Market Synopsis

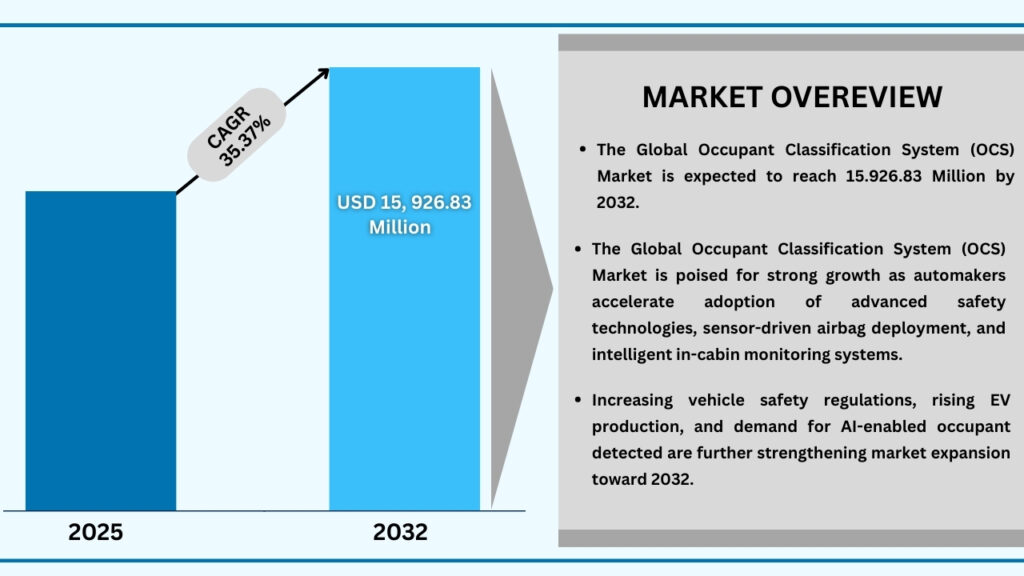

The Occupant Classification System (OCS) Market size was USD 1,426.56 Million in 2024 and is expected to reach USD 15,926.83 million in 20232 at a CAGR of 35.37% during the forecast period.

Rising Global Emphasis on Advanced In-Cabin Safety Intelligence

Stringent vehicle safety norms, coupled with rising consumer expectations for intelligent cabin technologies, are accelerating the adoption of occupant classification systems (OCS) worldwide. Automakers, regulatory bodies, and fleet operators increasingly rely on OCS to enhance crash protection, optimize airbag deployment, and support next-generation ADAS and IVI functionalities. As global mandates focus on reducing fatalities and ensuring child occupant safety, OCS has become a central pillar of automotive safety innovation—driving rapid market expansion across passenger and commercial vehicles.

Widespread Integration Across Automotive OEMs, Mobility Services & Commercial Fleets

Leading automotive manufacturers are embedding OCS within advanced restraint control units to meet compliance requirements and deliver adaptive occupant protection. Ride-hailing fleets and shared mobility platforms leverage OCS for real-time passenger monitoring, safety tracking, and operational analytics. Meanwhile, logistics operators and commercial truck manufacturers adopt OCS to support driver fatigue detection, seatbelt monitoring, and cabin compliance. This cross-sector integration extends the relevance of OCS far beyond traditional passive safety systems, fueling broad-based demand.

Growing Need for Smart, Real-Time Occupant Sensing Architectures

As vehicle cabins evolve into intelligent, connected ecosystems, traditional weight-detection sensors are no longer sufficient. Modern OCS platforms integrate pressure mapping, camera-based vision analytics, and AI-driven classification algorithms to precisely identify passenger size, posture, and presence. These high-assurance sensing frameworks enable accurate airbag deployment logic, personalized infotainment experiences, and enhanced child presence detection. The shift toward fully autonomous and semi-autonomous vehicles amplifies the need for robust, tamper-proof occupant sensing—propelling OCS adoption across premium and mass-market segments.

Advances in Sensor Fusion, AI Vision & Embedded Safety Electronics

Rapid progress in edge AI processing, multi-modal sensor fusion, and low-power embedded controllers is reshaping the future of OCS. Innovations such as high-resolution 3D imaging, seat-integrated radar, and infrared-based occupant detection significantly improve classification accuracy and environmental adaptability. Standardization efforts around Euro NCAP, NHTSA, and global vehicle safety frameworks further accelerate OEM integration. The convergence of AI-enabled detection algorithms with next-gen safety electronics is creating a scalable, high-performance ecosystem that strengthens the global OCS market.

Global Occupant Classification System (OCS) Market (USD Million)

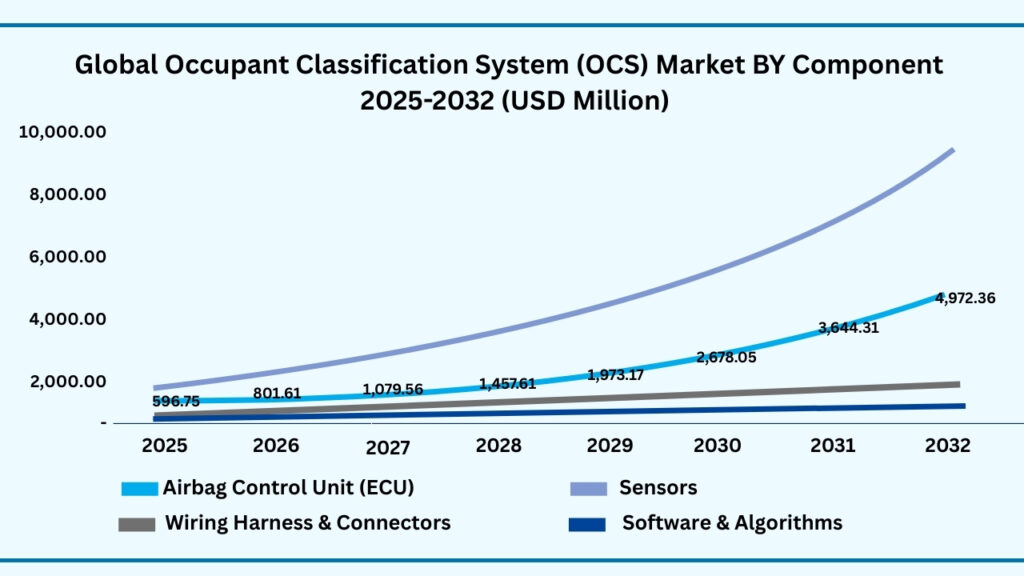

Global Occupant Classification System (OCS) Market by Component Insights:

Sensors segment accounted for market share of share 58.55% in 2024 in the global cultured meat market.

The Sensors segment accounted for the largest share of the global Occupant Classification System (OCS) market in 2024, representing 58.55% of total revenues. Soft Systems (QKD HW) segment is expected to register a CAGR of 35.41% during the forecast year from 2025 to 2032. The sensors segment dominated the global Occupant Classification System (OCS) market in 2024, driven by the growing need for precise, real-time detection of passenger presence, weight, and posture inside vehicle cabins. Automakers are increasingly integrating advanced pressure sensors, seat-mounted load cells, and vision-based detectors to enhance airbag deployment accuracy and meet stringent global safety norms. As vehicles transition toward intelligent and connected cabin environments, sensor-based OCS platforms are becoming foundational to ensuring occupant safety, improving crash mitigation outcomes, and supporting child seat recognition functionalities across passenger and commercial vehicles.

Meanwhile, the soft systems category is poised for exceptional growth throughout the forecast period as automotive manufacturers embrace smarter, AI-enabled occupant sensing and classification technologies. These software-driven systems enhance decision-making capabilities by combining multi-modal sensor inputs with machine-learning algorithms to deliver highly adaptive, tamper-resistant safety responses. With rising demand for advanced driver-assistance systems, autonomous mobility solutions, and personalized in-cabin experiences, software-centric OCS architectures are emerging as a preferred option for future-ready vehicle platforms, reshaping long-term market dynamics.

Global Occupant Classification System (OCS) Market by Component (USD Million)

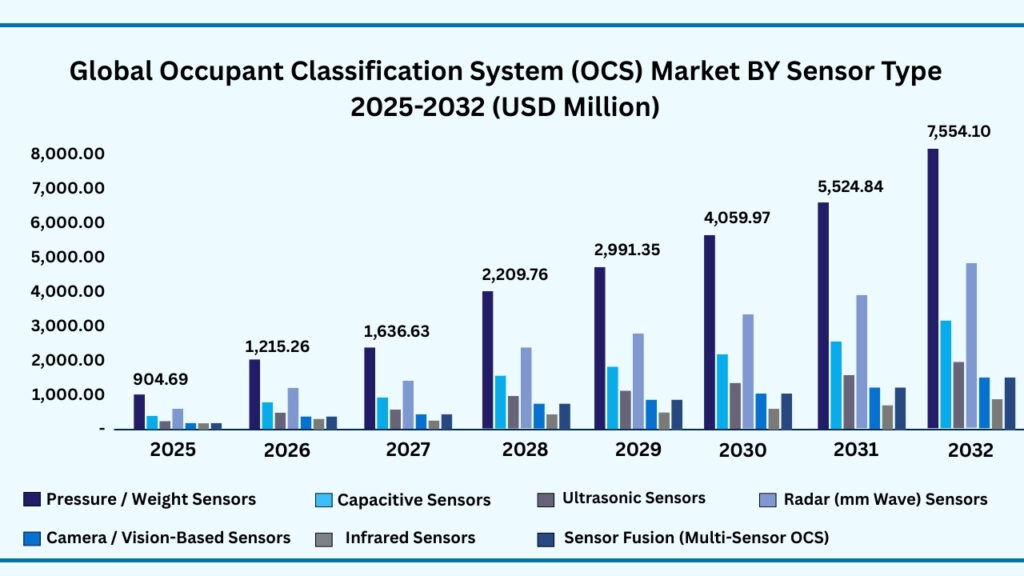

Global Occupant Classification System (OCS) Market by Sensor Type Insights:

Pressure / Weight Sensors segment accounted for the largest market share of share 47.33% in 2024 in the global Occupant Classification System (OCS) market.

Based on the Sensor Type, Pressure / Weight Sensors held the largest revenue share of 47.33% 2024, and expected to register a CAGR of 35.42% between 2025 to 2032 and the market is expected to reach USD 7,554.10 million by 2032. Pressure and weight sensors formed the dominant segment within the global Occupant Classification System (OCS) market in 2024, supported by their crucial role in accurately detecting occupant presence, distribution, and seating posture. These sensors enable automakers to optimize airbag deployment, improve crash protection, and ensure compliance with evolving global safety regulations. Their reliability, cost-effectiveness, and seamless integration into standard seating architectures have positioned them as an essential component across both mass-market and premium vehicle platforms, strengthening their overall market influence.

Looking ahead, this segment is set to experience strong and consistent growth as advancements in sensor miniaturization, material engineering, and AI-assisted signal processing continue to elevate performance standards. Automakers are increasingly adopting next-generation pressure-sensing technologies to support intelligent cabin functions, child presence detection, and adaptive restraint systems that align with the shift toward autonomous and semi-autonomous mobility. With rising emphasis on high-accuracy occupant monitoring and future-proof safety frameworks, pressure and weight sensors are expected to remain a key driver of technology adoption across global OCS applications.

