Market Synopsis

The Global Vehicle inverters market was valued at USD 7,296.00 million in 2024 and is projected to reach USD 29,891.35 million by 2032, growing at a strong CAGR of 19.37%. The rapid global shift towards electric and hybrid vehicles is driving substantial growth in the vehicle inverter market. Inverters are vital for converting DC battery power into AC for electric motors, enabling efficient propulsion, smooth performance, and improved energy management across passenger cars, commercial vehicles, and off-highway vehicles. Increasing environmental awareness, stringent emission regulations, and government incentives for clean mobility are further accelerating the adoption of EVs, prompting manufacturers to invest heavily in high-performance inverter technologies that meet evolving automotive demands.

Innovations in semiconductor and power electronics technologies are significantly enhancing the performance, reliability, and efficiency of vehicle inverters. Advanced materials such as silicon carbide (SiC) and gallium nitride (GaN) enable the production of lighter, more compact, and energy-efficient inverters that minimize thermal losses and improve overall vehicle efficiency. These technological advancements support the development of next-generation electric propulsion systems, allowing automotive manufacturers to meet stricter regulatory standards, deliver higher-performing EVs, and expand the adoption of electric mobility across diverse vehicle segments.

The growing development of EV charging networks and the focus on vehicle-to-grid (V2G) and vehicle-to-home (V2H) technologies are creating new opportunities for vehicle inverters. Bi-directional inverters are increasingly in demand to support energy flow between vehicles and the grid, enabling efficient energy management and load balancing. As governments and private companies invest in smarter, more resilient energy systems, the adoption of advanced inverters that can handle both traction and auxiliary loads is accelerating, further driving growth in the global vehicle inverter market.

Global Vehicle Inverters Market (USD Million), 2025-2032

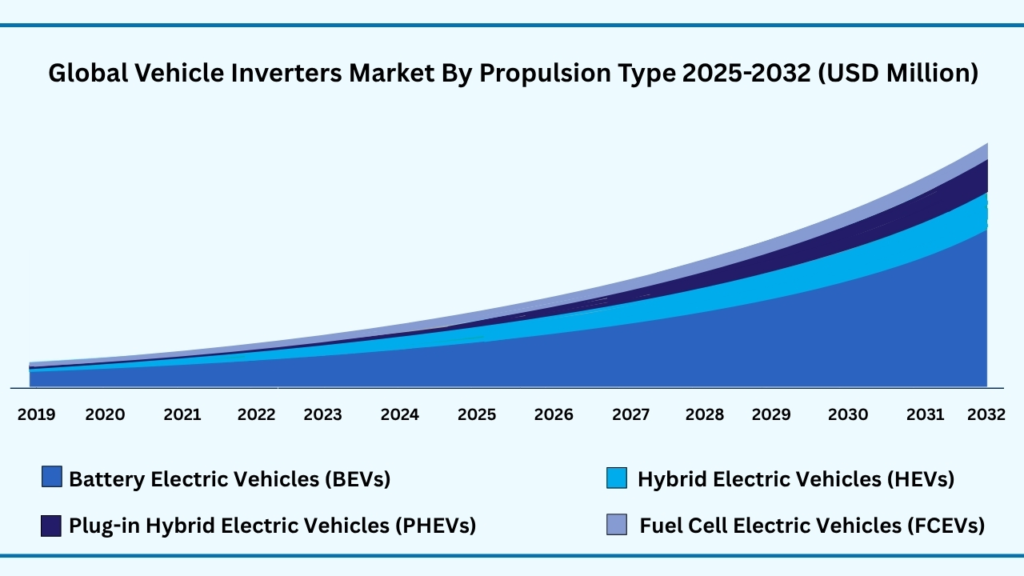

Global Vehicle Inverters Market By Propulsion Type Insights:

Battery Electric Vehicles (BEVs) segment accounted for market share of share 65.32%% in 2024 in the Global Vehicle Inverters Market.

The Battery Electric Vehicles (BEVs) segment accounted for the largest share of the Global Vehicle INVERTERS MARKET in 2024, representing 65.32 of total revenues. fix installations segment is expected to register a CAGR of 19.50 % during the forecast year from 2025 to 2032 and expected to reach USD 19,674.49 million in 2032. The BEV segment leads the vehicle inverter market due to the rapid global adoption of fully electric passenger cars and commercial vehicles. Inverters are essential for converting DC battery power into AC for electric motors, making them a critical component of BEV propulsion systems. As consumers increasingly prefer zero-emission vehicles, automakers are expanding their BEV offerings, which directly boosts the demand for high-performance, reliable inverters capable of supporting longer driving ranges and higher efficiency.

Battery electric vehicles require inverters that can handle high power demands and optimize energy efficiency for extended battery life. Advanced inverter technologies, including silicon carbide (SiC) and gallium nitride (GaN) semiconductors, provide BEVs with improved thermal management, reduced energy loss, and compact designs suitable for modern vehicle architectures. The increasing focus on enhancing vehicle performance, reducing weight, and achieving efficient power conversion further reinforces the BEV segment’s dominant share in the global vehicle inverter market.

Global Vehicle Inverters Market by Propulsion Type (USD Million)

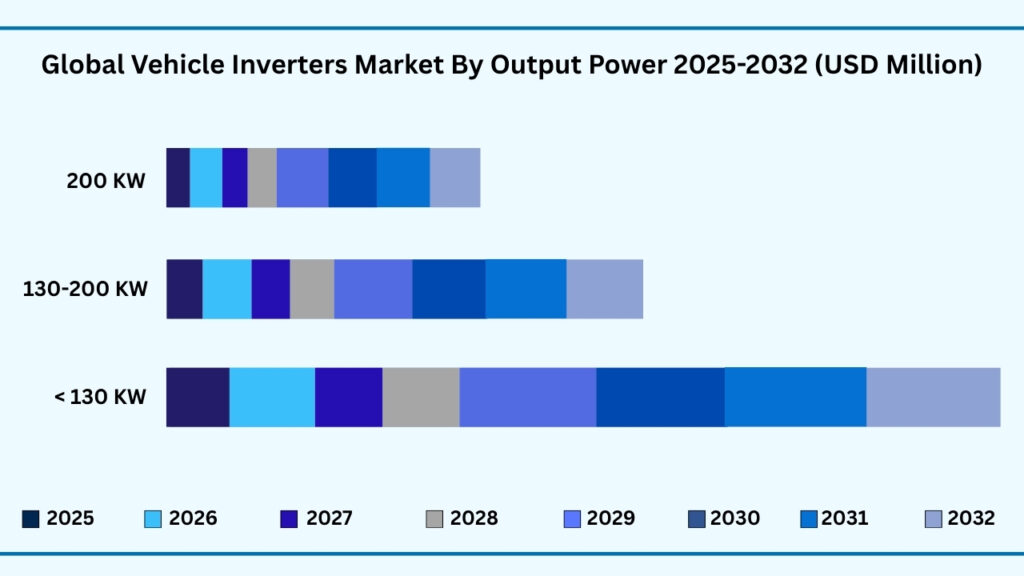

Global Vehicle Inverters Market by Output Power Insights:

< 130 kW segment accounted for the largest market share of share 57.21% in 2024 in the Global Vehicle Inverters Market.

Based on the output segment, < 130 kW segment held the largest revenue share of 57.21% in 2024, and expected to register a CAGR of 19.57% between 2025 to 2032 and the market is expected to reach USD 17,301.12 million by 2032. The <130 kW segment dominates the vehicle inverter market due to its widespread use in passenger cars and light commercial vehicles, which make up the bulk of global EV sales. These inverters provide sufficient power for efficient propulsion in smaller and mid-sized electric vehicles, offering an optimal balance between performance, energy efficiency, and cost. As the adoption of compact and mid-range EVs continues to grow globally, the demand for lower-power inverters remains strong, supporting the segment’s leading revenue share.

Inverters under 130 kW are generally more compact, lightweight, and cost-effective compared to higher-power units, making them ideal for mass-market EV applications. Their simpler design ensures easier integration into vehicles, reduces production costs, and improves reliability, which appeals to automakers and consumers alike. The combination of affordability, efficiency, and sufficient performance for everyday driving reinforces the segment’s dominance in the global vehicle inverter market.

Global Vehicle Inverters Market by Output Power (USD Million)

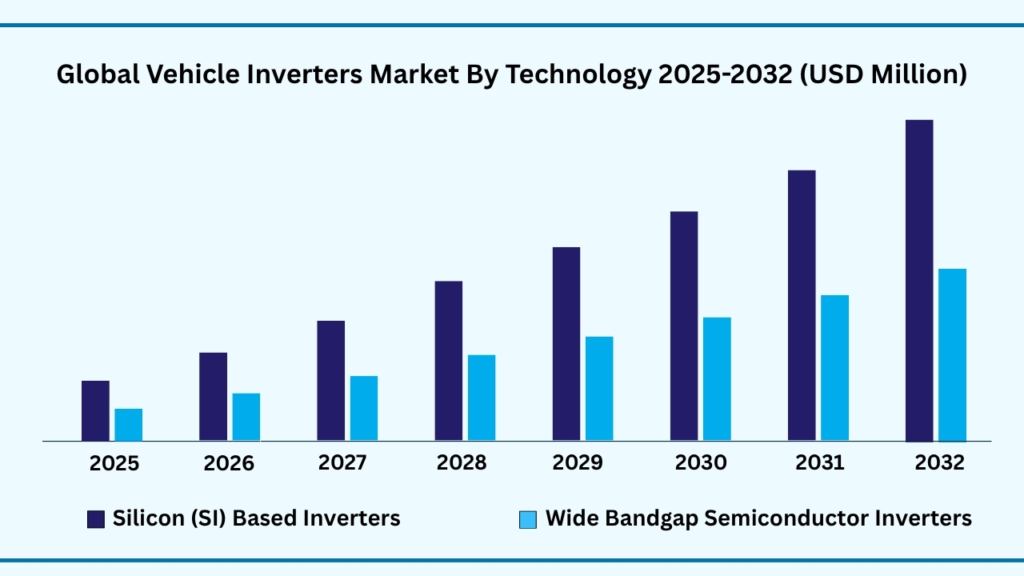

Global Vehicle Inverters Maret by Technology Insights:

Silicon (Si) Based Inverters segment accounted for the largest market share of share 68.22% in 2024 in the Global Vehicle Inverters Market.

