Market Synopsis

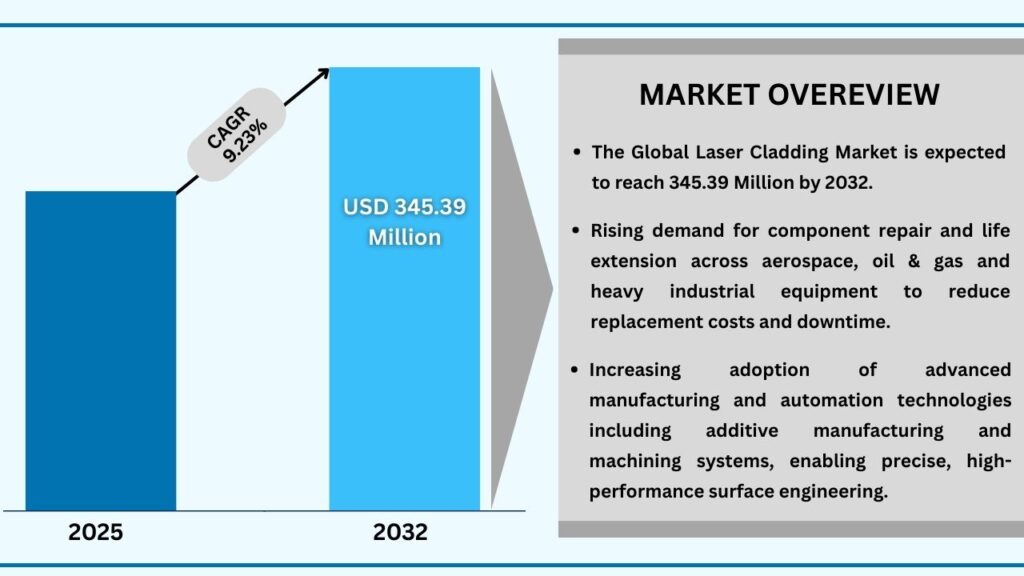

The Laser Cladding Market size was USD 170.98 Million in 2024 and is expected to reach USD 345.39 million in 2032 at a CAGR of 9.23% during the forecast period.

Growing Demand for High-Performance Surface Engineering and Component Life Extension

Industries such as aerospace, oil & gas, power generation, and heavy manufacturing are increasingly focused on extending the service life of critical components operating under extreme wear, heat, and corrosion conditions. As conventional coating and welding techniques reach their performance limits, laser cladding is gaining traction for its ability to deliver metallurgically bonded, high-precision surface layers with minimal dilution. The need to reduce maintenance costs, unplanned downtime, and material waste is accelerating global adoption of laser cladding technologies.

Widening Industrial Adoption Across Manufacturing, Repair, and Remanufacturing Operations

Laser cladding is being rapidly integrated into production and maintenance workflows across OEMs, MRO providers, and industrial service companies. Applications ranging from turbine blade repair and hydraulic component refurbishment to automotive tooling and mining equipment hardfacing are driving adoption. Manufacturers are leveraging laser cladding to enable faster turnaround times, consistent quality, and enhanced component performance, supporting its transition from specialized applications to mainstream industrial deployment.

Rising Focus on Precision Manufacturing and Low-Distortion Processing

Modern industrial systems increasingly demand high dimensional accuracy, controlled heat input, and repeatable process outcomes. Laser cladding addresses these requirements by enabling localized energy delivery, precise material deposition, and minimal thermal distortion compared to traditional overlay methods. As industries move toward tighter tolerances, lightweight designs, and complex geometries, the demand for precision surface modification technologies is strengthening market momentum.

Technological Advancements in Laser Sources, Automation, and Hybrid Manufacturing Systems

Continuous innovation in high-power diode and fiber lasers, robotic integration, and digital process control is enhancing the efficiency and scalability of laser cladding solutions. Improvements in powder and wire feeding systems, real-time monitoring, and hybrid platforms combining cladding with CNC machining are improving productivity and cost-effectiveness. These advancements are positioning laser cladding as a mature, industrial-grade technology aligned with smart manufacturing and Industry 4.0 initiatives.

Global Laser Cladding Market (USD Million)

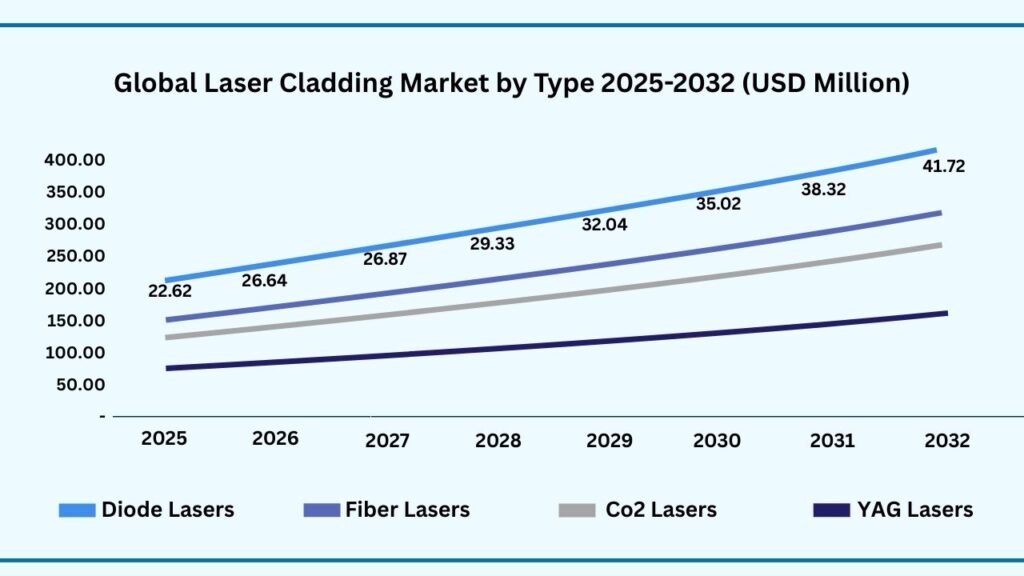

Global Laser Cladding Market by Type Insights:

Diode Lasers segment accounted for market share of share 43.21% in 2024 in the global Laser Cladding market.

The Diode Lasers segment accounted for the largest share of the global Laser Cladding market in 2024, representing 43.21% of total revenues. Diode Lasers segment is expected to register a CAGR of 9.30 during the forecast year from 2025 to 2032. The diode lasers segment emerged as the leading contributor to the global laser cladding market in 2024, driven by its strong balance of performance, efficiency, and operational reliability. Diode lasers are widely preferred for laser cladding applications due to their high electrical-to-optical efficiency, stable and uniform energy output, and lower heat input compared to alternative laser types. These characteristics enable precise material deposition with minimal dilution and reduced thermal distortion, making diode lasers particularly suitable for surface repair, hardfacing, and wear-resistant coatings across aerospace, automotive, and industrial machinery applications.

Looking ahead, the diode lasers segment is expected to maintain robust growth momentum throughout the forecast period, supported by increasing adoption across automated and high-volume manufacturing environments. Their compact design, lower maintenance requirements, and compatibility with robotic and hybrid manufacturing systems are encouraging wider deployment in advanced production and remanufacturing facilities. As industries continue to prioritize energy-efficient, cost-effective, and precision-driven surface engineering solutions, diode lasers are well positioned to remain a core technology within the evolving laser cladding landscape.

