Market Synopsis

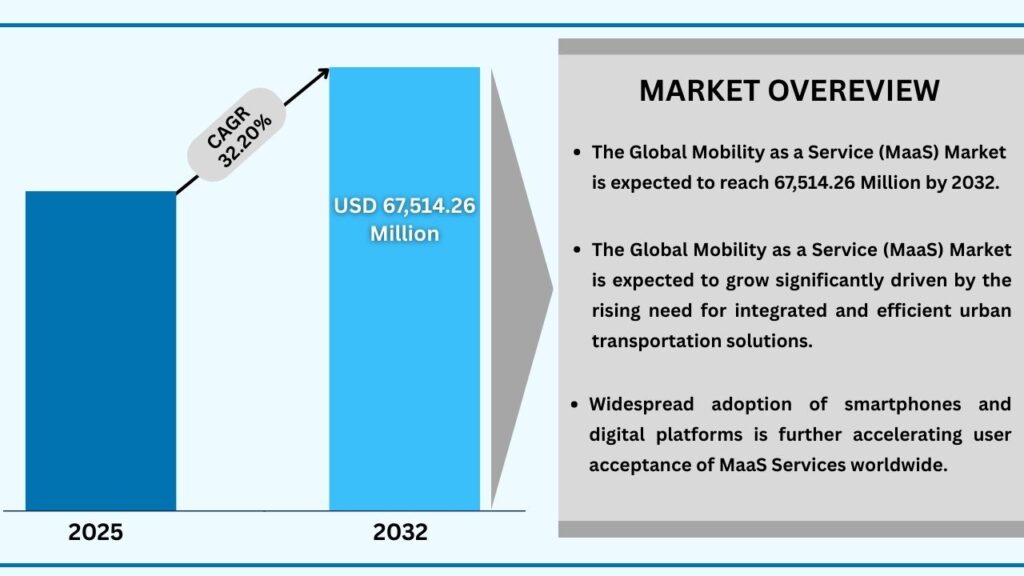

The Mobility as a Service (MaaS) Market size was USD 7,305.17 Million in 2024 and is expected to reach USD 67,514.26 million in 20232 at a CAGR of 32.20% during the forecast period.

Escalating Urban Mobility Challenges Driving Integrated Transportation Demand

Rapid urbanization, increasing traffic congestion, and pressure on existing transport infrastructure are accelerating the shift toward integrated mobility ecosystems. Cities and commuters are seeking seamless, efficient alternatives to private vehicle ownership, pushing adoption of unified platforms that combine multiple transport modes into a single, user-centric mobility experience.

Accelerated Adoption Across Smart Cities, Corporate Mobility & Public Transport Networks

Municipal authorities, enterprises, and transport operators are increasingly deploying Mobility as a Service (MaaS) to optimize urban transport systems and reduce environmental impact. Smart city initiatives integrate MaaS platforms to improve traffic flow and accessibility, while corporations adopt MaaS solutions for employee mobility, and public transit agencies leverage digital platforms to enhance ridership and service efficiency.

Growing Necessity for Cost-Efficient, Sustainable & User-Centric Mobility Models

Rising fuel costs, environmental concerns, and shifting consumer preferences are reducing reliance on private car ownership. MaaS enables flexible, pay-per-use mobility with real-time information, multimodal trip planning, and seamless payments, making sustainable transportation both economically viable and convenient for users across urban and suburban settings.

Technological Advancements in AI, IoT & Cloud-Based Mobility Platforms

Continuous innovation in artificial intelligence, real-time data analytics, IoT-enabled vehicles, and cloud infrastructure is transforming MaaS capabilities. Enhanced route optimization, predictive demand management, dynamic pricing, and platform interoperability are improving service reliability and scalability, accelerating global adoption of MaaS across both developed and emerging markets.

Global Mobility as a Service (MaaS) Market (USD Million)

Global Mobility as a Service (MaaS) Market by Component Insights:

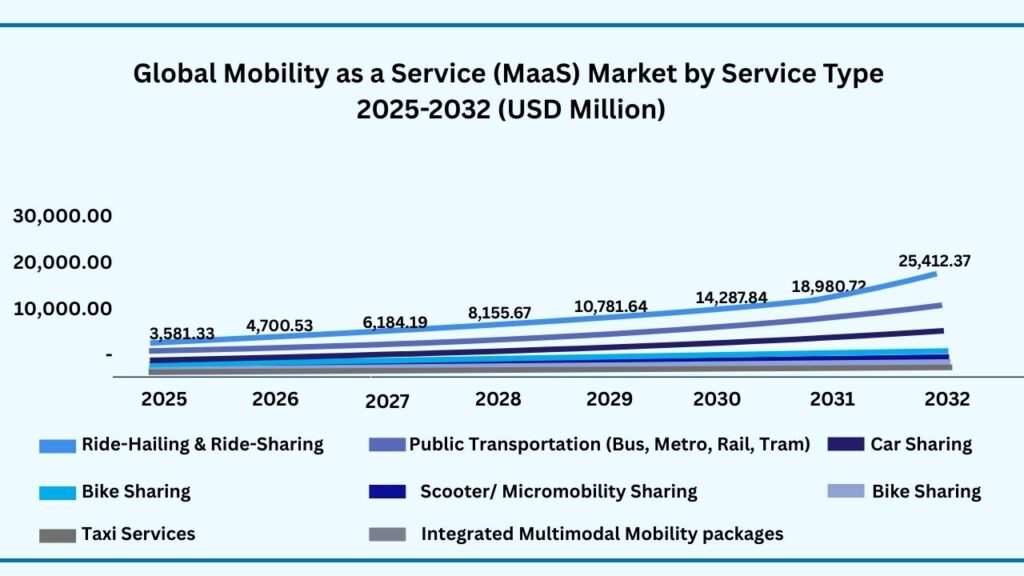

Ride-hailing & Ride-sharing segment accounted for market share of share 37.44% in 2024 in the Global Mobility as a Service (MaaS) Market

The Ride-hailing & Ride-sharing segment accounted for the largest share of the global Mobility as a Service (MaaS) market in 2024, representing 37.44% of total revenues. Ride-hailing & Ride-sharing segment is expected to register a CAGR of 32.30% during the forecast year from 2025 to 2032.

The ride-hailing and ride-sharing segment accounted for the largest share of the global Mobility as a Service (MaaS) market in the base year, driven by its high usage frequency, convenience, and widespread availability across urban and semi-urban regions. These services have become an integral part of daily commuting, offering flexible, on-demand transportation without the need for vehicle ownership. Strong smartphone penetration, real-time ride matching, and integrated digital payment systems continue to enhance user adoption, particularly among urban consumers seeking time-efficient and cost-effective mobility options.

Looking ahead, the ride-hailing and ride-sharing segment is expected to witness robust growth throughout the forecast period, supported by expanding service coverage, integration with multimodal MaaS platforms, and increasing focus on sustainability. Operators are increasingly incorporating electric vehicles, pooling options, and AI-driven route optimization to reduce costs and emissions while improving service efficiency. Additionally, partnerships with public transport agencies and corporate mobility programs are strengthening the segment’s role as a core pillar of the evolving MaaS ecosystem.

Global Mobility as a Service (MaaS) Market by Service Type (USD Million)

Global Mobility as a Service (MaaS) Market by Transportation Mode Insights:

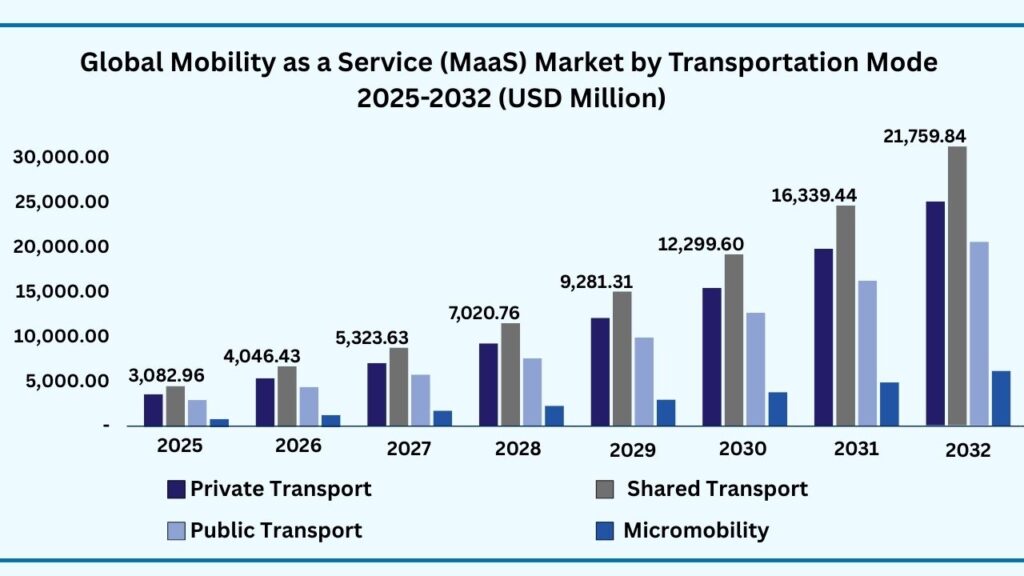

Shared Transport segment accounted for the largest market share of 38.66% in 2024 in the global Mobility as a Service (MaaS) market.

Based on the Transportation Mode, Shared Transport held the largest revenue share of 38.66% 2024, and expected to register a CAGR of 32.25% between 2025 to 2032 and the market is expected to reach USD 26,168.53 million by 2032. Based on transportation mode, shared transport emerged as the dominant segment in the global Mobility as a Service (MaaS) market during the base year, supported by the growing preference for access over ownership and the rising adoption of shared mobility solutions in urban environments. Ride-sharing, car sharing, and shared shuttle services are increasingly favored due to their cost efficiency, flexibility, and contribution to reducing traffic congestion and carbon emissions. Strong urban demand, combined with supportive government policies and smart city initiatives, has reinforced the position of shared transport as a core component of integrated mobility ecosystems.

Over the forecast period, the shared transport segment is expected to experience rapid growth, driven by continuous platform innovation, expanding multimodal integration, and increasing enterprise and municipal adoption. Advances in digital platforms, real-time fleet management, and electric vehicle deployment are enhancing service reliability and scalability. As cities prioritize sustainable mobility and consumers seek seamless, technology-enabled travel experiences, shared transport is set to play a pivotal role in shaping the future of global MaaS solutions.

Global Mobility as a Service (MaaS) Market by Transportation Mode (USD Million)

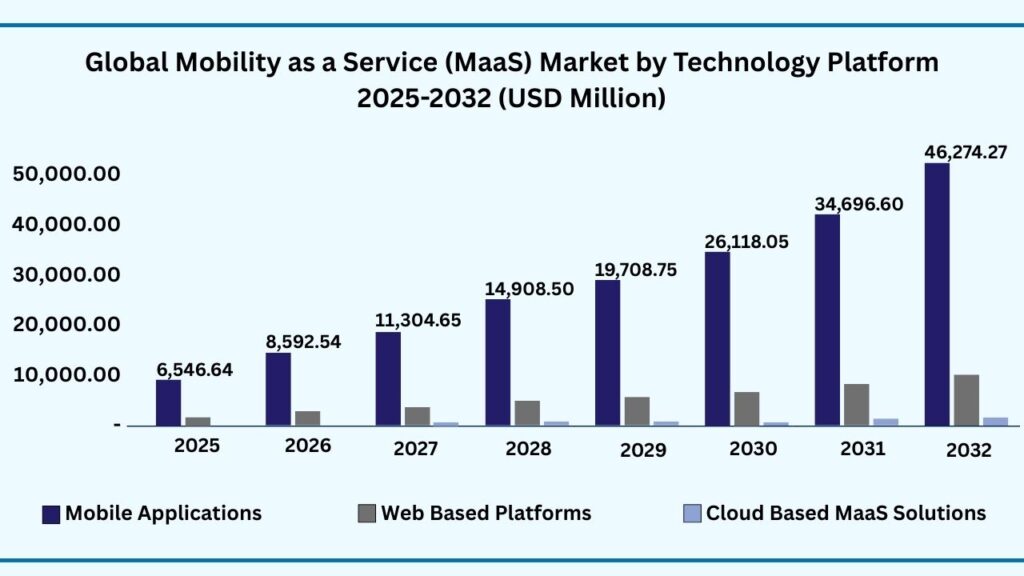

Global Mobility as a Service (MaaS) Maret by Technology Platform Insights:

Fiber-based QKD segment accounted for the largest market share of share 68.44% in 2024 in the global Mobility as a Service (MaaS) market.