Global Occupant Classification System (OCS) Market by Sensor Type (USD Million)

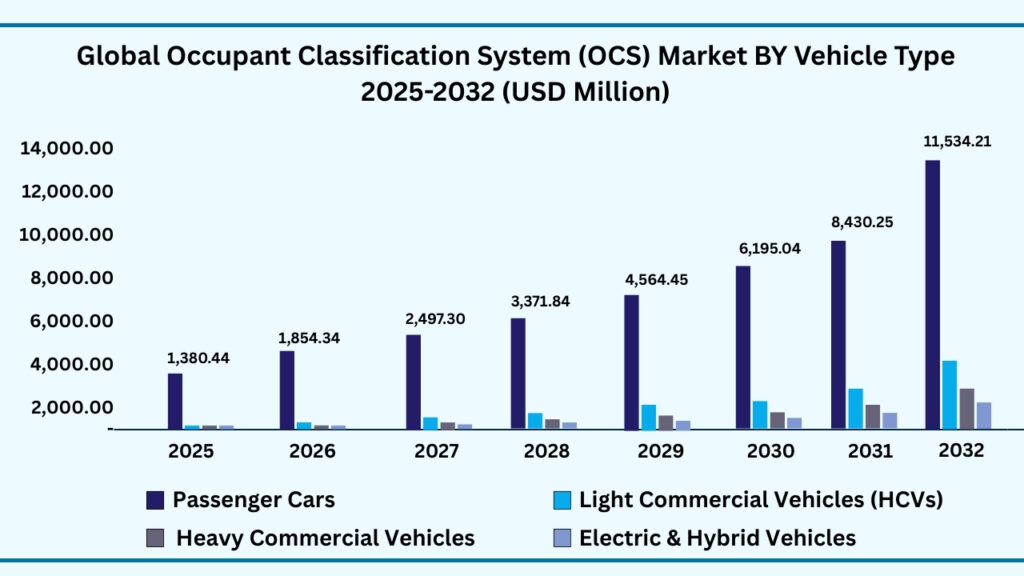

Global Occupant Classification System (OCS) Maret by Vehicle Type Insights:

Passenger Cars segment accounted for the largest market share of share 72.22% in 2024 in the global Occupant Classification System (OCS) market.

Based on Vehicle Type , Passenger Cars segment held the largest revenue share of 72.22% in the global Occupant Classification System (OCS) market in 2024 and expected to register a CAGR of 35.43% from 2025 to 2032 and expected to reach USD 11,534.21 million. The passenger cars segment led the global Occupant Classification System (OCS) market in 2024, driven by rapid advancements in in-cabin safety technologies and the growing integration of intelligent sensing systems across mid-range and premium vehicles. Automakers are prioritizing enhanced occupant protection features to meet stringent regulatory standards and rising consumer expectations for safer, smarter mobility experiences. As a result, OCS has become a standard component in most modern passenger vehicles, enabling precise airbag deployment, child seat detection, and advanced passenger monitoring capabilities that significantly improve overall crash safety performance.

Over the forecast period, the passenger cars category is poised to experience strong and sustained growth as manufacturers continue to adopt AI-enabled occupant detection, sensor fusion platforms, and adaptive safety architectures. The transition toward connected, semi-autonomous, and autonomous vehicles further strengthens the need for robust occupant classification systems capable of analyzing seating behavior, posture variations, and in-cabin risk factors in real time. With continued regulatory push and increasing emphasis on personalized and predictive safety systems, the passenger car segment will remain a major contributor to overall OCS market expansion in the coming years.

Global Occupant Classification System (OCS) Market by Vehicle Type (USD Million)

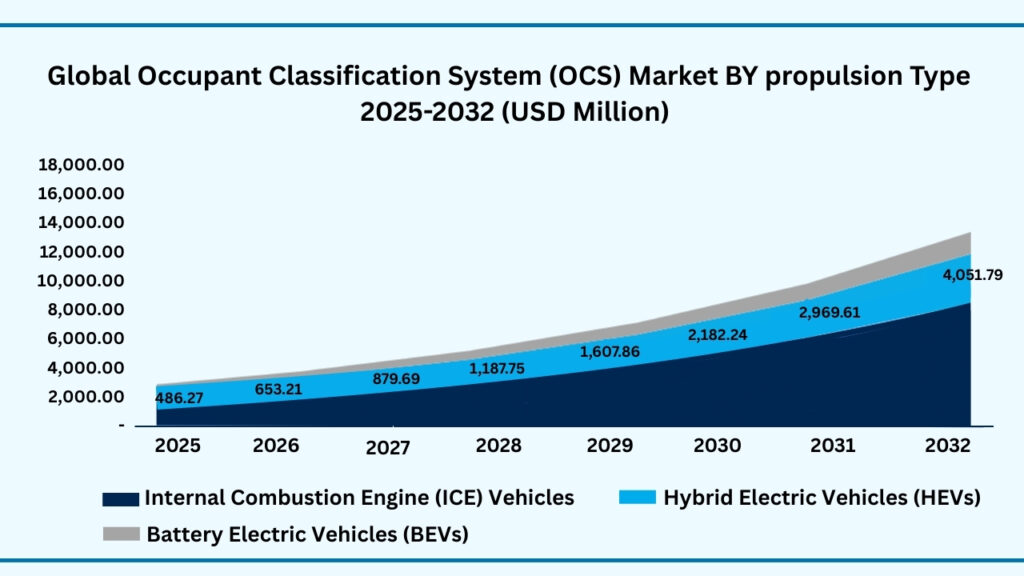

Global Occupant Classification System (OCS) Market by Propulsion Type :

Internal Combustion Engine (ICE) Vehicles segment accounted for the largest market share of share 63.43% in 2024 in the global Occupant Classification System (OCS) market.

Based on Propulsion Type , On- Internal Combustion Engine (ICE) Vehicles segment held the largest revenue share of 63.43% in the global Occupant Classification System (OCS) market in 2024 and expected to register a CAGR of 35.23% from 2025 to 2032 is expected to reach USD 10,118.32 million. The internal combustion engine (ICE) vehicles segment dominated the global Occupant Classification System (OCS) market in 2024, supported by the large existing on-road fleet and steady production volumes across key automotive markets. Automakers continue to integrate advanced occupant sensing technologies into ICE platforms to comply with evolving safety regulations and enhance overall vehicle protection systems. As passenger safety becomes a primary differentiator for buyers, OCS installations in ICE vehicles have grown rapidly, enabling more accurate airbag deployment, improved child seat detection, and reliable monitoring of occupant presence and posture.

Over the forecast period, ICE vehicles are expected to maintain strong demand for OCS solutions as manufacturers optimize traditional platforms with smarter electronic architectures and AI-based sensing capabilities. Even as electric mobility expands, ICE vehicles—especially in developing regions—will continue to rely on advanced occupant classification technologies to meet safety benchmarks and deliver modern in-cabin experiences. Continued enhancements in sensor accuracy, software-driven detection, and integration with advanced driver-assistance systems will ensure that ICE vehicles remain a major contributor to the broader OCS market’s long-term growth trajectory.

Global Occupant Classification System (OCS) Market by Propulsion Type (USD Million)

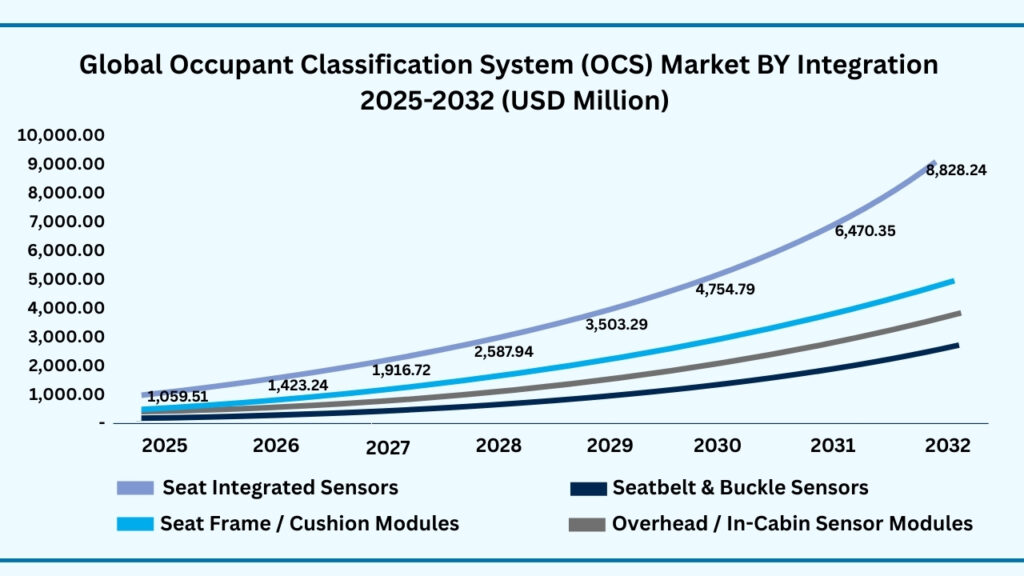

Global Occupant Classification System (OCS) Market by Integration Insights:

Seat-Integrated Sensors segment accounted for the largest market share of share 31.33% in 2024 in the global Occupant Classification System (OCS) market.

Based on Seat-Integrated Sensors held the largest revenue share of 55.53% in the global Occupant Classification System (OCS) market in 2024 and expected to register a CAGR of 35.20% from 2025 to 2032 and expected to reach USD 8,828.24. Seat-integrated sensors accounted for the leading share of the global Occupant Classification System (OCS) market in 2024, driven by their precision, reliability, and seamless placement within vehicle seating structures. These sensors allow automakers to capture highly accurate data on occupant weight, posture, and presence, ensuring optimal airbag deployment and superior crash protection. Their ability to operate discreetly within the seat without altering cabin aesthetics has made them a preferred choice for OEMs, particularly as safety compliance standards become more stringent and passenger comfort expectations continue to rise.

Looking ahead, seat-integrated sensors are set for strong adoption as vehicles transition toward smarter cabin environments and advanced safety architectures. Automakers are increasingly incorporating AI-enhanced detection algorithms and multi-modal sensing technologies into seat platforms to improve classification accuracy and support child presence detection, adaptive restraint systems, and in-cabin behavioral analysis. As the industry moves toward intelligent, connected, and autonomous mobility, these seat-embedded sensing systems will play an even more critical role in enabling personalized protection and enhancing the overall safety ecosystem.

