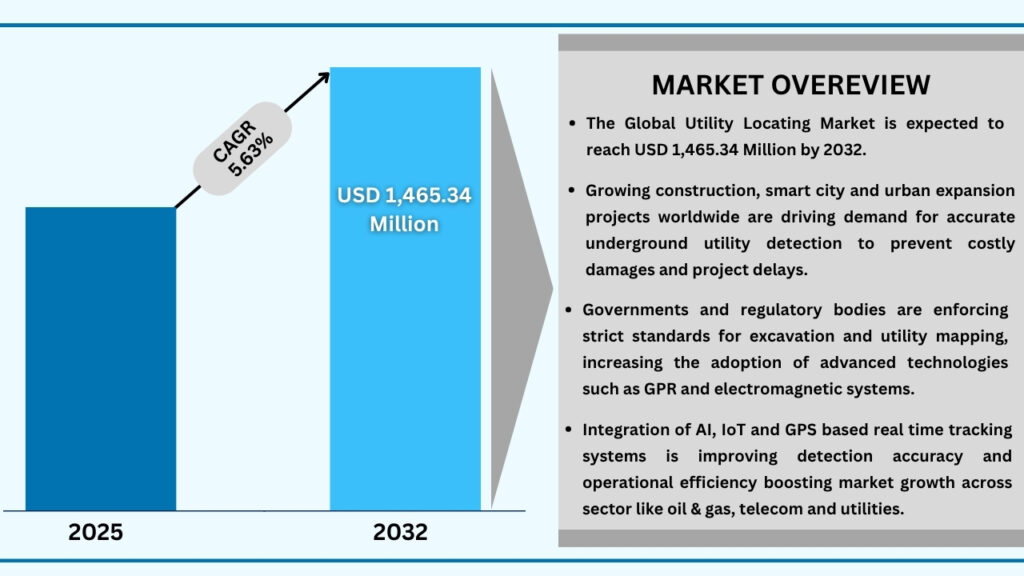

The Utility Locating Market size was USD 947.18 Million in 2024 and is expected to reach USD 1,465.34 million at a CAGR of 5.63% during the forecast period. The Global Utility Locating Market is experiencing steady growth, driven by the rising demand for accurate mapping and detection of underground utilities to prevent damage during construction and excavation activities. As infrastructure development accelerates globally—particularly in sectors such as oil & gas, telecommunications, electric power, and water & wastewater management—the need for efficient and precise utility detection systems has become critical. Governments and municipal bodies are also enforcing stricter regulations to minimize utility strikes, further propelling the adoption of advanced ground-penetrating radar (GPR), electromagnetic induction, and acoustic technology-based systems. Moreover, the increasing deployment of smart city projects and the integration of GIS (Geographic Information Systems) and IoT-enabled locating tools are enhancing real-time monitoring and data accuracy, contributing to market expansion.

Additionally, technological innovations and growing investments in subsurface utility engineering (SUE) are transforming the industry landscape. The emergence of AI-powered detection systems and cloud-based data management solutions is enabling utility service providers and construction companies to reduce project downtime and enhance operational efficiency. The surge in urbanization and infrastructure upgrades in emerging economies—especially across Asia-Pacific and the Middle East—is expected to create significant growth opportunities for market players. However, factors such as high equipment costs and lack of skilled operators may restrain adoption to some extent. Nevertheless, the growing emphasis on safety, digitalization, and environmental sustainability will continue to drive the global utility locating market toward a more connected and intelligent future.

Global Utility Locating Market (USD Million)

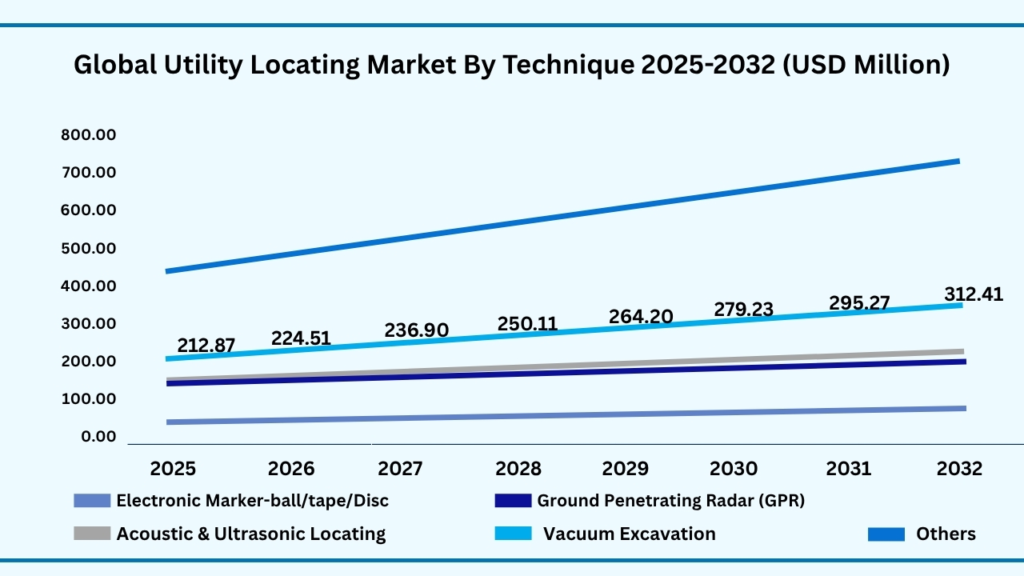

Global Utility Locating Market by Technique Insights:

Electronic Marker-ball/tape/Disc segment accounted for market share of share 45.32% in 2024 in the global Utility Locating market.

The Electronic Marker-ball/tape/Disc Based segment accounted for the largest share of the global Utility Locating market in 2024, representing 45.32 % of total revenues. Electronic Marker-ball/tape/Disc Based segment is expected to register a CAGR of 5.73% during the forecast year from 2025 to 2032. The Electronic Marker-Ball/Tape/Disc-Based segment held the leading position in the Global Utility Locating Market in 2024, driven by its high precision, reliability, and efficiency in detecting buried utilities. These systems utilize electronic markers that emit unique frequencies, making it easier for operators to identify and differentiate between various underground assets such as water pipelines, telecommunication lines, gas networks, and power cables. Their ability to deliver consistent performance across diverse terrains, combined with compatibility with advanced mapping technologies like GPS and GIS, has made them the preferred choice across sectors including construction, oil and gas, and municipal infrastructure. The growing emphasis on reducing excavation risks and preventing utility damage has further strengthened their adoption worldwide.

In the coming years, the Electronic Marker-Ball/Tape/Disc-Based segment is anticipated to maintain strong growth momentum, supported by continuous advancements in RFID detection, IoT integration, and cloud-based monitoring systems. These innovations are enabling more efficient data collection, real-time utility tracking, and improved decision-making during excavation and maintenance projects. The increasing pace of smart city development and the expansion of underground utility networks in both developed and emerging regions will continue to fuel demand for these technologies. As industries prioritize safety, digital accuracy, and operational efficiency, electronic marker-based systems are expected to remain at the forefront of the utility locating market’s technological evolution.

Global Utility Locating Market by Product Type (USD Million)

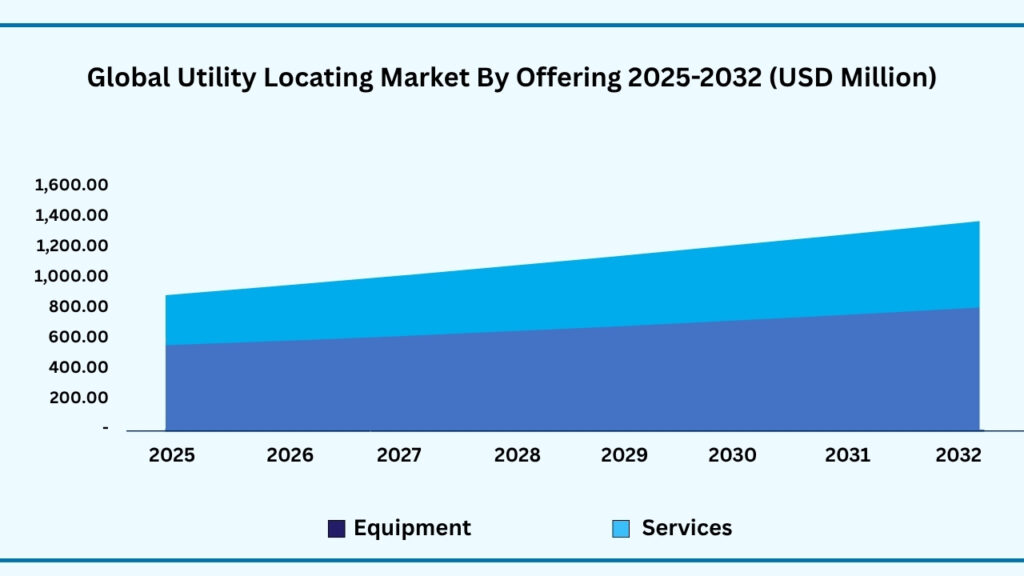

Global Utility Locating Market by Offering Insights:

Equipment segment accounted for the largest market share of share 65.43% in 2024 in the global Utility Locating market.

