Market Synopsis

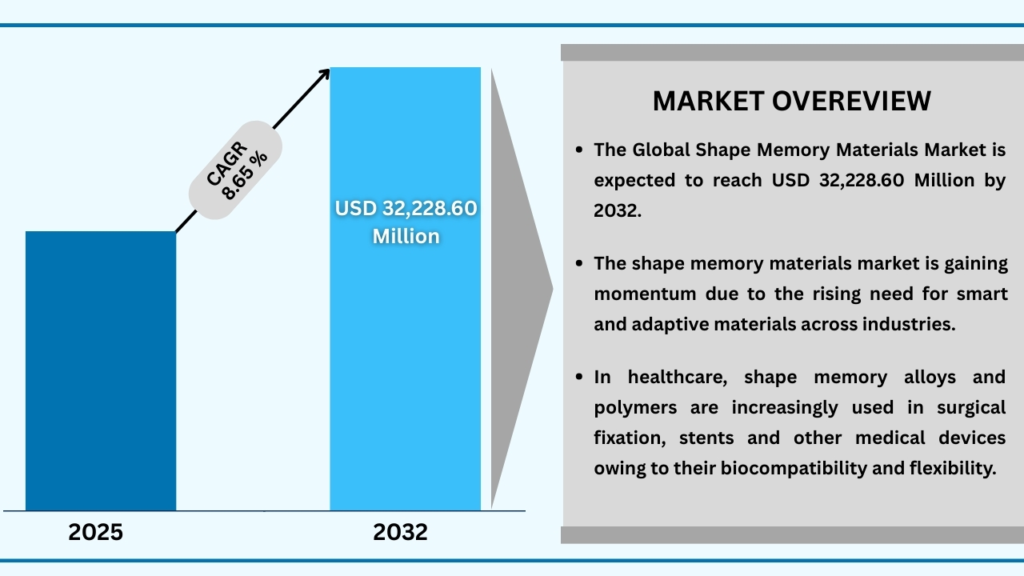

The Global Shape Memory Materials market was valued at USD 16,644.75 million in 2024 and is projected to reach USD 32,228.60 million by 2032, growing at a strong CAGR of 8.65%. The shape memory materials market is being propelled by their increasing use in advanced industries that demand smart, adaptive, and multifunctional materials. Their unique ability to respond to external stimuli, such as heat or stress, makes them highly suitable for actuators, sensors, and robotics, where precision and efficiency are critical. Moreover, the growing focus on lightweight and high-strength solutions in aerospace and automotive sectors is further accelerating their adoption.

In addition, the healthcare industry is playing a pivotal role in driving growth, with shape memory alloys and polymers being widely used in surgical implants, stents, and other medical devices. Rising innovation in consumer electronics, coupled with ongoing research into hybrid and polymer-based variants, is opening new avenues for applications. These diverse opportunities across multiple industries highlight the strong demand for shape memory materials.

Global Shape Memory Materials Market (USD Million), 2025-2032

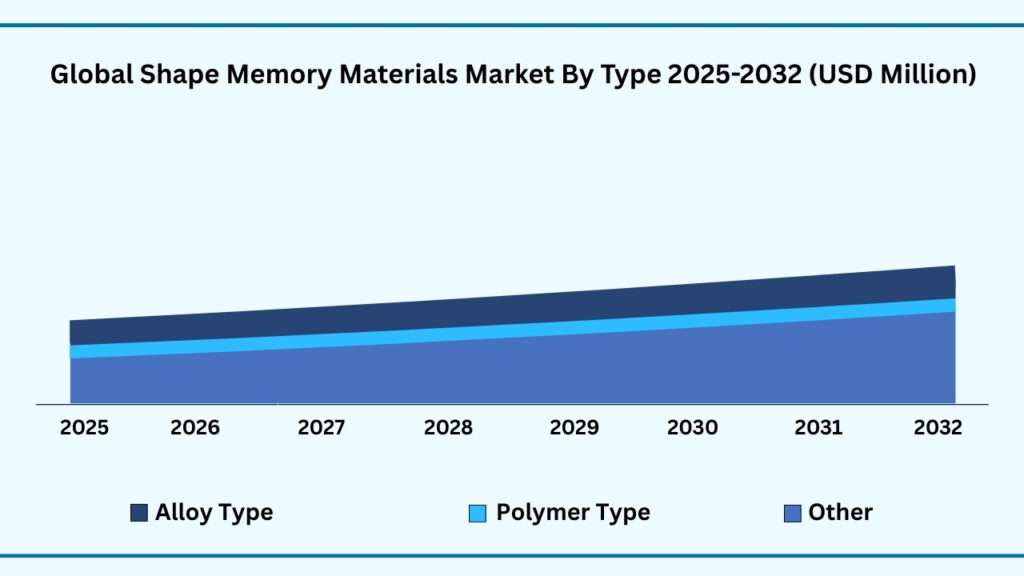

Global Shape Memory Materials Market By Type Insights:

Alloy Type segment accounted for market share of share 80.56% in 2024 in the Global Shape Memory Materials market.

The Alloy Type segment accounted for the largest share of the Global Shape Memory Materials market in 2024, representing 80.56% of total revenues. Alloy Type segment is expected to register a CAGR of 8.73 % during the forecast year from 2025 to 2032 and expected to reach USD 26,098.72 million in 2032. The Alloy Type segment dominates the Global Shape Memory Materials market, reflecting its extensive adoption across high-performance industries such as aerospace, automotive, healthcare, and robotics. Alloys, particularly nickel-titanium (NiTi) and copper-based compositions, are preferred for their superior mechanical properties, shape recovery capabilities, and reliability under extreme conditions. Their versatility allows them to be used in critical applications such as actuators, stents, surgical tools, and adaptive structural components, making them a core component of the market’s growth trajectory.

The widespread use of alloy-based shape memory materials is further supported by ongoing advancements in metallurgical processes, improved fatigue resistance, and enhanced thermal stability. As industries continue to demand lightweight, durable, and multifunctional materials, the Alloy Type segment is expected to maintain its market leadership, driven by continuous innovation, expanding end-use applications, and increasing awareness of the benefits of shape memory alloys over alternative polymers or hybrid materials.

Global Shape Memory Materials Market By Type (USD Million)

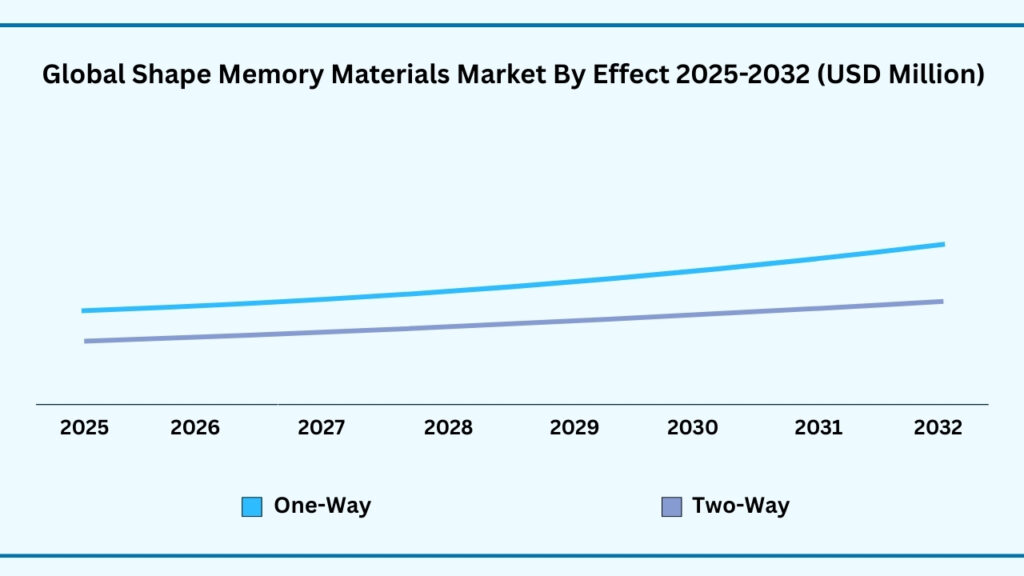

Global Shape Memory Materials Maret by Effect Insights:

One-Way segment accounted for the largest market share of share 61.32% in 2024 in the Global Shape Memory Materials market.

Based on the effect type, one-way segment held the largest revenue share of 61.32% in 2024, and expected to register a CAGR of 8.79% between 2025 to 2032 and the market is expected to reach USD 19,943.06 million by 2032. The one-way effect type segment dominates the shape memory materials market, primarily because of its broad applicability and relatively simpler functionality compared to two-way systems. These materials are widely adopted in industries such as healthcare, aerospace, and automotive, where reliable performance, cost-effectiveness, and durability are key priorities. Their ability to return to a pre-defined shape after deformation under specific stimuli makes them an ideal choice for surgical implants, actuators, and structural components.

Furthermore, the strong preference for one-way materials is also driven by ease of manufacturing and scalability, making them accessible for mass adoption across multiple industries. With growing demand for smart and adaptive materials in robotics, sensors, and lightweight aerospace structures, the one-way segment continues to benefit from rising innovation and expanding end-use applications. This steady uptake underscores its position as the leading effect type in the global market.

Global Shape Memory Materials Market by Effect (USD Million)

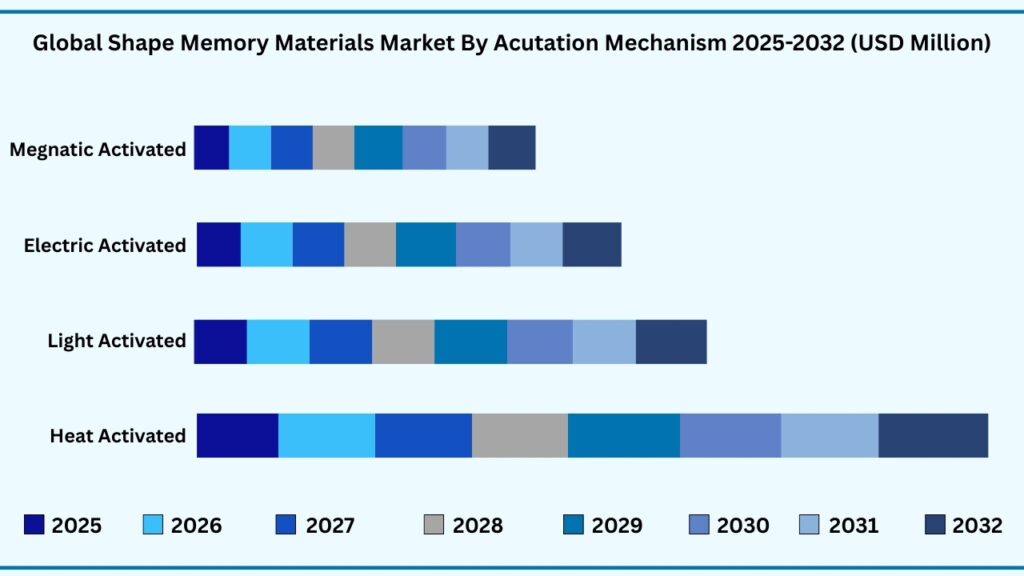

Global Shape Memory Materials Maret by Acutation Mechanism Insights:

Heat-Activated segment accounted for the largest market share of share 46.21% in 2024 in the Global Shape Memory Materials market.

Based on effect, heat-activated segment held the largest revenue share of 46.21% in the Global Shape Memory Materials market in 2024 and expected to register a CAGR of 8.99% from 2025 to 2032 and expected to reach USD 15,215.12 million. The end-use segment holding the largest share of the shape memory materials market reflects their extensive adoption in critical industries such as healthcare, aerospace, and automotive. In medical applications, these materials are widely used for stents, surgical fixation devices, and minimally invasive tools due to their biocompatibility and adaptability. Their ability to conform to the body’s environment and then return to their original shape enhances patient outcomes and drives demand in the healthcare sector.