Global Occupant Classification System (OCS) by Integration (USD Million)

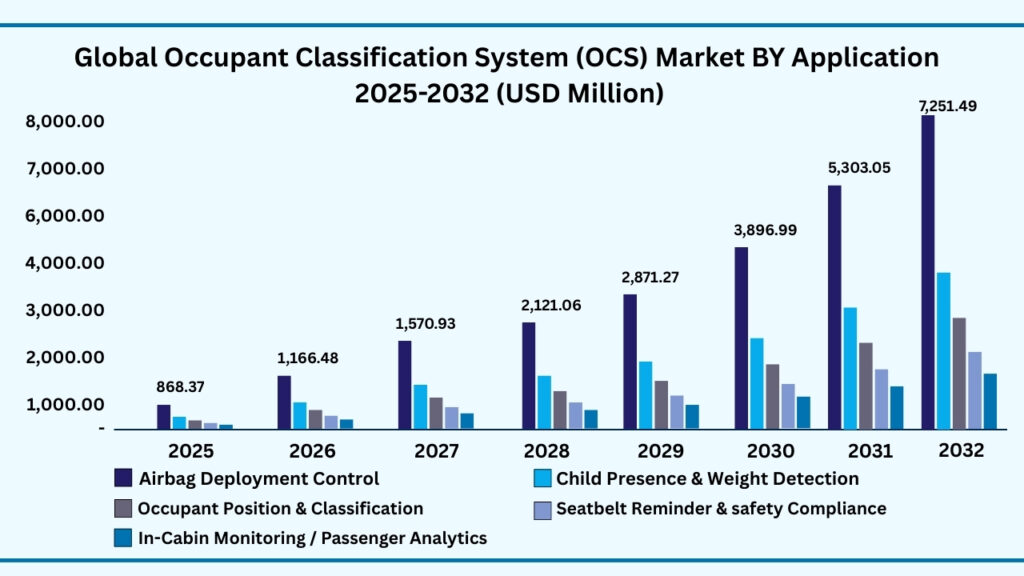

Global Occupant Classification System (OCS) Market by Application Insights:

Airbag Deployment Control segment accounted for the largest market share of share 45.43% in 2024 in the global Occupant Classification System (OCS) market.

Based on Application segment Airbag Deployment Control held the largest revenue share of 45.43% in the global Occupant Classification System (OCS) market in 2024 and expected to register a CAGR of 35.24% from 2025 to 2032 and expected to reach USD 7,251.49 million. Airbag deployment control represented the leading application area within the global Occupant Classification System (OCS) market in 2024, driven by its central role in enhancing vehicle safety and meeting increasingly stringent regulatory requirements. Automakers rely on OCS-enabled airbag systems to determine whether a passenger is present, assess their seating posture, and evaluate weight distribution to trigger the most appropriate airbag response. This capability significantly reduces the risk of injury from unnecessary or incorrect airbag deployment, particularly for children and smaller occupants, making it a foundational safety feature across modern passenger and commercial vehicles.

In the coming years, airbag deployment control is set to witness strong growth as manufacturers adopt more advanced sensing technologies and AI-powered algorithms capable of delivering higher accuracy and adaptability. Evolving in-cabin safety architectures, combined with the shift toward autonomous and semi-autonomous mobility, are further elevating the need for intelligent airbag management systems that can interpret complex occupant behaviors in real time. As vehicles become more connected and safety standards continue to evolve worldwide, OCS-driven airbag control will remain a priority investment area for OEMs seeking to improve crash performance, passenger protection, and overall vehicle safety ratings.

Global Occupant Classification System (OCS) by Application (USD Million)

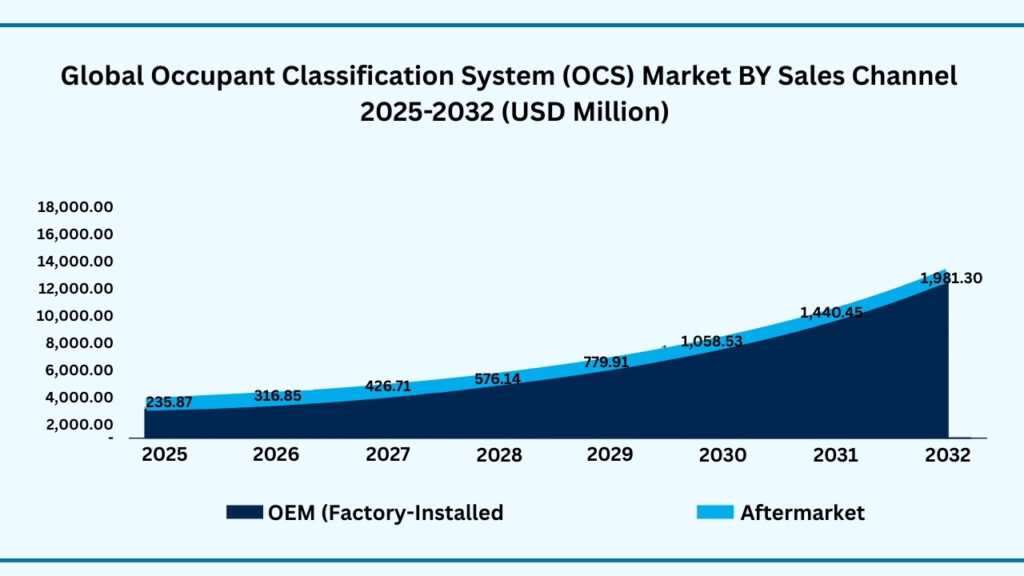

Global Occupant Classification System (OCS) Market by Sales Channele Insights:

OEM (Factory-Installed) segment accounted for the largest market share of share 87.66% in 2024 in the global Occupant Classification System (OCS) market.

Based on sales channel segment OEM (Factory-Installed) held the largest revenue share of 87.66% in the global Occupant Classification System (OCS) market in 2024 and expected to register a CAGR of 35.18% from 2025 to 2032 and expected to reach USD 13,945.53 million. The OEM (factory-installed) segment dominated the global Occupant Classification System (OCS) market in 2024, supported by the widespread integration of advanced safety technologies directly into new vehicle models. Automakers are prioritizing built-in OCS solutions to meet stringent regulatory standards, enhance crash protection, and differentiate their offerings with smarter, more reliable in-cabin safety features. By embedding OCS components during production, OEMs ensure seamless compatibility with airbag systems, seat architectures, and onboard electronics, making factory-installed solutions the preferred choice across both passenger and commercial vehicles.

Over the coming years, the OEM segment is expected to experience sustained momentum as manufacturers accelerate the adoption of AI-enabled occupant detection, multi-sensor fusion platforms, and intelligent safety analytics. The push toward connected, electrified, and autonomous mobility further amplifies the importance of integrating OCS at the production stage, allowing vehicles to deliver real-time occupant monitoring and adaptive protection capabilities. With growing emphasis on premium safety offerings and next-generation cabin intelligence, OEM installations will remain the primary driver of market expansion, outpacing aftermarket solutions by offering superior performance, reliability, and long-term scalability.

Global Occupant Classification System (OCS) by Sales Channel (USD Million)

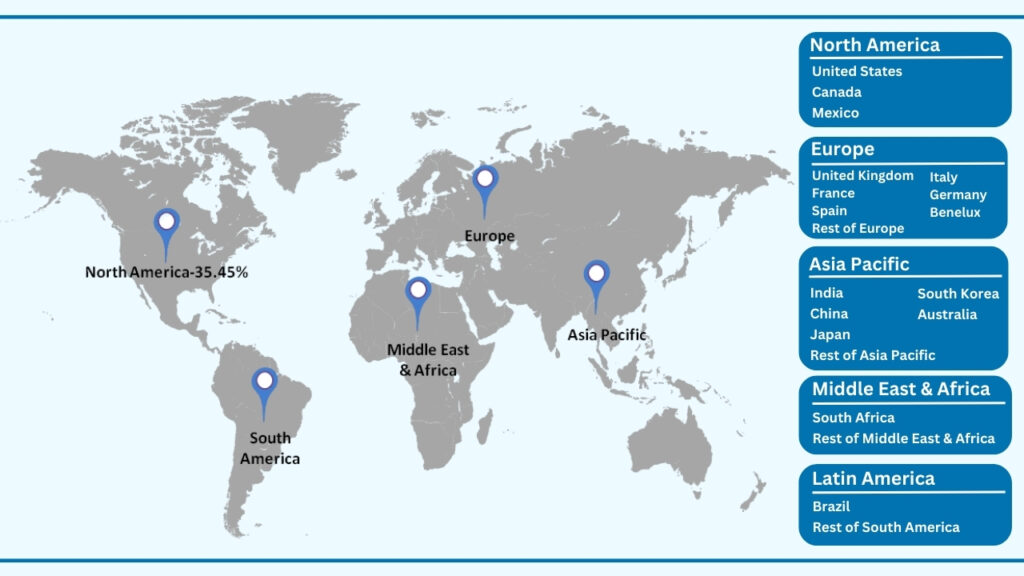

Global Occupant Classification System (OCS) Market by Region Insights:

North America segment accounted for the largest market share of share of 35.45% in 2024 in the global Occupant Classification System (OCS) market.

Based on region, the global Occupant Classification System (OCS) market is segmented into Europe, Asia-Pacific, North America, Latin America and Middle East & Africa. Among these, North America region held the largest revenue share of 35.45% in the global Occupant Classification System (OCS) market in 2024 and expected to reach USD 5,661.99 million in 2032. North America dominated the global Occupant Classification System (OCS) market in 2024, driven by the region’s strong regulatory framework, high vehicle safety standards, and rapid adoption of advanced in-cabin technologies. Automakers in the region consistently integrate intelligent occupant sensing solutions to comply with mandatory safety norms and enhance crash protection across passenger cars, SUVs, and commercial fleets. The presence of major automotive manufacturers, technology developers, and strong consumer demand for premium safety features further strengthens the region’s leadership in OCS adoption.

Over the forecast period, North America is expected to maintain a strong growth trajectory as the market shifts toward AI-powered detection, sensor fusion systems, and smart cabin environments. Increasing investment in connected and autonomous vehicle development continues to elevate the need for highly accurate occupant monitoring technologies capable of supporting predictive safety and adaptive airbag deployment. With continuous regulatory upgrades and rising consumer focus on advanced vehicle safety, the region will remain a key contributor to the long-term expansion of the global OCS market.

Global Occupant Classification System (OCS) Market by Region (USD Million)

Major Companies and Competitive Landscape

The competitive landscape of the Occupant Classification System (OCS) market is defined by a mix of established automotive safety suppliers, electronics manufacturers, sensor technology innovators, and emerging AI-driven mobility startups. Industry players are focused on advancing precision occupant detection, enhancing sensor fusion capabilities, and developing intelligent in-cabin monitoring solutions to meet growing safety mandates. Companies are increasingly incorporating smart sensing platforms, machine-learning–based classification algorithms, and integrated electronic control units to deliver more accurate, real-time occupant assessments that align with global regulatory and vehicle safety requirements.

To strengthen their market presence, leading manufacturers are forming partnerships with automotive OEMs, seat system providers, and ADAS solution developers to expand the integration of OCS across new vehicle platforms. Competitive strategies emphasize differentiation through advanced sensing accuracy, improved system reliability, and seamless compatibility with next-generation safety architectures. While major suppliers invest heavily in high-performance hardware, embedded software, and scalable cabin intelligence systems, agile startups are introducing compact, cost-effective, and AI-enhanced sensing modules aimed at emerging mobility and electric vehicle applications. This blend of long-standing players and innovative new entrants contributes to a fast-evolving and highly dynamic OCS market, driving continuous enhancement of occupant safety technologies worldwide.

Some of the leading companies profiled in the global cultured meat market report include:

- Robert Bosch GmbH

- Denso Corporation

- ZF Friedrichshafen AG

- Continental AG

- Aptiv PLC

- Autoliv, Inc.

- Joyson Safety Systems

- TE Connectivity

- NIDEC Corporation

- AISIN Corporation

Strategic Development

ID Quantique (Switzerland)

- In 2025, ID Quantique’s “Clavis XG” became the first QKD product globally to receive official national-security certification from a major country’s intelligence service — a significant milestone validating its quantum-safe encryption for government and critical-infrastructure use.