Based on the offering, Equipment segment held the largest revenue share of 65.43% 2024, and expected to register a CAGR of 5.68% between 2025 to 2032 and the market is expected to reach USD 961.70. The Equipment segment dominated the Global Utility Locating Market in 2024, capturing the largest revenue share due to the increasing reliance on advanced detection and mapping tools across multiple industries. Utility locating equipment—such as ground-penetrating radar (GPR), electromagnetic locators, and acoustic sensors—plays a crucial role in identifying underground utilities with high precision and minimal disruption. The growing need to prevent utility strikes, coupled with rapid urbanization and infrastructure expansion, has accelerated the adoption of these devices in sectors such as construction, oil and gas, telecommunications, and public works. Furthermore, the integration of GPS and GIS technologies with utility locating equipment has improved data accuracy and real-time visibility, helping operators make more informed decisions and reduce costly errors during excavation projects.

Over the forecast period, the Equipment segment is projected to maintain its dominance, supported by the rising adoption of smart, digital, and automated detection systems. Manufacturers are increasingly investing in R&D to develop next-generation solutions featuring IoT connectivity, AI-based analytics, and wireless communication capabilities. These innovations are enhancing field efficiency, safety, and productivity while aligning with the growing trend toward digital infrastructure management. Additionally, the expanding deployment of smart city projects and the modernization of aging utility networks will continue to create strong demand for advanced locating equipment. As a result, this segment will remain a key growth driver, propelling the overall utility locating market toward sustained expansion through the forecast period.

Global Utility Locating Market by Offering (USD Million)

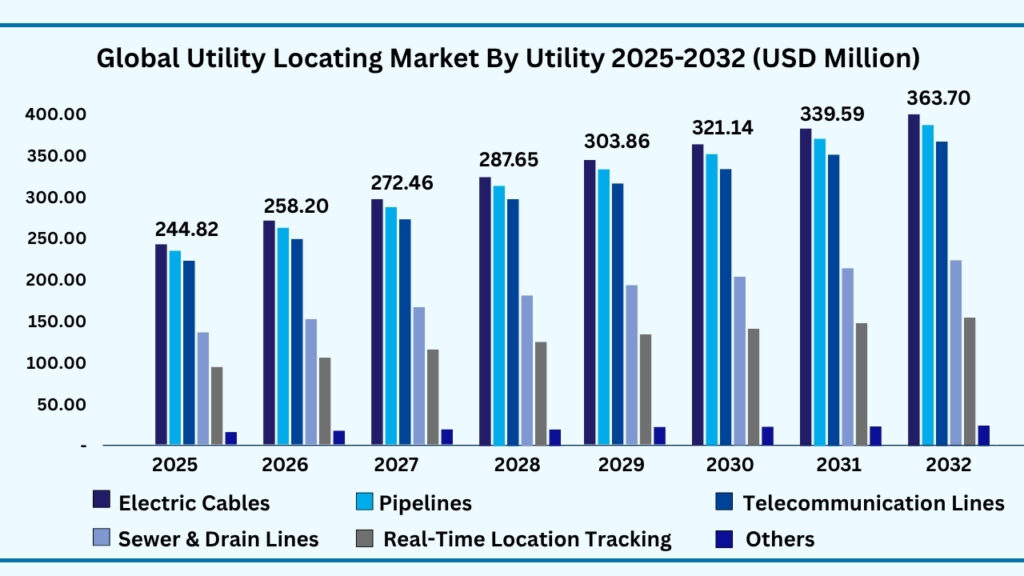

Global Utility Locating Maret by Utility Type Insights:

Electric Cables segment accounted for the largest market share of 24.52% in 2024 in the global Utility Locating market.

Based on Utility type segment, Electric Cables segment held the largest revenue share of 24.52% in the global Utility Locating market in 2024 and expected to register a CAGR of 5.82% from 2025 to 2032 and expected to reach USD 363.70 million. The Electric Cables segment accounted for the largest share of the Global Utility Locating Market in 2024, driven by the growing need for accurate detection and mapping of underground power lines to prevent damage during excavation and construction projects. With increasing electricity demand, expanding transmission and distribution networks, and ongoing infrastructure modernization, the identification of buried electrical utilities has become a critical safety and operational priority. Utility locating systems for electric cables—such as electromagnetic field detectors, ground-penetrating radar, and advanced sensor-based solutions—are widely used to ensure precision, reduce power outages, and prevent costly repair work. The adoption of these technologies is especially strong across urban infrastructure projects, smart grid development, and renewable energy installations, where efficiency and safety standards are paramount.

Looking ahead, the Electric Cables segment is projected to witness steady growth, supported by rising investments in smart power distribution systems, urban electrification, and smart city initiatives across the globe. The integration of IoT-enabled locating tools and cloud-based data platforms is enabling real-time monitoring, predictive maintenance, and improved asset management for power utilities. As governments and private developers continue to emphasize sustainable and resilient infrastructure development, the demand for advanced electric cable locating solutions will further increase. Continuous technological advancements, coupled with regulatory mandates for safe digging and accurate mapping, will ensure that the Electric Cables segment remains a dominant contributor to the overall growth of the global utility locating market in the coming years.

Global Utility Locating Market by Utility Type (USD Million)

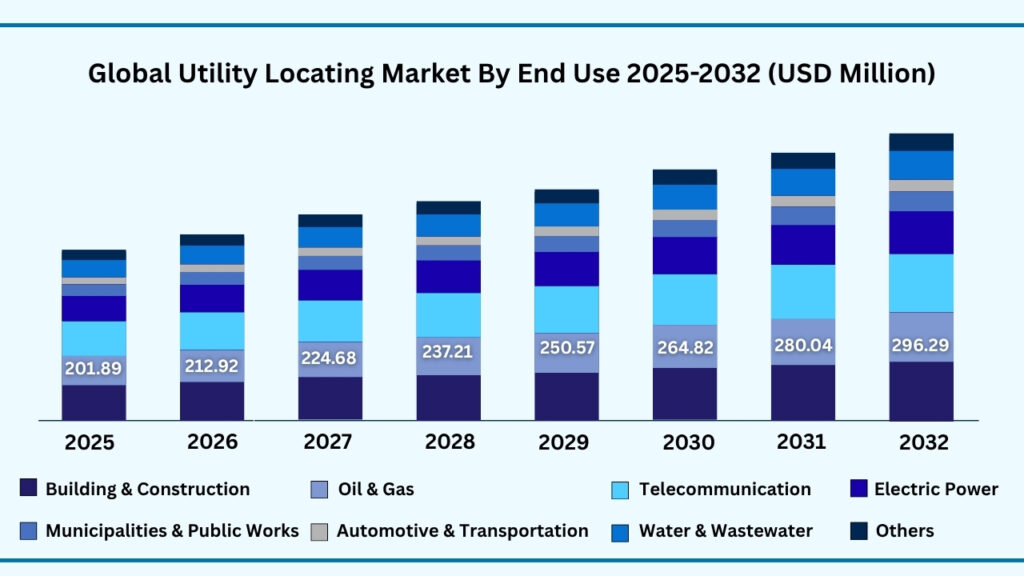

Global Utility Locating Market by End Use:

End Use type accounted for the largest market share of share 22.22%in 2024 in the global Utility Locating market.

Based on End Use, Telecommunication segment held the largest revenue share of 22.22% in the global Utility Locating market in 2024 and expected to register a CAGR of 5.84% from 2025 to 2032 is expected to reach USD 331.46 million. The Telecommunication segment emerged as the leading end-use category in the Global Utility Locating Market in 2024, driven by the rapid expansion of fiber optic networks, 5G infrastructure, and broadband connectivity projects worldwide. The increasing volume of underground telecom cables and the need for precise mapping to avoid accidental damage during construction or maintenance activities have significantly boosted demand for advanced locating technologies. Equipment such as electromagnetic locators, ground-penetrating radar systems, and RFID-based tools are extensively used by telecom operators to ensure accurate detection and minimize service disruptions. With the growing emphasis on seamless digital connectivity and smart communication infrastructure, telecom providers are increasingly adopting sophisticated utility locating solutions to enhance network reliability and reduce downtime.

Over the forecast period, the Telecommunication segment is expected to maintain strong growth momentum, supported by continuous investments in 5G deployment, data center expansion, and smart city development. The integration of IoT-enabled monitoring systems and AI-based data analytics is revolutionizing how telecom utilities manage underground assets, enabling real-time visibility and predictive maintenance. Furthermore, government initiatives promoting digital infrastructure development in emerging economies are creating significant opportunities for market growth. As global communication networks continue to evolve, ensuring the safety, accuracy, and efficiency of underground telecom line detection will remain a key operational priority—positioning this segment as a major contributor to the overall expansion of the utility locating market.

Global Utility Locating Market by End Use (USD Million)

Global Utility Locating Market by Region Insights:

North America segment accounted for the largest market share of share of 39.21% in 2024 in the global Utility Locating market.