Global Laser Cladding Market by Type (USD Million)

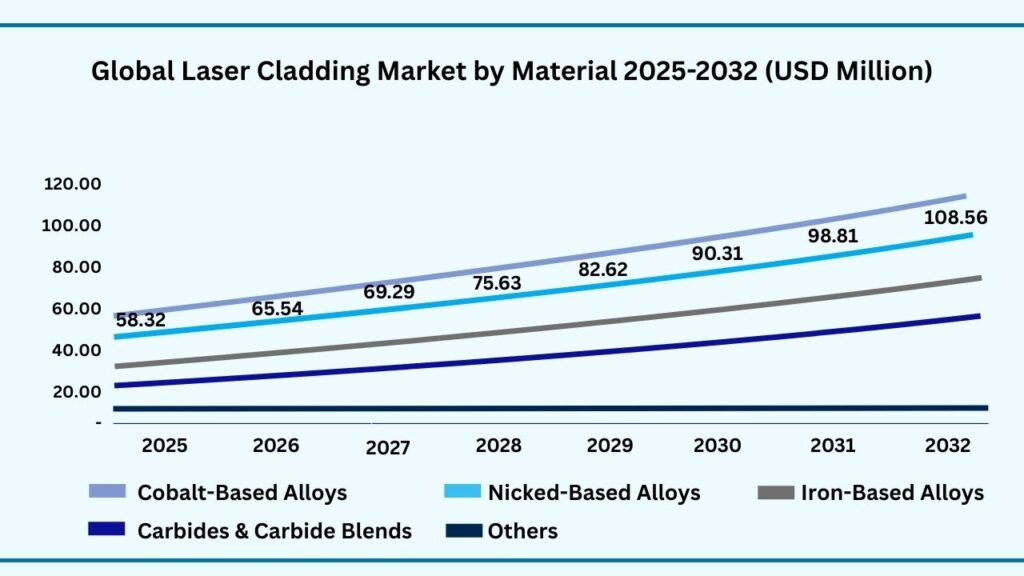

Global Laser Cladding Market by Material Insights:

Cobalt-based alloys segment accounted for the largest market share of 31.33% in 2024 in the global Laser Cladding market.

Based on the Material segment, Cobalt-based alloys held the largest revenue share of 31.33% 2024, and expected to register a CAGR of 9.28% between 2025 to 2032 and the market is expected to reach USD 108.56 million by 2032. Based on the material segment, cobalt-based alloys dominated the global laser cladding market in 2024, supported by their exceptional resistance to wear, corrosion, and high-temperature degradation. These alloys are widely used in demanding applications where components are exposed to extreme mechanical stress and harsh operating environments, particularly in aerospace, oil and gas, power generation, and industrial machinery. Their ability to retain hardness and structural integrity under severe conditions makes cobalt-based alloys a preferred choice for critical surface protection and component restoration applications.

The cobalt-based alloys segment is expected to experience sustained growth over the forecast period, driven by increasing demand for high-performance surface engineering solutions and extended equipment service life. Ongoing advancements in laser cladding processes are further enhancing deposition quality, bonding strength, and material efficiency for cobalt-based coatings. As industries continue to focus on reducing maintenance costs, improving operational reliability, and maximizing asset utilization, cobalt-based alloys are expected to remain a key material category within the evolving laser cladding market.

Global Laser Cladding Market by Material (USD Million)

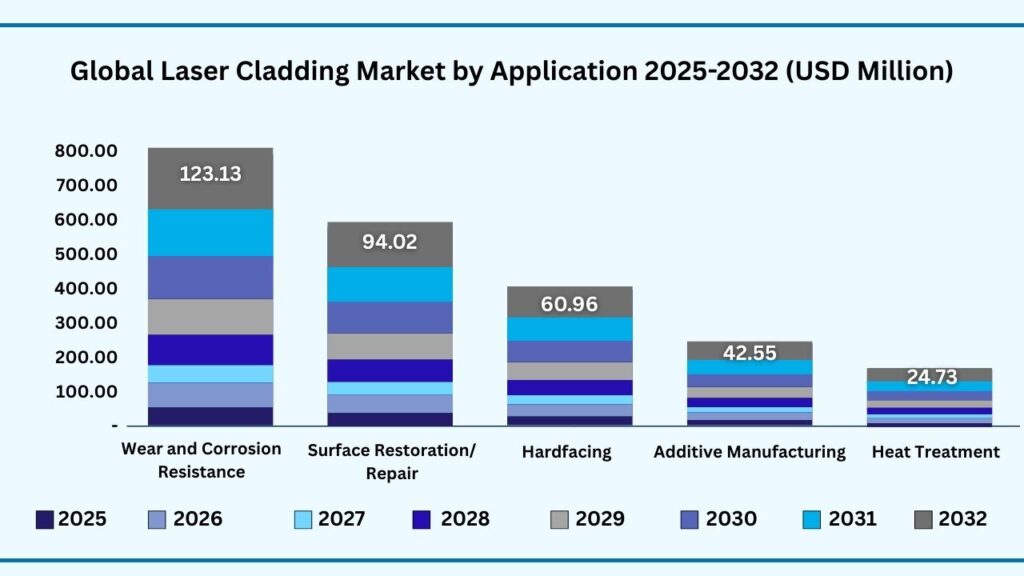

Global Laser Cladding Maret by Application Insights:

Wear and corrosion resistance segment accounted for the largest market share of share 35.45% in 2024 in the global Laser Cladding market.

Based on Manufacturing Process , Wear and corrosion resistance segment held the largest revenue share of 35.45% in the global Laser Cladding market in 2024 and expected to register a CAGR of 9.23% from 2025 to 2032 and expected to reach USD 123.13 million. Based on the manufacturing process segment, applications focused on wear and corrosion resistance accounted for the largest share of the global laser cladding market in 2024. This dominance is driven by the widespread need to protect critical components operating in abrasive, high-pressure, and chemically aggressive environments. Industries such as oil and gas, mining, power generation, and heavy manufacturing increasingly rely on laser cladding to enhance surface durability, reduce material degradation, and extend component service life while maintaining dimensional accuracy.

The wear and corrosion resistance segment is expected to witness strong growth over the forecast period, supported by rising maintenance optimization strategies and the shift toward high-performance surface engineering solutions. Laser cladding enables precise deposition of advanced alloy coatings with minimal dilution, ensuring superior bonding and long-term reliability. As industrial operators continue to prioritize asset longevity, reduced downtime, and lower lifecycle costs, demand for laser cladding solutions focused on wear and corrosion protection is expected to remain a key driver of market expansion.

Global Laser Cladding Market by Application (USD Million)

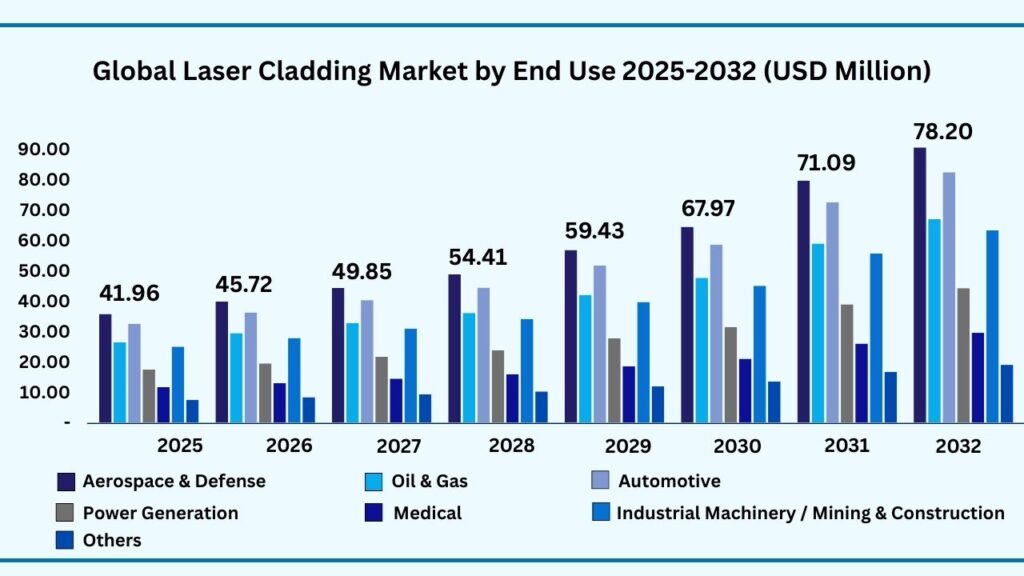

Global Laser Cladding Market by End Use :

Aerospace & Defense segment accounted for the largest market share of share 22.54% in 2024 in the global Laser Cladding market.