Based on technology, Silicon (Si) Based Inverters segment held the largest revenue share of 68.22% in the Global Vehicle Inverters market in 2024 and expected to register a CAGR of 19.36% from 2025 to 2032 and expected to reach USD 20,511.45 million. Silicon (Si) based inverters continue to dominate the market due to their long-standing presence, well-established supply chain, and cost-effectiveness compared to wide bandgap alternatives like SiC (silicon carbide) and GaN (gallium nitride). Automakers favor Si-based inverters as they offer reliable performance at a lower cost, which is crucial for scaling EV production and keeping vehicles affordable for mass-market consumers. The mature ecosystem around silicon technology enables consistent availability, robust production capacity, and compatibility with existing automotive designs, all of which reinforce its market leadership.

Silicon inverters have a track record of proven reliability, making them the default choice for automakers seeking dependable solutions for passenger cars and commercial EVs. Their extensive use across a wide range of electric vehicle platforms, from compact city cars to hybrid and plug-in hybrid models, highlights their versatility and broad applicability. As OEMs prioritize technologies that balance performance with safety and compliance standards, silicon-based inverters remain the trusted option, thereby securing their large market share even as next-generation wide bandgap technologies gradually expand.

Global Vehicle Inverters Market by Technology (USD Million)

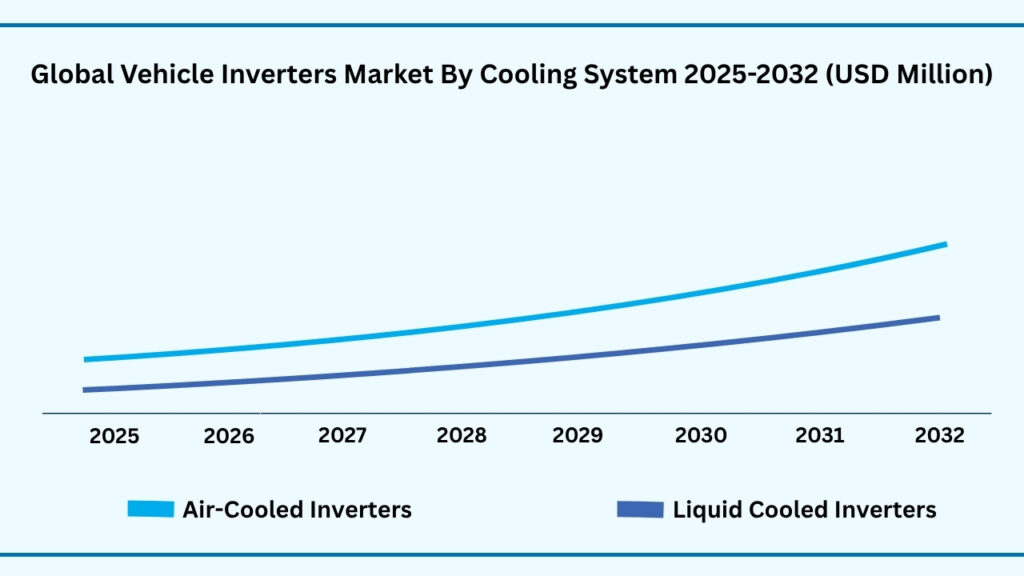

Global Vehicle Inverters Market by Cooling System Insights:

Air-Cooled Inverters segment accounted for the largest market share of share of 59.33% in 2024 in the Global Vehicle Inverters Market.

Based on by cooling system, wire segment held the largest revenue share of 45.21% in the Global Vehicle Inverters market in 2024 and expected to register a CAGR of 28.10% from 2024 to 2032 and expected to reach USD 17,854.11 million in 2032. Air-cooled inverters, often referred to as wire-based or naturally ventilated systems, dominate the market due to their simpler design and lower manufacturing costs. Unlike liquid-cooled inverters, they do not require complex cooling circuits, pumps, or additional maintenance components, making them easier to integrate into passenger cars and light commercial vehicles. This cost advantage allows automakers to produce reliable EV models at competitive prices, contributing to the strong adoption and revenue share of air-cooled inverters globally.

Air-cooled inverters are widely used because they offer reliable performance under standard operating conditions without significant thermal management challenges. Their lightweight and compact design makes them suitable for a variety of vehicle types, including passenger cars and urban delivery vehicles. The simplicity and dependability of these systems, combined with adequate cooling for low- to mid-power applications, reinforce their dominance in the vehicle inverter market while supporting steady growth in both developed and emerging regions.

Global Vehicle Inverters Cooling System (USD Million)

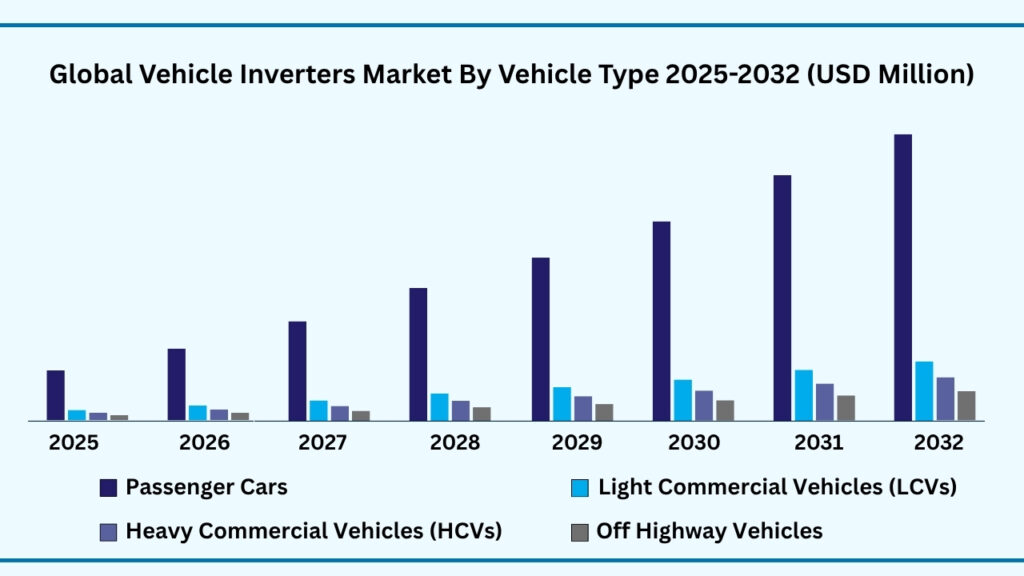

Global Vehicle Inverters Market By Vehicle Type Insights:

Passenger Cars segment accounted for the largest market share of share of 59.33% in 2024 in the Global Vehicle Inverters Market.

Based on by Vehicle Type, Passenger Cars segment held the largest revenue share of 76.22% in the Global Vehicle Inverters Market in 2024 and expected to register a CAGR of 19.30% from 2024 to 2032 and expected to reach USD 22,813.08 million in 2032. Passenger cars account for the largest share in the vehicle inverter market due to the rapid adoption of electric and hybrid models globally. Inverters are essential for converting battery power into AC for electric motors, making them critical for efficient propulsion and energy management. The growing consumer preference for eco-friendly, zero-emission vehicles, combined with government incentives and stricter emission regulations, is driving high demand for inverters in this segment.

Passenger vehicles typically require low- to mid-power inverters, which are simpler, cost-effective, and compatible with existing EV platforms. Technologies like silicon-based and air-cooled inverters are widely used in these vehicles due to their reliability, efficiency, and ease of integration. The broad market reach of passenger EVs ensures consistent demand, reinforcing this segment’s dominant position in the global vehicle inverter market.

Global Vehicle Inverters Vehicle Type (USD Million)

Global Vehicle Inverters Market by Region Insights:

North America segment accounted for the largest market share of share of 43.46% in 2024 in the Global Vehicle Inverters Market.

Based on region, the Global Vehicle Inverters market is segmented into Europe, Asia-Pacific, North America, Latin America and Middle East & Africa. Among these, Asia-Pacific region held the largest revenue share of 24.21% in the Global Vehicle Inverters market in 2024 and expected to register a CAGR of 19.49% from 2024 to 2032 and expected to reach USD 13,343.50 million in 2032.

Asia-Pacific leads the vehicle inverter market due to the rapid adoption of electric vehicles across countries like China, Japan, India, and South Korea. Strong industrial growth, expanding automotive manufacturing capabilities, and increasing government incentives for clean mobility are driving demand for advanced inverter technologies. The region’s focus on urban electrification, emission reduction policies, and infrastructure development for electric vehicles further strengthens its position as a leading market.

The Asia-Pacific region hosts several major automakers and inverter manufacturers, which actively invest in research, development, and production of advanced inverter solutions. Companies are leveraging local manufacturing ecosystems, skilled labor, and cost efficiencies to develop high-performance, reliable inverters for passenger cars, commercial vehicles, and off-highway vehicles. These strategic initiatives, combined with growing consumer demand for electric mobility, contribute significantly to the region’s market dominance and robust growth prospects.

Global Vehicle Inverters Market By Region (USD Million)

Major Companies and Competitive Landscape

The global Vehicle Inverters Market is highly fragmented, comprising a mix of multinational automotive manufacturers, specialized inverter solution providers, and innovative startups. Leading companies are actively pursuing strategies such as mergers and acquisitions, joint ventures, and strategic collaborations with technology partners, EV OEMs, and component suppliers to strengthen their market presence. Significant investments are being made in expanding production capacities, enhancing inverter efficiency, and developing advanced silicon-based, wide bandgap, and bi-directional inverter technologies to meet growing demand across passenger cars, commercial vehicles, and off-highway applications. These initiatives focus on improving energy efficiency, ensuring reliability, and scaling production while maintaining strict quality and regulatory compliance.

In addition, market leaders are increasingly emphasizing sustainability and operational efficiency. Companies are optimizing power usage, improving thermal management, and ensuring compliance with global automotive and safety standards. Research and development efforts are concentrated on producing high-efficiency traction and auxiliary inverters, integrating smart energy management systems, and developing modular solutions that reduce operational costs while improving vehicle performance. By combining technological innovation, sustainability, and strategic market expansion, key players are strengthening their competitive positioning and driving broader adoption of vehicle inverters across diverse automotive and commercial sectors worldwide.

Some of the leading companies profiled in the Global Vehicle Inverters Market report include:

- Vitesco Technologie

- Denso Corporation

- Toyota Industries Corporation

- Hitachi Astemo

- Meidensha Corporation

- Aptiv

- Mitsubishi Electric

- Marelli

- Valeo Group

- Continental AG

- BorgWarner Inc.