Based on region, the global Utility Locating market is segmented into Europe, Asia-Pacific, North America, Latin America and Middle East & Africa. Among these, North America region held the largest revenue share of 39.21% in the global Utility Locating market in 2024 and expected to reach USD 580.42 million in 2032. The North America region dominated the Global Utility Locating Market in 2024, accounting for the largest revenue share, primarily due to the region’s strong infrastructure development, advanced technology adoption, and stringent regulatory standards for underground utility management. The United States and Canada have been at the forefront of implementing modern locating systems to prevent utility damages and ensure public safety during excavation activities. Rapid urbanization, aging utility networks, and continuous upgrades in the oil & gas, telecommunications, and power distribution sectors have significantly contributed to market growth. Additionally, the widespread use of ground-penetrating radar (GPR), electromagnetic locators, and GPS-integrated mapping solutions, supported by robust government initiatives like the “Call Before You Dig” programs, has further strengthened the region’s leadership position.

Looking ahead, the North America utility locating market is projected to sustain steady growth, driven by increasing investments in smart infrastructure, 5G network deployment, and renewable energy projects. The integration of IoT, AI, and cloud-based technologies is transforming the region’s utility detection landscape, enabling more accurate, real-time data collection and predictive maintenance capabilities. Moreover, growing collaboration between public and private stakeholders to enhance underground utility mapping and data sharing is expected to further accelerate market expansion. As safety awareness and regulatory compliance continue to rise, North America will remain a key hub for innovation and technological advancement in the global utility locating industry.

Global Utility Locating Market by Region (USD Million)

Major Companies and Competitive Landscape

The global Utility Locating market is highly competitive and fragmented, with the presence of several established players, regional companies, and emerging startups striving to strengthen their market positions. Leading players are focusing on strategic initiatives such as mergers and acquisitions, partnerships with construction and utility service providers, and collaborations with technology firms to enhance their offerings and expand geographic reach. Companies are heavily investing in research and development to introduce advanced locating technologies, including AI-powered detection systems, IoT-enabled sensors, and cloud-based mapping platforms, aimed at improving accuracy, efficiency, and operational safety. Furthermore, the growing adoption of ground-penetrating radar (GPR), electromagnetic locators, and acoustic sensors across construction, oil & gas, and telecommunication sectors is driving continuous innovation and product diversification in the market.

Market participants are also prioritizing system integration, digital connectivity, and user-friendly designs to deliver enhanced performance in field operations. Efforts include developing portable, wireless, and GPS-integrated devices that provide real-time data visualization, predictive maintenance insights, and compatibility with Geographic Information Systems (GIS). Companies are increasingly aligning their solutions with sustainability and smart city initiatives, catering to the growing demand for efficient underground infrastructure management. With governments mandating safer excavation practices and increased investment in digital infrastructure, competition is intensifying among global and regional players. The combined impact of technological advancements, strategic alliances, product differentiation, and expanding infrastructure projects is expected to propel sustained growth and innovation across the global Utility Locating market.

Some of the leading companies profiled in the global cultured meat market report include:

- Radiodetection Ltd.

- Leica Geosystems AG (Hexagon AB)

- Vivax-Metrotech Corporation

- GSSI (Geophysical Survey Systems, Inc.)

- Guideline Geo AB (MALA Geoscience & ABEM Instrument)

- 3M Company

- Subsite Electronics

- Sensors & Software Inc.

- Schonstedt Instrument Company

- Fuji Tecom Inc.

- Civils.ai

- Pipehawk plc

- US Radar Inc.

- Rycom Instruments, Inc.

- Metrotech Corporation

- ACCP (Aegion/Underground Solutions)

- Guideline Geo AB (ABEM Instrument)

- IDS GeoRadar (Part of Hexagon Group)

- Pipehorn Company, Inc.

- SEBAKMT GmbH (Megger Group)

Strategic Development

Radiodetection Ltd. – Smart Locating and AI Integration Initiative (2024)

In early 2024, Radiodetection Ltd. introduced a new generation of utility locating systems featuring AI-assisted signal processing, enhanced electromagnetic detection, and integrated cloud connectivity. These upgrades were designed to improve detection precision, minimize false readings, and enable real-time data sharing across field teams. The innovation reflects Radiodetection’s ongoing commitment to digital transformation and operational efficiency in underground utility detection and mapping applications.

Leica Geosystems AG (Hexagon AB) – Integrated Mapping and 3D Visualization Platform (2025) In mid-2025, Leica Geosystems AG, a Hexagon company, launched an integrated 3D utility mapping and visualization solution that combines ground-penetrating radar (GPR) with LiDAR and GIS analytics. The platform enables users to create accurate subsurface utility maps and supports digital twin development for smart infrastructure projects. This launch aligns with Hexagon’s strategic focus on advancing precision technology, improving asset management, and promoting sustainable construction practices globally.

Vivax-Metrotech Corporation – Wireless Utility Locator and Cloud Data Suite (2024)

In 2024, Vivax-Metrotech Corporation expanded its product portfolio with the introduction of wireless utility locators equipped with Bluetooth-enabled controllers and a cloud-based data management suite. The solution allows seamless transfer of field data, real-time location tracking, and integration with project management tools. The development underscores Vivax-Metrotech’s focus on enhancing field productivity, data accuracy, and user convenience for contractors and utility service providers worldwide.

Scope of Research

| Report Details | Outcome |

|---|---|

| Market size in 2024 | USD 947.18 Million |

| CAGR (2024–2032) | 11.10% |

| Revenue forecast to 2033 | USD 1,465.34 Million |

| Base year for estimation | 2024 |

| Historical data | 2019–2023 |

| Forecast period | 2025–2032 |

| Quantitative units | Revenue in USD Million, and CAGR in % from 2025 to 2032 |

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | By Technique, By Offering, By Utility Type, By End Use and by region for 2019 to 2032 |

| Regional scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Country scope | U.S., Canada, Mexico, Germany, France, U.K., Italy, Spain, Benelux, Russia, Finland, Sweden, Rest of Europe, China, India, Japan, South Korea, Indonesia, Thailand, Vietnam, Australia, New Zealand Rest of APAC, Brazil, Rest of LATAM, Saudi Arabia, Rest of MEA |

| Key companies profiled | Radiodetection Ltd. | Leica Geosystems AG (Hexagon AB) | Vivax-Metrotech Corporation | GSSI (Geophysical Survey Systems, Inc.) | Guideline Geo AB (MALA Geoscience & ABEM Instrument) | 3M Company | Subsite Electronics | Sensors & Software Inc. | Schonstedt Instrument Company | Fuji Tecom Inc. | Civils.ai | Pipehawk plc | US Radar Inc. | Rycom Instruments, Inc. | Metrotech Corporation | ACCP (Aegion/Underground Solutions) | Guideline Geo AB (ABEM Instrument) | IDS GeoRadar (Part of Hexagon Group) | Pipehorn Company, Inc. | SEBAKMT GmbH (Megger Group) |

| Customization scope | 10 hours of free customization and expert consultation |

Some Key Questions the Report Will Answer

- What is the expected revenue Compound Annual Growth Rate (CAGR) of the global Utility Locating market over the forecast period (2025–2032)?

- The global Utility Locating market revenue is expected to register a Compound Annual Growth Rate (CAGR) of 5.80% during the forecast period.

- What was the size of the global Utility Locating in 2024?

- The global Utility Locating market size was USD 947.18 Million in 2024.

- Which factors are expected to drive the global Utility Locating market growth?

- The global Utility Locating market is expected to grow due to increasing urbanization, rapid infrastructure development, and expansion of underground utility networks. Rising safety regulations and initiatives to prevent utility strikes are driving demand for precise locating solutions. Technological advancements, including AI, IoT, and cloud-based mapping, are enhancing detection accuracy and operational efficiency. Additionally, smart city projects and growing investments in digital infrastructure are creating significant growth opportunities for market players.

Which was the leading segment in the global Utility Locating market in terms of technique in 2024?

-

- Electronic Marker-ball/tape/Disc Based segment was leading in the Utility Locating market on the basis of technique in 2024.

- What are some restraints for revenue growth of the global Utility Locating market?

- Revenue growth in the global Utility Locating market is restrained by the high cost of advanced locating equipment and maintenance. A shortage of skilled operators and technicians limits efficient adoption of these technologies. Additionally, inconsistent regulations across regions can hinder widespread deployment and standardization of utility locating solutions.

Follow us on: Facebook, Twitter, Instagram and LinkedIn.