Beyond healthcare, industries such as aerospace and automotive are increasingly integrating shape memory materials to achieve lightweight designs, improved energy efficiency, and enhanced structural performance. These materials are also finding use in sensors, actuators, and robotics, where their precision and responsiveness support advanced technological innovations. The versatility and multifunctionality across such high-demand applications ensure continued dominance of this end-use segment in the global market.

Global Shape Memory Materials Market by Acutation Mechanism (USD Million)

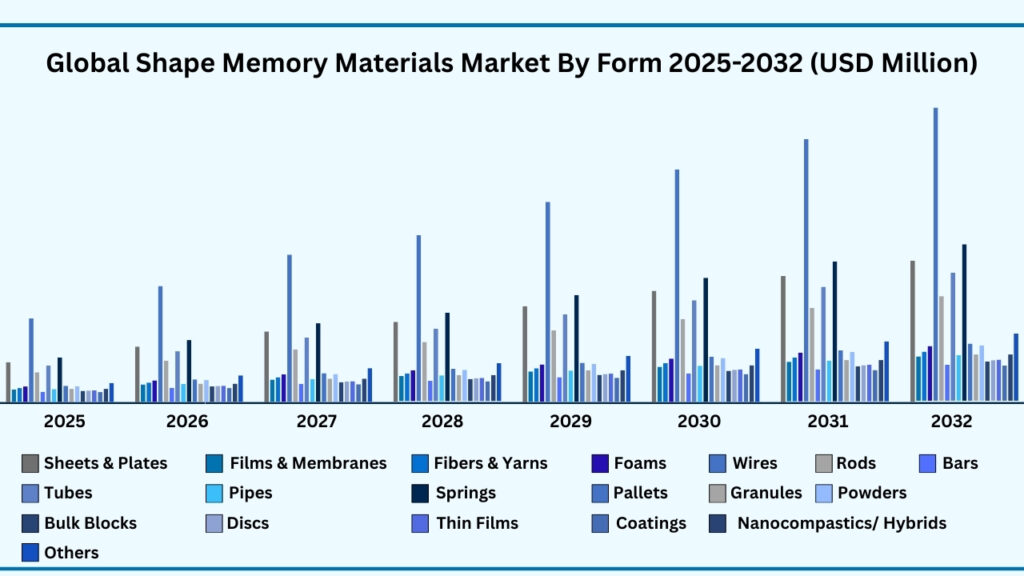

Global Shape Memory Materials Market by Form Insights:

Wires segment accounted for the largest market share of share of 27.21% in 2024 in the Global Shape Memory Materials market.

Based on by form, wire segment held the largest revenue share of 27.21% in the Global Shape Memory Materials market in 2024 and expected to register a CAGR of 8.61% from 2024 to 2032 and expected to reach USD 8,769.40 million in 2032. The wire segment dominates the shape memory materials market owing to its widespread use across medical, aerospace, and robotics applications. In healthcare, shape memory wires are extensively utilized in stents, orthodontic wires, and surgical tools because of their flexibility, durability, and ability to recover their original shape. Their biocompatibility and precision make them a preferred choice in life-saving medical procedures, significantly contributing to their high market share.

In addition, industries such as aerospace, automotive, and consumer electronics are leveraging shape memory wires for actuators, sensors, and lightweight structural components. Their adaptability, ease of integration, and cost-effectiveness make them suitable for a wide range of smart applications. With rising demand for miniaturized and efficient solutions in robotics and industrial automation, the wire segment continues to attract strong adoption, reinforcing its position as the leading form in the global shape memory materials market.

Global Shape Memory Materials By Form (USD Million)

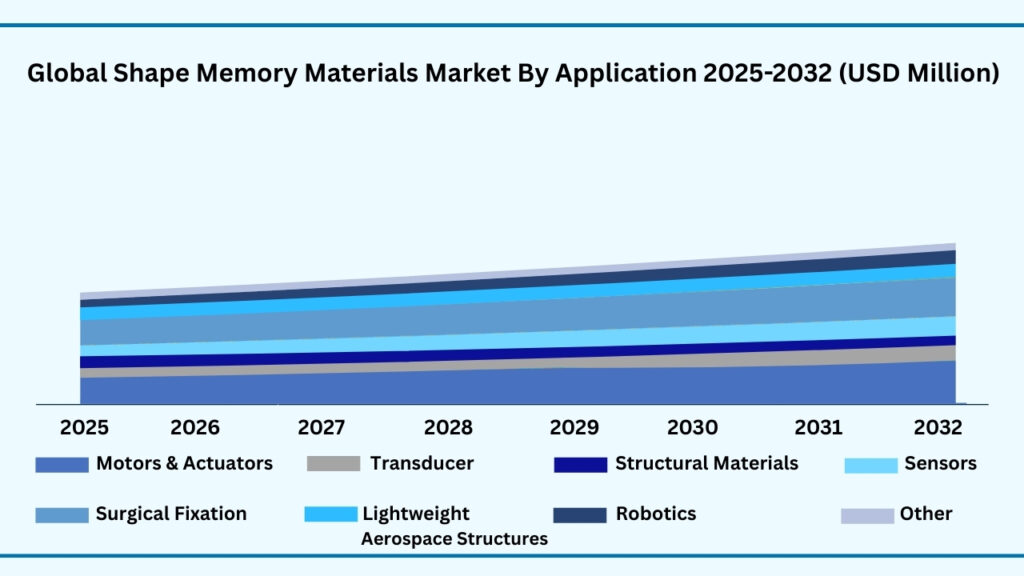

Global Shape Memory Materials Market by Application Insights:

Motors & Actuators segment accounted for the largest market share of share of 27.23% in 2024 in the Global Shape Memory Materials market.

Based on by Application, Motors & Actuators segment held the largest revenue share of 27.23% in the Global Shape Memory Materials market in 2024 and expected to register a CAGR of 9.20% from 2024 to 2032 and expected to reach USD 9,091.69 million in 2032. The motors and actuators segment holds the largest share in the shape memory materials market due to their critical role in enabling smart movement and automation across industries. Shape memory alloys and polymers are increasingly used in actuators because of their ability to convert thermal or electrical stimuli into mechanical motion with high precision. This makes them highly suitable for applications in robotics, aerospace systems, and automotive components, where efficiency, reliability, and miniaturization are essential. Their unique properties also reduce the need for complex mechanical parts, helping industries streamline designs and improve overall performance.

Moreover, the growing adoption of advanced automation and robotics is driving demand for shape memory-based motors and actuators in both industrial and consumer applications. From medical devices requiring delicate precision to aerospace systems demanding lightweight, responsive materials, these applications highlight the versatility of shape memory materials. Continuous innovation and integration with smart technologies are further expanding the use of these materials, ensuring the motors and actuators segment remains at the forefront of market growth.

Global Shape Memory Materials By Application (USD Million)

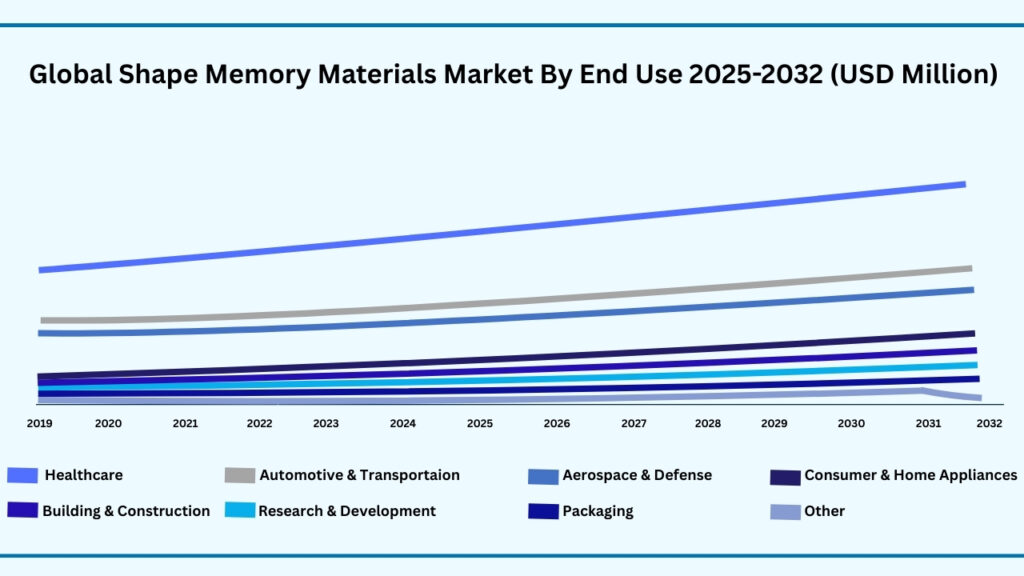

Global Shape Memory Materials Market by End Use Insights:

Healthcare segment accounted for the largest market share of share of 36.55% in 2024 in the Global Shape Memory Materials market.

Based on by Application, Healthcare segment held the largest revenue share of 36.55% in the Global Shape Memory Materials market in 2024 and expected to register a CAGR of 9.12% from 2024 to 2032 and expected to reach USD 12,137.29 million in 2032. The motors and actuators segment accounts for the largest share of the shape memory materials market, driven by their essential role in delivering precise, efficient, and responsive movement in advanced systems. Shape memory alloys and polymers used in actuators can directly transform thermal, magnetic, or electrical energy into mechanical motion, making them invaluable in robotics, aerospace, and automotive industries. Their ability to replace bulky mechanical parts with lightweight, smart alternatives supports the push for miniaturization and efficiency in modern engineering applications.

Additionally, growing demand for automation and intelligent systems across healthcare, consumer electronics, and industrial machinery continues to fuel the adoption of shape memory materials in this segment. Medical devices such as surgical tools and minimally invasive instruments rely on actuators for delicate and controlled operations, while aerospace and automotive systems leverage them for lightweight and adaptive components. With increasing R&D investments and integration into next-generation technologies, the motors and actuators segment is set to remain a cornerstone of growth in the shape memory materials market.

Global Shape Memory Materials by End Use (USD Million)

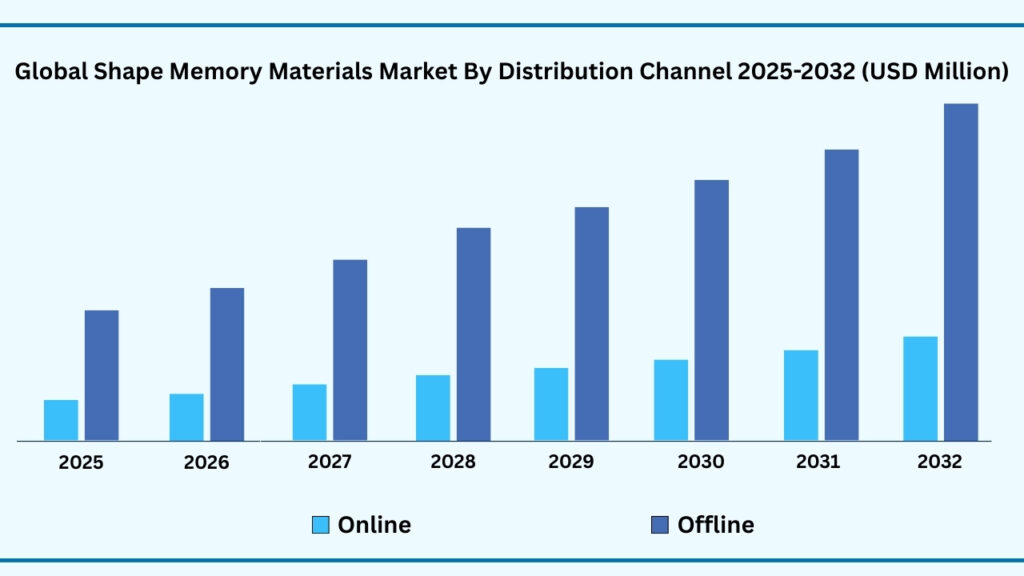

Global Shape Memory Materials Market by Distribution Channel Insights:

Offline segment accounted for the largest market share of share of 78.66% in 2024 in the Global Shape Memory Materials market.