Based on Technology Platform , Mobile Applications segment held the largest revenue share of 68.44% in the global Mobility as a Service (MaaS) market in 2024 and expected to register a CAGR of 32.23% from 2025 to 2032 and expected to reach USD 46,274.27 million. Based on the technology platform, mobile applications emerged as the leading segment in the global Mobility as a Service (MaaS) market during the base year, driven by their ease of use, real-time functionality, and widespread smartphone adoption. Mobile apps serve as the primary interface for users to plan trips, compare transport options, book rides, and make seamless digital payments within a single platform. The convenience of on-the-go access, combined with features such as live tracking, route optimization, and personalized notifications, has made mobile applications the preferred choice among MaaS users.

Looking ahead, the mobile applications segment is expected to witness strong growth over the forecast period, supported by continuous enhancements in user experience, integration of multiple transport modes, and advancements in AI-driven analytics. MaaS providers are increasingly leveraging mobile platforms to deliver personalized mobility recommendations, dynamic pricing, and loyalty programs, further strengthening user engagement. As urban mobility becomes more digitized and user-centric, mobile applications will remain central to the expansion and evolution of MaaS ecosystems worldwide.

Global Mobility as a Service (MaaS) Market by Technology Platform (USD Million)

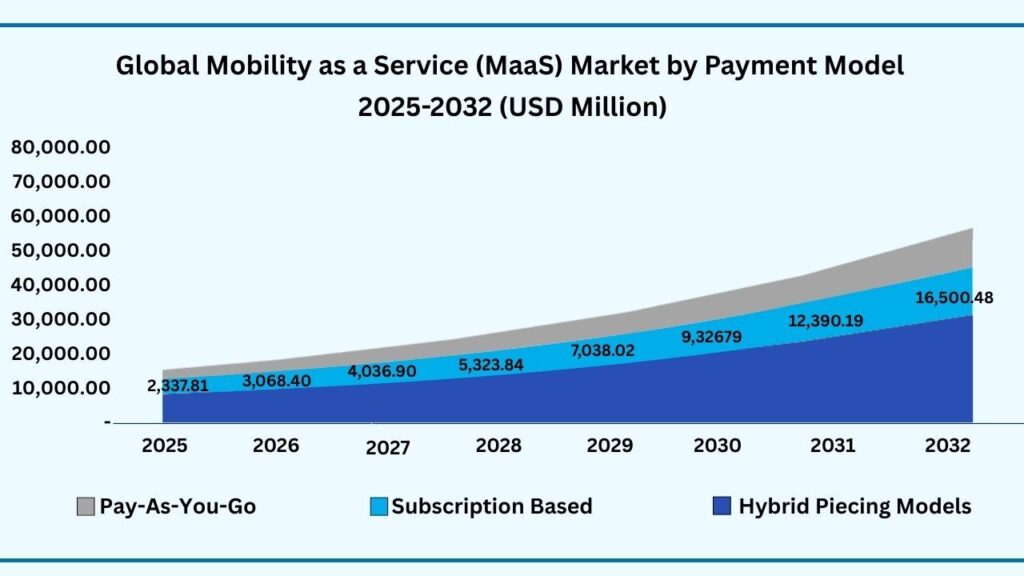

Global Mobility as a Service (MaaS) Market by Payment Model :

On-premise / dedicated fiber segment accounted for the largest market share of share 55.43% in 2024 in the global Mobility as a Service (MaaS) market.

Based on Payment Model , Pay-as-you-go segment held the largest revenue share of 55.43% in the global Mobility as a Service (MaaS) market in 2024 and expected to register a CAGR of 32.07% from 2025 to 2032 is expected to reach USD 37,490.67 million. Based on the payment model, the pay-as-you-go segment dominated the global Mobility as a Service (MaaS) market during the base year, primarily due to its flexibility and ease of adoption among a wide range of users. This model allows consumers to pay only for the trips they take, eliminating long-term commitments and making MaaS accessible to occasional users, daily commuters, and tourists alike. The transparency in pricing and compatibility with digital wallets and in-app payments have further strengthened the appeal of pay-as-you-go mobility solutions.

Over the forecast period, the pay-as-you-go segment is expected to maintain strong growth as urban travelers increasingly prioritize convenience and cost control in their mobility choices. Expanding multimodal integration, real-time fare comparison, and dynamic pricing mechanisms are enhancing the value proposition of this model. Additionally, growing adoption across emerging markets and integration with public transport systems are reinforcing the role of pay-as-you-go pricing as a cornerstone of the evolving MaaS ecosystem.

Global Mobility as a Service (MaaS) Market by Payment Model (USD Million)

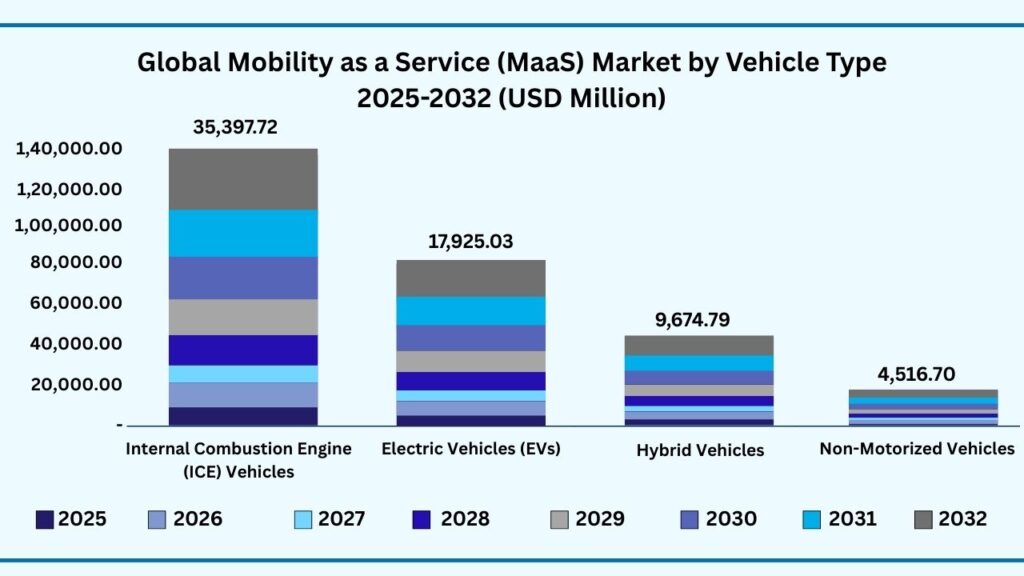

Global Mobility as a Service (MaaS) Market by Vehicle Type Insights:

Internal Combustion Engine (ICE) Vehicles segment accounted for the largest market share of share 52.33% in 2024 in the global Mobility as a Service (MaaS) market.

Based on Vehicle Type segment Internal Combustion Engine (ICE) Vehicles held the largest revenue share of 52.33% in the global Mobility as a Service (MaaS) market in 2024 and expected to register a CAGR of 32.08% from 2025 to 2032 and expected to reach USD 35,397.72 million in 2032. Based on vehicle type, internal combustion engine vehicles accounted for the largest share of the global Mobility as a Service (MaaS) market during the base year, supported by their widespread availability and well-established fueling infrastructure across both developed and emerging economies. A significant portion of existing ride-hailing, car-sharing, and taxi fleets continues to rely on conventional vehicles, enabling rapid service deployment and broad geographic coverage. The lower upfront cost and operational familiarity of these vehicles have further reinforced their dominance within current MaaS ecosystems.

Over the forecast period, the internal combustion engine vehicle segment is expected to experience strong growth as MaaS platforms expand into new cities and underserved regions. Despite the gradual transition toward electrification, conventional vehicles remain critical for meeting immediate mobility demand, particularly in markets with limited electric charging infrastructure. Ongoing fleet optimization, improved fuel efficiency, and integration within multimodal mobility platforms are expected to sustain the relevance of this segment while supporting the overall expansion of the MaaS market.

Global Mobility as a Service (MaaS) by Vehicle Type (USD Million)

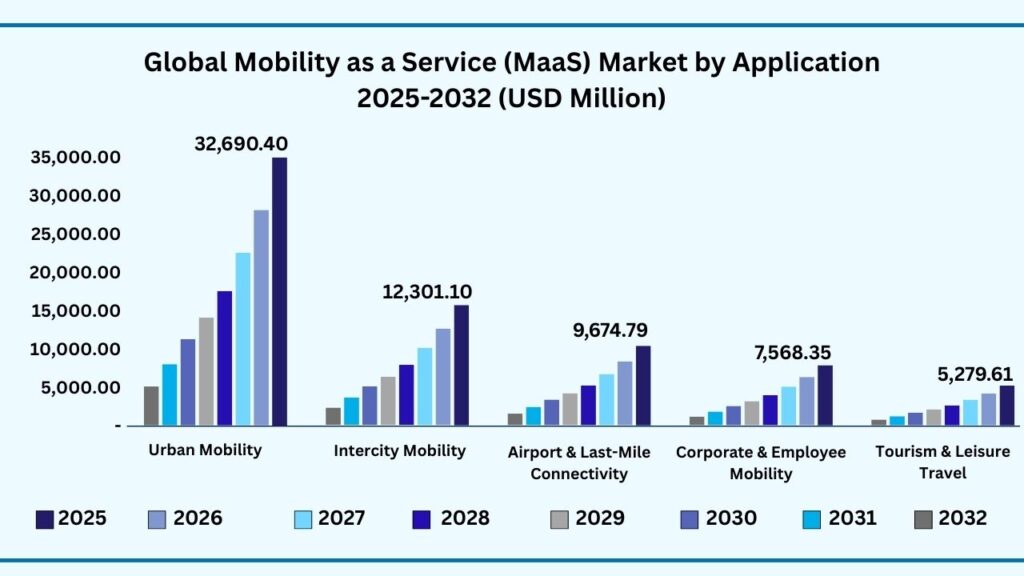

Global Mobility as a Service (MaaS) Market by Application Insights:

Urban Mobility segment accounted for the largest market share of share 48.22% in 2024 in the global Mobility as a Service (MaaS) market.

Based on Application segment Urban Mobility held the largest revenue share of 48.22% in the global Mobility as a Service (MaaS) market in 2024 and expected to register a CAGR of 32.11% from 2025 to 2032 and expected to reach USD 32,690.40 million in 2032. Based on application, urban mobility represented the dominant segment in the global Mobility as a Service (MaaS) market during the base year, driven by high population density, frequent commuting needs, and persistent traffic congestion in metropolitan areas. Daily travel for work, education, and essential services has increased reliance on integrated mobility platforms that combine ride-hailing, public transit, and micromobility options. The growing emphasis on reducing private vehicle usage and improving last-mile connectivity has further strengthened the adoption of MaaS solutions within urban environments.