Chapter 1. Introduction

1.1. Market Definition

1.2. Objectives of the study

1.3. Overview of Global Utility Locating Market

1.4. Currency and pricing

1.5. Limitation

1.6. Markets covered

1.7. Research Scope

Chapter 2. Research Methodology

2.1. Research Sources

2.1.1. Primary

2.1.2. Secondary

2.1.3. Paid Sources

2.2. Years considered for the study

2.3. Assumptions

2.3.1. Market value

2.3.2. Market volume

2.3.3. Exchange rate

2.3.4. Price

2.3.5. Economic & political stability

Chapter 3. Executive Summary

3.1. Summary Snapshot, 2025–2032

Chapter 4. Key Insights

4.1. Production consumption analysis

4.2. Strategic partnerships & alliances

4.3. Joint ventures

4.4. Acquisition of local players

4.5. Contract manufacturing

4.6. Digital & e-commerce sales channels

4.7. Compliance with standards

4.8. Value chain analysis

4.9. Raw material sourcing

4.10. Formulation & manufacturing

4.11. Distribution & retail

4.12. Import-export analysis

4.13. Brand comparative analysis

4.14. Technological advancements

4.15. Porter’s five force

4.15.1. Threat of new entrants

4.15.1.1. Capital requirement

4.15.1.2. Product knowledge

4.15.1.3. Technical knowledge

4.15.1.4. Customer relation

4.15.1.5. Access to application and technology

4.15.2. Threat of substitutes

4.15.2.1. Cost

4.15.2.2. Performance

4.15.2.3. Availability

4.15.2.4. Technical knowledge

4.15.2.5. Durability

4.15.3. Bargaining power of buyers

4.15.3.1. Numbers of buyers relative to suppliers

4.15.3.2. Product differentiation

4.15.3.3. Threat of forward integration

4.15.3.4. Buyers’ volume

4.15.4. Bargaining power of suppliers

4.15.4.1. Suppliers’ concentration

4.15.4.2. Buyers switching cost to other suppliers

4.15.4.3. Threat of backward integration

4.15.5. Bargaining power of suppliers

4.15.5.1. Industry concentration

4.15.5.2. Industry growth rate

4.15.5.3. Product differentiation

4.16. Patent analysis

4.17. Regulation coverage

4.18. Pricing analysis

4.19. Competitive Metric Space Analysis

Chapter 5. Market Overview

5.1. Drivers

5.1.1. Rising Infrastructure Development & Urbanization

5.1.2. Stringent Safety & Damage Prevention Regulations

5.1.3. Adoption of Advanced Detection Technologies

5.2. Restraints

5.2.1. High Equipment & Maintenance Costs

5.2.2. Limited Skilled Workforce

5.3. Opportunities

5.3.1. Expansion of Smart City & 5G Infrastructure Projects

5.3.2. Integration with Cloud-Based Mapping & Digital Twins

5.3.3. Growing Investments in Renewable Energy Infrastructure

5.4. Threat

5.4.1. Data Accuracy & Standardization Issues

5.4.2. Environmental & Site Complexity

Chapter 6. Global Utility Locating Market By Technique Insights & Trends, Revenue (USD Million),

6.1. Technique Dynamics & Market Share, 2025–2032

6.1.1.1. Electronic Marker-ball/tape/Disc

6.1.1.2. Ground Penetrating Radar (GPR)

6.1.1.3. Acoustic & Ultrasonic Locating

6.1.1.4. Vacuum Excavation

6.1.1.5. Others

Chapter 7. Global Utility Locating Market By Offering Insights & Trends, Revenue (USD Million),

7.1. Offering Dynamics & Market Share, 2025–2032

7.1.1. Equipment

7.1.1.1. Handheld locators,

7.1.1.2. GPR systems

7.1.1.3. cable & pipe locators

7.1.1.4. sensors

7.1.1.5. transmitters

7.1.1.6. receivers

7.1.2. Services

7.1.2.1. Underground utility mapping

7.1.2.2. damage prevention

7.1.2.3. consulting

7.1.2.4. Data interpretation

7.1.2.5. GIS integration

Chapter 8. Global Utility Locating Market By Utility Type Insights & Trends, Revenue (USD

Million),

8.1. Utility Dynamics & Market Share, 2025–2032

8.1.1. Electric Cables

8.1.2. Pipelines

8.1.3. Telecommunication Lines

8.1.4. Sewer & Drain Lines

8.1.5. Real-Time Location Tracking

8.1.6. Others

Chapter 9. Global Utility Locating Market By End Use Insights & Trends, Revenue (USD Million),