Based on by distribution channel, Offline segment held the largest revenue share of 78.66% in the Global Shape Memory Materials market in 2024 and expected to register a CAGR of 8.57% from 2024 to 2032 and expected to reach USD 25,209.21 million in 2032. The offline segment dominates the distribution of shape memory materials due to the highly specialized nature of these products and the preference for direct business-to-business transactions. Industries such as aerospace, healthcare, and automotive require stringent quality checks, certifications, and technical support, which are more efficiently handled through established offline channels. Direct sales, supplier agreements, and distributor networks allow for customization, bulk purchasing, and assurance of compliance with regulatory standards—factors that are critical when deploying advanced materials in sensitive applications like surgical implants, actuators, or aerospace components.

Moreover, offline distribution provides stronger customer relationships and post-purchase support, making it the preferred channel for industries where performance and reliability are paramount. The ability to physically inspect materials, negotiate tailored contracts, and receive technical consultations strengthens the value of offline channels in this market. As demand for shape memory materials continues to grow across multiple sectors, the offline channel is expected to retain its dominance, supported by its ability to meet the complex and highly specific requirements of end-use industries.

Global Shape Memory Materials by Distribution Channel (USD Million)

Global Shape Memory Materials Market by Region Insights:

North America segment accounted for the largest market share of share of 35.33% in 2024 in the Global Shape Memory Materials market.

Based on region, the Global Shape Memory Materials market is segmented into Europe, Asia-Pacific, North America, Latin America and Middle East & Africa. Among these, North America region held the largest revenue share of 35.33% in the Global Shape Memory Materials market in 2024 and expected to register a CAGR of 9.13% from 2024 to 2032 and expected to reach USD 11,740.88 million in 2032. North America holds the largest share in the global shape memory materials market, driven by the region’s advanced industrial base, high adoption of innovative technologies, and strong presence of key market players. The healthcare, aerospace, and automotive sectors in North America are major consumers of shape memory alloys and polymers, leveraging their unique properties in medical devices, actuators, sensors, and lightweight structural components. High R&D investment, regulatory support, and a focus on automation and smart technologies further contribute to the region’s market dominance.

In addition, North America benefits from well-established distribution networks and a robust supply chain, enabling efficient delivery of specialized materials to end-use industries. Continuous innovation and collaborations between material manufacturers, research institutions, and industrial users are driving the development of advanced shape memory solutions. As industries in the region increasingly adopt lightweight, multifunctional, and high-performance materials, North America is expected to maintain its leadership position in the global market throughout the forecast period.

Global Shape Memory Materials Market By Region (USD Million)

Major Companies and Competitive Landscape

The global Shape Memory Materials market is highly fragmented, comprising a mix of multinational metal and polymer manufacturers, specialized solution providers, and innovative startups. Leading companies are actively pursuing strategies such as mergers and acquisitions, joint ventures, and strategic collaborations with raw material suppliers, OEMs, and end-use industries to strengthen their market presence. Investments are also being made in expanding production capacities, enhancing material performance, and developing advanced shape memory alloys and polymers to meet the growing demand across healthcare, aerospace, automotive, robotics, and consumer electronics. These initiatives focus on improving efficiency, ensuring reliability, and scaling production while maintaining strict quality and safety standards.

In addition, market leaders are increasingly emphasizing sustainability and environmentally responsible practices. Companies are adopting eco-friendly production methods, optimizing material usage, and ensuring compliance with global environmental and regulatory standards. Research and development efforts are concentrated on producing high-performance, lightweight, and multifunctional materials that reduce energy consumption and support next-generation applications. By combining innovation, sustainability, and strategic market expansion, key players are strengthening their competitive positioning and driving the broader adoption of shape memory materials across diverse industries.

Some of the leading companies profiled in the Global Shape Memory Materials market report include:

- SAES Getters S.p.A

- Johnson Matthey Plc

- Furukawa Electric Co., Ltd.

- ATI Specialty Alloys & Components

- Fort Wayne Metals Research Products Corp

- Dynalloy, Inc.

- Nippon Steel Corporation

- Nippon Seisen Co., Ltd.

- Memry Corporation

- Admedes Schuessler GmbH

- Metalwerks PMD, Inc.

- Xian Saite Metal Materialss Development Co., Ltd.

Strategic Development

Expansion in China

In February 2025, SAES inaugurated a new office in Nanjing, China, reinforcing its commitment to the Asian market. This strategic move aims to enhance local partnerships and support the growing demand for advanced materials in the region.

Johnson Matthey Plc

Divestment of Catalyst Technologies

In May 2025, Johnson Matthey agreed to sell its Catalyst Technologies division to Honeywell for USD 1.34 billion. This decision is part of the company’s strategy to streamline operations and focus on core areas such as Clean Air and PGM Services.

Scope of Research

| Report Details | Outcome |

|---|---|

| Market size in 2024 | USD 16,644.75 Million |

| CAGR (2024–2032) | 8.65% |

| Revenue forecast to 2033 | USD 32,228.60 Million |

| Base year for estimation | 2024 |

| Historical data | 2019–2023 |

| Forecast period | 2025–2032 |

| Quantitative units | Revenue in USD Million, Volume Kiloton and CAGR in % from 2025 to 2032 |

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | By Ingredient, By Product Form, By Type, By Source, By Distribution Channel, By End Use and By region |

| Regional scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Country scope | U.S., Canada, Mexico, Germany, France, U.K., Italy, Spain, Benelux, Russia, Finland, Sweden, Rest of Europe, China, India, Japan, South Korea, Indonesia, Thailand, Vietnam, Australia, New Zealand Rest of APAC, Brazil, Rest of LATAM, Saudi Arabia, Rest of MEA |

| Key companies profiled | “SAES Getters S.p.A, Johnson Matthey Plc, Furukawa Electric Co., Ltd., ATI Specialty Alloys & Components, Fort Wayne Metals Research Products Corp, Dynalloy, Inc., Nippon Steel Corporation, Memory Corporation, Admedes Schuessler GmbH, Metalwerks PMD, Inc., Xian Saite Metal Materialss Development Co., Ltd., Ultimate NiTi Technologies, Inc.,. EUROFLEX GmbH, Memry / SAES Memory-Metalle (division), BASF SE, Covestro AG, Medtronic Sappho, Spintech Holdings Inc., SMP Technologies Inc, Mitsubishi Materialss / Mitsubishi Chemical Co., Daido Steel Co., Ltd., Goodfellow Corporation, Ingpuls GmbH, Aerofits Products Inc, |

| Customization scope | 10 hours of free customization and expert consultation |

Some Key Questions the Report Will Answer

- What is the expected revenue Compound Annual Growth Rate (CAGR) of the Global Shape Memory Materials market over the forecast period (2025–2032)?

- The Global Shape Memory Materials market revenue is expected to register a Compound Annual Growth Rate (CAGR) of 8.65% during the forecast period.

- What was the size of the Global Shape Memory Materials in 2024?

- The global Shape Memory Materials market size was USD 16,644.75 Million in 2024.

- Which factors are expected to drive the Global Shape Memory Materials market growth?

- The growth of the global Shape Memory Materials market is being driven by increasing demand for smart, adaptive, and multifunctional materials across diverse industries. Their ability to return to a pre-defined shape in response to external stimuli, such as heat, electricity, or magnetism, makes them highly valuable in applications like healthcare, aerospace, automotive, and robotics. Rising adoption in medical devices, actuators, sensors, and lightweight structural components, coupled with ongoing research and development in advanced alloys and polymers, is further accelerating market expansion. Additionally, the push for energy-efficient, compact, and high-performance solutions in emerging technologies continues to boost the demand for shape memory materials worldwide.

- Which was the leading segment in the Global Shape Memory Materials market in terms of type in 2024?

- In 2024, Alloy Type accounted for the largest market share with a market share of 80.56% in terms of USD million.

- What are some restraints for revenue growth of the Global Shape Memory Materials market?

- The global Shape Memory Materials market faces several restraints that could limit revenue growth. High production and material costs associated with specialized alloys and polymers make widespread adoption challenging, particularly for small and medium-sized enterprises. Additionally, the complexity of manufacturing processes and the need for precise quality control can hinder scalability and increase lead times. Limited awareness and technical expertise among end-users in emerging markets, along with stringent regulatory requirements for medical and aerospace applications, also pose challenges. These factors collectively create barriers that may slow market expansion despite growing demand.

Follow us on: Facebook, Twitter, Instagram and LinkedIn.

Chapter 1. Introduction

1.1. Market Definition

1.2. Objectives of the study

1.3. Overview of Shape Memory Materials Market

1.4. Currency and pricing

1.5. Limitation

1.6. Markets covered

1.7. Research Scope

Chapter 2. Research Methodology

2.1. Research Sources

2.1.1.Primary

2.1.2.Secondary

2.1.3.Paid Sources

2.2. Years considered for the study

2.3. Assumptions

2.3.1.Market value

2.3.2.Market volume

2.3.3.Exchange rate

2.3.4.Price

2.3.5.Economic & political stability

Chapter 3. Executive Summary

3.1. Summary Snapshot, 2019–2032

Chapter 4. Key Insights

4.1. Production consumption analysis

4.2. Strategic partnerships & alliances

4.3. Joint ventures

4.4. Acquisition of local players

4.5. Contract manufacturing

4.6. Digital & e-commerce sales channels

4.7. Compliance with standards

4.8. Value chain analysis

4.9. Raw Materials sourcing

4.10. Formulation & manufacturing

4.11. Distribution & retail

4.12. Import-export analysis

4.13. Brand comparative analysis

4.14. Technological advancements

4.15. Porter’s five force

4.15.1. Threat of new entrants

4.15.1.1. Capital requirment

4.15.1.2. Product knowledge

4.15.1.3. Technical knowledge

4.15.1.4. Customer relation

4.15.1.5. Access to appliation and technology

4.15.2. Threat of substitutes

4.15.2.1. Cost

4.15.2.2. Performance

4.15.2.3. Availability

4.15.2.4. Technical knowledge

4.15.2.5. Durability

4.15.3. Bargainning power of buyers

4.15.3.1. Numbers of buyers relative to suppliers

4.15.3.2. Product differentiation

4.15.3.3. Threat of forward integration

4.15.3.4. Buyers volume

4.15.4. Bargainning power of suppliers

4.15.4.1. Suppliers concentration

4.15.4.2. Buyers switching cost to other suppliers

4.15.4.3. Threat of backward integration

4.15.5.Bargainning power of suppliers

4.15.5.1. Industry concentration

4.15.5.2. Industry growth rate

4.15.5.3. Product differentiation

4.16. Patent analysis

4.17. Regulation coverage

4.18. Pricing analysis

4.19. Competitive Metric Space Analysis

Chapter 5. Market Overview

5.1. Drivers

5.1.1.Rising demand in medical applications

5.1.2.Growth in aerospace & automotive sectors

5.1.3.Innovation in robotics & smart textiles

5.2. Restraints

5.2.1.High production and processing costs

5.2.2.Limited availability of raw Materialss egulatory Challenges

5.3. Opportunities

5.3.1.Expansion in minimally invasive surgery

5.3.2.Integration with IoT & smart devices

5.3.3.Sustainability focus

5.4. Challenges

5.4.1.Materials fatigue & durability issues

5.4.2.Standardization & design complexity

Chapter 6. Global Shape Memory Materials Market By Type Insights & Trends, Revenue (USD

Million), Volume (Kiloton)