- ID Quantique continues to advance its quantum-key-distribution network platform by enabling full QKD-network deployments (not just point-to-point), with a management layer that integrates key-management (QKMS) and network orchestration — making long-distance, scalable quantum-safe communications practically deployable.

Scope of Research

| Report Details | Outcome |

|---|---|

| Market size in 2024 | USD 1,426.56 Million |

| CAGR (2024–2032) | 35.37% |

| Revenue forecast to 2033 | USD 15,926.83 Million |

| Base year for estimation | 2024 |

| Historical data | 2019–2023 |

| Forecast period | 2025–2032 |

| Quantitative units | Revenue in USD Million, and CAGR in % from 2025 to 2032 |

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | Component, By Sensor Type , By Vehicle Type , By Propulsion Type , By Integration, By Application, By Sales Channel and By region for 2019 to 2032 |

| Regional scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Country scope | U.S., Canada, Mexico, Germany, France, U.K., Italy, Spain, Benelux, Russia, Finland, Sweden, Rest of Europe, China, India, Japan, South Korea, Indonesia, Thailand, Vietnam, Australia, New Zealand Rest of APAC, Brazil, Rest of LATAM, Saudi Arabia, Rest of MEA |

| Key companies profiled | Robert Bosch GmbH, Denso Corporation, ZF Friedrichshafen AG, Continental AG, Aptiv PLC, Autoliv Inc., Joyson Safety Systems, TE Connectivity, NIDEC Corporation, AISIN Corporation, IEE Smart Sensing Solutions, Valeo SA, HELLA GmbH & Co. KGaA, Sensata Technologies Inc., Honeywell International Inc., OMRON Corporation, Magna International Inc., CTS Corporation, Forciot Oy, IGB Automotive Ltd. |

| Customization scope | 10 hours of free customization and expert consultation |

Some Key Questions the Report Will Answer

- What is the expected revenue Compound Annual Growth Rate (CAGR) of the global Occupant Classification System (OCS) market over the forecast period (2025–2032)?

- The global Occupant Classification System (OCS) market revenue is expected to register a Compound Annual Growth Rate (CAGR) of 35.37% during the forecast period.

- What was the size of the global Occupant Classification System (OCS) in 2024?

- The global Occupant Classification System (OCS) market size was USD 1,426.56 Million in 2024.

- Which factors are expected to drive the global Occupant Classification System (OCS) market growth?

- The global Occupant Classification System (OCS) market is driven by rising automotive safety regulations and increasing adoption of advanced airbag deployment technologies. Growing demand for smart in-cabin sensing, electrification, and AI-enabled vehicle safety systems further accelerates market expansion.

- Which was the leading segment in the global Occupant Classification System (OCS) market in terms of component in 2024?

- Sensors segment was leading in the Occupant Classification System (OCS) market on the basis of component in 2024.

- What are some restraints for revenue growth of the global Occupant Classification System (OCS) market?

- Revenue growth in the global Occupant Classification System (OCS) market is restrained by high integration and calibration costs, which increase overall vehicle manufacturing expenses. Technical complexities in sensor accuracy, environmental interference, and compliance testing also slow adoption. Additionally, lack of standardization across global safety regulations creates hurdles for large-scale deployment.

Follow us on: Facebook, Twitter, Instagram and LinkedIn.

Chapter 1. Introduction

1.1. Market Definition

1.2. Objectives of the study

1.3. Overview of Global Occupant Classification System (OCS) Market Market

1.4. Currency and pricing

1.5. Limitation

1.6. Market s covered

1.7. Research Scope

Chapter 2. Research Methodology

2.1. Research Sources

2.1.1. Primary

2.1.2. Secondary

2.1.3. Paid Sources

2.2. Years considered for the study

2.3. Assumptions

2.3.1. Market value

2.3.2. Market volume

2.3.3. Exchange rate

2.3.4. Price

2.3.5. Economic & political stability

Chapter 3. Executive Summary

3.1. Summary Snapshot, 2019–2032

Chapter 4. Key Insights

4.1. Production consumption analysis

4.2. Strategic partnerships & alliances

4.3. Joint ventures

4.4. Acquisition of local players

4.5. Contract manufacturing

4.6. Digital & e-commerce sales channels

4.7. Compliance with standards

4.8. Value chain analysis

4.9. Raw material sourcing

4.10. Formulation & manufacturing

4.11. Distribution & retail

4.12. Import-export analysis

4.13. Brand comparative analysis

4.14. Technological advancements

4.15. Porter’s five force

4.16. Threat of new entrants

4.16.1.1. Capital requirment

4.16.1.2. Product knowledge

4.16.1.3. Technical knowledge

4.16.1.4. Customer relation

4.16.1.5. Access to appliation and technology

4.16.2. Threat of substitutes

4.16.2.1. Cost

4.16.2.2. Performance

4.16.2.3. Availability

4.16.2.4. Technical knowledge

4.16.2.5. Durability

4.16.3. Bargainning power of buyers

4.16.3.1. Numbers of buyers relative to suppliers

4.16.3.2. Product differentiation

4.16.3.3. Threat of forward integration

4.16.3.4. Buyers volume

4.16.4. Bargainning power of suppliers

4.16.4.1. Suppliers concentration

4.16.4.2. Buyers switching cost to other suppliers

4.16.4.3. Threat of backward integration

4.16.5. Bargainning power of suppliers

4.16.5.1. Industry concentration

4.16.5.2. Industry growth rate

4.16.5.3. Product differentiation

4.17. Patent analysis

4.18. Regulation coverage

4.19. Pricing analysis

4.20. Competitive Metric Space Analysis

Chapter 5. Market Overview

5.1. Drivers

5.1.1. Rising demand for advanced vehicle safety systems

5.1.2. Increasing adoption of electric and autonomous vehicles

5.1.3. Stringent government mandates

5.2. Restraints

5.2.1.High system development and calibration costs

5.2.2.Complexity in ensuring accuracy

5.3. Opportunities

5.3.1.Growing shift toward AI-based and vision-enabled OCS

5.3.2.Rising demand in emerging markets

5.3.3.Increasing integration of OCS with in-cabin monitoring systems (ICMS)

5.4. Challenges

5.4.1.Cybersecurity vulnerabilities in connected OCS platforms

5.4.2.Supply chain disruptions and sensor shortages

Chapter 6. Global Occupant Classification System (OCS) Market By Component Insights &

Trends, Revenue (USD Million)

6.1. Component Dynamics & Market Share, 2019–2032

6.1.1. Airbag Control Unit (ECU)

6.1.2. Sensors

6.1.3. Wiring Harness & Connectors

6.1.4. Software & Algorithms

Chapter 7. Global Occupant Classification System (OCS) Market By Sensor Type Insights &

Trends, Revenue (USD Million)

7.1. Sensor Type Dynamics & Market Share, 2019–2032

7.1.1. Pressure / Weight Sensors

7.1.2. Capacitive Sensors

7.1.3. Ultrasonic Sensors

7.1.4. Radar (mmWave) Sensors

7.1.5. Camera / Vision-Based Sensors

7.1.6. Infrared Sensors

7.1.7. Sensor Fusion (Multi-Sensor OCS)

Chapter 8. Global Occupant Classification System (OCS) Market By Vehicle Type Insights &

Trends, Revenue (USD Million)

8.1. Vehicle Type Dynamics & Market Share, 2019–2032

8.1.1. Passenger Cars

8.1.2. Light Commercial Vehicles (LCVs)

8.1.3. Heavy Commercial Vehicles (HCVs)

8.1.4. Electric & Hybrid Vehicles

Chapter 9. Global Occupant Classification System (OCS) Market By Propulsion Type Insights &

Trends, Revenue (USD Million)

9.1. Propulsion Type Dynamics & Market Share, 2019–2032

9.1.1. Internal Combustion Engine (ICE) Vehicles

9.1.2. Hybrid Electric Vehicles (HEVs)

9.1.3. Battery Electric Vehicles (BEVs)

Chapter 10. Global Occupant Classification System (OCS) Market By Integration Insights &

Trends, Revenue (USD Million)

10.1. Integration Dynamics & Market Share, 2019–2032

10.1.1. Seat-Integrated Sensors

10.1.2. Seatbelt & Buckle Sensors

10.1.3. Seat Frame / Cushion Modules

10.1.4. Overhead / In-Cabin Sensor Modules

Chapter 11. Global Occupant Classification System (OCS) Market By Application Insights &

Trends, Revenue (USD Million)

11.1. Application Dynamics & Market Share, 2019–2032

11.1.1. Airbag Deployment Control

11.1.2. Child Presence & Weight Detection

11.1.3. Occupant Position & Classification

11.1.4. Seatbelt Reminder & Safety Compliance

11.1.5. In-Cabin Monitoring / Passenger Analytics

Chapter 12. Global Occupant Classification System (OCS) Market By Sales Channel Insights &

Trends, Revenue (USD Million)

12.1. Sales Channel Dynamics & Market Share, 2019–2032

12.1.1. OEM (Factory-Installed)

12.1.2. Aftermarket

Chapter 13. Global Occupant Classification System (OCS) Market Market Regional Outlook

13.1. Occupant Classification System (OCS) Market Share By Region, 2019–2032

13.2. North America

13.2.1. North America Market By Component Insights & Trends, Revenue (USD Million)

13.2.1.1. Airbag Control Unit (ECU)

13.2.1.2. Sensors

13.2.1.3. Wiring Harness & Connectors

13.2.1.4. Software & Algorithms

13.2.2. North America Occupant Classification System (OCS) Market By Sensor Type Insights & Trends, Revenue (USD Million)

13.2.2.1. Pressure / Weight Sensors

13.2.2.2. Capacitive Sensors

13.2.2.3. Ultrasonic Sensors

13.2.2.4. Radar (mmWave) Sensors

13.2.2.5. Camera / Vision-Based Sensors

13.2.2.6. Infrared Sensors

13.2.2.7. Sensor Fusion (Multi-Sensor OCS)

13.2.3. North America Occupant Classification System (OCS) Market By Vehicle Type Insights & Trends, Revenue (USD Million)

13.2.3.1. Passenger Cars

13.2.3.2. Light Commercial Vehicles (LCVs)

13.2.3.3. Heavy Commercial Vehicles (HCVs)

13.2.3.4. Electric & Hybrid Vehicles

13.2.4. North America Occupant Classification System (OCS) Market By Propulsion Type Insights & Trends, Revenue (USD Million)

13.2.4.1. Internal Combustion Engine (ICE) Vehicles

13.2.4.2. Hybrid Electric Vehicles (HEVs)

13.2.4.3. Battery Electric Vehicles (BEVs)

13.2.5. North America Occupant Classification System (OCS) Market By Integration Insights & Trends, Revenue (USD Million)

13.2.5.1. Seat-Integrated Sensors

13.2.5.2. Seatbelt & Buckle Sensors

13.2.5.3. Seat Frame / Cushion Modules

13.2.5.4. Overhead / In-Cabin Sensor Modules

13.2.6. North America Occupant Classification System (OCS) Market By Application Insights & Trends, Revenue (USD Million)

13.2.6.1. Airbag Deployment Control

13.2.6.2. Child Presence & Weight Detection

13.2.6.3. Occupant Position & Classification

13.2.6.4. Seatbelt Reminder & Safety Compliance

13.2.6.5. In-Cabin Monitoring / Passenger Analytics

13.2.7. North America Occupant Classification System (OCS) Market By Sales Channel Insights & Trends, Revenue (USD Million)