9.1. End Use Dynamics & Market Share, 2025–2032

9.1.1. Building & Construction

9.1.2. Oil & Gas

9.1.3. Telecommunication

9.1.4. Electric Power

9.1.5. Municipalities & Public Works

9.1.6. Automotive & Transportation

9.1.7. Water & Wastewater

9.1.8. Others

Chapter 10. Global Utility Locating Market Regional Outlook

10.1. Utility Locating Share By Region, 2025–2032

10.2. North America

10.2.1.Market By Technique, Market Estimates and Forecast, USD Million,2025-2032

10.2.1.1. Electronic Marker-ball/tape/Disc

10.2.1.2. Ground Penetrating Radar (GPR)

10.2.1.3. Acoustic & Ultrasonic Locating

10.2.1.4. Vacuum Excavation

10.2.1.5. Others

10.2.2.Market By Offering, Market Estimates and Forecast, USD Million,2025-2032

10.2.2.1. Equipment

10.2.2.1.1. Handheld locators,

10.2.2.1.2. GPR systems

10.2.2.1.3. cable & pipe locators

10.2.2.1.4. sensors

10.2.2.1.5. transmitters

10.2.2.1.6. receivers

10.2.2.2. Services

10.2.2.2.1. Underground utility mapping

10.2.2.2.2. damage prevention

10.2.2.2.3. consulting

10.2.2.2.4. Data interpretation

10.2.2.2.5. GIS integration

10.2.3. Market By Utility Type Estimates and Forecast, USD Million, 2025-2032

10.2.3.1. Electric Cables

10.2.3.2. Pipelines

10.2.3.3. Telecommunication Lines

10.2.3.4. Sewer & Drain Lines

10.2.3.5. Real-Time Location Tracking

10.2.3.6. Others

10.2.4. Market By End Use, Market Estimates and Forecast, USD Million, 2025-2032

10.2.4.1. Building & Construction

10.2.4.2. Oil & Gas

10.2.4.3. Telecommunication

10.2.4.4. Electric Power

10.2.4.5. Municipalities & Public Works

10.2.4.6. Automotive & Transportation

10.2.4.7. Water & Wastewater

10.2.4.8. Others

10.2.5. Market By Country, Market Estimates and Forecast, USD Million, 2025-2032

10.2.5.1. US

10.2.5.2. Canada

10.2.5.3. Mexico

10.3. Europe

10.3.1.Market By Technique, Market Estimates and Forecast, USD Million,2025-2032

10.3.1.1. Electronic Marker-ball/tape/Disc

10.3.1.2. Ground Penetrating Radar (GPR)

10.3.1.3. Acoustic & Ultrasonic Locating

10.3.1.4. Vacuum Excavation

10.3.1.5. Others

10.3.2.Market By Offering, Market Estimates and Forecast, USD Million,2025-2032

10.3.3. Equipment

10.3.3.1. Handheld locators,

10.3.3.2. GPR systems

10.3.3.3. cable & pipe locators

10.3.3.4. sensors

10.3.3.5. transmitters

10.3.3.6. receivers

10.3.4. Services

10.3.4.1. Underground utility mapping

10.3.4.2. damage prevention

10.3.4.3. consulting

10.3.4.4. Data interpretation

10.3.4.5. GIS integration

10.3.5. Market By Utility Type Estimates and Forecast, USD Million, 2025-2032

10.3.5.1. Electric Cables

10.3.5.2. Pipelines

10.3.5.3. Telecommunication Lines

10.3.5.4. Sewer & Drain Lines

10.3.5.5. Real-Time Location Tracking

10.3.5.6. Others

10.3.6. Market By End Use, Market Estimates and Forecast, USD Million, 2025-2032

10.3.6.1. Building & Construction

10.3.6.2. Oil & Gas

10.3.6.3. Telecommunication

10.3.6.4. Electric Power

10.3.6.5. Municipalities & Public Works

10.3.6.6. Automotive & Transportation

10.3.6.7. Water & Wastewater

10.3.6.8. Others

10.3.7. Market By Country, Market Estimates and Forecast, USD Million, 2025-2032

10.3.7.1. Germany

10.3.7.2. France

10.3.7.3. U.K.

10.3.7.4. Poland

10.3.7.5. Spain

10.3.7.6. Benelux

10.3.7.7. Italy

10.3.7.8. Russia

10.3.7.9. Rest of Europe

10.4. Asia-Pacific

10.4.1.Market By Technique, Market Estimates and Forecast, USD Million,2025-2032

10.4.1.1. Electronic Marker-ball/tape/Disc

10.4.1.2. Ground Penetrating Radar (GPR)

10.4.1.3. Acoustic & Ultrasonic Locating

10.4.1.4. Vacuum Excavation

10.4.1.5. Others

10.4.2.Market By Offering, Market Estimates and Forecast, USD Million,2025-2032

10.4.3. Equipment

10.4.3.1. Handheld locators,

10.4.3.2. GPR systems

10.4.3.3. cable & pipe locators

10.4.3.4. sensors

10.4.3.5. transmitters

10.4.3.6. receivers

10.4.4. Services

10.4.4.1. Underground utility mapping

10.4.4.2. damage prevention

10.4.4.3. consulting

10.4.4.4. Data interpretation

10.4.4.5. GIS integration

10.4.5. Market By Utility Type Estimates and Forecast, USD Million, 2025-2032

10.4.5.1. Electric Cables

10.4.5.2 .Pipelines

10.4.5.3. Telecommunication Lines

10.4.5.4. Sewer & Drain Lines

10.4.5.5. Real-Time Location Tracking

10.4.5.6. Others

10.4.6. Market By End Use, Market Estimates and Forecast, USD Million, 2025-2032

10.4.6.1. Building & Construction

10.4.6.2. Oil & Gas

10.4.6.3. Telecommunication

10.4.6.4. Electric Power

10.4.6.5. Municipalities & Public Works

10.4.6.6. Automotive & Transportation

10.4.6.7. Water & Wastewater

10.4.6.8. Others

10.4.7. Market By Country, Market Estimates and Forecast, USD Million, 2025-2032

10.4.7.1. China

10.4.7.2. India

10.4.7.3. South Korea

10.4.7.4. Japan

10.4.7.5. Australia

10.4.7.6. New Zealand

10.4.7.7. Rest of Asia-Pacific

10.5. Latin America

10.5.1. Market By Technique, Market Estimates and Forecast, USD Million,2025-2032

10.5.1.1. Electronic Marker-ball/tape/Disc

10.5.1.2. Ground Penetrating Radar (GPR)

10.5.1.3. Acoustic & Ultrasonic Locating

10.5.1.4. Vacuum Excavation

10.5.1.5. Others

10.5.2. Market By Offering, Market Estimates and Forecast, USD Million,2025-2032

10.5.3. Equipment

10.5.3.1. Handheld locators,

10.5.3.2. GPR systems

10.5.3.3. cable & pipe locators

10.5.3.4. sensors

10.5.3.5. transmitters

10.5.3.6. receivers

10.5.4. Services

10.5.4.1. Underground utility mapping

10.5.4.2. damage prevention

10.5.4.3. consulting

10.5.4.4. Data interpretation

10.5.4.5. GIS integration

10.5.5. Market By Utility Type Estimates and Forecast, USD Million, 2025-2032

10.5.5.1. Electric Cables

10.5.5.2. Pipelines

10.5.5.3. Telecommunication Lines

10.5.5.4. Sewer & Drain Lines

10.5.5.5. Real-Time Location Tracking

10.5.5.6. Others

10.5.6. Market By End Use, Market Estimates and Forecast, USD Million, 2025-2032

10.5.6.1. Building & Construction

10.5.6.2. Oil & Gas

10.5.6.3. Telecommunication

10.5.6.4. Electric Power

10.5.6.5. Municipalities & Public Works

10.5.6.6. Automotive & Transportation

10.5.6.7. Water & Wastewater

10.5.6.8. Others

10.5.7. Market By Country, Market Estimates and Forecast, USD Million, 2025-2032

10.5.7.1. Brazil

10.5.7.2. Rest of Latin America

10.6. Middle East & Africa

10.6.1. Market By Technique, Market Estimates and Forecast, USD Million,2025-2032

10.6.1.1. Electronic Marker-ball/tape/Disc

10.6.1.2. Ground Penetrating Radar (GPR)

10.6.1.3. Acoustic & Ultrasonic Locating

10.6.1.4. Vacuum Excavation

10.6.1.5. Others

10.6.2. Market By Offering, Market Estimates and Forecast, USD Million,2025-2032

10.6.3. Equipment

10.6.3.1. Handheld locators,

10.6.3.2. GPR systems

10.6.3.3. cable & pipe locators

10.6.3.4. sensors

10.6.3.5. transmitters

10.6.3.6. receivers

10.6.4. Services

10.6.4.1. Underground utility mapping

10.6.4.2. damage prevention

10.6.4.3. consulting

10.6.4.4. Data interpretation

10.6.4.5. GIS integration

10.6.5. Market By Utility Type Estimates and Forecast, USD Million, 2025-2032

10.6.5.1. Electric Cables

10.6.5.2. Pipelines

10.6.5.3. Telecommunication Lines

10.6.5.4. Sewer & Drain Lines

10.6.5.5. Real-Time Location Tracking

10.6.5.6. Others

10.6.6. Market By End Use, Market Estimates and Forecast, USD Million, 2025-2032

10.6.6.1. Building & Construction

10.6.6.2. Oil & Gas

10.6.6.3. Telecommunication

10.6.6.4. Electric Power

10.6.6.5. Municipalities & Public Works

10.6.6.6. Automotive & Transportation

10.6.6.7. Water & Wastewater

10.6.6.8. Others

10.6.7. Market By Country, Market Estimates and Forecast, USD Million, 2025-2032

10.6.7.1. Saudi Arabia

10.6.7.2. Rest of Middle East & Africa

Chapter 11. Competitive Landscape

11.1. Market Revenue Share By Manufacturers

11.2. Mergers & Acquisitions

11.3. Competitor’s Positioning

11.4. Strategy Benchmarking

11.5. Vendor Landscape

11.5.1. Distributors

11.5.1.1. North America

11.5.1.2. Europe

11.5.1.3. Asia Pacific

11.5.1.4. Middle East & Africa

11.5.1.5. Latin America

Chapter 12. Company Profiles

12.1. Radiodetection Ltd.

12.1.1. Company Overview

12.1.2. Product & Service Offerings

12.1.3. Strategic Initiatives

12.1.4. Financials

12.2. Leica Geosystems AG (Hexagon AB)

12.2.1. Company Overview

12.2.2. Product & Service Offerings

12.2.3. Strategic Initiatives

12.2.4. Financials

12.3. Vivax-Metrotech Corporation

12.3.1. Company Overview

12.3.2. Product & Service Offerings

12.3.3. Strategic Initiatives

12.3.4. Financials

12.4. GSSI (Geophysical Survey Systems, Inc.)

12.4.1. Company Overview

12.4.2. Product & Service Offerings

12.4.3. Strategic Initiatives

12.4.4. Financials

12.5. Guideline Geo AB (MALA Geoscience & ABEM Instrument)

12.5.1. Company Overview

12.5.2. Product & Service Offerings

12.5.3. Strategic Initiatives

12.5.4. Financials

12.6. 3M Company

12.6.1. Company Overview

12.6.2. Product & Service Offerings

12.6.3. Strategic Initiatives

12.6.4. Financials

12.7. Subsite Electronics

12.7.1. Company Overview

12.7.2. Product & Service Offerings

12.7.3. Strategic Initiatives

12.7.4. Financials

12.7.5. Conclusion

12.8. Sensors & Software Inc.

12.8.1. Company Overview

12.8.2. Product & Service Offerings

12.8.3. Strategic Initiatives

12.8.4. Financials

12.8.5. Conclusion

12.9. Schonstedt Instrument Company

12.9.1. Company Overview

12.9.2. Product & Service Offerings

12.9.3. Strategic Initiatives

12.9.4. Financials

12.9.5. Conclusion

12.10. Fuji Tecom Inc.

12.10.1. Company Overview

12.10.2. Product & Service Offerings

12.10.3. Strategic Initiatives

12.10.4. Financials

12.10.5. Conclusion

12.11. Civils.ai

12.11.1. Company Overview

12.11.2. Product & Service Offerings

12.11.3. Strategic Initiatives

12.11.4. Financials

12.11.5. Conclusion

12.12. Pipehawk plc

12.12.1. Company Overview

12.12.2. Product & Service Offerings

12.12.3. Strategic Initiatives

12.12.4. Financials

12.12.5. Conclusion

12.13. US Radar Inc.

12.13.1. Company Overview

12.13.2. Product & Service Offerings

12.13.3. Strategic Initiatives

12.13.4. Financials

12.13.5. Conclusion

12.14. Rycom Instruments, Inc.

12.14.1. Company Overview

12.14.2. Product & Service Offerings

12.14.3. Strategic Initiatives

12.14.4. Financials

12.14.5. Conclusion

12.15. Metrotech Corporation

12.15.1. Company Overview

12.15.2. Product & Service Offerings

12.15.3. Strategic Initiatives

12.15.4. Financials

12.15.5. Conclusion

12.16. ACCP (Aegion/Underground Solutions)

12.16.1. Company Overview

12.16.2. Product & Service Offerings

12.16.3. Strategic Initiatives

12.16.4. Financials

12.16.5. Conclusion

12.17. Guideline Geo AB (ABEM Instrument)

12.17.1. Company Overview

12.17.2. Product & Service Offerings

12.17.3. Strategic Initiatives

12.17.4. Financials

12.17.5. Conclusion

12.18. IDS GeoRadar (Part of Hexagon Group)

12.18.1. Company Overview

12.18.2. Product & Service Offerings

12.18.3. Strategic Initiatives

12.18.4. Financials

12.18.5. Conclusion

12.19. Pipehorn Company, Inc.

12.19.1. Company Overview

12.19.2. Product & Service Offerings

12.19.3. Strategic Initiatives

12.19.4. Financials

12.19.5. Conclusion

12.20. SEBAKMT GmbH (Megger Group)

Segments Covered in Report

For the purpose of this report, Advantia Business Consulting LLP. has segmented global Utility Locating Market on the basis of By Technique, By Offering, By Utility Type, By End Use and by region for 2019 to 2032