Over the forecast period, the urban mobility segment is expected to witness sustained and robust growth as cities continue to invest in smart transportation infrastructure and digital mobility platforms. Enhanced real-time traffic management, seamless multimodal integration, and improved user experience are making MaaS an integral part of urban transport planning. As urban centers prioritize sustainability, accessibility, and efficient movement of people, MaaS-enabled urban mobility is set to play a central role in shaping the future of city transportation systems.

Global Mobility as a Service (MaaS) by Application (USD Million)

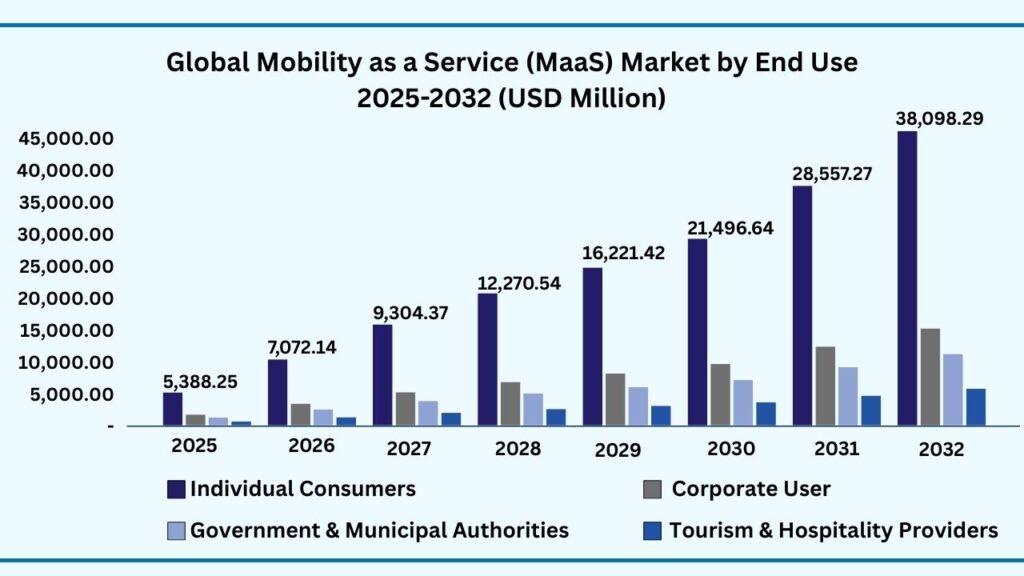

Global Mobility as a Service (MaaS) Market by End Use Insights:

Urban Mobility segment accounted for the largest market share of 56.33% in 2024 in the global Mobility as a Service (MaaS) market.

Based on End Use segment Urban Mobility held the largest revenue share of 56.33% in the global Mobility as a Service (MaaS) market in 2024 and expected to register a CAGR of 32.07% from 2025 to 2032 and expected to reach USD 38,098.29 million in 2032. Based on the end-use segment, urban mobility emerged as the leading contributor to the global Mobility as a Service (MaaS) market during the base year, supported by high daily commuting demand and the concentration of users in metropolitan areas. Urban commuters increasingly rely on MaaS platforms for convenient access to multiple transport modes, including ride-hailing, public transit, and micromobility, through a single digital interface. The need to reduce travel time, manage congestion, and improve accessibility has positioned urban users as the primary drivers of MaaS adoption.

Over the forecast period, the urban mobility end-use segment is expected to demonstrate strong and sustained growth as cities continue to expand and modernize their transportation systems. Smart city initiatives, investments in digital infrastructure, and growing emphasis on sustainable mobility are accelerating the integration of MaaS into urban transport planning. As city authorities and service providers focus on improving mobility efficiency and user experience, urban mobility will remain the dominant end-use segment within the global MaaS ecosystem.

Global Mobility as a Service (MaaS) by End Use (USD Million)

Global Mobility as a Service (MaaS) Market by Region Insights:

Europe segment accounted for the largest market share of share of 34.55% in 2024 in the global Mobility as a Service (MaaS) market.

Based on region, the global Mobility as a Service (MaaS) market is segmented into Europe, Asia-Pacific, North America, Latin America and Middle East & Africa. Among these, Europe region held the largest revenue share of 34.55% in the global Mobility as a Service (MaaS) market in 2024 and expected to reach USD 23,393.69 million in 2032. Based on region, the global Mobility as a Service (MaaS) market is segmented into Europe, Asia-Pacific, North America, Latin America, and the Middle East & Africa. Among these, Europe emerged as the leading regional market during the base year, supported by early adoption of integrated mobility platforms and strong collaboration between public transport authorities and private mobility providers. The region benefits from well-developed public transportation networks, high urban density, and favorable regulatory frameworks that encourage shared mobility, multimodal integration, and sustainable transport solutions.

Looking ahead, Europe is expected to maintain its dominant position as MaaS adoption continues to expand across major cities and secondary urban centers. Ongoing investments in smart city initiatives, digital ticketing, and low-emission transportation are strengthening the MaaS ecosystem across the region. Additionally, strong environmental policies and growing consumer preference for car-free and flexible mobility solutions are further accelerating the uptake of MaaS platforms, reinforcing Europe’s role as a key growth driver in the global market.

Global Mobility as a Service (MaaS) Market by Region (USD Million)

Major Companies and Competitive Landscape

The competitive landscape of the Mobility as a Service (MaaS) market is shaped by a diverse mix of global ride-hailing leaders, mobility platform providers, public transport integrators, automotive companies, and emerging mobility startups. Market participants are focused on building seamless, user-centric platforms that integrate multiple transportation modes, including ride-sharing, public transit, car sharing, and micromobility. Emphasis is placed on real-time data analytics, AI-enabled route optimization, digital payments, and platform interoperability to address growing demand for efficient, flexible, and sustainable urban mobility solutions across residential, corporate, and municipal use cases.

Key players are actively pursuing strategic partnerships with city authorities, transit agencies, automotive OEMs, and technology providers to expand service coverage and enhance ecosystem integration. Competitive strategies center on service differentiation, geographic expansion, improved user experience, and scalable platform architecture. While established companies leverage large user bases and strong brand recognition to drive adoption, new entrants focus on agile deployment models, niche mobility offerings, and innovative pricing structures. This combination of mature market leaders and innovative challengers continues to create a highly competitive and fast-evolving MaaS environment, accelerating innovation and adoption across the global mobility landscape.

Some of the leading companies profiled in the global cultured meat market report include:

- Uber Technologies Inc.

- Lyft Inc.

- DiDi Global Inc.

- Grab Holdings Inc.

- Bolt Technology OU

- BlaBlaCar

- FREE NOW (BMW Group & Mercedes-Benz Mobility)

- Moovit (Intel subsidiary)

- Whim (MaaS Global Ltd.)

- Via Transportation Inc.

Strategic Development

• Uber expanded integration of public transit options — In 2025, Uber broadened its MaaS platform by incorporating public transportation choices in key metropolitan regions to enhance seamless mobility and support multimodal travel experiences.

• Asia Mobiliti signed an MoU with Theoremus — In 2025, Malaysia-based MaaS technology provider Asia Mobiliti entered a memorandum of understanding with European intelligent transport specialist Theoremus to jointly explore and develop advanced mobility solutions across Asia and Eastern Europe.

Scope of Research

| Report Details | Outcome |

|---|---|

| Market size in 2024 | USD 7,305.17 Million |

| CAGR (2024–2032) | 32.20% |

| Revenue forecast to 2033 | USD 67,514.26 Million |

| Base year for estimation | 2024 |

| Historical data | 2019–2023 |

| Forecast period | 2025–2032 |

| Quantitative units | Revenue in USD Million, and CAGR in % from 2025 to 2032 |

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | By Service Type, By Transportation Mode Technology Platform, By Payment Model, By Vehicle Type, By Application, By End Use and By region for 2019 to 2032 |

| Regional scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Country scope | U.S., Canada, Mexico, Germany, France, U.K., Italy, Spain, Benelux, Russia, Finland, Sweden, Rest of Europe, China, India, Japan, South Korea, Indonesia, Thailand, Vietnam, Australia, New Zealand Rest of APAC, Brazil, Rest of LATAM, Saudi Arabia, Rest of MEA |

| Key companies profiled | Uber Technologies Inc., Lyft Inc., DiDi Global Inc., Grab Holdings Inc., Bolt Technology OU, BlaBlaCar, FREE NOW (BMW Group & Mercedes-Benz Mobility), Moovit (Intel subsidiary), Whim (MaaS Global Ltd.), Via Transportation Inc., Gett, Ola Cabs, Citymapper, Transit App Inc., Cabify, Tier Mobility, Lime, Bird Global, Zipcar (Avis Budget Group), Careem (Uber subsidiary) |

| Customization scope | 10 hours of free customization and expert consultation |

Some Key Questions the Report Will Answer

- What is the expected revenue Compound Annual Growth Rate (CAGR) of the global Mobility as a Service (MaaS) market over the forecast period (2025–2032)?

- The global Mobility as a Service (MaaS) market revenue is expected to register a Compound Annual Growth Rate (CAGR) of 32.20% during the forecast period.

- What was the size of the global Mobility as a Service (MaaS) in 2024?

- The global Mobility as a Service (MaaS) market size was USD 7,305.17 Million in 2024.

- Which factors are expected to drive the global Mobility as a Service (MaaS) market growth?

- The global Mobility as a Service (MaaS) market is driven by rising urbanization and congestion, increasing demand for integrated and cost-efficient transportation solutions. Widespread smartphone adoption and digital payment integration are enabling seamless access to multimodal mobility services. Additionally, government initiatives promoting shared mobility, sustainability, and smart city development are accelerating MaaS adoption worldwide.

- Which was the leading segment in the global Mobility as a Service (MaaS) market in terms of Service Type in 2024?

- Ride-hailing & Ride-sharing segment was leading in the Mobility as a Service (MaaS) market on the basis of component in 2024.

- What are some restraints for revenue growth of the global Mobility as a Service (MaaS) market?

- Revenue growth of the global Mobility as a Service (MaaS) market is restrained by fragmented transport ecosystems and limited integration between public and private mobility providers. Data privacy, cybersecurity concerns, and complex regulatory frameworks create operational and compliance challenges for MaaS platforms. Additionally, high infrastructure costs and resistance from traditional transport operators can slow large-scale deployment.

Follow us on: Facebook, Twitter, Instagram and LinkedIn.