13.2.7.1. OEM (Factory-Installed)

13.2.7.2. Aftermarket

13.2.8. North America Market By Country, Market Estimates and Forecast, USD Million, 2025- 2032

13.2.8.1. US

13.2.8.2. Canada

13.2.8.3. Mexico

13.3.Europe

13.3.1. Europe Market By Component Insights & Trends, Revenue (USD Million)

13.3.1.1. Airbag Control Unit (ECU)

13.3.1.2. Sensors

13.3.1.3. Wiring Harness & Connectors

13.3.1.4. Software & Algorithms

13.3.2. Europe Occupant Classification System (OCS) Market By Sensor Type Insights & Trends, Revenue (USD Million)

13.3.2.1. Pressure / Weight Sensors

13.3.2.2. Capacitive Sensors

13.3.2.3. Ultrasonic Sensors

13.3.2.4. Radar (mmWave) Sensors

13.3.2.5. Camera / Vision-Based Sensors

13.3.2.6. Infrared Sensors

13.3.2.7. Sensor Fusion (Multi-Sensor OCS)

13.3.3. Europe Occupant Classification System (OCS) Market By Vehicle Type Insights & Trends, Revenue (USD Million)

13.3.3.1. Passenger Cars

13.3.3.2. Light Commercial Vehicles (LCVs)

13.3.3.3. Heavy Commercial Vehicles (HCVs)

13.3.3.4. Electric & Hybrid Vehicles

13.3.4. Europe Occupant Classification System (OCS) Market By Propulsion Type Insights & Trends, Revenue (USD Million)

13.3.4.1. Internal Combustion Engine (ICE) Vehicles

13.3.4.2. Hybrid Electric Vehicles (HEVs)

13.3.4.3. Battery Electric Vehicles (BEVs)

13.3.5. Europe Occupant Classification System (OCS) Market By Integration Insights & Trends, Revenue (USD Million)

13.3.5.1. Seat-Integrated Sensors

13.3.5.2. Seatbelt & Buckle Sensors

13.3.5.3. Seat Frame / Cushion Modules

13.3.5.4. Overhead / In-Cabin Sensor Modules

13.3.6. Europe Occupant Classification System (OCS) Market By Application Insights & Trends, Revenue (USD Million)

13.3.6.1. Airbag Deployment Control

13.3.6.2. Child Presence & Weight Detection

13.3.6.3. Occupant Position & Classification

13.3.6.4. Seatbelt Reminder & Safety Compliance

13.3.6.5. In-Cabin Monitoring / Passenger Analytics

13.3.7. Europe Occupant Classification System (OCS) Market By Sales Channel Insights & Trends, Revenue (USD Million)

13.3.7.1. OEM (Factory-Installed)

13.3.7.2. Aftermarket

13.3.8. Europe Market By Country, Market Estimates and Forecast, USD Million,

13.3.8.1. Germany

13.3.8.2. France

13.3.8.3. U.K

13.3.8.4. Italy

13.3.8.5. Spain

13.3.8.6. Benelux

13.3.8.7. Russia

13.3.8.8. Finland

13.3.8.9. Sweden

13.3.8.10. Rest Of Europe

13.4. Asia-Pacific

13.4.1. Asia-Pacific Market By Component Insights & Trends, Revenue (USD Million)

13.4.1.1. Airbag Control Unit (ECU)

13.4.1.2. Sensors

13.4.1.3. Wiring Harness & Connectors

13.4.1.4. Software & Algorithms

13.4.2. Asia-Pacific Occupant Classification System (OCS) Market By Sensor Type Insights & Trends, Revenue (USD Million)

13.4.2.1. Pressure / Weight Sensors

13.4.2.2. Capacitive Sensors

13.4.2.3. Ultrasonic Sensors

13.4.2.4. Radar (mmWave) Sensors

13.4.2.5. Camera / Vision-Based Sensors

13.4.2.6. Infrared Sensors

13.4.2.7. Sensor Fusion (Multi-Sensor OCS)

13.4.3. Asia-Pacific Occupant Classification System (OCS) Market By Vehicle Type Insights & Trends, Revenue (USD Million)

13.4.3.1. Passenger Cars

13.4.3.2. Light Commercial Vehicles (LCVs)

13.4.3.3. Heavy Commercial Vehicles (HCVs)

13.4.3.4. Electric & Hybrid Vehicles

13.4.4. Asia-Pacific Occupant Classification System (OCS) Market By Propulsion Type Insights & Trends, Revenue (USD Million)

13.4.4.1. Internal Combustion Engine (ICE) Vehicles

13.4.4.2. Hybrid Electric Vehicles (HEVs)

13.4.4.3. Battery Electric Vehicles (BEVs)

13.4.5. Asia-Pacific Occupant Classification System (OCS) Market By Integration Insights & Trends, Revenue (USD Million)

13.4.5.1. Seat-Integrated Sensors

13.4.5.2. Seatbelt & Buckle Sensors

13.4.5.3. Seat Frame / Cushion Modules

13.4.5.4. Overhead / In-Cabin Sensor Modules

13.4.6. Asia-Pacific Occupant Classification System (OCS) Market By Application Insights & Trends, Revenue (USD Million)

13.4.6.1. Airbag Deployment Control

13.4.6.2. Child Presence & Weight Detection

13.4.6.3. Occupant Position & Classification

13.4.6.4. Seatbelt Reminder & Safety Compliance

13.4.6.5. In-Cabin Monitoring / Passenger Analytics

13.4.7. Asia-Pacific Occupant Classification System (OCS) Market By Sales Channel Insights & Trends, Revenue (USD Million)

13.4.7.1. OEM (Factory-Installed)

13.4.7.2. Aftermarket

13.4.8. Asia-Pacific Market By Country, Market Estimates and Forecast, USD Million,

13.4.8.1. China

13.4.8.2. India

13.4.8.3. Japan

13.4.8.4. South Korea

13.4.8.5. Indonesia

13.4.8.6. Thailand

13.4.8.7. Vietnam

13.4.8.8. Australia

13.4.8.9. New Zeland

13.4.8.10. Rest of APAC

13.5. Latin America

13.5.1. Latin America Market By Component Insights & Trends, Revenue (USD Million)

13.5.1.1. Airbag Control Unit (ECU)

13.5.1.2. Sensors

13.5.1.3. Wiring Harness & Connectors

13.5.1.4. Software & Algorithms

13.5.2. Latin America Occupant Classification System (OCS) Market By Sensor Type Insights & Trends, Revenue (USD Million)

13.5.2.1. Pressure / Weight Sensors

13.5.2.2. Capacitive Sensors

13.5.2.3. Ultrasonic Sensors

13.5.2.4. Radar (mmWave) Sensors

13.5.2.5. Camera / Vision-Based Sensors

13.5.2.6. Infrared Sensors

13.5.2.7. Sensor Fusion (Multi-Sensor OCS)

13.5.3. Latin America Occupant Classification System (OCS) Market By Vehicle Type Insights & Trends, Revenue (USD Million)

13.5.3.1. Passenger Cars

13.5.3.2. Light Commercial Vehicles (LCVs)

13.5.3.3. Heavy Commercial Vehicles (HCVs)

13.5.3.4. Electric & Hybrid Vehicles

13.5.4. Latin America Occupant Classification System (OCS) Market By Propulsion Type Insights & Trends, Revenue (USD Million)

13.5.4.1. Internal Combustion Engine (ICE) Vehicles

13.5.4.2. Hybrid Electric Vehicles (HEVs)

13.5.4.3. Battery Electric Vehicles (BEVs)

13.5.5. Latin America Occupant Classification System (OCS) Market By Integration Insights & Trends, Revenue (USD Million)

13.5.5.1. Seat-Integrated Sensors

13.5.5.2. Seatbelt & Buckle Sensors

13.5.5.3. Seat Frame / Cushion Modules

13.5.5.4. Overhead / In-Cabin Sensor Modules

13.5.6. Latin America Occupant Classification System (OCS) Market By Application Insights & Trends, Revenue (USD Million)

13.5.6.1. Airbag Deployment Control

13.5.6.2. Child Presence & Weight Detection

13.5.6.3. Occupant Position & Classification

13.5.6.4. Seatbelt Reminder & Safety Compliance

13.5.6.5. In-Cabin Monitoring / Passenger Analytics

13.5.7. Latin America Occupant Classification System (OCS) Market By Sales Channel Insights & Trends, Revenue (USD Million)

13.5.7.1. OEM (Factory-Installed)

13.5.7.2. Aftermarket

13.5.8. Latin America Market By Country, Market Estimates and Forecast, USD Million,

13.5.8.1. Brazil

13.5.8.2. Rest of LATAM

13.6. Middle East & Africa

13.6.1. Middle East & Africa Market By Component Insights & Trends, Revenue (USD Million)

13.6.1.1. Airbag Control Unit (ECU)

13.6.1.2. Sensors

13.6.1.3. Wiring Harness & Connectors

13.6.1.4. Software & Algorithms

13.6.2. Middle East & Africa Occupant Classification System (OCS) Market By Sensor Type Insights & Trends, Revenue (USD Million)

13.6.2.1. Pressure / Weight Sensors

13.6.2.2. Capacitive Sensors

13.6.2.3. Ultrasonic Sensors

13.6.2.4. Radar (mmWave) Sensors

13.6.2.5. Camera / Vision-Based Sensors

13.6.2.6. Infrared Sensors

13.6.2.7. Sensor Fusion (Multi-Sensor OCS)

13.6.3. Middle East & Africa Occupant Classification System (OCS) Market By Vehicle Type Insights & Trends, Revenue (USD Million)

13.6.3.1. Passenger Cars

13.6.3.2. Light Commercial Vehicles (LCVs)

13.6.3.3. Heavy Commercial Vehicles (HCVs)

13.6.3.4. Electric & Hybrid Vehicles

13.6.4. Middle East & Africa Occupant Classification System (OCS) Market By Propulsion Type Insights & Trends, Revenue (USD Million)

13.6.4.1. Internal Combustion Engine (ICE) Vehicles

13.6.4.2. Hybrid Electric Vehicles (HEVs)

13.6.4.3. Battery Electric Vehicles (BEVs)

13.6.5. Middle East & Africa Occupant Classification System (OCS) Market ByIntegration Insights & Trends, Revenue (USD Million)

13.6.5.1. Seat-Integrated Sensors

13.6.5.2. Seatbelt & Buckle Sensors

13.6.5.3. Seat Frame / Cushion Modules

13.6.5.4. Overhead / In-Cabin Sensor Modules

13.6.6. Middle East & Africa Occupant Classification System (OCS) Market By Application Insights & Trends, Revenue (USD Million)

13.6.6.1. Airbag Deployment Control

13.6.6.2. Child Presence & Weight Detection

13.6.6.3. Occupant Position & Classification

13.6.6.4. Seatbelt Reminder & Safety Compliance

13.6.6.5. In-Cabin Monitoring / Passenger Analytics

13.6.7. Middle East & Africa Occupant Classification System (OCS) Market By Sales Channel Insights & Trends, Revenue (USD Million)