Global Utility Locating Market By Technique Outlook (Revenue, USD Million 2019-2032)

-

- Electronic Marker-ball/tape/Disc

- Ground Penetrating Radar (GPR)

- Acoustic & Ultrasonic Locating

- Vacuum Excavation

- Others

Global Utility Locating Market, By Offering Outlook (Revenue, USD Million; 2019-2032)

-

- Equipment

- Service

Global Utility Locating Market by Utility Type Outlook (Revenue, USD Million; 2019-2032)

-

- Electric Cables

- Pipelines

- Telecommunication Lines

- Sewer & Drain Lines

- Real-Time Location Tracking

- Others

Global Utility Locating By End Use Market (Revenue, USD Million; 2019-2032)

-

- Building & Construction

- Oil & Gas

- Telecommunication

- Electric Power

- Municipalities & Public Works

- Automotive & Transportation

- Water & Wastewater

- Others

- North America

North America Utility Locating Market By Technique Outlook (Revenue, USD Million 2019-2032)

-

- Electronic Marker-ball/tape/Disc

- Ground Penetrating Radar (GPR)

- Acoustic & Ultrasonic Locating

- Vacuum Excavation

- Others

North America Utility Locating Market, By Offering Outlook (Revenue, USD Million; 2019-2032)

-

- Equipment

- Service

North America Utility Locating Market by Utility Type Outlook (Revenue, USD Million; 2019-2032)

-

- Electric Cables

- Pipelines

- Telecommunication Lines

- Sewer & Drain Lines

- Real-Time Location Tracking

- Others

North America Utility Locating By End Use Market (Revenue, USD Million; 2019-2032)

-

- Building & Construction

- Oil & Gas

- Telecommunication

- Electric Power

- Municipalities & Public Works

- Automotive & Transportation

- Water & Wastewater

- Others

- U.S.

U.S Utility Locating Market By Technique Outlook (Revenue, USD Million 2019-2032)

-

- Electronic Marker-ball/tape/Disc

- Ground Penetrating Radar (GPR)

- Acoustic & Ultrasonic Locating

- Vacuum Excavation

- Others

U.S Utility Locating Market, By Offering Outlook (Revenue, USD Million; 2019-2032)

-

- Equipment

- Service

U.S Utility Locating Market by Utility Type Outlook (Revenue, USD Million; 2019-2032)

-

- Electric Cables

- Pipelines

- Telecommunication Lines

- Sewer & Drain Lines

- Real-Time Location Tracking

- Others

U.S Utility Locating By End Use Market (Revenue, USD Million; 2019-2032)

-

- Building & Construction

- Oil & Gas

- Telecommunication

- Electric Power

- Municipalities & Public Works

- Automotive & Transportation

- Water & Wastewater

- Others

- Canada

Canada Utility Locating Market By Technique Outlook (Revenue, USD Million 2019-2032)

-

- Electronic Marker-ball/tape/Disc

- Ground Penetrating Radar (GPR)

- Acoustic & Ultrasonic Locating

- Vacuum Excavation

- Others

Canada Utility Locating Market, By Offering Outlook (Revenue, USD Million; 2019-2032)

-

- Equipment

- Service

Canada Utility Locating Market by Utility Type Outlook (Revenue, USD Million; 2019-2032)

-

- Electric Cables

- Pipelines

- Telecommunication Lines

- Sewer & Drain Lines

- Real-Time Location Tracking

- Others

Canada Utility Locating By End Use Market (Revenue, USD Million; 2019-2032)

-

- Building & Construction

- Oil & Gas

- Telecommunication

- Electric Power

- Municipalities & Public Works

- Automotive & Transportation

- Water & Wastewater

- Others

- Mexico

Mexico Utility Locating Market By Technique Outlook (Revenue, USD Million 2019-2032)

-

- Electronic Marker-ball/tape/Disc

- Ground Penetrating Radar (GPR)

- Acoustic & Ultrasonic Locating

- Vacuum Excavation

- Others

Mexico Utility Locating Market, By Offering Outlook (Revenue, USD Million; 2019-2032)

-

- Equipment

- Service

Mexico Utility Locating Market by Utility Type Outlook (Revenue, USD Million; 2019-2032)

-

- Electric Cables

- Pipelines

- Telecommunication Lines

- Sewer & Drain Lines

- Real-Time Location Tracking

- Others

Mexico Utility Locating By End Use Market (Revenue, USD Million; 2019-2032)

-

- Building & Construction

- Oil & Gas

- Telecommunication

- Electric Power

- Municipalities & Public Works

- Automotive & Transportation

- Water & Wastewater

- Others

- Europe

Europe Utility Locating Market By Technique Outlook (Revenue, USD Million 2019-2032)

-

- Electronic Marker-ball/tape/Disc

- Ground Penetrating Radar (GPR)

- Acoustic & Ultrasonic Locating

- Vacuum Excavation

- Others

Europe Utility Locating Market, By Offering Outlook (Revenue, USD Million; 2019-2032)

-

- Equipment

- Service

Europe Utility Locating Market by Utility Type Outlook (Revenue, USD Million; 2019-2032)

-

- Electric Cables

- Pipelines

- Telecommunication Lines

- Sewer & Drain Lines

- Real-Time Location Tracking

- Others

Europe Utility Locating By End Use Market (Revenue, USD Million; 2019-2032)

-

- Building & Construction

- Oil & Gas

- Telecommunication

- Electric Power

- Municipalities & Public Works

- Automotive & Transportation

- Water & Wastewater

- Others

- Germany

Germany Utility Locating Market By Technique Outlook (Revenue, USD Million 2019-2032)

-

- Electronic Marker-ball/tape/Disc

- Ground Penetrating Radar (GPR)

- Acoustic & Ultrasonic Locating

- Vacuum Excavation

- Others

Germany Utility Locating Market, By Offering Outlook (Revenue, USD Million; 2019-2032)

-

- Equipment

- Service

Germany Utility Locating Market by Utility Type Outlook (Revenue, USD Million; 2019-2032)

-

- Electric Cables

- Pipelines

- Telecommunication Lines

- Sewer & Drain Lines

- Real-Time Location Tracking

- Others

Germany Utility Locating By End Use Market (Revenue, USD Million; 2019-2032)

-

- Building & Construction

- Oil & Gas

- Telecommunication

- Electric Power

- Municipalities & Public Works

- Automotive & Transportation

- Water & Wastewater

- Others

- France

France Utility Locating Market By Technique Outlook (Revenue, USD Million 2019-2032)

-

- Electronic Marker-ball/tape/Disc

- Ground Penetrating Radar (GPR)

- Acoustic & Ultrasonic Locating

- Vacuum Excavation

- Others

France Utility Locating Market, By Offering Outlook (Revenue, USD Million; 2019-2032)

-

- Equipment

- Service

France Utility Locating Market by Utility Type Outlook (Revenue, USD Million; 2019-2032)

-

- Electric Cables

- Pipelines

- Telecommunication Lines

- Sewer & Drain Lines

- Real-Time Location Tracking

- Others

France Utility Locating By End Use Market (Revenue, USD Million; 2019-2032)

-

- Building & Construction

- Oil & Gas

- Telecommunication

- Electric Power

- Municipalities & Public Works

- Automotive & Transportation

- Water & Wastewater

- Others

- U.K

U.K Utility Locating Market By Technique Outlook (Revenue, USD Million 2019-2032)

-

- Electronic Marker-ball/tape/Disc

- Ground Penetrating Radar (GPR)

- Acoustic & Ultrasonic Locating

- Vacuum Excavation

- Others

U.K Utility Locating Market, By Offering Outlook (Revenue, USD Million; 2019-2032)

-

- Equipment

- Service

U.K Utility Locating Market by Utility Type Outlook (Revenue, USD Million; 2019-2032)

-

- Electric Cables

- Pipelines

- Telecommunication Lines

- Sewer & Drain Lines

- Real-Time Location Tracking

- Others

U.K Utility Locating By End Use Market (Revenue, USD Million; 2019-2032)

-

- Building & Construction

- Oil & Gas

- Telecommunication

- Electric Power

- Municipalities & Public Works

- Automotive & Transportation

- Water & Wastewater

- Others

- Poland

Poland Utility Locating Market By Technique Outlook (Revenue, USD Million 2019-2032)

-

- Electronic Marker-ball/tape/Disc

- Ground Penetrating Radar (GPR)

- Acoustic & Ultrasonic Locating

- Vacuum Excavation

- Others

Poland Utility Locating Market, By Offering Outlook (Revenue, USD Million; 2019-2032)

-

- Equipment

- Service

Poland Utility Locating Market by Utility Type Outlook (Revenue, USD Million; 2019-2032)

-

- Electric Cables

- Pipelines

- Telecommunication Lines

- Sewer & Drain Lines

- Real-Time Location Tracking

- Others

Poland Utility Locating By End Use Market (Revenue, USD Million; 2019-2032)