Based on End use segment , Aerospace & Defense held the largest revenue share of 22.54% in the global Laser Cladding market in 2024 and expected to register a CAGR of 9.30% from 2025 to 2032 is expected to reach USD 78.20 million. Based on the end-use segment, aerospace and defense emerged as the leading contributor to the global laser cladding market in 2024, supported by the sector’s stringent performance, reliability, and safety requirements. Laser cladding is extensively used in this industry for repairing and enhancing high-value components such as turbine blades, engine parts, landing gear, and structural elements. The technology’s ability to deliver precise, low-distortion coatings with superior metallurgical bonding makes it well suited for extending component life while meeting rigorous regulatory and quality standards.

The aerospace and defense segment is expected to maintain strong growth momentum throughout the forecast period, driven by increasing aircraft production, fleet modernization programs, and rising maintenance, repair, and overhaul activities. Growing investments in defense infrastructure and next-generation aerospace platforms are further supporting adoption of advanced surface engineering technologies. As manufacturers and service providers continue to focus on cost efficiency, operational readiness, and long-term durability, laser cladding is expected to remain a critical solution within aerospace and defense applications.

Global Laser Cladding Market by End Use (USD Million)

Global Laser Cladding Market by Region Insights:

Asia-Pacific segment accounted for the largest market share of share of 38.33% in 2024 in the global Laser Cladding market.

Based on region, the global Laser Cladding market is segmented into Europe, Asia-Pacific, North America, Latin America and Middle East & Africa. Among these, Asia-Pacific region held the largest revenue share of 38.33% in the global Laser Cladding market in 2024 and expected to reach USD 132.73 million in 2032. Based on region, the global laser cladding market is segmented into Europe, Asia-Pacific, North America, Latin America, and the Middle East & Africa. Among these regions, Asia-Pacific emerged as the dominant market in 2024, driven by its strong industrial manufacturing base, rapid infrastructure development, and expanding adoption of advanced manufacturing technologies. The presence of large-scale automotive, aerospace, heavy machinery, and electronics manufacturing hubs across countries such as China, Japan, South Korea, and India is significantly supporting regional demand for laser cladding solutions.

The Asia-Pacific market is expected to continue its leadership position through the forecast period, supported by rising investments in automation, industrial modernization, and maintenance-intensive sectors. Increasing focus on extending equipment lifespan, improving operational efficiency, and reducing production downtime is encouraging wider adoption of laser cladding across both manufacturing and repair applications. In addition, supportive government initiatives promoting advanced manufacturing and the growing presence of laser system manufacturers and service providers are further strengthening the region’s long-term market outlook.

Global Laser Cladding Market by Region (USD Million)

Major Companies and Competitive Landscape

The competitive landscape of the Laser Cladding market is defined by a mix of established laser system manufacturers, surface engineering solution providers, material suppliers, and emerging technology specialists focused on advanced manufacturing and repair applications. Market participants are actively enhancing laser cladding capabilities to meet growing demand for high-precision surface modification, superior metallurgical bonding, and extended component durability across industrial sectors. Competition is largely driven by innovation in laser source efficiency, powder and wire delivery systems, process control software, and integration with automated and robotic manufacturing platforms.

Leading companies are prioritizing improvements in process reliability, deposition efficiency, and scalability to support high-volume industrial deployment. Strategic focus areas include aerospace and defense component refurbishment, oil and gas equipment protection, power generation asset maintenance, and automotive tooling enhancement. Manufacturers are increasingly aligning laser cladding solutions with additive manufacturing and hybrid production models, enabling near-net-shape fabrication, reduced material waste, and faster repair cycles. Continuous investment in digital monitoring, real-time quality control, and advanced materials engineering is strengthening competitive differentiation.

Strategic partnerships and collaborations play a central role in market expansion, with key players working closely with OEMs, maintenance service providers, robotics integrators, and material developers to accelerate technology adoption. Competitive strategies emphasize expanding application portfolios, enhancing automation compatibility, and improving cost-performance ratios. While established companies benefit from extensive industrial experience, global service networks, and strong customer relationships, emerging players are gaining momentum by introducing flexible, application-specific laser cladding systems. This balance between incumbents and innovators is creating a highly dynamic and technology-driven competitive environment that continues to shape the global laser cladding market.

Key Companies Operating in the Global Laser Cladding Market Include

- TRUMPF Group

- Coherent Corp.

- IPG Photonics Corporation

- Laserline GmbH

- DMG MORI Co., Ltd.

- GE Additive

- Optomec Inc.

- Prima Industrie S.p.A.

- Han’s Laser Technology Industry Group

- FANUC Corporation

- Panasonic Corporation

- Lincoln Electric Holdings, Inc.

- Jenoptik AG

- Lumentum Holdings Inc.

- EOS GmbH

- Mazak Corporation

- Höganäs AB

- Sandvik AB

- Bodycote plc

Strategic Development

TRUMPF Group – Launch of Next-Generation High-Power Laser Cladding Systems (2024)

In 2024, TRUMPF Group introduced an upgraded portfolio of high-power laser cladding systems designed for large-scale industrial repair and additive manufacturing applications. The development emphasizes improved beam stability, higher deposition efficiency, and seamless integration with automated and robotic production cells. This initiative strengthens TRUMPF’s position in aerospace, automotive, and heavy industrial markets by enabling faster processing, reduced material waste, and enhanced coating quality.

Optomec Inc. – Expansion of Directed Energy Deposition Capabilities for Industrial Repair (2025)

In 2025, Optomec announced the expansion of its directed energy deposition and laser cladding capabilities to support advanced component repair and hybrid manufacturing platforms. The development focuses on improved powder delivery control, real-time process monitoring, and compatibility with CNC machining systems. This expansion targets growing demand from aerospace, defense, and energy sectors, reinforcing Optomec’s role in high-value repair, refurbishment, and additive manufacturing solutions.

Scope of Research

| Report Details | Outcome |

|---|---|

| Market size in 2024 | USD 170.98 Million |

| CAGR (2024–2032) | 9.23% |

| Revenue forecast to 2033 | USD 345.39 Million |

| Base year for estimation | 2024 |

| Historical data | 2019–2023 |

| Forecast period | 2025–2032 |

| Quantitative units | Revenue in USD Million, and CAGR in % from 2025 to 2032 |

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | By, Type, By Material , By Application, By End Use and By region for 2019 to 2032 |

| Regional scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Country scope | U.S., Canada, Mexico, Germany, France, U.K., Italy, Spain, Benelux, Russia, Finland, Sweden, Rest of Europe, China, India, Japan, South Korea, Indonesia, Thailand, Vietnam, Australia, New Zealand Rest of APAC, Brazil, Rest of LATAM, Saudi Arabia, Rest of MEA |

| Key companies profiled | TRUMPF Group, Coherent Corp., IPG Photonics Corporation, Laserline GmbH, DMG MORI Co., Ltd., GE Additive, Optomec Inc., Prima Industrie S.p.A., Han’s Laser Technology Industry Group, FANUC Corporation, Panasonic Corporation, Lincoln Electric Holdings, Inc., Jenoptik AG, Lumentum Holdings Inc., EOS GmbH, Mazak Corporation, Höganäs AB, Sandvik AB, Bodycote plc, Saint-Gobain |

| Customization scope | 10 hours of free customization and expert consultation |

Some Key Questions the Report Will Answer

- What is the expected revenue Compound Annual Growth Rate (CAGR) of the global Laser Cladding market over the forecast period (2025–2032)?

- The global Laser Cladding market revenue is expected to register a Compound Annual Growth Rate (CAGR) of 9.23% during the forecast period.

- What was the size of the global Laser Cladding in 2024?

- The global Laser Cladding market size was USD 170.98 Million in 2024.

- Which factors are expected to drive the global Laser Cladding market growth?

- Growing demand for component repair, life extension, and wear-resistant surfaces across aerospace, oil & gas, power generation, and heavy industries is driving adoption of laser cladding technologies.

- Advancements in high-power laser systems, automation, and hybrid manufacturing platforms are improving process efficiency, precision, and scalability, accelerating market growth.

- Which was the leading segment in the global Laser Cladding market in terms of Type in 2024?

- Diode Lasers segment was leading in the Laser Cladding market on the basis of component in 2024.

- What are some restraints for revenue growth of the global Laser Cladding market?

