3. Coconut shells

10.4.4.4. Sugarcane bagasse

10.4.4.5. Wheat straw

10.4.5. Algae-Derived Solvents

10.4.5.1. Microalgae lipid

10.4.5.2. Marine algae bio-oils

10.4.5.3. Omega-rich solvent

10.4.6. Algae-Derived Solvents

10.4.6.1. Microalgae lipid

10.4.6.2. Marine algae bio-oils

10.4.6.3. Omega-rich solvent

10.4.7. Bioengineered

10.4.7.1. Bio-butanol

10.4.7.2. Bio-propylene glycol

10.4.7.3. Bio-succinic acid

10.4.8. Other

10.4.9. Market By End Use, Market Estimates and Forecast, USD Million, Volume

(Kiloton) 2019-2032

10.4.10.

10.4.11. Personal Care & Cosmetics

10.4.11.1. Skincare

10.4.11.1.1. Creams

10.4.11.1.2. Lotions

10.4.11.1.3. Gels

10.4.11.1.4. Serums

10.4.11.1.5.Others

10.4.11.2. Hair Care

10.4.11.2.1. Shampoos

10.4.11.2.2. Conditioners

10.4.11.2.3. hair oils

10.4.11.2.4. Other

10.4.11.3. Makeup

10.4.11.3.1. Foundations

10.4.11.3.2. Primers

10.4.11.3.3. Concealers

10.4.11.3.4. antioxidants

10.4.11.3.5. Other

10.4.12. Pharmaceuticals & Healthcare

10.4.12.1. Drug Formulations

10.4.12.2. Vaccines & Biologics

10.4.12.3. Medical Devices & Diagnostics

10.4.13. Building & Construction

10.4.13.1. Architectural Coatings

10.4.13.1.1. Wall paints and primers

10.4.13.1.2. Waterproofing formulations

10.4.13.1.3. Anti-corrosion coatings

10.4.13.2. Industrial Coatings

10.4.13.2.1. Automotive paints

10.4.13.2.2. Protective coatings for machinery

10.4.13.2.3. Anti-fouling marine coatings

10.4.13.3. Printing Inks

10.4.13.3.1. Packaging inks

10.4.13.3.2. Textile printing formulations

10.4.13.3.3. Conductive inks for electronics

10.4.14. Agrochemicals

10.4.14.1. Pesticides & Herbicides

10.4.14.1.1. Solubilizers

10.4.14.1.2. Adjuvants

10.4.14.2. Fertilizers

10.4.14.2.1. nutrient blends

10.4.14.2.2. Adjuvants Chelating agents

10.4.14.3. Seed Treatment

10.4.14.3.1. seed coatings

10.4.14.3.2. Fungicidal and insecticidal carriers

10.4.14.3.3. Enhanced nutrient uptake agents

10.4.15. Food & Beverages

10.4.15.1. Extraction of Natural Ingredients

10.4.15.1.1. Essential oils

10.4.15.1.2. Flavors

10.4.15.1.3. colors

10.4.15.2. Beverage Formulations

10.4.15.2.1. Solubilizers

10.4.15.2.2. Carriers for vitamins and supplements

10.4.15.2.3. Stabilizers in emulsions and syrups

10.4.15.3. Food Preservation

10.4.15.3.1. Antimicrobial agents

10.4.15.3.2. Moisture retention enhancers

10.4.15.3.3. Packaging adhesives

10.4.16. Electronics & Semiconductors

10.4.16.1. Printed Circuit Board (PCB) Cleaning

10.4.16.1.1. Removal of flux residues

10.4.16.1.2. Surface preparation solvents

10.4.16.1.3. High-purity cleaning agents

10.4.16.1.4. Others