6.1. Type Dynamics & Market Share, 2019–2032

6.1.1.1. Alloy Type:

6.1.1.1.1. Nitinol (Ni-Ti)

6.1.1.1.2. Copper-based (Cu-Zn-Al, Cu-Al-Ni…)

6.1.1.1.3. Iron-based (Fe-Mn-Si)

6.1.1.1.4. Aluminium

6.1.1.1.5. Stainless Steel

6.1.1.1.6. Niobium

6.1.1.1.7. Others

6.1.1.2. Polymer Type:

6.1.1.2.1. Polyurethane (PU)

6.1.1.2.2. Epoxy

6.1.1.2.3. Polyvinyl Chloride (PVC)

6.1.1.2.4. Acrylic

6.1.1.2.5. Polylactide (PLA)

6.1.1.2.6. Nylon

6.1.1.2.7. Polyethylene

6.1.1.2.8. Polypropylene

6.1.1.2.9. Others

Chapter 7. Global Shape Memory Materials Market By Effect Insights & Trends, Revenue (USD

Million), Volume (Kiloton)

7.1. Effect Dynamics & Market Share, 2019–2032

7.1.1. One-Way

7.1.2. Two-Way

Chapter 8. Global Shape Memory Materials Market By Acutation Mechanism Insights &

Trends, Revenue (USD Million), Volume (Kiloton)

8.1. Acutation Mechanism Dynamics & Market Share, 2019–2032

8.1.1. Heat-Activated

8.1.2. Light-Activated

8.1.3. Electrical-Activated

8.1.4. Magnetic-Activated

Chapter 9. Global Shape Memory Materials Market By Form Insights & Trends, Revenue (USD

Million), Volume (Kiloton)

9.1. Application Dynamics & Market Share, 2019–2032

9.1.1.Sheets & Plates

9.1.2.Films & Membranes

9.1.3.Fibers & Yarns

9.1.4.Foams

9.1.5.Wires

9.1.6.Rods

9.1.7. Bars

9.1.8.Tubes

9.1.9. Pipes

9.1.10.Springs

9.1.11.Pellets

9.1.12.Granules

9.1.13.Powders

9.1.14.Bulk Blocks

9.1.15.Discs

9.1.16.Thin Films

9.1.17.Coatings

9.1.18.Nanocomposites / Hybrids

9.1.19.Other

Chapter 10. Global Shape Memory Materials Market By Application Insights & Trends,

Revenue (USD Million), Volume (Kiloton)

10.1. Application Dynamics & Market Share, 2019–2032

10.1.1.Motors & Actuators

10.1.2.Transducers

10.1.3.Structural Materialss

10.1.4.Sensors

10.1.5.Surgical Fixation

10.1.6.Lightweight / Deployable aerospace structures

10.1.7.Robotics

10.1.8.Other

Chapter 11. Global Shape Memory Materials Market By End Use Insights & Trends, Revenue

(USD Million), Volume (Kiloton)

11.1. End Use Dynamics & Market Share, 2019–2032

11.1.1. Healthcare

11.1.2. Automotive & Transporation

11.1.3. Aerospace & Defense

11.1.4. Consumer Electronics & Home Appliances

11.1.5. Building & Construction

11.1.6. Research & Development

11.1.7. Packaging

11.1.8. Other

Chapter 12. Global Shape Memory Materials Market By Distribution Channel Insights &