- Infineon Technologies AG

- Eaton Corporation

- ABB

- Delta Electronics

- Huawei Technologies

- Brusa Technology

- Cascadia Motion

- Cascadia Motion

Strategic Development

Expansion in Asia-Pacific:

In early 2025, a leading vehicle inverter manufacturer inaugurated a new office in Shanghai, China, reinforcing its commitment to the rapidly growing Asia-Pacific EV market. This strategic expansion aims to strengthen local partnerships, enhance customer support, and address the increasing demand for advanced inverter solutions across passenger vehicles, commercial EVs, and off-highway applications.

Strategic Divestment:

In mid-2025, a major automotive component company divested a portion of its non-core power electronics business to focus on its vehicle inverter portfolio, including silicon-based, wide bandgap, and bi-directional inverters. This decision aligns with the company’s strategy to streamline operations, concentrate on high-growth inverter technologies, and expand its market presence across North America, Europe, and Asia-Pacific.

Scope of Research

| Report Details | Outcome |

|---|---|

| Market size in 2024 | USD 7,296.00 Million |

| CAGR (2024–2032) | 19.37% |

| Revenue forecast to 2033 | USD 32,228.60 Million |

| Base year for estimation | 2024 |

| Historical data | 2019–2023 |

| Forecast period | 2025–2032 |

| Quantitative units | Revenue in USD Million, Volume Kiloton and CAGR in % from 2025 to 2032 |

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | By Platform Type, By Propulsion Type, By Inverter Type, By Output Power, By Technology, By Cooling System, By Vehicle Type, By Region |

| Regional scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Country scope | U.S., Canada, Mexico, Germany, France, U.K., Italy, Spain, Benelux, Russia, Finland, Sweden, Rest of Europe, China, India, Japan, South Korea, Indonesia, Thailand, Vietnam, Australia, New Zealand Rest of APAC, Brazil, Rest of LATAM, Saudi Arabia, Rest of MEA |

| Key companies profiled | “Vitesco Technologie , Denso Corporation, Toyota Industries Corporation, Hitachi Astemo, Meidensha Corporation, Aptiv, Mitsubishi Electric, Marelli, Valeo Group, Continental AG, BorgWarner Inc., Infineon Technologies AG , Eaton Corporation ABB, Delta Electronics, Huawei Technologies, Brusa Technology, Cascadia Motion, Cascadia Motion |

| Customization scope | 10 hours of free customization and expert consultation |

Some Key Questions the Report Will Answer

- What is the expected revenue Compound Annual Growth Rate (CAGR) of the Global Vehicle Inverters Market over the forecast period (2025–2032)?

- The Global Vehicle Inverters market revenue is expected to register a Compound Annual Growth Rate (CAGR) of 19.37% during the forecast period.

- What was the size of the Global Vehicle Inverters in 2024?

- The global Vehicle Inverters market size was USD 7,296.00 Million in 2024.

- Which factors are expected to drive the Global Vehicle Inverters Market growth?

- The growth of the global vehicle inverter market is primarily driven by the rapid adoption of electric and hybrid vehicles worldwide, as inverters are essential for converting battery power into AC for propulsion systems. Technological advancements in power electronics, including silicon carbide (SiC) and gallium nitride (GaN) semiconductors, are enhancing inverter efficiency, reducing energy loss, and enabling lighter, more compact designs. Additionally, increasing investments in EV infrastructure, government incentives for clean mobility, and the rising demand for energy-efficient and high-performance vehicles are collectively fueling market expansion across passenger cars, commercial vehicles, and off-highway applications.

- Which was the leading segment in the Global Vehicle Inverters Market in Propulsion Type in 2024?

- In 2024, Battery Electric Vehicles (BEVs)segment accounted for the largest market share with a market share of 65.32% in terms of USD million.

- What are some restraints for revenue growth of the Global Vehicle Inverters Market?

- Revenue growth in the global vehicle inverter market is restrained by high production and component costs, particularly for advanced wide bandgap (SiC and GaN) inverters, which can increase the overall cost of electric vehicles. Additionally, complex thermal management requirements, supply chain challenges for critical semiconductor materials, and variability in regulatory standards across regions can limit large-scale adoption. The slower transition from conventional vehicles in price-sensitive markets and the technical challenges of integrating high-power inverters into diverse vehicle platforms further constrain rapid market expansion.

Chapter 1. Introduction

1.1. Market Definition

1.2. Objectives of the study

1.3. Overview of Global Vehicle Inverters Market

1.4. Currency and pricing

1.5. Limitation

1.6. Market s covered

1.7. Research Scope

Chapter 2. Research Methodology

2.1. Research Sources

2.1.1.Primary

2.1.2.Secondary

2.1.3.Paid Sources

2.2. Years considered for the study

2.3. Assumptions

2.3.1.Market value

2.3.2.Market volume

2.3.3.Exchange rate

2.3.4.Price

2.3.5.Economic & political stability

Chapter 3. Executive Summary

3.1. Summary Snapshot, 2019–2032

Chapter 4. Key Insights

4.1. Production consumption analysis

4.2. Strategic partnerships & alliances

4.3. Joint ventures

4.4. Acquisition of local players

4.5. Contract manufacturing

4.6. Digital & e-commerce sales channels

4.7. Compliance with standards

4.8. Value chain analysis

4.9. Raw material sourcing

4.10. Formulation & manufacturing

4.11. Distribution & retail

4.12. Import-export analysis

4.13. Brand comparative analysis

4.14. Technological advancements

4.15. Porter’s five force

4.16. Threat of new entrants

4.16.1.1. Capital requirment

4.16.1.2. Product knowledge

4.16.1.3. Technical knowledge

4.16.1.4. Customer relation

4.16.1.5. Access to appliation and technology

4.16.2. Threat of substitutes

4.16.2.1. Cost

4.16.2.2. Performance

4.16.2.3. Availability

4.16.2.4. Technical knowledge

4.16.2.5. Durability

4.16.3. Bargainning power of buyers

4.16.3.1. Numbers of buyers relative to suppliers

4.16.3.2. Product differentiation

4.16.3.3. Threat of forward integration

4.16.3.4. Buyers volume

4.16.4. Bargainning power of suppliers

4.16.4.1. Suppliers concentration

4.16.4.2. Buyers switching cost to other suppliers

4.16.4.3. Threat of backward integration

4.16.5. Bargainning power of suppliers

4.16.5.1. Industry concentration

4.16.5.2. Industry growth rate

4.16.5.3. Product differentiation

4.17. Patent analysis

4.18. Regulation coverage

4.19. Pricing analysis

4.20. Competitive Metric Space Analysis

Chapter 5. Market Overview

5.1. Drivers

5.1.1. Rising Adoption of Electric & Hybrid Vehicles

5.1.2. Government Policies & Incentives

5.1.3. Advancements in Power Electronics

5.1.4. Rising Security Threats from Unauthorized Drones

5.2. Restraints

5.2.1. High Production Costs

5.2.2. Thermal Management Challenges

5.3. Opportunities

5.3.1. Integration with Renewable Energy & V2G (Vehicle-to-Grid)

5.3.2. Expansion in Emerging Market s

5.3.3. Smart & Connected Inverters

5.4. Challenges

5.4.1. Intense Competition & Price Pressure

5.4.2. Supply Chain Disruptions

Chapter 6. Global Vehicle Inverters Market Million) By Propulsion Type Insights & Trends, Revenue (USD

6.1. Propulsion Type Dynamics & Market Share, 2019–2032

6.1.1. Battery Electric Vehicles (BEVs)

6.1.2. Hybrid Electric Vehicles (HEVs)

6.1.3. Plug-in Hybrid Electric Vehicles (PHEVs)

6.1.4. Fuel Cell Electric Vehicles (FCEVs)

Chapter 7. Global Vehicle Inverters Market Million) By Inverter Type Insights & Trends, Revenue (USD

7.1. Inverter Type Dynamics & Market Share, 2019–2032

7.1.1. Traction Inverters (for motor drive)

7.1.2. Auxiliary Inverters (for onboard power supply)

7.1.3. Bi-directional Inverters (supporting V2G, V2H)

Chapter 8. Global Vehicle Inverters Market Million) By Output Power Insights & Trends, Revenue (USD

8.1. By Output Power Dynamics & Market Share, 2019–2032

8.1.1. < 130 kW

8.1.2. 130 – 200 kW

8.1.3. 200 kW

Chapter 9. Global Vehicle Inverters Market Million) By Technology Insights & Trends, Revenue (USD

9.1. Technology Use Dynamics & Market Share, 2019–2032

9.1.1. Silicon (Si) Based Inverters

9.1.2. Wide Bandgap Semiconductor Inverters:

9.1.2.1. Silicon Carbide (SiC)

9.1.2.2. Gallium Nitride (GaN)

Chapter 10. Global Vehicle Inverters Market Million) By Cooling System Insights & Trends, Revenue (USD

10.1. Cooling System Use Dynamics & Market Share, 2019–2032

10.1.1.Air-Cooled Inverters

10.1.2.Liquid-Cooled Inverters

Chapter 11. Global Vehicle Inverters Market Million) By Vehicle Type Insights & Trends, Revenue (USD

11.1. Vehicle Type Use Dynamics & Market Share, 2019–2032

11.1.1.Passenger Cars

11.1.2.Light Commercial Vehicles (LCVs)

11.1.3.Heavy Commercial Vehicles (HCVs)