10.4.16.2. Semiconductor Processing

10.4.16.2.1. Photoresist stripping solvents

10.4.16.2.2. Dielectric cleaning formulations

10.4.16.2.3. Solvent carriers for doping agents

10.4.16.2.4. Others

10.4.16.3. Battery Manufacturing

10.4.16.3.1. Electrolyte formulations

10.4.16.3.2. Solvent carriers for active materials

10.4.16.3.3. Stabilizers in lithium-based batteries

10.4.17. Market By Distribution Channel, Market Estimates and Forecast, USD Million,

Volume (Kiloton) 2019-2032

10.4.18. Offline

10.4.18.1. Distributors / Wholesalers

10.4.18.2. Retail Stores

10.4.18.3. Trade Fairs / Exhibitions / Conferences

10.4.19. Online

10.4.19.1. . E-Commerce Platforms

10.4.19.2.. Manufacturer Websites

10.4.19.3. Social Media & Influencer Marketing

10.4.19.4. Digital B2B Marketplaces

10.4.20. Market By Country, Market Estimates and Forecast, USD Million,

10.4.20.1. China

10.4.20.2. India

10.4.20.3. Japan

10.4.20.4. South Korea

10.4.20.5. Indonesia

10.4.20.6. Thailand

10.4.20.7. Vietnam

10.4.20.8. Australia

10.4.20.9. New Zeland

10.4.20.10. Rest of APAC

10.5.Latin-America

10.5.1. Market By Type Estimates and Forecast, USD Million, Volume (Kiloton)

2019-2032

10.5.1.1. Bio-Alcohols

10.5.1.1.1. Ethanol

10.5.1.1.2. Butanol

10.5.1.1.3. Propanol

10.5.1.1.4. Isopropanol

10.5.1.2. Bio-Diols & Glycols

10.5.1.2.1. Propylene glycol

10.5.1.2.2. Butylene glycol

10.5.1.3. Lactate Esters

10.5.1.3.1. Ethyl lactate

10.5.1.3.2. Butyl lactate

10.5.1.4. Tarpenes

10.5.1.4.1. D-Limonene

10.5.1.4.2. Pinene

10.5.1.5. Fatty Acid Esters

10.5.1.5.1. Methyl soyate

10.5.1.5.2. Ethyl oleate

10.5.1.6. Water-Based Solvents

10.5.1.6.1. Non-ionic surfactants

10.5.1.6.2. Anionic surfactants

10.5.1.6.3. Cationic surfactants

10.5.1.7. Others

10.5.2. Market By Source, Market Estimates and Forecast, USD Million, Volume

(Kiloton) 2019-2032

10.5.3. Plant-Based

10.5.3.1. Soybean oil derivatives

10.5.3.2. Corn-based alcohols

10.5.3.3. Citrus peel extracts

10.5.3.4. Sugar-derived solvents

10.5.4. Agricultural Waste

10.5.4.1. Corn husks

10.5.4.2. Rice bran oil

10.5.4.3. Coconut shells

10.5.4.4. Sugarcane bagasse

10.5.4.5. Wheat straw

10.5.5. Algae-Derived Solvents

10.5.5.1. Microalgae lipid

10.5.5.2. Marine algae bio-oils

10.5.5.3. Omega-rich solvent

10.5.6. Algae-Derived Solvents

10.5.6.1. Microalgae lipid

10.5.6.2. Marine algae bio-oils

10.5.6.3. Omega-rich solvent

10.5.7. Bioengineered

10.5.7.1. Bio-butanol

10.5.7.2. Bio-propylene glycol

10.5.7.3. Bio-succinic acid

10.5.8. Other

10.5.9. Market By End Use, Market Estimates and Forecast, USD Million, Volume

(Kiloton) 2019-2032

10.5.10.