Trends, Revenue (USD Million),

12.1. Distribution Channel & Market Share, 2019–2032

12.1.1.Offline

12.1.1.1. Direct Sales to OEMs

12.1.1.2. Distributors / Wholesalers

12.1.1.3. Contract Manufacturing & Custom Orders

12.1.1.4. Hypermarkets & Supermarkets

12.1.1.5. Research & Academic Partnerships

12.1.2.Online

12.1.2.1. E-Commerce Platforms

12.1.2.2. Specialty Supplier Websites

12.1.2.3. Digital B2B Marketplaces

Chapter 13. Global Shape Memory Materials Market Regional Outlook

13.1. Shape Memory Materials Share By Region, 2019–2032

13.2. North America

13.2.1. Market By Type Estimates and Forecast, USD Million, 2019-2032

13.2.1.1. Alloy Type:

13.2.1.1.1. Nitinol (Ni-Ti)

13.2.1.1.2. Copper-based (Cu-Zn-Al, Cu-Al-Ni…)

13.2.1.1.3. Iron-based (Fe-Mn-Si)

13.2.1.1.4. Aluminium

13.2.1.1.5. Stainless Steel

13.2.1.1.6. Niobium

13.2.1.1.7. Others

13.2.1.2. Polymer Type:

13.2.1.2.1. Polyurethane (PU)

13.2.1.2.2. Epoxy

13.2.1.2.3. Polyvinyl Chloride (PVC)

13.2.1.2.4. Acrylic

13.2.1.2.5. Polylactide (PLA)

13.2.1.2.6. Nylon

13.2.1.2.7. Polyethylene

13.2.1.2.8. Polypropylene

13.2.1.2.9. Others

13.2.1.3. Others

13.2.2. Market By Effect, Market Estimates and Forecast, USD Million, 2019-2032

13.2.2.1. One-Way

13.2.2.2. Two-Way

13.2.3. Market By Acutation Mechanism, Market Estimates and Forecast, USD Million,

2019-2032

13.2.3.1. Heat-Activated

13.2.3.2. Light-Activated

13.2.3.3. Electrical-Activated

13.2.3.4. Magnetic-Activated

13.2.4. Market By Form, Market Estimates and Forecast, USD Million, 2019-2032

13.2.4.1. Sheets & Plates

13.2.4.2. Films & Membranes

13.2.4.3. Fibers & Yarns

13.2.4.4. Foams

13.2.4.5. Wires

13.2.4.6. Rods

13.2.4.7. Bars

13.2.4.8. Tubes

13.2.4.9. Pipes

13.2.4.10. Springs

13.2.4.11. Pellets

13.2.4.12. Granules

13.2.4.13. Powders

13.2.4.14. Bulk Blocks

13.2.4.15. Discs

13.2.4.16. Thin Films

13.2.4.17. Coatings

13.2.4.18. Nanocomposites / Hybrids

13.2.4.19. Other

13.2.5. Market By Application, Market Estimates and Forecast, USD Million, 2019-2032

13.2.5.1. Motors & Actuators

13.2.5.2. Transducers

13.2.5.3. Structural Materialss

13.2.5.4. Sensors

13.2.5.5. Surgical Fixation

13.2.5.6. Lightweight / Deployable aerospace structures

13.2.5.7. Robotics

13.2.5.8. Other

13.2.6. Market By End Use, Market Estimates and Forecast, USD Million, 2019-2032

13.2.6.1. Healthcare

13.2.6.2. Automotive & Transporation

13.2.6.3. Aerospace & Defense

13.2.6.4. Consumer Electronics & Home Appliances

13.2.6.5. Building & Construction

13.2.6.6. Research & Development

13.2.6.7. Packaging

13.2.6.8. Other

13.2.7. Market By Distribution Channel, Market Estimates and Forecast, USD Million,

2019-2032

13.2.7.1. Offline

13.2.7.1.1. Direct Sales to OEMs

13.2.7.1.2. Distributors / Wholesalers

13.2.7.1.3. Contract Manufacturing & Custom Orders

13.2.7.1.4. Hypermarkets & Supermarkets

13.2.7.1.5. Research & Academic Partnerships

13.2.7.2. Online

13.2.7.2.1. E-Commerce Platforms

13.2.7.2.2. Specialty Supplier Websites

13.2.7.2.3. Digital B2B Marketplaces

13.2.8. Market By Country, Market Estimates and Forecast, USD Million, 2025-2032

13.2.8.1. US

13.2.8.2. Canada

13.2.8.3. Mexico

13.3. Europe

13.3.1. Market By Type Estimates and Forecast, USD Million, 2019-2032

13.3.1.1. Alloy Type:

13.3.1.1.1. Nitinol (Ni-Ti)

13.3.1.1.2. Copper-based (Cu-Zn-Al, Cu-Al-Ni…)

13.3.1.1.3. Iron-based (Fe-Mn-Si)

13.3.1.1.4. Aluminium

13.3.1.1.5. Stainless Steel

13.3.1.1.6. Niobium

13.3.1.1.7. Others

13.3.1.2. Polymer Type:

13.3.1.2.1. Polyurethane (PU)

13.3.1.2.2. Epoxy

13.3.1.2.3. Polyvinyl Chloride (PVC)

13.3.1.2.4. Acrylic

13.3.1.2.5. Polylactide (PLA)

13.3.1.2.6. Nylon

13.3.1.2.7. Polyethylene

13.3.1.2.8. Polypropylene

13.3.1.2.9. Others

13.3.1.3. Others

13.3.2. Market By Effect, Market Estimates and Forecast, USD Million, 2019-2032

13.3.2.1. One-Way

13.3.2.2. Two-Way

13.3.3. Market By Acutation Mechanism, Market Estimates and Forecast, USD Million,

2019-2032

13.3.3.1. Heat-Activated

13.3.3.2. Light-Activated

13.3.3.3. Electrical-Activated

13.3.3.4. Magnetic-Activated

13.3.4. Market By Form, Market Estimates and Forecast, USD Million, 2019-2032

13.3.4.1. Sheets & Plates

13.3.4.2. Films & Membranes

13.3.4.3. Fibers & Yarns

13.3.4.4. Foams

13.3.4.5. Wires

13.3.4.6. Rods

13.3.4.7. Bars

13.3.4.8. Tubes

13.3.4.9. Pipes

13.3.4.10. Springs

13.3.4.11. Pellets

13.3.4.12. Granules

13.3.4.13. Powders

13.3.4.14. Bulk Blocks

13.3.4.15. Discs

13.3.4.16. Thin Films

13.3.4.17. Coatings

13.3.4.18. Nanocomposites / Hybrids

13.3.4.19. Other

13.3.5. Market By Application, Market Estimates and Forecast, USD Million, 2019-2032

13.3.5.1. Motors & Actuators

13.3.5.2. Transducers

13.3.5.3. Structural Materialss

13.3.5.4. Sensors

13.3.5.5. Surgical Fixation

13.3.5.6. Lightweight / Deployable aerospace structures

13.3.5.7. Robotics

13.3.5.8. Other

13.3.6. Market By End Use, Market Estimates and Forecast, USD Million, 2019-2032

13.3.6.1. Healthcare

13.3.6.2. Automotive & Transporation

13.3.6.3. Aerospace & Defense

13.3.6.4. Consumer Electronics & Home Appliances

13.3.6.5. Building & Construction

13.3.6.6. Research & Development

13.3.6.7. Packaging

13.3.6.8. Other

13.3.7. Market By Distribution Channel, Market Estimates and Forecast, USD Million,

2019-2032

13.3.7.1. Offline

13.3.7.1.1. Direct Sales to OEMs

13.3.7.1.2. Distributors / Wholesalers

13.3.7.1.3. Contract Manufacturing & Custom Orders

13.3.7.1.4. Hypermarkets & Supermarkets

13.3.7.1.5. Research & Academic Partnerships

13.3.7.2. Online

13.3.7.2.1. E-Commerce Platforms

13.3.7.2.2. Specialty Supplier Websites

13.3.7.2.3. Digital B2B Marketplaces

13.3.8. Market By Country, Market Estimates and Forecast, USD Million, 2025-2032

13.3.8.1. US

13.3.8.2. Canada

13.3.8.3. Mexico

13.3.9. Market By Country, Market Estimates and Forecast, USD Million,

13.3.9.1. Germany

13.3.9.2. France

13.3.9.3. U.K

13.3.9.4. Italy

13.3.9.5. Spain

13.3.9.6. Benelux

13.3.9.7. Russia

13.3.9.8. Finland

13.3.9.9. Sweden

13.3.9.10. Rest Of Europe

13.4. Asia-Pacific

13.4.1. Market By Type Estimates and Forecast, USD Million, 2019-2032

13.4.1.1. Alloy Type:

13.4.1.1.1. Nitinol (Ni-Ti)

13.4.1.1.2. Copper-based (Cu-Zn-Al, Cu-Al-Ni…)

13.4.1.1.3. Iron-based (Fe-Mn-Si)

13.4.1.1.4. Aluminium

13.4.1.1.5. Stainless Steel

13.4.1.1.6. Niobium

13.4.1.1.7. Others

13.4.1.2. Polymer Type:

13.4.1.2.1. Polyurethane (PU)

13.4.1.2.2. Epoxy

13.4.1.2.3. Polyvinyl Chloride (PVC)

13.4.1.2.4. Acrylic

13.4.1.2.5. Polylactide (PLA)

13.4.1.2.6. Nylon

13.4.1.2.7. Polyethylene

13.4.1.2.8. Polypropylene

13.4.1.2.9. Others

13.4.1.3. Others

13.4.2. Market By Effect, Market Estimates and Forecast, USD Million, 2019-2032

13.4.2.1. One-Way

13.4.2.2. Two-Way

13.4.3. Market By Acutation Mechanism, Market Estimates and Forecast, USD Million,

2019-2032

13.4.3.1. Heat-Activated

13.4.3.2. Light-Activated

13.4.3.3. Electrical-Activated

13.4.3.4. Magnetic-Activated

13.4.4. Market By Form, Market Estimates and Forecast, USD Million, 2019-2032

13.4.4.1. Sheets & Plates

13.4.4.2. Films & Membranes

13.4.4.3. Fibers & Yarns

13.4.4.4. Foams

13.4.4.5. Wires

13.4.4.6. Rods

13.4.4.7. Bars

13.4.4.8. Tubes

13.4.4.9. Pipes

13.4.4.10. Springs

13.4.4.11. Pellets

13.4.4.12. Granules

13.4.4.13. Powders

13.4.4.14. Bulk Blocks

13.4.4.15. Discs

13.4.4.16. Thin Films

13.4.4.17. Coatings

13.4.4.18. Nanocomposites / Hybrids

13.4.4.19. Other

13.4.5. Market By Application, Market Estimates and Forecast, USD Million, 2019-2032

13.4.5.1. Motors & Actuators

13.4.5.2. Transducers

13.4.5.3. Structural Materialss

13.4.5.4. Sensors

13.4.5.5. Surgical Fixation

13.4.5.6. Lightweight / Deployable aerospace structures

13.4.5.7. Robotics

13.4.5.8. Other

13.4.6. Market By End Use, Market Estimates and Forecast, USD Million, 2019-2032

13.4.6.1. Healthcare

13.4.6.2. Automotive & Transporation

13.4.6.3. Aerospace & Defense

13.4.6.4. Consumer Electronics & Home Appliances

13.4.6.5. Building & Construction

13.4.6.6. Research & Development

13.4.6.7. Packaging

13.4.6.8. Other

13.4.7. Market By Distribution Channel, Market Estimates and Forecast, USD Million,

2019-2032

13.4.7.1. Offline

13.4.7.1.1. Direct Sales to OEMs

13.4.7.1.2. Distributors / Wholesalers

13.4.7.1.3. Contract Manufacturing & Custom Orders

13.4.7.1.4. Hypermarkets & Supermarkets

13.4.7.1.5. Research & Academic Partnerships

13.4.7.2. Online

13.4.7.2.1. E-Commerce Platforms

13.4.7.2.2. Specialty Supplier Websites

13.4.7.2.3. Digital B2B Marketplaces

13.4.8. Market By Country, Market Estimates and Forecast, USD Million, 2025-2032

13.4.8.1. US

13.4.8.2. Canada

13.4.8.3. Mexico

13.4.9. Market By Country, Market Estimates and Forecast, USD Million,

13.4.9.1.1. China

13.4.9.1.2. India

13.4.9.1.3. Japan

13.4.9.1.4. South Korea

13.4.9.1.5. Indonesia

13.4.9.1.6. Thailand

13.4.9.1.7. Vietnam

13.4.9.1.8. Australia

13.4.9.1.9. New Zeland

13.4.9.1.10. Rest of APAC

13.5. Latin America

13.5.1. Market By Type Estimates and Forecast, USD Million, 2019-2032

13.5.1.1. Alloy Type:

13.5.1.1.1. Nitinol (Ni-Ti)

13.5.1.1.2. Copper-based (Cu-Zn-Al, Cu-Al-Ni…)

13.5.1.1.3. Iron-based (Fe-Mn-Si)

13.5.1.1.4. Aluminium

13.5.1.1.5. Stainless Steel

13.5.1.1.6. Niobium

13.5.1.1.7. Others

13.5.1.2. Polymer Type:

13.5.1.2.1. Polyurethane (PU)

13.5.1.2.2. Epoxy

13.5.1.2.3. Polyvinyl Chloride (PVC)

13.5.1.2.4. Acrylic

13.5.1.2.5. Polylactide (PLA)

13.5.1.2.6. Nylon

13.5.1.2.7. Polyethylene

13.5.1.2.8. Polypropylene

13.5.1.2.9. Others

13.5.1.3. Others

13.5.2. Market By Effect, Market Estimates and Forecast, USD Million, 2019-2032

13.5.2.1. One-Way

13.5.2.2. Two-Way

13.5.3. Market By Acutation Mechanism, Market Estimates and Forecast, USD Million,

2019-2032

13.5.3.1. Heat-Activated

13.5.3.2. Light-Activated

13.5.3.3. Electrical-Activated

13.5.3.4. Magnetic-Activated

13.5.4. Market By Form, Market Estimates and Forecast, USD Million, 2019-2032

13.5.4.1. Sheets & Plates

13.5.4.2. Films & Membranes

13.5.4.3. Fibers & Yarns

13.5.4.4. Foams

13.5.4.5. Wires

13.5.4.6. Rods

13.5.4.7. Bars

13.5.4.8. Tubes

13.5.4.9. Pipes

13.5.4.10. Springs

13.5.4.11. Pellets

13.5.4.12. Granules

13.5.4.13. Powders

13.5.4.14. Bulk Blocks

13.5.4.15. Discs

13.5.4.16. Thin Films

13.5.4.17. Coatings

13.5.4.18. Nanocomposites / Hybrids

13.5.4.19. Other

13.5.5. Market By Application, Market Estimates and Forecast, USD Million, 2019-2032

13.5.5.1. Motors & Actuators

13.5.5.2. Transducers

13.5.5.3. Structural Materialss

13.5.5.4. Sensors

13.5.5.5. Surgical Fixation

13.5.5.6. Lightweight / Deployable aerospace structures

13.5.5.7. Robotics

13.5.5.8. Other

13.5.6. Market By End Use, Market Estimates and Forecast, USD Million, 2019-2032

13.5.6.1. Healthcare

13.5.6.2. Automotive & Transporation

13.5.6.3. Aerospace & Defense

13.5.6.4. Consumer Electronics & Home Appliances

13.5.6.5. Building & Construction

13.5.6.6. Research & Development

13.5.6.7. Packaging

13.5.6.8. Other

13.5.7. Market By Distribution Channel, Market Estimates and Forecast, USD Million,

2019-2032

13.5.7.1. Offline

13.5.7.1.1. Direct Sales to OEMs

13.5.7.1.2. Distributors / Wholesalers

13.5.7.1.3. Contract Manufacturing & Custom Orders

13.5.7.1.4. Hypermarkets & Supermarkets

13.5.7.1.5. Research & Academic Partnerships

13.5.7.2. Online

13.5.7.2.1. E-Commerce Platforms

13.5.7.2.2. Specialty Supplier Websites

13.5.7.2.3. Digital B2B Marketplaces

13.5.8. Market By Country, Market Estimates and Forecast, USD Million, 2025-2032

13.5.8.1. US

13.5.8.2. Canada

13.5.8.3. Mexico

13.5.9. Market By Country, Market Estimates and Forecast, USD Million,

13.5.9.1. Brazil

13.5.9.2. Rest of LATAM

13.6. Middle East & Africa

13.6.1. Market By Type Estimates and Forecast, USD Million, 2019-2032

13.6.1.1. Alloy Type:

13.6.1.1.1. Nitinol (Ni-Ti)

13.6.1.1.2. Copper-based (Cu-Zn-Al, Cu-Al-Ni…)

13.6.1.1.3. Iron-based (Fe-Mn-Si)

13.6.1.1.4. Aluminium

13.6.1.1.5. Stainless Steel

13.6.1.1.6. Niobium

13.6.1.1.7. Others

13.6.1.2. Polymer Type:

13.6.1.2.1. Polyurethane (PU)