Chapter 1. Introduction

1.1. Market Definition

1.2. Objectives of the study

1.3. Overview of Global Mobility as a Service (MaaS) Market Market

1.4. Currency and pricing

1.5. Limitation

1.6. Market s covered

1.7. Research Scope

Chapter 2. Research Methodology

2.1. Research Sources

2.1.1.Primary

2.1.2.Secondary

2.1.3.Paid Sources

2.2. Years considered for the study

2.3. Assumptions

2.3.1.Market value

2.3.2.Market volume

2.3.3.Exchange rate

2.3.4.Price

2.3.5.Economic & political stability

Chapter 3. Executive Summary

3.1. Summary Snapshot, 2019–2032

Chapter 4. Key Insights

4.1. Production consumption analysis

4.2. Strategic partnerships & alliances

4.3. Joint ventures

4.4. Acquisition of local players

4.5. Contract manufacturing

4.6. Digital & e-commerce sales channels

4.7. Compliance with standards

4.8. Value chain analysis

4.9. Raw material sourcing

4.10.Formulation & manufacturing4.11.Distribution & retail

4.12.Import-export analysis

4.13.Brand comparative analysis

4.14.Technological advancements

4.15.Porter’s five force

4.16.Threat of new entrants

4.16.1.1.Capital requirment

4.16.1.2.Product knowledge

4.16.1.3.Technical knowledge

4.16.1.4.Customer relation

4.16.1.5.Access to appliation and technology

4.16.2.Threat of substitutes

4.16.2.1.Cost

4.16.2.2.Performance

4.16.2.3.Availability

4.16.2.4.Technical knowledge

4.16.2.5.Durability

4.16.3.Bargainning power of buyers

4.16.3.1.Numbers of buyers relative to suppliers

4.16.3.2.Product differentiation

4.16.3.3.Threat of forward integration

4.16.3.4.Buyers volume

4.16.4.Bargainning power of suppliers

4.16.4.1.Suppliers concentration

4.16.4.2.Buyers switching cost to other suppliers

4.16.4.3.Threat of backward integration

4.16.5.Bargainning power of suppliers

4.16.5.1.Industry concentration

4.16.5.2.Industry growth rate

4.16.5.3.Product differentiation

4.17.Patent analysis

4.18.Regulation coverage

4.19.Pricing analysis

4.20.Competitive Metric Space Analysis

Chapter 5. Market Overview

5.1. Drivers

5.1.1.Urbanization & Congestion Pressure

5.1.2.Smartphone Penetration & Digital Payments

5.1.3.Government Support for Sustainable Mobility

5.2. Restraints

5.2.1.Fragmented Transport Ecosystems

5.2.2.Data Privacy & Cybersecurity Concerns

5.3. Opportunities

5.3.1.Integration of EVs & Micromobility

5.3.2.AI-Driven Personalization & Analytics

5.3.3.Expansion in Emerging Markets

5.4. Challenges

5.4.1.Regulatory Uncertainty & Policy Shifts

5.4.2.Intense Competition from Single-Mode Platforms

Chapter 6. Global Mobility as a Service (MaaS) Market By Service Type Insights & Trends,

Revenue (USD Million)

6.1. Service Type Dynamics & Market Share, 2019–2032

6.1.1.Ride-hailing & Ride-sharing

6.1.2.Public Transportation (Bus, Metro, Rail, Tram)

6.1.3.Car Sharing

6.1.4.Bike Sharing

6.1.5.Scooter / Micromobility Sharing

6.1.6.Taxi Services

6.1.7.Integrated Multimodal Mobility Packages

Chapter 7. Global Mobility as a Service (MaaS) Market By Transportation Mode Insights &

Trends, Revenue (USD Million)

7.1. Transportation Mode Dynamics & Market Share, 2019–2032

7.1.1.Private Transport

7.1.2.Shared Transport

7.1.3.Public Transport

7.1.4.Micromobility

Chapter 8. Global Mobility as a Service (MaaS) Market By Technology Platform Insights &

Trends, Revenue (USD Million)

8.1. Technology Platform Dynamics & Market Share, 2019–2032

8.1.1.Mobile Applications

8.1.2.Web-Based Platforms

8.1.3.Cloud-Based MaaS Solutions

Chapter 9. Global Mobility as a Service (MaaS) Market By Payment Model Insights & Trends,

Revenue (USD Million)

9.1. Payment Model Dynamics & Market Share, 2019–2032

9.1.1.Pay-as-you-go

9.1.2.Subscription-Based

9.1.3.Hybrid Pricing Models

Chapter 10. Global Mobility as a Service (MaaS) Market By Vehicle Type Insights & Trends,

Revenue (USD Million)

10.1.Vehicle Type Dynamics & Market Share, 2019–2032

10.1.1.Internal Combustion Engine (ICE) Vehicles

10.1.2.Electric Vehicles (EVs)

10.1.3.Hybrid Vehicles

10.1.4.Non-motorized Vehicles

Chapter 11. Global Mobility as a Service (MaaS) Market By Application Insights & Trends,

Revenue (USD Million)

11.1.Application Dynamics & Market Share, 2019–2032

11.1.1.Urban Mobility

11.1.2.Intercity Mobility

11.1.3.Airport & Last-Mile Connectivity

11.1.4.Corporate & Employee Mobility

11.1.5.Tourism & Leisure Travel

Chapter12. Global Mobility as a Service (MaaS) Market By End Use Insights & Trends, Revenue

(USD Million)

12.1.End Use Dynamics & Market Share, 2019–2032

12.1.1.Individual Consumers

12.1.2.Corporate Users

12.1.3.Government & Municipal Authorities

12.1.4.Tourism & Hospitality Providers

Chapter 13. Global Mobility as a Service (MaaS) Market Market Regional Outlook

13.1.Mobility as a Service (MaaS) Market Share By Region, 2019–2032

13.2.North America

13.2.1.North America Market By Service Type Insights & Trends, Revenue (USD Million)

13.2.1.1.Ride-hailing & Ride-sharing

13.2.1.2.Public Transportation (Bus, Metro, Rail, Tram)

13.2.1.3.Car Sharing

13.2.1.4.Bike Sharing

13.2.1.5.Scooter / Micromobility Sharing

13.2.1.6.Taxi Services

13.2.1.7.Integrated Multimodal Mobility Packages

13.2.2.North America Mobility as a Service (MaaS) Market By Transportation Mode Insights & Trends, Revenue (USD Million)

13.2.2.1.Private Transport

13.2.2.2.Shared Transport

13.2.2.3.Public Transport

13.2.2.4.Micromobility

13.2.3.North America Mobility as a Service (MaaS) Market By Technology Platform Insights & Trends, Revenue (USD Million)

13.2.3.1.Mobile Applications

13.2.3.2.Web-Based Platforms

13.2.3.3.Cloud-Based MaaS Solutions

13.2.4.North America Mobility as a Service (MaaS) Market By Payment Model Insights & Trends, Revenue (USD Million)

13.2.4.1.Pay-as-you-go

13.2.4.2.Subscription-Based

13.2.4.3.Hybrid Pricing Models

13.2.5.North America Mobility as a Service (MaaS) Market By Vehicle Type Insights & Trends, Revenue (USD Million)

13.2.5.1.Internal Combustion Engine (ICE) Vehicles

13.2.5.2.Electric Vehicles (EVs)

13.2.5.3.Hybrid Vehicles

13.2.5.4.Non-motorized Vehicles

13.2.6.North America Mobility as a Service (MaaS) Market By Application Insights & Trends, Revenue (USD Million)

13.2.6.1.Urban Mobility

13.2.6.2.Intercity Mobility

13.2.6.3.Airport & Last-Mile Connectivity

13.2.6.4.Corporate & Employee Mobility

13.2.6.5.Tourism & Leisure Travel

13.2.7.North America Mobility as a Service (MaaS) Market By End Use Insights & Trends, Revenue (USD Million)

13.2.7.1.Individual Consumers

13.2.7.2.Corporate Users

13.2.7.3.Government & Municipal Authorities

13.2.7.4.Tourism & Hospitality Providers

13.2.8.North America Market By Country, Market Estimates and Forecast, USD Million, 2025-2032

13.2.8.1.US

13.2.8.2.Canada

13.2.8.3.Mexico

13.3.Europe

13.3.1.Europe Market By Service Type Insights & Trends, Revenue (USD Million)

13.3.1.1.Ride-hailing & Ride-sharing

13.3.1.2.Public Transportation (Bus, Metro, Rail, Tram)

13.3.1.3.Car Sharing

13.3.1.4.Bike Sharing

13.3.1.5.Scooter / Micromobility Sharing

13.3.1.6.Taxi Services

13.3.1.7.Integrated Multimodal Mobility Packages

13.3.2.Europe Mobility as a Service (MaaS) Market By Transportation Mode Insights & Trends, Revenue (USD Million)

13.3.2.1.Private Transport

13.3.2.2.Shared Transport

13.3.2.3.Public Transport

13.3.2.4.Micromobility

13.3.3.Europe Mobility as a Service (MaaS) Market By Technology Platform Insights & Trends, Revenue (USD Million)

13.3.3.1.Mobile Applications

13.3.3.2.Web-Based Platforms

13.3.3.3.Cloud-Based MaaS Solutions

13.3.4.Europe Mobility as a Service (MaaS) Market By Payment Model Insights & Trends, Revenue (USD Million)

13.3.4.1.Pay-as-you-go

13.3.4.2.Subscription-Based

13.3.4.3.Hybrid Pricing Models

13.3.5.Europe Mobility as a Service (MaaS) Market By Vehicle Type Insights & Trends, Revenue (USD Million)

13.3.5.1.Internal Combustion Engine (ICE) Vehicles

13.3.5.2.Electric Vehicles (EVs)

13.3.5.3.Hybrid Vehicles

13.3.5.4.Non-motorized Vehicles

13.3.6.Europe Mobility as a Service (MaaS) Market By Application Insights & Trends, Revenue (USD Million)

13.3.6.1.Urban Mobility

13.3.6.2.Intercity Mobility

13.3.6.3.Airport & Last-Mile Connectivity

13.3.6.4.Corporate & Employee Mobility

13.3.6.5.Tourism & Leisure Travel

13.3.7.Europe Mobility as a Service (MaaS) Market By End Use Insights & Trends, Revenue (USD Million)

13.3.7.1.Individual Consumers

13.3.7.2.Corporate Users

13.3.7.3.Government & Municipal Authorities

13.3.7.4.Tourism & Hospitality Providers

13.3.8.Europe Market By Country, Market Estimates and Forecast, USD Million,

13.3.8.1.Germany

13.3.8.2.France

13.3.8.3.U.K

13.3.8.4.Italy

13.3.8.5.Spain

13.3.8.6.Benelux

13.3.8.7.Russia

13.3.8.8.Finland

13.3.8.9.Sweden

13.3.8.10.Rest Of Europe

13.4.Asia-Pacific

13.4.1.Asia-Pacific Market By Service Type Insights & Trends, Revenue (USD Million)

13.4.1.1.Ride-hailing & Ride-sharing

13.4.1.2.Public Transportation (Bus, Metro, Rail, Tram)

13.4.1.3.Car Sharing

13.4.1.4.Bike Sharing

13.4.1.5.Scooter / Micromobility Sharing

13.4.1.6.Taxi Services

13.4.1.7.Integrated Multimodal Mobility Packages

13.4.2.Asia-Pacific Mobility as a Service (MaaS) Market By Transportation Mode Insights & Trends, Revenue (USD Million)

13.4.2.1.Private Transport

13.4.2.2.Shared Transport

13.4.2.3.Public Transport

13.4.2.4.Micromobility

13.4.3.Asia-Pacific Mobility as a Service (MaaS) Market By Technology Platform Insights & Trends, Revenue (USD Million)

13.4.3.1.Mobile Applications

13.4.3.2.Web-Based Platforms

13.4.3.3.Cloud-Based MaaS Solutions

13.4.4.Asia-Pacific Mobility as a Service (MaaS) Market By Payment Model Insights & Trends, Revenue (USD Million)

13.4.4.1.Pay-as-you-go

13.4.4.2.Subscription-Based

13.4.4.3.Hybrid Pricing Models

13.4.5.Asia-Pacific Mobility as a Service (MaaS) Market By Vehicle Type Insights & Trends, Revenue (USD Million)

13.4.5.1.Internal Combustion Engine (ICE) Vehicles

13.4.5.2.Electric Vehicles (EVs)

13.4.5.3.Hybrid Vehicles

13.4.5.4.Non-motorized Vehicles

13.4.6.Asia-Pacific Mobility as a Service (MaaS) Market By Application Insights & Trends, Revenue (USD Million)