13.6.7.1. OEM (Factory-Installed)

13.6.7.2. Aftermarket

13.6.8. Middle East & Africa Market By Country, Market Estimates and Forecast, USD Million,

13.6.8.1. Saudi Arabia

13.6.8.2. Rest of MEA

Chapter 14. Competitive Landscape

14.1. Market Revenue Share By Manufacturers

14.2. Mergers & Acquisitions

14.3. Competitor’s Positioning

14.4. Strategy Benchmarking

14.5. Vendor Landscape

14.6. Distributors

14.6.1.1. North America

14.6.1.2. Europe

14.6.1.3. Asia Pacific

14.6.1.4. Middle East & Africa

14.6.1.5. Latin America

Chapter 15. Company Profiles

15.1. Robert Bosch GmbH

15.1.1. Company Overview

15.1.2. Product & Service Offerings

15.1.3. Strategic Initiatives

15.1.4. Financials

15.2. Denso Corporation

15.2.1. Company Overview

15.2.2. Product & Service Offerings

15.2.3. Strategic Initiatives

15.2.4. Financials

15.3. ZF Friedrichshafen AG

15.3.1. Company Overview

15.3.2. Product & Service Offerings

15.3.3. Strategic Initiatives

15.3.4. Financials

15.4. Continental AG

15.4.1. Company Overview

15.4.2. Product & Service Offerings

15.4.3. Strategic Initiatives

15.4.4. Financials

15.5. Aptiv PLC

15.5.1. Company Overview

15.5.2. Product & Service Offerings

15.5.3. Strategic Initiatives

15.5.4. Financials

15.6. Autoliv, Inc.

15.6.1. Company Overview

15.6.2. Product & Service Offerings

15.6.3. Strategic Initiatives

15.6.4. Financials

15.7. Joyson Safety Systems

15.7.1. Company Overview

15.7.2. Product & Service Offerings

15.7.3. Strategic Initiatives

15.7.4. Financials

15.7.5. Conclusion

15.8. TE Connectivity

15.8.1. Company Overview

15.8.2. Product & Service Offerings

15.8.3. Strategic Initiatives

15.8.4. Financials

15.8.5. Conclusion

15.9. NIDEC Corporation

15.9.1. Company Overview

15.9.2. Product & Service Offerings

15.9.3. Strategic Initiatives

15.9.4. Financials

15.9.5. Conclusion

15.10. AISIN Corporation

15.10.1. Company Overview

15.10.2. Product & Service Offerings

15.10.3. Strategic Initiatives

15.10.4. Financials

15.10.5. Conclusion

15.11. IEE Smart Sensing Solutions

15.11.1. Company Overview

15.11.2. Product & Service Offerings

15.11.3. Strategic Initiatives

15.11.4. Financials

15.11.5. Conclusion

15.12. Valeo SA

15.12.1. Company Overview

15.12.2. Product & Service Offerings

15.12.3. Strategic Initiatives

15.12.4. Financials

15.12.5. Conclusion

15.13. HELLA GmbH & Co. KGaA

15.13.1. Company Overview

15.13.2. Product & Service Offerings

15.13.3. Strategic Initiatives

15.13.4. Financials

15.13.5. Conclusion

15.14. Sensata Technologies, Inc.

15.14.1. Company Overview

15.14.2. Product & Service Offerings

15.14.3. Strategic Initiatives

15.14.4. Financials

15.14.5. Conclusion

15.15. Honeywell International Inc.

15.15.1. Company Overview

15.15.2. Product & Service Offerings

15.15.3. Strategic Initiatives

15.15.4. Financials

15.15.5. Conclusion

15.16. OMRON Corporation

15.16.1. Company Overview

15.16.2. Produ

15.16.3. ct & Service Offerings

15.16.4. Strategic Initiatives

15.16.5. Financials

15.16.6. Conclusion

15.17. Magna International Inc.

15.17.1. Company Overview

15.17.2. Product & Service Offerings

15.17.3. Strategic Initiatives

15.17.4. Financials

15.17.5. Conclusion

15.18. CTS Corporation

15.18.1. Company Overview

15.18.2. Product & Service Offerings

15.18.3. Strategic Initiatives

15.18.4. Financials

15.18.5. Conclusion

15.19. Forciot Oy

15.19.1. Company Overview

15.19.2. Product & Service Offerings

15.19.3. Strategic Initiatives

15.19.4. Financials

15.19.5. Conclusion

15.20. IGB Automotive Ltd.

1.1.1. Company Overview

1.1.2. Product & Service Offerings

1.1.3. Strategic Initiatives

1.1.4. Financials

1.1.5. Conclusion

Segments Covered in Report

For the purpose of this report, Advantia Business Consulting LLP has segmented Global Quantum Cryptography Market on the basis of By Component, By Technology, By Transmission, By Deployment, By Application, By End Use and By region for 2019 to 2032

Global Quantum Cryptography Market Systems By Component Outlook (Revenue, USD Million)

- Systems (QKD HW)

- Software

- Services

Global Quantum Cryptography Market By Technology Outlook (Revenue, USD Million)

- Discrete-Variable QKD

- Continuous-Variable QKD

- Quantum Random Number Generators

- Post-Quantum Cryptography (PQC)

Global Quantum Cryptography Market By Transmission (Revenue, USD Million)

- Fiber-based QKD

- Free-space QKD

- Satellite / Space-based QKD

- Quantum repeaters & trusted-node networks

Global Quantum Cryptography Market By Deployment Outlook, Revenue (USD Million)

- On-premise / dedicated fiber

- Managed / as-a-service

Global Quantum Cryptography Market By Application Outlook, Revenue (USD Million)

- Network / Backbone security

- Data-at-rest encryption / database encryption

- Financial transactions & payment security

- Cloud / data center interconnects

- Critical infrastructure

Global Quantum Cryptography Market By End Use Outlook, Revenue (USD Million)

- BFSI

- Government, Defense & Intelligence

- Telecom service providers / ISPs

- Cloud providers & hyperscalers

- Healthcare & life sciences

- Large enterprises / data centers / research institutes

North America

North America Quantum Cryptography Market Systems By Component Outlook (Revenue, USD Million)

- Systems (QKD HW)

- Software

- Services

North America Quantum Cryptography Market By Technology Outlook (Revenue, USD Million)

- Discrete-Variable QKD

- Continuous-Variable QKD

- Quantum Random Number Generators

- Post-Quantum Cryptography (PQC)

North America Quantum Cryptography Market By Transmission (Revenue, USD Million)

- Fiber-based QKD

- Free-space QKD

- Satellite / Space-based QKD

- Quantum repeaters & trusted-node networks

North America Quantum Cryptography Market By Deployment Outlook, Revenue (USD Million)

- On-premise / dedicated fiber

- Managed / as-a-service

North America Quantum Cryptography Market By Application Outlook, Revenue (USD Million)

- Network / Backbone security

- Data-at-rest encryption / database encryption

- Financial transactions & payment security

- Cloud / data center interconnects

- Critical infrastructure

North America Quantum Cryptography Market By End Use Outlook, Revenue (USD Million)

- BFSI

- Government, Defense & Intelligence

- Telecom service providers / ISPs

- Cloud providers & hyperscalers

- Healthcare & life sciences

- Large enterprises / data centers / research institutes

U.S

U.S Quantum Cryptography Market Systems By Component Outlook (Revenue, USD Million)

- Systems (QKD HW)

- Software

- Services

U.S Quantum Cryptography Market By Technology Outlook (Revenue, USD Million)

- Discrete-Variable QKD

- Continuous-Variable QKD

- Quantum Random Number Generators

- Post-Quantum Cryptography (PQC)

U.S Quantum Cryptography Market By Transmission (Revenue, USD Million)

- Fiber-based QKD

- Free-space QKD

- Satellite / Space-based QKD

- Quantum repeaters & trusted-node networks

U.S Quantum Cryptography Market By Deployment Outlook, Revenue (USD Million)

- On-premise / dedicated fiber

- Managed / as-a-service

U.S Quantum Cryptography Market By Application Outlook, Revenue (USD Million)

- Network / Backbone security

- Data-at-rest encryption / database encryption

- Financial transactions & payment security

- Cloud / data center interconnects

- Critical infrastructure

U.S Quantum Cryptography Market By End Use Outlook, Revenue (USD Million)

- BFSI

- Government, Defense & Intelligence

- Telecom service providers / ISPs

- Cloud providers & hyperscalers

- Healthcare & life sciences

- Large enterprises / data centers / research institutes

Canada

Canada Quantum Cryptography Market Systems By Component Outlook (Revenue, USD Million)

- Systems (QKD HW)

- Software

- Services

Canada Quantum Cryptography Market By Technology Outlook (Revenue, USD Million)

- Discrete-Variable QKD

- Continuous-Variable QKD

- Quantum Random Number Generators

- Post-Quantum Cryptography (PQC)

Canada Quantum Cryptography Market By Transmission (Revenue, USD Million)

- Fiber-based QKD

- Free-space QKD

- Satellite / Space-based QKD

- Quantum repeaters & trusted-node networks

Canada Quantum Cryptography Market By Deployment Outlook, Revenue (USD Million)

- On-premise / dedicated fiber

- Managed / as-a-service

Canada Quantum Cryptography Market By Application Outlook, Revenue (USD Million)

- Network / Backbone security

- Data-at-rest encryption / database encryption

- Financial transactions & payment security

- Cloud / data center interconnects

- Critical infrastructure

Canada Quantum Cryptography Market By End Use Outlook, Revenue (USD Million)

- BFSI

- Government, Defense & Intelligence

- Telecom service providers / ISPs

- Cloud providers & hyperscalers

- Healthcare & life sciences

- Large enterprises / data centers / research institutes

Mexico

Mexico Quantum Cryptography Market Systems By Component Outlook (Revenue, USD Million)

- Systems (QKD HW)

- Software

- Services

Mexico Quantum Cryptography Market By Technology Outlook (Revenue, USD Million)

- Discrete-Variable QKD

- Continuous-Variable QKD

- Quantum Random Number Generators

- Post-Quantum Cryptography (PQC)

Mexico Quantum Cryptography Market By Transmission (Revenue, USD Million)

- Fiber-based QKD

- Free-space QKD

- Satellite / Space-based QKD

- Quantum repeaters & trusted-node networks

Mexico Quantum Cryptography Market By Deployment Outlook, Revenue (USD Million)

- On-premise / dedicated fiber

- Managed / as-a-service

Mexico Quantum Cryptography Market By Application Outlook, Revenue (USD Million)

- Network / Backbone security

- Data-at-rest encryption / database encryption

- Financial transactions & payment security

- Cloud / data center interconnects

- Critical infrastructure

Mexico Quantum Cryptography Market By End Use Outlook, Revenue (USD Million)

- BFSI

- Government, Defense & Intelligence

- Telecom service providers / ISPs

- Cloud providers & hyperscalers

- Healthcare & life sciences

- Large enterprises / data centers / research institutes

Europe

Europe Quantum Cryptography Market Systems By Component Outlook (Revenue, USD Million)

- Systems (QKD HW)

- Software

- Services

Europe Quantum Cryptography Market By Technology Outlook (Revenue, USD Million)

- Discrete-Variable QKD

- Continuous-Variable QKD

- Quantum Random Number Generators

- Post-Quantum Cryptography (PQC)

Europe Quantum Cryptography Market By Transmission (Revenue, USD Million)

- Fiber-based QKD

- Free-space QKD

- Satellite / Space-based QKD

- Quantum repeaters & trusted-node networks

Europe Quantum Cryptography Market By Deployment Outlook, Revenue (USD Million)