13.6.1.2.2. Epoxy

13.6.1.2.3. Polyvinyl Chloride (PVC)

13.6.1.2.4. Acrylic

13.6.1.2.5. Polylactide (PLA)

13.6.1.2.6. Nylon

13.6.1.2.7. Polyethylene

13.6.1.2.8. Polypropylene

13.6.1.2.9. Others

13.6.1.3. Others

13.6.2. Market By Effect, Market Estimates and Forecast, USD Million,

2019-2032

13.6.2.1. One-Way

13.6.2.2. Two-Way

13.6.3. Market By Acutation Mechanism, Market Estimates and Forecast,

USD Million, 2019-2032

13.6.3.1. Heat-Activated

13.6.3.2. Light-Activated

13.6.3.3. Electrical-Activated

13.6.3.4. Magnetic-Activated

13.6.4. Market By Form, Market Estimates and Forecast, USD Million,

2019-2032

13.6.4.1. Sheets & Plates

13.6.4.2. Films & Membranes

13.6.4.3. Fibers & Yarns

13.6.4.4. Foams

13.6.4.5. Wires

13.6.4.6. Rods

13.6.4.7. Bars

13.6.4.8. Tubes

13.6.4.9. Pipes

13.6.4.10. Springs

13.6.4.11. Pellets

13.6.4.12. Granules

13.6.4.13. Powders

13.6.4.14. Bulk Blocks

13.6.4.15. Discs

13.6.4.16. Thin Films

13.6.4.17. Coatings

13.6.4.18. Nanocomposites / Hybrids

13.6.4.19. Other

13.6.5. Market By Application, Market Estimates and Forecast, USD Million,

2019-2032

13.6.5.1. Motors & Actuators

13.6.5.2. Transducers

13.6.5.3. Structural Materialss

13.6.5.4. Sensors

13.6.5.5. Surgical Fixation

13.6.5.6 .Lightweight / Deployable aerospace structures

13.6.5.7. Robotics

13.6.5.8. Other

13.6.6. Market By End Use, Market Estimates and Forecast, USD Million,

2019-2032

13.6.6.1. Healthcare

13.6.6.2. Automotive & Transporation

13.6.6.3. Aerospace & Defense

13.6.6.4. Consumer Electronics & Home Appliances

13.6.6.5. Building & Construction

13.6.6.6. Research & Development

13.6.6.7. Packaging

13.6.6.8. Other

13.6.7. Market By Distribution Channel, Market Estimates and Forecast,

USD Million, 2019-2032

13.6.7.1. Offline

13.6.7.1.1. Direct Sales to OEMs

13.6.7.1.2. Distributors / Wholesalers

13.6.7.1.3. Contract Manufacturing & Custom Orders

13.6.7.1.4. Hypermarkets & Supermarkets

13.6.7.1.5. Research & Academic Partnerships

13.6.7.2. Online

13.6.7.2.1.E-Commerce Platforms

13.6.7.2.2.Specialty Supplier Websites

13.6.7.2.3.Digital B2B Marketplaces

13.6.8. Market By Country, Market Estimates and Forecast, USD Million,

13.6.8.1. Saudi Arabia

13.6.8.2. Rest of MEA

Chapter 14. Competitive Landscape

14.1. Market Revenue Share By Manufacturers

14.2. Mergers & Acquisitions

14.3. Competitor’s Positioning

14.4. Strategy Benchmarking

14.5. Vendor Landscape

14.5.1. Distributors

14.5.1.1. North America

14.5.1.2. Europe

14.5.1.3. Asia Pacific

14.5.1.4. Middle East & Africa

14.5.1.5. Latin America

Chapter 15. Company Profiles

15.1. SAES Getters S.p.A

15.1.1. Company Overview

15.1.2. Product & Service Offerings

15.1.3. Strategic Initiatives

15.1.4. Financials

15.2. Johnson Matthey Plc

15.2.1. Company Overview

15.2.2. Product & Service Offerings

15.2.3. Strategic Initiatives

15.2.4. Financials

15.3. Furukawa Electric Co., Ltd.

15.3.1. Company Overview

15.3.2. Product & Service Offerings

15.3.3. Strategic Initiatives

15.3.4. Financials

15.4. ATI Specialty Alloys & Components

15.4.1. Company Overview

15.4.2. Product & Service Offerings

15.4.3. Strategic Initiatives

15.4.4. Financials

15.5. Fort Wayne Metals Research Products Corp

15.5.1. Company Overview

15.5.2. Product & Service Offerings

15.5.3. Strategic Initiatives

15.5.4. Financials

15.6. Dynalloy, Inc.

15.6.1. Company Overview

15.6.2. Product & Service Offerings

15.6.3. Strategic Initiatives

15.6.4. Financials

15.7. Nippon Steel Corporation

15.7.1. Company Overview

15.7.2. Product & Service Offerings

15.7.3. Strategic Initiatives

15.7.4. Financials

15.7.5. Conclusion

15.8. Memry Corporation

15.8.1. Company Overview

15.8.2. Product & Service Offerings

15.8.3. Strategic Initiatives

15.8.4. Financials

15.8.5. Conclusion

15.9. Admedes Schuessler GmbH

15.9.1. Company Overview

15.9.2. Product & Service Offerings

15.9.3. Strategic Initiatives

15.9.4. Financials

15.9.5. Conclusion

15.10. Metalwerks PMD, Inc.

15.10.1. Company Overview

15.10.2. Product & Service Offerings

15.10.3. Strategic Initiatives

15.10.4. Financials

15.10.5. Conclusion

15.11. Xian Saite Metal Materialss Development Co., Ltd.

15.11.1. Company Overview

15.11.2. Product & Service Offerings

15.11.3. Strategic Initiatives

15.11.4. Financials

15.11.5. Conclusion

15.12. Ultimate NiTi Technologies, Inc.

15.12.1. Company Overview

15.12.2. Product & Service Offerings

15.12.3. Strategic Initiatives

15.12.4. Financials

15.12.5. Conclusion

15.13. EUROFLEX GmbH

15.13.1. Company Overview

15.13.2. Product & Service Offerings

15.13.3. Strategic Initiatives

15.13.4. Financials

15.13.5. Conclusion

15.14. Memry / SAES Memory-Metalle (division)

15.14.1. Company Overview

15.14.2. Product & Service Offerings

15.14.3. Strategic Initiatives

15.14.4. Financials

15.14.5. Conclusion

15.15. BASF SE

15.15.1. Company Overview

15.15.2. Product & Service Offerings

15.15.3. Strategic Initiatives

15.15.4. Financials

15.15.5. Conclusion

15.16. Covestro AG

15.16.1. Company Overview

15.16.2. Product & Service Offerings

15.16.3. Strategic Initiatives

15.16.4. Financials

15.16.5. Conclusion

15.17. Medtronic Sappho

15.17.1. Company Overview

15.17.2. Product & Service Offerings

15.17.3. Strategic Initiatives

15.17.4. Financials

15.17.5. Conclusion

15.18. Spintech Holdings Inc.

15.18.1. Company Overview

15.18.2. Product & Service Offerings

15.18.3. Strategic Initiatives

15.18.4. Financials

15.18.5. Conclusion

15.19. SMP Technologies Inc

15.19.1. Company Overview

15.19.2. Product & Service Offerings

15.19.3. Strategic Initiatives

15.19.4. Financials

15.19.5. Conclusion

15.20. Mitsubishi Materialss / Mitsubishi Chemical Co.

15.20.1. Company Overview

15.20.2. Product & Service Offerings

15.20.3. Strategic Initiatives

15.20.4. Financials

15.20.5. Conclusion

15.21. Daido Steel Co., Ltd.

15.21.1. Company Overview

15.21.2. Product & Service Offerings

15.21.3. Strategic Initiatives

15.21.4. Financials

15.21.5. Conclusion

15.22. Goodfellow Corporation

15.22.1. Company Overview

15.22.2. Product & Service Offerings

15.22.3. Strategic Initiatives

15.22.4. Financials

15.22.5. Conclusion

15.23. Ingpuls GmbH

15.23.1. Company Overview

15.23.2. Product & Service Offerings

15.23.3. Strategic Initiatives

15.23.4. Financials

15.23.5. Conclusion

15.24. Aerofits Products Inc

15.24.1. Company Overview

15.24.2. Product & Service Offerings

15.24.3. Strategic Initiatives

15.24.4. Financials

15.24.5. Conclusion

Segments Covered in Report

For the purpose of this report, Advantia Business Consulting LLP. has segmented global Shape Memory Materials market on the basis of By Type, By Effect, By Function, By Acutation Mechanism, By Form, By Application, By End, By Distribution Channel, By region for 2019 to 2032

Global Shape Memory Materials Market By Type Outlook (Revenue, USD Million, Volume Kiloton, 2019-2032)

- Alloy Type:

- Nitinol (Ni-Ti)

- Copper-based (Cu-Zn-Al, Cu-Al-Ni…)

- Iron-based (Fe-Mn-Si)

- Aluminum

- Stainless Steel

- Niobium

- Others

- Polymer Type:

- Polyurethane (PU)

- Epoxy

- Polyvinyl Chloride (PVC)

- Acrylic

- Polylactide (PLA)

- Nylon

- Polyethylene

- Polypropylene

- Others

Global Shape Memory Materials By Effect (Revenue, USD Million; Volume Kiloton, 2019-2032)

- One-Way

- Two-Way

Global Shape Memory Materials By Acutation Mechanism Use Outlook (Revenue, USD Million; Volume Kiloton, 2019-2032)

- Heat-Activated

- Light-Activated

- Electrical-Activated

- Magnetic-Activated

Global Shape Memory Materials By Form (Revenue, USD Million; Volume Kiloton, 2019-2032)

- Sheets & Plates

- Films & Membranes

- Fibers & Yarns

- Foams

- Wires

- Rods

- Bars

- Tubes

- Pipes

- Springs

- Pellets

- Granules

- Powders

- Bulk Blocks

- Discs

- Thin Films

- Coatings

- Nanocomposites / Hybrids

- Other

Global Shape Memory Materials By Application Outlook (Revenue, USD Million; 2019-2032) Volume Kiloton, 2019-2032)

- Motors & Actuators

- Transducers

- Structural Materials

- Sensors

- Surgical Fixation

- Lightweight / Deployable aerospace structures

- Robotics

- Other

Global Shape Memory Materials By End Use Outlook (Revenue, USD Million; 2019-2032), Volume Kiloton, 2019-2032)

- Healthcare

- Automotive & Transportation

- Aerospace & Defense

- Consumer Electronics & Home Appliances

- Building & Construction

- Research & Development

- Packaging

- Other

Global Shape Memory Materials By Distribution Channel Outlook (Revenue, USD Million; 2019-2032), Volume Kiloton, 2019-2032)

- Offline

- Direct Sales to OEMs

- Distributors / Wholesalers

- Contract Manufacturing & Custom Orders

- Hypermarkets & Supermarkets

- Research & Academic Partnerships

- Online

- E-Commerce Platforms

- Specialty Supplier Websites

- Digital B2B Marketplaces

- North America

- North America Shape Memory Materials Market By Type Outlook (Revenue, USD Million 2019-2032), Volume Kiloton, 2019-2032)

- Alloy Type:

- Nitinol (Ni-Ti)

- Copper-based (Cu-Zn-Al, Cu-Al-Ni…)

- Iron-based (Fe-Mn-Si)

- Aluminum

- Stainless Steel

- Niobium

- Others

- Polymer Type:

- Polyurethane (PU)

- Epoxy

- Polyvinyl Chloride (PVC)

- Acrylic

- Polylactide (PLA)

- Nylon

- Polyethylene

- Polypropylene

- Others

- North America Shape Memory Materials Market By Effect Outlook (Revenue, USD Million 2019-2032), Volume Kiloton, 2019-2032)

- One-Way

- Two-Way

- North America Shape Memory Materials Market By Acutation Mechanism Outlook (Revenue, USD Million 2019-2032), Volume Kiloton, 2019-2032)

- Heat-Activated

- Light-Activated

- Electrical-Activated

- Magnetic-Activated

- North America Form Outlook (Revenue, USD Million; 2019-2032), Volume Kiloton, 2019-2032)

- Sheets & Plates

- Films & Membranes

- Fibers & Yarns

- Foams

- Wires

- Rods

- Bars

- Tubes

- Pipes

- Springs

- Pellets

- Granules

- Powders

- Bulk Blocks

- Discs

- Thin Films

- Coatings

- Nanocomposites / Hybrids

- Other

- North America Application Outlook (Revenue, USD Million; 2019-2032), Volume Kiloton, 2019-2032)

- Motors & Actuators

- Transducers

- Structural Materials

- Sensors

- Surgical Fixation

- Lightweight / Deployable aerospace structures

- Robotics

- Other

- North America End Use Outlook (Revenue, USD Million; 2019-2032), Volume Kiloton, 2019-2032)

- Healthcare

- Automotive & Transportation

- Aerospace & Defense

- Consumer Electronics & Home Appliances

- Building & Construction

- Research & Development

- Packaging

- Other

- North America Distribution Channel Outlook (Revenue, USD Million; 2019-2032), Volume Kiloton, 2019-2032)

- Offline

- Direct Sales to OEMs

- Distributors / Wholesalers

- Contract Manufacturing & Custom Orders

- Hypermarkets & Supermarkets

- Research & Academic Partnerships

- Online

- E-Commerce Platforms

- Specialty Supplier Websites

- Digital B2B Marketplaces

- U.S

- U.S Shape Memory Materials Market By Type Outlook (Revenue, USD Million 2019-2032), Volume Kiloton, 2019-2032)

- Alloy Type:

- Nitinol (Ni-Ti)

- Copper-based (Cu-Zn-Al, Cu-Al-Ni…)

- Iron-based (Fe-Mn-Si)

- Aluminum

- Stainless Steel

- Niobium

- Others

- Polymer Type:

- Polyurethane (PU)

- Epoxy

- Polyvinyl Chloride (PVC)

- Acrylic

- Polylactide (PLA)

- Nylon

- Polyethylene

- Polypropylene

- Others

- U.S Shape Memory Materials Market By Effect Outlook (Revenue, USD Million 2019-2032), Volume Kiloton, 2019-2032)

- One-Way

- Two-Way

- U.S Shape Memory Materials Market By Acutation Mechanism Outlook (Revenue, USD Million 2019-2032), Volume Kiloton, 2019-2032)

- Heat-Activated

- Light-Activated

- Electrical-Activated

- Magnetic-Activated

- U.S Form Outlook (Revenue, USD Million; 2019-2032), Volume Kiloton, 2019-2032)

- Sheets & Plates

- Films & Membranes

- Fibers & Yarns

- Foams

- Wires

- Rods

- Bars

- Tubes

- Pipes

- Springs

- Pellets

- Granules

- Powders

- Bulk Blocks

- Discs

- Thin Films

- Coatings

- Nanocomposites / Hybrids

- Other

- U.S Application Outlook (Revenue, USD Million; 2019-2032), Volume Kiloton, 2019-2032)