13.4.6.1.Urban Mobility

13.4.6.2.Intercity Mobility

13.4.6.3.Airport & Last-Mile Connectivity

13.4.6.4.Corporate & Employee Mobility

13.4.6.5.Tourism & Leisure Travel

13.4.7.Asia-Pacific Mobility as a Service (MaaS) Market By End Use Insights & Trends, Revenue (USD Million)

13.4.7.1.Individual Consumers

13.4.7.2.Corporate Users

13.4.7.3.Government & Municipal Authorities

13.4.7.4.Tourism & Hospitality Providers

13.4.8.Asia-Pacific Market By Country, Market Estimates and Forecast, USD Million,

13.4.8.1.China

13.4.8.2.India

13.4.8.3.Japan

13.4.8.4.South Korea

13.4.8.5.Indonesia

13.4.8.6.Thailand

13.4.8.7.Vietnam

13.4.8.8.Australia

13.4.8.9.New Zeland

13.4.8.10.Rest of APAC

13.5.Latin America

13.5.1.Latin America Market By Service Type Insights & Trends, Revenue (USD Million)

13.5.1.1.Ride-hailing & Ride-sharing

13.5.1.2.Public Transportation (Bus, Metro, Rail, Tram)

13.5.1.3.Car Sharing

13.5.1.4.Bike Sharing

13.5.1.5.Scooter / Micromobility Sharing

13.5.1.6.Taxi Services

13.5.1.7.Integrated Multimodal Mobility Packages

13.5.2.Latin America Mobility as a Service (MaaS) Market By Transportation Mode Insights & Trends, Revenue (USD Million)

13.5.2.1.Private Transport

13.5.2.2.Shared Transport

13.5.2.3.Public Transport

13.5.2.4.Micromobility

13.5.3.Latin America Mobility as a Service (MaaS) Market By Technology Platform Insights & Trends, Revenue (USD Million)

13.5.3.1.Mobile Applications

13.5.3.2.Web-Based Platforms

13.5.3.3.Cloud-Based MaaS Solutions

13.5.4.North America Mobility as a Service (MaaS) Market By Payment Model Insights & Trends, Revenue (USD Million)

13.5.4.1.Pay-as-you-go

13.5.4.2.Subscription-Based

13.5.4.3.Hybrid Pricing Models

13.5.5.Latin America Mobility as a Service (MaaS) Market By Vehicle Type Insights & Trends, Revenue (USD Million)

13.5.5.1.Internal Combustion Engine (ICE) Vehicles

13.5.5.2.Electric Vehicles (EVs)

13.5.5.3.Hybrid Vehicles

13.5.5.4.Non-motorized Vehicles

13.5.6.Latin America Mobility as a Service (MaaS) Market By Application Insights & Trends, Revenue (USD Million)

13.5.6.1.Urban Mobility

13.5.6.2.Intercity Mobility

13.5.6.3.Airport & Last-Mile Connectivity

13.5.6.4.Corporate & Employee Mobility

13.5.6.5.Tourism & Leisure Travel

13.5.7.Latin America Mobility as a Service (MaaS) Market By End Use Insights & Trends, Revenue (USD Million)

13.5.7.1.Individual Consumers

13.5.7.2.Corporate Users

13.5.7.3.Government & Municipal Authorities

13.5.7.4.Tourism & Hospitality Providers

13.5.8.Latin America Market By Country, Market Estimates and Forecast, USD Million,

13.5.8.1.Brazil

13.5.8.2.Rest of LATAM

13.6.Middle East & Africa

13.6.1.Middle East & Africa Market By Service Type Insights & Trends, Revenue (USD Million)

13.6.1.1.Ride-hailing & Ride-sharing

13.6.1.2.Public Transportation (Bus, Metro, Rail, Tram)

13.6.1.3.Car Sharing

13.6.1.4.Bike Sharing

13.6.1.5.Scooter / Micromobility Sharing

13.6.1.6.Taxi Services

13.6.1.7.Integrated Multimodal Mobility Packages

13.6.2.Middle East & Africa Mobility as a Service (MaaS) Market By TransportationMode Insights & Trends, Revenue (USD Million)

13.6.2.1.Private Transport

13.6.2.2.Shared Transport

13.6.2.3.Public Transport

13.6.2.4.Micromobility

13.6.3.Middle East & Africa Mobility as a Service (MaaS) Market By Technology Platform Insights & Trends, Revenue (USD Million)

13.6.3.1.Mobile Applications

13.6.3.2.Web-Based Platforms

13.6.3.3.Cloud-Based MaaS Solutions

13.6.4.Middle East & Africa Mobility as a Service (MaaS) Market By Payment ModelInsights & Trends, Revenue (USD Million)

13.6.4.1.Pay-as-you-go

13.6.4.2.Subscription-Based

13.6.4.3.Hybrid Pricing Models

13.6.5.Middle East & Africa Mobility as a Service (MaaS) Market By Vehicle Type Insights & Trends, Revenue (USD Million)

13.6.5.1.Internal Combustion Engine (ICE) Vehicles

13.6.5.2.Electric Vehicles (EVs)

13.6.5.3.Hybrid Vehicles

13.6.5.4.Non-motorized Vehicles

13.6.6.Middle East & Africa Mobility as a Service (MaaS) Market By Application Insights & Trends, Revenue (USD Million)

13.6.6.1.Urban Mobility

13.6.6.2.Intercity Mobility

13.6.6.3.Airport & Last-Mile Connectivity

13.6.6.4.Corporate & Employee Mobility

13.6.6.5.Tourism & Leisure Travel

13.6.7.Middle East & Africa Mobility as a Service (MaaS) Market By End Use Insights & Trends, Revenue (USD Million)

13.6.7.1.Individual Consumers

13.6.7.2.Corporate Users

13.6.7.3.Government & Municipal Authorities

13.6.7.4.Tourism & Hospitality Providers

13.6.8.Middle East & Africa Market By Country, Market Estimates and Forecast, USDMillion,

13.6.8.1.Saudi Arabia

13.6.8.2.Rest of MEA

Chapter14. Competitive Landscape

14.1. Market Revenue Share By Manufacturers

14.2. Mergers & Acquisitions

14.3. Competitor’s Positioning

14.4. Strategy Benchmarking

14.5. Vendor Landscape

14.6. Distributors

14.6.1.1.North America

14.6.1.2.Europe

14.6.1.3.Asia Pacific

14.6.1.4.Middle East & Africa

14.6.1.5.Latin America

Chapter 15. Company Profiles

15.1.Uber Technologies Inc.

15.1.1.Company Overview

15.1.2.Product & Service Offerings

15.1.3.Strategic Initiatives

15.1.4.Financials

15.2.Lyft Inc.

15.2.1.Company Overview

15.2.2.Product & Service Offerings

15.2.3.Strategic Initiatives

15.2.4.Financials

15.3.DiDi Global Inc.

15.3.1.Company Overview

15.3.2.Product & Service Offerings

15.3.3.Strategic Initiatives

15.3.4.Financials

15.4.Grab Holdings Inc.

15.4.1.Company Overview

15.4.2.Product & Service Offerings

15.4.3.Strategic Initiatives

15.4.4.Financials

15.5.Bolt Technology OU

15.5.1.Company Overview

15.5.2.Product & Service Offerings

15.5.3.Strategic Initiatives

15.5.4.Financials

15.6.BlaBlaCar

15.6.1.Company Overview

15.6.2.Product & Service Offerings

15.6.3.Strategic Initiatives

15.6.4.Financials

15.7.FREE NOW (BMW Group & Mercedes-Benz Mobility)

15.7.1.Company Overview

15.7.2.Product & Service Offerings

15.7.3.Strategic Initiatives

15.7.4.Financials

15.7.5.Conclusion

15.8.Moovit (Intel subsidiary)

15.8.1.Company Overview

15.8.2.Product & Service Offerings

15.8.3.Strategic Initiatives

15.8.4.Financials

15.8.5.Conclusion

15.9.Whim (MaaS Global Ltd.)

15.9.1.Company Overview

15.9.2.Product & Service Offerings

15.9.3.Strategic Initiatives

15.9.4.Financials

15.9.5.Conclusion

15.10.Via Transportation Inc.

15.10.1.Company Overview

15.10.2.Product & Service Offerings

15.10.3.Strategic Initiatives

15.10.4.Financials

15.10.5.Conclusion

15.11.Gett

15.11.1.Company Overview

15.11.2.Product & Service Offerings

15.11.3.Strategic Initiatives

15.11.4.Financials

15.11.5.Conclusion

15.12.Ola Cabs

15.12.1.Company Overview

15.12.2.Product & Service Offerings

15.12.3.Strategic Initiatives

15.12.4.Financials

15.12.5.Conclusion

15.13.Citymapper

15.13.1.Company Overview

15.13.2.Product & Service Offerings

15.13.3.Strategic Initiatives

15.13.4.Financials

15.13.5.Conclusion

15.14.Transit App Inc.

15.14.1.Company Overview

15.14.2.Product & Service Offerings

15.14.3.Strategic Initiatives

15.14.4.Financials

15.14.5.Conclusion

15.15.Cabify

15.15.1.Company Overview

15.15.2.Product & Service Offerings

15.15.3.Strategic Initiatives

15.15.4.Financials

15.15.5.Conclusion

15.16.Tier Mobility

15.16.1.Company Overview

15.16.2.Produ

15.16.3.ct & Service Offerings

15.16.4.Strategic Initiatives

15.16.5.Financials

15.16.6.Conclusion

15.17.Lime

15.17.1.Company Overview

15.17.2.Product & Service Offerings

15.17.3.Strategic Initiatives

15.17.4.Financials

15.17.5.Conclusion

15.18.Bird Global

15.18.1.Company Overview

15.18.2.Product & Service Offerings

15.18.3.Strategic Initiatives

15.18.4.Financials

15.18.5.Conclusion

15.19.Zipcar (Avis Budget Group)

15.19.1.Company Overview

15.19.2.Product & Service Offerings

15.19.3.Strategic Initiatives

15.19.4.Financials

15.19.5.Conclusion

15.20.Careem (Uber subsidiary)

1.1.1 Company Overview

1.1.2. Product & Service Offerings

1.1.3. Strategic Initiatives

1.1.4. Financials

1.1.5. Conclusion

Segments Covered in Report

For the purpose of this report, Advantia Business Consulting LLP has segmented Global Mobility as a Service (MaaS) Market on the basis of By Service Type, By Transportation Mode Technology Platform, By Payment Model, By Vehicle Type, By Application, By End Use and By region for 2019 to 2032

Global Mobility as a Service (MaaS) Market Systems By Service Type Outlook (Revenue, USD Million)

- Ride-hailing & Ride-sharing

- Public Transportation (Bus, Metro, Rail, Tram)

- Car Sharing

- Bike Sharing

- Scooter / Micromobility Sharing

- Taxi Services

- Integrated Multimodal Mobility Packages

Global Mobility as a Service (MaaS) Market By Transportation Mode Outlook (Revenue, USD Million)

- Private Transport

- Shared Transport

- Public Transport

- Micromobility

Global Mobility as a Service (MaaS) Market By Technology Platform (Revenue, USD Million)

- Mobile Applications

- Web-Based Platforms

- Cloud-Based MaaS Solutions

Global Mobility as a Service (MaaS) Market By Payment Model Outlook, Revenue (USD Million)

- Pay-as-you-go

- Subscription-Based

- Hybrid Pricing Models

Global Mobility as a Service (MaaS) Market By Vehicle Type Outlook, Revenue (USD Million)

- Internal Combustion Engine (ICE) Vehicles

- Electric Vehicles (EVs)