- • High initial capital investment for laser systems, automation equipment, and supporting infrastructure limits adoption among small and mid-sized manufacturers.

• Technical complexity, skilled labor requirements, and process optimization challenges can increase operating costs and slow deployment.

• Competition from established thermal spray and conventional welding technologies continues to restrain faster revenue growth in cost-sensitive applications.

- • High initial capital investment for laser systems, automation equipment, and supporting infrastructure limits adoption among small and mid-sized manufacturers.

Follow us on: Facebook, Twitter, Instagram and LinkedIn.

Chapter 1. Introduction

1.1. Market Definition

1.2. Objectives of the study

1.3. Overview of Global Glass Laser Cladding Market

1.4. Currency and pricing

1.5. Limitation

1.6. Market s covered

1.7. Research Scope

Chapter 2. Research Methodology

2.1. Research Sources

2.1.1. Primary

2.1.2. Secondary

2.1.3. Paid Sources

2.2. Years considered for the study

2.3. Assumptions

2.3.1. Market value

2.3.2. Market volume

2.3.3. Exchange rate

2.3.4. Price

2.3.5. Economic & political stability

Chapter 3. Executive Summary

3.1. Summary Snapshot, 2019–2032

Chapter 4. Key Insights

4.1. Production consumption analysis

4.2. Strategic partnerships & alliances

4.3. Joint ventures

4.4. Acquisition of local players

4.5. Contract manufacturing

4.6. Digital & e-commerce sales channels

4.7. Compliance with standards

4.8. Value chain analysis

4.9. Raw material sourcing

4.10. Formulation & manufacturing

4.11. Distribution & retail

4.12. Import-export analysis

4.13. Brand comparative analysis

4.14.Technological advancements

4.15. Porter’s five force

4.16. Threat of new entrants

4.16.1.1. Capital requirment

4.16.1.2. Product knowledge

4.16.1.3. Technical knowledge

4.16.1.4. Customer relation

4.16.1.5. Access to appliation and technology

4.16.2. Threat of substitutes

4.16.2.1. Cost

4.16.2.2. Performance

4.16.2.3. Availability

4.16.2.4. Technical knowledge

4.16.2.5. Durability

4.16.3. Bargainning power of buyers

4.16.3.1. Numbers of buyers relative to suppliers

4.16.3.2. Product differentiation

4.16.3.3. Threat of forward integration

4.16.3.4. Buyers volume

4.16.4. Bargainning power of suppliers

4.16.4.1. Suppliers concentration

4.16.4.2. Buyers switching cost to other suppliers

4.16.4.3. Threat of backward integration

4.16.5. Bargainning power of suppliers

4.16.5.1. Industry concentration

4.16.5.2. Industry growth rate

4.16.5.3. Product differentiation

4.17. Patent analysis

4.18. Regulation coverage

4.19. Pricing analysis

4.20. Competitive Metric Space Analysis

Chapter 5. Market Overview

5.1. Drivers

5.1.1. Rising demand for surface repair & life extension

5.1.2. Growth of advanced manufacturing & Industry 4.0

5.1.3. Superior coating performance

5.2. Restraints

5.2.1. High initial investment cost

5.2.2. Technical complexity & skill requirement

5.3. Opportunities

5.3.1. Expanding adoption in additive manufacturing & hybrid manufacturing

5.3.2. Rising demand in renewable energy & EV sectors

5.3.3. Emerging markets industrialization

5.4. Challenges

5.4.1. Competition from alternative surface technologies

5.4.2. Economic slowdowns affecting capital spending

Chapter 6. Global Glass Laser Cladding By Type Insights & Trends, Revenue (USD Million)

6.1. Type Dynamics & Market Share, 2019–2032

6.1.1. Diode Lasers

6.1.2. Fiber Lasers

6.1.3. CO₂ Lasers

6.1.4. YAG Lasers

Chapter 7. Global Glass Laser Cladding By Material Insights & Trends, Revenue (USD Million)

7.1. Material Dynamics & Market Share, 2019–2032

7.1.1. Cobalt-based alloys

7.1.2. Nickel-based alloys

7.1.3. Iron-based alloys

7.1.4. Carbides & carbide blends

7.1.5. Others

Chapter 8. Global Glass Laser Cladding By Application Insights & Trends, Revenue (USD Million)

8.1. Application Dynamics & Market Share, 2019–2032

8.1.1. Wear and corrosion resistance

8.1.2. Surface restoration / repair

8.1.3. Hardfacing

8.1.4. Additive manufacturing

8.1.5. Heat treatment

Chapter 9. Global Glass Laser Cladding By End-Use Insights & Trends, Revenue (USD Million)

9.1. End-Use Dynamics & Market Share, 2019–2032

9.1.1. Aerospace & Defense

9.1.2. Oil & Gas

9.1.3. Automotive

9.1.4. Power Generation

9.1.5. Medical

9.1.6. Industrial Machinery / Mining & Construction

9.1.7. Others

Chapter 10. Global Glass Laser Cladding Market Regional Outlook

10.1. Glass Laser Cladding Share By Region, 2019–2032

10.2. North America

10.2.1. North America Market By Type Insights & Trends, Revenue (USD Million)

10.2.1.1. Diode Lasers

10.2.1.2. Fiber Lasers

10.2.1.3. CO₂ Lasers

10.2.1.4. YAG Lasers

10.2.2. North America Glass Laser Cladding By Material Insights & Trends, Revenue

(USD Million)

10.2.2.1. Cobalt-based alloys

10.2.2.2. Nickel-based alloys

10.2.2.3. Iron-based alloys

10.2.2.4. Carbides & carbide blends

10.2.2.5. Others

10.2.3. North America Glass Laser Cladding By Application Insights & Trends, Revenue

(USD Million)

10.2.3.1. Wear and corrosion resistance

10.2.3.2. Surface restoration / repair

10.2.3.3. Hardfacing

10.2.3.4. Additive manufacturing

10.2.3.5. Heat treatment

10.2.4. North America Glass Laser Cladding By End Use Insights & Trends, Revenue

(USD Million)

10.2.4.1. Aerospace & Defense

10.2.4.2. Oil & Gas

10.2.4.3. Automotive

10.2.4.4. Power Generation

10.2.4.5. Medical

10.2.4.6. Industrial Machinery / Mining & Construction

10.2.4.7. Others

10.2.5. North America Market By Country, Market Estimates and Forecast, USD

Million, 2025-2032

10.2.5.1. US

10.2.5.2. Canada

10.2.5.3. Mexico

10.3. Europe

10.3.1. Europe Market By Type Insights & Trends, Revenue (USD Million)

10.3.1.1. Diode Lasers

10.3.1.2. Fiber Lasers

10.3.1.3. CO₂ Lasers

10.3.1.4. YAG Lasers

10.3.2. Europe Glass Laser Cladding By Material Insights & Trends, Revenue (USD

Million)

10.3.2.1. Cobalt-based alloys

10.3.2.2. Nickel-based alloys

10.3.2.3. Iron-based alloys

10.3.2.4. Carbides & carbide blends

10.3.2.5. Others

10.3.3. Europe Glass Laser Cladding By Application Insights & Trends, Revenue (USD

Million)

10.3.3.1. Wear and corrosion resistance

10.3.3.2. Surface restoration / repair

10.3.3.3. Hardfacing

10.3.3.4. Additive manufacturing

10.3.3.5. Heat treatment

10.3.4. Europe Glass Laser Cladding By End Use Insights & Trends, Revenue (USD

Million)

10.3.4.1. Aerospace & Defense

10.3.4.2. Oil & Gas

10.3.4.3. Automotive

10.3.4.4. Power Generation

10.3.4.5. Medical

10.3.4.6. Industrial Machinery / Mining & Construction

10.3.4.7. Others

10.3.5. Europe Market By Country, Market Estimates and Forecast, USD Million,

10.3.5.1. Germany

10.3.5.2. France

10.3.5.3. U.K

10.3.5.4. Italy

10.3.5.5. Spain

10.3.5.6. Benelux

10.3.5.7. Russia

10.3.5.8. Finland

10.3.5.9. Sweden

10.3.5.10. Rest Of Europe

10.4. Asia-Pacific

10.4.1. Asia-Pacific Market By Type Insights & Trends, Revenue (USD Million)

10.4.1.1. Diode Lasers

10.4.1.2. Fiber Lasers

10.4.1.3. CO₂ Lasers

10.4.1.4. YAG Lasers

10.4.2. Asia-Pacific Glass Laser Cladding By Material Insights & Trends, Revenue

(USD Million)