11.1.4.Off-Highway Vehicles

11.1.4.1. Construction

11.1.4.2. Agriculture

11.1.4.3. Mining

Chapter 12. Global Vehicle Inverters Market Regional Outlook

12.1. Vehicle Inverters Market Share By Region, 2019–2032

12.2. North America

12.2.1. Market By Propulsion Type Estimates and Forecast, USD Million, 2019-2032

12.2.1.1. Fix installations

12.2.1.2. Battery Electric Vehicles (BEVs)

12.2.1.3. Hybrid Electric Vehicles (HEVs)

12.2.1.4. Plug-in Hybrid Electric Vehicles (PHEVs)

12.2.2. Market 2019-2032 By Inverter Type, Market Estimates and Forecast, USD Million,

12.2.2.1. Traction Inverters (for motor drive)

12.2.2.2. Auxiliary Inverters (for onboard power supply)

12.2.2.3. Bi-directional Inverters (supporting V2G, V2H)

12.2.3. Market 2019-2032 By Output Power, Market Estimates and Forecast, USD Million,

12.2.3.1. < 130 kW

12.2.3.2. 130 – 200 kW

12.2.3.3. 200 kW

12.2.4. Market By Vehicle Inverters Estimates and Forecast, USD Million, 2019-2032

12.2.4.1. Silicon (Si) Based Inverters

12.2.4.2. Wide Bandgap Semiconductor Inverters:

12.2.4.2.1. Silicon Carbide (SiC)

12.2.4.2.2. Gallium Nitride (GaN)

12.2.5. Market By Cooling System Estimates and Forecast, USD Million, 2019-2032

12.2.5.1. Air-Cooled Inverters

12.2.5.2. Liquid-Cooled Inverters

12.2.6. Market By Vehicle Type Estimates and Forecast, USD Million, 2019-2032

12.2.6.1. Passenger Cars

12.2.6.2. Light Commercial Vehicles (LCVs)

12.2.6.3. Heavy Commercial Vehicles (HCVs)

12.2.6.4. Off-Highway Vehicles

12.2.6.4.1. Construction

12.2.6.4.2. Agriculture

12.2.6.4.3. Mining

12.2.7. Market By Country, Market Estimates and Forecast, USD Million, 2025 2032

12.2.7.1. US

12.2.7.2. Canada

12.2.7.3. Mexico

12.3. Europe

12.3.1. Market By Propulsion Type Estimates and Forecast, USD Million, 2019-2032

12.3.1.1. Fix installations

12.3.1.2. Battery Electric Vehicles (BEVs)

12.3.1.3. Hybrid Electric Vehicles (HEVs)

12.3.1.4. Plug-in Hybrid Electric Vehicles (PHEVs)

12.3.2. Market 2019-2032 By Inverter Type, Market Estimates and Forecast, USD Million,

12.3.2.1. Traction Inverters (for motor drive)

12.3.2.2. Auxiliary Inverters (for onboard power supply)

12.3.2.3. Bi-directional Inverters (supporting V2G, V2H)

12.3.3. Market 2019-2032 By Output Power, Market Estimates and Forecast, USD Million,

12.3.3.1. < 130 kW

12.3.3.2. 130 – 200 kW

12.3.3.3. 200 kW

12.3.4. Market By Vehicle Inverters Estimates and Forecast, USD Million, 2019 2032

12.3.4.1. Silicon (Si) Based Inverters

12.3.4.2. Wide Bandgap Semiconductor Inverters:

12.3.4.2.1. Silicon Carbide (SiC)

12.3.4.2.2. Gallium Nitride (GaN)

12.3.5. Market By Cooling System Estimates and Forecast, USD Million, 2019-2032

12.3.5.1. Air-Cooled Inverters

12.3.5.2. Liquid-Cooled Inverters

12.3.6. Market By Vehicle Type Estimates and Forecast, USD Million, 2019-2032

12.3.6.1. Passenger Cars

12.3.6.2. Light Commercial Vehicles (LCVs)

12.3.6.3. Heavy Commercial Vehicles (HCVs)

12.3.6.4. Off-Highway Vehicles

12.3.6.4.1. Construction

12.3.6.4.2. Agriculture

12.3.6.4.3. Mining

12.3.7. Market By Country, Market Estimates and Forecast, USD Million,

12.3.7.1. Germany

12.3.7.2. France

12.3.7.3. U.K

12.3.7.4. Italy

12.3.7.5. Spain

12.3.7.6. Benelux

12.3.7.7. Russia

12.3.7.8. Finland

12.3.7.9. Sweden

12.3.7.10. Rest Of Europe

12.4. Asia-Pacific

12.4.1. Market By Propulsion Type Estimates and Forecast, USD Million, 2019-2032

12.4.1.1. Fix installations

12.4.1.2. Battery Electric Vehicles (BEVs)

12.4.1.3. Hybrid Electric Vehicles (HEVs)

12.4.1.4. Plug-in Hybrid Electric Vehicles (PHEVs)

12.4.2. Market 2019-2032 By Inverter Type, Market Estimates and Forecast, USD Million,

12.4.2.1. Traction Inverters (for motor drive)

12.4.2.2. Auxiliary Inverters (for onboard power supply)

12.4.2.3. Bi-directional Inverters (supporting V2G, V2H)

12.4.3. Market 2019-2032 By Output Power, Market Estimates and Forecast, USD Million,

12.4.3.1. < 130 kW

12.4.3.2. 130 – 200 kW

12.4.3.3. 200 kW

12.4.4. Market By Vehicle Inverters Estimates and Forecast, USD Million, 2019-2032

12.4.4.1. Silicon (Si) Based Inverters

12.4.4.2. Wide Bandgap Semiconductor Inverters:

12.4.4.2.1. Silicon Carbide (SiC)

12.4.4.2.2. Gallium Nitride (GaN)

12.4.5. Market By Cooling System Estimates and Forecast, USD Million, 2019-2032

12.4.5.1. Air-Cooled Inverters

12.4.5.2. Liquid-Cooled Inverters

12.4.6. Market By Vehicle Type Estimates and Forecast, USD Million, 2019-2032

12.4.6.1. Passenger Cars

12.4.6.2. Light Commercial Vehicles (LCVs)

12.4.6.3. Heavy Commercial Vehicles (HCVs)

12.4.6.4. Off-Highway Vehicles

12.4.6.4.1. Construction

12.4.6.4.2. Agriculture

12.4.6.4.3. Mining

12.4.7. Market By Country, Market Estimates and Forecast, USD Million,

12.4.7.1. China

12.4.7.2. India

12.4.7.3. Japan

12.4.7.4. South Korea

12.4.7.5. Indonesia

12.4.7.6. Thailand

12.4.7.7. Vietnam

12.4.7.8. Australia

12.4.7.9. New Zeland

12.4.7.10. Rest of APAC

12.5. Latin America

12.5.1. Market By Propulsion Type Estimates and Forecast, USD Million, 2019-2032

12.5.1.1. Fix installations

12.5.1.2. Battery Electric Vehicles (BEVs)

12.5.1.3. Hybrid Electric Vehicles (HEVs)

12.5.1.4. Plug-in Hybrid Electric Vehicles (PHEVs)

12.5.2. Market 2019-2032 By Inverter Type, Market Estimates and Forecast, USD Million,

12.5.2.1. Traction Inverters (for motor drive)

12.5.2.2. Auxiliary Inverters (for onboard power supply)

12.5.2.3. Bi-directional Inverters (supporting V2G, V2H)

12.5.3. Market 2019-2032 By Output Power, Market Estimates and Forecast, USD Million,

12.5.3.1. < 130 kW

12.5.3.2. 130 – 200 kW

12.5.3.3. 200 kW

12.5.4. Market By Vehicle Inverters Estimates and Forecast, USD Million, 2019-2032

12.5.4.1. Silicon (Si) Based Inverters

12.5.4.2. Wide Bandgap Semiconductor Inverters:

12.5.4.2.1. Silicon Carbide (SiC)

12.5.4.2.2. Gallium Nitride (GaN)

12.5.5. Market By Cooling System Estimates and Forecast, USD Million, 2019-2032

12.5.5.1. Air-Cooled Inverters

12.5.5.2. Liquid-Cooled Inverters

12.5.6. Market By Vehicle Type Estimates and Forecast, USD Million, 2019-2032

12.5.6.1. Passenger Cars

12.5.6.2. Light Commercial Vehicles (LCVs)

12.5.6.3. Heavy Commercial Vehicles (HCVs)

12.5.6.4. Off-Highway Vehicles

12.5.6.4.1. Construction

12.5.6.4.2. Agriculture

12.5.6.4.3. Mining

12.5.7. Market By Country, Market Estimates and Forecast, USD Million,

12.5.7.1. Brazil

12.5.7.2. Rest of LATAM

12.6. Middle East & Africa

12.6.1. Market By Propulsion Type Estimates and Forecast, USD Million, 2019-2032

12.6.1.1. Fix installations

12.6.1.2. Battery Electric Vehicles (BEVs)

12.6.1.3. Hybrid Electric Vehicles (HEVs)

12.6.1.4. Plug-in Hybrid Electric Vehicles (PHEVs)

12.6.2. Market 2019-2032 By Inverter Type, Market Estimates and Forecast, USD Million, 2019-2032

12.6.2.1. Traction Inverters (for motor drive)

12.6.2.2. Auxiliary Inverters (for onboard power supply)

12.6.2.3. Bi-directional Inverters (supporting V2G, V2H)

12.6.3. Market 2019-2032 By Output Power, Market Estimates and Forecast, USD Million, 2019-2032

12.6.3.1. < 130 kW

12.6.3.2. 130 – 200 kW

12.6.3.3. 200 kW

12.6.4. Market By Vehicle Inverters Estimates and Forecast, USD Million, 2019-2032

12.6.4.1. Silicon (Si) Based Inverters

12.6.4.2. Wide Bandgap Semiconductor Inverters:

12.6.4.2.1. Silicon Carbide (SiC)

12.6.4.2.2. Gallium Nitride (GaN)

12.6.5. Market By Cooling System Estimates and Forecast, USD Million, 2019-2032

12.6.5.1. Air-Cooled Inverters

12.6.5.2. Liquid-Cooled Inverters

12.6.6. Market By Vehicle Type Estimates and Forecast, USD Million, 2019-2032

12.6.6.1. Passenger Cars

12.6.6.2. Light Commercial Vehicles (LCVs)

12.6.6.3. Heavy Commercial Vehicles (HCVs)

12.6.6.4. Off-Highway Vehicles

12.6.6.4.1. Construction

12.6.6.4.2. Agriculture

12.6.6.4.3. Mining

12.6.7. Market By Country, Market Estimates and Forecast, USD Million,

12.6.7.1. Saudi Arabia

12.6.7.2. Rest of MEA

Chapter 13. Competitive Landscape

13.1. Market Revenue Share By Manufacturers

13.2. Mergers & Acquisitions

13.3. Competitor’s Positioning

13.4. Strategy Benchmarking

13.5. Vendor Landscape

13.6. Distributors

13.6.1.1. North America

13.6.1.2. Europe

13.6.1.3. Asia Pacific

13.6.1.4. Middle East & Africa

13.6.1.5. Latin America

Chapter 14. Company Profiles

14.1. Vitesco Technologie

14.1.1. Company Overview

14.1.2. Product & Service Offerings

14.1.3. Strategic Initiatives

14.1.4. Financials

14.2. Robert Bosch GmbH

14.2.1. Company Overview

14.2.2. Product & Service Offerings

14.2.3. Strategic Initiatives

14.2.4. Financials

14.3. Denso Corporation

14.3.1. Company Overview

14.3.2. Product & Service Offerings

14.3.3. Strategic Initiatives

14.3.4. Financials

14.4. Toyota Industries Corporation

14.4.1. Company Overview

14.4.2. Product & Service Offerings

14.4.3. Strategic Initiatives

14.4.4. Financials

14.5. Hitachi Astemo

14.5.1. Company Overview

14.5.2. Product & Service Offerings

14.5.3. Strategic Initiatives

14.5.4. Financials