10.5.11. Personal Care & Cosmetics

10.5.11.1. Skincare

10.5.11.1.1. Creams

10.5.11.1.2. Lotions

10.5.11.1.3. Gels

10.5.11.1.4. Serums

10.5.11.1.5. Others

10.5.11.2. Hair Care

10.5.11.2.1. Shampoos

10.5.11.2.2. Conditioners

10.5.11.2.3. hair oils

10.5.11.2.4. Other

10.5.11.3. Makeup

10.5.11.3.1. Foundations

10.5.11.3.2. Primers

10.5.11.3.3. Concealers

10.5.11.3.4. antioxidants

10.5.11.3.5. Other

10.5.12. Pharmaceuticals & Healthcare

10.5.12.1. Drug Formulations

10.5.12.2. Vaccines & Biologics

10.5.12.3. Medical Devices & Diagnostics

10.5.13. Building & Construction

10.5.13.1. Architectural Coatings

10.5.13.1.1. Wall paints and primers

10.5.13.1.2. Waterproofing formulations

10.5.13.1.3. Anti-corrosion coatings

10.5.13.2. Industrial Coatings

10.5.13.2.1. Automotive paints

10.5.13.2.2. Protective coatings for machinery

10.5.13.2.3. Anti-fouling marine coatings

10.5.13.3. Printing Inks

10.5.13.3.1. Packaging inks

10.5.13.3.2. Textile printing formulations

10.5.13.3.3. Conductive inks for electronics

10.5.14. Agrochemicals

10.5.14.1. Pesticides & Herbicides

10.5.14.1.1. Solubilizers

10.5.14.1.2. Adjuvants

10.5.14.2. Fertilizers

10.5.14.2.1. nutrient blends

10.5.14.2.2. Adjuvants Chelating agents

10.5.14.3. Seed Treatment

10.5.14.3.1. seed coatings

10.5.14.3.2. Fungicidal and insecticidal carriers

10.5.14.3.3. Enhanced nutrient uptake agents

10.5.15. Food & Beverages

10.5.15.1. Extraction of Natural Ingredients

10.5.15.1.1. Essential oils

10.5.15.1.2. Flavors

10.5.15.1.3. colors

10.5.15.2. Beverage Formulations

10.5.15.2.1. Solubilizers

10.5.15.2.2. Carriers for vitamins and supplements

10.5.15.2.3. Stabilizers in emulsions and syrups

10.5.15.3. Food Preservation

10.5.15.3.1. Antimicrobial agents

10.5.15.3.2. Moisture retention enhancers

10.5.15.3.3. Packaging adhesives

10.5.16. Electronics & Semiconductors

10.5.16.1. Printed Circuit Board (PCB) Cleaning

10.5.16.1.1. Removal of flux residues

10.5.16.1.2. Surface preparation solvents

10.5.16.1.3. High-purity cleaning agents

10.5.16.1.4. Others

10.5.16.2. Semiconductor Processing

10.5.16.2.1. Photoresist stripping solvents

10.5.16.2.2. Dielectric cleaning formulations

10.5.16.2.3. Solvent carriers for doping agents

10.5.16.2.4. Others

10.5.16.3. Battery Manufacturing

10.5.16.3.1. Electrolyte formulations

10.5.16.3.2. Solvent carriers for active materials

10.5.16.3.3. Stabilizers in lithium-based batteries

10.5.17. Market By Distribution Channel, Market Estimates and Forecast, USD Million,

Volume (Kiloton) 2019-2032

10.5.18. Offline

10.5.18.1. Distributors / Wholesalers

10.5.18.2. Retail Stores

10.5.18.3. Trade Fairs / Exhibitions / Conferences

10.5.19. Online

10.5.19.1. E-Commerce Platforms

10.5.19.2. Manufacturer Websites

10.5.19.3. Social Media & Influencer Marketing

10.5.19.4.Digital B2B Marketplaces

10.5.20. Market By Country, Market Estimates and Forecast, USD Million,

10.5.20.1. Brazil

10.5.20.2. Rest of LATAM

10.6. Middle East & Africa

10.6.1. Market By Type Estimates and Forecast, USD Million, Volume (Kiloton)

2019-2032

10.6.1.1. Bio-Alcohols

10.6.1.1.1. Ethanol

10.6.1.1.2. Butanol

10.6.1.1.3. Propanol

10.6.1.1.4. Isopropanol

10.6.1.2. Bio-Diols & Glycols

10.6.1.2.1. Propylene glycol

10.6.1.2.2. Butylene glycol

10.6.1.3. Lactate Esters

10.6.1.3.1. Ethyl lactate

10.6.1.3.2. Butyl lactate

10.6.1.4. Tarpenes

10.6.1.4.1. D-Limonene

10.6.1.4.2. Pinene

10.6.1.5. Fatty Acid Esters

10.6.1.5.1. Methyl soyate

10.6.1.5.2. Ethyl oleate

10.6.1.6. Water-Based Solvents

10.6.1.6.1. Non-ionic surfactants

10.6.1.6.2. Anionic surfactants

10.6.1.6.3. Cationic surfactants

10.6.1.7. Others

10.6.2. Market By Source, Market Estimates and Forecast, USD Million, Volume

(Kiloton) 2019-2032

10.6.3. Plant-Based

10.6.3.1. Soybean oil derivatives

10.6.3.2. Corn-based alcohols

10.6.3.3. Citrus peel extracts

10.6.3.4. Sugar-derived solvents

10.6.4.Agricultural Waste

10.6.4.1. Corn husks

10.6.4.2. Rice bran oil

10.6.4.3. Coconut shells

10.6.4.4. Sugarcane bagasse

10.6.4.5. Wheat straw

10.6.5.Algae-Derived Solvents

10.6.5.1. Microalgae lipid

10.6.5.2. Marine algae bio-oils

10.6.5.3. Omega-rich solvent

10.6.6.Algae-Derived Solvents

10.6.6.1. Microalgae lipid

10.6.6.2. Marine algae bio-oils

10.6.6.3. Omega-rich solvent

10.6.7.Bioengineered

10.6.7.1. Bio-butanol

10.6.7.2. Bio-propylene glycol

10.6.7.3. Bio-succinic acid

10.6.8.Other

10.6.9.Market By End Use, Market Estimates and Forecast, USD Million, Volume

(Kiloton) 2019-2032

10.6.10.