- On-premise / dedicated fiber

- Managed / as-a-service

Europe Quantum Cryptography Market By Application Outlook, Revenue (USD Million)

- Network / Backbone security

- Data-at-rest encryption / database encryption

- Financial transactions & payment security

- Cloud / data center interconnects

- Critical infrastructure

Europe Quantum Cryptography Market By End Use Outlook, Revenue (USD Million)

- BFSI

- Government, Defense & Intelligence

- Telecom service providers / ISPs

- Cloud providers & hyperscalers

- Healthcare & life sciences

- Large enterprises / data centers / research institutes

Germany

Germany Quantum Cryptography Market Systems By Component Outlook (Revenue, USD Million)

- Systems (QKD HW)

- Software

- Services

Germany Quantum Cryptography Market By Technology Outlook (Revenue, USD Million)

- Discrete-Variable QKD

- Continuous-Variable QKD

- Quantum Random Number Generators

- Post-Quantum Cryptography (PQC)

Germany Quantum Cryptography Market By Transmission (Revenue, USD Million)

- Fiber-based QKD

- Free-space QKD

- Satellite / Space-based QKD

- Quantum repeaters & trusted-node networks

Germany Quantum Cryptography Market By Deployment Outlook, Revenue (USD Million)

- On-premise / dedicated fiber

- Managed / as-a-service

Germany Quantum Cryptography Market By Application Outlook, Revenue (USD Million)

- Network / Backbone security

- Data-at-rest encryption / database encryption

- Financial transactions & payment security

- Cloud / data center interconnects

- Critical infrastructure

Germany Quantum Cryptography Market By End Use Outlook, Revenue (USD Million)

- BFSI

- Government, Defense & Intelligence

- Telecom service providers / ISPs

- Cloud providers & hyperscalers

- Healthcare & life sciences

- Large enterprises / data centers / research institutes

France

France Quantum Cryptography Market Systems By Component Outlook (Revenue, USD Million)

- Systems (QKD HW)

- Software

- Services

France Quantum Cryptography Market By Technology Outlook (Revenue, USD Million)

- Discrete-Variable QKD

- Continuous-Variable QKD

- Quantum Random Number Generators

- Post-Quantum Cryptography (PQC)

France Quantum Cryptography Market By Transmission (Revenue, USD Million)

- Fiber-based QKD

- Free-space QKD

- Satellite / Space-based QKD

- Quantum repeaters & trusted-node networks

France Quantum Cryptography Market By Deployment Outlook, Revenue (USD Million)

- On-premise / dedicated fiber

- Managed / as-a-service

France Quantum Cryptography Market By Application Outlook, Revenue (USD Million)

- Network / Backbone security

- Data-at-rest encryption / database encryption

- Financial transactions & payment security

- Cloud / data center interconnects

- Critical infrastructure

France Quantum Cryptography Market By End Use Outlook, Revenue (USD Million)

- BFSI

- Government, Defense & Intelligence

- Telecom service providers / ISPs

- Cloud providers & hyperscalers

- Healthcare & life sciences

- Large enterprises / data centers / research institutes

Italy

Italy Quantum Cryptography Market Systems By Component Outlook (Revenue, USD Million)

- Systems (QKD HW)

- Software

- Services

Italy Quantum Cryptography Market By Technology Outlook (Revenue, USD Million)

- Discrete-Variable QKD

- Continuous-Variable QKD

- Quantum Random Number Generators

- Post-Quantum Cryptography (PQC)

Italy Quantum Cryptography Market By Transmission (Revenue, USD Million)

- Fiber-based QKD

- Free-space QKD

- Satellite / Space-based QKD

- Quantum repeaters & trusted-node networks

Italy Quantum Cryptography Market By Deployment Outlook, Revenue (USD Million)

- On-premise / dedicated fiber

- Managed / as-a-service

Italy Quantum Cryptography Market By Application Outlook, Revenue (USD Million)

- Network / Backbone security

- Data-at-rest encryption / database encryption

- Financial transactions & payment security

- Cloud / data center interconnects

- Critical infrastructure

Italy Quantum Cryptography Market By End Use Outlook, Revenue (USD Million)

- BFSI

- Government, Defense & Intelligence

- Telecom service providers / ISPs

- Cloud providers & hyperscalers

- Healthcare & life sciences

- Large enterprises / data centers / research institutes

U.K

U.K Quantum Cryptography Market Systems By Component Outlook (Revenue, USD Million)

- Systems (QKD HW)

- Software

- Services

U.K Quantum Cryptography Market By Technology Outlook (Revenue, USD Million)

- Discrete-Variable QKD

- Continuous-Variable QKD

- Quantum Random Number Generators

- Post-Quantum Cryptography (PQC)

U.K Quantum Cryptography Market By Transmission (Revenue, USD Million)

- Fiber-based QKD

- Free-space QKD

- Satellite / Space-based QKD

- Quantum repeaters & trusted-node networks

U.K Quantum Cryptography Market By Deployment Outlook, Revenue (USD Million)

- On-premise / dedicated fiber

- Managed / as-a-service

U.K Quantum Cryptography Market By Application Outlook, Revenue (USD Million)

- Network / Backbone security

- Data-at-rest encryption / database encryption

- Financial transactions & payment security

- Cloud / data center interconnects

- Critical infrastructure

U.K Quantum Cryptography Market By End Use Outlook, Revenue (USD Million)

- BFSI

- Government, Defense & Intelligence

- Telecom service providers / ISPs

- Cloud providers & hyperscalers

- Healthcare & life sciences

- Large enterprises / data centers / research institutes

Benelux

Benelux Quantum Cryptography Market Systems By Component Outlook (Revenue, USD Million)

- Systems (QKD HW)

- Software

- Services

Benelux Quantum Cryptography Market By Technology Outlook (Revenue, USD Million)

- Discrete-Variable QKD

- Continuous-Variable QKD

- Quantum Random Number Generators

- Post-Quantum Cryptography (PQC)

Benelux Quantum Cryptography Market By Transmission (Revenue, USD Million)

- Fiber-based QKD

- Free-space QKD

- Satellite / Space-based QKD

- Quantum repeaters & trusted-node networks

Benelux Quantum Cryptography Market By Deployment Outlook, Revenue (USD Million)

- On-premise / dedicated fiber

- Managed / as-a-service

Benelux Quantum Cryptography Market By Application Outlook, Revenue (USD Million)

- Network / Backbone security

- Data-at-rest encryption / database encryption

- Financial transactions & payment security

- Cloud / data center interconnects

- Critical infrastructure

Benelux Quantum Cryptography Market By End Use Outlook, Revenue (USD Million)

- BFSI

- Government, Defense & Intelligence

- Telecom service providers / ISPs

- Cloud providers & hyperscalers

- Healthcare & life sciences

- Large enterprises / data centers / research institutes

Russia

Russia Quantum Cryptography Market Systems By Component Outlook (Revenue, USD Million)

- Systems (QKD HW)

- Software

- Services

Russia Quantum Cryptography Market By Technology Outlook (Revenue, USD Million)

- Discrete-Variable QKD

- Continuous-Variable QKD

- Quantum Random Number Generators

- Post-Quantum Cryptography (PQC)

Russia Quantum Cryptography Market By Transmission (Revenue, USD Million)

- Fiber-based QKD

- Free-space QKD

- Satellite / Space-based QKD

- Quantum repeaters & trusted-node networks

Russia Quantum Cryptography Market By Deployment Outlook, Revenue (USD Million)

- On-premise / dedicated fiber

- Managed / as-a-service

Russia Quantum Cryptography Market By Application Outlook, Revenue (USD Million)

- Network / Backbone security

- Data-at-rest encryption / database encryption

- Financial transactions & payment security

- Cloud / data center interconnects

- Critical infrastructure

Russia Quantum Cryptography Market By End Use Outlook, Revenue (USD Million)

- BFSI

- Government, Defense & Intelligence

- Telecom service providers / ISPs

- Cloud providers & hyperscalers

- Healthcare & life sciences

- Large enterprises / data centers / research institutes

Finland

Finland Quantum Cryptography Market Systems By Component Outlook (Revenue, USD Million)

- Systems (QKD HW)

- Software

- Services

Finland Quantum Cryptography Market By Technology Outlook (Revenue, USD Million)

- Discrete-Variable QKD

- Continuous-Variable QKD

- Quantum Random Number Generators

- Post-Quantum Cryptography (PQC)

Finland Quantum Cryptography Market By Transmission (Revenue, USD Million)

- Fiber-based QKD

- Free-space QKD

- Satellite / Space-based QKD

- Quantum repeaters & trusted-node networks

Finland Quantum Cryptography Market By Deployment Outlook, Revenue (USD Million)

- On-premise / dedicated fiber

- Managed / as-a-service

Finland Quantum Cryptography Market By Application Outlook, Revenue (USD Million)

- Network / Backbone security

- Data-at-rest encryption / database encryption

- Financial transactions & payment security

- Cloud / data center interconnects

- Critical infrastructure

Finland Quantum Cryptography Market By End Use Outlook, Revenue (USD Million)

- BFSI

- Government, Defense & Intelligence

- Telecom service providers / ISPs

- Cloud providers & hyperscalers

- Healthcare & life sciences

- Large enterprises / data centers / research institutes

Sweden

Sweden Quantum Cryptography Market Systems By Component Outlook (Revenue, USD Million)

- Systems (QKD HW)

- Software

- Services

Sweden Quantum Cryptography Market By Technology Outlook (Revenue, USD Million)

- Discrete-Variable QKD

- Continuous-Variable QKD

- Quantum Random Number Generators

- Post-Quantum Cryptography (PQC)

Sweden Quantum Cryptography Market By Transmission (Revenue, USD Million)

- Fiber-based QKD

- Free-space QKD

- Satellite / Space-based QKD

- Quantum repeaters & trusted-node networks

Sweden Quantum Cryptography Market By Deployment Outlook, Revenue (USD Million)

- On-premise / dedicated fiber

- Managed / as-a-service

Sweden Quantum Cryptography Market By Application Outlook, Revenue (USD Million)

- Network / Backbone security

- Data-at-rest encryption / database encryption

- Financial transactions & payment security

- Cloud / data center interconnects

- Critical infrastructure

Sweden Quantum Cryptography Market By End Use Outlook, Revenue (USD Million)

- BFSI

- Government, Defense & Intelligence

- Telecom service providers / ISPs

- Cloud providers & hyperscalers

- Healthcare & life sciences

- Large enterprises / data centers / research institutes

Rest of Europe

Rest of Europe Quantum Cryptography Market Systems By Component Outlook (Revenue, USD Million)

- Systems (QKD HW)

- Software

- Services

Rest of Europe Quantum Cryptography Market By Technology Outlook (Revenue, USD Million)

- Discrete-Variable QKD

- Continuous-Variable QKD

- Quantum Random Number Generators

- Post-Quantum Cryptography (PQC)

Rest of Europe Quantum Cryptography Market By Transmission (Revenue, USD Million)

- Fiber-based QKD

- Free-space QKD

- Satellite / Space-based QKD

- Quantum repeaters & trusted-node networks

Rest of Europe Quantum Cryptography Market By Deployment Outlook, Revenue (USD Million)

- On-premise / dedicated fiber

- Managed / as-a-service

Rest of Europe Quantum Cryptography Market By Application Outlook, Revenue (USD Million)