14.6. Meidensha Corporation

14.6.1. Company Overview

14.6.2. Product & Service Offerings

14.6.3. Strategic Initiatives

14.6.4. Financials

14.7. Aptiv

14.7.1. Company Overview

14.7.2. Product & Service Offerings

14.7.3. Strategic Initiatives

14.7.4. Financials

14.7.5. Conclusion

14.8. Mitsubishi Electric

14.8.1. Company Overview

14.8.2. Product & Service Offerings

14.8.3. Strategic Initiatives

14.8.4. Financials

14.8.5. Conclusion

14.9. Marelli

14.9.1. Company Overview

14.9.2. Product & Service Offerings

14.9.3. Strategic Initiatives

14.9.4. Financials

14.9.5. Conclusion

14.10. Valeo Group

14.10.1. Company Overview

14.10.2. Product & Service Offerings

14.10.3. Strategic Initiatives

14.10.4. Financials

14.10.5. Conclusion

14.11. Continental AG

14.11.1. Company Overview

14.11.2. Product & Service Offerings

14.11.3. Strategic Initiatives

14.11.4. Financials

14.11.5. Conclusion

14.12. BorgWarner Inc.

14.12.1. Company Overview

14.12.2. Product & Service Offerings

14.12.3. Strategic Initiatives

14.12.4. Financials

14.12.5. Conclusion

14.13. Infineon Technologies AG

14.13.1. Company Overview

14.13.2. Product & Service Offerings

14.13.3. Strategic Initiatives

14.13.4. Financials

14.13.5. Conclusion

14.14. Eaton Corporation

14.14.1. Company Overview

14.14.2. Product & Service Offerings

14.14.3. Strategic Initiatives

14.14.4. Financials

14.14.5. Conclusion

14.15. ABB

14.15.1. Company Overview

14.15.2. Product & Service Offerings

14.15.3. Strategic Initiatives

14.15.4. Financials

14.15.5. Conclusion

14.16. Delta Electronics

14.16.1. Company Overview

14.16.2. Product & Service Offerings

14.16.3. Strategic Initiatives

14.16.4. Financials

14.16.5. Conclusion

14.17. Huawei Technologies

14.17.1. Company Overview

14.17.2. Product & Service Offerings

14.17.3. Strategic Initiatives

14.17.4. Financials

14.17.5. Conclusion

14.18. Brusa Technology

14.18.1. Company Overview

14.18.2. Product & Service Offerings

14.18.3. Strategic Initiatives

14.18.4. Financials

14.18.5. Conclusion

14.19. Cascadia Motion

14.19.1. Company Overview

14.19.2. Product & Service Offerings

14.19.3. Strategic Initiatives

14.19.4. Financials

14.19.5. Conclusion

Segments Covered in Report

For the purpose of this report, Advantia Business Consulting LLP has segmented Global Vehicle Inverters market on the basis of By Propulsion Type, By Inverter Type, By Output Power, By Technology, By Cooling System, By Vehicle Type and By region for 2019 to 2032

Global Vehicle Inverters Market By Propulsion Type Outlook (Revenue, USD Million)

- Battery Electric Vehicles (BEVs)

- Hybrid Electric Vehicles (HEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

- Fuel Cell Electric Vehicles (FCEVs)

Global Vehicle Inverters By Inverter Type Outlook (Revenue, USD Million)

- Traction Inverters (for motor drive)

- Auxiliary Inverters (for onboard power supply)

- Bi-directional Inverters (supporting V2G, V2H)

Global Vehicle Inverters By Output Power Type Outlook (Revenue, USD Million)

- < 130 kW

- 130 – 200 kW

- 200 kW

Global Vehicle Inverters By Technology (Revenue, USD Million

- Silicon (Si) Based Inverters

- Wide Bandgap Semiconductor Inverters:

-

-

-

-

- Silicon Carbide (SiC)

- Gallium Nitride (GaN)

-

-

-

Global Vehicle Inverters Market By Cooling System Outlook, Revenue (USD Million)

- Air-Cooled Inverters

- Liquid-Cooled Inverters

Global Vehicle Inverters Market By Vehicle Type Outlook, Revenue (USD Million)

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Off-Highway Vehicles

-

-

-

-

- Construction

- Agriculture

- Mining

-

-

-

North America

North America Vehicle Inverters Market By Propulsion Type Outlook (Revenue, USD Million)

- Battery Electric Vehicles (BEVs)

- Hybrid Electric Vehicles (HEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

- Fuel Cell Electric Vehicles (FCEVs)

North America Vehicle Inverters By Inverter Type Outlook (Revenue, USD Million)

- Traction Inverters (for motor drive)

- Auxiliary Inverters (for onboard power supply)

- Bi-directional Inverters (supporting V2G, V2H)

North America Vehicle Inverters By Output Power Type Outlook (Revenue, USD Million)

- < 130 kW

- 130 – 200 kW

- 200 kW

North America Vehicle Inverters By Technology (Revenue, USD Million

- Silicon (Si) Based Inverters

- Wide Bandgap Semiconductor Inverters:

-

-

-

-

- Silicon Carbide (SiC)

- Gallium Nitride (GaN)

-

-

-

North America Vehicle Inverters Market By Cooling System Outlook, Revenue (USD Million)

- Air-Cooled Inverters

- Liquid-Cooled Inverters

North America Vehicle Inverters Market By Vehicle Type Outlook, Revenue (USD Million)

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Off-Highway Vehicles

-

-

-

-

- Construction

- Agriculture

- Mining

-

-

-

U.S

U.S Vehicle Inverters Market By Propulsion Type Outlook (Revenue, USD Million)

- Battery Electric Vehicles (BEVs)

- Hybrid Electric Vehicles (HEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

- Fuel Cell Electric Vehicles (FCEVs)

U.S Vehicle Inverters By Inverter Type Outlook (Revenue, USD Million)

- Traction Inverters (for motor drive)

- Auxiliary Inverters (for onboard power supply)

- Bi-directional Inverters (supporting V2G, V2H)

U.S Vehicle Inverters By Output Power Type Outlook (Revenue, USD Million)

- < 130 kW

- 130 – 200 kW

- 200 kW

U.S Vehicle Inverters By Technology (Revenue, USD Million

- Silicon (Si) Based Inverters

- Wide Bandgap Semiconductor Inverters:

-

-

-

-

- Silicon Carbide (SiC)

- Gallium Nitride (GaN)

-

-

-

U.S Vehicle Inverters Market By Cooling System Outlook, Revenue (USD Million)

- Air-Cooled Inverters

- Liquid-Cooled Inverters

U.S Vehicle Inverters Market By Vehicle Type Outlook, Revenue (USD Million)

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Off-Highway Vehicles

-

-

-

-

- Construction

- Agriculture

- Mining

-

-

-

Canada

Canada Vehicle Inverters Market By Propulsion Type Outlook (Revenue, USD Million)

- Battery Electric Vehicles (BEVs)

- Hybrid Electric Vehicles (HEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

- Fuel Cell Electric Vehicles (FCEVs)

Canada Vehicle Inverters By Inverter Type Outlook (Revenue, USD Million)

- Traction Inverters (for motor drive)

- Auxiliary Inverters (for onboard power supply)

- Bi-directional Inverters (supporting V2G, V2H)

Canada Vehicle Inverters By Output Power Type Outlook (Revenue, USD Million)

- < 130 kW

- 130 – 200 kW

- 200 kW

Canada Vehicle Inverters By Technology (Revenue, USD Million

- Silicon (Si) Based Inverters

- Wide Bandgap Semiconductor Inverters:

-

-

-

-

- Silicon Carbide (SiC)

- Gallium Nitride (GaN)

-

-

-

Canada Vehicle Inverters Market By Cooling System Outlook, Revenue (USD Million)

- Air-Cooled Inverters

- Liquid-Cooled Inverters

Canada Vehicle Inverters Market By Vehicle Type Outlook, Revenue (USD Million)

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Off-Highway Vehicles

-

-

-

-

- Construction

- Agriculture

- Mining

-

-

-

Mexico

Mexico Vehicle Inverters Market By Propulsion Type Outlook (Revenue, USD Million)

- Battery Electric Vehicles (BEVs)

- Hybrid Electric Vehicles (HEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

- Fuel Cell Electric Vehicles (FCEVs)

Mexico Vehicle Inverters By Inverter Type Outlook (Revenue, USD Million)

- Traction Inverters (for motor drive)

- Auxiliary Inverters (for onboard power supply)

- Bi-directional Inverters (supporting V2G, V2H)

Mexico Vehicle Inverters By Output Power Type Outlook (Revenue, USD Million)

- < 130 kW

- 130 – 200 kW

- 200 kW

Mexico Vehicle Inverters By Technology (Revenue, USD Million

- Silicon (Si) Based Inverters

- Wide Bandgap Semiconductor Inverters:

-

-

-

-

- Silicon Carbide (SiC)

- Gallium Nitride (GaN)

-

-

-

Mexico Vehicle Inverters Market By Cooling System Outlook, Revenue (USD Million)

- Air-Cooled Inverters

- Liquid-Cooled Inverters

Mexico Vehicle Inverters Market By Vehicle Type Outlook, Revenue (USD Million)

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Off-Highway Vehicles

-

-

-

-

- Construction

- Agriculture

- Mining

-

-

-

Europe

Europe Vehicle Inverters Market By Propulsion Type Outlook (Revenue, USD Million)

- Battery Electric Vehicles (BEVs)

- Hybrid Electric Vehicles (HEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

- Fuel Cell Electric Vehicles (FCEVs)

Europe Vehicle Inverters By Inverter Type Outlook (Revenue, USD Million)

- Traction Inverters (for motor drive)

- Auxiliary Inverters (for onboard power supply)

- Bi-directional Inverters (supporting V2G, V2H)

Europe Vehicle Inverters By Output Power Type Outlook (Revenue, USD Million)

- < 130 kW

- 130 – 200 kW

- 200 kW

Europe Vehicle Inverters By Technology (Revenue, USD Million

- Silicon (Si) Based Inverters

- Wide Bandgap Semiconductor Inverters:

-

-

-

-

- Silicon Carbide (SiC)

- Gallium Nitride (GaN)