10.6.11. Personal Care & Cosmetics

10.6.11.1. Skincare

10.6.11.1.1. Creams

10.6.11.1.2. Lotions

10.6.11.1.3. Gels

10.6.11.1.4. Serums

10.6.11.1.5. Others

10.6.11.2. Hair Care

10.6.11.2.1. Shampoos

10.6.11.2.2. Conditioners

10.6.11.2.3. hair oils

10.6.11.2.4. Other

10.6.11.3. Makeup

10.6.11.3.1. Foundations

10.6.11.3.2. Primers

10.6.11.3.3. Concealers

10.6.11.3.4. antioxidants

10.6.11.3.5. Other

10.6.12. Pharmaceuticals & Healthcare

10.6.12.1. Drug Formulations

10.6.12.2. Vaccines & Biologics

10.6.12.3. Medical Devices & Diagnostics

10.6.13. Building & Construction

10.6.13.1. Architectural Coatings

10.6.13.1.1. Wall paints and primers

10.6.13.1.2. Waterproofing formulations

10.6.13.1.3. Anti-corrosion coatings

10.6.13.2. Industrial Coatings

10.6.13.2.1. Automotive paints

10.6.13.2.2. Protective coatings for machinery

10.6.13.2.3. Anti-fouling marine coatings

10.6.13.3. Printing Inks

10.6.13.3.1. Packaging inks

10.6.13.3.2. Textile printing formulations

10.6.13.3.3. Conductive inks for electronics

10.6.14. Agrochemicals

10.6.14.1. Pesticides & Herbicides

10.6.14.1.1. Solubilizers

10.6.14.1.2. Adjuvants

10.6.14.2. Fertilizers

10.6.14.2.1. nutrient blends

10.6.14.2.2. Adjuvants Chelating agents

10.6.14.3. Seed Treatment

10.6.14.3.1. seed coatings

10.6.14.3.2. Fungicidal and insecticidal carriers

10.6.14.3.3. Enhanced nutrient uptake agents

10.6.15. Food & Beverages

10.6.15.1. Extraction of Natural Ingredients

10.6.15.1.1. Essential oils

10.6.15.1.2. Flavors

10.6.15.1.3. colors

10.6.15.2. Beverage Formulations

10.6.15.2.1. Solubilizers

10.6.15.2.2. Carriers for vitamins and supplements

10.6.15.2.3. Stabilizers in emulsions and syrups

10.6.15.3. Food Preservation

10.6.15.3.1. Antimicrobial agents

10.6.15.3.2. Moisture retention enhancers

10.6.15.3.3. Packaging adhesives

10.6.16. Electronics & Semiconductors

10.6.16.1. Printed Circuit Board (PCB) Cleaning

10.6.16.1.1. Removal of flux residues

10.6.16.1.2. Surface preparation solvents

10.6.16.1.3. High-purity cleaning agents

10.6.16.1.4. Others

10.6.16.2. Semiconductor Processing

10.6.16.2.1. Photoresist stripping solvents

10.6.16.2.2. Dielectric cleaning formulations

10.6.16.2.3. Solvent carriers for doping agents

10.6.16.2.4. Others

10.6.16.3. Battery Manufacturing

10.6.16.3.1. Electrolyte formulations

10.6.16.3.2. Solvent carriers for active materials

10.6.16.3.3. Stabilizers in lithium-based batteries

10.6.17. Market By Distribution Channel, Market Estimates and Forecast, USD Million,

Volume (Kiloton) 2019-2032

10.6.18. Offline

10.6.18.1. Distributors / Wholesalers

10.6.18.2. Retail Stores

10.6.18.3. Trade Fairs / Exhibitions / Conferences

10.6.19. Online

10.6.19.1. E-Commerce Platforms

10.6.19.2. Manufacturer Websites

10.6.19.3. Social Media & Influencer Marketing

10.6.19.4. Digital B2B Marketplaces

10.6.20. Market By Country, Market Estimates and Forecast, USD Million,

10.6.20.1. Saudi Arabia

10.6.20.2. Rest of MEA

Chapter 11. Competitive Landscape

11.1. Market Revenue Share By Manufacturers

11.2. Mergers & Acquisitions

11.3. Competitor’s Positioning

11.4. Strategy Benchmarking

11.5. Vendor Landscape

11.5.1. Distributors

11.5.1.1. North America

11.5.1.2. Europe

11.5.1.3. Asia Pacific

11.5.1.4. Middle East & Africa

11.5.1.5. Latin America

Chapter 12. Company Profiles

12.1. BASF

12.1.1. Company Overview

12.1.2. Product & Service Offerings

12.1.3. Strategic Initiatives

12.1.4. Financials

12.2. Dow Chemical

12.2.1. Company Overview

12.2.2. Product & Service Offerings

12.2.3. Strategic Initiatives

12.2.4. Financials

12.3. DuPont

12.3.1. Company Overview

12.3.2. Product & Service Offerings

12.3.3. Strategic Initiatives

12.3.4. Financials

12.4. Solvay

12.4.1. Company Overview

12.4.2. Product & Service Offerings

12.4.3. Strategic Initiatives

12.4.4. Financials

12.5. Arkema

12.5.1. Company Overview

12.5.2. Product & Service Offerings

12.5.3. Strategic Initiatives

12.5.4. Financials

12.6. Novozymes

12.6.1. Company Overview

12.6.2. Product & Service Offerings

12.6.3. Strategic Initiatives

12.6.4. Financials

12.7. Clariant

12.7.1. Company Overview

12.7.2. Product & Service Offerings

12.7.3. Strategic Initiatives

12.7.4. Financials

12.7.5. Conclusion

12.8. Evonik

12.8.1. Company Overview

12.8.2. Product & Service Offerings