- Network / Backbone security

- Data-at-rest encryption / database encryption

- Financial transactions & payment security

- Cloud / data center interconnects

- Critical infrastructure

Rest of Europe Quantum Cryptography Market By End Use Outlook, Revenue (USD Million)

- BFSI

- Government, Defense & Intelligence

- Telecom service providers / ISPs

- Cloud providers & hyperscalers

- Healthcare & life sciences

- Large enterprises / data centers / research institutes

Asia-Pacific

Asia-Pacific Quantum Cryptography Market Systems By Component Outlook (Revenue, USD Million)

- Systems (QKD HW)

- Software

- Services

Asia-Pacific Quantum Cryptography Market By Technology Outlook (Revenue, USD Million)

- Discrete-Variable QKD

- Continuous-Variable QKD

- Quantum Random Number Generators

- Post-Quantum Cryptography (PQC)

Asia-Pacific Quantum Cryptography Market By Transmission (Revenue, USD Million)

- Fiber-based QKD

- Free-space QKD

- Satellite / Space-based QKD

- Quantum repeaters & trusted-node networks

Asia-Pacific Quantum Cryptography Market By Deployment Outlook, Revenue (USD Million)

- On-premise / dedicated fiber

- Managed / as-a-service

Asia-Pacific Quantum Cryptography Market By Application Outlook, Revenue (USD Million)

- Network / Backbone security

- Data-at-rest encryption / database encryption

- Financial transactions & payment security

- Cloud / data center interconnects

- Critical infrastructure

Asia-Pacific Quantum Cryptography Market By End Use Outlook, Revenue (USD Million)

- BFSI

- Government, Defense & Intelligence

- Telecom service providers / ISPs

- Cloud providers & hyperscalers

- Healthcare & life sciences

- Large enterprises / data centers / research institutes

China

China Quantum Cryptography Market Systems By Component Outlook (Revenue, USD Million)

- Systems (QKD HW)

- Software

- Services

China Quantum Cryptography Market By Technology Outlook (Revenue, USD Million)

- Discrete-Variable QKD

- Continuous-Variable QKD

- Quantum Random Number Generators

- Post-Quantum Cryptography (PQC)

China Quantum Cryptography Market By Transmission (Revenue, USD Million)

- Fiber-based QKD

- Free-space QKD

- Satellite / Space-based QKD

- Quantum repeaters & trusted-node networks

China Quantum Cryptography Market By Deployment Outlook, Revenue (USD Million)

- On-premise / dedicated fiber

- Managed / as-a-service

China Quantum Cryptography Market By Application Outlook, Revenue (USD Million)

- Network / Backbone security

- Data-at-rest encryption / database encryption

- Financial transactions & payment security

- Cloud / data center interconnects

- Critical infrastructure

China Quantum Cryptography Market By End Use Outlook, Revenue (USD Million)

- BFSI

- Government, Defense & Intelligence

- Telecom service providers / ISPs

- Cloud providers & hyperscalers

- Healthcare & life sciences

- Large enterprises / data centers / research institutes

India

India Quantum Cryptography Market Systems By Component Outlook (Revenue, USD Million)

- Systems (QKD HW)

- Software

- Services

India Quantum Cryptography Market By Technology Outlook (Revenue, USD Million)

- Discrete-Variable QKD

- Continuous-Variable QKD

- Quantum Random Number Generators

- Post-Quantum Cryptography (PQC)

India Quantum Cryptography Market By Transmission (Revenue, USD Million)

- Fiber-based QKD

- Free-space QKD

- Satellite / Space-based QKD

- Quantum repeaters & trusted-node networks

India Quantum Cryptography Market By Deployment Outlook, Revenue (USD Million)

- On-premise / dedicated fiber

- Managed / as-a-service

India Quantum Cryptography Market By Application Outlook, Revenue (USD Million)

- Network / Backbone security

- Data-at-rest encryption / database encryption

- Financial transactions & payment security

- Cloud / data center interconnects

- Critical infrastructure

India Quantum Cryptography Market By End Use Outlook, Revenue (USD Million)

- BFSI

- Government, Defense & Intelligence

- Telecom service providers / ISPs

- Cloud providers & hyperscalers

- Healthcare & life sciences

- Large enterprises / data centers / research institutes

Japan

Japan Quantum Cryptography Market Systems By Component Outlook (Revenue, USD Million)

- Systems (QKD HW)

- Software

- Services

Japan Quantum Cryptography Market By Technology Outlook (Revenue, USD Million)

- Discrete-Variable QKD

- Continuous-Variable QKD

- Quantum Random Number Generators

- Post-Quantum Cryptography (PQC)

Japan Quantum Cryptography Market By Transmission (Revenue, USD Million)

- Fiber-based QKD

- Free-space QKD

- Satellite / Space-based QKD

- Quantum repeaters & trusted-node networks

Japan Quantum Cryptography Market By Deployment Outlook, Revenue (USD Million)

- On-premise / dedicated fiber

- Managed / as-a-service

Japan Quantum Cryptography Market By Application Outlook, Revenue (USD Million)

- Network / Backbone security

- Data-at-rest encryption / database encryption

- Financial transactions & payment security

- Cloud / data center interconnects

- Critical infrastructure

Japan Quantum Cryptography Market By End Use Outlook, Revenue (USD Million)

- BFSI

- Government, Defense & Intelligence

- Telecom service providers / ISPs

- Cloud providers & hyperscalers

- Healthcare & life sciences

- Large enterprises / data centers / research institutes

Indonesia

Indonesia Quantum Cryptography Market Systems By Component Outlook (Revenue, USD Million)

- Systems (QKD HW)

- Software

- Services

Indonesia Quantum Cryptography Market By Technology Outlook (Revenue, USD Million)

- Discrete-Variable QKD

- Continuous-Variable QKD

- Quantum Random Number Generators

- Post-Quantum Cryptography (PQC)

Indonesia Quantum Cryptography Market By Transmission (Revenue, USD Million)

- Fiber-based QKD

- Free-space QKD

- Satellite / Space-based QKD

- Quantum repeaters & trusted-node networks

Indonesia Quantum Cryptography Market By Deployment Outlook, Revenue (USD Million)

- On-premise / dedicated fiber

- Managed / as-a-service

Indonesia Quantum Cryptography Market By Application Outlook, Revenue (USD Million)

- Network / Backbone security

- Data-at-rest encryption / database encryption

- Financial transactions & payment security

- Cloud / data center interconnects

- Critical infrastructure

Indonesia Quantum Cryptography Market By End Use Outlook, Revenue (USD Million)

- BFSI

- Government, Defense & Intelligence

- Telecom service providers / ISPs

- Cloud providers & hyperscalers

- Healthcare & life sciences

- Large enterprises / data centers / research institutes

Thailand

Thailand Quantum Cryptography Market Systems By Component Outlook (Revenue, USD Million)

- Systems (QKD HW)

- Software

- Services

Thailand Quantum Cryptography Market By Technology Outlook (Revenue, USD Million)

- Discrete-Variable QKD

- Continuous-Variable QKD

- Quantum Random Number Generators

- Post-Quantum Cryptography (PQC)

Thailand Quantum Cryptography Market By Transmission (Revenue, USD Million)

- Fiber-based QKD

- Free-space QKD

- Satellite / Space-based QKD

- Quantum repeaters & trusted-node networks

Thailand Quantum Cryptography Market By Deployment Outlook, Revenue (USD Million)

- On-premise / dedicated fiber

- Managed / as-a-service

Thailand Quantum Cryptography Market By Application Outlook, Revenue (USD Million)

- Network / Backbone security

- Data-at-rest encryption / database encryption

- Financial transactions & payment security

- Cloud / data center interconnects

- Critical infrastructure

Thailand Quantum Cryptography Market By End Use Outlook, Revenue (USD Million)

- BFSI

- Government, Defense & Intelligence

- Telecom service providers / ISPs

- Cloud providers & hyperscalers

- Healthcare & life sciences

- Large enterprises / data centers / research institutes

Vietnam

Vietnam Quantum Cryptography Market Systems By Component Outlook (Revenue, USD Million)

- Systems (QKD HW)

- Software

- Services

Vietnam Quantum Cryptography Market By Technology Outlook (Revenue, USD Million)

- Discrete-Variable QKD

- Continuous-Variable QKD

- Quantum Random Number Generators

- Post-Quantum Cryptography (PQC)

Vietnam Quantum Cryptography Market By Transmission (Revenue, USD Million)

- Fiber-based QKD

- Free-space QKD

- Satellite / Space-based QKD

- Quantum repeaters & trusted-node networks

Vietnam Quantum Cryptography Market By Deployment Outlook, Revenue (USD Million)

- On-premise / dedicated fiber

- Managed / as-a-service

Vietnam Quantum Cryptography Market By Application Outlook, Revenue (USD Million)

- Network / Backbone security

- Data-at-rest encryption / database encryption

- Financial transactions & payment security

- Cloud / data center interconnects

- Critical infrastructure

Vietnam Quantum Cryptography Market By End Use Outlook, Revenue (USD Million)

- BFSI

- Government, Defense & Intelligence

- Telecom service providers / ISPs

- Cloud providers & hyperscalers

- Healthcare & life sciences

- Large enterprises / data centers / research institutes

Australia

Australia Quantum Cryptography Market Systems By Component Outlook (Revenue, USD Million)

- Systems (QKD HW)

- Software

- Services

Australia Quantum Cryptography Market By Technology Outlook (Revenue, USD Million)

- Discrete-Variable QKD

- Continuous-Variable QKD

- Quantum Random Number Generators

- Post-Quantum Cryptography (PQC)

Australia Quantum Cryptography Market By Transmission (Revenue, USD Million)

- Fiber-based QKD

- Free-space QKD

- Satellite / Space-based QKD

- Quantum repeaters & trusted-node networks

Australia Quantum Cryptography Market By Deployment Outlook, Revenue (USD Million)

- On-premise / dedicated fiber

- Managed / as-a-service

Australia Quantum Cryptography Market By Application Outlook, Revenue (USD Million)

- Network / Backbone security

- Data-at-rest encryption / database encryption

- Financial transactions & payment security

- Cloud / data center interconnects

- Critical infrastructure

Australia Quantum Cryptography Market By End Use Outlook, Revenue (USD Million)

- BFSI

- Government, Defense & Intelligence

- Telecom service providers / ISPs

- Cloud providers & hyperscalers

- Healthcare & life sciences

- Large enterprises / data centers / research institutes

New Zealand

New Zealand Quantum Cryptography Market Systems By Component Outlook (Revenue, USD Million)

- Systems (QKD HW)

- Software

- Services

New Zealand Quantum Cryptography Market By Technology Outlook (Revenue, USD Million)

- Discrete-Variable QKD

- Continuous-Variable QKD

- Quantum Random Number Generators

- Post-Quantum Cryptography (PQC)

New Zealand Quantum Cryptography Market By Transmission (Revenue, USD Million)

- Fiber-based QKD

- Free-space QKD

- Satellite / Space-based QKD

- Quantum repeaters & trusted-node networks

New Zealand Quantum Cryptography Market By Deployment Outlook, Revenue (USD Million)

- On-premise / dedicated fiber

- Managed / as-a-service

New Zealand Quantum Cryptography Market By Application Outlook, Revenue (USD Million)

- Network / Backbone security

- Data-at-rest encryption / database encryption

- Financial transactions & payment security