-

-

-

Europe Vehicle Inverters Market By Cooling System Outlook, Revenue (USD Million)

- Air-Cooled Inverters

- Liquid-Cooled Inverters

Europe Vehicle Inverters Market By Vehicle Type Outlook, Revenue (USD Million)

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Off-Highway Vehicles

-

-

-

-

- Construction

- Agriculture

- Mining

-

-

-

Germany

Germany Vehicle Inverters Market By Propulsion Type Outlook (Revenue, USD Million)

- Battery Electric Vehicles (BEVs)

- Hybrid Electric Vehicles (HEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

- Fuel Cell Electric Vehicles (FCEVs)

Germany Vehicle Inverters By Inverter Type Outlook (Revenue, USD Million)

- Traction Inverters (for motor drive)

- Auxiliary Inverters (for onboard power supply)

- Bi-directional Inverters (supporting V2G, V2H)

Germany Vehicle Inverters By Output Power Type Outlook (Revenue, USD Million)

- < 130 kW

- 130 – 200 kW

- 200 kW

Germany Vehicle Inverters By Technology (Revenue, USD Million

- Silicon (Si) Based Inverters

- Wide Bandgap Semiconductor Inverters:

-

-

-

-

- Silicon Carbide (SiC)

- Gallium Nitride (GaN)

-

-

-

Germany Vehicle Inverters Market By Cooling System Outlook, Revenue (USD Million)

- Air-Cooled Inverters

- Liquid-Cooled Inverters

Germany Vehicle Inverters Market By Vehicle Type Outlook, Revenue (USD Million)

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Off-Highway Vehicles

-

-

-

-

- Construction

- Agriculture

- Mining

-

-

-

France

France Vehicle Inverters Market By Propulsion Type Outlook (Revenue, USD Million)

- Battery Electric Vehicles (BEVs)

- Hybrid Electric Vehicles (HEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

- Fuel Cell Electric Vehicles (FCEVs)

France Vehicle Inverters By Inverter Type Outlook (Revenue, USD Million)

- Traction Inverters (for motor drive)

- Auxiliary Inverters (for onboard power supply)

- Bi-directional Inverters (supporting V2G, V2H)

France Vehicle Inverters By Output Power Type Outlook (Revenue, USD Million)

- < 130 kW

- 130 – 200 kW

- 200 kW

France Vehicle Inverters By Technology (Revenue, USD Million

- Silicon (Si) Based Inverters

- Wide Bandgap Semiconductor Inverters:

-

-

-

-

- Silicon Carbide (SiC)

- Gallium Nitride (GaN)

-

-

-

France Vehicle Inverters Market By Cooling System Outlook, Revenue (USD Million)

- Air-Cooled Inverters

- Liquid-Cooled Inverters

France Vehicle Inverters Market By Vehicle Type Outlook, Revenue (USD Million)

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Off-Highway Vehicles

-

-

-

-

- Construction

- Agriculture

- Mining

-

-

-

U.K

U.K Vehicle Inverters Market By Propulsion Type Outlook (Revenue, USD Million)

- Battery Electric Vehicles (BEVs)

- Hybrid Electric Vehicles (HEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

- Fuel Cell Electric Vehicles (FCEVs)

U.K Vehicle Inverters By Inverter Type Outlook (Revenue, USD Million)

- Traction Inverters (for motor drive)

- Auxiliary Inverters (for onboard power supply)

- Bi-directional Inverters (supporting V2G, V2H)

U.K Vehicle Inverters By Output Power Type Outlook (Revenue, USD Million)

- < 130 kW

- 130 – 200 kW

- 200 kW

U.K Vehicle Inverters By Technology (Revenue, USD Million

- Silicon (Si) Based Inverters

- Wide Bandgap Semiconductor Inverters:

-

-

-

-

- Silicon Carbide (SiC)

- Gallium Nitride (GaN)

-

-

-

U.K Vehicle Inverters Market By Cooling System Outlook, Revenue (USD Million)

- Air-Cooled Inverters

- Liquid-Cooled Inverters

U.K Vehicle Inverters Market By Vehicle Type Outlook, Revenue (USD Million)

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Off-Highway Vehicles

-

-

-

-

- Construction

- Agriculture

- Mining

-

-

-

Italy

Italy Vehicle Inverters Market By Propulsion Type Outlook (Revenue, USD Million)

- Battery Electric Vehicles (BEVs)

- Hybrid Electric Vehicles (HEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

- Fuel Cell Electric Vehicles (FCEVs)

Italy Vehicle Inverters By Inverter Type Outlook (Revenue, USD Million)

- Traction Inverters (for motor drive)

- Auxiliary Inverters (for onboard power supply)

- Bi-directional Inverters (supporting V2G, V2H)

Italy Vehicle Inverters By Output Power Type Outlook (Revenue, USD Million)

- < 130 kW

- 130 – 200 kW

- 200 kW

Italy Vehicle Inverters By Technology (Revenue, USD Million

- Silicon (Si) Based Inverters

- Wide Bandgap Semiconductor Inverters:

-

-

-

-

- Silicon Carbide (SiC)

- Gallium Nitride (GaN)

-

-

-

Italy Vehicle Inverters Market By Cooling System Outlook, Revenue (USD Million)

- Air-Cooled Inverters

- Liquid-Cooled Inverters

Italy Vehicle Inverters Market By Vehicle Type Outlook, Revenue (USD Million)

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Off-Highway Vehicles

-

-

-

-

- Construction

- Agriculture

- Mining

-

-

-

Benelux

Benelux Vehicle Inverters Market By Propulsion Type Outlook (Revenue, USD Million)

- Battery Electric Vehicles (BEVs)

- Hybrid Electric Vehicles (HEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

- Fuel Cell Electric Vehicles (FCEVs)

Benelux Vehicle Inverters By Inverter Type Outlook (Revenue, USD Million)

- Traction Inverters (for motor drive)

- Auxiliary Inverters (for onboard power supply)

- Bi-directional Inverters (supporting V2G, V2H)

Benelux Vehicle Inverters By Output Power Type Outlook (Revenue, USD Million)

- < 130 kW

- 130 – 200 kW

- 200 kW

Benelux Vehicle Inverters By Technology (Revenue, USD Million

- Silicon (Si) Based Inverters

- Wide Bandgap Semiconductor Inverters:

-

-

-

-

- Silicon Carbide (SiC)

- Gallium Nitride (GaN)

-

-

-

Benelux Vehicle Inverters Market By Cooling System Outlook, Revenue (USD Million)

- Air-Cooled Inverters

- Liquid-Cooled Inverters

Benelux Vehicle Inverters Market By Vehicle Type Outlook, Revenue (USD Million)

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Off-Highway Vehicles

-

-

-

-

- Construction

- Agriculture

- Mining

-

-

-

Russia

Russia Vehicle Inverters Market By Propulsion Type Outlook (Revenue, USD Million)

- Battery Electric Vehicles (BEVs)

- Hybrid Electric Vehicles (HEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

- Fuel Cell Electric Vehicles (FCEVs)

Russia Vehicle Inverters By Inverter Type Outlook (Revenue, USD Million)

- Traction Inverters (for motor drive)

- Auxiliary Inverters (for onboard power supply)

- Bi-directional Inverters (supporting V2G, V2H)

Russia Vehicle Inverters By Output Power Type Outlook (Revenue, USD Million)

- < 130 kW

- 130 – 200 kW

- 200 kW

Russia Vehicle Inverters By Technology (Revenue, USD Million

- Silicon (Si) Based Inverters

- Wide Bandgap Semiconductor Inverters:

-

-

-

-

- Silicon Carbide (SiC)

- Gallium Nitride (GaN)

-

-

-

Russia Vehicle Inverters Market By Cooling System Outlook, Revenue (USD Million)

- Air-Cooled Inverters

- Liquid-Cooled Inverters

Russia Vehicle Inverters Market By Vehicle Type Outlook, Revenue (USD Million)

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Off-Highway Vehicles

-

-

-

-

- Construction

- Agriculture

- Mining

-

-

-

Finland

Finland Vehicle Inverters Market By Propulsion Type Outlook (Revenue, USD Million)

- Battery Electric Vehicles (BEVs)

- Hybrid Electric Vehicles (HEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

- Fuel Cell Electric Vehicles (FCEVs)

Finland Vehicle Inverters By Inverter Type Outlook (Revenue, USD Million)

- Traction Inverters (for motor drive)

- Auxiliary Inverters (for onboard power supply)

- Bi-directional Inverters (supporting V2G, V2H)

Finland Vehicle Inverters By Output Power Type Outlook (Revenue, USD Million)

- < 130 kW

- 130 – 200 kW

- 200 kW

Finland Vehicle Inverters By Technology (Revenue, USD Million

- Silicon (Si) Based Inverters

- Wide Bandgap Semiconductor Inverters:

-

-

-

-

- Silicon Carbide (SiC)

- Gallium Nitride (GaN)

-

-

-

Finland Vehicle Inverters Market By Cooling System Outlook, Revenue (USD Million)

- Air-Cooled Inverters

- Liquid-Cooled Inverters

Finland Vehicle Inverters Market By Vehicle Type Outlook, Revenue (USD Million)

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Off-Highway Vehicles

-

-

-

-

- Construction

- Agriculture

- Mining

-

-

-

Sweden

Sweden Vehicle Inverters Market By Propulsion Type Outlook (Revenue, USD Million)

- Battery Electric Vehicles (BEVs)

- Hybrid Electric Vehicles (HEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

- Fuel Cell Electric Vehicles (FCEVs)

Sweden Vehicle Inverters By Inverter Type Outlook (Revenue, USD Million)

- Traction Inverters (for motor drive)

- Auxiliary Inverters (for onboard power supply)

- Bi-directional Inverters (supporting V2G, V2H)

Sweden Vehicle Inverters By Output Power Type Outlook (Revenue, USD Million)

- < 130 kW

- 130 – 200 kW

- 200 kW

Sweden Vehicle Inverters By Technology (Revenue, USD Million

- Silicon (Si) Based Inverters

- Wide Bandgap Semiconductor Inverters:

-

-

-

-

- Silicon Carbide (SiC)

- Gallium Nitride (GaN)

-

-

-

Sweden Vehicle Inverters Market By Cooling System Outlook, Revenue (USD Million)

- Air-Cooled Inverters

- Liquid-Cooled Inverters

Sweden Vehicle Inverters Market By Vehicle Type Outlook, Revenue (USD Million)