-

- Building & Construction

- Oil & Gas

- Telecommunication

- Electric Power

- Municipalities & Public Works

- Automotive & Transportation

- Water & Wastewater

- Others

- Spain

Spain Utility Locating Market By Technique Outlook (Revenue, USD Million 2019-2032)

-

- Electronic Marker-ball/tape/Disc

- Ground Penetrating Radar (GPR)

- Acoustic & Ultrasonic Locating

- Vacuum Excavation

- Others

Spain Utility Locating Market, By Offering Outlook (Revenue, USD Million; 2019-2032)

-

- Equipment

- Service

Spain Utility Locating Market by Utility Type Outlook (Revenue, USD Million; 2019-2032)

-

- Electric Cables

- Pipelines

- Telecommunication Lines

- Sewer & Drain Lines

- Real-Time Location Tracking

- Others

Spain Utility Locating By End Use Market (Revenue, USD Million; 2019-2032)

-

- Building & Construction

- Oil & Gas

- Telecommunication

- Electric Power

- Municipalities & Public Works

- Automotive & Transportation

- Water & Wastewater

- Others

- Benelux

Benelux Utility Locating Market By Technique Outlook (Revenue, USD Million 2019-2032)

-

- Electronic Marker-ball/tape/Disc

- Ground Penetrating Radar (GPR)

- Acoustic & Ultrasonic Locating

- Vacuum Excavation

- Others

Benelux Utility Locating Market, By Offering Outlook (Revenue, USD Million; 2019-2032)

-

- Equipment

- Service

Benelux Utility Locating Market by Utility Type Outlook (Revenue, USD Million; 2019-2032)

-

- Electric Cables

- Pipelines

- Telecommunication Lines

- Sewer & Drain Lines

- Real-Time Location Tracking

- Others

Benelux Utility Locating By End Use Market (Revenue, USD Million; 2019-2032)

-

- Building & Construction

- Oil & Gas

- Telecommunication

- Electric Power

- Municipalities & Public Works

- Automotive & Transportation

- Water & Wastewater

- Others

- Italy

Italy Utility Locating Market By Technique Outlook (Revenue, USD Million 2019-2032)

-

- Electronic Marker-ball/tape/Disc

- Ground Penetrating Radar (GPR)

- Acoustic & Ultrasonic Locating

- Vacuum Excavation

- Others

Italy Utility Locating Market, By Offering Outlook (Revenue, USD Million; 2019-2032)

-

- Equipment

- Service

Italy Utility Locating Market by Utility Type Outlook (Revenue, USD Million; 2019-2032)

-

- Electric Cables

- Pipelines

- Telecommunication Lines

- Sewer & Drain Lines

- Real-Time Location Tracking

- Others

Italy Utility Locating By End Use Market (Revenue, USD Million; 2019-2032)

-

- Building & Construction

- Oil & Gas

- Telecommunication

- Electric Power

- Municipalities & Public Works

- Automotive & Transportation

- Water & Wastewater

- Others

- Russia

Russia Utility Locating Market By Technique Outlook (Revenue, USD Million 2019-2032)

-

- Electronic Marker-ball/tape/Disc

- Ground Penetrating Radar (GPR)

- Acoustic & Ultrasonic Locating

- Vacuum Excavation

- Others

Russia Utility Locating Market, By Offering Outlook (Revenue, USD Million; 2019-2032)

-

- Equipment

- Service

Russia Utility Locating Market by Utility Type Outlook (Revenue, USD Million; 2019-2032)

-

- Electric Cables

- Pipelines

- Telecommunication Lines

- Sewer & Drain Lines

- Real-Time Location Tracking

- Others

Russia Utility Locating By End Use Market (Revenue, USD Million; 2019-2032)

-

- Building & Construction

- Oil & Gas

- Telecommunication

- Electric Power

- Municipalities & Public Works

- Automotive & Transportation

- Water & Wastewater

- Others

- Rest of Europe

Rest of Europe Utility Locating Market By Technique Outlook (Revenue, USD Million 2019-2032)

-

- Electronic Marker-ball/tape/Disc

- Ground Penetrating Radar (GPR)

- Acoustic & Ultrasonic Locating

- Vacuum Excavation

- Others

Rest of Europe Utility Locating Market, By Offering Outlook (Revenue, USD Million; 2019-2032)

-

- Equipment

- Service

Rest of Europe Utility Locating Market by Utility Type Outlook (Revenue, USD Million; 2019-2032)

-

- Electric Cables

- Pipelines

- Telecommunication Lines

- Sewer & Drain Lines

- Real-Time Location Tracking

- Others

Rest of Europe Utility Locating By End Use Market (Revenue, USD Million; 2019-2032)

-

- Building & Construction

- Oil & Gas

- Telecommunication

- Electric Power

- Municipalities & Public Works

- Automotive & Transportation

- Water & Wastewater

- Others

- Asia-Pacific

Asia-Pacific Utility Locating Market By Technique Outlook (Revenue, USD Million 2019-2032)

-

- Electronic Marker-ball/tape/Disc

- Ground Penetrating Radar (GPR)

- Acoustic & Ultrasonic Locating

- Vacuum Excavation

- Others

Asia-Pacific Utility Locating Market, By Offering Outlook (Revenue, USD Million; 2019-2032)

-

- Equipment

- Service

Asia-Pacific Utility Locating Market by Utility Type Outlook (Revenue, USD Million; 2019-2032)

-

- Electric Cables

- Pipelines

- Telecommunication Lines

- Sewer & Drain Lines

- Real-Time Location Tracking

- Others

Asia-Pacific Utility Locating By End Use Market (Revenue, USD Million; 2019-2032)

-

- Building & Construction

- Oil & Gas

- Telecommunication

- Electric Power

- Municipalities & Public Works

- Automotive & Transportation

- Water & Wastewater

- Others

- China

China Utility Locating Market By Technique Outlook (Revenue, USD Million 2019-2032)

-

- Electronic Marker-ball/tape/Disc

- Ground Penetrating Radar (GPR)

- Acoustic & Ultrasonic Locating

- Vacuum Excavation

- Others

China Utility Locating Market, By Offering Outlook (Revenue, USD Million; 2019-2032)

-

- Equipment

- Service

China Utility Locating Market by Utility Type Outlook (Revenue, USD Million; 2019-2032)

-

- Electric Cables

- Pipelines

- Telecommunication Lines

- Sewer & Drain Lines

- Real-Time Location Tracking

- Others

China Utility Locating By End Use Market (Revenue, USD Million; 2019-2032)

-

- Building & Construction

- Oil & Gas

- Telecommunication

- Electric Power

- Municipalities & Public Works

- Automotive & Transportation

- Water & Wastewater

- Others

- India

India Utility Locating Market By Technique Outlook (Revenue, USD Million 2019-2032)

-

- Electronic Marker-ball/tape/Disc

- Ground Penetrating Radar (GPR)

- Acoustic & Ultrasonic Locating

- Vacuum Excavation

- Others

India Utility Locating Market, By Offering Outlook (Revenue, USD Million; 2019-2032)

-

- Equipment

- Service

India Utility Locating Market by Utility Type Outlook (Revenue, USD Million; 2019-2032)

-

- Electric Cables

- Pipelines

- Telecommunication Lines

- Sewer & Drain Lines

- Real-Time Location Tracking

- Others

India Utility Locating By End Use Market (Revenue, USD Million; 2019-2032)

-

- Building & Construction

- Oil & Gas

- Telecommunication

- Electric Power

- Municipalities & Public Works

- Automotive & Transportation

- Water & Wastewater

- Others

- South Korea

South Korea Utility Locating Market By Technique Outlook (Revenue, USD Million 2019-2032)

-

- Electronic Marker-ball/tape/Disc

- Ground Penetrating Radar (GPR)

- Acoustic & Ultrasonic Locating

- Vacuum Excavation

- Others

South Korea Utility Locating Market, By Offering Outlook (Revenue, USD Million; 2019-2032)

-

- Equipment

- Service

South Korea Utility Locating Market by Utility Type Outlook (Revenue, USD Million; 2019-2032)

-

- Electric Cables

- Pipelines

- Telecommunication Lines

- Sewer & Drain Lines

- Real-Time Location Tracking

- Others

South Korea Utility Locating By End Use Market (Revenue, USD Million; 2019-2032)

-

- Building & Construction

- Oil & Gas

- Telecommunication

- Electric Power

- Municipalities & Public Works

- Automotive & Transportation

- Water & Wastewater

- Others

- Australia

Australia Utility Locating Market By Technique Outlook (Revenue, USD Million 2019-2032)

-

- Electronic Marker-ball/tape/Disc

- Ground Penetrating Radar (GPR)

- Acoustic & Ultrasonic Locating

- Vacuum Excavation

- Others

Australia Utility Locating Market, By Offering Outlook (Revenue, USD Million; 2019-2032)

-

- Equipment

- Service

Australia Utility Locating Market by Utility Type Outlook (Revenue, USD Million; 2019-2032)