10.4.2.1. Cobalt-based alloys

10.4.2.2. Nickel-based alloys

10.4.2.3. Iron-based alloys

10.4.2.4. Carbides & carbide blends

10.4.2.5. Others

10.4.3. Asia-Pacific Glass Laser Cladding By Application Insights & Trends, Revenue

(USD Million)

10.4.3.1. Wear and corrosion resistance

10.4.3.2. Surface restoration / repair

10.4.3.3. Hardfacing

10.4.3.4. Additive manufacturing

10.4.3.5. Heat treatment

10.4.4. Asia-Pacific Glass Laser Cladding By End Use Insights & Trends, Revenue

(USD Million)

10.4.4.1. Aerospace & Defense

10.4.4.2. Oil & Gas

10.4.4.3. Automotive

10.4.4.4. Power Generation

10.4.4.5. Medical

10.4.4.6. Industrial Machinery / Mining & Construction

10.4.4.7. Others

10.4.5. Asia-Pacific Market By Country, Market Estimates and Forecast, USD Million,

10.4.5.1. China

10.4.5.2. India

10.4.5.3. Japan

10.4.5.4. South Korea

10.4.5.5. Indonesia

10.4.5.6. Thailand

10.4.5.7. Vietnam

10.4.5.8. Australia

10.4.5.9. New Zeland

10.4.5.10. Rest of APAC

10.5. Latin America

10.5.1. Latin America Market By Type Insights & Trends, Revenue (USD Million)

10.5.1.1. Diode Lasers

10.5.1.2. Fiber Lasers

10.5.1.3. CO₂ Lasers

10.5.1.4. YAG Lasers

10.5.2. Latin America Glass Laser Cladding By Material Insights & Trends, Revenue

(USD Million)

10.5.2.1. Cobalt-based alloys

10.5.2.2. Nickel-based alloys

10.5.2.3. Iron-based alloys

10.5.2.4. Carbides & carbide blends

10.5.2.5. Others

10.5.3. Latin America Glass Laser Cladding By Application Insights & Trends, Revenue

(USD Million)

10.5.3.1. Wear and corrosion resistance

10.5.3.2. Surface restoration / repair

10.5.3.3. Hardfacing

10.5.3.4. Additive manufacturing

10.5.3.5. Heat treatment

10.5.4. Latin America Glass Laser Cladding By End Use Insights & Trends, Revenue

(USD Million)

10.5.4.1. Aerospace & Defense

10.5.4.2. Oil & Gas

10.5.4.3. Automotive

10.5.4.4. Power Generation

10.5.4.5. Medical

10.5.4.6. Industrial Machinery / Mining & Construction

10.5.4.7. Others

10.5.5. Latin America Market By Country, Market Estimates and Forecast, USD Million,

10.5.5.1. Brazil

10.5.5.2. Rest of LATAM

10.6. Middle East & Africa

10.6.1. Middle East & Africa Market By Type Insights & Trends, Revenue (USD Million)

10.6.1.1. Diode Lasers

10.6.1.2. Fiber Lasers

10.6.1.3. CO₂ Lasers

10.6.1.4. YAG Lasers

10.6.2. Middle East & Africa Glass Laser Cladding By Material Insights & Trends,

Revenue (USD Million)

10.6.2.1. Cobalt-based alloys

10.6.2.2. Nickel-based alloys

10.6.2.3. Iron-based alloys

10.6.2.4. Carbides & carbide blends

10.6.2.5. Others

10.6.3. Middle East & Africa Glass Laser Cladding By Application Insights & Trends,

Revenue (USD Million)

10.6.3.1. Wear and corrosion resistance

10.6.3.2. Surface restoration / repair

10.6.3.3. Hardfacing

10.6.3.4. Additive manufacturing

10.6.3.5. Heat treatment

10.6.4. Middle East & Africa Glass Laser Cladding By End Use Insights & Trends,

Revenue (USD Million)

10.6.4.1. Aerospace & Defense

10.6.4.2. Oil & Gas

10.6.4.3. Automotive

10.6.4.4. Power Generation

10.6.4.5. Medical

10.6.4.6. Industrial Machinery / Mining & Construction

10.6.4.7. Others

10.6.5. Middle East & Africa Market By Country, Market Estimates and Forecast, USD

Million,

10.6.5.1. Saudi Arabia

10.6.5.2. Rest of MEA

Chapter 11. Competitive Landscape

11.1. Market Revenue Share By Manufacturers

11.2. Mergers & Acquisitions

11.3. Competitor’s Positioning

11.4. Strategy Benchmarking

11.5. Vendor Landscape

11.6. Distributors

11.6.1.1. North America

11.6.1.2. Europe

11.6.1.3. Asia Pacific

11.6.1.4. Middle East & Africa

11.6.1.5. Latin America

12. Company Profiles

13.1. Intel Corporation

13.1.1. Company Overview

13.1.2. Product & Service Offerings

13.1.3. Strategic Initiatives

13.1.4. Financials

13.1.5. Conclusion

16.2. Samsung Electronics Co., Ltd.

16.3. Taiwan Semiconductor Manufacturing Company (TSMC)

16.4. Advanced Semiconductor Engineering, Inc. (ASE Group)

16.5. Amkor Technology, Inc.

16.6. Corning Incorporated

16.7. SCHOTT AG

16.8. AGC Inc.

16.9. SK hynix Inc.

16.10. Micron Technology, Inc.

16.11. Applied Materials, Inc.

16.12. Lam Research Corporation

16.13. Tokyo Electron Limited

16.14. KLA Corporation

16.15. DISCO Corporation

16.15.1. Company Overview

16.16. Canon Inc.

16.17. Entegris, Inc.

16.18. Fujifilm Holdings Corporation

1016.19. Veeco Instruments Inc.

16.20. Onto Innovation Inc.

Segments Covered in Report

For the purpose of this report, Advantia Business Consulting LLP has segmented Global Glass Laser Cladding on the basis of By, Type, By Material , By Application, By End Use and By region for 2019 to 2032

Global Glass Laser Cladding Systems By Type Outlook (Revenue, USD Million)

- Diode Lasers

- Fiber Lasers

- CO₂ Lasers

- YAG Lasers

Global Glass Laser Cladding By Material Outlook, Revenue (USD Million)

- Cobalt-based alloys

- Nickel-based alloys

- Iron-based alloys

- Carbides & carbide blends

- Others

Global Glass Laser Cladding By Application Outlook, Revenue (USD Million)

- Wear and corrosion resistance

- Surface restoration / repair

- Hardfacing

- Additive manufacturing

- Heat treatment

Global Glass Laser Cladding By End Use Outlook, Revenue (USD Million)

- Aerospace & Defense

- Oil & Gas

- Automotive

- Power Generation

- Medical

- Industrial Machinery / Mining & Construction

- Others

North America

North America Glass Laser Cladding Systems By Type Outlook (Revenue, USD Million)

- Diode Lasers

- Fiber Lasers

- CO₂ Lasers

- YAG Lasers

North America Glass Laser Cladding By Material Outlook, Revenue (USD Million)

- Cobalt-based alloys

- Nickel-based alloys

- Iron-based alloys

- Carbides & carbide blends

- Others

North America Glass Laser Cladding By Application Outlook, Revenue (USD Million)

- Wear and corrosion resistance

- Surface restoration / repair

- Hardfacing

- Additive manufacturing

- Heat treatment

North America Glass Laser Cladding By End Use Outlook, Revenue (USD Million)

- Aerospace & Defense

- Oil & Gas

- Automotive

- Power Generation

- Medical

- Industrial Machinery / Mining & Construction

- Others

U.S

U.S Glass Laser Cladding Systems By Type Outlook (Revenue, USD Million)