12.8.3. Strategic Initiatives

12.8.4. Financials

12.8.5. Conclusion

12.9. Mitsubishi Chemical Holdings Corporation

12.9.1. Company Overview

12.9.2. Product & Service Offerings

12.9.3. Strategic Initiatives

12.9.4. Financials

12.9.5. Conclusion

12.10. DSM (Koninklijke DSM N.V.)

12.10.1. Company Overview

12.10.2. Product & Service Offerings

12.10.3. Strategic Initiatives

12.10.4. Financials

12.10.5. Conclusion

12.11. Burt’s Bees

12.11.1. Company Overview

12.11.2. Product & Service Offerings

12.11.3. Strategic Initiatives

12.11.4. Financials

12.11.5. Conclusion

12.12. Cargill, Incorporated

12.12.1. Company Overview

12.12.2. Product & Service Offerings

12.12.3. Strategic Initiatives

12.12.4. Financials

12.12.5. Conclusion

12.13. ADM (Archer Daniels Midland Company)

12.13.1. Company Overview

12.13.2. Product & Service Offerings

12.13.3. Strategic Initiatives

12.13.4. Financials

12.13.5. Conclusion

12.14. InKemia Green Chemicals, Inc.

12.14.1. Company Overview

12.14.2. Product & Service Offerings

12.14.3. Strategic Initiatives

12.14.4. Financials

12.14.5. Conclusion

12.15. BioLogiQ, Inc.Dr.

12.15.1. Company Overview

12.15.2. Product & Service Offerings

12.15.3. Strategic Initiatives

12.15.4. Financials

12.15.5. Conclusion

12.16. GFBiochemicals Ltd.

12.16.1. Company Overview

12.16.2. Product & Service Offerings

12.16.3. Strategic Initiatives

12.16.4. Financials

12.16.5. Conclusion

12.17. Plantic Technologies Limited

12.17.1. Company Overview

12.17.2. Product & Service Offerings

12.17.3. Strategic Initiatives

12.17.4. Financials

12.17.5. Conclusion

12.18. VertecBioSolvents Inc.

12.18.1. Company Overview

12.18.2. Product & Service Offerings

12.18.3. Strategic Initiatives

12.18.4. Financials

12.18.5. Conclusion

12.19. Conagen, Inc.

12.19.1. Company Overview

12.19.2. Product & Service Offerings

12.19.3. Strategic Initiatives

12.19.4. Financials

12.19.5. Conclusion

12.20. Global Green Chemicals Public Company Limited

12.20.1. Company Overview

12.20.2. Product & Service Offerings

12.20.3. Strategic Initiatives

12.20.4. Financials

12.20.5. Conclusion

12.21. Impact Nano

12.21.1. Company Overview

12.21.2. Product & Service Offerings

12.21.3. Strategic Initiatives

12.21.4. Financials

12.21.5. Conclusion

12.22. Chemify

12.22.1. Company Overview

12.22.2. Product & Service Offerings

12.22.3. Strategic Initiatives

12.22.4. Financials

12.22.5. Conclusion

12.23. DUDE CHEMS

12.23.1. Company Overview

12.23.2. Product & Service Offerings

12.23.3. Strategic Initiatives

12.23.4. Financials

12.23.5. Conclusion

12.24. Gevo, Inc.

12.24.1. Company Overview

12.24.2. Product & Service Offerings

12.24.3. Strategic Initiatives

12.24.4. Financials

12.24.5. Conclusion

12.25. EnginZyme

12.25.1. Company Overview

12.25.2. Product & Service Offerings

12.25.3. Strategic Initiatives

12.25.4. Financials

12.25.5. Conclusion

Segments Covered in Report

For the purpose of this report, Advantia Business Consulting LLP. has segmented global Green Solvents market on the basis of By Type, By Source, By End Use, By Distribution Channel By End Use and By region for 2019 to 2032

- Global Green Solvents Market By Type Outlook (Revenue, USD Million 2019-2032)

- Bio-Alcohols

-

- Ethanol

-

- Butanol

-

- Propanol

-

- Isopropanol

- Bio-Diols & Glycols

-

- Propylene glycol

-

- Butylene glycol

- Lactate Esters

-

- Ethyl lactate

-

- Butyl lactate

- Tarpenes

-

- D-Limonene

-

- Pinene

- Fatty Acid Esters

-

- Methyl soyate

-

- Ethyl oleate

- Water-Based Solvents

-

- Non-ionic surfactants

-

- Anionic surfactants

-

- Cationic surfactants

- Others

- Global Green Solvents By Source (Revenue, USD Million; 2019-2032)

- Plant-Based

-

- Soybean oil derivatives

-

- Corn-based alcohols

-

- Citrus peel extracts

-

- Sugar-derived solvents

- Agricultural Waste

-

- Corn husks

-

- Rice bran oil

-

- Coconut shells

-

- Sugarcane bagasse

-

- Wheat straw

- Algae-Derived Solvents

-

- Microalgae lipid

-

- Marine algae bio-oils

-

- Omega-rich solvent

- Algae-Derived Solvents

-

- Microalgae lipid

-

- Marine algae bio-oils

-

- Omega-rich solvent

- Bioengineered

-

- Bio-butanol

-

- Bio-propylene glycol

-

- Bio-succinic acid

- Other

- Global Green Solvents By End Use Outlook (Revenue, USD Million; 2019-2032)