-

- Electric Cables

- Pipelines

- Telecommunication Lines

- Sewer & Drain Lines

- Real-Time Location Tracking

- Others

Australia Utility Locating By End Use Market (Revenue, USD Million; 2019-2032)

-

- Building & Construction

- Oil & Gas

- Telecommunication

- Electric Power

- Municipalities & Public Works

- Automotive & Transportation

- Water & Wastewater

- Others

- New Zealand

New Zealand Utility Locating Market By Technique Outlook (Revenue, USD Million 2019-2032)

-

- Electronic Marker-ball/tape/Disc

- Ground Penetrating Radar (GPR)

- Acoustic & Ultrasonic Locating

- Vacuum Excavation

- Others

New Zealand Utility Locating Market, By Offering Outlook (Revenue, USD Million; 2019-2032)

-

- Equipment

- Service

New Zealand Utility Locating Market by Utility Type Outlook (Revenue, USD Million; 2019-2032)

-

- Electric Cables

- Pipelines

- Telecommunication Lines

- Sewer & Drain Lines

- Real-Time Location Tracking

- Others

New Zealand Utility Locating By End Use Market (Revenue, USD Million; 2019-2032)

-

- Building & Construction

- Oil & Gas

- Telecommunication

- Electric Power

- Municipalities & Public Works

- Automotive & Transportation

- Water & Wastewater

- Others

- Rest of Asia-Pacific

Rest of Asia-Pacific Utility Locating Market By Technique Outlook (Revenue, USD Million 2019-2032)

-

- Electronic Marker-ball/tape/Disc

- Ground Penetrating Radar (GPR)

- Acoustic & Ultrasonic Locating

- Vacuum Excavation

- Others

Rest of Asia-Pacific Utility Locating Market, By Offering Outlook (Revenue, USD Million; 2019-2032)

-

- Equipment

- Service

Rest of Asia-Pacific Utility Locating Market by Utility Type Outlook (Revenue, USD Million; 2019-2032)

-

- Electric Cables

- Pipelines

- Telecommunication Lines

- Sewer & Drain Lines

- Real-Time Location Tracking

- Others

Rest of Asia-Pacific Utility Locating By End Use Market (Revenue, USD Million; 2019-2032)

-

- Building & Construction

- Oil & Gas

- Telecommunication

- Electric Power

- Municipalities & Public Works

- Automotive & Transportation

- Water & Wastewater

- Others

- Latin America

Latin-America Utility Locating Market By Technique Outlook (Revenue, USD Million 2019-2032)

-

- Electronic Marker-ball/tape/Disc

- Ground Penetrating Radar (GPR)

- Acoustic & Ultrasonic Locating

- Vacuum Excavation

- Others

Latin-America Utility Locating Market, By Offering Outlook (Revenue, USD Million; 2019-2032)

-

- Equipment

- Service

Latin-America Utility Locating Market by Utility Type Outlook (Revenue, USD Million; 2019-2032)

-

- Electric Cables

- Pipelines

- Telecommunication Lines

- Sewer & Drain Lines

- Real-Time Location Tracking

- Others

Latin-America Utility Locating By End Use Market (Revenue, USD Million; 2019-2032)

-

- Building & Construction

- Oil & Gas

- Telecommunication

- Electric Power

- Municipalities & Public Works

- Automotive & Transportation

- Water & Wastewater

- Others

- Brazil

Brazil Utility Locating Market By Technique Outlook (Revenue, USD Million 2019-2032)

-

- Electronic Marker-ball/tape/Disc

- Ground Penetrating Radar (GPR)

- Acoustic & Ultrasonic Locating

- Vacuum Excavation

- Others

Brazil Utility Locating Market, By Offering Outlook (Revenue, USD Million; 2019-2032)

-

- Equipment

- Service

Brazil Utility Locating Market by Utility Type Outlook (Revenue, USD Million; 2019-2032)

-

- Electric Cables

- Pipelines

- Telecommunication Lines

- Sewer & Drain Lines

- Real-Time Location Tracking

- Others

Brazil Utility Locating By End Use Market (Revenue, USD Million; 2019-2032)

-

- Building & Construction

- Oil & Gas

- Telecommunication

- Electric Power

- Municipalities & Public Works

- Automotive & Transportation

- Water & Wastewater

- Others

- Rest of Latin America

Rest of Latin America Locating Market By Technique Outlook (Revenue, USD Million 2019-2032)

-

- Electronic Marker-ball/tape/Disc

- Ground Penetrating Radar (GPR)

- Acoustic & Ultrasonic Locating

- Vacuum Excavation

- Others

Rest of Latin America Utility Locating Market, By Offering Outlook (Revenue, USD Million; 2019-2032)

-

- Equipment

- Service

Rest of Latin America Utility Locating Market by Utility Type Outlook (Revenue, USD Million; 2019-2032)

-

- Electric Cables

- Pipelines

- Telecommunication Lines

- Sewer & Drain Lines

- Real-Time Location Tracking

- Others

Rest of Latin America Utility Locating By End Use Market (Revenue, USD Million; 2019-2032)

-

- Building & Construction

- Oil & Gas

- Telecommunication

- Electric Power

- Municipalities & Public Works

- Automotive & Transportation

- Water & Wastewater

- Others

- Middle East & Africa

Middle East & Africa Locating Market By Technique Outlook (Revenue, USD Million 2019-2032)

-

- Electronic Marker-ball/tape/Disc

- Ground Penetrating Radar (GPR)

- Acoustic & Ultrasonic Locating

- Vacuum Excavation

- Others

Middle East & Africa America Utility Locating Market, By Offering Outlook (Revenue, USD Million; 2019-2032)

-

- Equipment

- Service

Middle East & Africa Utility Locating Market by Utility Type Outlook (Revenue, USD Million; 2019-2032)

-

- Electric Cables

- Pipelines

- Telecommunication Lines

- Sewer & Drain Lines

- Real-Time Location Tracking

- Others

Middle East & Africa Utility Locating By End Use Market (Revenue, USD Million; 2019-2032)

-

- Building & Construction

- Oil & Gas

- Telecommunication

- Electric Power

- Municipalities & Public Works

- Automotive & Transportation

- Water & Wastewater

- Others

- Saudi Arabia

Middle East & Africa Locating Market By Technique Outlook (Revenue, USD Million 2019-2032)

-

- Electronic Marker-ball/tape/Disc

- Ground Penetrating Radar (GPR)

- Acoustic & Ultrasonic Locating

- Vacuum Excavation

- Others

Middle East & Africa America Utility Locating Market, By Offering Outlook (Revenue, USD Million; 2019-2032)

-

- Equipment

- Service

Middle East & Africa Utility Locating Market by Utility Type Outlook (Revenue, USD Million; 2019-2032)

-

- Electric Cables

- Pipelines

- Telecommunication Lines

- Sewer & Drain Lines

- Real-Time Location Tracking

- Others

Middle East & Africa Utility Locating By End Use Market (Revenue, USD Million; 2019-2032)

-

- Building & Construction

- Oil & Gas

- Telecommunication

- Electric Power

- Municipalities & Public Works

- Automotive & Transportation

- Water & Wastewater

- Others

- Saudi Arabia

Saudi Arabia Utility Locating Market By Technique Outlook (Revenue, USD Million 2019-2032)

-

- Electronic Marker-ball/tape/Disc

- Ground Penetrating Radar (GPR)

- Acoustic & Ultrasonic Locating

- Vacuum Excavation

- Others

Middle East & Africa America Utility Locating Market, By Offering Outlook (Revenue, USD Million; 2019-2032)

-

- Equipment

- Service

Middle East & Africa Utility Locating Market by Utility Type Outlook (Revenue, USD Million; 2019-2032)

-

- Electric Cables

- Pipelines

- Telecommunication Lines

- Sewer & Drain Lines

- Real-Time Location Tracking

- Others

Middle East & Africa Utility Locating By End Use Market (Revenue, USD Million; 2019-2032)

-

- Building & Construction

- Oil & Gas

- Telecommunication

- Electric Power

- Municipalities & Public Works

- Automotive & Transportation

- Water & Wastewater

- Others

- Saudi Arabia

Rest of Middle East & Africa Utility Locating Market By Technique Outlook (Revenue, USD Million 2019-2032)

-

- Electronic Marker-ball/tape/Disc

- Ground Penetrating Radar (GPR)

- Acoustic & Ultrasonic Locating

- Vacuum Excavation

- Others

Rest of Middle East & Africa Utility Locating Market, By Offering Outlook (Revenue, USD Million; 2019-2032)

-

- Equipment

- Service

Rest of Middle East & Africa Utility Locating Market by Utility Type Outlook (Revenue, USD Million; 2019-2032)

-

- Electric Cables

- Pipelines

- Telecommunication Lines

- Sewer & Drain Lines

- Real-Time Location Tracking

- Others

Rest of Middle East & Africa Utility Locating By End Use Market (Revenue, USD Million; 2019-2032)

-

- Building & Construction

- Oil & Gas

- Telecommunication

- Electric Power

- Municipalities & Public Works

- Automotive & Transportation

- Water & Wastewater

- Others