- Motors & Actuators

- Transducers

- Structural Materials

- Sensors

- Surgical Fixation

- Lightweight / Deployable aerospace structures

- Robotics

- Other

- U.S End Use Outlook (Revenue, USD Million; 2019-2032), Volume Kiloton, 2019-2032)

- Healthcare

- Automotive & Transportation

- Aerospace & Defense

- Consumer Electronics & Home Appliances

- Building & Construction

- Research & Development

- Packaging

- Other

- U.S Distribution Channel Outlook (Revenue, USD Million; 2019-2032), Volume Kiloton, 2019-2032)

- Offline

- Direct Sales to OEMs

- Distributors / Wholesalers

- Contract Manufacturing & Custom Orders

- Hypermarkets & Supermarkets

- Research & Academic Partnerships

- Online

- E-Commerce Platforms

- Specialty Supplier Websites

- Digital B2B Marketplaces

- Canada

- Canada Shape Memory Materials Market By Type Outlook (Revenue, USD Million 2019-2032), Volume Kiloton, 2019-2032)

- Alloy Type:

- Nitinol (Ni-Ti)

- Copper-based (Cu-Zn-Al, Cu-Al-Ni…)

- Iron-based (Fe-Mn-Si)

- Aluminum

- Stainless Steel

- Niobium

- Others

- Polymer Type:

- Polyurethane (PU)

- Epoxy

- Polyvinyl Chloride (PVC)

- Acrylic

- Polylactide (PLA)

- Nylon

- Polyethylene

- Polypropylene

- Others

- Canada Shape Memory Materials Market By Effect Outlook (Revenue, USD Million 2019-2032), Volume Kiloton, 2019-2032)

- One-Way

- Two-Way

- Canada Shape Memory Materials Market By Acutation Mechanism Outlook (Revenue, USD Million 2019-2032), Volume Kiloton, 2019-2032)

- Heat-Activated

- Light-Activated

- Electrical-Activated

- Magnetic-Activated

- Canada Form Outlook (Revenue, USD Million; 2019-2032), Volume Kiloton, 2019-2032)

- Sheets & Plates

- Films & Membranes

- Fibers & Yarns

- Foams

- Wires

- Rods

- Bars

- Tubes

- Pipes

- Springs

- Pellets

- Granules

- Powders

- Bulk Blocks

- Discs

- Thin Films

- Coatings

- Nanocomposites / Hybrids

- Other

- Canada Application Outlook (Revenue, USD Million; 2019-2032), Volume Kiloton, 2019-2032)

- Motors & Actuators

- Transducers

- Structural Materials

- Sensors

- Surgical Fixation

- Lightweight / Deployable aerospace structures

- Robotics

- Other

- Canada End Use Outlook (Revenue, USD Million; 2019-2032), Volume Kiloton, 2019-2032)

- Healthcare

- Automotive & Transportation

- Aerospace & Defense

- Consumer Electronics & Home Appliances

- Building & Construction

- Research & Development

- Packaging

- Other

- Canada Distribution Channel Outlook (Revenue, USD Million; 2019-2032), Volume Kiloton, 2019-2032)

- Offline

- Direct Sales to OEMs

- Distributors / Wholesalers

- Contract Manufacturing & Custom Orders

- Hypermarkets & Supermarkets

- Research & Academic Partnerships

- Online

- E-Commerce Platforms

- Specialty Supplier Websites

- Digital B2B Marketplaces

- Mexico

- Mexico Shape Memory Materials Market By Type Outlook (Revenue, USD Million 2019-2032), Volume Kiloton, 2019-2032)

- Alloy Type:

- Nitinol (Ni-Ti)

- Copper-based (Cu-Zn-Al, Cu-Al-Ni…)

- Iron-based (Fe-Mn-Si)

- Aluminum

- Stainless Steel

- Niobium

- Others

- Polymer Type:

- Polyurethane (PU)

- Epoxy

- Polyvinyl Chloride (PVC)

- Acrylic

- Polylactide (PLA)

- Nylon

- Polyethylene

- Polypropylene

- Others

- Mexico Shape Memory Materials Market By Effect Outlook (Revenue, USD Million 2019-2032), Volume Kiloton, 2019-2032)

- One-Way

- Two-Way

- Mexico Shape Memory Materials Market By Acutation Mechanism Outlook (Revenue, USD Million 2019-2032), Volume Kiloton, 2019-2032)

- Heat-Activated

- Light-Activated

- Electrical-Activated

- Magnetic-Activated

- Mexico Form Outlook (Revenue, USD Million; 2019-2032), Volume Kiloton, 2019-2032)

- Sheets & Plates

- Films & Membranes

- Fibers & Yarns

- Foams

- Wires

- Rods

- Bars

- Tubes

- Pipes

- Springs

- Pellets

- Granules

- Powders

- Bulk Blocks

- Discs

- Thin Films

- Coatings

- Nanocomposites / Hybrids

- Other

- Mexico Application Outlook (Revenue, USD Million; 2019-2032), Volume Kiloton, 2019-2032)

- Motors & Actuators

- Transducers

- Structural Materials

- Sensors

- Surgical Fixation

- Lightweight / Deployable aerospace structures

- Robotics

- Other

- Mexico End Use Outlook (Revenue, USD Million; 2019-2032), Volume Kiloton, 2019-2032)

- Healthcare

- Automotive & Transportation

- Aerospace & Defense

- Consumer Electronics & Home Appliances

- Building & Construction

- Research & Development

- Packaging

- Other

- Mexico Distribution Channel Outlook (Revenue, USD Million; 2019-2032), Volume Kiloton, 2019-2032)

- Offline

- Direct Sales to OEMs

- Distributors / Wholesalers

- Contract Manufacturing & Custom Orders

- Hypermarkets & Supermarkets

- Research & Academic Partnerships

- Online

- E-Commerce Platforms

- Specialty Supplier Websites

- Digital B2B Marketplaces

- Europe

- Europe Shape Memory Materials Market By Type Outlook (Revenue, USD Million 2019-2032), Volume Kiloton, 2019-2032)

- Alloy Type:

- Nitinol (Ni-Ti)

- Copper-based (Cu-Zn-Al, Cu-Al-Ni…)

- Iron-based (Fe-Mn-Si)

- Aluminum

- Stainless Steel

- Niobium

- Others

- Polymer Type:

- Polyurethane (PU)

- Epoxy

- Polyvinyl Chloride (PVC)

- Acrylic

- Polylactide (PLA)

- Nylon

- Polyethylene

- Polypropylene

- Others

- Europe Shape Memory Materials Market By Effect Outlook (Revenue, USD Million 2019-2032), Volume Kiloton, 2019-2032)

- One-Way

- Two-Way

- Europe Shape Memory Materials Market By Acutation Mechanism Outlook (Revenue, USD Million 2019-2032), Volume Kiloton, 2019-2032)

- Heat-Activated

- Light-Activated

- Electrical-Activated

- Magnetic-Activated

- Europe Form Outlook (Revenue, USD Million; 2019-2032), Volume Kiloton, 2019-2032)

- Sheets & Plates

- Films & Membranes

- Fibers & Yarns

- Foams

- Wires

- Rods

- Bars

- Tubes

- Pipes

- Springs

- Pellets

- Granules

- Powders

- Bulk Blocks

- Discs

- Thin Films

- Coatings

- Nanocomposites / Hybrids

- Other

- Europe Application Outlook (Revenue, USD Million; 2019-2032), Volume Kiloton, 2019-2032)

- Motors & Actuators

- Transducers

- Structural Materials

- Sensors

- Surgical Fixation

- Lightweight / Deployable aerospace structures

- Robotics

- Other

- Europe End Use Outlook (Revenue, USD Million; 2019-2032), Volume Kiloton, 2019-2032)

- Healthcare

- Automotive & Transportation

- Aerospace & Defense

- Consumer Electronics & Home Appliances

- Building & Construction

- Research & Development

- Packaging

- Other

- Europe Distribution Channel Outlook (Revenue, USD Million; 2019-2032), Volume Kiloton, 2019-2032)

- Offline

- Direct Sales to OEMs

- Distributors / Wholesalers

- Contract Manufacturing & Custom Orders

- Hypermarkets & Supermarkets

- Research & Academic Partnerships

- Online

- E-Commerce Platforms

- Specialty Supplier Websites

- Digital B2B Marketplaces

- Germany

- Germany Shape Memory Materials Market By Type Outlook (Revenue, USD Million 2019-2032), Volume Kiloton, 2019-2032)

- Alloy Type:

- Nitinol (Ni-Ti)

- Copper-based (Cu-Zn-Al, Cu-Al-Ni…)

- Iron-based (Fe-Mn-Si)

- Aluminum

- Stainless Steel

- Niobium

- Others

- Polymer Type:

- Polyurethane (PU)

- Epoxy

- Polyvinyl Chloride (PVC)

- Acrylic

- Polylactide (PLA)

- Nylon

- Polyethylene

- Polypropylene

- Others

- Germany Shape Memory Materials Market By Effect Outlook (Revenue, USD Million 2019-2032), Volume Kiloton, 2019-2032)

- One-Way

- Two-Way

- Germany Shape Memory Materials Market By Acutation Mechanism Outlook (Revenue, USD Million 2019-2032), Volume Kiloton, 2019-2032)

- Heat-Activated

- Light-Activated

- Electrical-Activated

- Magnetic-Activated

- Germany Form Outlook (Revenue, USD Million; 2019-2032), Volume Kiloton, 2019-2032)

- Sheets & Plates

- Films & Membranes

- Fibers & Yarns

- Foams

- Wires

- Rods

- Bars

- Tubes

- Pipes

- Springs

- Pellets

- Granules

- Powders

- Bulk Blocks

- Discs

- Thin Films

- Coatings

- Nanocomposites / Hybrids

- Other

- Germany Application Outlook (Revenue, USD Million; 2019-2032), Volume Kiloton, 2019-2032)

- Motors & Actuators

- Transducers

- Structural Materials

- Sensors

- Surgical Fixation

- Lightweight / Deployable aerospace structures

- Robotics

- Other

- Germany End Use Outlook (Revenue, USD Million; 2019-2032), Volume Kiloton, 2019-2032)

- Healthcare

- Automotive & Transportation

- Aerospace & Defense

- Consumer Electronics & Home Appliances

- Building & Construction

- Research & Development

- Packaging

- Other

- Germany Distribution Channel Outlook (Revenue, USD Million; 2019-2032), Volume Kiloton, 2019-2032)

- Offline

- Direct Sales to OEMs

- Distributors / Wholesalers

- Contract Manufacturing & Custom Orders

- Hypermarkets & Supermarkets

- Research & Academic Partnerships

- Online

- E-Commerce Platforms

- Specialty Supplier Websites

- Digital B2B Marketplaces

- France

- France Shape Memory Materials Market By Type Outlook (Revenue, USD Million 2019-2032), Volume Kiloton, 2019-2032)

- Alloy Type:

- Nitinol (Ni-Ti)

- Copper-based (Cu-Zn-Al, Cu-Al-Ni…)

- Iron-based (Fe-Mn-Si)

- Aluminum

- Stainless Steel

- Niobium

- Others

- Polymer Type:

- Polyurethane (PU)

- Epoxy

- Polyvinyl Chloride (PVC)

- Acrylic

- Polylactide (PLA)

- Nylon

- Polyethylene

- Polypropylene

- Others

- France Shape Memory Materials Market By Effect Outlook (Revenue, USD Million 2019-2032), Volume Kiloton, 2019-2032)

- One-Way

- Two-Way

- France Shape Memory Materials Market By Acutation Mechanism Outlook (Revenue, USD Million 2019-2032), Volume Kiloton, 2019-2032)

- Heat-Activated

- Light-Activated

- Electrical-Activated

- Magnetic-Activated

- France Form Outlook (Revenue, USD Million; 2019-2032), Volume Kiloton, 2019-2032)