- Hybrid Vehicles

- Non-motorized Vehicles

Global Mobility as a Service (MaaS) Market By Application Use Outlook, Revenue (USD Million)

- Urban Mobility

- Intercity Mobility

- Airport & Last-Mile Connectivity

- Corporate & Employee Mobility

- Tourism & Leisure Travel

Global Mobility as a Service (MaaS) Market By End Use Outlook, Revenue (USD Million)

- Individual Consumers

- Corporate Users

- Government & Municipal Authorities

- Tourism & Hospitality Providers

North America

North America Mobility as a Service (MaaS) Market Systems By Service Type Outlook (Revenue, USD Million)

- Ride-hailing & Ride-sharing

- Public Transportation (Bus, Metro, Rail, Tram)

- Car Sharing

- Bike Sharing

- Scooter / Micromobility Sharing

- Taxi Services

- Integrated Multimodal Mobility Packages

North America Mobility as a Service (MaaS) Market By Transportation Mode Outlook (Revenue, USD Million)

- Private Transport

- Shared Transport

- Public Transport

- Micromobility

North America Mobility as a Service (MaaS) Market By Technology Platform (Revenue, USD Million)

- Mobile Applications

- Web-Based Platforms

- Cloud-Based MaaS Solutions

North America Mobility as a Service (MaaS) Market By Payment Model Outlook, Revenue (USD Million)

- Pay-as-you-go

- Subscription-Based

- Hybrid Pricing Models

North America Mobility as a Service (MaaS) Market By Vehicle Type Outlook, Revenue (USD Million)

- Internal Combustion Engine (ICE) Vehicles

- Electric Vehicles (EVs)

- Hybrid Vehicles

- Non-motorized Vehicles

North America Mobility as a Service (MaaS) Market By Application Use Outlook, Revenue (USD Million)

- Urban Mobility

- Intercity Mobility

- Airport & Last-Mile Connectivity

- Corporate & Employee Mobility

- Tourism & Leisure Travel

North America Mobility as a Service (MaaS) Market By End Use Outlook, Revenue (USD Million)

- Individual Consumers

- Corporate Users

- Government & Municipal Authorities

- Tourism & Hospitality Providers

U.S

U.S Mobility as a Service (MaaS) Market Systems By Service Type Outlook (Revenue, USD Million)

- Ride-hailing & Ride-sharing

- Public Transportation (Bus, Metro, Rail, Tram)

- Car Sharing

- Bike Sharing

- Scooter / Micromobility Sharing

- Taxi Services

- Integrated Multimodal Mobility Packages

U.S Mobility as a Service (MaaS) Market By Transportation Mode Outlook (Revenue, USD Million)

- Private Transport

- Shared Transport

- Public Transport

- Micromobility

U.S Mobility as a Service (MaaS) Market By Technology Platform (Revenue, USD Million)

- Mobile Applications

- Web-Based Platforms

- Cloud-Based MaaS Solutions

U.S Mobility as a Service (MaaS) Market By Payment Model Outlook, Revenue (USD Million)

- Pay-as-you-go

- Subscription-Based

- Hybrid Pricing Models

U.S Mobility as a Service (MaaS) Market By Vehicle Type Outlook, Revenue (USD Million)

- Internal Combustion Engine (ICE) Vehicles

- Electric Vehicles (EVs)

- Hybrid Vehicles

- Non-motorized Vehicles

U.S Mobility as a Service (MaaS) Market By Application Use Outlook, Revenue (USD Million)

- Urban Mobility

- Intercity Mobility

- Airport & Last-Mile Connectivity

- Corporate & Employee Mobility

- Tourism & Leisure Travel

U.S Mobility as a Service (MaaS) Market By End Use Outlook, Revenue (USD Million)

- Individual Consumers

- Corporate Users

- Government & Municipal Authorities

- Tourism & Hospitality Providers

Canada

Canada Mobility as a Service (MaaS) Market Systems By Service Type Outlook (Revenue, USD Million)

- Ride-hailing & Ride-sharing

- Public Transportation (Bus, Metro, Rail, Tram)

- Car Sharing

- Bike Sharing

- Scooter / Micromobility Sharing

- Taxi Services

- Integrated Multimodal Mobility Packages

Canada Mobility as a Service (MaaS) Market By Transportation Mode Outlook (Revenue, USD Million)

- Private Transport

- Shared Transport

- Public Transport

- Micromobility

Canada Mobility as a Service (MaaS) Market By Technology Platform (Revenue, USD Million)

- Mobile Applications

- Web-Based Platforms

- Cloud-Based MaaS Solutions

Canada Mobility as a Service (MaaS) Market By Payment Model Outlook, Revenue (USD Million)

- Pay-as-you-go

- Subscription-Based

- Hybrid Pricing Models

Canada Mobility as a Service (MaaS) Market By Vehicle Type Outlook, Revenue (USD Million)

- Internal Combustion Engine (ICE) Vehicles

- Electric Vehicles (EVs)

- Hybrid Vehicles

- Non-motorized Vehicles

Canada Mobility as a Service (MaaS) Market By Application Use Outlook, Revenue (USD Million)

- Urban Mobility

- Intercity Mobility

- Airport & Last-Mile Connectivity

- Corporate & Employee Mobility

- Tourism & Leisure Travel

Canada Mobility as a Service (MaaS) Market By End Use Outlook, Revenue (USD Million)

- Individual Consumers

- Corporate Users

- Government & Municipal Authorities

- Tourism & Hospitality Providers

Mexico

Mexico Mobility as a Service (MaaS) Market Systems By Service Type Outlook (Revenue, USD Million)

- Ride-hailing & Ride-sharing

- Public Transportation (Bus, Metro, Rail, Tram)

- Car Sharing

- Bike Sharing

- Scooter / Micromobility Sharing

- Taxi Services

- Integrated Multimodal Mobility Packages

Mexico Mobility as a Service (MaaS) Market By Transportation Mode Outlook (Revenue, USD Million)

- Private Transport

- Shared Transport

- Public Transport

- Micromobility

Mexico Mobility as a Service (MaaS) Market By Technology Platform (Revenue, USD Million)

- Mobile Applications

- Web-Based Platforms

- Cloud-Based MaaS Solutions

Mexico Mobility as a Service (MaaS) Market By Payment Model Outlook, Revenue (USD Million)

- Pay-as-you-go

- Subscription-Based

- Hybrid Pricing Models

Mexico Mobility as a Service (MaaS) Market By Vehicle Type Outlook, Revenue (USD Million)

- Internal Combustion Engine (ICE) Vehicles

- Electric Vehicles (EVs)

- Hybrid Vehicles

- Non-motorized Vehicles

Mexico Mobility as a Service (MaaS) Market By Application Use Outlook, Revenue (USD Million)

- Urban Mobility

- Intercity Mobility

- Airport & Last-Mile Connectivity

- Corporate & Employee Mobility

- Tourism & Leisure Travel

Mexico Mobility as a Service (MaaS) Market By End Use Outlook, Revenue (USD Million)

- Individual Consumers

- Corporate Users

- Government & Municipal Authorities

- Tourism & Hospitality Providers

Europe

Europe Mobility as a Service (MaaS) Market Systems By Service Type Outlook (Revenue, USD Million)

- Ride-hailing & Ride-sharing

- Public Transportation (Bus, Metro, Rail, Tram)

- Car Sharing

- Bike Sharing

- Scooter / Micromobility Sharing

- Taxi Services

- Integrated Multimodal Mobility Packages

Europe Mobility as a Service (MaaS) Market By Transportation Mode Outlook (Revenue, USD Million)

- Private Transport

- Shared Transport

- Public Transport

- Micromobility

Europe Mobility as a Service (MaaS) Market By Technology Platform (Revenue, USD Million)

- Mobile Applications

- Web-Based Platforms

- Cloud-Based MaaS Solutions

Europe Mobility as a Service (MaaS) Market By Payment Model Outlook, Revenue (USD Million)

- Pay-as-you-go

- Subscription-Based

- Hybrid Pricing Models

Europe Mobility as a Service (MaaS) Market By Vehicle Type Outlook, Revenue (USD Million)

- Internal Combustion Engine (ICE) Vehicles

- Electric Vehicles (EVs)

- Hybrid Vehicles

- Non-motorized Vehicles

Europe Mobility as a Service (MaaS) Market By Application Use Outlook, Revenue (USD Million)

- Urban Mobility

- Intercity Mobility

- Airport & Last-Mile Connectivity

- Corporate & Employee Mobility

- Tourism & Leisure Travel

Europe Mobility as a Service (MaaS) Market By End Use Outlook, Revenue (USD Million)

- Individual Consumers

- Corporate Users

- Government & Municipal Authorities

- Tourism & Hospitality Providers

Germany

Germany Mobility as a Service (MaaS) Market Systems By Service Type Outlook (Revenue, USD Million)

- Ride-hailing & Ride-sharing

- Public Transportation (Bus, Metro, Rail, Tram)

- Car Sharing

- Bike Sharing

- Scooter / Micromobility Sharing

- Taxi Services

- Integrated Multimodal Mobility Packages

Germany Mobility as a Service (MaaS) Market By Transportation Mode Outlook (Revenue, USD Million)

- Private Transport

- Shared Transport

- Public Transport

- Micromobility

Germany Mobility as a Service (MaaS) Market By Technology Platform (Revenue, USD Million)

- Mobile Applications

- Web-Based Platforms

- Cloud-Based MaaS Solutions

Germany Mobility as a Service (MaaS) Market By Payment Model Outlook, Revenue (USD Million)

- Pay-as-you-go

- Subscription-Based

- Hybrid Pricing Models

Germany Mobility as a Service (MaaS) Market By Vehicle Type Outlook, Revenue (USD Million)

- Internal Combustion Engine (ICE) Vehicles

- Electric Vehicles (EVs)

- Hybrid Vehicles

- Non-motorized Vehicles

Germany Mobility as a Service (MaaS) Market By Application Use Outlook, Revenue (USD Million)

- Urban Mobility

- Intercity Mobility

- Airport & Last-Mile Connectivity

- Corporate & Employee Mobility

- Tourism & Leisure Travel

Germany Mobility as a Service (MaaS) Market By End Use Outlook, Revenue (USD Million)

- Individual Consumers

- Corporate Users

- Government & Municipal Authorities

- Tourism & Hospitality Providers

France

France Mobility as a Service (MaaS) Market Systems By Service Type Outlook (Revenue, USD Million)

- Ride-hailing & Ride-sharing

- Public Transportation (Bus, Metro, Rail, Tram)

- Car Sharing

- Bike Sharing

- Scooter / Micromobility Sharing

- Taxi Services

- Integrated Multimodal Mobility Packages

France Mobility as a Service (MaaS) Market By Transportation Mode Outlook (Revenue, USD Million)

- Private Transport

- Shared Transport

- Public Transport

- Micromobility

France Mobility as a Service (MaaS) Market By Technology Platform (Revenue, USD Million)

- Mobile Applications

- Web-Based Platforms

- Cloud-Based MaaS Solutions

France Mobility as a Service (MaaS) Market By Payment Model Outlook, Revenue (USD Million)

- Pay-as-you-go

- Subscription-Based

- Hybrid Pricing Models

France Mobility as a Service (MaaS) Market By Vehicle Type Outlook, Revenue (USD Million)

- Internal Combustion Engine (ICE) Vehicles

- Electric Vehicles (EVs)

- Hybrid Vehicles

- Non-motorized Vehicles

France Mobility as a Service (MaaS) Market By Application Use Outlook, Revenue (USD Million)

- Urban Mobility

- Intercity Mobility

- Airport & Last-Mile Connectivity

- Corporate & Employee Mobility

- Tourism & Leisure Travel

France Mobility as a Service (MaaS) Market By End Use Outlook, Revenue (USD Million)