- Diode Lasers

- Fiber Lasers

- CO₂ Lasers

- YAG Lasers

U.S Glass Laser Cladding By Material Outlook, Revenue (USD Million)

- Cobalt-based alloys

- Nickel-based alloys

- Iron-based alloys

- Carbides & carbide blends

- Others

U.S Glass Laser Cladding By Application Outlook, Revenue (USD Million)

- Wear and corrosion resistance

- Surface restoration / repair

- Hardfacing

- Additive manufacturing

- Heat treatment

U.S Glass Laser Cladding By End Use Outlook, Revenue (USD Million)

- Aerospace & Defense

- Oil & Gas

- Automotive

- Power Generation

- Medical

- Industrial Machinery / Mining & Construction

- Others

Canada

Canada Glass Laser Cladding Systems By Type Outlook (Revenue, USD Million)

- Diode Lasers

- Fiber Lasers

- CO₂ Lasers

- YAG Lasers

Canada Glass Laser Cladding By Material Outlook, Revenue (USD Million)

- Cobalt-based alloys

- Nickel-based alloys

- Iron-based alloys

- Carbides & carbide blends

- Others

Canada Glass Laser Cladding By Application Outlook, Revenue (USD Million)

- Wear and corrosion resistance

- Surface restoration / repair

- Hardfacing

- Additive manufacturing

- Heat treatment

Canada Glass Laser Cladding By End Use Outlook, Revenue (USD Million)

- Aerospace & Defense

- Oil & Gas

- Automotive

- Power Generation

- Medical

- Industrial Machinery / Mining & Construction

- Others

Mexico

Mexico Glass Laser Cladding Systems By Type Outlook (Revenue, USD Million)

- Diode Lasers

- Fiber Lasers

- CO₂ Lasers

- YAG Lasers

Mexico Glass Laser Cladding By Material Outlook, Revenue (USD Million)

- Cobalt-based alloys

- Nickel-based alloys

- Iron-based alloys

- Carbides & carbide blends

- Others

Mexico Glass Laser Cladding By Application Outlook, Revenue (USD Million)

- Wear and corrosion resistance

- Surface restoration / repair

- Hardfacing

- Additive manufacturing

- Heat treatment

Mexico Glass Laser Cladding By End Use Outlook, Revenue (USD Million)

- Aerospace & Defense

- Oil & Gas

- Automotive

- Power Generation

- Medical

- Industrial Machinery / Mining & Construction

- Others

Europe

Europe Glass Laser Cladding Systems By Type Outlook (Revenue, USD Million)

- Diode Lasers

- Fiber Lasers

- CO₂ Lasers

- YAG Lasers

Europe Glass Laser Cladding By Material Outlook, Revenue (USD Million)

- Cobalt-based alloys

- Nickel-based alloys

- Iron-based alloys

- Carbides & carbide blends

- Others

Europe Glass Laser Cladding By Application Outlook, Revenue (USD Million)

- Wear and corrosion resistance

- Surface restoration / repair

- Hardfacing

- Additive manufacturing

- Heat treatment

Europe Glass Laser Cladding By End Use Outlook, Revenue (USD Million)

- Aerospace & Defense

- Oil & Gas

- Automotive

- Power Generation

- Medical

- Industrial Machinery / Mining & Construction

- Others

Germany

Germany Glass Laser Cladding Systems By Type Outlook (Revenue, USD Million)

- Diode Lasers

- Fiber Lasers

- CO₂ Lasers

- YAG Lasers

Germany Glass Laser Cladding By Material Outlook, Revenue (USD Million)

- Cobalt-based alloys

- Nickel-based alloys

- Iron-based alloys

- Carbides & carbide blends

- Others

Germany Glass Laser Cladding By Application Outlook, Revenue (USD Million)

- Wear and corrosion resistance

- Surface restoration / repair

- Hardfacing

- Additive manufacturing

- Heat treatment

Germany Glass Laser Cladding By End Use Outlook, Revenue (USD Million)

- Aerospace & Defense

- Oil & Gas

- Automotive

- Power Generation

- Medical

- Industrial Machinery / Mining & Construction

- Others

France

France Glass Laser Cladding Systems By Type Outlook (Revenue, USD Million)

- Diode Lasers

- Fiber Lasers

- CO₂ Lasers

- YAG Lasers

France Glass Laser Cladding By Material Outlook, Revenue (USD Million)

- Cobalt-based alloys

- Nickel-based alloys

- Iron-based alloys

- Carbides & carbide blends

- Others

France Glass Laser Cladding By Application Outlook, Revenue (USD Million)

- Wear and corrosion resistance

- Surface restoration / repair

- Hardfacing

- Additive manufacturing

- Heat treatment

France Glass Laser Cladding By End Use Outlook, Revenue (USD Million)

- Aerospace & Defense

- Oil & Gas

- Automotive

- Power Generation

- Medical

- Industrial Machinery / Mining & Construction

- Others

Italy

Italy Glass Laser Cladding Systems By Type Outlook (Revenue, USD Million)

- Diode Lasers

- Fiber Lasers

- CO₂ Lasers

- YAG Lasers

France Glass Laser Cladding By Material Outlook, Revenue (USD Million)

- Cobalt-based alloys

- Nickel-based alloys

- Iron-based alloys

- Carbides & carbide blends

- Others

France Glass Laser Cladding By Application Outlook, Revenue (USD Million)

- Wear and corrosion resistance

- Surface restoration / repair

- Hardfacing

- Additive manufacturing

- Heat treatment

France Glass Laser Cladding By End Use Outlook, Revenue (USD Million)

- Aerospace & Defense

- Oil & Gas

- Automotive

- Power Generation

- Medical

- Industrial Machinery / Mining & Construction

- Others

U.K

U.K Glass Laser Cladding Systems By Type Outlook (Revenue, USD Million)

- Diode Lasers

- Fiber Lasers

- CO₂ Lasers

- YAG Lasers

U.K Glass Laser Cladding By Material Outlook, Revenue (USD Million)

- Cobalt-based alloys

- Nickel-based alloys

- Iron-based alloys

- Carbides & carbide blends

- Others

U.K Glass Laser Cladding By Application Outlook, Revenue (USD Million)

- Wear and corrosion resistance

- Surface restoration / repair

- Hardfacing

- Additive manufacturing

- Heat treatment

U.K Glass Laser Cladding By End Use Outlook, Revenue (USD Million)

- Aerospace & Defense

- Oil & Gas

- Automotive

- Power Generation

- Medical

- Industrial Machinery / Mining & Construction

- Others

Benelux

Benelux Glass Laser Cladding Systems By Type Outlook (Revenue, USD Million)

- Diode Lasers

- Fiber Lasers

- CO₂ Lasers

- YAG Lasers

Benelux Glass Laser Cladding By Material Outlook, Revenue (USD Million)

- Cobalt-based alloys

- Nickel-based alloys

- Iron-based alloys

- Carbides & carbide blends

- Others

Benelux Glass Laser Cladding By Application Outlook, Revenue (USD Million)

- Wear and corrosion resistance

- Surface restoration / repair

- Hardfacing

- Additive manufacturing

- Heat treatment

Benelux Glass Laser Cladding By End Use Outlook, Revenue (USD Million)

- Aerospace & Defense

- Oil & Gas

- Automotive

- Power Generation

- Medical

- Industrial Machinery / Mining & Construction

- Others

Russia

Russia Glass Laser Cladding Systems By Type Outlook (Revenue, USD Million)

- Diode Lasers

- Fiber Lasers

- CO₂ Lasers

- YAG Lasers

Russia Glass Laser Cladding By Material Outlook, Revenue (USD Million)

- Cobalt-based alloys

- Nickel-based alloys

- Iron-based alloys

- Carbides & carbide blends

- Others

Russia Glass Laser Cladding By Application Outlook, Revenue (USD Million)

- Wear and corrosion resistance

- Surface restoration / repair

- Hardfacing

- Additive manufacturing

- Heat treatment

Russia Glass Laser Cladding By End Use Outlook, Revenue (USD Million)

- Aerospace & Defense

- Oil & Gas

- Automotive

- Power Generation

- Medical

- Industrial Machinery / Mining & Construction

- Others

Finland

Finland Glass Laser Cladding Systems By Type Outlook (Revenue, USD Million)