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Off-Highway Vehicles

-

-

-

-

- Construction

- Agriculture

- Mining

-

-

-

Rest of Europe

Rest of Europe Vehicle Inverters Market By Propulsion Type Outlook (Revenue, USD Million)

- Battery Electric Vehicles (BEVs)

- Hybrid Electric Vehicles (HEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

- Fuel Cell Electric Vehicles (FCEVs)

Rest of Europe Vehicle Inverters By Inverter Type Outlook (Revenue, USD Million)

- Traction Inverters (for motor drive)

- Auxiliary Inverters (for onboard power supply)

- Bi-directional Inverters (supporting V2G, V2H)

Rest of Europe Vehicle Inverters By Output Power Type Outlook (Revenue, USD Million)

- < 130 kW

- 130 – 200 kW

- 200 kW

Rest of Europe Vehicle Inverters By Technology (Revenue, USD Million

- Silicon (Si) Based Inverters

- Wide Bandgap Semiconductor Inverters:

-

-

-

-

- Silicon Carbide (SiC)

- Gallium Nitride (GaN)

-

-

-

Rest of Europe Vehicle Inverters Market By Cooling System Outlook, Revenue (USD Million)

- Air-Cooled Inverters

- Liquid-Cooled Inverters

Rest of Europe Vehicle Inverters Market By Vehicle Type Outlook, Revenue (USD Million)

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Off-Highway Vehicles

-

-

-

-

- Construction

- Agriculture

- Mining

-

-

-

Asia-Pacific

Asia-Pacific Vehicle Inverters Market By Propulsion Type Outlook (Revenue, USD Million)

- Battery Electric Vehicles (BEVs)

- Hybrid Electric Vehicles (HEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

- Fuel Cell Electric Vehicles (FCEVs)

Asia-Pacific Vehicle Inverters By Inverter Type Outlook (Revenue, USD Million)

- Traction Inverters (for motor drive)

- Auxiliary Inverters (for onboard power supply)

- Bi-directional Inverters (supporting V2G, V2H)

Asia-Pacific Vehicle Inverters By Output Power Type Outlook (Revenue, USD Million)

- < 130 kW

- 130 – 200 kW

- 200 kW

Asia-Pacific Vehicle Inverters By Technology (Revenue, USD Million

- Silicon (Si) Based Inverters

- Wide Bandgap Semiconductor Inverters:

-

-

-

-

- Silicon Carbide (SiC)

- Gallium Nitride (GaN)

-

-

-

Asia-Pacific Vehicle Inverters Market By Cooling System Outlook, Revenue (USD Million)

- Air-Cooled Inverters

- Liquid-Cooled Inverters

Asia-Pacific Vehicle Inverters Market By Vehicle Type Outlook, Revenue (USD Million)

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Off-Highway Vehicles

-

-

-

-

- Construction

- Agriculture

- Mining

-

-

-

China

China Vehicle Inverters Market By Propulsion Type Outlook (Revenue, USD Million)

- Battery Electric Vehicles (BEVs)

- Hybrid Electric Vehicles (HEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

- Fuel Cell Electric Vehicles (FCEVs)

China Vehicle Inverters By Inverter Type Outlook (Revenue, USD Million)

- Traction Inverters (for motor drive)

- Auxiliary Inverters (for onboard power supply)

- Bi-directional Inverters (supporting V2G, V2H)

China Vehicle Inverters By Output Power Type Outlook (Revenue, USD Million)

- < 130 kW

- 130 – 200 kW

- 200 kW

China Vehicle Inverters By Technology (Revenue, USD Million

- Silicon (Si) Based Inverters

- Wide Bandgap Semiconductor Inverters:

-

-

-

-

- Silicon Carbide (SiC)

- Gallium Nitride (GaN)

-

-

-

China Vehicle Inverters Market By Cooling System Outlook, Revenue (USD Million)

- Air-Cooled Inverters

- Liquid-Cooled Inverters

China Vehicle Inverters Market By Vehicle Type Outlook, Revenue (USD Million)

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Off-Highway Vehicles

-

-

-

-

- Construction

- Agriculture

- Mining

-

-

-

India

India Vehicle Inverters Market By Propulsion Type Outlook (Revenue, USD Million)

- Battery Electric Vehicles (BEVs)

- Hybrid Electric Vehicles (HEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

- Fuel Cell Electric Vehicles (FCEVs)

India Vehicle Inverters By Inverter Type Outlook (Revenue, USD Million)

- Traction Inverters (for motor drive)

- Auxiliary Inverters (for onboard power supply)

- Bi-directional Inverters (supporting V2G, V2H)

India Vehicle Inverters By Output Power Type Outlook (Revenue, USD Million)

- < 130 kW

- 130 – 200 kW

- 200 kW

India Vehicle Inverters By Technology (Revenue, USD Million

- Silicon (Si) Based Inverters

- Wide Bandgap Semiconductor Inverters:

-

-

-

-

- Silicon Carbide (SiC)

- Gallium Nitride (GaN)

-

-

-

India Vehicle Inverters Market By Cooling System Outlook, Revenue (USD Million)

- Air-Cooled Inverters

- Liquid-Cooled Inverters

India Vehicle Inverters Market By Vehicle Type Outlook, Revenue (USD Million)

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Off-Highway Vehicles

-

-

-

-

- Construction

- Agriculture

- Mining

-

-

-

Japan

Japan Vehicle Inverters Market By Propulsion Type Outlook (Revenue, USD Million)

- Battery Electric Vehicles (BEVs)

- Hybrid Electric Vehicles (HEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

- Fuel Cell Electric Vehicles (FCEVs)

Japan Vehicle Inverters By Inverter Type Outlook (Revenue, USD Million)

- Traction Inverters (for motor drive)

- Auxiliary Inverters (for onboard power supply)

- Bi-directional Inverters (supporting V2G, V2H)

Japan Vehicle Inverters By Output Power Type Outlook (Revenue, USD Million)

- < 130 kW

- 130 – 200 kW

- 200 kW

Japan Vehicle Inverters By Technology (Revenue, USD Million

- Silicon (Si) Based Inverters

- Wide Bandgap Semiconductor Inverters:

-

-

-

-

- Silicon Carbide (SiC)

- Gallium Nitride (GaN)

-

-

-

Japan Vehicle Inverters Market By Cooling System Outlook, Revenue (USD Million)

- Air-Cooled Inverters

- Liquid-Cooled Inverters

Japan Vehicle Inverters Market By Vehicle Type Outlook, Revenue (USD Million)

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Off-Highway Vehicles

-

-

-

-

- Construction

- Agriculture

- Mining

-

-

-

Indonesia

Indonesia Vehicle Inverters Market By Propulsion Type Outlook (Revenue, USD Million)

- Battery Electric Vehicles (BEVs)

- Hybrid Electric Vehicles (HEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

- Fuel Cell Electric Vehicles (FCEVs)

Indonesia Vehicle Inverters By Inverter Type Outlook (Revenue, USD Million)

- Traction Inverters (for motor drive)

- Auxiliary Inverters (for onboard power supply)

- Bi-directional Inverters (supporting V2G, V2H)

Indonesia Vehicle Inverters By Output Power Type Outlook (Revenue, USD Million)

- < 130 kW

- 130 – 200 kW

- 200 kW

Indonesia Vehicle Inverters By Technology (Revenue, USD Million

- Silicon (Si) Based Inverters

- Wide Bandgap Semiconductor Inverters:

-

-

-

-

- Silicon Carbide (SiC)

- Gallium Nitride (GaN)

-

-

-

Indonesia Vehicle Inverters Market By Cooling System Outlook, Revenue (USD Million)

- Air-Cooled Inverters

- Liquid-Cooled Inverters

Indonesia Vehicle Inverters Market By Vehicle Type Outlook, Revenue (USD Million)

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Off-Highway Vehicles

-

-

-

-

- Construction

- Agriculture

- Mining

-

-

-

Thailand

Thailand Vehicle Inverters Market By Propulsion Type Outlook (Revenue, USD Million)

- Battery Electric Vehicles (BEVs)

- Hybrid Electric Vehicles (HEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

- Fuel Cell Electric Vehicles (FCEVs)

Thailand Vehicle Inverters By Inverter Type Outlook (Revenue, USD Million)

- Traction Inverters (for motor drive)

- Auxiliary Inverters (for onboard power supply)

- Bi-directional Inverters (supporting V2G, V2H)

Thailand Vehicle Inverters By Output Power Type Outlook (Revenue, USD Million)

- < 130 kW

- 130 – 200 kW

- 200 kW

Thailand Vehicle Inverters By Technology (Revenue, USD Million

- Silicon (Si) Based Inverters

- Wide Bandgap Semiconductor Inverters:

-

-

-

-

- Silicon Carbide (SiC)

- Gallium Nitride (GaN)

-

-

-

Thailand Vehicle Inverters Market By Cooling System Outlook, Revenue (USD Million)

- Air-Cooled Inverters

- Liquid-Cooled Inverters

Thailand Vehicle Inverters Market By Vehicle Type Outlook, Revenue (USD Million)

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Off-Highway Vehicles

-

-

-

-

- Construction

- Agriculture

- Mining

-

-

-

Vietnam

Vietnam Vehicle Inverters Market By Propulsion Type Outlook (Revenue, USD Million)

- Battery Electric Vehicles (BEVs)

- Hybrid Electric Vehicles (HEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

- Fuel Cell Electric Vehicles (FCEVs)

Vietnam Vehicle Inverters By Inverter Type Outlook (Revenue, USD Million)

- Traction Inverters (for motor drive)

- Auxiliary Inverters (for onboard power supply)

- Bi-directional Inverters (supporting V2G, V2H)

Vietnam Vehicle Inverters By Output Power Type Outlook (Revenue, USD Million)

- < 130 kW

- 130 – 200 kW

- 200 kW

Vietnam Vehicle Inverters By Technology (Revenue, USD Million

- Silicon (Si) Based Inverters

- Wide Bandgap Semiconductor Inverters:

-

-

-

-

- Silicon Carbide (SiC)

- Gallium Nitride (GaN)

-

-

-

Vietnam Vehicle Inverters Market By Cooling System Outlook, Revenue (USD Million)

- Air-Cooled Inverters

- Liquid-Cooled Inverters

Vietnam Vehicle Inverters Market By Vehicle Type Outlook, Revenue (USD Million)

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Off-Highway Vehicles

-

-

-

-

- Construction

- Agriculture

- Mining

-

-

-

Australia

Australia Vehicle Inverters Market By Propulsion Type Outlook (Revenue, USD Million)

- Battery Electric Vehicles (BEVs)