- Sheets & Plates

- Films & Membranes

- Fibers & Yarns

- Foams

- Wires

- Rods

- Bars

- Tubes

- Pipes

- Springs

- Pellets

- Granules

- Powders

- Bulk Blocks

- Discs

- Thin Films

- Coatings

- Nanocomposites / Hybrids

- Other

- France Application Outlook (Revenue, USD Million; 2019-2032), Volume Kiloton, 2019-2032)

- Motors & Actuators

- Transducers

- Structural Materials

- Sensors

- Surgical Fixation

- Lightweight / Deployable aerospace structures

- Robotics

- Other

- France End Use Outlook (Revenue, USD Million; 2019-2032), Volume Kiloton, 2019-2032)

- Healthcare

- Automotive & Transportation

- Aerospace & Defense

- Consumer Electronics & Home Appliances

- Building & Construction

- Research & Development

- Packaging

- Other

- France Distribution Channel Outlook (Revenue, USD Million; 2019-2032), Volume Kiloton, 2019-2032)

- Offline

- Direct Sales to OEMs

- Distributors / Wholesalers

- Contract Manufacturing & Custom Orders

- Hypermarkets & Supermarkets

- Research & Academic Partnerships

- Online

- E-Commerce Platforms

- Specialty Supplier Websites

- Digital B2B Marketplaces

- U.K

- U.K Shape Memory Materials Market By Type Outlook (Revenue, USD Million 2019-2032), Volume Kiloton, 2019-2032)

- Alloy Type:

- Nitinol (Ni-Ti)

- Copper-based (Cu-Zn-Al, Cu-Al-Ni…)

- Iron-based (Fe-Mn-Si)

- Aluminum

- Stainless Steel

- Niobium

- Others

- Polymer Type:

- Polyurethane (PU)

- Epoxy

- Polyvinyl Chloride (PVC)

- Acrylic

- Polylactide (PLA)

- Nylon

- Polyethylene

- Polypropylene

- Others

- U.K Shape Memory Materials Market By Effect Outlook (Revenue, USD Million 2019-2032), Volume Kiloton, 2019-2032)

- One-Way

- Two-Way

- U.K Shape Memory Materials Market By Acutation Mechanism Outlook (Revenue, USD Million 2019-2032), Volume Kiloton, 2019-2032)

- Heat-Activated

- Light-Activated

- Electrical-Activated

- Magnetic-Activated

- U.K Form Outlook (Revenue, USD Million; 2019-2032), Volume Kiloton, 2019-2032)

- Sheets & Plates

- Films & Membranes

- Fibers & Yarns

- Foams

- Wires

- Rods

- Bars

- Tubes

- Pipes

- Springs

- Pellets

- Granules

- Powders

- Bulk Blocks

- Discs

- Thin Films

- Coatings

- Nanocomposites / Hybrids

- Other

- U.K Application Outlook (Revenue, USD Million; 2019-2032), Volume Kiloton, 2019-2032)

- Motors & Actuators

- Transducers

- Structural Materials

- Sensors

- Surgical Fixation

- Lightweight / Deployable aerospace structures

- Robotics

- Other

- U.K End Use Outlook (Revenue, USD Million; 2019-2032), Volume Kiloton, 2019-2032)

- Healthcare

- Automotive & Transportation

- Aerospace & Defense

- Consumer Electronics & Home Appliances

- Building & Construction

- Research & Development

- Packaging

- Other

- U.K Distribution Channel Outlook (Revenue, USD Million; 2019-2032), Volume Kiloton, 2019-2032)

- Offline

- Direct Sales to OEMs

- Distributors / Wholesalers

- Contract Manufacturing & Custom Orders

- Hypermarkets & Supermarkets

- Research & Academic Partnerships

- Online

- E-Commerce Platforms

- Specialty Supplier Websites

- Digital B2B Marketplaces

- Italy

- Italy Shape Memory Materials Market By Type Outlook (Revenue, USD Million 2019-2032), Volume Kiloton, 2019-2032)

- Alloy Type:

- Nitinol (Ni-Ti)

- Copper-based (Cu-Zn-Al, Cu-Al-Ni…)

- Iron-based (Fe-Mn-Si)

- Aluminum

- Stainless Steel

- Niobium

- Others

- Polymer Type:

- Polyurethane (PU)

- Epoxy

- Polyvinyl Chloride (PVC)

- Acrylic

- Polylactide (PLA)

- Nylon

- Polyethylene

- Polypropylene

- Others

- Italy Shape Memory Materials Market By Effect Outlook (Revenue, USD Million 2019-2032), Volume Kiloton, 2019-2032)

- One-Way

- Two-Way

- Italy Shape Memory Materials Market By Acutation Mechanism Outlook (Revenue, USD Million 2019-2032), Volume Kiloton, 2019-2032)

- Heat-Activated

- Light-Activated

- Electrical-Activated

- Magnetic-Activated

- Italy Form Outlook (Revenue, USD Million; 2019-2032), Volume Kiloton, 2019-2032)

- Sheets & Plates

- Films & Membranes

- Fibers & Yarns

- Foams

- Wires

- Rods

- Bars

- Tubes

- Pipes

- Springs

- Pellets

- Granules

- Powders

- Bulk Blocks

- Discs

- Thin Films

- Coatings

- Nanocomposites / Hybrids

- Other

- Italy Application Outlook (Revenue, USD Million; 2019-2032), Volume Kiloton, 2019-2032)

- Motors & Actuators

- Transducers

- Structural Materials

- Sensors

- Surgical Fixation

- Lightweight / Deployable aerospace structures

- Robotics

- Other

- Italy End Use Outlook (Revenue, USD Million; 2019-2032), Volume Kiloton, 2019-2032)

- Healthcare

- Automotive & Transportation

- Aerospace & Defense

- Consumer Electronics & Home Appliances

- Building & Construction

- Research & Development

- Packaging

- Other

- Italy Distribution Channel Outlook (Revenue, USD Million; 2019-2032), Volume Kiloton, 2019-2032)

- Offline

- Direct Sales to OEMs

- Distributors / Wholesalers

- Contract Manufacturing & Custom Orders

- Hypermarkets & Supermarkets

- Research & Academic Partnerships

- Online

- E-Commerce Platforms

- Specialty Supplier Websites

- Digital B2B Marketplaces

- Spain

- Spain Shape Memory Materials Market By Type Outlook (Revenue, USD Million 2019-2032), Volume Kiloton, 2019-2032)

- Alloy Type:

- Nitinol (Ni-Ti)

- Copper-based (Cu-Zn-Al, Cu-Al-Ni…)

- Iron-based (Fe-Mn-Si)

- Aluminum

- Stainless Steel

- Niobium

- Others

- Polymer Type:

- Polyurethane (PU)

- Epoxy

- Polyvinyl Chloride (PVC)

- Acrylic

- Polylactide (PLA)

- Nylon

- Polyethylene

- Polypropylene

- Others

- Spain Shape Memory Materials Market By Effect Outlook (Revenue, USD Million 2019-2032), Volume Kiloton, 2019-2032)

- One-Way

- Two-Way

- Spain Shape Memory Materials Market By Acutation Mechanism Outlook (Revenue, USD Million 2019-2032), Volume Kiloton, 2019-2032)

- Heat-Activated

- Light-Activated

- Electrical-Activated

- Magnetic-Activated

- Spain Form Outlook (Revenue, USD Million; 2019-2032), Volume Kiloton, 2019-2032)

- Sheets & Plates

- Films & Membranes

- Fibers & Yarns

- Foams

- Wires

- Rods

- Bars

- Tubes

- Pipes

- Springs

- Pellets

- Granules

- Powders

- Bulk Blocks

- Discs

- Thin Films

- Coatings

- Nanocomposites / Hybrids

- Other

- Spain Application Outlook (Revenue, USD Million; 2019-2032), Volume Kiloton, 2019-2032)

- Motors & Actuators

- Transducers

- Structural Materials

- Sensors

- Surgical Fixation

- Lightweight / Deployable aerospace structures

- Robotics

- Other

- Spain End Use Outlook (Revenue, USD Million; 2019-2032), Volume Kiloton, 2019-2032)

- Healthcare

- Automotive & Transportation

- Aerospace & Defense

- Consumer Electronics & Home Appliances

- Building & Construction

- Research & Development

- Packaging

- Other

- Spain Distribution Channel Outlook (Revenue, USD Million; 2019-2032), Volume Kiloton, 2019-2032)

- Offline

- Direct Sales to OEMs

- Distributors / Wholesalers

- Contract Manufacturing & Custom Orders

- Hypermarkets & Supermarkets

- Research & Academic Partnerships

- Online

- E-Commerce Platforms

- Specialty Supplier Websites

- Digital B2B Marketplaces

- Benelux

- Benelux Shape Memory Materials Market By Type Outlook (Revenue, USD Million 2019-2032), Volume Kiloton, 2019-2032)

- Alloy Type:

- Nitinol (Ni-Ti)

- Copper-based (Cu-Zn-Al, Cu-Al-Ni…)

- Iron-based (Fe-Mn-Si)

- Aluminum

- Stainless Steel

- Niobium

- Others

- Polymer Type:

- Polyurethane (PU)

- Epoxy

- Polyvinyl Chloride (PVC)

- Acrylic

- Polylactide (PLA)

- Nylon

- Polyethylene

- Polypropylene

- Others

- Benelux Shape Memory Materials Market By Effect Outlook (Revenue, USD Million 2019-2032), Volume Kiloton, 2019-2032)

- One-Way

- Two-Way

- Benelux Shape Memory Materials Market By Acutation Mechanism Outlook (Revenue, USD Million 2019-2032), Volume Kiloton, 2019-2032)

- Heat-Activated

- Light-Activated

- Electrical-Activated

- Magnetic-Activated

- Benelux Form Outlook (Revenue, USD Million; 2019-2032), Volume Kiloton, 2019-2032)

- Sheets & Plates

- Films & Membranes

- Fibers & Yarns

- Foams

- Wires

- Rods

- Bars

- Tubes

- Pipes

- Springs

- Pellets

- Granules

- Powders

- Bulk Blocks

- Discs

- Thin Films

- Coatings

- Nanocomposites / Hybrids

- Other

- Benelux Application Outlook (Revenue, USD Million; 2019-2032), Volume Kiloton, 2019-2032)

- Motors & Actuators

- Transducers

- Structural Materials

- Sensors

- Surgical Fixation

- Lightweight / Deployable aerospace structures

- Robotics

- Other

- Benelux End Use Outlook (Revenue, USD Million; 2019-2032), Volume Kiloton, 2019-2032)

- Healthcare

- Automotive & Transportation

- Aerospace & Defense

- Consumer Electronics & Home Appliances

- Building & Construction

- Research & Development

- Packaging

- Other

- Benelux Distribution Channel Outlook (Revenue, USD Million; 2019-2032), Volume Kiloton, 2019-2032)

- Offline

- Direct Sales to OEMs

- Distributors / Wholesalers

- Contract Manufacturing & Custom Orders

- Hypermarkets & Supermarkets

- Research & Academic Partnerships

- Online

- E-Commerce Platforms

- Specialty Supplier Websites

- Digital B2B Marketplaces

- Russia

- Russia Shape Memory Materials Market By Type Outlook (Revenue, USD Million 2019-2032), Volume Kiloton, 2019-2032)

- Alloy Type:

- Nitinol (Ni-Ti)

- Copper-based (Cu-Zn-Al, Cu-Al-Ni…)

- Iron-based (Fe-Mn-Si)

- Aluminum

- Stainless Steel

- Niobium

- Others

- Polymer Type:

- Polyurethane (PU)

- Epoxy

- Polyvinyl Chloride (PVC)

- Acrylic

- Polylactide (PLA)

- Nylon

- Polyethylene

- Polypropylene

- Others

- Russia Shape Memory Materials Market By Effect Outlook (Revenue, USD Million 2019-2032), Volume Kiloton, 2019-2032)

- One-Way