- Diode Lasers

- Fiber Lasers

- CO₂ Lasers

- YAG Lasers

Finland Glass Laser Cladding By Material Outlook, Revenue (USD Million)

- Cobalt-based alloys

- Nickel-based alloys

- Iron-based alloys

- Carbides & carbide blends

- Others

Finland Glass Laser Cladding By Application Outlook, Revenue (USD Million)

- Wear and corrosion resistance

- Surface restoration / repair

- Hardfacing

- Additive manufacturing

- Heat treatment

Finland Glass Laser Cladding By End Use Outlook, Revenue (USD Million)

- Aerospace & Defense

- Oil & Gas

- Automotive

- Power Generation

- Medical

- Industrial Machinery / Mining & Construction

- Others

Sweden

Sweden Glass Laser Cladding Systems By Type Outlook (Revenue, USD Million)

- Diode Lasers

- Fiber Lasers

- CO₂ Lasers

- YAG Lasers

Sweden Glass Laser Cladding By Material Outlook, Revenue (USD Million)

- Cobalt-based alloys

- Nickel-based alloys

- Iron-based alloys

- Carbides & carbide blends

- Others

Sweden Glass Laser Cladding By Application Outlook, Revenue (USD Million)

- Wear and corrosion resistance

- Surface restoration / repair

- Hardfacing

- Additive manufacturing

- Heat treatment

Sweden Glass Laser Cladding By End Use Outlook, Revenue (USD Million)

- Aerospace & Defense

- Oil & Gas

- Automotive

- Power Generation

- Medical

- Industrial Machinery / Mining & Construction

- Others

Rest of Europe

Rest of Europe Glass Laser Cladding Systems By Type Outlook (Revenue, USD Million)

- Diode Lasers

- Fiber Lasers

- CO₂ Lasers

- YAG Lasers

Rest of Europe Glass Laser Cladding By Material Outlook, Revenue (USD Million)

- Cobalt-based alloys

- Nickel-based alloys

- Iron-based alloys

- Carbides & carbide blends

- Others

Rest of Europe Glass Laser Cladding By Application Outlook, Revenue (USD Million)

- Wear and corrosion resistance

- Surface restoration / repair

- Hardfacing

- Additive manufacturing

- Heat treatment

Rest of Europe Glass Laser Cladding By End Use Outlook, Revenue (USD Million)

- Aerospace & Defense

- Oil & Gas

- Automotive

- Power Generation

- Medical

- Industrial Machinery / Mining & Construction

- Others

Asia-Pacific

Asia-Pacific Glass Laser Cladding Systems By Type Outlook (Revenue, USD Million)

- Diode Lasers

- Fiber Lasers

- CO₂ Lasers

- YAG Lasers

Asia-Pacific Glass Laser Cladding By Material Outlook, Revenue (USD Million)

- Cobalt-based alloys

- Nickel-based alloys

- Iron-based alloys

- Carbides & carbide blends

- Others

Asia-Pacific Glass Laser Cladding By Application Outlook, Revenue (USD Million)

- Wear and corrosion resistance

- Surface restoration / repair

- Hardfacing

- Additive manufacturing

- Heat treatment

Asia-Pacific Glass Laser Cladding By End Use Outlook, Revenue (USD Million)

- Aerospace & Defense

- Oil & Gas

- Automotive

- Power Generation

- Medical

- Industrial Machinery / Mining & Construction

- Others

China

China Glass Laser Cladding Systems By Type Outlook (Revenue, USD Million)

- Diode Lasers

- Fiber Lasers

- CO₂ Lasers

- YAG Lasers

China Glass Laser Cladding By Material Outlook, Revenue (USD Million)

- Cobalt-based alloys

- Nickel-based alloys

- Iron-based alloys

- Carbides & carbide blends

- Others

China Glass Laser Cladding By Application Outlook, Revenue (USD Million)

- Wear and corrosion resistance

- Surface restoration / repair

- Hardfacing

- Additive manufacturing

- Heat treatment

China Glass Laser Cladding By End Use Outlook, Revenue (USD Million)

- Aerospace & Defense

- Oil & Gas

- Automotive

- Power Generation

- Medical

- Industrial Machinery / Mining & Construction

- Others

India

India Glass Laser Cladding Systems By Type Outlook (Revenue, USD Million)

- Diode Lasers

- Fiber Lasers

- CO₂ Lasers

- YAG Lasers

India Glass Laser Cladding By Material Outlook, Revenue (USD Million)

- Cobalt-based alloys

- Nickel-based alloys

- Iron-based alloys

- Carbides & carbide blends

- Others

India Glass Laser Cladding By Application Outlook, Revenue (USD Million)

- Wear and corrosion resistance

- Surface restoration / repair

- Hardfacing

- Additive manufacturing

- Heat treatment

India Glass Laser Cladding By End Use Outlook, Revenue (USD Million)

- Aerospace & Defense

- Oil & Gas

- Automotive

- Power Generation

- Medical

- Industrial Machinery / Mining & Construction

- Others

Japan

Japan Glass Laser Cladding Systems By Type Outlook (Revenue, USD Million)

- Diode Lasers

- Fiber Lasers

- CO₂ Lasers

- YAG Lasers

Japan Glass Laser Cladding By Material Outlook, Revenue (USD Million)

- Cobalt-based alloys

- Nickel-based alloys

- Iron-based alloys

- Carbides & carbide blends

- Others

Japan Glass Laser Cladding By Application Outlook, Revenue (USD Million)

- Wear and corrosion resistance

- Surface restoration / repair

- Hardfacing

- Additive manufacturing

- Heat treatment

Japan Glass Laser Cladding By End Use Outlook, Revenue (USD Million)

- Aerospace & Defense

- Oil & Gas

- Automotive

- Power Generation

- Medical

- Industrial Machinery / Mining & Construction

- Others

Indonesia

Indonesia Glass Laser Cladding Systems By Type Outlook (Revenue, USD Million)

- Diode Lasers

- Fiber Lasers

- CO₂ Lasers

- YAG Lasers

Indonesia Glass Laser Cladding By Material Outlook, Revenue (USD Million)

- Cobalt-based alloys

- Nickel-based alloys

- Iron-based alloys

- Carbides & carbide blends

- Others

Indonesia Glass Laser Cladding By Application Outlook, Revenue (USD Million)

- Wear and corrosion resistance

- Surface restoration / repair

- Hardfacing

- Additive manufacturing

- Heat treatment

Indonesia Glass Laser Cladding By End Use Outlook, Revenue (USD Million)

- Aerospace & Defense

- Oil & Gas

- Automotive

- Power Generation

- Medical

- Industrial Machinery / Mining & Construction

- Others

Thailand

Thailand Glass Laser Cladding Systems By Type Outlook (Revenue, USD Million)

- Diode Lasers

- Fiber Lasers

- CO₂ Lasers

- YAG Lasers

Thailand Glass Laser Cladding By Material Outlook, Revenue (USD Million)

- Cobalt-based alloys

- Nickel-based alloys

- Iron-based alloys

- Carbides & carbide blends

- Others

Thailand Glass Laser Cladding By Application Outlook, Revenue (USD Million)

- Wear and corrosion resistance

- Surface restoration / repair

- Hardfacing

- Additive manufacturing

- Heat treatment

Thailand Glass Laser Cladding By End Use Outlook, Revenue (USD Million)

- Aerospace & Defense

- Oil & Gas

- Automotive

- Power Generation

- Medical

- Industrial Machinery / Mining & Construction

- Others

Vietnam

Vietnam Glass Laser Cladding Systems By Type Outlook (Revenue, USD Million)

- Diode Lasers

- Fiber Lasers

- CO₂ Lasers

- YAG Lasers

Vietnam Glass Laser Cladding By Material Outlook, Revenue (USD Million)

- Cobalt-based alloys

- Nickel-based alloys

- Iron-based alloys

- Carbides & carbide blends

- Others

Vietnam Glass Laser Cladding By Application Outlook, Revenue (USD Million)