- Personal Care & Cosmetics

-

- Skincare

-

- Lotions

-

- Gels

-

- Serums

-

- Others

- Hair Care

-

- Shampoos

-

- Conditioners

-

- Hair oils

-

- Other

- Makeup

-

- Foundations

-

- Primers

-

- Concealers

-

- Antioxidants

-

- Other

- Pharmaceuticals & Healthcare

-

- Drug Formulations

-

- Vaccines & Biologics

-

- Medical Devices & Diagnostics

- Building & Construction

- Architectural Coatings

-

- Wall paints and primers

-

- Waterproofing formulations

-

- Anti-corrosion coatings

- Industrial Coatings

-

- Automotive Paints

-

- Protective coatings for machinery

-

- Anti-fouling marine coatings

- Printing Inks

-

- Packaging inks

-

- Textile printing formulations

-

- Conductive inks for electronics

- Agrochemicals

- Pesticides & Herbicides

-

- Solubilizers

-

- Adjuvants

- Fertilizers

-

- Nutrient blends

-

- Adjuvants Chelating agents

- Seed Treatment

-

- Seed coatings

-

- Fungicidal and insecticidal carriers

-

- Enhanced nutrient uptake agents

- Food & Beverages

- Extraction of Natural Ingredients

-

- Essential Oils

-

- Flavors

-

- Colors

- Beverage Formulations

-

- Solubilizers

-

- Carriers for vitamins and supplements

-

- Stabilizers in emulsions and syrups

- Food Preservation

-

- Antimicrobial agents

-

- Moisture retention enhancers

-

- Packaging adhesives

- Electronics & Semiconductors

- Extraction of Natural Ingredients

-

- Removal of flux residues

-

- Surface preparation solvents

-

- High-purity cleaning agents

-

- Others

- Semiconductor Processing

-

- Photoresist stripping solvents

-

- Dielectric cleaning formulations

-

- Solvent carriers for doping agents

-

- Others

- Battery Manufacturing

-

- Electrolyte formulations

-

- Solvent carriers for active materials

-

- Stabilizers in lithium-based batteries

- Global By Distribution Channel (Revenue, USD Million; 2019-2032)

- Offline

-

- Distributors / Wholesalers

-

- Retail Stores

-

- Trade Fairs / Exhibitions / Conferences

- Online

-

- E-Commerce Platforms

-

- Manufacturer Websites

-

- Social Media & Influencer Marketing

-

- Digital B2B Marketplaces

- North America

- North America Green Solvent Market By Type Outlook (Revenue, USD Million 2019-2032)

- Bio-Alcohols

-

- Ethanol

-

- Butanol

-

- Propanol

-

- Isopropanol

- Bio-Diols & Glycols

-

- Propylene glycol

-

- Butylene glycol

- Lactate Esters

-

- Ethyl lactate

-

- Butyl lactate

- Tarpenes

-

- D-Limonene

-

- Pinene

- Fatty Acid Esters

-

- Methyl soyate

-

- Ethyl oleate

- Water-Based Solvents

-

- Non-ionic surfactants

-

- Anionic surfactants

-

- Cationic surfactants

- Others

- North America Green Solvent Market By Source Outlook (Revenue, USD Million 2019-2032)

- Plant-Based

-

- Soybean oil derivatives

-

- Corn-based alcohols

-

- Citrus peel extracts

-

- Sugar-derived solvents

- Agricultural Waste

-

- Corn husks

-

- Rice bran oil

-

- Coconut shells

-

- Sugarcane bagasse

-

- Wheat straw

- Algae-Derived Solvents

-

- Microalgae lipid

-

- Marine algae bio-oils

-

- Omega-rich solvent

- Algae-Derived Solvents

-

- Microalgae lipid

-

- Marine algae bio-oils

-

- Omega-rich solvent

- Bioengineered

-

- Bio-butanol

-

- Bio-propylene glycol

-

- Bio-succinic acid

- Other

- North America Green Solvent Market By End Use Outlook (Revenue, USD Million 2019-2032)

- Personal Care & Cosmetics

-

- Skincare

-

- Lotions

-

- Gels

-

- Serums

-

- Others

- Hair Care

-

- Shampoos

-

- Conditioners

-

- Hair oils

-

- Other

- Makeup

-

- Foundations

-

- Primers

-

- Concealers

-

- Antioxidants

-

- Other

- Pharmaceuticals & Healthcare

-

- Drug Formulations

-

- Vaccines & Biologics

-

- Medical Devices & Diagnostics

- Building & Construction

- Architectural Coatings

-

- Wall paints and primers

-

- Waterproofing formulations

-

- Anti-corrosion coatings

- Industrial Coatings

-

- Automotive Paints

-

- Protective coatings for machinery

-

- Anti-fouling marine coatings

- Printing Inks

-

- Packaging inks

-

- Textile printing formulations

-

- Conductive inks for electronics

- Agrochemicals

- Pesticides & Herbicides

-

- Solubilizers

-

- Adjuvants

- Fertilizers

-

- Nutrient blends

-

- Adjuvants Chelating agents

- Seed Treatment

-

- Seed coatings

-

- Fungicidal and insecticidal carriers

-

- Enhanced nutrient uptake agents

- Food & Beverages

- Extraction of Natural Ingredients

-

- Essential Oils

-

- Flavors

-

- Colors

- Beverage Formulations

-

- Solubilizers

-

- Carriers for vitamins and supplements

-

- Stabilizers in emulsions and syrups

- Food Preservation

-

- Antimicrobial agents

-

- Moisture retention enhancers

-

- Packaging adhesives

- Electronics & Semiconductors

- Extraction of Natural Ingredients

-

- Removal of flux residues

-

- Surface preparation solvents

-

- High-purity cleaning agents

-

- Others

- Semiconductor Processing

-

- Photoresist stripping solvents

-

- Dielectric cleaning formulations

-

- Solvent carriers for doping agents

-

- Others

- Battery Manufacturing

-

- Electrolyte formulations

-

- Solvent carriers for active materials

-

- Stabilizers in lithium-based batteries

- North America Distribution Channel Outlook (Revenue, USD Million; 2019-2032)

- Offline

-

- Distributors / Wholesalers

-

- Retail Stores

-

- Trade Fairs / Exhibitions / Conferences

- Online

-

- E-Commerce Platforms

-

- Manufacturer Websites

-

- Social Media & Influencer Marketing

-

- Digital B2B Marketplaces

- U.S

- U.S Green Solvent Market By Ingredient Outlook (Revenue, USD Million 2019-2032)