- Hybrid Electric Vehicles (HEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

- Fuel Cell Electric Vehicles (FCEVs)

Australia Vehicle Inverters By Inverter Type Outlook (Revenue, USD Million)

- Traction Inverters (for motor drive)

- Auxiliary Inverters (for onboard power supply)

- Bi-directional Inverters (supporting V2G, V2H)

Australia Vehicle Inverters By Output Power Type Outlook (Revenue, USD Million)

- < 130 kW

- 130 – 200 kW

- 200 kW

Australia Vehicle Inverters By Technology (Revenue, USD Million

- Silicon (Si) Based Inverters

- Wide Bandgap Semiconductor Inverters:

-

-

-

-

- Silicon Carbide (SiC)

- Gallium Nitride (GaN)

-

-

-

Australia Vehicle Inverters Market By Cooling System Outlook, Revenue (USD Million)

- Air-Cooled Inverters

- Liquid-Cooled Inverters

Australia Vehicle Inverters Market By Vehicle Type Outlook, Revenue (USD Million)

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Off-Highway Vehicles

-

-

-

-

- Construction

- Agriculture

- Mining

-

-

-

New Zealand

New Zealand Vehicle Inverters Market By Propulsion Type Outlook (Revenue, USD Million)

- Battery Electric Vehicles (BEVs)

- Hybrid Electric Vehicles (HEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

- Fuel Cell Electric Vehicles (FCEVs)

New Zealand Vehicle Inverters By Inverter Type Outlook (Revenue, USD Million)

- Traction Inverters (for motor drive)

- Auxiliary Inverters (for onboard power supply)

- Bi-directional Inverters (supporting V2G, V2H)

New Zealand Vehicle Inverters By Output Power Type Outlook (Revenue, USD Million)

- < 130 kW

- 130 – 200 kW

- 200 kW

New Zealand Vehicle Inverters By Technology (Revenue, USD Million

- Silicon (Si) Based Inverters

- Wide Bandgap Semiconductor Inverters:

-

-

-

-

- Silicon Carbide (SiC)

- Gallium Nitride (GaN)

-

-

-

New Zealand Vehicle Inverters Market By Cooling System Outlook, Revenue (USD Million)

- Air-Cooled Inverters

- Liquid-Cooled Inverters

New Zealand Vehicle Inverters Market By Vehicle Type Outlook, Revenue (USD Million)

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Off-Highway Vehicles

-

-

-

-

- Construction

- Agriculture

- Mining

-

-

-

Rest of Asia-Pacific

Rest of Asia-Pacific Vehicle Inverters Market By Propulsion Type Outlook (Revenue, USD Million)

- Battery Electric Vehicles (BEVs)

- Hybrid Electric Vehicles (HEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

- Fuel Cell Electric Vehicles (FCEVs)

Rest of Asia-Pacific Vehicle Inverters By Inverter Type Outlook (Revenue, USD Million)

- Traction Inverters (for motor drive)

- Auxiliary Inverters (for onboard power supply)

- Bi-directional Inverters (supporting V2G, V2H)

Rest of Asia-Pacific Vehicle Inverters By Output Power Type Outlook (Revenue, USD Million)

- < 130 kW

- 130 – 200 kW

- 200 kW

Rest of Asia-Pacific Vehicle Inverters By Technology (Revenue, USD Million

- Silicon (Si) Based Inverters

- Wide Bandgap Semiconductor Inverters:

-

-

-

-

- Silicon Carbide (SiC)

- Gallium Nitride (GaN)

-

-

-

Rest of Asia-Pacific Vehicle Inverters Market By Cooling System Outlook, Revenue (USD Million)

- Air-Cooled Inverters

- Liquid-Cooled Inverters

Rest of Asia-Pacific Vehicle Inverters Market By Vehicle Type Outlook, Revenue (USD Million)

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Off-Highway Vehicles

-

-

-

-

- Construction

- Agriculture

- Mining

-

-

-

Latin America

Latin America Vehicle Inverters Market By Propulsion Type Outlook (Revenue, USD Million)

- Battery Electric Vehicles (BEVs)

- Hybrid Electric Vehicles (HEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

- Fuel Cell Electric Vehicles (FCEVs)

Latin America Vehicle Inverters By Inverter Type Outlook (Revenue, USD Million)

- Traction Inverters (for motor drive)

- Auxiliary Inverters (for onboard power supply)

- Bi-directional Inverters (supporting V2G, V2H)

Latin America Vehicle Inverters By Output Power Type Outlook (Revenue, USD Million)

- < 130 kW

- 130 – 200 kW

- 200 kW

Latin America Vehicle Inverters By Technology (Revenue, USD Million

- Silicon (Si) Based Inverters

- Wide Bandgap Semiconductor Inverters:

-

-

-

-

- Silicon Carbide (SiC)

- Gallium Nitride (GaN)

-

-

-

Latin America Vehicle Inverters Market By Cooling System Outlook, Revenue (USD Million)

- Air-Cooled Inverters

- Liquid-Cooled Inverters

Latin America Vehicle Inverters Market By Vehicle Type Outlook, Revenue (USD Million)

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Off-Highway Vehicles

-

-

-

-

- Construction

- Agriculture

- Mining

-

-

-

Brazil

Brazil Vehicle Inverters Market By Propulsion Type Outlook (Revenue, USD Million)

- Battery Electric Vehicles (BEVs)

- Hybrid Electric Vehicles (HEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

- Fuel Cell Electric Vehicles (FCEVs)

Brazil Vehicle Inverters By Inverter Type Outlook (Revenue, USD Million)

- Traction Inverters (for motor drive)

- Auxiliary Inverters (for onboard power supply)

- Bi-directional Inverters (supporting V2G, V2H)

Brazil Vehicle Inverters By Output Power Type Outlook (Revenue, USD Million)

- < 130 kW

- 130 – 200 kW

- 200 kW

Brazil Vehicle Inverters By Technology (Revenue, USD Million

- Silicon (Si) Based Inverters

- Wide Bandgap Semiconductor Inverters:

-

-

-

-

- Silicon Carbide (SiC)

- Gallium Nitride (GaN)

-

-

-

Brazil Vehicle Inverters Market By Cooling System Outlook, Revenue (USD Million)

- Air-Cooled Inverters

- Liquid-Cooled Inverters

Brazil Vehicle Inverters Market By Vehicle Type Outlook, Revenue (USD Million)

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Off-Highway Vehicles

-

-

-

-

- Construction

- Agriculture

- Mining

-

-

-

Rest of Latin America

Rest of Latin America Vehicle Inverters Market By Propulsion Type Outlook (Revenue, USD Million)

- Battery Electric Vehicles (BEVs)

- Hybrid Electric Vehicles (HEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

- Fuel Cell Electric Vehicles (FCEVs)

Rest of Latin America Vehicle Inverters By Inverter Type Outlook (Revenue, USD Million)

- Traction Inverters (for motor drive)

- Auxiliary Inverters (for onboard power supply)

- Bi-directional Inverters (supporting V2G, V2H)

Rest of Latin America Vehicle Inverters By Output Power Type Outlook (Revenue, USD Million)

- < 130 kW

- 130 – 200 kW

- 200 kW

Rest of Latin America Vehicle Inverters By Technology (Revenue, USD Million

- Silicon (Si) Based Inverters

- Wide Bandgap Semiconductor Inverters:

-

-

-

-

- Silicon Carbide (SiC)

- Gallium Nitride (GaN)

-

-

-

Rest of Latin America Vehicle Inverters Market By Cooling System Outlook, Revenue (USD Million)

- Air-Cooled Inverters

- Liquid-Cooled Inverters

Rest of Latin America Vehicle Inverters Market By Vehicle Type Outlook, Revenue (USD Million)

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Off-Highway Vehicles

-

-

-

-

- Construction

- Agriculture

- Mining

-

-

-

Middle East & Africa

Middle East & Africa Vehicle Inverters Market By Propulsion Type Outlook (Revenue, USD Million)

- Battery Electric Vehicles (BEVs)

- Hybrid Electric Vehicles (HEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

- Fuel Cell Electric Vehicles (FCEVs)

Middle East & Africa Vehicle Inverters By Inverter Type Outlook (Revenue, USD Million)

- Traction Inverters (for motor drive)

- Auxiliary Inverters (for onboard power supply)

- Bi-directional Inverters (supporting V2G, V2H)

Middle East & Africa Vehicle Inverters By Output Power Type Outlook (Revenue, USD Million)

- < 130 kW

- 130 – 200 kW

- 200 kW

Middle East & Africa Vehicle Inverters By Technology (Revenue, USD Million

- Silicon (Si) Based Inverters

- Wide Bandgap Semiconductor Inverters:

-

-

-

-

- Silicon Carbide (SiC)

- Gallium Nitride (GaN)

-

-

-

Middle East & Africa Vehicle Inverters Market By Cooling System Outlook, Revenue (USD Million)

- Air-Cooled Inverters

- Liquid-Cooled Inverters

Middle East & Africa Vehicle Inverters Market By Vehicle Type Outlook, Revenue (USD Million)

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Off-Highway Vehicles

-

-

-

-

- Construction

- Agriculture

- Mining

-

-

-

Saudi Arabia

Saudi Arabia Vehicle Inverters Market By Propulsion Type Outlook (Revenue, USD Million)

- Battery Electric Vehicles (BEVs)

- Hybrid Electric Vehicles (HEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

- Fuel Cell Electric Vehicles (FCEVs)

Saudi Arabia Vehicle Inverters By Inverter Type Outlook (Revenue, USD Million)

- Traction Inverters (for motor drive)

- Auxiliary Inverters (for onboard power supply)

- Bi-directional Inverters (supporting V2G, V2H)

Saudi Arabia Vehicle Inverters By Output Power Type Outlook (Revenue, USD Million)

- < 130 kW

- 130 – 200 kW

- 200 kW

Saudi Arabia Vehicle Inverters By Technology (Revenue, USD Million

- Silicon (Si) Based Inverters

- Wide Bandgap Semiconductor Inverters:

-

-

-

-

- Silicon Carbide (SiC)

- Gallium Nitride (GaN)

-

-

-

Saudi Arabia Vehicle Inverters Market By Cooling System Outlook, Revenue (USD Million)

- Air-Cooled Inverters

- Liquid-Cooled Inverters

Saudi Arabia Vehicle Inverters Market By Vehicle Type Outlook, Revenue (USD Million)

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Off-Highway Vehicles

-

-

-

-

- Construction

- Agriculture

- Mining