- Individual Consumers

- Corporate Users

- Government & Municipal Authorities

- Tourism & Hospitality Providers

Italy

Italy Mobility as a Service (MaaS) Market Systems By Service Type Outlook (Revenue, USD Million)

- Ride-hailing & Ride-sharing

- Public Transportation (Bus, Metro, Rail, Tram)

- Car Sharing

- Bike Sharing

- Scooter / Micromobility Sharing

- Taxi Services

- Integrated Multimodal Mobility Packages

Italy Mobility as a Service (MaaS) Market By Transportation Mode Outlook (Revenue, USD Million)

- Private Transport

- Shared Transport

- Public Transport

- Micromobility

Italy Mobility as a Service (MaaS) Market By Technology Platform (Revenue, USD Million)

- Mobile Applications

- Web-Based Platforms

- Cloud-Based MaaS Solutions

Italy Mobility as a Service (MaaS) Market By Payment Model Outlook, Revenue (USD Million)

- Pay-as-you-go

- Subscription-Based

- Hybrid Pricing Models

Italy Mobility as a Service (MaaS) Market By Vehicle Type Outlook, Revenue (USD Million)

- Internal Combustion Engine (ICE) Vehicles

- Electric Vehicles (EVs)

- Hybrid Vehicles

- Non-motorized Vehicles

Italy Mobility as a Service (MaaS) Market By Application Use Outlook, Revenue (USD Million)

- Urban Mobility

- Intercity Mobility

- Airport & Last-Mile Connectivity

- Corporate & Employee Mobility

- Tourism & Leisure Travel

Italy Mobility as a Service (MaaS) Market By End Use Outlook, Revenue (USD Million)

- Individual Consumers

- Corporate Users

- Government & Municipal Authorities

- Tourism & Hospitality Providers

U.K

U.K Mobility as a Service (MaaS) Market Systems By Service Type Outlook (Revenue, USD Million)

- Ride-hailing & Ride-sharing

- Public Transportation (Bus, Metro, Rail, Tram)

- Car Sharing

- Bike Sharing

- Scooter / Micromobility Sharing

- Taxi Services

- Integrated Multimodal Mobility Packages

U.K Mobility as a Service (MaaS) Market By Transportation Mode Outlook (Revenue, USD Million)

- Private Transport

- Shared Transport

- Public Transport

- Micromobility

U.K Mobility as a Service (MaaS) Market By Technology Platform (Revenue, USD Million)

- Mobile Applications

- Web-Based Platforms

- Cloud-Based MaaS Solutions

U.K Mobility as a Service (MaaS) Market By Payment Model Outlook, Revenue (USD Million)

- Pay-as-you-go

- Subscription-Based

- Hybrid Pricing Models

U.K Mobility as a Service (MaaS) Market By Vehicle Type Outlook, Revenue (USD Million)

- Internal Combustion Engine (ICE) Vehicles

- Electric Vehicles (EVs)

- Hybrid Vehicles

- Non-motorized Vehicles

U.K Mobility as a Service (MaaS) Market By Application Use Outlook, Revenue (USD Million)

- Urban Mobility

- Intercity Mobility

- Airport & Last-Mile Connectivity

- Corporate & Employee Mobility

- Tourism & Leisure Travel

U.K Mobility as a Service (MaaS) Market By End Use Outlook, Revenue (USD Million)

- Individual Consumers

- Corporate Users

- Government & Municipal Authorities

- Tourism & Hospitality Providers

Benelux

Benelux Mobility as a Service (MaaS) Market Systems By Service Type Outlook (Revenue, USD Million)

- Ride-hailing & Ride-sharing

- Public Transportation (Bus, Metro, Rail, Tram)

- Car Sharing

- Bike Sharing

- Scooter / Micromobility Sharing

- Taxi Services

- Integrated Multimodal Mobility Packages

Benelux Mobility as a Service (MaaS) Market By Transportation Mode Outlook (Revenue, USD Million)

- Private Transport

- Shared Transport

- Public Transport

- Micromobility

Benelux Mobility as a Service (MaaS) Market By Technology Platform (Revenue, USD Million)

- Mobile Applications

- Web-Based Platforms

- Cloud-Based MaaS Solutions

Benelux Mobility as a Service (MaaS) Market By Payment Model Outlook, Revenue (USD Million)

- Pay-as-you-go

- Subscription-Based

- Hybrid Pricing Models

Benelux Mobility as a Service (MaaS) Market By Vehicle Type Outlook, Revenue (USD Million)

- Internal Combustion Engine (ICE) Vehicles

- Electric Vehicles (EVs)

- Hybrid Vehicles

- Non-motorized Vehicles

Benelux Mobility as a Service (MaaS) Market By Application Use Outlook, Revenue (USD Million)

- Urban Mobility

- Intercity Mobility

- Airport & Last-Mile Connectivity

- Corporate & Employee Mobility

- Tourism & Leisure Travel

Benelux Mobility as a Service (MaaS) Market By End Use Outlook, Revenue (USD Million)

- Individual Consumers

- Corporate Users

- Government & Municipal Authorities

- Tourism & Hospitality Providers

Russia

Russia Mobility as a Service (MaaS) Market Systems By Service Type Outlook (Revenue, USD Million)

- Ride-hailing & Ride-sharing

- Public Transportation (Bus, Metro, Rail, Tram)

- Car Sharing

- Bike Sharing

- Scooter / Micromobility Sharing

- Taxi Services

- Integrated Multimodal Mobility Packages

Russia Mobility as a Service (MaaS) Market By Transportation Mode Outlook (Revenue, USD Million)

- Private Transport

- Shared Transport

- Public Transport

- Micromobility

Russia Mobility as a Service (MaaS) Market By Technology Platform (Revenue, USD Million)

- Mobile Applications

- Web-Based Platforms

- Cloud-Based MaaS Solutions

Russia Mobility as a Service (MaaS) Market By Payment Model Outlook, Revenue (USD Million)

- Pay-as-you-go

- Subscription-Based

- Hybrid Pricing Models

Russia Mobility as a Service (MaaS) Market By Vehicle Type Outlook, Revenue (USD Million)

- Internal Combustion Engine (ICE) Vehicles

- Electric Vehicles (EVs)

- Hybrid Vehicles

- Non-motorized Vehicles

Russia Mobility as a Service (MaaS) Market By Application Use Outlook, Revenue (USD Million)

- Urban Mobility

- Intercity Mobility

- Airport & Last-Mile Connectivity

- Corporate & Employee Mobility

- Tourism & Leisure Travel

Russia Mobility as a Service (MaaS) Market By End Use Outlook, Revenue (USD Million)

- Individual Consumers

- Corporate Users

- Government & Municipal Authorities

- Tourism & Hospitality Providers

Finland

Finland Mobility as a Service (MaaS) Market Systems By Service Type Outlook (Revenue, USD Million)

- Ride-hailing & Ride-sharing

- Public Transportation (Bus, Metro, Rail, Tram)

- Car Sharing

- Bike Sharing

- Scooter / Micromobility Sharing

- Taxi Services

- Integrated Multimodal Mobility Packages

Finland Mobility as a Service (MaaS) Market By Transportation Mode Outlook (Revenue, USD Million)

- Private Transport

- Shared Transport

- Public Transport

- Micromobility

Finland Mobility as a Service (MaaS) Market By Technology Platform (Revenue, USD Million)

- Mobile Applications

- Web-Based Platforms

- Cloud-Based MaaS Solutions

Finland Mobility as a Service (MaaS) Market By Payment Model Outlook, Revenue (USD Million)

- Pay-as-you-go

- Subscription-Based

- Hybrid Pricing Models

Finland Mobility as a Service (MaaS) Market By Vehicle Type Outlook, Revenue (USD Million)

- Internal Combustion Engine (ICE) Vehicles

- Electric Vehicles (EVs)

- Hybrid Vehicles

- Non-motorized Vehicles

Finland Mobility as a Service (MaaS) Market By Application Use Outlook, Revenue (USD Million)

- Urban Mobility

- Intercity Mobility

- Airport & Last-Mile Connectivity

- Corporate & Employee Mobility

- Tourism & Leisure Travel

Finland Mobility as a Service (MaaS) Market By End Use Outlook, Revenue (USD Million)

- Individual Consumers

- Corporate Users

- Government & Municipal Authorities

- Tourism & Hospitality Providers

Sweden

Sweden Mobility as a Service (MaaS) Market Systems By Service Type Outlook (Revenue, USD Million)

- Ride-hailing & Ride-sharing

- Public Transportation (Bus, Metro, Rail, Tram)

- Car Sharing

- Bike Sharing

- Scooter / Micromobility Sharing

- Taxi Services

- Integrated Multimodal Mobility Packages

Sweden Mobility as a Service (MaaS) Market By Transportation Mode Outlook (Revenue, USD Million)

- Private Transport

- Shared Transport

- Public Transport

- Micromobility

Sweden Mobility as a Service (MaaS) Market By Technology Platform (Revenue, USD Million)

- Mobile Applications

- Web-Based Platforms

- Cloud-Based MaaS Solutions

Sweden Mobility as a Service (MaaS) Market By Payment Model Outlook, Revenue (USD Million)

- Pay-as-you-go

- Subscription-Based

- Hybrid Pricing Models

Sweden Mobility as a Service (MaaS) Market By Vehicle Type Outlook, Revenue (USD Million)

- Internal Combustion Engine (ICE) Vehicles

- Electric Vehicles (EVs)

- Hybrid Vehicles

- Non-motorized Vehicles

Sweden Mobility as a Service (MaaS) Market By Application Use Outlook, Revenue (USD Million)

- Urban Mobility

- Intercity Mobility

- Airport & Last-Mile Connectivity

- Corporate & Employee Mobility

- Tourism & Leisure Travel

Sweden Mobility as a Service (MaaS) Market By End Use Outlook, Revenue (USD Million)

- Individual Consumers

- Corporate Users

- Government & Municipal Authorities

- Tourism & Hospitality Providers

Rest of Europe

Rest of Europe Mobility as a Service (MaaS) Market Systems By Service Type Outlook (Revenue, USD Million)

- Ride-hailing & Ride-sharing

- Public Transportation (Bus, Metro, Rail, Tram)

- Car Sharing

- Bike Sharing

- Scooter / Micromobility Sharing

- Taxi Services

- Integrated Multimodal Mobility Packages

Rest of Europe Mobility as a Service (MaaS) Market By Transportation Mode Outlook (Revenue, USD Million)

- Private Transport

- Shared Transport

- Public Transport

- Micromobility

Rest of Europe Mobility as a Service (MaaS) Market By Technology Platform (Revenue, USD Million)

- Mobile Applications

- Web-Based Platforms

- Cloud-Based MaaS Solutions

Rest of Europe Mobility as a Service (MaaS) Market By Payment Model Outlook, Revenue (USD Million)

- Pay-as-you-go

- Subscription-Based

- Hybrid Pricing Models

Rest of Europe Mobility as a Service (MaaS) Market By Vehicle Type Outlook, Revenue (USD Million)

- Internal Combustion Engine (ICE) Vehicles

- Electric Vehicles (EVs)

- Hybrid Vehicles

- Non-motorized Vehicles

Rest of Europe Mobility as a Service (MaaS) Market By Application Use Outlook, Revenue (USD Million)

- Urban Mobility

- Intercity Mobility

- Airport & Last-Mile Connectivity

- Corporate & Employee Mobility

- Tourism & Leisure Travel

Rest of Europe Mobility as a Service (MaaS) Market By End Use Outlook, Revenue (USD Million)