- Wear and corrosion resistance

- Surface restoration / repair

- Hardfacing

- Additive manufacturing

- Heat treatment

Vietnam Glass Laser Cladding By End Use Outlook, Revenue (USD Million)

- Aerospace & Defense

- Oil & Gas

- Automotive

- Power Generation

- Medical

- Industrial Machinery / Mining & Construction

- Others

Australia

Australia Glass Laser Cladding Systems By Type Outlook (Revenue, USD Million)

- Diode Lasers

- Fiber Lasers

- CO₂ Lasers

- YAG Lasers

Australia Glass Laser Cladding By Material Outlook, Revenue (USD Million)

- Cobalt-based alloys

- Nickel-based alloys

- Iron-based alloys

- Carbides & carbide blends

- Others

Australia Glass Laser Cladding By Application Outlook, Revenue (USD Million)

- Wear and corrosion resistance

- Surface restoration / repair

- Hardfacing

- Additive manufacturing

- Heat treatment

Australia Glass Laser Cladding By End Use Outlook, Revenue (USD Million)

- Aerospace & Defense

- Oil & Gas

- Automotive

- Power Generation

- Medical

- Industrial Machinery / Mining & Construction

- Others

New Zealand

New Zealand Glass Laser Cladding Systems By Type Outlook (Revenue, USD Million)

- Diode Lasers

- Fiber Lasers

- CO₂ Lasers

- YAG Lasers

New Zealand Glass Laser Cladding By Material Outlook, Revenue (USD Million)

- Cobalt-based alloys

- Nickel-based alloys

- Iron-based alloys

- Carbides & carbide blends

- Others

New Zealand Glass Laser Cladding By Application Outlook, Revenue (USD Million)

- Wear and corrosion resistance

- Surface restoration / repair

- Hardfacing

- Additive manufacturing

- Heat treatment

New Zealand Glass Laser Cladding By End Use Outlook, Revenue (USD Million)

- Aerospace & Defense

- Oil & Gas

- Automotive

- Power Generation

- Medical

- Industrial Machinery / Mining & Construction

- Others

Rest of Asia-Pacific

Rest of Asia-Pacific Glass Laser Cladding Systems By Type Outlook (Revenue, USD Million)

- Diode Lasers

- Fiber Lasers

- CO₂ Lasers

- YAG Lasers

Rest of Asia-Pacific Glass Laser Cladding By Material Outlook, Revenue (USD Million)

- Cobalt-based alloys

- Nickel-based alloys

- Iron-based alloys

- Carbides & carbide blends

- Others

Rest of Asia-Pacific Glass Laser Cladding By Application Outlook, Revenue (USD Million)

- Wear and corrosion resistance

- Surface restoration / repair

- Hardfacing

- Additive manufacturing

- Heat treatment

Rest of Asia-Pacific Glass Laser Cladding By End Use Outlook, Revenue (USD Million)

- Aerospace & Defense

- Oil & Gas

- Automotive

- Power Generation

- Medical

- Industrial Machinery / Mining & Construction

- Others

Latin America

Latin America Glass Laser Cladding Systems By Type Outlook (Revenue, USD Million)

- Diode Lasers

- Fiber Lasers

- CO₂ Lasers

- YAG Lasers

Latin America Glass Laser Cladding By Material Outlook, Revenue (USD Million)

- Cobalt-based alloys

- Nickel-based alloys

- Iron-based alloys

- Carbides & carbide blends

- Others

Latin America Glass Laser Cladding By Application Outlook, Revenue (USD Million)

- Wear and corrosion resistance

- Surface restoration / repair

- Hardfacing

- Additive manufacturing

- Heat treatment

Latin America Glass Laser Cladding By End Use Outlook, Revenue (USD Million)

- Aerospace & Defense

- Oil & Gas

- Automotive

- Power Generation

- Medical

- Industrial Machinery / Mining & Construction

- Others

Brazil

Brazil Glass Laser Cladding Systems By Type Outlook (Revenue, USD Million)

- Diode Lasers

- Fiber Lasers

- CO₂ Lasers

- YAG Lasers

Brazil Glass Laser Cladding By Material Outlook, Revenue (USD Million)

- Cobalt-based alloys

- Nickel-based alloys

- Iron-based alloys

- Carbides & carbide blends

- Others

Brazil Glass Laser Cladding By Application Outlook, Revenue (USD Million)

- Wear and corrosion resistance

- Surface restoration / repair

- Hardfacing

- Additive manufacturing

- Heat treatment

Brazil Glass Laser Cladding By End Use Outlook, Revenue (USD Million)

- Aerospace & Defense

- Oil & Gas

- Automotive

- Power Generation

- Medical

- Industrial Machinery / Mining & Construction

- Others

Rest of Latin America

Rest of Latin America Glass Laser Cladding Systems By Type Outlook (Revenue, USD Million)

- Diode Lasers

- Fiber Lasers

- CO₂ Lasers

- YAG Lasers

Rest of Latin America Glass Laser Cladding By Material Outlook, Revenue (USD Million)

- Cobalt-based alloys

- Nickel-based alloys

- Iron-based alloys

- Carbides & carbide blends

- Others

Rest of Latin America Glass Laser Cladding By Application Outlook, Revenue (USD Million)

- Wear and corrosion resistance

- Surface restoration / repair

- Hardfacing

- Additive manufacturing

- Heat treatment

Rest of Latin America Glass Laser Cladding By End Use Outlook, Revenue (USD Million)

- Aerospace & Defense

- Oil & Gas

- Automotive

- Power Generation

- Medical

- Industrial Machinery / Mining & Construction

- Others

Middle East & Africa

Middle East & Africa Glass Laser Cladding Systems By Type Outlook (Revenue, USD Million)

- Diode Lasers

- Fiber Lasers

- CO₂ Lasers

- YAG Lasers

Middle East & Africa Glass Laser Cladding By Material Outlook, Revenue (USD Million)

- Cobalt-based alloys

- Nickel-based alloys

- Iron-based alloys

- Carbides & carbide blends

- Others

Middle East & Africa Glass Laser Cladding By Application Outlook, Revenue (USD Million)

- Wear and corrosion resistance

- Surface restoration / repair

- Hardfacing

- Additive manufacturing

- Heat treatment

Middle East & Africa Glass Laser Cladding By End Use Outlook, Revenue (USD Million)

- Aerospace & Defense

- Oil & Gas

- Automotive

- Power Generation

- Medical

- Industrial Machinery / Mining & Construction

- Others

Saudi Arabia

Saudi Arabia Glass Laser Cladding Systems By Type Outlook (Revenue, USD Million)

- Diode Lasers

- Fiber Lasers

- CO₂ Lasers

- YAG Lasers

Saudi Arabia Glass Laser Cladding By Material Outlook, Revenue (USD Million)

- Cobalt-based alloys

- Nickel-based alloys

- Iron-based alloys

- Carbides & carbide blends

- Others

Saudi Arabia Glass Laser Cladding By Application Outlook, Revenue (USD Million)

- Wear and corrosion resistance

- Surface restoration / repair

- Hardfacing

- Additive manufacturing

- Heat treatment

Saudi Arabia Glass Laser Cladding By End Use Outlook, Revenue (USD Million)

- Aerospace & Defense

- Oil & Gas

- Automotive

- Power Generation

- Medical

- Industrial Machinery / Mining & Construction

- Others

Rest of Middle East & Africa

Rest of Latin America Glass Laser Cladding Systems By Type Outlook (Revenue, USD Million)

- Diode Lasers

- Fiber Lasers

- CO₂ Lasers

- YAG Lasers

Rest of Latin America Glass Laser Cladding By Material Outlook, Revenue (USD Million)

- Cobalt-based alloys

- Nickel-based alloys

- Iron-based alloys

- Carbides & carbide blends

- Others

Rest of Latin America Glass Laser Cladding By Application Outlook, Revenue (USD Million)

- Wear and corrosion resistance

- Surface restoration / repair

- Hardfacing

- Additive manufacturing

- Heat treatment

Rest of Latin America Glass Laser Cladding By End Use Outlook, Revenue (USD Million)

- Aerospace & Defense

- Oil & Gas

- Automotive

- Power Generation

- Medical

- Industrial Machinery / Mining & Construction

- Others