- Bio-Alcohols

-

- Ethanol

-

- Butanol

-

- Propanol

-

- Isopropanol

- Bio-Diols & Glycols

-

- Propylene glycol

-

- Butylene glycol

- Lactate Esters

-

- Ethyl lactate

-

- Butyl lactate

- Tarpenes

-

- D-Limonene

-

- Pinene

- Fatty Acid Esters

-

- Methyl soyate

-

- Ethyl oleate

- Water-Based Solvents

-

- Non-ionic surfactants

-

- Anionic surfactants

-

- Cationic surfactants

- Others

- U.S Green Solvent Market By Source Outlook (Revenue, USD Million 2019-2032)

- Plant-Based

-

- Soybean oil derivatives

-

- Corn-based alcohols

-

- Citrus peel extracts

-

- Sugar-derived solvents

- Agricultural Waste

-

- Corn husks

-

- Rice bran oil

-

- Coconut shells

-

- Sugarcane bagasse

-

- Wheat straw

- Algae-Derived Solvents

-

- Microalgae lipid

-

- Marine algae bio-oils

-

- Omega-rich solvent

- Algae-Derived Solvents

-

- Microalgae lipid

-

- Marine algae bio-oils

-

- Omega-rich solvent

- Bioengineered

-

- Bio-butanol

-

- Bio-propylene glycol

-

- Bio-succinic acid

- Other

- U.S Green Solvent Market By End Use Outlook (Revenue, USD Million 2019-2032)

- Personal Care & Cosmetics

-

- Skincare

-

- Lotions

-

- Gels

-

- Serums

-

- Others

- Hair Care

-

- Shampoos

-

- Conditioners

-

- Hair oils

-

- Other

- Makeup

-

- Foundations

-

- Primers

-

- Concealers

-

- Antioxidants

-

- Other

- Pharmaceuticals & Healthcare

-

- Drug Formulations

-

- Vaccines & Biologics

-

- Medical Devices & Diagnostics

- Building & Construction

- Architectural Coatings

-

- Wall paints and primers

-

- Waterproofing formulations

-

- Anti-corrosion coatings

- Industrial Coatings

-

- Automotive Paints

-

- Protective coatings for machinery

-

- Anti-fouling marine coatings

- Printing Inks

-

- Packaging inks

-

- Textile printing formulations

-

- Conductive inks for electronics

- Agrochemicals

- Pesticides & Herbicides

-

- Solubilizers

-

- Adjuvants

- Fertilizers

-

- Nutrient blends

-

- Adjuvants Chelating agents

- Seed Treatment

-

- Seed coatings

-

- Fungicidal and insecticidal carriers

-

- Enhanced nutrient uptake agents

- Food & Beverages

- Extraction of Natural Ingredients

-

- Essential Oils

-

- Flavors

-

- Colors

- Beverage Formulations

-

- Solubilizers

-

- Carriers for vitamins and supplements

-

- Stabilizers in emulsions and syrups

- Food Preservation

-

- Antimicrobial agents

-

- Moisture retention enhancers

-

- Packaging adhesives

- Electronics & Semiconductors

- Extraction of Natural Ingredients

-

- Removal of flux residues

-

- Surface preparation solvents

-

- High-purity cleaning agents

-

- Others

- Semiconductor Processing

-

- Photoresist stripping solvents

-

- Dielectric cleaning formulations

-

- Solvent carriers for doping agents

-

- Others

- Battery Manufacturing

-

- Electrolyte formulations

-

- Solvent carriers for active materials

-

- Stabilizers in lithium-based batteries

- U.S Distribution Channel Outlook (Revenue, USD Million; 2019-2032)

- Offline

-

- Distributors / Wholesalers

-

- Retail Stores

-

- Trade Fairs / Exhibitions / Conferences

- Online

-

- E-Commerce Platforms

-

- Manufacturer Websites

-

- Social Media & Influencer Marketing

-

- Digital B2B Marketplaces

- Canada

- Canada Green Solvent Market By Ingredient Outlook (Revenue, USD Million 2019-2032)

- Bio-Alcohols

-

- Ethanol

-

- Butanol

-

- Propanol

-

- Isopropanol

- Bio-Diols & Glycols

-

- Propylene glycol

-

- Butylene glycol

- Lactate Esters

-

- Ethyl lactate

-

- Butyl lactate

- Tarpenes

-

- D-Limonene

-

- Pinene

- Fatty Acid Esters

-

- Methyl soyate

-

- Ethyl oleate

- Water-Based Solvents

-

- Non-ionic surfactants

-

- Anionic surfactants

-

- Cationic surfactants

- Others

- Canada Green Solvent Market By Source Outlook (Revenue, USD Million 2019-2032)

- Plant-Based

-

- Soybean oil derivatives

-

- Corn-based alcohols

-

- Citrus peel extracts

-

- Sugar-derived solvents

- Agricultural Waste

-

- Corn husks

-

- Rice bran oil

-

- Coconut shells

-

- Sugarcane bagasse

-

- Wheat straw

- Algae-Derived Solvents

-

- Microalgae lipid

-

- Marine algae bio-oils

-

- Omega-rich solvent

- Algae-Derived Solvents

-

- Microalgae lipid

-

- Marine algae bio-oils

-

- Omega-rich solvent

- Bioengineered

-

- Bio-butanol

-

- Bio-propylene glycol

-

- Bio-succinic acid

- Other

- Canada Green Solvent Market By End Use Outlook (Revenue, USD Million 2019-2032)