- Individual Consumers

- Corporate Users

- Government & Municipal Authorities

- Tourism & Hospitality Providers

Asia-Pacific

Asia-Pacific Mobility as a Service (MaaS) Market Systems By Service Type Outlook (Revenue, USD Million)

- Ride-hailing & Ride-sharing

- Public Transportation (Bus, Metro, Rail, Tram)

- Car Sharing

- Bike Sharing

- Scooter / Micromobility Sharing

- Taxi Services

- Integrated Multimodal Mobility Packages

Asia-Pacific Mobility as a Service (MaaS) Market By Transportation Mode Outlook (Revenue, USD Million)

- Private Transport

- Shared Transport

- Public Transport

- Micromobility

Asia-Pacific Mobility as a Service (MaaS) Market By Technology Platform (Revenue, USD Million)

- Mobile Applications

- Web-Based Platforms

- Cloud-Based MaaS Solutions

Asia-Pacific Mobility as a Service (MaaS) Market By Payment Model Outlook, Revenue (USD Million)

- Pay-as-you-go

- Subscription-Based

- Hybrid Pricing Models

Asia-Pacific Mobility as a Service (MaaS) Market By Vehicle Type Outlook, Revenue (USD Million)

- Internal Combustion Engine (ICE) Vehicles

- Electric Vehicles (EVs)

- Hybrid Vehicles

- Non-motorized Vehicles

Asia-Pacific Mobility as a Service (MaaS) Market By Application Use Outlook, Revenue (USD Million)

- Urban Mobility

- Intercity Mobility

- Airport & Last-Mile Connectivity

- Corporate & Employee Mobility

- Tourism & Leisure Travel

Asia-Pacific Mobility as a Service (MaaS) Market By End Use Outlook, Revenue (USD Million)

- Individual Consumers

- Corporate Users

- Government & Municipal Authorities

- Tourism & Hospitality Providers

China

China Mobility as a Service (MaaS) Market Systems By Service Type Outlook (Revenue, USD Million)

- Ride-hailing & Ride-sharing

- Public Transportation (Bus, Metro, Rail, Tram)

- Car Sharing

- Bike Sharing

- Scooter / Micromobility Sharing

- Taxi Services

- Integrated Multimodal Mobility Packages

China Mobility as a Service (MaaS) Market By Transportation Mode Outlook (Revenue, USD Million)

- Private Transport

- Shared Transport

- Public Transport

- Micromobility

China Mobility as a Service (MaaS) Market By Technology Platform (Revenue, USD Million)

- Mobile Applications

- Web-Based Platforms

- Cloud-Based MaaS Solutions

China Mobility as a Service (MaaS) Market By Payment Model Outlook, Revenue (USD Million)

- Pay-as-you-go

- Subscription-Based

- Hybrid Pricing Models

China Mobility as a Service (MaaS) Market By Vehicle Type Outlook, Revenue (USD Million)

- Internal Combustion Engine (ICE) Vehicles

- Electric Vehicles (EVs)

- Hybrid Vehicles

- Non-motorized Vehicles

China Mobility as a Service (MaaS) Market By Application Use Outlook, Revenue (USD Million)

- Urban Mobility

- Intercity Mobility

- Airport & Last-Mile Connectivity

- Corporate & Employee Mobility

- Tourism & Leisure Travel

China Mobility as a Service (MaaS) Market By End Use Outlook, Revenue (USD Million)

- Individual Consumers

- Corporate Users

- Government & Municipal Authorities

- Tourism & Hospitality Providers

India

India Mobility as a Service (MaaS) Market Systems By Service Type Outlook (Revenue, USD Million)

- Ride-hailing & Ride-sharing

- Public Transportation (Bus, Metro, Rail, Tram)

- Car Sharing

- Bike Sharing

- Scooter / Micromobility Sharing

- Taxi Services

- Integrated Multimodal Mobility Packages

India Mobility as a Service (MaaS) Market By Transportation Mode Outlook (Revenue, USD Million)

- Private Transport

- Shared Transport

- Public Transport

- Micromobility

India Mobility as a Service (MaaS) Market By Technology Platform (Revenue, USD Million)

- Mobile Applications

- Web-Based Platforms

- Cloud-Based MaaS Solutions

India Mobility as a Service (MaaS) Market By Payment Model Outlook, Revenue (USD Million)

- Pay-as-you-go

- Subscription-Based

- Hybrid Pricing Models

India Mobility as a Service (MaaS) Market By Vehicle Type Outlook, Revenue (USD Million)

- Internal Combustion Engine (ICE) Vehicles

- Electric Vehicles (EVs)

- Hybrid Vehicles

- Non-motorized Vehicles

India Mobility as a Service (MaaS) Market By Application Use Outlook, Revenue (USD Million)

- Urban Mobility

- Intercity Mobility

- Airport & Last-Mile Connectivity

- Corporate & Employee Mobility

- Tourism & Leisure Travel

India Mobility as a Service (MaaS) Market By End Use Outlook, Revenue (USD Million)

- Individual Consumers

- Corporate Users

- Government & Municipal Authorities

- Tourism & Hospitality Providers

Japan

Japan Mobility as a Service (MaaS) Market Systems By Service Type Outlook (Revenue, USD Million)

- Ride-hailing & Ride-sharing

- Public Transportation (Bus, Metro, Rail, Tram)

- Car Sharing

- Bike Sharing

- Scooter / Micromobility Sharing

- Taxi Services

- Integrated Multimodal Mobility Packages

Japan Mobility as a Service (MaaS) Market By Transportation Mode Outlook (Revenue, USD Million)

- Private Transport

- Shared Transport

- Public Transport

- Micromobility

Japan Mobility as a Service (MaaS) Market By Technology Platform (Revenue, USD Million)

- Mobile Applications

- Web-Based Platforms

- Cloud-Based MaaS Solutions

Japan Mobility as a Service (MaaS) Market By Payment Model Outlook, Revenue (USD Million)

- Pay-as-you-go

- Subscription-Based

- Hybrid Pricing Models

Japan Mobility as a Service (MaaS) Market By Vehicle Type Outlook, Revenue (USD Million)

- Internal Combustion Engine (ICE) Vehicles

- Electric Vehicles (EVs)

- Hybrid Vehicles

- Non-motorized Vehicles

Japan Mobility as a Service (MaaS) Market By Application Use Outlook, Revenue (USD Million)

- Urban Mobility

- Intercity Mobility

- Airport & Last-Mile Connectivity

- Corporate & Employee Mobility

- Tourism & Leisure Travel

Japan Mobility as a Service (MaaS) Market By End Use Outlook, Revenue (USD Million)

- Individual Consumers

- Corporate Users

- Government & Municipal Authorities

- Tourism & Hospitality Providers

Indonesia

Indonesia Mobility as a Service (MaaS) Market Systems By Service Type Outlook (Revenue, USD Million)

- Ride-hailing & Ride-sharing

- Public Transportation (Bus, Metro, Rail, Tram)

- Car Sharing

- Bike Sharing

- Scooter / Micromobility Sharing

- Taxi Services

- Integrated Multimodal Mobility Packages

Indonesia Mobility as a Service (MaaS) Market By Transportation Mode Outlook (Revenue, USD Million)

- Private Transport

- Shared Transport

- Public Transport

- Micromobility

Indonesia Mobility as a Service (MaaS) Market By Technology Platform (Revenue, USD Million)

- Mobile Applications

- Web-Based Platforms

- Cloud-Based MaaS Solutions

Indonesia Mobility as a Service (MaaS) Market By Payment Model Outlook, Revenue (USD Million)

- Pay-as-you-go

- Subscription-Based

- Hybrid Pricing Models

Indonesia Mobility as a Service (MaaS) Market By Vehicle Type Outlook, Revenue (USD Million)

- Internal Combustion Engine (ICE) Vehicles

- Electric Vehicles (EVs)

- Hybrid Vehicles

- Non-motorized Vehicles

Indonesia Mobility as a Service (MaaS) Market By Application Use Outlook, Revenue (USD Million)

- Urban Mobility

- Intercity Mobility

- Airport & Last-Mile Connectivity

- Corporate & Employee Mobility

- Tourism & Leisure Travel

Indonesia Mobility as a Service (MaaS) Market By End Use Outlook, Revenue (USD Million)

- Individual Consumers

- Corporate Users

- Government & Municipal Authorities

- Tourism & Hospitality Providers

Thailand

Thailand Mobility as a Service (MaaS) Market Systems By Service Type Outlook (Revenue, USD Million)

- Ride-hailing & Ride-sharing

- Public Transportation (Bus, Metro, Rail, Tram)

- Car Sharing

- Bike Sharing

- Scooter / Micromobility Sharing

- Taxi Services

- Integrated Multimodal Mobility Packages

Thailand Mobility as a Service (MaaS) Market By Transportation Mode Outlook (Revenue, USD Million)

- Private Transport

- Shared Transport

- Public Transport

- Micromobility

Thailand Mobility as a Service (MaaS) Market By Technology Platform (Revenue, USD Million)

- Mobile Applications

- Web-Based Platforms

- Cloud-Based MaaS Solutions

Thailand Mobility as a Service (MaaS) Market By Payment Model Outlook, Revenue (USD Million)

- Pay-as-you-go

- Subscription-Based

- Hybrid Pricing Models

Thailand Mobility as a Service (MaaS) Market By Vehicle Type Outlook, Revenue (USD Million)

- Internal Combustion Engine (ICE) Vehicles

- Electric Vehicles (EVs)

- Hybrid Vehicles

- Non-motorized Vehicles

Thailand Mobility as a Service (MaaS) Market By Application Use Outlook, Revenue (USD Million)

- Urban Mobility

- Intercity Mobility

- Airport & Last-Mile Connectivity

- Corporate & Employee Mobility

- Tourism & Leisure Travel

Thailand Mobility as a Service (MaaS) Market By End Use Outlook, Revenue (USD Million)

- Individual Consumers

- Corporate Users

- Government & Municipal Authorities

- Tourism & Hospitality Providers

Vietnam

Vietnam Mobility as a Service (MaaS) Market Systems By Service Type Outlook (Revenue, USD Million)

- Ride-hailing & Ride-sharing

- Public Transportation (Bus, Metro, Rail, Tram)

- Car Sharing

- Bike Sharing

- Scooter / Micromobility Sharing

- Taxi Services

- Integrated Multimodal Mobility Packages

Vietnam Mobility as a Service (MaaS) Market By Transportation Mode Outlook (Revenue, USD Million)

- Private Transport

- Shared Transport

- Public Transport

- Micromobility

Vietnam Mobility as a Service (MaaS) Market By Technology Platform (Revenue, USD Million)

- Mobile Applications

- Web-Based Platforms

- Cloud-Based MaaS Solutions

Vietnam Mobility as a Service (MaaS) Market By Payment Model Outlook, Revenue (USD Million)

- Pay-as-you-go

- Subscription-Based

- Hybrid Pricing Models

Vietnam Mobility as a Service (MaaS) Market By Vehicle Type Outlook, Revenue (USD Million)

- Internal Combustion Engine (ICE) Vehicles

- Electric Vehicles (EVs)

- Hybrid Vehicles

- Non-motorized Vehicles

Vietnam Mobility as a Service (MaaS) Market By Application Use Outlook, Revenue (USD Million)

- Urban Mobility

- Intercity Mobility

- Airport & Last-Mile Connectivity

- Corporate & Employee Mobility

- Tourism & Leisure Travel

Vietnam Mobility as a Service (MaaS) Market By End Use Outlook, Revenue (USD Million)

- Individual Consumers

- Corporate Users

- Government & Municipal Authorities