- Personal Care & Cosmetics

-

- Skincare

-

- Lotions

-

- Gels

-

- Serums

-

- Others

- Hair Care

-

- Shampoos

-

- Conditioners

-

- Hair oils

-

- Other

- Makeup

-

- Foundations

-

- Primers

-

- Concealers

-

- Antioxidants

-

- Other

- Pharmaceuticals & Healthcare

-

- Drug Formulations

-

- Vaccines & Biologics

-

- Medical Devices & Diagnostics

- Building & Construction

- Architectural Coatings

-

- Wall paints and primers

-

- Waterproofing formulations

-

- Anti-corrosion coatings

- Industrial Coatings

-

- Automotive Paints

-

- Protective coatings for machinery

-

- Anti-fouling marine coatings

- Printing Inks

-

- Packaging inks

-

- Textile printing formulations

-

- Conductive inks for electronics

- Agrochemicals

- Pesticides & Herbicides

-

- Solubilizers

-

- Adjuvants

- Fertilizers

-

- Nutrient blends

-

- Adjuvants Chelating agents

- Seed Treatment

-

- Seed coatings

-

- Fungicidal and insecticidal carriers

-

- Enhanced nutrient uptake agents

- Food & Beverages

- Extraction of Natural Ingredients

-

- Essential Oils

-

- Flavors

-

- Colors

- Beverage Formulations

-

- Solubilizers

-

- Carriers for vitamins and supplements

-

- Stabilizers in emulsions and syrups

- Food Preservation

-

- Antimicrobial agents

-

- Moisture retention enhancers

-

- Packaging adhesives

- Electronics & Semiconductors

- Extraction of Natural Ingredients

-

- Removal of flux residues

-

- Surface preparation solvents

-

- High-purity cleaning agents

-

- Others

- Semiconductor Processing

-

- Photoresist stripping solvents

-

- Dielectric cleaning formulations

-

- Solvent carriers for doping agents

-

- Others

- Battery Manufacturing

-

- Electrolyte formulations

-

- Solvent carriers for active materials

-

- Stabilizers in lithium-based batteries

- Canada Distribution Channel Outlook (Revenue, USD Million; 2019-2032)

- Offline

-

- Distributors / Wholesalers

-

- Retail Stores

-

- Trade Fairs / Exhibitions / Conferences

- Online

-

- E-Commerce Platforms

-

- Manufacturer Websites

-

- Social Media & Influencer Marketing

-

- Digital B2B Marketplaces

- Mexico

- Mexico Green Solvent Market By Ingredient Outlook (Revenue, USD Million 2019-2032)

- Bio-Alcohols

-

- Ethanol

-

- Butanol

-

- Propanol

-

- Isopropanol

- Bio-Diols & Glycols

-

- Propylene glycol

-

- Butylene glycol

- Lactate Esters

-

- Ethyl lactate

-

- Butyl lactate

- Tarpenes

-

- D-Limonene

-

- Pinene

- Fatty Acid Esters

-

- Methyl soyate

-

- Ethyl oleate

- Water-Based Solvents

-

- Non-ionic surfactants

-

- Anionic surfactants

-

- Cationic surfactants

- Others

- Mexico Green Solvent Market By Source Outlook (Revenue, USD Million 2019-2032)

- Plant-Based

-

- Soybean oil derivatives

-

- Corn-based alcohols

-

- Citrus peel extracts

-

- Sugar-derived solvents

- Agricultural Waste

-

- Corn husks

-

- Rice bran oil

-

- Coconut shells

-

- Sugarcane bagasse

-

- Wheat straw

- Algae-Derived Solvents

-

- Microalgae lipid

-

- Marine algae bio-oils

-

- Omega-rich solvent

- Algae-Derived Solvents

-

- Microalgae lipid

-

- Marine algae bio-oils

-

- Omega-rich solvent

- Bioengineered

-

- Bio-butanol

-

- Bio-propylene glycol

-

- Bio-succinic acid

- Other

- Mexico Green Solvent Market By End Use Outlook (Revenue, USD Million 2019-2032)

- Personal Care & Cosmetics

-

- Skincare

-

- Lotions

-

- Gels

-

- Serums

-

- Others

- Hair Care

-

- Shampoos

-

- Conditioners

-

- Hair oils

-

- Other

- Makeup

-

- Foundations

-

- Primers

-

- Concealers

-

- Antioxidants

-

- Other

- Pharmaceuticals & Healthcare

-

- Drug Formulations

-

- Vaccines & Biologics

-

- Medical Devices & Diagnostics

- Building & Construction

- Architectural Coatings

-

- Wall paints and primers

-

- Waterproofing formulations

-

- Anti-corrosion coatings

- Industrial Coatings

-

- Automotive Paints

-

- Protective coatings for machinery

-

- Anti-fouling marine coatings

- Printing Inks

-

- Packaging inks

-

- Textile printing formulations

-